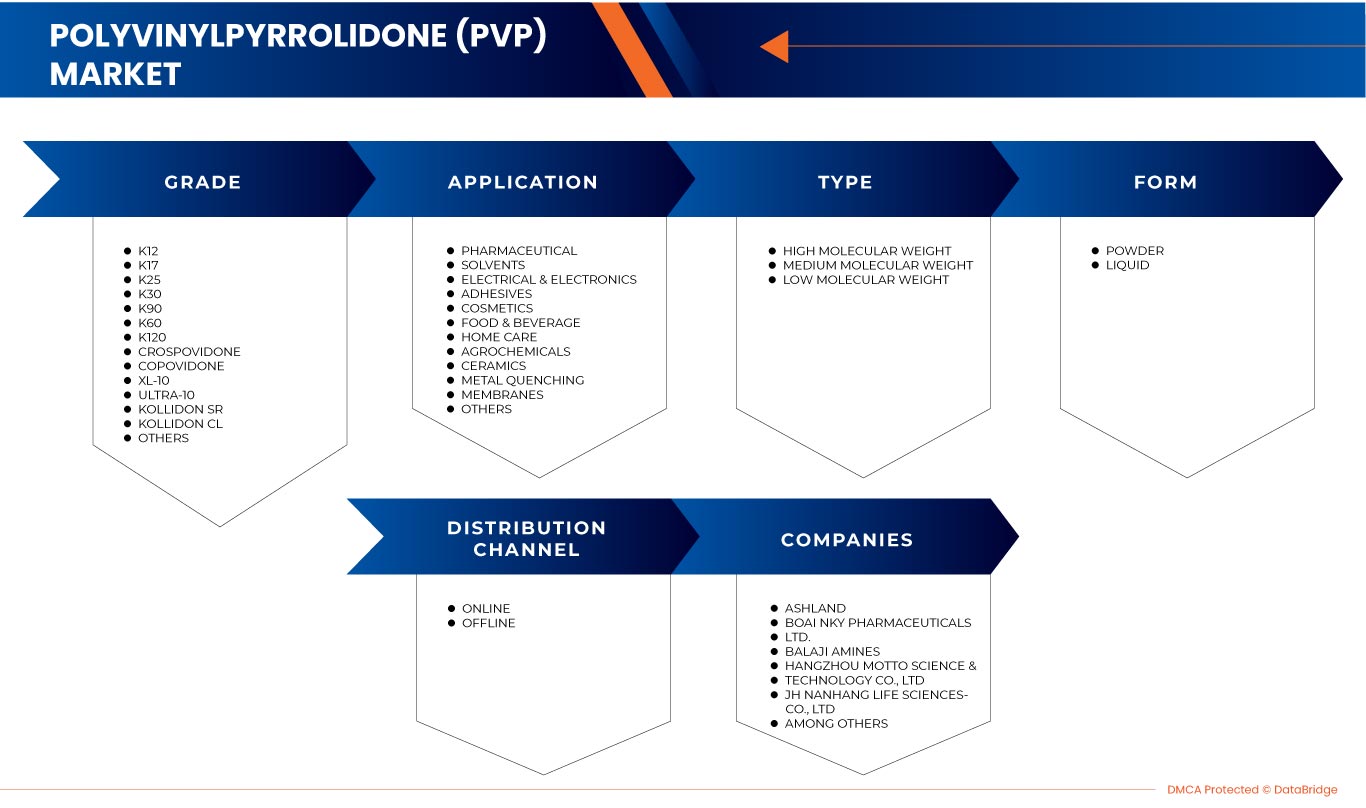

Marché nord-américain de la polyvinylpyrrolidone (PVP), par grade (K30, K90, K12, K25, K17, K60, K120, Kollidon SR, Kollidon CL, Crospovidone, Copovidone, XL-10, Ultra-10 et autres), type (poids moléculaire moyen, poids moléculaire élevé et faible poids moléculaire), forme (poudre et liquide), application (produits pharmaceutiques, cosmétiques, solvants, électricité et électronique, adhésifs, produits agrochimiques , aliments et boissons, membranes, céramique, soins à domicile, trempe des métaux et autres), canal de distribution (hors ligne et en ligne) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché de la polyvinylpyrrolidone (PVP) en Amérique du Nord

