Marché nord-américain des composés de chlorure de polyvinyle plastifié (PVC), par forme (sec et humide), procédé de fabrication (moulage par injection, extrusion, autres), application (film et feuille, fil et câblage, tuyaux et raccords, profilés et tubes, autres), utilisateur final (médical, bâtiment et construction, emballage, automobile, biens de consommation, électricité et électronique, autres) – Tendances et prévisions de l’industrie jusqu’en 2029

Analyse et taille du marché

Les composés de chlorure de polyvinyle plastifié (PVC) sont des adhésifs utilisés dans la fabrication de différents types de PVC flexibles avec différentes applications dans différents secteurs industriels. Les technologies de production de composés de chlorure de polyvinyle plastifié (PVC) sont principalement utilisées dans la fabrication de produits finis tels que des tuyaux, des flexibles , des sacs et autres qui sont utilisés dans le bâtiment et la construction, la tuyauterie et l'isolation, les soins de santé, l'automobile et les fils et câbles.

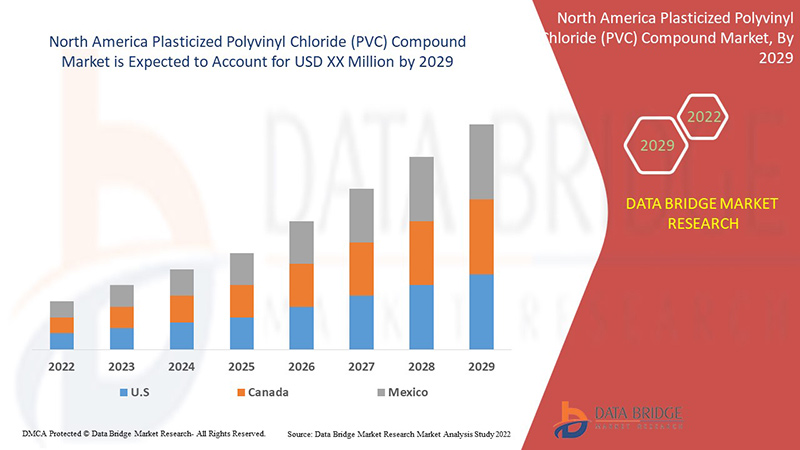

Ces composés de chlorure de polyvinyle plastifié (PVC) sont fabriqués par deux procédés différents, le moulage par injection et l'extrusion. Ils sont extraits de sels et de pétrole brut. Data Bridge Market Research analyse que le marché des composés de chlorure de polyvinyle plastifié (PVC) devrait croître à un TCAC de 4,9 % au cours de la période de prévision. « Film et feuille » représente le segment d'application le plus important sur le marché respectif en raison de l'augmentation des composés de chlorure de polyvinyle plastifié (PVC). Le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et un scénario de chaîne climatique.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volume en kilotonnes, prix en USD |

|

Segments couverts |

Forme (sèche et humide), procédé de fabrication (moulage par injection, extrusion, autres), application (film et feuille, fil et câblage, tuyaux et raccords, profilés et tubes, autres), utilisation finale (médical, bâtiment et construction, emballage, automobile, biens de consommation, électricité et électronique, autres) |

|

Pays couverts |

États-Unis, Canada, Mexique |

|

Acteurs du marché couverts |

INEOS, Westlake Corporation, Ercros SA, Teknor Apex, Aurora Plastics LLC, Roscom Inc., PKN ORLEN, BENVIC, Rainmaker Polymers LLC |

Définition du marché

Le composé PVC est basé sur la combinaison de polymères qui donnent une formulation pour les produits finis nécessaires selon les exigences de l'utilisateur final. Il est fabriqué en mélangeant différents ingrédients de matières premières PVC, qui sont ensuite convertis en une substance gélatineuse utile pour la fabrication de produits finis. Plusieurs types de matières premières sont utilisées dans la fabrication du composé PVC, telles que des plastifiants , des stabilisants, des lubrifiants , des charges et des polymères d'alliage. Le composé de chlorure de polyvinyle plastifié (PVC) contient des plastifiants et des agents adoucissants, qui confèrent une propriété semblable à celle du caoutchouc. Les composés PVC flexibles apportent de la flexibilité aux produits. Les composés de chlorure de polyvinyle plastifié (PVC) sont principalement utilisés pour fabriquer des tubes médicaux, des carrosseries automobiles, des câbles électriques et autres. Ces produits ont besoin de flexibilité, c'est pourquoi des composés de chlorure de polyvinyle plastifié (PVC) sont utilisés dans leur fabrication.

