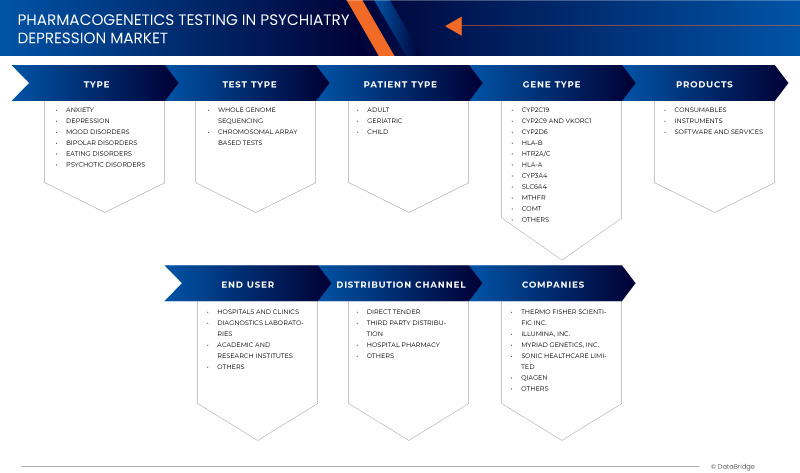

Tests pharmacogénétiques en psychiatrie/marché de la dépression en Amérique du Nord, par type (anxiété, troubles de l'humeur, dépression, troubles bipolaires, troubles psychotiques et troubles de l'alimentation), type de test (séquençage du génome entier et tests basés sur des matrices chromosomiques), type de patient (enfant, adulte et gériatrique), type de gène (CYP2C19, CYP2C9, VKORC1, CYP2D6, HLA-B, HTR2A/C, HLA-A, CYP3A4, SLC6A4, MTHFR, COMT et autres), produits (instruments, consommables, logiciels et services), utilisateur final (hôpitaux et cliniques, laboratoires de diagnostic, instituts universitaires et de recherche, et autres), canal de distribution (appel d'offres direct, distribution par des tiers, pharmacie hospitalière et autres) - Tendances et prévisions de l'industrie jusqu'en 2029

Analyse et perspectives du marché des tests pharmacogénétiques en psychiatrie/dépression en Amérique du Nord

Les tests pharmacogénétiques aident les professionnels de la santé en leur fournissant des informations sur la façon dont une personne métabolise un médicament. Ces informations peuvent aider les médecins et d’autres personnes à éviter de prescrire des antidépresseurs qui pourraient produire des effets indésirables. La pharmacogénomique s’est révélée prometteuse pour prédire la réponse et la tolérance aux antidépresseurs dans le traitement du trouble dépressif majeur (TDM). La pharmacogénomique peut améliorer les résultats cliniques en guidant le choix et le dosage des antidépresseurs. Le secteur des biotechnologies en pleine croissance et l’augmentation des dépenses de santé ont accéléré la demande de tests pharmacogénétiques en psychiatrie/dépression.

La prévalence croissante du cancer, les nouvelles technologies dans le traitement de la dépression et/ou d'autres troubles psychiatriques augmentent l'adoption des tests pharmacogénétiques dans les dispositifs et procédures de psychiatrie/dépression, et la préférence croissante pour les procédures non chirurgicales sont les principaux facteurs qui ont propulsé la demande du marché au cours de la période de prévision. Cependant, le coût élevé associé aux tests, la réglementation stricte et le manque de sensibilisation pourraient freiner la croissance du marché des tests pharmacogénétiques en psychiatrie/dépression au cours de la période de prévision.

