North America Phytogenic Feed Additives Market

Taille du marché en milliards USD

TCAC :

%

USD

172.07 Million

USD

338.63 Million

2022

2030

USD

172.07 Million

USD

338.63 Million

2022

2030

| 2023 –2030 | |

| USD 172.07 Million | |

| USD 338.63 Million | |

|

|

|

|

Marché des additifs alimentaires phytogéniques en Amérique du Nord, par type ( huiles essentielles , flavonoïdes, saponines, oléorésines, tanins et autres), type d'aliments pour animaux (aliments pour volaille, aliments pour ruminants, aliments aquatiques, aliments pour porcs et autres), sources (herbes et épices), forme (sèche et liquide), fonction (améliorants de performance, propriétés antimicrobiennes, améliorants de palatabilité, améliorants de digestion et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des additifs alimentaires phytogéniques en Amérique du Nord

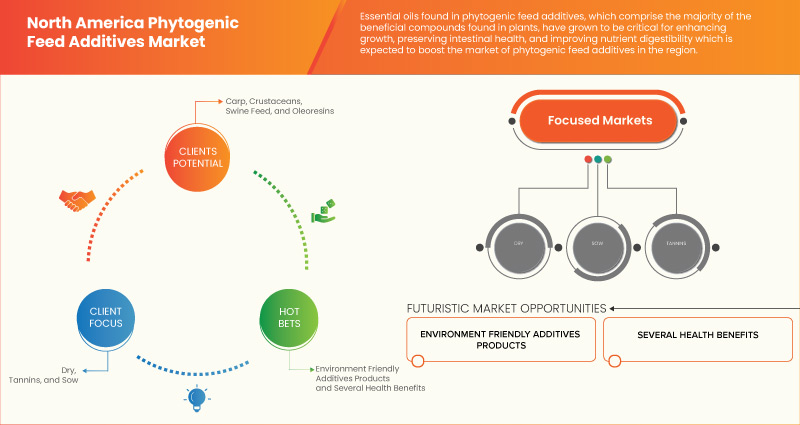

La demande croissante d'additifs alimentaires naturels, l'augmentation de la consommation de protéines animales, la réglementation stricte sur les additifs alimentaires antibiotiques et les préoccupations croissantes concernant le bien-être animal sont quelques-uns des facteurs qui devraient stimuler la croissance du marché. Cependant, la disponibilité d'alternatives établies aux additifs alimentaires sur le marché devrait freiner la croissance du marché.

Le rapport sur le marché des additifs alimentaires phytogéniques en Amérique du Nord fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

