North America Radioimmunoassay Market

Taille du marché en milliards USD

TCAC :

%

USD

314.48 Million

USD

443.82 Million

2024

2032

USD

314.48 Million

USD

443.82 Million

2024

2032

| 2025 –2032 | |

| USD 314.48 Million | |

| USD 443.82 Million | |

|

|

|

|

Segmentation du marché nord-américain des radio-immuno-essais, par type de produit (réactifs et kits de radio-immuno-essais et analyseur de radio-immuno-essais), application (recherche scientifique et diagnostic clinique), utilisateur final (hôpitaux, laboratoires de diagnostic clinique, instituts universitaires et de recherche, industrie pharmaceutique et biopharmaceutique, organismes de recherche sous contrat, etc.), canal de distribution (appels d'offres directs, ventes en ligne, distribution par des tiers, etc.) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des radio-immunoessais en Amérique du Nord

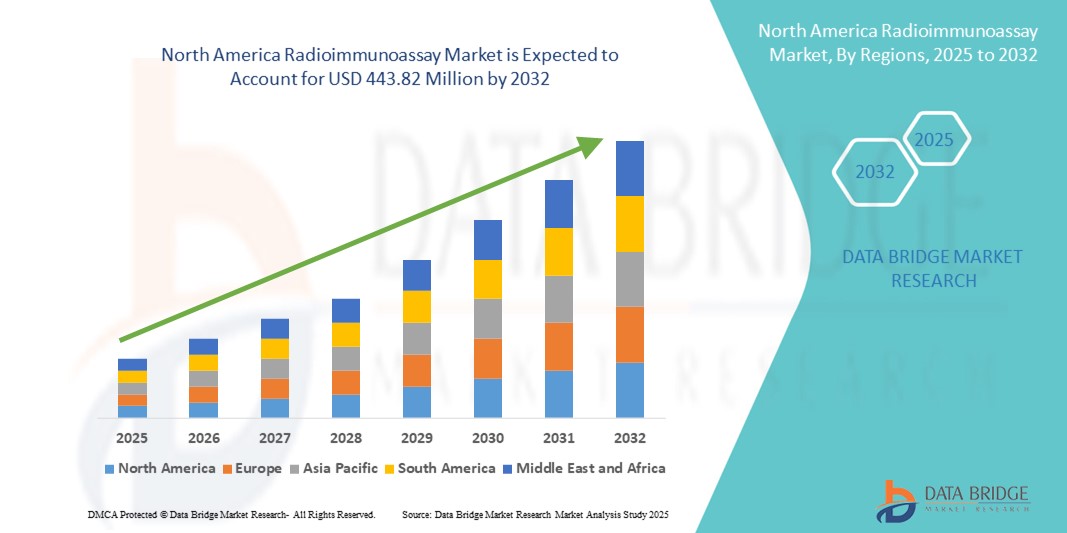

- La taille du marché nord-américain des radioimmunoessais était évaluée à 314,48 millions USD en 2024 et devrait atteindre 443,82 millions USD d'ici 2032 , à un TCAC de 4,4 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la prévalence croissante des maladies chroniques et infectieuses, ainsi que par l'importance croissante accordée aux techniques de diagnostic précoces et précises, ce qui favorise l'adoption du radioimmunoessai dans les applications cliniques et de recherche.

- De plus, les progrès en matière de sensibilité des dosages, d'automatisation et de développement de réactifs améliorent la précision et l'efficacité, faisant du radioimmunoessai un choix privilégié en laboratoire. Ces facteurs convergents accélèrent l'adoption de solutions de radioimmunoessai, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché des radio-immunoessais en Amérique du Nord

- Le radioimmunoessai (RIA), une technique de laboratoire hautement sensible pour la détection et la quantification des hormones, des antigènes et d'autres biomarqueurs , demeure un outil essentiel dans les diagnostics cliniques, la recherche pharmaceutique et les laboratoires universitaires en Amérique du Nord en raison de sa précision, de sa reproductibilité et de sa capacité à mesurer les analytes à l'état de traces.

- La demande croissante de radioimmunoessais est principalement alimentée par la prévalence croissante de maladies chroniques telles que le cancer et les troubles endocriniens , le besoin croissant de méthodes de diagnostic précoces et précises et l'augmentation du financement de la recherche dans les sciences biomédicales.