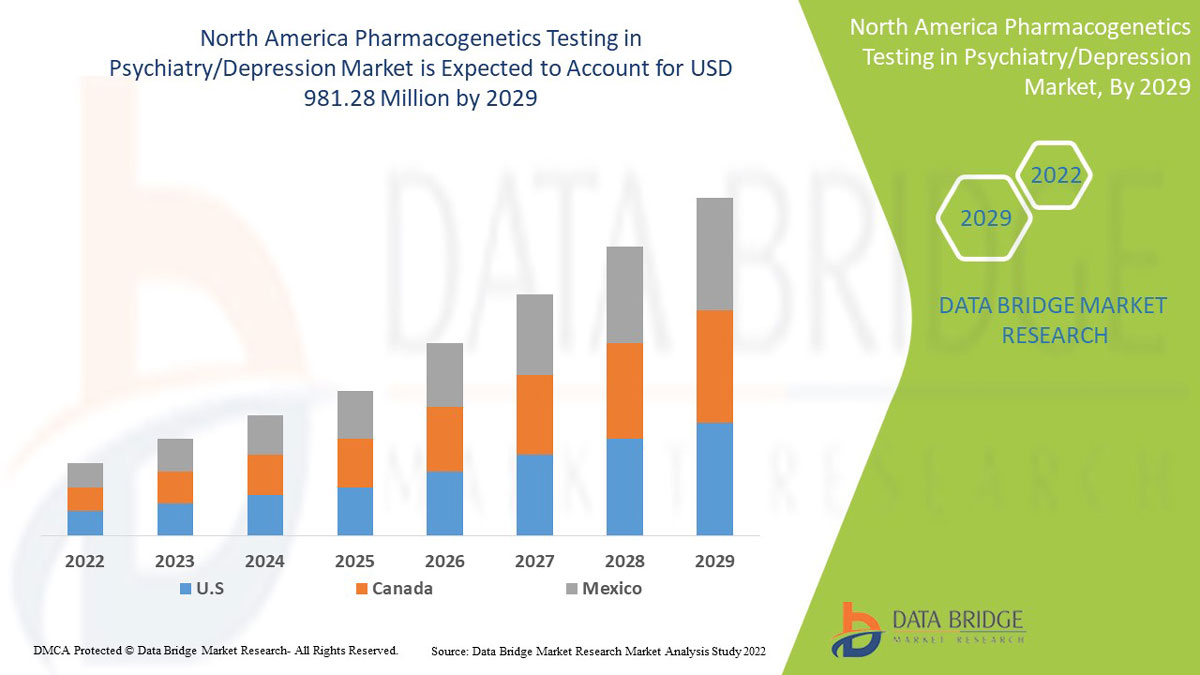

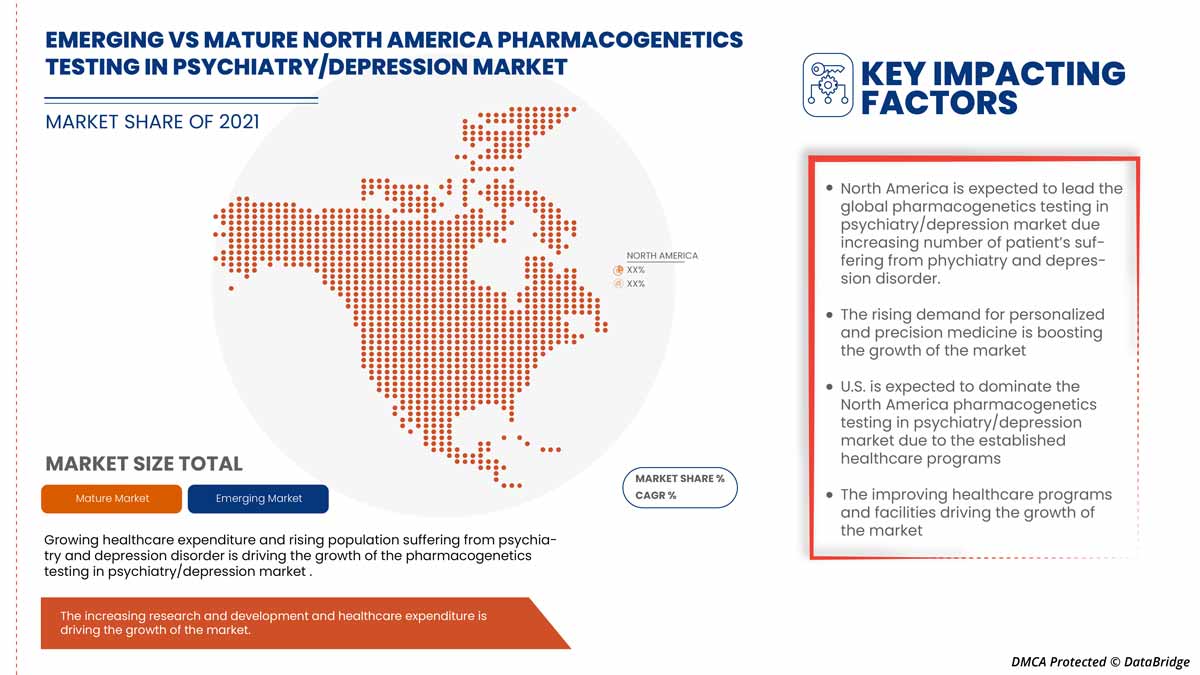

Data Bridge Market Research analyse que le marché nord-américain des tests pharmacogénétiques en psychiatrie/dépression devrait atteindre la valeur de 981,28 millions USD d'ici 2029, à un TCAC de 9,7 % au cours de la période de prévision. L'anxiété représente le segment de type le plus important du marché en raison du taux croissant de dépression au sein de la population nord-américaine. Ce rapport de marché couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Tests pharmacogénétiques en Amérique du Nord sur le marché de la psychiatrie/dépression, par application (nouveaux candidats médicaments, tests et approbations précliniques d'optimisation et de réorientation des médicaments, surveillance des médicaments, recherche de nouvelles cibles et voies associées aux maladies, compréhension des mécanismes des maladies, agrégation et synthèse des informations, formation et qualification d'hypothèses, conception de nouveaux médicaments, recherche de cibles médicamenteuses d'un ancien médicament, et autres), technologie (apprentissage automatique, apprentissage profond, traitement du langage naturel, et autres), type de médicament (petite molécule et grande molécule), offre (logiciels et services), indication (immuno-oncologie, maladies neurodégénératives, maladies cardiovasculaires, maladies métaboliques, et autres), utilisation finale (organismes de recherche sous contrat (CRO), sociétés pharmaceutiques et biotechnologiques, centres de recherche et instituts universitaires, et autres) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

Genelex (une partie de la société Invitae), Genewiz (une partie d'Azenta Life Sciences), MD Labs, BiogeneiQ, Inc., ONEOME, LLC, Myriad Genetics, Inc., GenXys, Castle Biosciences, Inc., PacBio, QIAGEN, Thermo Fisher Scientific Inc., AB-Biotics.SA, Coriell Life Sciences, Eurofins Scientific, Illumina, Inc., Dynamic DNA Laboratories, STADAPHARM GmbH, Color, cnsdose, Genomind, Inc., Healthspek, myDNA Life Australia Pty Ltd., HudsonAlpha, Sonic Healthcare Limited, entre autres. |

Définition du marché des tests pharmacogénétiques en psychiatrie/dépression en Amérique du Nord

Les tests pharmacogénomiques sont récemment devenus évolutifs et disponibles pour guider le trouble dépressif majeur (TDM). Les cliniciens reconnaissent de plus en plus les tests pharmacogénomiques (PGx) comme un outil essentiel pour guider les décisions en matière de médicaments pour les maladies psychiatriques. La mise en œuvre à grande échelle des tests PGx stimule le marché au cours de la période de prévision.