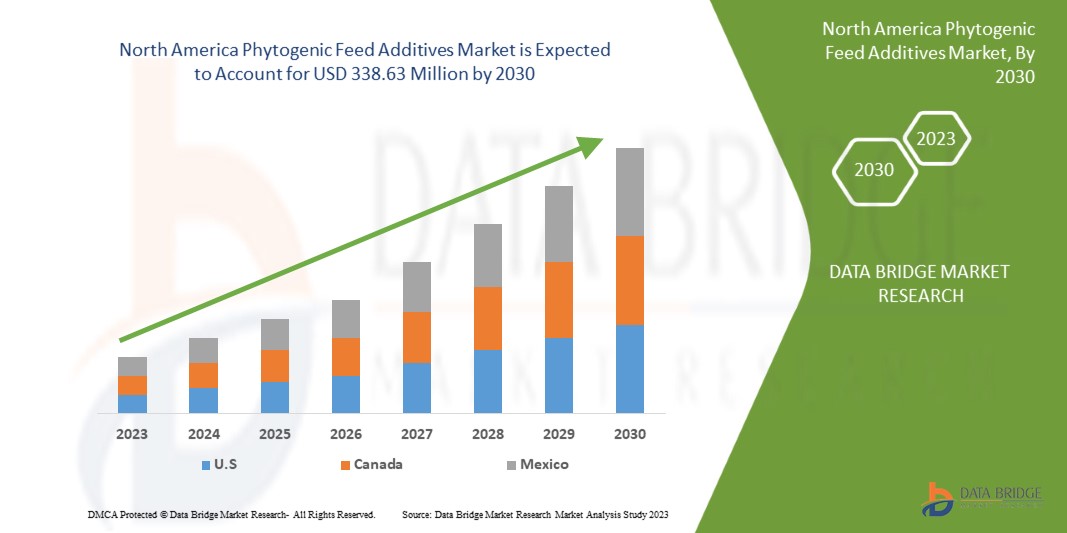

Le marché nord-américain des additifs alimentaires phytogéniques devrait connaître une croissance significative au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 9,0 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 338,63 millions USD d'ici 2030 contre 172,07 millions USD d'ici 2022.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Année historique |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Type (huiles essentielles, flavonoïdes, saponines, oléorésines, tannins et autres), type d'alimentation animale (alimentation pour volaille, alimentation pour ruminants, alimentation aquatique, alimentation pour porcs et autres), sources (herbes et épices), forme (sèche et liquide), fonction (améliorants de performance, propriétés antimicrobiennes, améliorants de l'appétence, améliorants de la digestion et autres) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

Cargill, Incorporated., DSM, Kemin Industries, Inc., ADM, Nutreco, Natural Remedies., Himalaya Wellness Company, Vinayak Ingredients. India, Silvateam Spa, Phytobiotics Futterzusatzstoffe GmbH, Tegasa, MIAVIT GMBH, Indian Herbs, Customer DOSTOFARM GmbH, British Horse Feeds, Orffa, Igusol, Glamac International Private Limited., et Nor-Feed, entre autres |

Définition du marché

Les additifs phytogéniques sont une classe de promoteurs de croissance organiques utilisés comme additifs alimentaires dérivés d'herbes, d'épices ou d'autres plantes. La gamme d'additifs alimentaires phytogéniques est large et comprend des huiles essentielles et des classes d'ingrédients actifs tels que les saponines, les flavonoïdes, les mucilages, les tanins et les substances amères et piquantes. Les additifs alimentaires phytogéniques sont des substances d'origine végétale ajoutées aux régimes alimentaires des animaux aux niveaux recommandés pour améliorer la croissance et la nutrition des animaux.

Dynamique du marché des additifs alimentaires phytogéniques en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Réglementation stricte sur les additifs alimentaires contenant des antibiotiques

Les antibiotiques sont une classe de composés organiques, semi-organiques ou synthétiques ayant une activité antimicrobienne et qui sont largement utilisés pour traiter et prévenir les maladies infectieuses chez les humains et les animaux. Ils peuvent également être ajoutés à l'alimentation comme facteurs de croissance pour favoriser le développement des animaux.

L'utilisation d'antibiotiques dans la production de volailles et de bétail est considérée comme avantageuse par les agriculteurs et l'économie dans son ensemble, car elle améliore généralement les performances des volailles de manière économique et efficace. Cependant, la propagation potentielle de souches résistantes aux antibiotiques d'organismes pathogènes et non pathogènes dans l'environnement et leur transmission ultérieure à l'homme via la chaîne alimentaire pourraient avoir de graves conséquences sur la santé publique. Des lois et d'autres restrictions sur l'utilisation d'antibiotiques chez les animaux d'élevage sont mises en place dans le monde entier en raison de ces préoccupations sanitaires.

Par exemple,

- En novembre 2017, l’OMS a publié un article contre l’administration fréquente d’antibiotiques pour stimuler la croissance et prévenir les maladies chez les animaux en bonne santé. En minimisant leur utilisation inutile chez les animaux, les nouvelles recommandations de l’OMS visent à préserver l’efficacité des antibiotiques qui sont essentiels pour la santé humaine.

- Selon la Commission européenne, les antibiotiques sont largement utilisés dans l'élevage depuis des décennies dans le monde entier. Ils améliorent les performances de croissance des animaux d'élevage lorsqu'ils sont ajoutés à petites doses à leur alimentation. Cependant, la Commission a décidé d'éliminer progressivement et finalement d'interdire la commercialisation et l'utilisation d'antibiotiques comme facteurs de croissance dans l'alimentation à partir de 2006 en raison de l'augmentation de la résistance bactérienne aux antibiotiques utilisés pour traiter les maladies humaines et animales.