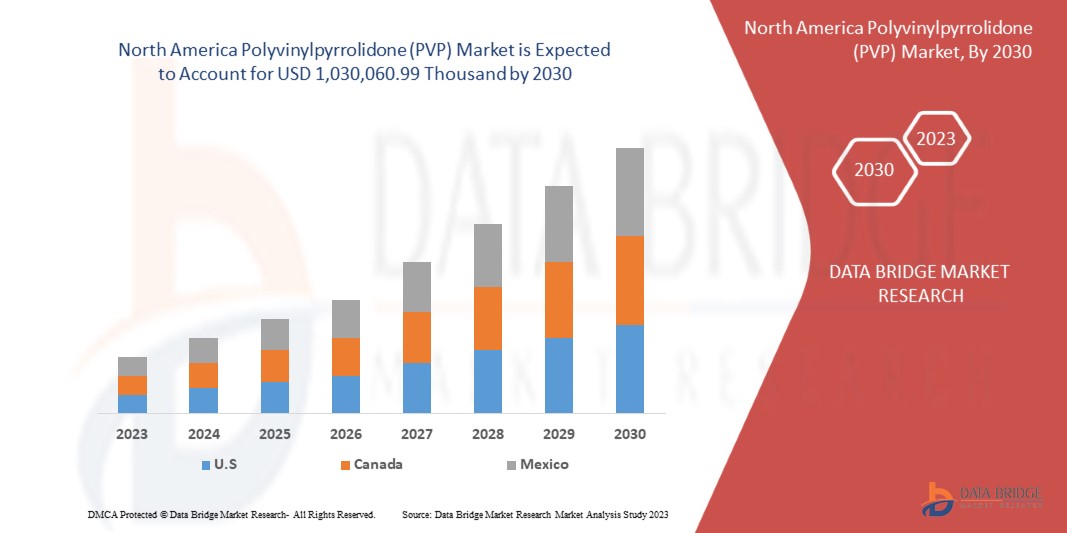

Le marché nord-américain de la polyvinylpyrrolidone (PVP) devrait connaître une croissance du marché au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît à un TCAC de 6,8 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 1 030 060,99 milliers de dollars d'ici 2030. L'application en tant qu'excipient dans les produits pharmaceutiques est un facteur important pour le marché nord-américain de la polyvinylpyrrolidone (PVP).

Le rapport sur le marché de la polyvinylpyrrolidone (PVP) fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et localisé, analyse les opportunités en termes de poches de revenus émergentes, les changements dans la réglementation du marché, les approbations de produits, les décisions stratégiques, les lancements de produits, les expansions géographiques et les innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable pour 2020-2015) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Par grade (K30, K90, K12, K25, K17, K60, K120, Kollidon SR, Kollidon CL, Crospovidone, Copovidone, XL-10, Ultra-10 et autres), type (poids moléculaire moyen, poids moléculaire élevé et faible poids moléculaire), forme (poudre et liquide), application (produits pharmaceutiques, cosmétiques, solvants, électricité et électronique, adhésifs, produits agrochimiques, aliments et boissons, membranes, céramiques , produits d'entretien, trempe des métaux et autres), canal de distribution (hors ligne et en ligne) |

|

Pays couverts |

États-Unis, Canada, Mexique |

|

Acteurs du marché couverts |

Ashland, BALAJI AMINES, Hangzhou Motto Science & Technology Co., Ltd., NIPPON SHOKUBAI CO., LTD., BASF SE, Merck KGaA, Alfa Aesar et Thermo Fisher Scientific, entre autres |

Définition du marché

La polyvinylpyrrolidone est également connue sous le nom de povidone ou PVP. Elle est couramment utilisée dans l'industrie pharmaceutique comme véhicule polymère synthétique pour disperser et suspendre des médicaments. La PVP est utilisée dans diverses opérations pharmaceutiques, notamment comme liant pour comprimés et gélules, comme filmogène pour solutions ophtalmiques, comme liquide aromatisant et comme comprimé à croquer, et comme adhésif pour systèmes transdermiques. La PVP se présente sous la forme d'une poudre blanche à légèrement blanc cassé et peut se dissoudre dans les solvants aqueux et huileux. La PVP est de plus en plus utilisée pour sa biocompatibilité, son absence de toxicité et sa grande capacité à former des complexes interpolymères. Ainsi, le marché de la PVP devrait croître en raison de la demande de PVP dans la conception de matériaux pour différentes applications en tant que biomatériaux à usage médical et non médical.