Les termes médecine personnalisée, médecine stratifiée et médecine de précision sont proches de la pharmacogénétique, mais ce sont des termes plus larges qui couvrent également d'autres facteurs non génétiques. Néanmoins, la pharmacogénétique est une composante importante de ces domaines. La pharmacogénétique s'intéresse principalement à la variation de l'ADN germinal humain, mais des avancées importantes ont également été réalisées récemment dans la compréhension des troubles de l'humeur et des maladies mentales.

Les tests pharmacogénétiques étudient l'interaction entre un médicament et la réponse génique d'une personne et recherchent la variation génétique responsable de l'influence de l'effet du médicament. Ce test est de plus en plus demandé car de nombreux chercheurs et scientifiques ont identifié l'interaction unique entre les médicaments et les gènes individuels et fournissent des informations précieuses qui peuvent ensuite être utilisées pour développer des médicaments personnalisés.

Dynamique du marché des tests pharmacogénétiques en psychiatrie/dépression en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- AUGMENTATION DU NOMBRE DE PATIENTS SOUFFRANT DE TROUBLES PSYCHIATRIQUES ET DÉPRESSIFS

La dépression est une maladie courante dans le monde entier, avec environ 3,8 % de la population touchée, dont 5,0 % chez les adultes et 5,7 % chez les adultes de plus de 60 ans. La dépression peut devenir un problème de santé grave de gravité légère à extrême, entraînant une souffrance importante chez la personne et pouvant conduire au suicide dans les cas les plus graves. Bien que plus de 45 antidépresseurs soient disponibles, la réponse sous-optimale pose un défi et est considérée comme le résultat de variations génétiques, de psychiatrie/dépression. En fonction de la gravité et du schéma des épisodes dépressifs au fil du temps, les prestataires de soins de santé peuvent proposer un diagnostic psychologique tel que l'activation comportementale, la thérapie cognitivo-comportementale, la psychothérapie interpersonnelle et/ou des médicaments antidépresseurs tels que les inhibiteurs sélectifs de la recapture de la sérotonine (ISRS) et les antidépresseurs tricycliques (ATC). Différents médicaments sont utilisés pour ce type de trouble mental.

Avec l'augmentation de la prévalence de la dépression, la demande de tests pharmacogénétiques augmente également, car ils étudient l'effet des variantes génétiques dans le but de fournir un diagnostic personnalisé. Le marché devrait croître pendant la période de foresterie.

