Marché nord-américain de la transformation des pommes de terre, par catégorie (biologique et inorganique), type (congelé, séché et autres), forme (rond, râpé, dés, quartiers, tambours de pommes de terre et autres), emballage (sachets, canettes, boîtes en carton), application (industrie des collations, aliments pour bébés , plats préparés et prêts à cuire, mélanges de pâte, produits de boulangerie, garnitures et tartinades, et autres) Utilisateur final (secteur de la vente au détail/des ménages et de la restauration) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché de la transformation des pommes de terre en Amérique du Nord

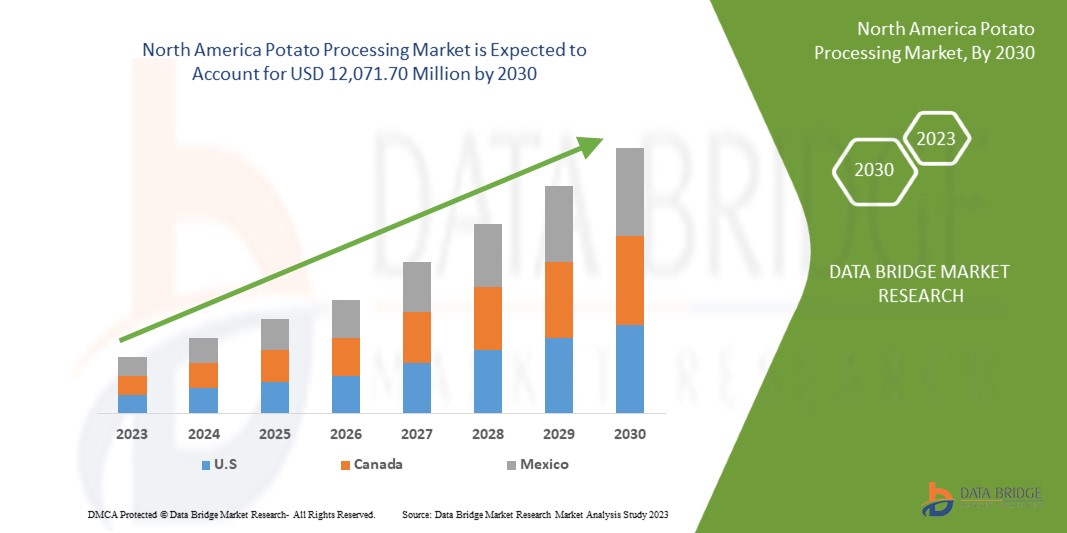

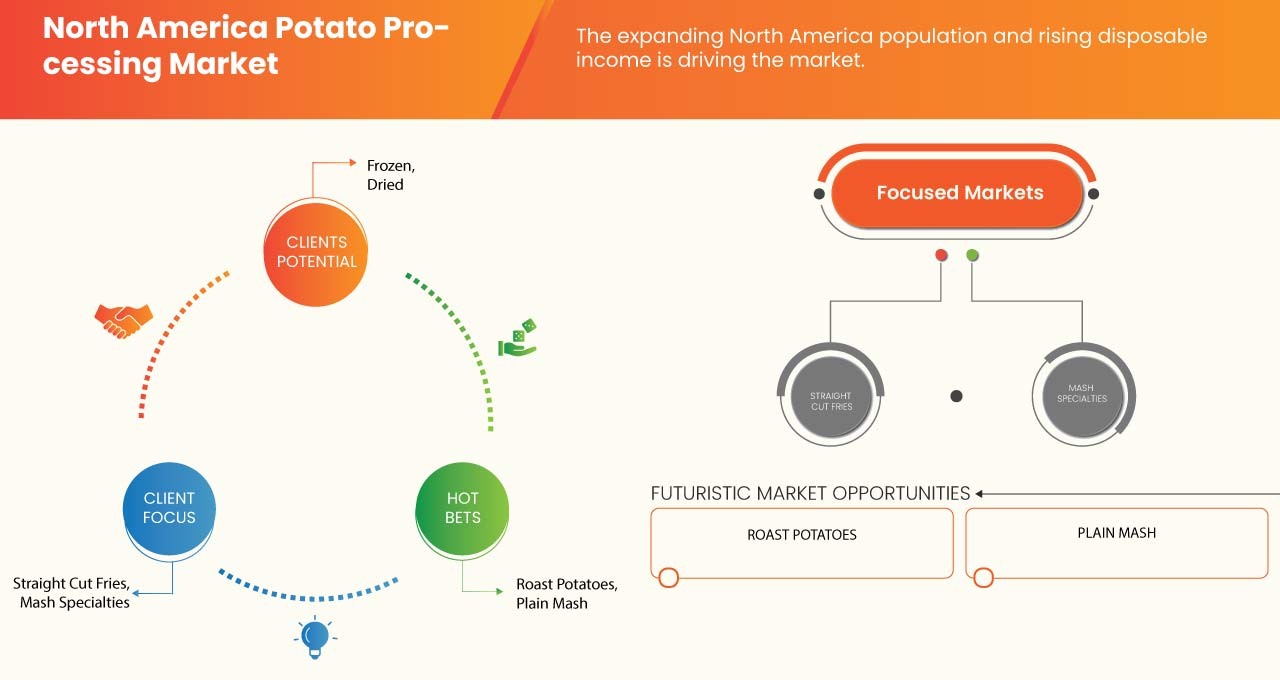

Le marché nord-américain de la transformation de la pomme de terre devrait connaître une croissance significative au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 4,5 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 12 071,70 millions USD d'ici 2030.

L’augmentation du nombre de consommateurs optant pour des plats préparés et des produits surgelés dans le monde entier est un facteur clé qui alimente l’expansion du marché de la transformation de la pomme de terre.

La disponibilité d'une gamme plus large de produits de transformation de la pomme de terre stimule l'expansion du marché. En outre, le marché est encore plus influencé par l'augmentation du nombre d'hôtels et de restaurants. De plus, l'augmentation des activités promotionnelles et du marketing sur les réseaux sociaux pour les produits de transformation de la pomme de terre a stimulé le marché. En plus de ces expansions, la R&D et la modernisation de la transformation de la pomme de terre sur le marché ont ouvert davantage de potentiel commercial.

Le rapport sur le marché de la transformation de la pomme de terre en Amérique du Nord fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Catégorie (biologique et inorganique), type (congelé, séché et autres), forme (rond, en lambeaux, en dés, en quartiers, en pilons de pommes de terre et autres), emballage (sachets, canettes, boîtes en carton), application (industrie des snacks, aliments pour bébés, plats préparés et prêts à cuire, mélanges de pâte, produits de boulangerie, garnitures et tartinades et autres), utilisateur final (secteur de la vente au détail/des ménages et de la restauration) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

Lamb Weston, Inc., Lutosa, Idahoan Foods, LLC., AGRANA Beteiligungs-AG, Alexia Foods., Farm Frites, HyFun Foods., JR Simplot Company, 11er Nahrungsmittel GmbH, Bem Brasil Alimentos, Cavendish Farms, Agrarfrost GmbH & Co. KG, McCain Foods Limited, Aviko, MASH DIRECT, JR Short Snack Products, Bart's Potato Company, The Kraft Heinz Company, Agristo et Himalaya Food International Ltd., entre autres |