Dynamique du marché nord-américain de la polyvinylpyrrolidone (PVP)

Conducteurs

-

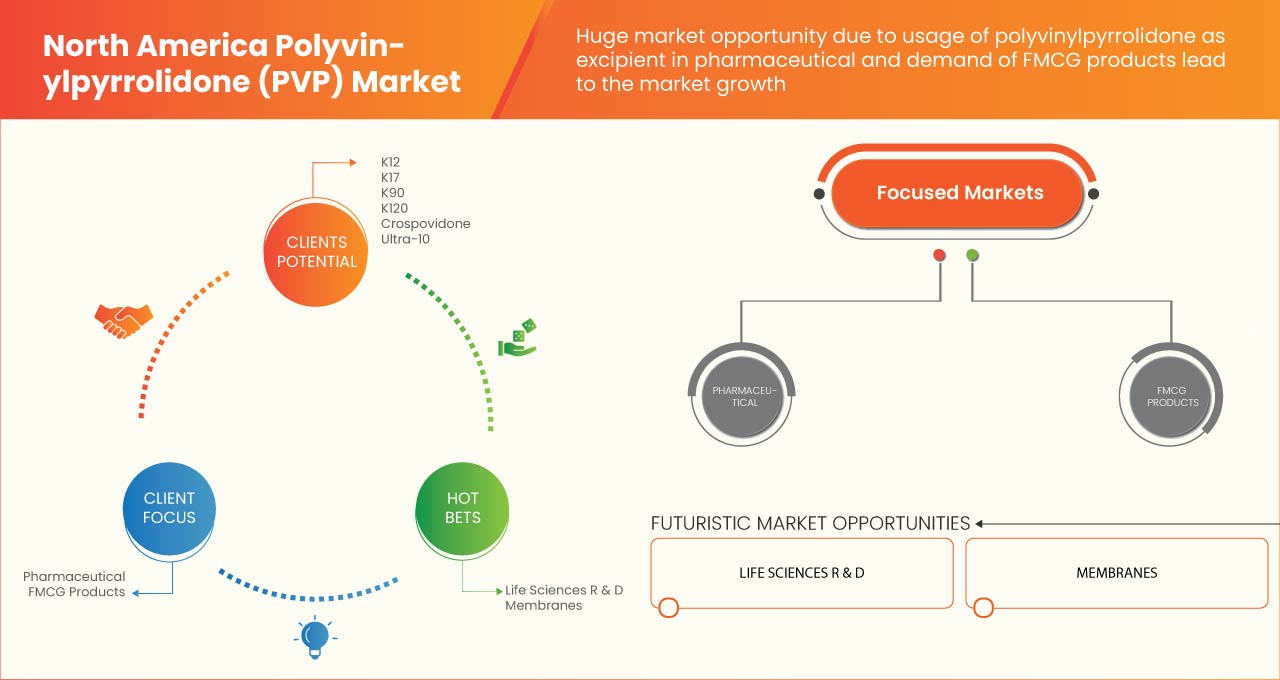

Application comme excipient dans les produits pharmaceutiques

Les excipients sont des composants médicinaux inertes utilisés dans le développement de produits pharmaceutiques. Chaque excipient a sa fonction unique, comme désintégrant, ajusteur de pH, liant ou solvant. Ils sont largement utilisés dans le processus de formulation de médicaments pour améliorer la stabilisation à long terme, fournir des formulations solides plus résistantes et améliorer la biodisponibilité des médicaments thérapeutiques. L'augmentation des maladies chroniques, la demande croissante de médicaments génériques et le développement de nouveaux principes actifs pharmaceutiques et vaccins sont quelques-uns des facteurs qui stimulent la demande et l'utilisation dans les industries pharmaceutiques. La récente pandémie de COVID-19 a également influencé la croissance du marché mondial des excipients en raison de la demande accrue de médicaments pharmaceutiques.

