Marché des films vinyles auto-adhésifs imprimables en Amérique du Nord, par procédé de fabrication (films calandrés et films coulés ), épaisseur (mince (2-3 mils) et épais (plus de 3 mils)), type (opaque, transparent et translucide), substrat (sol, plastique, verre et autres), application (graphiques de flotte, graphiques de bateaux, habillage de voiture, graphiques de sol, étiquettes et autocollants, graphiques de fenêtre, panneaux d'exposition, publicité extérieure, décoration de meubles, revêtement mural et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des films vinyles auto-adhésifs imprimables en Amérique du Nord

Les films vinyles auto-adhésifs imprimables offrent une clarté optique ainsi qu'une facilité de retrait. Ces films sont utilisés comme autocollants promotionnels et graphiques de fenêtre. Ces films sont placés sur les fenêtres des restaurants, des magasins, des bureaux et d'autres établissements commerciaux pour assurer l'intimité ou la publicité. Ces films sont polyvalents et flexibles, et ils sont fabriqués à partir d'adhésifs vinyliques comme l'acrylique. Ils sont utilisés pour créer des logos, des enseignes et des campagnes publicitaires pour promouvoir les entreprises et diffuser des informations à un large public.

Les films vinyles auto-adhésifs imprimables sont principalement fabriqués à partir de nombreux polymères vinyliques qui utilisent des monomères tels que les esters vinyliques ou l'acétate de vinyle. La demande croissante de films vinyles auto-adhésifs imprimables dans les applications de construction et d'architecture devrait stimuler le marché nord-américain des films vinyles auto-adhésifs imprimables. En outre, une large gamme de films vinyles auto-adhésifs aux caractéristiques différentes est disponible. Cependant, de nouveaux développements stratégiques et initiatives des fabricants peuvent constituer une opportunité pour le marché nord-américain. En revanche, les préoccupations environnementales croissantes et les réglementations gouvernementales peuvent constituer un sérieux défi pour la croissance du marché nord-américain des films vinyles auto-adhésifs imprimables.

La demande de films vinyles auto-adhésifs imprimables augmente, et les fabricants se concentrent désormais davantage sur ce sujet et s'impliquent dans le lancement de nouveaux produits, la promotion, les récompenses, la certification et la participation à des événements sur le marché. Ces décisions favorisent en fin de compte la croissance du marché.

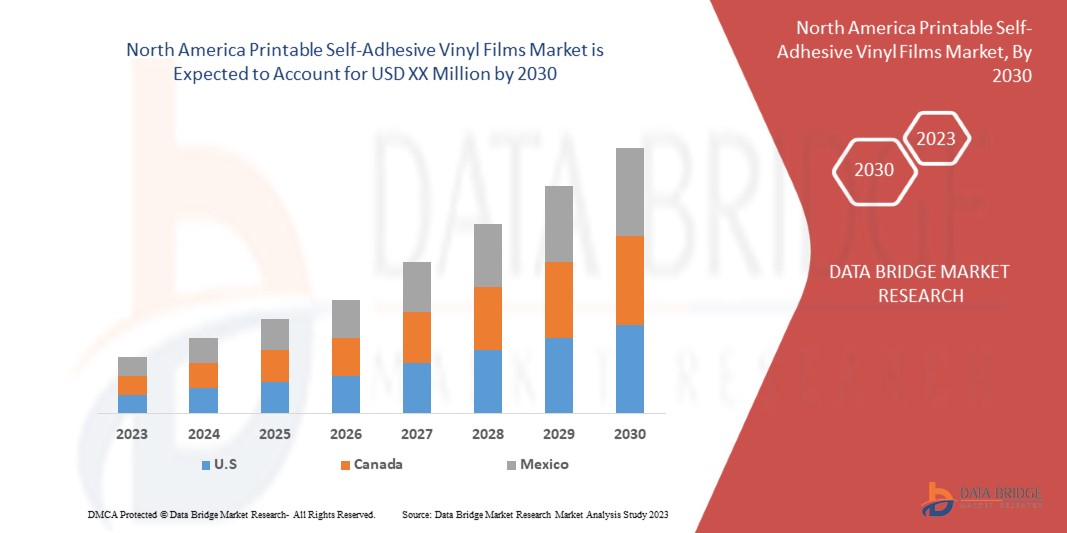

Data Bridge Market Research analyse que le marché des films vinyles auto-adhésifs imprimables en Amérique du Nord connaîtra un TCAC de 4,1 % entre 2023 et 2030.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2020 à 2016) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par procédé de fabrication (films calandrés et films coulés), épaisseur (mince (2-3 mils) et épais (plus de 3 mils)), type (opaque, transparent et translucide), substrat (sol, plastique, verre et autres), application (graphiques de flotte, graphiques de bateaux, habillage de voiture, graphiques de sol, étiquettes et autocollants, graphiques de fenêtre, panneaux d'exposition, publicité extérieure, décoration de meubles, revêtement mural et autres) |