Il est peu probable que les antibiotiques soient un jour éliminés de l’élevage, car cela nuirait au secteur de l’élevage. Il est essentiel de rechercher des promoteurs de croissance naturels, accessibles, abordables et efficaces pour remplacer les promoteurs de croissance antibiotiques (AGP) dans l’alimentation du bétail, en particulier dans les régions où les antibiotiques sont interdits. Par conséquent, dans un souci de durabilité environnementale, de santé humaine et de sécurité alimentaire, les chercheurs se sont récemment concentrés davantage sur les alternatives naturelles qui pourraient remplacer l’utilisation d’antibiotiques dans la production animale. Cela conduit à des alternatives efficaces appelées additifs alimentaires naturels, tels que les additifs alimentaires phytogéniques. Ces facteurs devraient stimuler la croissance du marché.

Opportunité

- Demande croissante d'additifs alimentaires phytogéniques dans l'aquaculture et les aliments pour animaux de compagnie

Le marché de l'aquaculture biologique est en plein essor, car il tend à protéger la santé des consommateurs en réduisant l'utilisation de produits chimiques synthétiques ou nocifs. La croissance de l'aquaculture biologique conduit à l'utilisation accrue d'additifs alimentaires biologiques dans la fabrication d'aliments pour l'aquaculture biologique, tels que les additifs alimentaires phytogéniques. Ainsi, l'augmentation de l'aquaculture biologique devrait créer une opportunité de croissance du marché.

Par exemple,

- En août 2020, Delacon a lancé un produit appelé Syrena Boost. Le produit est un prémélange de saponines, d'épices et d'huiles essentielles, offrant des solutions phytogéniques complètes aux pratiques aquacoles modernes. Il a été conçu de manière à pouvoir cibler les performances et la productivité intestinales. Il est présenté sous forme microencapsulée pour maintenir sa stabilité thermique et pour la libération intestinale progressive des ingrédients sensibles impliqués.

- En décembre 2020, selon le Philippines Journal of Fisheries, des médicaments ont été utilisés pour la chimiothérapie afin de réduire, de prévenir et de traiter les maladies en aquaculture. Ainsi, la chimiothérapie a des effets négatifs sur la santé des poissons et des humains. En guise de substitut, les aliments phytogéniques ont montré des résultats exceptionnels, tels que la stimulation de l'appétit et la prise de poids. En plus de cela, on dit qu'il agit comme un immunostimulant héritant de propriétés antipathogènes chez les poissons.

L'utilisation d'additifs phytogéniques dans les aliments pour l'aquaculture améliore l'appétit des poissons et agit comme un promoteur de croissance organique. De plus, les propriétés antimicrobiennes et antifongiques des phytogènes amélioreraient la santé des poissons en prévenant et en guérissant diverses maladies.

En conclusion, le marché de l'aquaculture est en croissance en raison de la consommation de poisson par les mangeurs de viande et de l'implication dans les compléments médicinaux tels que les huiles de poisson. L'aquaculture étant désormais orientée vers les méthodes biologiques, la consommation d'aliments à base biologique augmente. Pour toutes les raisons mentionnées ci-dessus, l'utilisation d'additifs alimentaires phytogéniques en aquaculture devrait offrir une opportunité de croissance du marché et de tous les fabricants d'additifs alimentaires phytogéniques.

Retenue/Défi

- Disponibilité d'alternatives établies pour les additifs alimentaires

Les additifs alimentaires phytogéniques sont recherchés dans l'élevage pour améliorer l'immunité, les performances et la santé générale. Les effets compensatoires des antibiotiques et l'augmentation de la production ont amené les additifs alimentaires phytogéniques à introduire divers composants alimentaires et les ajustements nécessaires dans la gestion des animaux.