-

Croissance du secteur des biens de consommation à évolution rapide

Le terme « biens de consommation courante » (FMCG) désigne les biens emballés qui sont achetés ou vendus souvent et en petites quantités. Le FMCG se compose de diverses industries qui sont engagées dans la production de cosmétiques, de produits de soins personnels, d'aliments et de boissons, de produits d'entretien ménager et autres. Ces produits sont achetés à petite échelle auprès des consommateurs dans les supermarchés et les épiceries. L'augmentation des revenus disponibles, les nouvelles technologies de fabrication des produits, l'augmentation des investissements directs étrangers, les cadres gouvernementaux favorables, les stratégies de marketing uniques, l'urbanisation rapide et l'essor des plateformes de commerce électronique sont les facteurs qui ont provoqué la croissance de l'industrie des biens de consommation courante.

-

Augmentation de la demande des industries utilisatrices finales

La polyvinylpyrrolidone est utilisée dans différentes industries d'utilisation finale, telles que les adhésifs, les peintures, l'électronique, la céramique et les membranes. Le polymère possède des propriétés importantes telles qu'une solubilité élevée, une réticulabilité, une polarité élevée et une hydrophilie qui en font une option efficace pour une utilisation dans la production d'adhésifs. Ces adhésifs ont une viscosité élevée, qui est également utilisée dans la liaison de matériaux comme le bois et le papier et dans l'industrie de la construction. En raison de sa propriété de liaison, il est utilisé comme agent liant dans la production de céramiques telles que les carreaux et les briques. De même, la polyvinylpyrrolidone est utilisée à grande échelle dans l'industrie électronique, comme dans la fabrication de batteries, de cellules solaires inorganiques, de tubes cathodiques et de circuits imprimés.

Opportunités

-

Croissance des activités de recherche et développement

Le polymère possède des propriétés exceptionnelles en tant qu'excipient dans les produits pharmaceutiques et a également été approuvé par la FDA américaine comme un produit chimique généralement reconnu comme sûr. La recherche sur de nouveaux médicaments thérapeutiques pour guérir les maladies offre une énorme opportunité pour la croissance du marché nord-américain de la polyvinylpyrrolidone.

La polyvinylpyrrolidone a également des applications en biologie moléculaire. Elle est utilisée comme ingrédient dans la préparation de la solution de Denhardt, qui est employée dans les techniques d'hybridation des acides nucléiques comme l'analyse Southern blot. Le polymère peut également être utilisé dans les expériences d'isolement des acides nucléiques. Il a la propriété exceptionnelle d'absorber les polyphénols lors de la purification des acides nucléiques

-

Perspectives favorables pour l’industrie chimique dans les économies émergentes

La diversité des applications industrielles, la forte consommation, l'augmentation des revenus et de l'urbanisation, l'augmentation des investissements directs étrangers et le potentiel d'exportation prometteur sont quelques-uns des facteurs qui encouragent la croissance de l'industrie chimique dans les économies en développement comme l'Inde et la Chine. Les opportunités à venir de fabrication de produits chimiques et de polymères spécialisés créeront une énorme demande intérieure et le pays sera auto-efficace dans la production de produits chimiques. De plus, les investissements des pays développés ou la création d'une usine chimique dans les économies émergentes peuvent offrir une large opportunité de croissance du marché nord-américain de la polyvinylpyrrolidone.

Retenue

- Volatilité des prix des matières premières

Fabriquée à partir du monomère N-vinylpyrrolidone, la polyvinylpyrrolidone est un polymère hydrocarboné aromatique. La réaction de l'acétylène et de la 2-pyrrolidone permet d'obtenir de la polyvinylpyrrolidone. Parallèlement, un initiateur comme le 2,2'-azobisisobutyronitrile est utilisé dans la production de polyvinylpyrrolidone. Il est raisonnable de prévoir que, l'acétylène étant le produit du traitement du pétrole et du gaz naturel, ses prix suivront le prix du pétrole brut. De plus, les installations nécessaires à la production de cette polyvinylpyrrolidone nécessitent des capitaux importants et une infrastructure étendue.