Définition du marché

La transformation des pommes de terre implique une multitude de techniques pour obtenir les produits finis souhaités. Ce processus est généralement réalisé dans des usines de transformation de pommes de terre spécialisées, équipées de divers outils et équipements. Les étapes typiques de la production de frites, chips, flocons et fécule comprennent le nettoyage, l'épluchage, le lavage, le tranchage et le blanchiment des pommes de terre fraîches. Les produits à base de pommes de terre transformées sont utilisés par les ménages, les chaînes de restauration rapide et les restaurants car ils sont déjà partiellement préparés, ce qui réduit le temps nécessaire à la préparation de plats tels que les frites, les soupes, les salades et les snacks à base de pommes de terre. Les pommes de terre transformées sont utilisées dans diverses applications par de nombreuses industries utilisatrices finales, notamment l'industrie des snacks, l'industrie des aliments prêts à cuire, la boulangerie et l'industrie de la restauration, entre autres.

Dynamique du marché de la transformation de la pomme de terre en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteur

- Consommation croissante de plats préparés et de produits surgelés parmi les consommateurs

La demande de produits surgelés et de plats préparés est en hausse. De nombreux facteurs ont contribué à l’augmentation de la demande de produits de transformation surgelés et de pommes de terre. En raison de modes de vie plus occupés, les gens ont désormais besoin d’options de repas rapides et simples. Les produits à base de pommes de terre surgelées offrent une solution rapide et facile. De plus, les pommes de terre surgelées et les produits pratiques ont une durée de conservation plus longue que les produits à base de pommes de terre fraîches, ce qui en fait un choix judicieux pour les clients qui souhaitent s’approvisionner en produits de première nécessité. De plus, comme les pommes de terre surgelées et les produits pratiques sont adaptables et peuvent être utilisés dans une variété de plats, des accompagnements aux plats principaux, les cuisiniers à domicile et les prestataires de services alimentaires les privilégient. De plus, le coût des produits est économique, ce qui est un autre facteur important pour les personnes qui tentent de réduire leurs coûts d’épicerie. Dans l’ensemble, la demande croissante de produits de pommes de terre surgelés est motivée par une combinaison de commodité, d’utilité, de polyvalence et d’abordabilité.