Bien que les additifs alimentaires phytogéniques présentent divers avantages et améliorent les performances et la santé des animaux, d'autres additifs alimentaires naturels tels que les prébiotiques, les probiotiques, les enzymes, les acides organiques, les sels, les huiles essentielles et les algues sont commercialisés. Ces additifs sont fabriqués à partir de sources organiques, notamment de minéraux, de plantes et de microbes. Ils sont utilisés dans la nutrition animale pour améliorer les performances, la santé et le bien-être des animaux. Outre les additifs alimentaires phytogéniques, de nombreuses entreprises d'additifs alimentaires ont récemment lancé de nouveaux produits pour certains additifs alimentaires naturels.

Par exemple,

- En novembre 2022, selon l’article publié dans Feed-lot Magazine Inc, les prébiotiques sont des substances présentes dans les aliments qui stimulent le développement ou l’activité de bonnes bactéries et de champignons. Dans le système digestif, les prébiotiques peuvent modifier la composition des bactéries du microbiome intestinal. Le prébiotique de précision Amaferm de BioZyme, Inc. est fabriqué à partir d’un produit de fermentation complet d’une souche particulière d’Aspergillus oryzae.

Ainsi, d’autres additifs alimentaires naturels gagnent en importance dans le monde entier. Ces additifs présentent des avantages presque équivalents à ceux des additifs alimentaires phytogéniques, qui devraient freiner la croissance du marché.

Impact post-COVID-19 sur le marché nord-américain des additifs alimentaires phytogéniques

L'incertitude causée par l'apparition de la pandémie de COVID-19 dans le monde a affecté et modifié la dynamique complète des industries nord-américaines et a eu un impact négatif sur la croissance du marché de l'économie nord-américaine. Les effets peuvent être observés sur l'intensité et l'efficacité des efforts de confinement, les changements de comportement (comme l'évitement des achats et des investissements), les changements dans les habitudes de dépenses, les efforts de confinement pour les perturbations de l'offre, les séquelles du resserrement spectaculaire du marché, la volatilité des prix des matières premières et l'augmentation du fardeau de la dette. En raison de la COVID-19, tous les pays ont été confrontés à une crise à plusieurs niveaux comprenant des perturbations économiques intérieures, une chute de la demande extérieure, un effondrement des prix et un effondrement de l'offre et de la demande de produits.

Développements récents

- En mars 2023, Indian Herbs a annoncé le lancement d'un nouveau produit appelé HEATBEAT pour la volaille. Ce produit est une combinaison de vitamine C naturelle, de complexe de chrome organique et de menthe. Ce lancement a aidé l'entreprise à élargir son portefeuille de produits.

- En février 2022, Orffa a annoncé un nouvel accord de distribution avec Eigenmann & Veronelli, un fournisseur de solutions de premier plan dans le secteur des produits chimiques de spécialité et des ingrédients alimentaires à Rho (MI), en Italie. Cet accord aiderait l'entreprise à promouvoir ses produits en Italie.

Portée du marché des additifs alimentaires phytogéniques en Amérique du Nord

Le marché nord-américain des additifs alimentaires phytogéniques est segmenté en cinq segments notables en fonction du type, du type d'alimentation animale, des sources, de la forme et de la fonction. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Taper

- Huiles essentielles

- Flavonoïdes

- Saponines

- Oléorésines

- Tannins

- Autres

Sur la base du type, le marché est segmenté en huiles essentielles, flavonoïdes, saponines, oléorésines, tanins et autres.

Type d'alimentation animale

- Alimentation pour volaille

- Alimentation des ruminants

- Alimentation aquatique

- Alimentation porcine

- Autres

Sur la base du type d'aliments pour animaux, le marché est segmenté en aliments pour volaille, aliments pour ruminants, aliments pour poissons, aliments pour porcs et autres.

Sources

- Herbes

- Épices

Sur la base des sources, le marché est segmenté en herbes et épices.

Formulaire

- Sec

- Liquide

Sur la base de la forme, le marché est segmenté en sec et liquide.