- Utilisation de produits chimiques nocifs dans la production de polyvinylpyrrolidone

Le produit chimique 2-pyrrolidone, lorsqu'il est exposé aux yeux, peut provoquer une irritation et des lésions graves. Le produit chimique peut provoquer une inflammation de la peau et des voies respiratoires en cas d'exposition prolongée. L'acétylène est un gaz qui s'enflamme facilement et qui a de graves effets sur la santé. S'il est inhalé, l'acétylène peut provoquer des nausées, des étourdissements, des maux de tête et des vomissements, des troubles du rythme cardiaque, de l'hypertension artérielle et des difficultés respiratoires. L'exposition à long terme à des produits chimiques comme le 2,2'-azobisisobutyronitrile et le peroxyde d'hydrogène entraîne de graves problèmes de santé, tels que des problèmes respiratoires et cutanés.

DÉFI

- Menace crédible d'autres substituts

La polyvinylpyrrolidone est l'un des polymères les plus utilisés en raison de sa large gamme d'applications. En raison de ses propriétés uniques, elle joue un rôle important d'excipient comme liant dans la production de produits pharmaceutiques. Cependant, la production de polyvinylpyrrolidone nécessite des produits chimiques nocifs qui ont des effets secondaires négatifs sur la santé. Le polymère n'est pas non plus biodégradable. Ainsi, il reste longtemps dans l'environnement. En raison de ces inconvénients, les consommateurs recherchent d'autres substituts qui sont également durables dans la nature.

L'hyaluronate est l'une des alternatives naturellement disponibles à la polyvinylpyrrolidone artificielle, qui a été remplacée dans les applications d'injection intracytoplasmique de spermatozoïdes .

Développement récent

6 octobre 2022, Selon le Times of India, le secteur FMCG d'Amérique du Nord est bien placé pour croître de 310,5 milliards USD entre 2022 et 2026, principalement en raison d'une augmentation de la consommation de produits alimentaires prêts à consommer

Portée du marché nord-américain de la polyvinylpyrrolidone (PVP)

Le marché nord-américain de la polyvinylpyrrolidone (PVP) est classé en catégories de qualité, de type, de forme, d'application et de canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Grade

- K30

- K90

- K12

- K25

- K17

- K60

- K120

- Crospovidone

- Copovidone

- XL-10

- Ultra-10

- Kollidon SR

- Kollidon CL

- Autres

Sur la base de la qualité, le marché est segmenté en K30, K90, K12, K25, K17, K60, K120, Crosopovidone, Copovidone, XL-10, Ultra-10, Kollidon SR, Kollidon CL et autres.

Taper

- Poids moléculaire moyen

- Poids moléculaire élevé

- Faible poids moléculaire

Sur la base du type, le marché est segmenté en poids moléculaire moyen, poids moléculaire élevé, faible poids moléculaire et autres.

Formulaire

- Poudre

- Liquide

Sur la base de la forme, le marché est segmenté en poudre, liquide et autres.

Application

- Pharmaceutique

- produits de beauté

- Solvants

- Électricité et électronique

- Adhésifs

- Produits agrochimiques

- Alimentation et boissons

- Membranes

- Céramique

- Soins à domicile

- Trempe des métaux

- Autres

Sur la base des applications, le marché est segmenté en produits pharmaceutiques, cosmétiques, solvants, produits électriques et électroniques, adhésifs, produits agrochimiques, aliments et boissons, membranes, céramiques, soins à domicile, trempe des métaux et autres.

Canal de distribution

- Hors ligne

- En ligne

Sur la base des canaux de distribution, le marché est segmenté hors ligne et en ligne.

Analyse/perspectives régionales du marché nord-américain de la polyvinylpyrrolidone (PVP)

La polyvinylpyrrolidone (PVP) d’Amérique du Nord est analysée et des informations sur la taille du marché sont fournies par pays, qualité, type, forme, application et canal de distribution, comme référencé ci-dessus.

Les pays couverts sont les États-Unis, le Canada et le Mexique.

Les États-Unis dominent le marché en raison de la croissance rapide du secteur des biens de consommation, et une augmentation de la demande des industries utilisatrices finales devrait offrir des opportunités dans la région.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie du pays, les actes réglementaires et les tarifs douaniers d'import-export sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales et l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du polyvinylpyrrolidone (PVP)

Le paysage concurrentiel du marché nord-américain de la polyvinylpyrrolidone (PVP) fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais cliniques, l'analyse de la marque, les approbations de produits, les brevets, la largeur et l'ampleur du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise sur le marché nord-américain de la polyvinylpyrrolidone (PVP).