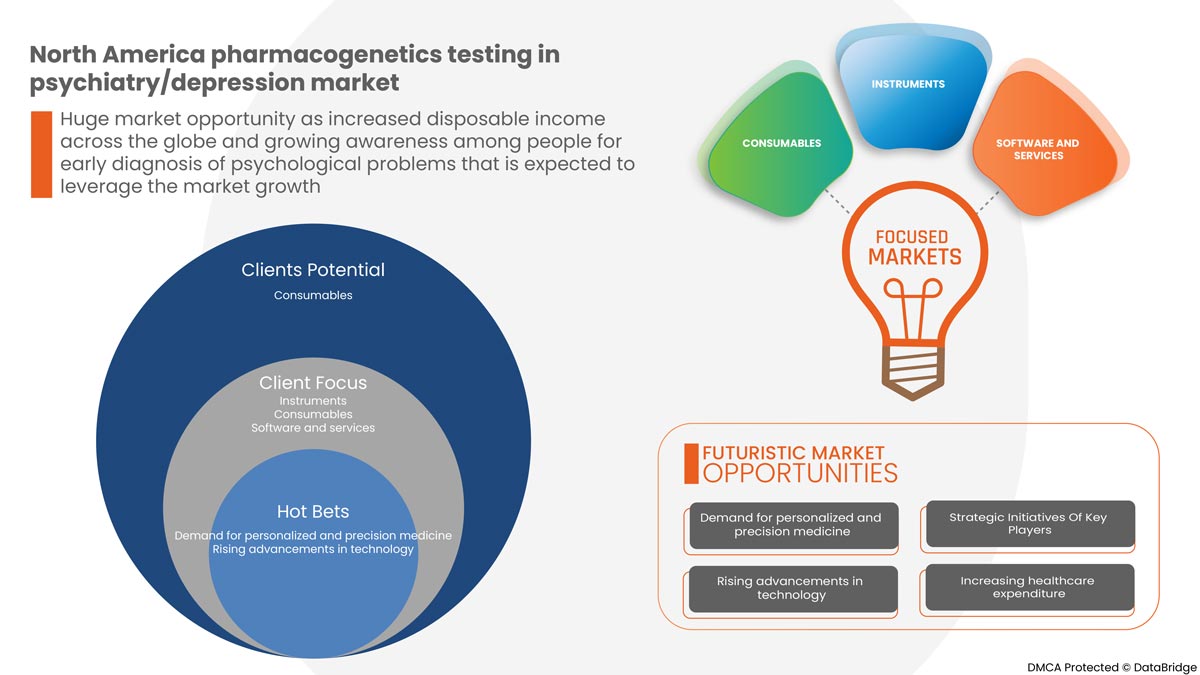

- AUGMENTATION DE LA DEMANDE DE MÉDECINE PERSONNALISÉE ET DE PRÉCISION

Le test de pharmacogénétique aide le professionnel de la santé à choisir le meilleur médicament pour la personne, car le test recherche la variante génétique qui peut être responsable de l’influence de l’effet du médicament.

La médecine commence à devenir plus personnelle et les patients expriment peu à peu leur intérêt pour de meilleurs résultats et moins d’effets indésirables grâce à des médicaments personnalisés. La médecine personnalisée a le potentiel d’adapter la thérapie avec une marge de sécurité élevée et la meilleure réponse. Cette tendance est en grande partie due aux améliorations du séquençage du génome.

L'évolution vers des soins de santé personnalisés implique des changements dans la fabrication des médicaments. Les fabricants passent de la création de petites molécules à la combinaison de petites molécules et de thérapies géniques. Les promoteurs s'efforcent de remplacer la production inefficace de lots à grande échelle par des investissements dans de nouvelles technologies et la production de médicaments personnalisés.

Retenue

- Manque d'experts médicaux et génomiques qualifiés

La plupart des cliniciens manquent encore de confiance dans les tests pharmacogénétiques (PGx) et l'interprétation des données qui en découle, ce qui indique un manque de connaissances dans ce domaine. Cela souligne la nécessité d'améliorer les connaissances des professionnels de santé en matière d'expertise et de compréhension des tests pharmacogénétiques (PGx).

Le manque de connaissances des praticiens sur les possibilités de la pharmacogénétique et l'explication insuffisante des résultats des tests réduisent également les technologies de personnalisation pour les patients. Outre le développement de cours de formation thématiques dans les universités de médecine, y compris les cycles de formation dans les systèmes de formation professionnelle continue, et la mise en place gratuite d'informations pour les médecins en exercice sont nécessaires : portails Internet universitaires, webinaires, etc. Le pharmacologue clinicien joue un rôle crucial dans la mise en œuvre des tests pharmacogénétiques.

La compétence d'un pharmacologue clinicien dans le domaine de la pharmacogénétique est essentielle : c'est lui qui organise l'application du génotypage dans la pratique clinique, interprète les tests et informe les médecins sur les possibilités de la pharmacogénétique pour les patients présentant des nosologies spécifiques, c'est-à-dire qu'il agit comme le lien principal entre le monde scientifique, le système de santé et les médecins praticiens dans le processus d'introduction de la pharmacogénétique.