Outre les facteurs susmentionnés, la demande croissante de produits de pommes de terre surgelés et de transformation pratique a également été influencée par la pandémie de COVID-19. La demande de produits de première nécessité ayant une durée de conservation plus longue, comme les produits de pommes de terre surgelés, a augmenté à mesure que de plus en plus de personnes restent à la maison et cuisinent plus fréquemment. La pandémie a également affecté la chaîne d'approvisionnement alimentaire mondiale, ce qui a entraîné des changements dans la disponibilité et le coût des produits frais. En tant que substitut plus fiable et plus rentable aux pommes de terre fraîches, les consommateurs se tournent de plus en plus vers les produits de pommes de terre surgelés. Dans l'ensemble, la pandémie a souligné l'importance de disposer d'options alimentaires fiables et pratiques à la maison, et les produits de pommes de terre surgelés sont un choix que les consommateurs font plus fréquemment.

Ainsi, plusieurs facteurs peuvent être attribués à la demande croissante de produits de pommes de terre surgelés et pratiques. La popularité des pommes de terre surgelées et des produits pratiques a été influencée par les modes de vie actifs, la durée de conservation plus longue, la polyvalence, l'accessibilité et les perturbations de la chaîne d'approvisionnement alimentaire en Amérique du Nord. Cette tendance a également été influencée par la pandémie de COVID-19, car les consommateurs recherchent des options fiables et pratiques pour remplir leurs garde-manger en période d'incertitude. En raison de la rapidité et de la facilité avec lesquelles ils peuvent être préparés, les pommes de terre surgelées et les produits pratiques sont désormais un ingrédient courant dans de nombreux foyers et restaurants. Les pommes de terre surgelées et les produits pratiques continueront probablement d'être des options populaires dans les années à venir, car la demande des consommateurs pour la commodité et l'aspect pratique augmente. Cette demande croissante de produits de pommes de terre surgelés et pratiques devrait stimuler le marché au cours de la période de prévision.

Opportunité

- Innovation technologique dans la transformation de la pomme de terre

Le marché nord-américain de la transformation de la pomme de terre connaît une croissance importante en raison de l'innovation technologique dans le secteur. Les avancées technologiques dans la transformation ont permis aux entreprises de transformation de la pomme de terre d'augmenter leur productivité, de réduire les déchets et de créer des produits nouveaux et inventifs, comme les frites aromatisées. De plus, ces développements technologiques ont amélioré le contrôle de la qualité des produits pour les transformateurs de pommes de terre, leur permettant de garantir que chaque lot de pommes de terre est traité de manière uniforme et selon des normes élevées de qualité et de sécurité. En outre, la recherche et le développement continus concernant les mesures de la qualité des pommes de terre transformées ou le contrôle de la transformation devraient créer une opportunité de croissance du marché à l'avenir.

Retenue/Défi

- Préoccupations environnementales défavorables

La pomme de terre est considérée comme une culture de climat tempéré. Elle est cultivée uniquement dans des conditions où la température pendant les saisons de croissance est modérément fraîche. La croissance végétative de la plante est optimale à une température de 24°C tandis que le développement du tubercule est favorisé à 20°C. La pomme de terre est cultivée comme culture d'été dans les collines et comme culture d'hiver dans les régions tropicales et subtropicales. La culture peut être cultivée jusqu'à une altitude de 3000 m au-dessus du niveau de la mer. La culture de la pomme de terre est compliquée car elle nécessite certaines conditions météorologiques et températures pour prospérer et pousser. Cela crée une difficulté pour les cultivateurs du monde entier, en raison des conditions météorologiques fluctuantes. En raison du réchauffement de l'Amérique du Nord, il est devenu difficile pour les cultivateurs de gérer ces conditions de température, ce qui a entraîné une diminution de la production de pommes de terre.

Ainsi, les fluctuations climatiques et les exigences spécifiques de température des pommes de terre ont été une raison de la diminution de la production de pommes de terre dans toutes les régions, ce qui affecte en fin de compte le marché de la transformation de la pomme de terre en Amérique du Nord, créant ainsi un frein majeur à la croissance du marché.

Développements récents

- En mars 2023, The Kraft Heinz Company, en collaboration avec BEES, a annoncé l'extension de leur partenariat pour dynamiser le marché B2B. L'objectif est de débloquer environ 1 million de nouveaux points de vente potentiels en Amérique latine (LATAM), notamment au Mexique, en Colombie et au Pérou. Le nouvel accord dans la région LATAM devrait servir de force motrice à Kraft Heinz pour réaliser sa stratégie sur les marchés émergents en élargissant ses points de distribution et en fournissant davantage de produits aux détaillants de la région.