Certains des principaux acteurs couverts dans le rapport sont Ashland, BALAJI AMINES, Hangzhou Motto Science & Technology Co., Ltd., NIPPON SHOKUBAI CO., LTD., BASF SE, Merck KGaA, Alfa Aesar et Thermo Fisher Scientific, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 GRADE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT’S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 LIST OF KEY PATENTS LAUNCHED

4.5 SUPPLY CHAIN ANALYSIS

4.6 VENDOR SELECTION CRITERIA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 APPLICATION AS EXCIPIENT IN PHARMACEUTICAL PRODUCTS

5.1.2 GROWTH IN THE FAST-MOVING CONSUMER GOODS INDUSTRY

5.1.3 INCREASE IN DEMAND FROM END-USER INDUSTRIES

5.2 RESTRAINTS

5.2.1 VOLATILITY IN RAW MATERIAL PRICES

5.2.2 USAGE OF HARMFUL CHEMICALS IN POLYVINYLPYRROLIDONE PRODUCTION

5.3 OPPORTUNITIES

5.3.1 GROWTH IN RESEARCH AND DEVELOPMENT ACTIVITIES

5.3.2 SUPPORTIVE CHEMICAL INDUSTRY OUTLOOK IN EMERGING ECONOMIES

5.4 CHALLENGES

5.4.1 CREDIBLE THREAT OF OTHER SUBSTITUTES

6 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE

6.1 OVERVIEW

6.2 K30

6.3 K90

6.4 K12

6.5 K25

6.6 K17

6.7 K60

6.8 K120

6.9 CROSPOVIDONE

6.1 COPOVIDONE

6.11 XL-10

6.12 ULTRA-10

6.13 KOLLIDON SR

6.14 KOLLIDON CL

6.15 OTHERS

7 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE

7.1 OVERVIEW

7.2 MEDIUM MOLECULAR WEIGHT

7.3 HIGH MOLECULAR WEIGHT

7.4 LOW MOLECULAR WEIGHT

8 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET, BY FORM

8.1 OVERVIEW

8.2 POWDER

8.3 LIQUID

9 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 PHARMACEUTICAL

9.2.1 TABLETS

9.2.2 LIQUID SUSPENSIONS/OINTMENT

9.2.3 INJECTIONS

9.2.4 OTHERS

9.3 COSMETICS

9.3.1 HAIR FIXATIVE POLYMERS

9.3.2 SKIN CARE

9.3.3 ORAL CARE

9.3.4 PERFUMES

9.4 SOLVENTS

9.4.1 INKS

9.4.2 PAINTS & COATINGS

9.4.3 POLISHING AGENTS

9.5 ELECTRICAL & ELECTRONICS

9.5.1 BATTERIES

9.5.2 PCBS

9.5.3 OTHERS

9.5.3.1 SCREENS

9.5.3.2 CMP

9.6 ADHESIVES

9.6.1 HOT MELT ADHESIVES

9.6.2 SKIN ADHESIVES

9.6.3 THICKENERS

9.7 AGROCHEMICALS

9.8 FOOD & BEVERAGE

9.8.1 ALCOHOLIC

9.8.2 NON-ALCOHOLIC

9.9 MEMBRANES

9.9.1 WATER

9.9.2 HEMODIALYSIS

9.1 CERAMICS

9.11 HOME CARE

9.12 METAL QUENCHING

9.13 OTHERS

10 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 OFFLINE

10.3 ONLINE

11 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.2 RECOGNITION

12.3 EVENT

12.4 JOINT VENTURE

12.5 CERTIFICATION

12.6 INVESTMENT

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 BASF SE

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 ASHLAND

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DVELOPMENT

14.3 NIPPON SHOKUBAI CO., LTD.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 BOAI NKY PHARMACEUTICALS LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 BALAJI AMINES

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 ALFA AESAR, THERMO FISHER SCIENTIFIC

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 HANGZHOU MOTTO SCIENCE & TECHNOLOGY CO., LTD.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 HUANGSHAN BONSUN PHARMACEUTICALS CO., LTD.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 JH NANHANG LIFE SCIENCES CO., LTD.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 MERCK KGAA

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF POLYMERS OF VINYL ESTERS AND OTHER VINYL POLYMERS, IN PRIMARY FORMS; HS CODE - 390599 (USD THOUSAND)