- Les États-Unis ont dominé le marché nord-américain des radioimmunoessais avec la plus grande part de revenus de 47,9 % en 2024, caractérisé par une infrastructure de soins de santé avancée, de solides capacités de R&D et la présence de fabricants de kits de diagnostic de premier plan, avec une adoption encore renforcée par des innovations dans les plates-formes d'analyse automatisées et les réactifs à haute sensibilité.

- Le Canada devrait être le pays connaissant la croissance la plus rapide sur le marché nord-américain des radio-immuno-essais dans la région au cours de la période de prévision en raison de l'augmentation des investissements dans les soins de santé, de l'expansion des laboratoires de diagnostic spécialisés et de la sensibilisation croissante aux techniques avancées d'immuno-essais dans la pratique clinique.

- Le segment des réactifs et des kits a dominé le marché nord-américain des radioimmunoessais avec une part de marché de 75,26 % en 2024, grâce à leur utilisation répétée dans les tests de routine et les flux de recherche, ce qui en fait le principal contributeur aux revenus dans toutes les catégories de produits.

Portée du rapport et segmentation du marché des radio-immunoessais en Amérique du Nord

|

Attributs |

Informations clés sur le marché des radio-immunoessais en Amérique du Nord |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des radio-immunoessais en Amérique du Nord

Automatisation et développement d'essais à haute sensibilité

- Une tendance importante et croissante sur le marché nord-américain des radioimmunoessais (RIA) est l'intégration de technologies d'automatisation avancées et le développement de kits de dosage haute sensibilité pour la détection de concentrations extrêmement faibles d'hormones, de médicaments et de biomarqueurs. Cette évolution améliore la précision, le rendement et l'efficacité des tests dans les laboratoires cliniques et de recherche.

- Par exemple, Siemens Healthineers et Beckman Coulter ont introduit des analyseurs d'immunoessais automatisés capables d'exécuter des kits RIA avec une intervention manuelle minimale, réduisant ainsi l'erreur humaine et améliorant la reproductibilité.

- L'adoption de réactifs RIA à haute sensibilité permet une détection précoce des troubles endocriniens et des cancers en identifiant des concentrations infimes de biomarqueurs, une capacité de plus en plus demandée en médecine de précision.

- L'automatisation prend également en charge le dépistage à haut débit, permettant aux hôpitaux, aux laboratoires de diagnostic et aux organismes de recherche sous contrat de traiter un plus grand nombre d'échantillons par jour tout en maintenant la précision.

- De plus, l'intégration numérique des plateformes RIA automatisées avec les systèmes de gestion des informations de laboratoire (LIMS) facilite le suivi centralisé des données, le contrôle qualité et la conformité réglementaire, rationalisant ainsi les opérations sur les réseaux multisites.

- Cette tendance vers des solutions RIA automatisées, de haute précision et connectées numériquement remodèle les attentes des utilisateurs, incitant les fabricants tels que PerkinElmer et DIAsource ImmunoAssays à se concentrer sur des plateformes innovantes combinant vitesse, précision et flux de travail simplifiés.

- La demande de solutions RIA à haute sensibilité et prêtes à l'automatisation augmente rapidement parmi les établissements de santé et les centres de recherche nord-américains, car ils accordent la priorité à l'efficacité opérationnelle, à la précision du diagnostic et au respect de normes de qualité strictes.

Dynamique du marché nord-américain des radio-immunoessais

Conducteur

La prévalence croissante des troubles chroniques et endocriniens stimule la demande de diagnostic

- Le fardeau croissant des maladies chroniques, en particulier les troubles endocriniens tels que le dysfonctionnement thyroïdien, le diabète et les problèmes de santé reproductive, stimule considérablement la demande de tests RIA en Amérique du Nord.

- Par exemple, l’American Thyroid Association rapporte que plus de 12 % de la population américaine développera une maladie thyroïdienne au cours de sa vie, ce qui souligne la nécessité de tests hormonaux sensibles.

- La fiabilité éprouvée du RIA dans la détection des hormones et des antigènes de faible niveau en fait un choix privilégié dans le diagnostic clinique et la surveillance thérapeutique, en particulier pour les affections nécessitant une mesure précise du niveau d'hormones.

- L'expansion des initiatives de médecine personnalisée et des programmes de traitement de la fertilité amplifie encore l'utilisation du RIA dans les tests spécialisés

- En outre, l’augmentation du financement de la recherche par des institutions telles que les National Institutes of Health (NIH) favorise l’adoption de l’RIA dans la R&D biomédicale et pharmaceutique.