Opportunité

-

Progrès technologiques croissants

Les progrès de la pharmacogénomique ont ouvert un nombre croissant d’opportunités pour intégrer la médecine personnalisée dans la pratique clinique des troubles psychiatriques. La médecine personnalisée peut être définie comme une approche globale et prospective de la prévention, du diagnostic, du traitement et du suivi des maladies de manière à obtenir des décisions optimales en matière de soins de santé individuels. Plus de 100 médicaments portent désormais l’étiquetage de la Food and Drug Administration (FDA) des États-Unis relatif à des biomarqueurs pharmacogénomiques potentiellement applicables grâce aux avancées technologiques dans le domaine des soins de santé. De plus, de nouvelles méthodes avancées sont en cours de développement pour promouvoir les tests pharmacogénétiques dans les troubles de type dépressif. Ces tests utilisent des méthodes de test génétique avancées pour donner des résultats précis afin de former un schéma thérapeutique. Les améliorations de la technologie à l’appui des tests ont amélioré l’accessibilité des options de test, et le nombre croissant de ressources qui aident les cliniciens à comprendre comment utiliser ces informations lorsqu’elles sont disponibles font de cet aspect de la médecine personnalisée ou de précision une réalité. Ainsi, les prestataires doivent devenir plus conscients de la pertinence scientifique et clinique des tests pharmacogénomiques.

Les tests permettent également d'établir une relation significative entre un médicament et la constitution génétique d'un individu. Cela permet de décider quels médicaments administrer au patient pour traiter les troubles dépressifs majeurs et d'autres troubles psychiatriques.

Défi

- Réglementation gouvernementale stricte sur l'approbation de nouveaux produits et instruments

Les inquiétudes concernant l'efficacité et la sécurité des produits ont conduit la plupart des gouvernements à mettre en place des agences et des politiques de réglementation pour surveiller le développement de nouveaux produits ou tests médicaux. L'utilisation de ces produits médicaux peut être effectuée après avoir satisfait à des normes réglementaires strictes, qui garantissent que le produit est sûr, bien étudié et ne présente pas d'effets indésirables.

Les directives récentes et leur amendement fournissent des orientations adéquates aux fabricants. Les réglementations internationales telles que celles relatives aux aliments, aux médicaments et à l'administration jouent un rôle majeur dans le lancement de nouveaux produits médicaux ou de tests sur le marché. Elles peuvent donc constituer un frein majeur pour le marché. Par conséquent, une réglementation gouvernementale stricte sur les nouveaux produits et l'approbation des instruments aura probablement un impact sur le marché.

Impact post- COVID-19 sur le marché nord-américain des tests pharmacogénétiques en psychiatrie/dépression

L'épidémie de COVID-19 a eu un impact positif sur l'expansion de l'industrie des tests pharmacogénétiques. La pandémie a eu un impact négatif sur la croissance du marché de la pharmacogénomique en raison de l'arrêt temporaire des activités de recherche dans ce domaine, couplé au faible afflux de patients dans les hôpitaux et les centres de diagnostic. Depuis le second semestre 2020, avec la demande croissante de recherche sur certains médicaments et kits de test pour le COVID-19, les pratiques pharmacogénomiques sont à la mode.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de multiples activités de R&D, de lancements de produits et de partenariats stratégiques pour améliorer la technologie et les résultats des tests impliqués dans le marché des tests pharmacogénétiques.

Développements récents

- En avril 2022, Blue Care Network (BCN) a lancé un programme de médecine de précision, Blue Cross Personalized Medicine, qui s'appuie sur la pharmacogénomique, ou les tests génétiques, pour personnaliser et adapter plus efficacement les traitements médicamenteux pour certains membres en fonction d'un examen de leurs médicaments prescrits pour divers diagnostics, notamment la santé comportementale, la cardiologie, les maladies cardiovasculaires et l'oncologie. OneOme LLC a aidé BCN à atteindre les objectifs de son programme de médecine de précision et à réduire le coût total des soins et à améliorer les résultats de santé des patients en réduisant les effets indésirables des médicaments. Cela a aidé l'entreprise à améliorer son portefeuille de produits.

- En février 2022, PacBio, l'un des principaux fournisseurs de plateformes de séquençage de haute qualité et de haute précision, a annoncé qu'il soutenait l'hôpital pour enfants malades (SickKids) de Toronto, au Canada, dans l'utilisation du séquençage du génome entier HiFi (HiFi WGS) pour identifier potentiellement des variantes génétiques pouvant être associées à des conditions médicales et développementales. Les échantillons examinés à l'aide du HiFi WGS ont été précédemment séquencés à l'aide de la technologie de séquençage d'ADN à lecture courte, mais il manque toujours l'identification d'une variante causant une maladie. Cela a aidé l'entreprise à améliorer l'utilisation de ses produits.