TABLE 2 EXPORT DATA OF POLYMERS OF VINYL ESTERS AND OTHER VINYL POLYMERS, IN PRIMARY FORMS; HS CODE - 390599 (USD THOUSAND)

TABLE 3 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (TONS)

TABLE 5 NORTH AMERICA K30 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA K30 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (TONS)

TABLE 7 NORTH AMERICA K90 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA K90 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (TONS)

TABLE 9 NORTH AMERICA K12 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA K12 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (TONS)

TABLE 11 NORTH AMERICA K25 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA K25 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (TONS)

TABLE 13 NORTH AMERICA K17 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA K17 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (TONS)

TABLE 15 NORTH AMERICA K60 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA K60 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (TONS)

TABLE 17 NORTH AMERICA K120 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA K120 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (TONS)

TABLE 19 NORTH AMERICA CROSPOVIDONE IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA CROSPOVIDONE IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (TONS)

TABLE 21 NORTH AMERICA COPOVIDONE IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA COPOVIDONE IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (TONS)

TABLE 23 NORTH AMERICA XL-10 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA XL-10 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (TONS)

TABLE 25 NORTH AMERICA ULTRA-10 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA ULTRA-10 IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (TONS)

TABLE 27 NORTH AMERICA KOLLIDON SR IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA KOLLIDON SR IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (TONS)

TABLE 29 NORTH AMERICA KOLLIDON CL IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA KOLLIDON CL IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (TONS)

TABLE 31 NORTH AMERICA OTHERS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA OTHERS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (TONS)

TABLE 33 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA MEDIUM MOLECULAR WEIGHT IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA HIGH MOLECULAR WEIGHT IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA LOW MOLECULAR WEIGHT IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 37 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET, BY FORM, 2017-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA POWDER IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 39 NORTH AMERICA LIQUID IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET, BY APPLICATION, 2017-2030 (USD THOUSAND)

TABLE 41 NORTH AMERICA PHARMACEUTICAL IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA PHARMACEUTICAL IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 43 NORTH AMERICA COSMETICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 44 NORTH AMERICA COSMETICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 45 NORTH AMERICA SOLVENTS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 46 NORTH AMERICA SOLVENTS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 47 NORTH AMERICA ELECTRICAL & ELECTRONICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 48 NORTH AMERICA ELECTRICAL & ELECTRONICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 49 NORTH AMERICA OTHERS IN ELECTRICAL & ELECTRONICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 50 NORTH AMERICA ADHESIVES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 51 NORTH AMERICA ADHESIVES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 52 NORTH AMERICA AGROCHEMICALS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 53 NORTH AMERICA FOOD & BEVERAGE IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 54 NORTH AMERICA FOOD & BEVERAGE IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 55 NORTH AMERICA MEMBRANES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 56 NORTH AMERICA MEMBRANES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 57 NORTH AMERICA CERAMICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 58 NORTH AMERICA HOME CARE IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 59 NORTH AMERICA METAL QUENCHING IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 60 NORTH AMERICA OTHERS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 61 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET, BY DISTRIBUTION CHANNEL, 2017-2030 (USD THOUSAND)

TABLE 62 NORTH AMERICA OFFLINE IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 63 NORTH AMERICA ONLINE IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY REGION, 2017-2030 (USD THOUSAND)

TABLE 64 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET, BY COUNTRY, 2017-2030 (USD THOUSAND)

TABLE 65 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET, BY COUNTRY, 2017-2030 (TONS)

TABLE 66 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (USD THOUSAND)

TABLE 67 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (TONS)

TABLE 68 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 69 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET, BY FORM, 2017-2030 (USD THOUSAND)

TABLE 70 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET, BY APPLICATION, 2017-2030 (USD THOUSAND)

TABLE 71 NORTH AMERICA PHARMACEUTICAL IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 72 NORTH AMERICA COSMETICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 73 NORTH AMERICA SOLVENTS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 74 NORTH AMERICA ELECTRICAL & ELECTRONICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 75 NORTH AMERICA OTHERS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 76 NORTH AMERICA ADHESIVES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 77 NORTH AMERICA FOOD & BEVERAGE IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 78 NORTH AMERICA MEMBRANES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 79 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET, BY DISTRIBUTION CHANNEL, 2017-2030 (USD THOUSAND)