|

Pays couverts |

États-Unis, Canada, Mexique |

|

Acteurs du marché couverts |

Brite Coatings Private Limited, Item Plastic Corp., 3M, AVERY DENNISON CORPORATION, Arlon Graphics, LLC., HEXIS SAS, Metamark, DRYTAC, FLEXcon Company, Inc., TEKRA LLC, LX Hausys, LINTEC Corporation, Stahls' International, Groupe POLI-TAPE, Innovia Films, Henkel Adhesives Technologies India Private Limited, Responsive Industries Ltd., ACHILLIES CORPORATION, ORAFOL Europe GmbH, Shubh Plastics |

Définition du marché

Les films vinyles auto-adhésifs imprimables offrent une clarté optique ainsi qu'une facilité de retrait. Ces films sont utilisés comme autocollants promotionnels et graphiques de fenêtre. Ces films sont placés sur les fenêtres des restaurants, des magasins, des bureaux et d'autres établissements commerciaux pour assurer l'intimité ou la publicité. Ces films sont polyvalents, flexibles et fabriqués à partir d'adhésifs vinyliques comme l'acrylique. Ils sont utilisés pour créer des logos, des enseignes et des campagnes publicitaires pour promouvoir les entreprises et diffuser des informations à un large public.

Dynamique du marché des films vinyles auto-adhésifs imprimables en Amérique du Nord

Conducteurs

-

Demande croissante de films vinyles auto-adhésifs imprimables dans les applications de construction et d'architecture

L'utilisation croissante de films vinyles autocollants dans diverses applications architecturales telles que les revêtements de sol, les revêtements muraux, les terrasses et les revêtements de quais influence positivement la demande du marché pour les films vinyles autocollants. Le film autocollant est un matériau solide et durable qui peut être utilisé pour protéger une variété de surfaces. Ces films sont largement utilisés pour protéger les surfaces contre les rayures, les abrasions, le vandalisme, les éclats, les dommages causés par les UV et la décoloration. De plus, les films vinyles autocollants ont divers modèles qui sont utilisés pour le revêtement mural.

Les films vinyles autocollants imprimables sont destinés à être utilisés sur des surfaces lisses pour améliorer la texture et la couleur de la surface proposée. En raison de leurs designs actualisés et de leur durabilité, les films deviennent populaires comme la meilleure solution pour les rénovations commerciales et les nouveaux projets de construction. En outre, divers fabricants clés fournissent des films vinyles autocollants pour des applications architecturales, ce qui devrait stimuler la croissance du marché des films vinyles autocollants en Amérique du Nord.

Par exemple,

- DRYTAC propose un rouleau de film vinyle autocollant appelé TimeTech Wall Protector. Le film peut être utilisé pour le papier peint de cuisine, les placards, les revêtements muraux ainsi que pour les meubles.

- La société Avery Dennison propose à ses utilisateurs finaux une collection de décoration intérieure. Les films de la série MPI 8000 sont disponibles dans différents modèles. Ces films peuvent être appliqués sans apprêt et leur excellente opacité garantit que le mur sous-jacent est complètement caché.

Par conséquent, la demande croissante de films vinyles auto-adhésifs imprimables pour les applications architecturales et de construction devrait stimuler la croissance du marché. De plus, les fabricants fournissant des films nouveaux et innovants pour ces applications devraient stimuler la croissance du marché à l'échelle mondiale.