- En février 2023, selon un communiqué de Lamb Weston Holdings Inc., les participations restantes dans la coentreprise européenne de la société avec Meijer Frozen Foods BV ont désormais été entièrement acquises. Le montant final de la transaction comprenait 1 952 421 actions ordinaires de Lamb Weston et 525 millions d'euros en espèces, sous réserve de certains ajustements. En octobre 2022, la société a déclaré son intention d'acquérir une participation dans la société. Cette acquisition a aidé l'entreprise à être plus compétitive sur le marché et à gagner une nouvelle base de consommateurs.

Portée du marché nord-américain de la transformation des pommes de terre

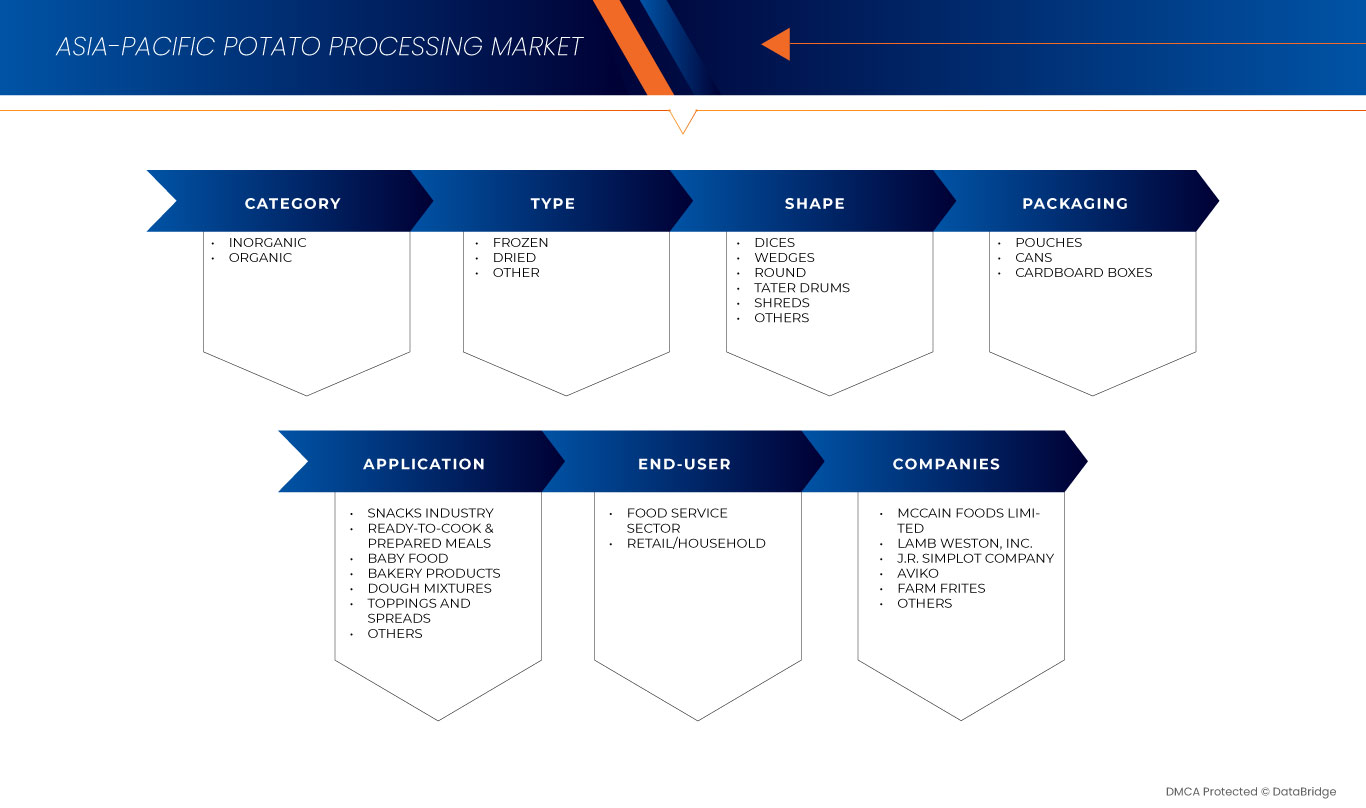

Le marché nord-américain de la transformation de la pomme de terre est segmenté en six segments notables en fonction de la catégorie, du type, de la forme, de l'emballage, de l'application et de l'utilisateur final. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Catégorie

- Organique

- Inorganique

Sur la base de la catégorie, le marché nord-américain de la transformation de la pomme de terre est segmenté en biologique et inorganique.

Taper

- Congelé

- Séché

- Autres

Sur la base du type, le marché nord-américain de la transformation des pommes de terre est segmenté en surgelées, séchées et autres.

Forme

- Rond

- Des lambeaux

- Dés

- Cales

- Tambours Tater

- Autres

Sur la base de la forme, le marché nord-américain de la transformation des pommes de terre est segmenté en rondelles, en lambeaux, en dés, en quartiers, en tambours de pommes de terre et autres.