Fonction

- Améliorateurs de performances

- Propriétés antimicrobiennes

- Améliorateurs de palatabilité

- Stimulateurs de digestion

- Autres

Sur la base de la fonction, le marché est segmenté en exhausteurs de performances, propriétés antimicrobiennes, exhausteurs de goût, exhausteurs de digestion et autres.

Analyse/perspectives régionales du marché des additifs alimentaires phytogéniques en Amérique du Nord

Le marché nord-américain des additifs alimentaires phytogéniques est segmenté en cinq segments notables en fonction du type, du type d’alimentation animale, des sources, de la forme et de la fonction.

Les pays couverts dans ce rapport de marché sont les États-Unis, le Canada et le Mexique.

Les États-Unis devraient dominer le marché nord-américain des additifs alimentaires phytogéniques en raison de la disponibilité facile des matières premières pour les additifs alimentaires phytogéniques.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse des points de données en aval et en amont de la chaîne de valeur, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques régionales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des additifs alimentaires phytogéniques en Amérique du Nord

Le paysage concurrentiel du marché des additifs alimentaires phytogéniques en Amérique du Nord fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications et la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises par rapport au marché.

Français Certains des principaux acteurs du marché opérant sur le marché des additifs alimentaires phytogéniques en Amérique du Nord sont Cargill, Incorporated., DSM, Kemin Industries, Inc., ADM, Nutreco, Natural Remedies., Himalaya Wellness Company, Vinayak Ingredients. India, Silvateam Spa, Phytobiotics Futterzusatzstoffe GmbH, Tegasa, MIAVIT GMBH, Indian Herbs, Customer DOSTOFARM GmbH, British Horse Feeds, Orffa, Igusol, Glamac International Private Limited., et Nor-Feed entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TREATMENT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 FACTORS INFLUENCING PURCHASE DECISION

4.1.1 PRODUCT PRICING

4.1.2 INGREDIENTS

4.1.3 AUTHENTICITY OF PRODUCT

4.2 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.3 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.3.1 GROWING DEMAND FOR NATURAL ADDITIVES

4.3.2 MANUFACTURERS OFFERING CERTIFIED FEED SUPPLEMENTS

4.3.3 BUSINESS EXPANSIONS THROUGH DIFFERENT STRATEGIC DECISIONS

4.4 FUTURE PERSPECTIVE

4.5 PORTER’S FIVE FORCES ANALYSIS FOR THE NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 RAW MATERIAL PROCUREMENT & MANUFACTURING

4.6.2 DISTRIBUTION

4.6.3 END USERS

4.7 TECHNOLOGICAL ADVANCEMENT

4.8 VALUE CHAIN ANALYSIS: NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET

5 PRICING INDEX

6 PRODUCTION CAPACITY OF KEY MANUFACTURERS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 IMPACT OF ECONOMIC SLOWDOWN ON THE MARKET