-

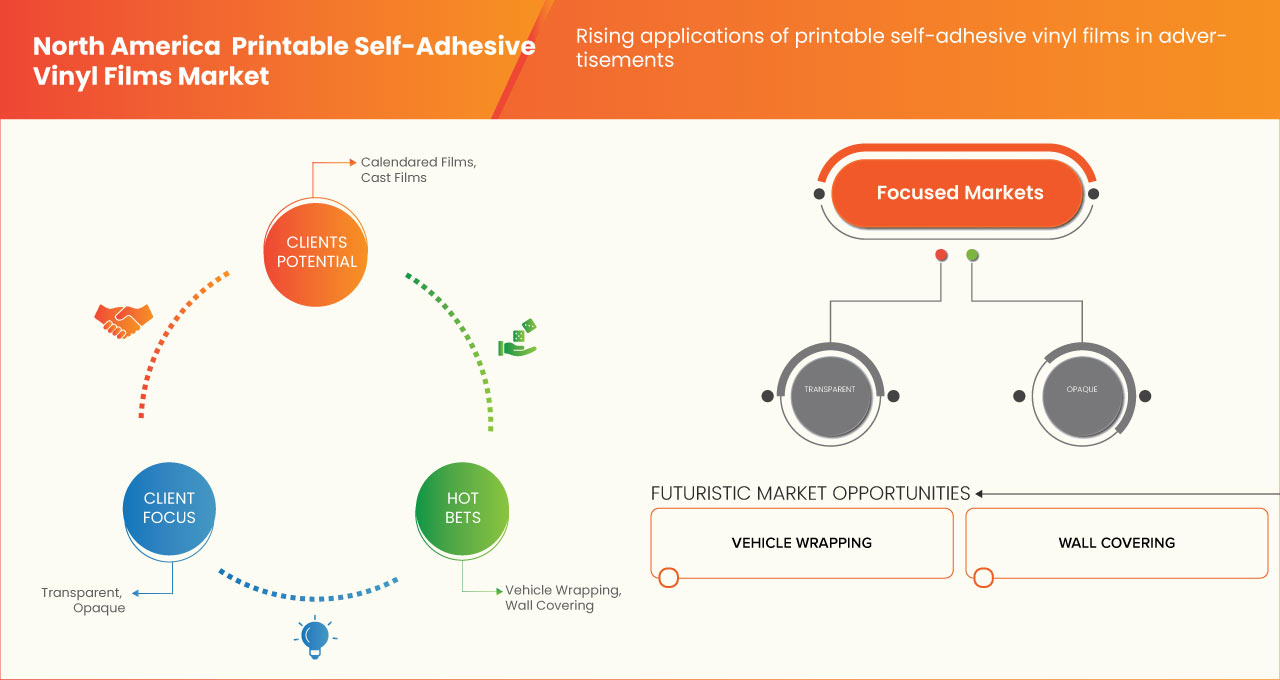

Applications croissantes des films vinyles auto-adhésifs imprimables dans la publicité

Les films vinyles auto-adhésifs imprimables sont largement utilisés dans la publicité, notamment en extérieur. Ces films sont généralement utilisés dans les publicités extérieures pour accroître la notoriété et la visibilité de la marque. En raison de leur capacité, ils offrent aux entreprises une toile créative sur laquelle transmettre leur message de marque, ainsi que la facilité avec laquelle il peut être modifié.

La demande pour ces films à des fins de branding et de publicité est alimentée par des caractéristiques esthétiques telles qu'une luminosité accrue, qui attire les voyageurs et autres clients notables. En outre, la demande pour ces films a augmenté en raison des initiatives gouvernementales visant à promouvoir le tourisme, telles que l'utilisation de vinyle auto-adhésif imprimable pour les graphismes de flotte sur les véhicules commerciaux tels que les bus et les camions. En outre, les fabricants fournissent des produits spécialement conçus pour la publicité, ce qui alimente la croissance du marché.

Par exemple,

Avery Dennison Corporation propose une large gamme de films graphiques sensibles à la pression dans une variété de teintes et de finitions, ainsi que des films d'imagerie numérique de nouvelle génération qui peuvent transformer pratiquement n'importe quelle surface, des murs aux fenêtres, des sols aux meubles, en une toile fonctionnelle pour des promotions accrocheuses.

Par conséquent, en raison de la haute qualité et de la résolution élevée des images et des publicités, les films vinyles auto-adhésifs imprimables sont très utilisés pour les publicités. En outre, les fabricants fournissant des films pour la publicité devraient également stimuler la croissance du marché.

Opportunités

-

Nouveaux développements stratégiques et initiatives des principaux fabricants

Les nombreuses applications des films vinyles auto-adhésifs imprimables dans diverses industries ont considérablement accru leur demande sur le marché. Par conséquent, les principaux fabricants de films vinyles auto-adhésifs lancent des produits nouveaux et innovants afin de générer de bons revenus et de répondre à la demande des utilisateurs finaux. De plus, ils se livrent à de nouvelles acquisitions et fusions qui devraient créer d'immenses opportunités sur le marché.