Conditionnement

- Pochettes

- Canettes

- Boîtes en carton

Sur la base de l’emballage, le marché nord-américain de la transformation de la pomme de terre est segmenté en sachets, canettes et boîtes en carton.

Application

- Industrie des snacks

- Nourriture pour bébés

- Plats cuisinés et prêts à cuisiner

- Garnitures et tartinades

- Mélanges de pâte

- Produits de boulangerie

- Autres

Sur la base des applications, le marché nord-américain de la transformation des pommes de terre est segmenté en industrie des snacks, aliments pour bébés, plats préparés et prêts à cuisiner, garnitures et tartinades, mélanges de pâte, produits de boulangerie et autres.

Utilisateur final

- Commerce de détail/ménage

- Secteur de la restauration

Sur la base de l'utilisateur final, le marché nord-américain de la transformation de la pomme de terre est segmenté en secteurs de la vente au détail/des ménages et de la restauration.

Analyse/perspectives régionales du marché de la transformation des pommes de terre en Amérique du Nord

Le marché nord-américain de la transformation de la pomme de terre est segmenté en fonction de la catégorie, du type, de la forme, de l’emballage, de l’application et de l’utilisateur final.

Les pays du marché de la transformation de la pomme de terre en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Les États-Unis dominent le marché nord-américain de la transformation de la pomme de terre. Cette domination des États-Unis dans la région est due à l'utilisation croissante de la transformation de la pomme de terre et aux activités promotionnelles des acteurs du marché, ce qui stimule la demande de produits de transformation de la pomme de terre. Parallèlement, les fabricants lancent divers produits à base de pomme de terre qui stimulent la demande du marché.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse des données en aval et en amont de la chaîne de valeur, l'analyse des tendances techniques des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données par pays.

Analyse du paysage concurrentiel et des parts de marché de la transformation des pommes de terre en Amérique du Nord

Le paysage concurrentiel du marché de la transformation de la pomme de terre en Amérique du Nord fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises par rapport au marché de la transformation de la pomme de terre en Amérique du Nord.

Français Certains des principaux acteurs opérant sur le marché de la transformation de la pomme de terre en Amérique du Nord sont Lamb Weston, Inc., Lutosa, Idahoan Foods, LLC., AGRANA Beteiligungs-AG, Alexia Foods., Farm Frites, HyFun Foods., JR Simplot Company, 11er Nahrungsmittel GmbH, Bem Brasil Alimentos, Cavendish Farms, Agrarfrost GmbH & Co. KG, McCain Foods Limited, Aviko, MASH DIRECT, JR Short Snack Products, Bart's Potato Company, The Kraft Heinz Company, Agristo et Himalaya Food International Ltd. entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA POTATO PROCESSING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 MULTIVARIATE MODELLING

2.9 CATEGORY LIFELINE CURVE

2.1 MARKET END-USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 THREAT OF SUBSTITUTES

4.1.3 CUSTOMER BARGAINING POWER

4.1.4 SUPPLIER BARGAINING POWER

4.1.5 INTERNAL COMPETITION (RIVALRY)

4.2 BRAND OUTLOOK

4.2.1 COMPARATIVE BRAND ANALYSIS

4.2.2 PRODUCT VS BRAND OVERVIEW

4.3 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.4 IMPACT OF ECONOMIC SLOWDOWN

4.4.1 OVERVIEW

4.4.2 IMPACT ON PRICE

4.4.3 IMPACT ON SUPPLY CHAIN

4.4.4 IMPACT ON SHIPMENT

4.4.5 IMPACT ON COMPANY'S STRATEGIC DECISIONS

4.5 IMPORT-EXPORT ANALYSIS

4.6 TECHNOLOGICAL INNOVATIONS

4.7 FACTORS AFFECTING BUYING DECISION

4.7.1 LARGE PRODUCT RANGE

4.7.2 COMPANY AUTHENTICITY

4.7.3 DISPOSABLE INCOME

4.8 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.8.1 RISING ADOPTION OF ADVANCED TECHNOLOGIES IN THE POTATO PROCESSING INDUSTRY

4.8.2 CERTIFICATIONS AND LABELLING CLAIMS AMONG MANUFACTURERS

4.8.3 BUSINESS EXPANSIONS THROUGH DIFFERENT STRATEGIC DECISIONS

4.8.4 FUTURE PERSPECTIVE

4.9 PRICING INDEX

4.1 PRODUCTION CAPACITY OUTLOOK

4.11 RAW MATERIAL COVERAGE

4.11.1 FRENCH FRIES AND OTHER FROZEN POTATO PRODUCTS

4.11.2 DRIED POTATO PRODUCTS

4.11.3 PRE-COOKED AND READY-TO-EAT POTATO PRODUCTS

4.12 SUPPLY CHAIN ANALYSIS

4.12.1 RAW MATERIAL PROCUREMENT

4.12.2 PROCESSING

4.12.3 MARKETING AND DISTRIBUTION

4.12.4 END USERS

4.13 VALUE CHAIN ANALYSIS

4.14 REGULATION COVERAGE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING CONSUMPTION OF CONVENIENCE AND FROZEN FOODS AMONG THE CONSUMERS