- En juillet 2022, selon une nouvelle étude nationale menée auprès de près de 2 000 vétérans par le ministère américain des Anciens Combattants (VA), les taux de rémission du trouble dépressif majeur (TDM) ont été considérablement améliorés lorsque les cliniciens ont eu accès aux résultats du test psychotrope GeneSight de Myriad Genetics, Inc. dans le cadre du plus grand essai contrôlé randomisé PGx sur la santé mentale jamais réalisé. Cela a aidé l'entreprise à montrer ses progrès en matière de tests pharmacogénétiques.

- En janvier 2021, myDNA Life Australia Pty Ltd a annoncé une fusion avec la société américaine de tests ADN grand public basée à Houston, FamilyTreeDNA, et sa société mère, Gene by Gene, pour révolutionner le domaine de la pharmacogénomique, faisant de la médecine véritablement personnalisée une réalité avant de s'étendre à la nutrigénomique pour fournir des recommandations personnalisées et exploitables en matière de nutrition, de remise en forme et de soins de la peau. Cela a aidé l'entreprise à développer ses activités.

Portée du marché nord-américain des tests pharmacogénétiques en psychiatrie/dépression

Le marché nord-américain des tests pharmacogénétiques en psychiatrie/dépression est segmenté en type, type de test, type de gène, type de patient, produit, utilisateur final et canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

- Tests pharmacogénétiques en Amérique du Nord sur le marché de la psychiatrie et de la dépression, par type

- Anxiété

- Troubles de l'humeur

- Dépression

- Troubles bipolaires

- Troubles psychotiques

- Troubles de l'alimentation

Sur la base du type, le marché nord-américain des tests pharmacogénétiques en psychiatrie/dépression est segmenté en anxiété, troubles de l’humeur, dépression, troubles bipolaires, troubles psychotiques et troubles de l’alimentation.

- Tests pharmacogénétiques en Amérique du Nord sur le marché de la psychiatrie et de la dépression, par type de test

- Séquençage du génome entier

- Tests basés sur des matrices chromosomiques

Sur la base du type de test, le marché nord-américain des tests pharmacogénétiques en psychiatrie/dépression est segmenté en tests basés sur le séquençage du génome entier et sur des puces chromosomiques.

- Tests pharmacogénétiques en Amérique du Nord sur le marché de la psychiatrie et de la dépression, par type de gène

- CYP2C19

- CYP2C9 et VKORC1

- CYP2D6

- HLA-B

- HTR2A/C

- HLA-A

- CYP3A4

- SLC6A4

- MTHFR

- COMT

- AUTRES

Sur la base du type de gène, le marché nord-américain des tests pharmacogénétiques en psychiatrie/dépression est segmenté en CYP2C19, CYP2C9, VKORC1, CYP2D6, HLA-B, HTR2A/C, HLA-A, CYP3A4, SLC6A4, MTHFR, COMT et autres.

- Tests pharmacogénétiques en psychiatrie/marché de la dépression en Amérique du Nord, par type de patient

- Enfant

- Adulte

- Gériatrie

Sur la base du type de patient, le marché nord-américain des tests pharmacogénétiques en psychiatrie/dépression est segmenté en enfants, adultes et gériatrie.

- Tests pharmacogénétiques en Amérique du Nord sur le marché de la psychiatrie et de la dépression, par produit

- Instruments

- Consommables

- Logiciels et services

Sur la base du type de produit, le marché nord-américain des tests pharmacogénétiques en psychiatrie/dépression est segmenté en instruments, consommables et logiciels et services.

- Tests pharmacogénétiques en Amérique du Nord sur le marché de la psychiatrie et de la dépression, par utilisateur final

- Hôpitaux et cliniques

- Laboratoires Dignostics

- Instituts universitaires et de recherche

- Autres

Sur la base de l'utilisateur final, le marché nord-américain des tests pharmacogénétiques en psychiatrie/dépression est segmenté en hôpitaux et cliniques, laboratoires de diagnostic, instituts universitaires et de recherche, et autres.

- North America Pharmacogenetics Testing In Psychiatry/Depression Market, By Distribution Channel

- Direct Tender

- Third-Party Distribution

- Hospital Pharmacy

- Others

On the basis of distribution channel, the North America pharmacogenetics testing in psychiatry/depression market is segmented into direct tender, third-party distribution hospital pharmacy, and others.

North America Pharmacogenetics Testing in Psychiatry/Depression Market Regional Analysis/Insights

The North America pharmacogenetics testing in psychiatry/depression market is analyzed, and market size information is provided by the type, test type, gene type, patient type, product, end user, and distribution channel. The countries covered in this market report are the U.S., Canada, and Mexico.

In 2022, North America is dominating due to the presence of key market players in the largest consumer market with high GDP. The U.S is expected to grow due to the rise in technological advancement in pharmacogenetics testing.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape And North America Pharmacogenetics Testing In Psychiatry/Depression Market Share Analysis

North America pharmacogenetics testing in psychiatry/depression market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus on the North America pharmacogenetics testing in psychiatry/depression market.