Par exemple,

-

En décembre 2022, LX International a accepté d'acquérir une participation de 100 % dans HanGlas. L'objectif principal de l'acquisition était d'accroître la taille de l'activité de vitrages et de fenêtres à revêtement de sa filiale LX Hausys.

Par conséquent, les nouveaux développements stratégiques et initiatives des principaux fabricants devraient créer des opportunités sur le marché des films vinyles auto-adhésifs imprimables en Amérique du Nord.

Contraintes/Défis

- Disponibilité de divers substituts

Les films vinyles auto-adhésifs imprimables ont de nombreuses applications telles que les étiquettes, les panneaux, les graphiques de sol, les revêtements muraux, etc. et sont largement utilisés dans le monde entier. Cependant, il existe de nombreux substituts aux films vinyles auto-adhésifs imprimables tels que les papiers, les tissus, les films biodégradables et les films sans PVC. Le papier peut être utilisé pour imprimer des étiquettes, des autocollants et des décalcomanies. Il est biodégradable et également présent dans une gamme de finitions et de textures. De plus, les films biodégradables sont une alternative écologique aux films vinyles traditionnels. Ils sont fabriqués à partir de matériaux tels que l'acide polylactique (PLA) ou la cellulose et sont destinés à se dégrader avec le temps. Il existe divers substituts présents sur le marché, ce qui peut entraver la croissance du marché.

Par exemple,

- Next Day Flyers propose des étiquettes en papier telles que les étiquettes BOPP blanches et les étiquettes BOPP transparentes, laminées brillantes, transparentes et résistantes à l'eau, à l'huile et à la réfrigération. Le papier peut être utilisé à la place des films vinyles autocollants.

Impact de la pandémie de COVID-19 sur le marché nord-américain des films vinyles auto-adhésifs imprimables

Le COVID-19 a affecté le marché dans une certaine mesure. En raison du confinement, le commerce des matières premières et des films vinyles autocollants imprimables à travers le monde a été gravement affecté par les mesures de quarantaine, ce qui a influencé le marché. En raison du changement de nombreux mandats et réglementations, les fabricants peuvent concevoir et lancer de nouveaux produits sur le marché, ce qui contribuera à la croissance du marché.

Développements récents

- En février 2022, Stahls a lancé les transferts directs sur film (DTF) UltraColor Max en tant que nouvelle option de service de transfert thermique personnalisé. Le service offre des couleurs illimitées et des détails extrêmement fins sans contour blanc ou clair. Il élargira le portefeuille de produits de l'entreprise

- En octobre 2019, le groupe POLI-TAPE a acquis Aslan, un développeur, fabricant et distributeur leader de films auto-adhésifs spécialisés.

Portée du marché des films vinyles auto-adhésifs imprimables en Amérique du Nord

Le marché nord-américain des films vinyles auto-adhésifs imprimables est segmenté en cinq segments notables en fonction du processus de fabrication, de l'épaisseur, du type, du substrat et de l'application. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Processus de fabrication

- Films programmés

- Films avec casting

Sur la base du processus de fabrication, le marché des films vinyles autocollants imprimables est segmenté en films calandrés et films coulés.

Épaisseur

- Épais (2-3 mils)

- Mince (plus de 3 mils)

Sur la base de l'épaisseur, le marché des films vinyles autocollants imprimables est segmenté en mince (2-3 mils) et épais (plus de 3 mils).

Taper

- Transparent

- Translucide

- Opaque

Sur la base du type, le marché des films vinyles autocollants imprimables est segmenté en transparent, translucide et opaque.

Application

- Graphiques de la flotte

- Graphiques de bateaux

- Habillage de voiture

- Graphiques de sol

- Étiquettes et autocollants

- Graphiques de fenêtre

- Panneaux d'exposition

- Publicité extérieure

- Décoration de meubles

- Revêtement mural

- Autres

Sur la base de l'application, le marché des films vinyles autocollants imprimables est segmenté en graphiques de flotte, graphiques de bateaux, habillage de voiture, graphiques de sol, étiquettes et autocollants, graphiques de fenêtre, panneaux d'exposition, publicité extérieure, décoration de meubles, revêtement mural et autres.