Cadre réglementaire

- Conformément aux réglementations imposées par l'Agence de protection de l'environnement (EPA), la fabrication du chlorure de polyvinyle (PVC) est réglementée. Cette réglementation contribue à réduire les émissions de toxines atmosphériques des usines de PVC.

Le COVID-19 a eu un impact minimal sur le marché nord-américain des composés de chlorure de polyvinyle plastifié (PVC)

La COVID-19 a eu un impact sur diverses industries manufacturières au cours de l'année 2020-2021, car elle a entraîné la fermeture de lieux de travail, la perturbation des chaînes d'approvisionnement et des restrictions sur les transports. Cependant, aucun impact significatif n'a été constaté sur leurs opérations et leur chaîne d'approvisionnement en composés de chlorure de polyvinyle plastifié (PVC) en Amérique du Nord, car l'importation et l'exportation de vaccins et de biens essentiels ont entraîné une demande croissante de composés de chlorure de polyvinyle plastifié (PVC). Cette prise de conscience croissante et l'impulsion gouvernementale pour la recherche et le développement de nouveaux composés de chlorure de polyvinyle plastifié (PVC) augmentent la croissance du marché des composés de chlorure de polyvinyle plastifié (PVC).

La dynamique du marché des composés de chlorure de polyvinyle plastifié (PVC) en Amérique du Nord comprend :

Facteurs moteurs/opportunités rencontrés par le marché nord-américain des composés de chlorure de polyvinyle plastifié (PVC)

- Croissance des activités de construction dans les pays en développement

Les pays investissent des sommes considérables dans les activités de construction, s'engageant sur la voie du développement. Ainsi, l'augmentation des activités de construction dans les pays en développement a augmenté l'utilisation de produits composés de PVC plastifié, ce qui devrait stimuler la croissance du marché des composés de PVC plastifié en Amérique du Nord.

- Demande croissante de tubes et de profilés

L'urbanisation croissante a augmenté la demande de tubes et raccords en PVC plastifié. Selon un article intitulé World's Top Exports de Daniel Workman publié en 2020, les ventes d'articles exportés en Amérique du Nord en plastique de tous les pays se sont élevées au total à 85,3 milliards USD en 2020, soit une augmentation moyenne de 26,3 % par rapport à tous les pays exportateurs depuis 2016. Ainsi, la demande croissante de tubes et de profilés dans divers secteurs a augmenté l'utilisation de composés de PVC plastifié dans la production de tubes et de profilés moulés. Par conséquent, la demande croissante de tubes et de profilés devrait stimuler la croissance du marché.

- Capacité à former la forme souhaitée grâce à la qualité du moulage

Les composés de PVC plastifiés ont une variété d'applications en raison de leur faible coût et de leurs propriétés mécaniques et physiques. Dans le secteur médical, il est couramment utilisé dans les sacs de collecte de sang car il est flexible et incassable, qui sont préférés dans les banques de sang modernes car il est crucial dans les soins de santé. La souplesse du composé de PVC plastifié flexible garantit des dispositifs médicaux confortables. En outre, il a diverses autres applications et avantages dans les domaines de l'emballage, des ménages et des activités de construction. Ainsi, la qualité de moulage qui permet d'obtenir n'importe quelle forme souhaitée augmente la demande de produits fabriqués à partir de composés de PVC plastifiés sur le marché. Cela conduit à une demande accrue de composés de PVC plastifiés, agissant comme un moteur sur le marché des composés de PVC plastifiés.