Some of the major players operating in the North America pharmacogenetics testing in psychiatry/depression market are

- Genelex (Part of Invitae corporation)

- Genewiz (Part of Azenta Life Sciences)

- MD Labs

- BiogeneiQ, Inc.

- ONEOME, LLC

- Myriad Genetics, Inc.

- GenXys

- Castle Biosciences, Inc.

- PacBio

- QIAGEN

- Thermo Fisher Scientific Inc.

- AB-Biotics.S.A.

- Coriell Life Sciences

- Eurofins Scientific

- Illumina, Inc.

- Dynamic DNA Laboratories

- STADAPHARM GmbH

- Color

- Cnsdose

- Genomind, Inc.

- Healthspek

- myDNA Life Australia Pty Ltd.

- HudsonAlpha

- Sonic Healthcare Limited

Méthodologie de recherche : Marché nord-américain des tests pharmacogénétiques en psychiatrie/dépression

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché des entreprises, les normes de mesure, l'Amérique du Nord par rapport aux régions et l'analyse des parts des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of North America pharmacogenetic testing in psychiatry/depression market

- LIMITATIONs

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographical scope

- years considered for the study

- currency and pricing

- DBMR TRIPOD DATA VALIDATION MODEL

- MULTIVARIATE MODELLING

- type LIFELINE CURVE

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- market application coverage grid

- vendor share analysis

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- REGULATIONS: North America pharmacogenetic testing IN PSYCHIATRY/DEPRESSION MARKET

- UNITED STATES

- ROLE OF FDA

- ROLE OF CDC AND HCFA

- market overview

- drivers

- RISING NUMBER OF POPULATION SUFFERING FROM DEPRESSIVE DISORDER

- INITIATIVES TAKEN BY MANUFACTURERS

- GROWING BIOTECHNOLOGY SECTOR ALONG WITH RISING HEALTHCARE EXPENDITURE

- INCREASING INTEREST FOR PERSONALIZED AND PRECISION MEDICATION

- RESTRAINTS

- LACK OF STRONG CLINICAL EVIDENCE

- HIGH COST

- LACK OF REIMBURSEMENT

- OPPORTUNITIES

- TECHNOLOGICAL ADVANCEMENTS

- EMERGENCE OF NEW PLAYERS

- Untapped market

- CHALLENGES

- STRINGENT GOVERNMENT REGULATION

- SHORTAGE OF SKILLED PERSONNEL

- COVID-19 IMPACT ON North America pharmacogenetic testing IN PSYCHIATRY/DEPRESSION MARKET

- IMPACT ON PRICE

- IMPACT ON DEMAND

- IMPACT ON SUPPLY

- KEY INITIATIVES BY MARKET PLAYER DURING COVID 19

- CONCLUSION:

- NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET, BY TYPE

- overview

- WHOLE GENOME SEQUENCING

- array-based TESTS

- NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET, BY GENES

- overview

- cyp2c19

- CYP2C9 and VKORC1

- cyp2d6

- HLA-B

- htr2a/c

- HLA-A

- cyp3A4

- slc6a4

- MTHFR

- COMT

- others

- NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET, BY DRUG TYPE

- overview

- PRESCRIPTION DRUGS

- Over-the-counter medications

- RECREATIONAL DRUGS

- VITAMINS/NUTRACEUTICals

- NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET, BY SAMPLE TYPE

- overview

- SALIVA

- BLOOD

- NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET, BY application

- overview

- DRUG DEVELOPMENT

- CLINICAL PRACTICE

- NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET, BY END USER

- overview

- pharmaceutical and biotechnology companies

- HEALTHCARE PROVIDERS

- research centers and academic institutes

- others

- NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET, BY DISTRIBUTION CHANNEL

- overview

- RETAIL PHARMACIES

- HOSPITAL PHARMACIES

- MAIL-ORDER PHARMACIES

- DIRECt-to-customer services

- NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET, by Country

- u.s.