5.1.2 GROWTH OF RESTAURANT AND QUICK SERVICE FOOD SECTORS

5.1.3 GROWING POPULATION AND DISPOSABLE INCOME OF CONSUMERS

5.1.1 AVAILABILITY OF WIDE RANGE VARIETIES OF PRODUCTS

5.2 RESTRAINTS

5.2.1 INCREASING HEALTH PROBLEMS ASSOCIATED WITH THE HIGHER CONSUMPTION OF PROCESSED POTATO SNACKS

5.2.2 UNFAVORABLE ENVIRONMENTAL CONCERNS

5.3 OPPORTUNITIES

5.3.1 TECHNOLOGICAL INNOVATION IN POTATO PROCESSING

5.3.2 INCREASING DEMAND FOR ORGANIC POTATO PROCESSING PRODUCTS

5.4 CHALLENGES

5.4.1 HIGH COST ASSOCIATED WITH POTATO CHIPS MACHINES

5.4.2 FLUCTUATION IN PRICES OF RAW MATERIALS

6 NORTH AMERICA POTATO PROCESSING MARKET, BY REGION

6.1 NORTH AMERICA

6.1.1 U.S.

6.1.2 MEXICO

6.1.3 CANADA

7 COMPANY LANDSCAPE

7.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

8 SWOT ANALYSIS

9 COMPANY PROFILES

9.1 MCCAIN FOODS LIMITED

9.1.1 COMPANY SNAPSHOT

9.1.2 COMPANY SHARE ANALYSIS

9.1.3 PRODUCT PORTFOLIO

9.1.4 RECENT DEVELOPMENTS

9.2 LAMB WESTON, INC. (2022)

9.2.1 COMPANY SNAPSHOT

9.2.2 REVENUE ANALYSIS

9.2.3 COMPANY SHARE ANALYSIS

9.2.4 PRODUCT PORTFOLIO

9.2.5 RECENT DEVELOPMENTS

9.3 J.R. SIMPLOT COMPANY

9.3.1 COMPANY SNAPSHOT

9.3.2 COMPANY SHARE ANALYSIS

9.3.3 PRODUCT PORTFOLIO

9.3.4 RECENT DEVELOPMENT

9.4 AVIKO

9.4.1 COMPANY SNAPSHOT

9.4.2 COMPANY SHARE ANALYSIS

9.4.3 PRODUCT PORTFOLIO

9.4.4 RECENT DEVELOPMENTS

9.5 FARM FRITES

9.5.1 COMPANY SNAPSHOT

9.5.2 COMPANY SHARE ANALYSIS

9.5.3 PRODUCT PORTFOLIO

9.5.4 RECENT DEVELOPMENTS

9.6 11ER NAHRUNGSMITTEL GMBH

9.6.1 COMPANY SNAPSHOT

9.6.2 PRODUCT PORTFOLIO

9.6.3 RECENT DEVELOPMENT

9.7 AGRANA BETEILIGUNGS-AG (2022)

9.7.1 COMPANY SNAPSHOT

9.7.2 REVENUE ANALYSIS

9.7.3 PRODUCT PORTFOLIO

9.7.4 RECENT DEVELOPMENT

9.8 AGRARFROST GMBH & CO. KG GMBH & CO. KG

9.8.1 COMPANY SNAPSHOT

9.8.2 PRODUCT PORTFOLIO

9.8.3 RECENT DEVELOPMENTS

9.9 AGRISTO

9.9.1 COMPANY SNAPSHOT

9.9.2 PRODUCT PORTFOLIO

9.9.3 RECENT DEVELOPMENT

9.1 ALEXIA FOODS.

9.10.1 COMPANY SNAPSHOT

9.10.2 PRODUCT PORTFOLIO

9.10.3 RECENT DEVELOPMENTS

9.11 BART’S POTATO COMPANY

9.11.1 COMPANY SNAPSHOT

9.11.2 PRODUCT PORTFOLIO

9.11.3 RECENT DEVELOPMENTS

9.12 BEM BRASIL ALIMENTOS

9.12.1 COMPANY SNAPSHOT

9.12.2 PRODUCT PORTFOLIO

9.12.3 RECENT DEVELOPMENT

9.13 CAVENDISH FARMS

9.13.1 COMPANY SNAPSHOT

9.13.2 PRODUCT PORTFOLIO

9.13.3 RECENT DEVELOPMENTS

9.14 HIMALAYA FOOD INTERNATIONAL LTD. (2022)

9.14.1 COMPANY SNAPSHOT

9.14.2 REVENUE ANALYSIS

9.14.3 PRODUCT PORTFOLIO

9.14.4 RECENT DEVELOPMENT

9.15 HYFUN FOODS.

9.15.1 COMPANY SNAPSHOT

9.15.2 PRODUCT PORTFOLIO

9.15.3 RECENT DEVELOPMENT

9.16 IDAHOAN FOODS, LLC.

9.16.1 COMPANY SNAPSHOT

9.16.2 PRODUCT PORTFOLIO

9.16.3 RECENT DEVELOPMENTS

9.17 J.R. SHORT SNACK PRODUCTS

9.17.1 COMPANY SNAPSHOT

9.17.2 PRODUCT PORTFOLIO

9.17.3 RECENT DEVELOPMENTS

9.18 LUTOSA

9.18.1 COMPANY SNAPSHOT

9.18.2 PRODUCT PORTFOLIO

9.18.3 RECENT DEVELOPMENT

9.19 MASH DIRECT

9.19.1 COMPANY SNAPSHOT

9.19.2 PRODUCT PORTFOLIO

9.19.3 RECENT DEVELOPMENTS

9.2 THE KRAFT HEINZ COMPANY (2022)

9.20.1 COMPANY SNAPSHOT

9.20.2 REVENUE ANALYSIS

9.20.3 PRODUCT PORTFOLIO

9.20.4 RECENT DEVELOPMENTS

10 QUESTIONNAIRE

11 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF "POTATOES, PREPARED OR PRESERVED OTHERWISE THAN BY VINEGAR OR ACETIC ACID, FROZEN"; HS CODE OF PRODUCT: 200410