- Capacités de recyclage des dispositifs médicaux en PVC plastifié

Les dispositifs médicaux en PVC plastifié sont recyclables et peuvent être transformés en divers nouveaux produits. Ainsi, au lieu de gaspiller de l'argent pour éliminer les déchets et de dépenser de l'argent pour produire de nouveaux matériaux, la meilleure solution est de recycler les produits. Parfois, les prix des matières premières des composés de PVC plastifié augmentent et offrent une incitation financière à utiliser du PVC recyclé dans la fabrication, encourageant les unités de fabrication à utiliser des composés de PVC recyclé. La nature recyclable des produits composés de PVC plastifié a augmenté sa demande dans la production de produits secondaires qui sont utilisés dans le secteur médical. Par conséquent, les propriétés de recyclage des dispositifs médicaux en PVC plastifié devraient stimuler la croissance du marché des composés de PVC plastifié.

Contraintes/défis rencontrés par le marché nord-américain des composés de chlorure de polyvinyle plastifié (PVC)

- Effet de la température sur le composé PVC plastifié

Les composés de PVC plastifiés sont utilisés pour fabriquer des produits finis utilisés dans différentes conditions atmosphériques. Lorsque les composés de PVC plastifiés sont exposés à des conditions atmosphériques dynamiques, divers facteurs affectent les composés de PVC plastifiés, tels que les rayons UV et les changements de température, ce qui entraîne la fissure des liaisons au sein du composé de PVC plastifié et la séparation du chlorure d'hydrogène et la formation de nouvelles liaisons dans le composé de PVC plastifié. Ainsi, à partir des déclarations ci-dessus, on peut affirmer que la température élevée a un effet négatif sur le composé de PVC plastifié, ce qui conduit à une durée de vie plus courte des produits finis en PVC plastifié

- Élimination progressive du PVC plastifié dans les hôpitaux

L'industrie de la santé est préoccupée par les produits en PVC plastifié, car plusieurs organismes gouvernementaux ont émis des avertissements concernant les produits fabriqués à partir de PVC. Les patients, en particulier les nourrissons, sont exposés à des risques pour la santé liés aux produits contenant du PVC plastifié en raison de ses effets secondaires graves. Les chercheurs ont constaté que les nourrissons malades traités dans les unités de soins intensifs néonatals étaient plus exposés aux substances toxiques dans leur corps. Ainsi, on peut conclure des déclarations ci-dessus que les produits et équipements médicaux fabriqués à partir de composés de PVC plastifié sont infectieux pour les nourrissons, ce qui pourrait entraîner une baisse de la demande de composés de PVC plastifié dans l'industrie médicale dans un avenir proche.

Développements récents

- En décembre 2021, Roscom Inc a été rachetée par Geon Performance. Ce développement a aidé l'entreprise à augmenter ses revenus et à travailler efficacement

- En janvier 2022, Westlake a lancé le chlorure de polyvinyle (PVC) GreenVin, une alternative au PVC à faible teneur en carbone. Il est lancé par l'une de ses filiales, la filiale allemande Vinnolit. Il est principalement utilisé dans les secteurs de la construction, de l'automobile et de la médecine. Cela aidera l'entreprise à élargir son portefeuille de produits

Portée du marché des composés de chlorure de polyvinyle plastifié (PVC) en Amérique du Nord