8.1 IMPACT ON PRICE

8.2 IMPACT ON SUPPLY CHAIN

8.3 IMPACT ON SHIPMENT

8.4 IMPACT ON COMPANY'S STRATEGIC DECISIONS

9 BRAND OUTLOOK

10 MARKET OVERVIEW

10.1 DRIVERS

10.1.1 SURGING DEMAND FOR NATURAL FEED ADDITIVES

10.1.2 INCREASE IN THE CONSUMPTION OF ANIMAL PROTEIN

10.1.3 STRINGENT REGULATIONS ON ANTIBIOTIC FEED ADDITIVES

10.1.4 ESCALATING CONCERN REGARDING ANIMAL WEALTH

10.2 RESTRAINTS

10.2.1 AVAILABILITY OF ESTABLISHED ALTERNATIVES FOR FEED ADDITIVES

10.2.2 HIGHER-END PRODUCT PRICES CAUSE LOW-PROFIT MARGIN

10.2.3 LIMITED R&D IN PHYTOGENIC FEED ADDITIVES

10.3 OPPORTUNITIES

10.3.1 RISING DEMAND FOR PHYTOGENIC FEED ADDITIVES IN AQUACULTURE AND PET FEEDS

10.3.2 MEDICINAL PROPERTIES OF HERBS AND SPICES

10.3.3 GROWING DEMAND FOR ORGANIC MEAT

10.4 CHALLENGES

10.4.1 AVAILABILITY AND VOLATILITY OF ORGANIC RAW MATERIALS

10.4.2 THE PREVALENCE OF ADULTERATION AND SIDE EFFECTS OF PHYTOGENIC MATERIALS

11 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 MEXICO

11.1.3 CANADA

12 COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT

14 COMPANY PROFILE

14.1 CARGILL, INCORPORATED

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 DSM

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 KEMIN INDUSTRIES, INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 ADM

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 NUTRECO

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 BRITISH HORSE FEEDS

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 CUSTOMER DOSTOFARM GMBH

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 GLAMAC INTERNATIONAL PRIVATE LIMITED

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 HIMALAYA WELLNESS COMPANY

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 IGUSOL

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 INDIAN HERBS

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 MIAVIT GMBH

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 NATURAL REMEDIES

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 NOR-FEED

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 ORFFA

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 PHYTOBIOTICS FUTTERZUSATZSTOFFE GMBH

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 SILVATEAM S.P.A.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 TEGASA

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 VINAYAK INGREDIENTS INDIA

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE OF ANIMAL FEED, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA POULTRY FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA RUMINANTS FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA SWINE FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA AQUA FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA FISH IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA MOLLUSKS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA CRUSTACEANS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCES, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA HERBS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA SPICES IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 17 U.S. PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 U.S. PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE OF ANIMAL FEED, 2021-2030 (USD MILLION)

TABLE 19 U.S. POULTRY FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 20 U.S. RUMINANTS FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 U.S. SWINE FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 22 U.S. AQUA FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 U.S. FISH IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 24 U.S. MOLLUSKS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 U.S. CRUSTACEANS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 26 U.S. PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCES, 2021-2030 (USD MILLION)

TABLE 27 U.S. HERBS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 U.S. SPICES IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 U.S. PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 30 U.S. PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 31 MEXICO PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 MEXICO PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE OF ANIMAL FEED, 2021-2030 (USD MILLION)

TABLE 33 MEXICO POULTRY FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 MEXICO RUMINANTS FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 MEXICO SWINE FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 36 MEXICO AQUA FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 MEXICO FISH IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 38 MEXICO MOLLUSKS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 MEXICO CRUSTACEANS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 MEXICO PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCES, 2021-2030 (USD MILLION)

TABLE 41 MEXICO HERBS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 MEXICO SPICES IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 MEXICO PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 44 MEXICO PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 45 CANADA PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 CANADA PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE OF ANIMAL FEED, 2021-2030 (USD MILLION)

TABLE 47 CANADA POULTRY FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 CANADA RUMINANTS FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 CANADA SWINE FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 CANADA AQUA FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 CANADA FISH IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 CANADA MOLLUSKS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 CANADA CRUSTACEANS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 CANADA PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCES, 2021-2030 (USD MILLION)

TABLE 55 CANADA HERBS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 56 CANADA SPICES IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 CANADA PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 58 CANADA PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET: SEGMENTATION

FIGURE 9 SURGING DEMAND FOR NATURAL FEED ADDITIVES IS DRIVING THE GROWTH OF THE NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET IN THE FORECAST PERIOD

FIGURE 10 THE ESSENTIAL OILS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET IN 2023 AND 2030

FIGURE 11 SUPPLY CHAIN OF THE NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET

FIGURE 12 VALUE CHAIN ANALYSIS OF THE NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET

FIGURE 14 AUSTRALIAN PRODUCTION AND CONSUMPTION OF CHICKEN MEAT (IN KT/KG)

FIGURE 15 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET: SNAPSHOT (2022)

FIGURE 16 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET: BY COUNTRY (2022)

FIGURE 17 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 18 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 19 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET: BY TYPE (2023-2030)

FIGURE 20 NORTH AMERICA PHYTOGENIC FEED ADDITIVES MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.