TABLE 2 IMPORT DATA OF " POTATOES, PREPARED OR PRESERVED OTHERWISE THAN BY VINEGAR OR ACETIC ACID (EXCLUDING FROZEN)"; HS CODE OF PRODUCT: 200520

TABLE 3 EXPORT DATA OF " POTATOES, PREPARED OR PRESERVED OTHERWISE THAN BY VINEGAR OR ACETIC ACID, FROZEN"; HS CODE OF PRODUCT: 200410

TABLE 4 EXPORT DATA OF " POTATOES, PREPARED OR PRESERVED OTHERWISE THAN BY VINEGAR OR ACETIC ACID (EXCLUDING FROZEN)"; HS CODE OF PRODUCT: 200520

TABLE 5 TOP 5 COMPANIES - PRODUCTION CAPACITY ANALYSIS

TABLE 6 SUPPLY CHAIN OF THE NORTH AMERICA POTATO PROCESSING MARKET

TABLE 7 REGULATORY COVERAGE

TABLE 8 NORTH AMERICA POTATO PROCESSING MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA POTATO PROCESSING MARKET, BY COUNTRY, 2021-2030 (KILO TONS)

TABLE 10 NORTH AMERICA POTATO PROCESSING MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA POTATO PROCESSING MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 12 NORTH AMERICA POTATO PROCESSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA FROZEN IN POTATO PROCESSING MARKET, BY SEGMENT, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY SEGMENT, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA CUT SPECIALTIES IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA MASH SPECIALTIES IN POTATO PROCESSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA SHREDDED SPECIALTIES IN POTATO PROCESSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA POTATO PROCESSING MARKET, BY SHAPE, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA POTATO PROCESSING MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA POTATO PROCESSING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA POTATO PROCESSING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA FOOD SERVICE SECTOR IN POTATO PROCESSING MARKET, BY SEGMENT, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA RESTAURANTS IN POTATO PROCESSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA RESTAURANTS IN POTATO PROCESSING MARKET, BY SERVICE CATEGORY, 2021-2030 (USD MILLION)

TABLE 26 U.S. POTATO PROCESSING MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 27 U.S. POTATO PROCESSING MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 28 U.S. POTATO PROCESSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 U.S. FROZEN IN POTATO PROCESSING MARKET, BY SEGMENT, 2021-2030 (USD MILLION)

TABLE 30 U.S. FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 U.S. POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY SEGMENT, 2021-2030 (USD MILLION)

TABLE 32 U.S. CUT SPECIALTIES IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 33 U.S. MASH SPECIALTIES IN POTATO PROCESSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 U.S. SHREDDED SPECIALTIES IN POTATO PROCESSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 U.S. POTATO PROCESSING MARKET, BY SHAPE, 2021-2030 (USD MILLION)

TABLE 36 U.S. POTATO PROCESSING MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 37 U.S. POTATO PROCESSING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 38 U.S. POTATO PROCESSING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 39 U.S. FOOD SERVICE SECTOR IN POTATO PROCESSING MARKET, BY SEGMENT, 2021-2030 (USD MILLION)