TABLE 80 U.S. POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (USD THOUSAND)

TABLE 81 U.S. POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (TONS)

TABLE 82 U.S. POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 83 U.S. POLYVINYLPYRROLIDONE (PVP) MARKET, BY FORM, 2017-2030 (USD THOUSAND)

TABLE 84 U.S. POLYVINYLPYRROLIDONE (PVP) MARKET, BY APPLICATION, 2017-2030 (USD THOUSAND)

TABLE 85 U.S. PHARMACEUTICAL IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 86 U.S. COSMETICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 87 U.S. SOLVENTS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 88 U.S. ELECTRICAL & ELECTRONICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 89 U.S. OTHERS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 90 U.S. ADHESIVES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 91 U.S. FOOD & BEVERAGE IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 92 U.S. MEMBRANES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 93 U.S. POLYVINYLPYRROLIDONE (PVP) MARKET, BY DISTRIBUTION CHANNEL, 2017-2030 (USD THOUSAND)

TABLE 94 CANADA POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (USD THOUSAND)

TABLE 95 CANADA POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (TONS)

TABLE 96 CANADA POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 97 CANADA POLYVINYLPYRROLIDONE (PVP) MARKET, BY FORM, 2017-2030 (USD THOUSAND)

TABLE 98 CANADA POLYVINYLPYRROLIDONE (PVP) MARKET, BY APPLICATION, 2017-2030 (USD THOUSAND)

TABLE 99 CANADA PHARMACEUTICAL IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 100 CANADA COSMETICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 101 CANADA SOLVENTS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 102 CANADA ELECTRICAL & ELECTRONICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 103 CANADA OTHERS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 104 CANADA ADHESIVES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 105 CANADA FOOD & BEVERAGE IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 106 CANADA MEMBRANES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 107 CANADA POLYVINYLPYRROLIDONE (PVP) MARKET, BY DISTRIBUTION CHANNEL, 2017-2030 (USD THOUSAND)

TABLE 108 MEXICO POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (USD THOUSAND)

TABLE 109 MEXICO POLYVINYLPYRROLIDONE (PVP) MARKET, BY GRADE, 2017-2030 (TONS)

TABLE 110 MEXICO POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 111 MEXICO POLYVINYLPYRROLIDONE (PVP) MARKET, BY FORM, 2017-2030 (USD THOUSAND)

TABLE 112 MEXICO POLYVINYLPYRROLIDONE (PVP) MARKET, BY APPLICATION, 2017-2030 (USD THOUSAND)

TABLE 113 MEXICO PHARMACEUTICAL IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 114 MEXICO COSMETICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 115 MEXICO SOLVENTS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 116 MEXICO ELECTRICAL & ELECTRONICS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 117 MEXICO OTHERS IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 118 MEXICO ADHESIVES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 119 MEXICO FOOD & BEVERAGE IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 120 MEXICO MEMBRANES IN POLYVINYLPYRROLIDONE (PVP) MARKET, BY TYPE, 2017-2030 (USD THOUSAND)

TABLE 121 MEXICO POLYVINYLPYRROLIDONE (PVP) MARKET, BY DISTRIBUTION CHANNEL, 2017-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET

FIGURE 2 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET: THE GRADE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET: SEGMENTATION

FIGURE 14 APPLICATION AS AN EXCIPIENT IN PHARMACEUTICAL PRODUCTS IS EXPECTED TO DRIVE THE NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET IN THE FORECAST PERIOD

FIGURE 15 K30 SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET IN 2023 & 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET

FIGURE 17 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET: BY GRADE, 2022

FIGURE 18 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET: BY TYPE, 2022

FIGURE 19 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET: BY FORM, 2022

FIGURE 20 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET: BY APPLICATION, 2022

FIGURE 21 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 22 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET: SNAPSHOT (2022)

FIGURE 23 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET: BY COUNTRY (2022)

FIGURE 24 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET: BY COUNTRY (2023 & 2030)

FIGURE 25 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET: BY COUNTRY (2022 & 2030)

FIGURE 26 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET: BY GRADE (2022 - 2030)

FIGURE 27 NORTH AMERICA POLYVINYLPYRROLIDONE (PVP) MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.