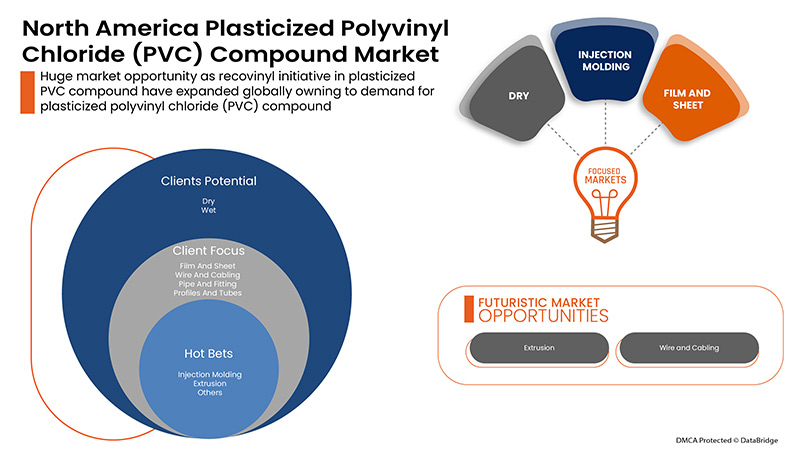

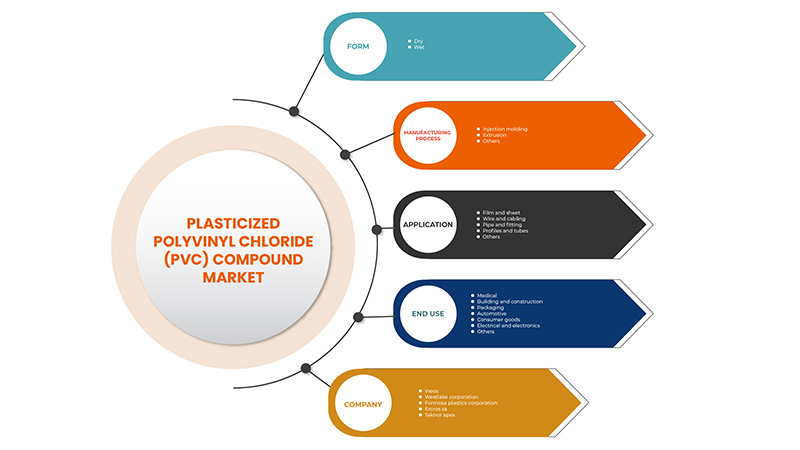

Le marché nord-américain des composés de chlorure de polyvinyle plastifié (PVC) est segmenté en fonction de la forme, du processus de fabrication, de l'application et de l'utilisation finale. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Formulaire

- Sec

- Mouillé

Sur la base de la forme, le marché des composés de polychlorure de vinyle plastifié (PVC) est segmenté en sec et humide.

Processus de fabrication

- Moulage par injection

- Extrusion

- Autres

Sur la base du processus de fabrication, le marché nord-américain des composés de polychlorure de vinyle (PVC) plastifié est segmenté en moulage par injection, extrusion et autres.

Application

- Film et feuille

- Fils et câblage

- Tuyaux et raccords,

- Profilés et tubes

- Autres

Sur la base de l'application, le marché nord-américain des composés de polychlorure de vinyle (PVC) plastifié est segmenté en films et feuilles, fils et câbles, tuyaux et raccords, profilés et tubes, autres.

Utilisation finale

- Médical

- Bâtiment et construction

- Conditionnement

- Automobile

- Biens de consommation

- Électricité et électronique

- Autres

Sur la base de l'utilisation finale, le marché nord-américain des composés de polychlorure de vinyle (PVC) plastifié est segmenté en médical, bâtiment et construction, emballage, automobile, biens de consommation, électricité et électronique, autres.

Analyse/perspectives régionales du marché des composés de chlorure de polyvinyle plastifié (PVC) en Amérique du Nord

Le marché nord-américain des composés de chlorure de polyvinyle plastifié (PVC) est analysé. Comme indiqué ci-dessus, des informations sur la taille et les tendances du marché sont fournies par pays, forme, processus de fabrication, application et utilisation finale.