TABLE 40 U.S. RESTAURANTS IN POTATO PROCESSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 41 U.S. RESTAURANTS IN POTATO PROCESSING MARKET, BY SERVICE CATEGORY, 2021-2030 (USD MILLION)

TABLE 42 MEXICO POTATO PROCESSING MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 43 MEXICO POTATO PROCESSING MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 44 MEXICO POTATO PROCESSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 MEXICO FROZEN IN POTATO PROCESSING MARKET, BY SEGMENT, 2021-2030 (USD MILLION)

TABLE 46 MEXICO FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 MEXICO POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY SEGMENT, 2021-2030 (USD MILLION)

TABLE 48 MEXICO CUT SPECIALTIES IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 49 MEXICO MASH SPECIALTIES IN POTATO PROCESSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 MEXICO SHREDDED SPECIALTIES IN POTATO PROCESSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 MEXICO POTATO PROCESSING MARKET, BY SHAPE, 2021-2030 (USD MILLION)

TABLE 52 MEXICO POTATO PROCESSING MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 53 MEXICO POTATO PROCESSING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 54 MEXICO POTATO PROCESSING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 55 MEXICO FOOD SERVICE SECTOR IN POTATO PROCESSING MARKET, BY SEGMENT, 2021-2030 (USD MILLION)

TABLE 56 MEXICO RESTAURANTS IN POTATO PROCESSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 MEXICO RESTAURANTS IN POTATO PROCESSING MARKET, BY SERVICE CATEGORY, 2021-2030 (USD MILLION)

TABLE 58 CANADA POTATO PROCESSING MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 59 CANADA POTATO PROCESSING MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 60 CANADA POTATO PROCESSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 CANADA FROZEN IN POTATO PROCESSING MARKET, BY SEGMENT, 2021-2030 (USD MILLION)

TABLE 62 CANADA FROZEN FRENCH FRIES IN POTATO PROCESSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 63 CANADA POTATO SPECIALTIES IN POTATO PROCESSING MARKET, BY SEGMENT, 2021-2030 (USD MILLION)

TABLE 64 CANADA CUT SPECIALTIES IN POTATO PROCESSING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 65 CANADA MASH SPECIALTIES IN POTATO PROCESSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 CANADA SHREDDED SPECIALTIES IN POTATO PROCESSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 CANADA POTATO PROCESSING MARKET, BY SHAPE, 2021-2030 (USD MILLION)

TABLE 68 CANADA POTATO PROCESSING MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 69 CANADA POTATO PROCESSING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 70 CANADA POTATO PROCESSING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 71 CANADA FOOD SERVICE SECTOR IN POTATO PROCESSING MARKET, BY SEGMENT, 2021-2030 (USD MILLION)

TABLE 72 CANADA RESTAURANTS IN POTATO PROCESSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 73 CANADA RESTAURANTS IN POTATO PROCESSING MARKET, BY SERVICE CATEGORY, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA POTATO PROCESSING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA POTATO PROCESSING MARKET: DATA TRIANGULATION

FIGURE 3 THE NORTH AMERICA POTATO PROCESSING MARKET : DROC ANALYSIS

FIGURE 4 THE NORTH AMERICA POTATO PROCESSING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA POTATO PROCESSING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA POTATO PROCESSING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA POTATO PROCESSING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA POTATO PROCESSING MARKET: MARKET END-USER COVERAGE GRID

FIGURE 9 THE NORTH AMERICA POTATO PROCESSING MARKET: SEGMENTATION

FIGURE 10 RISING DEMAND FOR FROZEN AND DEHYDRATED POTATO PRODUCTS AMONG CONSUMERS IS DRIVING THE GROWTH OF THE NORTH AMERICA POTATO PROCESSING MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 THE INORGANIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA POTATO PROCESSING MARKET IN 2023 & 2030

FIGURE 12 FIGURE: PORTER'S FIVE FORCES

FIGURE 13 VALUE CHAIN OF THE NORTH AMERICA POTATO PROCESSING MARKET

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA POTATO PROCESSING MARKET

FIGURE 15 NORTH AMERICA POTATO PROCESSING MARKET, BY SNAPSHOT (2022)

FIGURE 16 NORTH AMERICA POTATO PROCESSING MARKET, BY COUNTRY (2022)

FIGURE 17 NORTH AMERICA POTATO PROCESSING MARKET, BY COUNTRY (2023 & 2030)

FIGURE 18 NORTH AMERICA POTATO PROCESSING, BY COUNTRY (2022 & 2030)

FIGURE 19 NORTH AMERICA POTATO PROCESSING, BY CATEGORY (2023 - 2030)

FIGURE 20 NORTH AMERICA POTATO PROCESSING MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.