Analyse/perspectives régionales du marché des films vinyles auto-adhésifs imprimables en Amérique du Nord

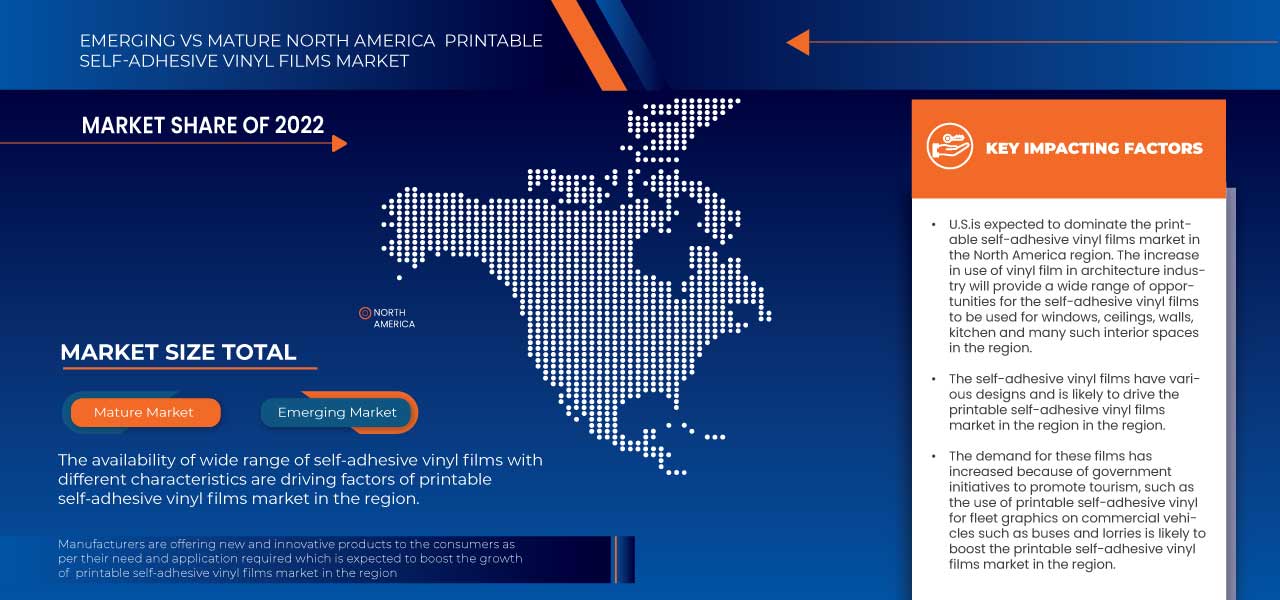

Le marché des films vinyles auto-adhésifs imprimables en Amérique du Nord est analysé et des informations sur la taille du marché et les tendances sont fournies sur la base des références ci-dessus.

Les pays couverts par le rapport sur le marché des films vinyles auto-adhésifs imprimables en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Les États-Unis devraient dominer le marché nord-américain des films vinyles auto-adhésifs imprimables en termes de part de marché et de chiffre d'affaires. Ils devraient maintenir leur domination au cours de la période de prévision en raison de la montée en puissance des films vinyles auto-adhésifs imprimables dans diverses industries. De plus, la disponibilité de plusieurs types de films vinyles auto-adhésifs imprimables permet aux fabricants de choisir le type de films vinyle requis en fonction de leurs besoins.

La section régionale du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse de la concurrence et des parts de marché des films vinyles auto-adhésifs imprimables en Amérique du Nord

Le paysage concurrentiel du marché des films vinyles auto-adhésifs imprimables en Amérique du Nord fournit des détails sur les concurrents. Les détails comprennent un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que les entreprises se concentrant sur le marché des films vinyles auto-adhésifs imprimables en Amérique du Nord.