Les pays couverts par le rapport sur le marché des composés de polychlorure de vinyle plastifié (PVC) en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Les États-Unis dominent le marché en raison des capacités de recyclage des dispositifs médicaux en PVC plastifié et de la croissance des activités de construction dans les pays en développement. En raison de l'initiative de récupération des composés de PVC plastifié dans la région et du composé de chlorure de polyvinyle (PVC) plastifié, les fabricants se sont engagés à développer de nouveaux produits à base de composés de chlorure de polyvinyle (PVC) plastifiés dans la région, ce qui stimule la demande de composés de chlorure de polyvinyle (PVC) plastifiés dans la région.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse de la concurrence et des parts de marché des composés de chlorure de polyvinyle plastifié (PVC) en Amérique du Nord

Le paysage concurrentiel du marché des composés de chlorure de polyvinyle plastifié (PVC) en Amérique du Nord fournit des détails sur les concurrents. Les détails inclus sont un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché des composés de chlorure de polyvinyle plastifié (PVC) en Amérique du Nord.

Certains des principaux acteurs opérant sur le marché des composés de polychlorure de vinyle (PVC) plastifiés sont INEOS, Westlake Corporation, Ercros SA, Teknor Apex, Aurora Plastics LLC, Roscom Inc., PKN ORLEN, BENVIC, Rainmaker Polymers LLC, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 FORM LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET CONSUMER CATEGORY COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 OVERVIEW: PLASTICIZERS’ USE IN NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND INDUSTRY

4.2 PESTLE ANALYSIS

4.2.1 POLITICAL FACTORS:

4.2.2 ECONOMIC FACTORS:

4.2.3 SOCIAL FACTORS:

4.2.4 TECHNOLOGICAL FACTORS:

4.2.5 LEGAL FACTORS:

4.2.6 ENVIRONMENTAL FACTORS:

4.3 PORTER’S FIVE FORCES:

4.3.1 THREAT OF NEW ENTRANTS:

4.3.2 THREAT OF SUBSTITUTES:

4.3.3 CUSTOMER BARGAINING POWER:

4.3.4 SUPPLIER BARGAINING POWER:

4.3.5 INTERNAL COMPETITION (RIVALRY):

4.4 SUPPLY CHAIN ANALYSIS

4.4.1 OVERVIEW

4.4.2 LOGISTIC COST SCENARIO

4.4.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.5 VENDOR SELECTION CRITERIA

4.6 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.6.1 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.7 RAW MATERIAL PRODUCTION COVERAGE