- La combinaison de la prévalence croissante des maladies, de l'accent mis sur le diagnostic précoce et de l'expansion des applications de recherche devrait soutenir une forte demande de RIA dans les années à venir.

Retenue/Défi

Réglementation sur la manipulation des radio-isotopes et contraintes de disponibilité

- Les exigences réglementaires strictes en matière de manipulation et d'élimination des matières radioactives posent des défis opérationnels et de conformité aux laboratoires utilisant la technologie RIA.

- Par exemple, les installations doivent se conformer aux directives de la Commission de réglementation nucléaire des États-Unis (NRC) ou des autorités nationales équivalentes au Canada, ce qui peut augmenter les coûts opérationnels et les frais administratifs.

- Les limitations de la disponibilité de certains isotopes, les perturbations de la chaîne d'approvisionnement et le besoin d'infrastructures de stockage et d'élimination spécialisées peuvent entraver l'adoption généralisée, en particulier parmi les petits laboratoires ou instituts de recherche.

- De plus, la concurrence des alternatives aux immuno-essais non radioactifs, tels que les tests ELISA et par chimioluminescence, s'accroît en raison de leur charge réglementaire réduite et de leurs flux de travail plus simples.

- Pour relever ces défis, il faut investir dans des technologies de manipulation des isotopes plus sûres, des processus de conformité rationalisés et une formation sur la valeur diagnostique unique de l'RIA.

- Sans de telles mesures, la complexité réglementaire et les contraintes opérationnelles pourraient ralentir la croissance de l’adoption de l’RIA malgré ses avantages diagnostiques

Portée du marché nord-américain des radio-immunoessais

Le marché est segmenté en fonction du type de produit, de l’application, de l’utilisateur final et du canal de distribution.

- Par type de produit

En fonction du type de produit, le marché nord-américain des radioimmunoessais est segmenté en réactifs et kits de radioimmunoessais et en analyseurs de radioimmunoessais. Le segment des réactifs et kits a dominé le marché avec la plus grande part de chiffre d'affaires (75,26 %) en 2024, grâce à leur rôle essentiel de consommables dans une large gamme de tests de diagnostic et de recherche. Les laboratoires et les hôpitaux ont constamment besoin de réactifs et de kits récents pour la quantification des hormones, des antigènes et des biomarqueurs, ce qui garantit des ventes récurrentes et la stabilité du marché. Les innovations en matière de sensibilité et de spécificité des tests, ainsi que l'expansion des applications des réactifs RIA, renforcent encore la domination de ce segment.

Le segment des analyseurs devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à l'adoption croissante de plateformes d'immunoessais automatisées et à haut débit. Ces analyseurs améliorent l'efficacité des laboratoires en réduisant les interventions manuelles, en augmentant la précision et en permettant une intégration transparente avec les systèmes de gestion des informations de laboratoire (LIMS), très prisés en milieu clinique et de recherche.

- Par application

En fonction des applications, le marché nord-américain des radioimmunoessais est segmenté entre le diagnostic clinique et la recherche scientifique. Le segment du diagnostic clinique détenait la plus grande part de marché en 2024, reflétant l'utilisation généralisée des RIA pour la détection et le suivi des troubles endocriniens, des cancers, des troubles de la fertilité et d'autres maladies chroniques. La prévalence croissante des maladies et la demande de diagnostics précoces et précis soutiennent la forte croissance de ce segment.

Le secteur de la recherche scientifique devrait connaître le TCAC le plus élevé entre 2025 et 2032, grâce au développement des activités de R&D pharmaceutique et biotechnologique. Cela comprend le développement de médicaments, la découverte de biomarqueurs et la recherche biomédicale fondamentale, où l'analyse d'impact sur la santé (RIA) demeure un outil précieux grâce à sa sensibilité et sa fiabilité.

- Par utilisateur final

En fonction de l'utilisateur final, le marché nord-américain des radioimmunoessais est segmenté entre les hôpitaux, les laboratoires de diagnostic clinique, les instituts universitaires et de recherche, l'industrie pharmaceutique et biopharmaceutique, les organismes de recherche sous contrat (ORC), etc. Le segment hospitalier a dominé le marché en 2024 en raison du volume élevé de tests diagnostiques effectués dans ces établissements et du rôle essentiel des RIA dans la prise en charge des patients. Les laboratoires de diagnostic clinique suivent de près, fournissant des services d'immunoessais spécialisés et à grande échelle aux hôpitaux et à d'autres clients. Les instituts universitaires et de recherche sont également des utilisateurs importants, exploitant les RIA dans diverses applications de recherche biomédicale.