Certains des principaux acteurs opérant sur le marché sont Brite Coatings Private Limited, Item Plastic Corp., 3M, AVERY DENNISON CORPORATION et Arlon Graphics, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 MANUFACTURING PROCESS LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE ANALYSIS FOR THE NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET

4.2.1 BARGAINING POWER OF BUYERS/CONSUMERS:

4.2.2 BARGAINING POWER OF SUPPLIERS:

4.2.3 THE THREAT OF NEW ENTRANTS:

4.2.4 THREAT OF SUBSTITUTES:

4.2.5 RIVALRY AMONG EXISTING COMPETITORS:

4.3 LIST OF KEY BUYERS

4.3.1 NORTH AMERICA

4.4 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILM MARKET: PRODUCTION CONSUMPTION ANALYSIS

4.5 CLIMATE CHANGE SCENARIO

4.5.1 ENVIRONMENTAL CONCERNS

4.5.2 INDUSTRY RESPONSE

4.5.3 GOVERNMENT’S ROLE

4.5.4 ANALYST RECOMMENDATION

4.6 TRADE ANALYSIS

4.7 RAW MATERIAL PRODUCTION COVERAGE

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 OVERVIEW

4.8.2 LOGISTIC COST SCENARIO

4.8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.9 TECHNOLOGICAL ADVANCEMENTS IN THE NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET

4.1 VENDOR SELECTION CRITERIA

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR PRINTABLE SELF-ADHESIVE VINYL FILMS IN CONSTRUCTION AND ARCHITECTURAL APPLICATIONS

6.1.2 RISING APPLICATIONS OF PRINTABLE SELF-ADHESIVE VINYL FILMS IN ADVERTISEMENTS

6.1.3 AVAILABILITY OF A WIDE RANGE OF SELF-ADHESIVE VINYL FILMS WITH DIFFERENT CHARACTERISTICS

6.2 RESTRAINTS

6.2.1 FLUCTUATION IN RAW MATERIAL PRICES

6.2.2 AVAILABILITY OF VARIOUS SUBSTITUTES

6.3 OPPORTUNITIES

6.3.1 NEW STRATEGIC DEVELOPMENTS AND INITIATIVES BY KEY MANUFACTURERS

6.3.2 RISING DEMAND FOR VEHICLE WRAPS

6.3.3 COMPANIES OFFERING SUSTAINABLE PRINTABLE SELF-ADHESIVE VINYL FILMS

6.4 CHALLENGES

6.4.1 HIGH COMPETITION AMONG KEY MANUFACTURERS

6.4.2 INCREASING ENVIRONMENTAL CONCERNS AND GOVERNMENT REGULATIONS

7 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS

7.1 OVERVIEW

7.2 CALENDERED FILMS

7.3 CAST FILMS

8 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS

8.1 OVERVIEW

8.2 THIN (2-3 MILS)

8.3 THICK (MORE THAN 3 MILS)

9 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE

9.1 OVERVIEW

9.2 OPAQUE

9.3 TRANSPARENT

9.4 TRANSLUCENT

10 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE

10.1 OVERVIEW

10.2 PLASTIC

10.3 FLOOR

10.4 GLASS

10.5 OTHERS

11 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 CAR WRAPPING

11.3 FLEET GRAPHICS

11.4 WATERCRAFT GRAPHICS

11.5 FLOOR GRAPHICS

11.6 WINDOW GRPAHICS

11.7 OUTDOOR ADVERTISING

11.8 LABLES& STICKERS

11.9 FURNITURE DECORATION

11.1 WALLCOVERING

11.11 EXHIBITION PANELS

11.12 OTHERS

12 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 COMPANY PROFILE

14.1 3M

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 SWOT

14.1.5 PRODUCT PORTFOLIO

14.1.6 RECENT DEVELOPMENTS

14.2 AVERY DENNISON CORPORATION

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 SWOT

14.2.5 PRODUCT PORTFOLIO

14.2.6 RECENT DEVELOPMENTS

14.3 ORAFOL EUROPE GMBH

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 SWOT

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 HENKEL ADHESIVES TECHNOLOGIES INDIA PRIVATE LIMITED

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 SWOT

14.4.5 PRODUCT PORTFOLIO

14.4.6 RECENT DEVELOPMENTS

14.5 LX HAUSYS

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 SWOT

14.5.5 PRODUCT PORTFOLIO

14.5.6 RECENT DEVELOPMENT

14.6 ACHILLIES CORPORATION

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 SWOT

14.6.4 PRODUCT PORTFOLIO

14.6.5 RECENT DEVELOPMENT

14.7 ARLON GRAPHICS, LLC.

14.7.1 COMPANY SNAPSHOT

14.7.2 SWOT

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 BRITE COATINGS PRIVATE LIMITED