4.8 PRODUCTION AND CONSUMPTION ANALYSIS

4.9 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, IMPACT OF REGULATIONS

4.9.1 REGULATORY FRAMWORK

5 IMPORT EXPORT SCENARIO

6 CLIMATE CHANGE SCENARIO

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWING BUILDING AND CONSTRUCTION ACTIVITIES IN DEVELOPING COUNTRIES

7.1.2 INCREASING DEMAND FOR TUBES AND PROFILES

7.1.3 ABILITY TO FORM DESIRED SHAPE DUE TO MOLDING QUALITY

7.1.4 RECYCLING ABILITIES OF PLASTICISED PVC MEDICAL DEVICES

7.2 RESTRAINTS

7.2.1 TEMPERATURE EFFECT ON PLASTICISED PVC COMPOUND

7.2.2 PHASING OUT PLASTICISED PVC IN HOSPITALS

7.3 OPPORTUNITIES

7.3.1 RECOVINYL INITIATIVE IN PVC COMPOUND

7.3.2 SUSTAINABLE FORMS OF PVC TO LESSEN THE POTENTIAL NEGATIVE IMPACT ON HUMAN HEALTH

7.4 CHALLENGES

7.4.1 PLASTISED PVC COMPOUND CAUSES ENVIRONMENT AND HEALTH CONCERNS IN MANUFACTURING UNITS

7.4.2 DIFFICULTY IN WASTE MANAGEMENT OF PVC COMPOUND

8 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM

8.1 OVERVIEW

8.2 DRY

8.3 WET

9 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY MANUFACTURING PROCESS

9.1 OVERVIEW

9.2 INJECTION MOLDING

9.3 EXTRUSION

9.4 OTHERS

10 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 FILM AND SHEET

10.2.1 DRY

10.2.2 WET

10.3 WIRE AND CABLING

10.3.1 DRY

10.3.2 WET

10.4 PIPE AND FITTING

10.4.1 DRY

10.4.2 WET

10.5 PROFILES AND TUBES

10.5.1 DRY

10.5.2 WET

10.6 OTHERS

10.6.1 DRY

10.6.2 WET

11 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY END USE

11.1 OVERVIEW

11.2 ELECTRICAL AND ELECTRONICS

11.2.1 DRY

11.2.2 WET

11.3 AUTOMOTIVE

11.3.1 DRY

11.3.2 WET

11.4 MEDICAL

11.4.1 DRY

11.4.2 WET

11.5 CONSUMER GOODS

11.5.1 DRY

11.5.2 WET

11.6 PACKAGING

11.6.1 DRY

11.6.2 WET

11.7 BUILDING AND CONSTRUCTION

11.7.1 DRY

11.7.2 WET

11.8 OTHERS

11.8.1 DRY

11.8.2 WET

12 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.1.1 MERGERS & ACQUISITIONS

13.1.2 NEW PRODUCT DEVELOPMENTS

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 INEOS

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 WESTLAKE CHEMICAL CORPORATION

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 FORMOSA PLASTICS CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 AURORA PLASTICS LLC

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENTS

15.5 BENVIC

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENTS

15.6 ERCROS S.A.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 PKN ORLEN

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 COMPANY SHARE ANALYSIS

15.7.4 PRODUCT PORTFOLIO

15.7.5 RECENT DEVELOPMENT

15.8 RAINMAKER POLYMERS LLC

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 ROSCOM INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 TEKNOR APEX

15.10.1 COMPANY SNAPSHOT

15.10.2 COMPANY SHARE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 ZHONGLIAN CHEMICAL

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF PLASTICISED POLY""VINYL CHLORIDE"", IN PRIMARY FORMS, MIXED WITH OTHER SUBSTANCE; HS CODE - 390422 (USD MILLION)

TABLE 2 EXPORT DATA OF PLASTICISED POLY""VINYL CHLORIDE"", IN PRIMARY FORMS, MIXED WITH OTHER SUBSTANCE; HS CODE – 390422 (USD MILLION)

TABLE 3 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 5 NORTH AMERICA DRY IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA DRY IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 7 NORTH AMERICA WET IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA WET IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 9 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY MANUFACTURING PROCESS, 2020-2029 (KILO TONS)

TABLE 11 NORTH AMERICA INJECTION MOLDING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA INJECTION MOLDING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 13 NORTH AMERICA EXTRUSION IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA EXTRUSION IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 15 NORTH AMERICA OTHERS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA OTHERS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 17 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 19 NORTH AMERICA FILM AND SHEET IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA FILM AND SHEET IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 21 NORTH AMERICA FILM AND SHEET IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA FILM AND SHEET IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 23 NORTH AMERICA WIRE AND CABLING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA WIRE AND CABLING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 25 NORTH AMERICA WIRE AND CABLING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA WIRE AND CABLING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 27 NORTH AMERICA PIPE AND FITTING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA PIPE AND FITTING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 29 NORTH AMERICA PIPE AND FITTING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA PIPE AND FITTING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 31 NORTH AMERICA PROFILES AND TUBES IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA PROFILES AND TUBES IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 33 NORTH AMERICA PROFILES AND TUBES IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA PROFILES AND TUBES IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 35 NORTH AMERICA OTHERS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA OTHERS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 37 NORTH AMERICA OTHERS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA OTHERS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 39 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY END USE, 2020-2029 (KILO TONS)