L'industrie pharmaceutique et biopharmaceutique, ainsi que les CRO, devraient connaître le TCAC le plus rapide de 2025 à 2032, propulsé par l'augmentation des essais cliniques et des programmes de développement de médicaments nécessitant des tests de biomarqueurs sensibles.

- Par canal de distribution

En fonction du canal de distribution, le marché nord-américain des radioimmunoessais est segmenté en appels d'offres directs, ventes en ligne, distribution par des tiers, etc. En 2024, le segment des appels d'offres directs détenait la plus grande part de marché, les hôpitaux et les grands laboratoires de diagnostic préférant s'approvisionner en réactifs, kits et analyseurs directement auprès des fabricants ou des distributeurs agréés afin de garantir l'authenticité des produits, des prix plus avantageux et des délais de livraison rapides. Les canaux de distribution par des tiers jouent un rôle crucial pour atteindre les petits laboratoires et les instituts de recherche qui ne disposent pas toujours de capacités d'approvisionnement direct.

Les ventes en ligne devraient connaître le TCAC le plus rapide entre 2025 et 2032, grâce à l'adoption croissante du numérique, à la facilité de commande et à l'accès élargi à une gamme plus large de produits, en particulier parmi les petits utilisateurs finaux et les centres de recherche émergents.

Analyse régionale du marché nord-américain des radio-immunoessais

- Les États-Unis ont dominé le marché nord-américain des radioimmunoessais avec la plus grande part de revenus de 47,9 % en 2024, caractérisé par une infrastructure de soins de santé avancée, de solides capacités de R&D et la présence de fabricants de kits de diagnostic de premier plan, avec une adoption encore renforcée par des innovations dans les plates-formes d'analyse automatisées et les réactifs à haute sensibilité.

- Les prestataires de soins de santé et les centres de recherche américains accordent une grande importance à la précision, à la sensibilité et à la fiabilité des techniques de radioimmunoessai pour la détection des hormones, des marqueurs tumoraux et des maladies infectieuses

- Cette domination est encore renforcée par la présence de sociétés de diagnostic de premier plan, un financement solide pour la recherche clinique, des politiques de remboursement favorables et le besoin croissant de solutions de tests avancées pour faire face au fardeau croissant des troubles chroniques et endocriniens, faisant des États-Unis une plaque tournante centrale pour l'adoption des radioimmunoessais dans la région.

Aperçu du marché américain des radioimmunoessais

En 2024, le marché américain des radioimmunoessais représentait la plus grande part de chiffre d'affaires en Amérique du Nord, avec 47,9 %, grâce à un solide réseau de laboratoires cliniques, d'hôpitaux et d'instituts de recherche. Les taux élevés de dépistage des maladies, l'accent mis sur la détection précoce et la forte activité d'essais cliniques sont des facteurs clés qui soutiennent la domination du marché. De plus, les États-Unis bénéficient d'un financement important pour les diagnostics de précision et les technologies avancées d'immunoessais. L'intégration croissante des radioimmunoessais aux systèmes automatisés et à l'interprétation des données basée sur l'IA améliore l'efficacité et la précision, consolidant ainsi la position des États-Unis comme plaque tournante de l'innovation en matière de radioimmunoessais.

Aperçu du marché canadien des radioimmunoessais

Le marché canadien des radioimmunoessais devrait connaître une croissance soutenue au cours de la période de prévision, grâce à des investissements croissants dans la modernisation des soins de santé et à l'expansion des réseaux de laboratoires de diagnostic. Le fardeau croissant des maladies chroniques, notamment le diabète et les troubles thyroïdiens, alimente la demande de tests immunologiques avancés. Les initiatives gouvernementales en matière de santé et les collaborations de recherche avec des institutions américaines accélèrent l'adoption de ces technologies. De plus, l'évolution vers des soins de santé centrés sur le patient et des programmes de dépistage préventif encourage une utilisation plus large des méthodes de radioimmunoessais en milieu clinique et de recherche.