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 SWOT

14.8.4 RECENT DEVELOPMENT

14.9 DRYTAC

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 SWOT

14.9.4 RECENT DEVELOPMENT

14.1 FLEXCON COMPANY, INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 SWOT

14.10.4 RECENT DEVELOPMENTS

14.11 HEXIS S.A.S.

14.11.1 COMPANY SNAPSHOT

14.11.2 SWOT

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENTS

14.12 INNOVIA FILMS

14.12.1 COMPANY SNAPSHOT

14.12.2 SWOT

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT

14.13 ITEM PLASTIC CORP.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 SWOT

14.13.4 RECENT DEVELOPMENTS

14.14 LINTEC CORPORATION

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 SWOT

14.14.4 PRODUCT PORTFOLIO

14.14.5 RECENT DEVELOPMENTS

14.15 METAMARK

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 SWOT

14.15.4 RECENT DEVELOPMENTS

14.16 POLI-TAPE GROUP

14.16.1 COMPANY SNAPSHOT

14.16.2 SWOT

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENT

14.17 RESPONSIVE INDUSTRIES LTD.

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 SWOT

14.17.4 PRODUCT PORTFOLIO

14.17.5 RECENT DEVELOPMENT

14.18 SHUBH PLASTICS

14.18.1 COMPANY SNAPSHOT

14.18.2 SWOT

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENT

14.19 STAHLS’ INTERNATIONAL

14.19.1 COMPANY SNAPSHOT

14.19.2 SWOT

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENTS

14.2 TEKRA, LLC.

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 SWOT

14.20.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF SELF-ADHESIVE PLATES, SHEETS, FILM, FOIL, TAPE, STRIP AND OTHER FLAT SHAPES, OF PLASTICS, WHETHER OR NOT IN ROLLS, HS CODE OF PRODUCT: 3919 (UNIT: US DOLLAR THOUSAND)

TABLE 2 EXPORT DATA OF SELF-ADHESIVE PLATES, SHEETS, FILM, FOIL, TAPE, STRIP AND OTHER FLAT SHAPES OF PLASTICS, WHETHER OR NOT IN ROLLS, HS CODE OF PRODUCT: 3919 (UNIT: US DOLLAR THOUSAND)

TABLE 3 LIST OF MAJOR RAW MATERIAL SUPPLIERS

TABLE 4 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA CALENDERED FILMS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA CAST FILMS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA THIN (2-3 MILS) IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA THICK (MORE THAN 3 MILS) IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA OPAQUE IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA TRANSPARENT IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA TRANSLUCENT IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA PLASTIC IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA FLOOR IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA GLASS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA OTHERS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA CAR WRAPPING IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA FLEET GRAPHICS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA WATERCRAFT GRAPHICS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA FLOOR GRAPHICS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA WINDOW GRAPHICS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA OUTDOOR ADVERTISING IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA LABELS & STICKERS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA FURNITURE DECORATION IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA WALLCOVERING IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA EXHIBITION PANELS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA OTHERS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 37 U.S. PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD MILLION)

TABLE 38 U.S. PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS, 2021-2030 (USD MILLION)

TABLE 39 U.S. PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 U.S. PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE, 2021-2030 (USD MILLION)

TABLE 41 U.S. PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 42 CANADA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD MILLION)

TABLE 43 CANADA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS, 2021-2030 (USD MILLION)

TABLE 44 CANADA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 CANADA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE, 2021-2030 (USD MILLION)

TABLE 46 CANADA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 47 MEXICO PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD MILLION)

TABLE 48 MEXICO PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS, 2021-2030 (USD MILLION)

TABLE 49 MEXICO PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 MEXICO PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE, 2021-2030 (USD MILLION)

TABLE 51 MEXICO PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: SEGMENTATION

FIGURE 10 INCREASING DEMAND FOR PRINTABLE SELF-ADHESIVE VINYL FILMS IN CONSTRUCTION AND ARCHITECTURAL APPLICATIONS IS EXPECTED TO DRIVE THE NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET IN THE FORECAST PERIOD FROM 2023 TO 2030

FIGURE 11 CALENDERED FILM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET IN 2023 & 2030

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET

FIGURE 13 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY MANUFACTURING PROCESS, 2022

FIGURE 14 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY THICKNESS, 2022

FIGURE 15 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY TYPE, 2022

FIGURE 16 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY SUBSTRATE, 2022

FIGURE 17 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY APPLICATION, 2022

FIGURE 18 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: SNAPSHOT (2022)

FIGURE 19 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY COUNTRY (2022)

FIGURE 20 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 21 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 22 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY MANUFACTURING PROCESS (2023-2030)

FIGURE 23 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.