TABLE 41 NORTH AMERICA ELECTRICAL AND ELECTRONICS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA ELECTRICAL AND ELECTRONICS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 43 NORTH AMERICA ELECTRICAL AND ELECTRONICS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA ELECTRICAL AND ELECTRONICS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 45 NORTH AMERICA AUTOMOTIVE IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA AUTOMOTIVE IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 47 NORTH AMERICA AUTOMOTIVE IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA AUTOMOTIVE IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 49 NORTH AMERICA MEDICAL IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA MEDICAL IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 51 NORTH AMERICA MEDICAL IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA MEDICAL IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 53 NORTH AMERICA CONSUMER GOODS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA CONSUMER GOODS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 55 NORTH AMERICA CONSUMER GOODS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA CONSUMER GOODS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 57 NORTH AMERICA PACKAGING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA PACKAGING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 59 NORTH AMERICA PACKAGING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA PACKAGING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 61 NORTH AMERICA BUILDING AND CONSTRUCTION IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA BUILDING AND CONSTRUCTION IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 63 NORTH AMERICA BUILDING AND CONSTRUCTION IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA BUILDING AND CONSTRUCTION IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 65 NORTH AMERICA OTHERS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA OTHERS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 67 NORTH AMERICA OTHERS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA OTHERS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 69 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 71 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 73 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY MANUFACTURING PROCESS, 2020-2029 (KILO TONS)

TABLE 75 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 76 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 77 NORTH AMERICA FILM AND SHEET IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA FILM AND SHEET IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 79 NORTH AMERICA WIRE AND CABLING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 80 NORTH AMERICA WIRE AND CABLING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 81 NORTH AMERICA PIPE AND FITTING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 82 NORTH AMERICA PIPE AND FITTING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 83 NORTH AMERICA PROFILES AND TUBES IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 84 NORTH AMERICA PROFILES AND TUBES IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 85 NORTH AMERICA OTHERS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 86 NORTH AMERICA OTHERS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 87 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 88 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY END USE, 2020-2029 (KILO TONS)

TABLE 89 NORTH AMERICA ELECTRICAL AND ELECTRONIC IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 90 NORTH AMERICA ELECTRICAL AND ELECTRONIC IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 91 NORTH AMERICA AUTOMOTIVE IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 92 NORTH AMERICA AUTOMOTIVE IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 93 NORTH AMERICA MEDICAL IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 94 NORTH AMERICA MEDICAL IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 95 NORTH AMERICA CONSUMER GOODS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 96 NORTH AMERICA CONSUMER GOODS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 97 NORTH AMERICA PACKAGING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 98 NORTH AMERICA PACKAGING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 99 NORTH AMERICA BUILDING AND CONSTRUCTION IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 100 NORTH AMERICA BUILDING AND CONSTRUCTION IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 101 NORTH AMERICA OTHERS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 102 NORTH AMERICA OTHERS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 103 U.S. PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 104 U.S. PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 105 U.S. PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD MILLION)

TABLE 106 U.S. PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY MANUFACTURING PROCESS, 2020-2029 (KILO TONS)

TABLE 107 U.S. PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 108 U.S. PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 109 U.S. FILM AND SHEET IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 110 U.S. FILM AND SHEET IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 111 U.S. WIRE AND CABLING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 112 U.S. WIRE AND CABLING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 113 U.S. PIPE AND FITTING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 114 U.S. PIPE AND FITTING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 115 U.S. PROFILES AND TUBES IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 116 U.S. PROFILES AND TUBES IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 117 U.S. OTHERS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 118 U.S. OTHERS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 119 U.S. PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 120 U.S. PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY END USE, 2020-2029 (KILO TONS)

TABLE 121 U.S. ELECTRICAL AND ELECTRONIC IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 122 U.S. ELECTRICAL AND ELECTRONIC IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 123 U.S. AUTOMOTIVE IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 124 U.S. AUTOMOTIVE IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 125 U.S. MEDICAL IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 126 U.S. MEDICAL IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 127 U.S. CONSUMER GOODS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 128 U.S. CONSUMER GOODS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 129 U.S. PACKAGING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 130 U.S. PACKAGING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 131 U.S. BUILDING AND CONSTRUCTION IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 132 U.S. BUILDING AND CONSTRUCTION IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 133 U.S. OTHERS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 134 U.S. OTHERS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 135 CANADA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 136 CANADA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 137 CANADA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD MILLION)

TABLE 138 CANADA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY MANUFACTURING PROCESS, 2020-2029 (KILO TONS)