Aperçu du marché mexicain des radio-immunoessais

Le marché mexicain des radio-immuno-essais devrait connaître une croissance considérable au cours de la période de prévision, stimulé par le besoin croissant d'outils de diagnostic rentables et extrêmement précis. La sensibilisation croissante au dépistage précoce des maladies, ainsi que l'amélioration des infrastructures de laboratoire, favorisent la pénétration du marché. Les partenariats entre les fournisseurs locaux de diagnostics et les entreprises internationales de technologies d'analyse facilitent l'accès à des méthodes de test avancées. De plus, les programmes gouvernementaux visant à renforcer les diagnostics de santé publique devraient favoriser l'adoption des radio-immuno-essais dans les hôpitaux, les cliniques et les laboratoires de recherche du pays.

Part de marché des radioimmunoessais en Amérique du Nord

L’industrie nord-américaine des radioimmunoessais est principalement dirigée par des entreprises bien établies, notamment :

- DiaSorin SpA (Italie)

- Medipan GmbH (Allemagne)

- PerkinElmer (États-Unis)

- Siemens Healthineers AG (Allemagne)

- Bio-Rad Laboratories, Inc. (États-Unis)

- Thermo Fisher Scientific Inc. (États-Unis)

- Beckman Coulter, Inc. (États-Unis)

- Abbott. (États-Unis)

- Ortho Clinical Diagnostics (États-Unis)

- Randox Laboratories Ltd. (Royaume-Uni)

- Euroimmun AG (Allemagne)

- Immunotech (France)

- Brahms GmbH (Allemagne)

- BD (États-Unis)

- Molecular Devices LLC (États-Unis)

- Tecan Group Ltd. (Suisse)

- BIOMÉRIEUX (France)

- Agilent Technologies, Inc. (États-Unis)

- Luminex Corporation (États-Unis)

- GenWay Biotech Inc. (États-Unis)

Quels sont les développements récents sur le marché des radioimmunoessais en Amérique du Nord ?

- En janvier 2025, la Food and Drug Administration (FDA) américaine a accordé l'autorisation 510(k) au test automatisé d'immuno-analyse par chimiluminescence (ChLIA) d'Euroimmun pour la mesure quantitative directe des taux de testostérone libre dans le sérum ou le plasma. Il s'agit du premier test de ce type approuvé par la FDA, offrant des résultats rapides en 48 minutes grâce aux plateformes iSYS ou i10, améliorant ainsi considérablement la rapidité et la fiabilité du diagnostic pour les pathologies hormonales telles que l'hypogonadisme et le SOPK.

- En janvier 2025, Medipan GmbH a annoncé la prolongation de la durée de conservation de plusieurs de ses kits de radio-immuno-essai (RIA), notamment les kits SELco TSH Rapid, SELco Tg 1 Step et SELco Calcitonin. En optimisant ses procédés de fabrication, Medipan a réussi à prolonger la durée de conservation de ces kits de deux semaines supplémentaires. Cette amélioration offre une plus grande flexibilité et une meilleure planification des tests diagnostiques, reflétant l'engagement de l'entreprise en faveur de l'innovation continue de ses produits et de solutions centrées sur le client dans le domaine du diagnostic.

- En mai 2023, Freenome, une société de biotechnologie privée basée aux États-Unis, a acquis Oncimmune Ltd, un leader britannique du développement mondial d'immunodiagnostics. Cette acquisition intègre le test pulmonaire EarlyCDT, marqué CE-IVD, la plateforme de profilage des autoanticorps et le pipeline de R&D d'Oncimmune aux capacités de détection précoce multiomique du cancer de Freenome. Cette expansion stratégique renforce les ressources de dépistage clinique et commercial de Freenome et accélère ainsi ses efforts de détection multi-cancers.

- En décembre 2022, Medipan GmbH a lancé le SELco TRAb human 1 step, un test radioimmunologique hautement sensible conçu pour la détection des anticorps anti-récepteurs de la thyréostimuline (TRAb). Ce nouveau test simplifie le processus de test traditionnel en deux étapes en une seule, réduisant le temps d'incubation à seulement 120 minutes. Cette innovation rationalise les flux de travail des laboratoires et améliore l'efficacité en réduisant les délais d'exécution.

- En octobre 2022, DiaSorin SpA a finalisé l'acquisition de Luminex Corporation, une société américaine leader dans les technologies de diagnostic multiplex et les solutions de tests moléculaires. Cette opération stratégique vise à renforcer la présence de DiaSorin sur les marchés du diagnostic moléculaire et de la recherche en sciences de la vie. Cette acquisition devrait faciliter le développement de tests multiplateformes, notamment des applications de radioimmunoessais pour des domaines de niche ou traditionnels exigeant des tests ultra-sensibles, comme l'analyse hormonale.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.