TABLE 139 CANADA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 140 CANADA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 141 CANADA FILM AND SHEET IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 142 CANADA FILM AND SHEET IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 143 CANADA WIRE AND CABLING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 144 CANADA WIRE AND CABLING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 145 CANADA PIPE AND FITTING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 146 CANADA PIPE AND FITTING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 147 CANADA PROFILES AND TUBES IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 148 CANADA PROFILES AND TUBES IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 149 CANADA OTHERS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 150 CANADA OTHERS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 151 CANADA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 152 CANADA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY END USE, 2020-2029 (KILO TONS)

TABLE 153 CANADA ELECTRICAL AND ELECTRONIC IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 154 CANADA ELECTRICAL AND ELECTRONIC IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 155 CANADA AUTOMOTIVE IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 156 CANADA AUTOMOTIVE IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 157 CANADA MEDICAL IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 158 CANADA MEDICAL IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 159 CANADA CONSUMER GOODS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 160 CANADA CONSUMER GOODS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 161 CANADA PACKAGING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 162 CANADA PACKAGING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 163 CANADA BUILDING AND CONSTRUCTION IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 164 CANADA BUILDING AND CONSTRUCTION IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 165 CANADA OTHERS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 166 CANADA OTHERS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 167 MEXICO PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 168 MEXICO PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 169 MEXICO PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD MILLION)

TABLE 170 MEXICO PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY MANUFACTURING PROCESS, 2020-2029 (KILO TONS)

TABLE 171 MEXICO PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 172 MEXICO PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 173 MEXICO FILM AND SHEET IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 174 MEXICO FILM AND SHEET IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 175 MEXICO WIRE AND CABLING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 176 MEXICO WIRE AND CABLING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 177 MEXICO PIPE AND FITTING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 178 MEXICO PIPE AND FITTING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 179 MEXICO PROFILES AND TUBES IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 180 MEXICO PROFILES AND TUBES IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 181 MEXICO OTHERS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 182 MEXICO OTHERS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 183 MEXICO PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 184 MEXICO PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY END USE, 2020-2029 (KILO TONS)

TABLE 185 MEXICO ELECTRICAL AND ELECTRONIC IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 186 MEXICO ELECTRICAL AND ELECTRONIC IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 187 MEXICO AUTOMOTIVE IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 188 MEXICO AUTOMOTIVE IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 189 MEXICO MEDICAL IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 190 MEXICO MEDICAL IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 191 MEXICO CONSUMER GOODS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 192 MEXICO CONSUMER GOODS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 193 MEXICO PACKAGING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 194 MEXICO PACKAGING IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 195 MEXICO BUILDING AND CONSTRUCTION IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 196 MEXICO BUILDING AND CONSTRUCTION IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

TABLE 197 MEXICO OTHERS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 198 MEXICO OTHERS IN PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2020-2029 (KILO TONS)

Liste des figures

FIGURE 1 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET: FORM LIFELINE CURVE

FIGURE 7 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET: CONSUMER CATEGORY COVERAGE GRID

FIGURE 11 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET: CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET AND NORTH AMERICA IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 INCREASING DEMAND FOR TUBES AND PROFILES IS EXPECTED TO DRIVE THE NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 DRY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET IN 2022 & 2029

FIGURE 17 NORTH AMERICA PLASTCISED PVC COMPOND MARKET - SUPPLY CHAIN ANALYSIS

FIGURE 18 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITY AND CHALLENGES OF NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET

FIGURE 20 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY FORM, 2021

FIGURE 21 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY MANUFACTURING PROCESS, 2021

FIGURE 22 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY APPLICATION, 2021

FIGURE 23 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET, BY END USE, 2021

FIGURE 24 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET: SNAPSHOT (2021)

FIGURE 25 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET: BY COUNTRY (2021)

FIGURE 26 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET: BY FORM (2022 & 2029)

FIGURE 29 NORTH AMERICA PLASTICISED POLYVINYL CHLORIDE (PVC) COMPOUND MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.