- canada

- mexico

- North America pharmacogenetic testing in psychiatry/depression market: COMPANY landscape

- company share analysis: North America

- swot analysis

- company profile

- MYRIAD GENETICS, INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- THERMO FISHER SCIENTIFIC INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- sonic healthcare

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Illumina, Inc.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- AB-Biotics, S.A.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- 6.3 PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- ALTHEADX

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- biogeniq inc.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Color

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- cnsdose

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- CORIELL LIFE SCIENCES

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Dynamic DNA Laboratories

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- GENELEX

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- genomind, inc.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- genxys

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- HEALTHSPEK

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- HudsonAlpha Health Alliance (A Division of HudsonAlpha)

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- luminex corporation

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- MILLENNIUM HEALTH

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- mydna life australia pty ltd.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- oneome

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- OMECARE

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- PerkinElmer Inc.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- R-Biopharm AG

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- questionnaire

- related reports

Liste des tableaux

TABLE 1 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET, BY TYPE, 2019-2028 (USD Million)

TABLE 2 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET, BY GENES, 2019-2028 (USD Million)

TABLE 3 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET, BY DRUG TYPE, 2019-2028 (USD Million)

TABLE 4 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET, BY SAMPLE TYPE, 2019-2028 (USD Million)

TABLE 5 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET, BY APPLICATION, 2019-2028 (USD Million)

TABLE 6 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET, BY END USER, 2019-2028 (USD Million)

TABLE 7 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD Million)

TABLE 8 North America pharmacogenetic testing in psychiatry/depression Market, By COUNTRY, 2019-2028 (USD MILLION)

TABLE 9 u.s. pharmacogenetic testing in psychiatry/depression Market, By type, 2019-2028 (USD MILLION)

TABLE 10 u.s. pharmacogenetic testing in psychiatry/depression Market, By genes, 2019-2028 (USD MILLION)

TABLE 11 u.s. pharmacogenetic testing in psychiatry/depression Market, By drug type, 2019-2028 (USD MILLION)

TABLE 12 u.s. pharmacogenetic testing in psychiatry/depression Market, By sample, 2019-2028 (USD MILLION)

TABLE 13 u.s. pharmacogenetic testing in psychiatry/depression Market, By application, 2019-2028 (USD MILLION)

TABLE 14 u.s. pharmacogenetic testing in psychiatry/depression Market, By end user, 2019-2028 (USD MILLION)

TABLE 15 u.s. pharmacogenetic testing in psychiatry/depression Market, By distribution channel, 2019-2028 (USD MILLION)

TABLE 16 canada pharmacogenetic testing in psychiatry/depression Market, By type, 2019-2028 (USD MILLION)

TABLE 17 canada pharmacogenetic testing in psychiatry/depression Market, By genes, 2019-2028 (USD MILLION)

TABLE 18 canada pharmacogenetic testing in psychiatry/depression Market, By drug type, 2019-2028 (USD MILLION)

TABLE 19 canada pharmacogenetic testing in psychiatry/depression Market, By sample, 2019-2028 (USD MILLION)

TABLE 20 canada pharmacogenetic testing in psychiatry/depression Market, By application, 2019-2028 (USD MILLION)

TABLE 21 canada pharmacogenetic testing in psychiatry/depression Market, By end user, 2019-2028 (USD MILLION)

TABLE 22 canada pharmacogenetic testing in psychiatry/depression Market, By distribution channel, 2019-2028 (USD MILLION)

TABLE 23 mexico pharmacogenetic testing in psychiatry/depression Market, By type, 2019-2028 (USD MILLION)

TABLE 24 mexico pharmacogenetic testing in psychiatry/depression Market, By genes, 2019-2028 (USD MILLION)

TABLE 25 mexico pharmacogenetic testing in psychiatry/depression Market, By drug type, 2019-2028 (USD MILLION)

TABLE 26 mexico pharmacogenetic testing in psychiatry/depression Market, By sample, 2019-2028 (USD MILLION)

TABLE 27 mexico pharmacogenetic testing in psychiatry/depression Market, By application, 2019-2028 (USD MILLION)

TABLE 28 mexico pharmacogenetic testing in psychiatry/depression Market, By end user, 2019-2028 (USD MILLION)

TABLE 29 mexico pharmacogenetic testing in psychiatry/depression Market, By distribution channel, 2019-2028 (USD MILLION)

Liste des figures

FIGURE 1 North America PHARMACOGENETIC TESTIG IN PSYCHIATRY/DEPRESSION market: segmentation

FIGURE 2 North America pharmacogenetic testing IN PSYCHIATRIC/DEPRESSION market: data triangulation

FIGURE 3 North America pharmacogenetic testing IN PSYCHIATRIC/DEPRESSION market: DROC ANALYSIS

FIGURE 4 North America pharmacogenetic testing IN PSYCHIATRIC/DEPRESSION market: Region vs country MARKET ANALYSIS

FIGURE 5 North America pharmacogenetic testing IN PSYCHIATRIC/DEPRESSION market: COMPANY RESEARCH ANALYSIS

FIGURE 6 North America pharmacogenetic testing IN PSYCHIATRIC/DEPRESSION market: DBMR MARKET POSITION GRID

FIGURE 7 North America pharmacogenetic testing in psychiatry/depression market: MARKET APPLICATION COVERAGE GRID

FIGURE 8 North America pharmacogenetic testing in psychiatry/depression market: vendor share analysis

FIGURE 9 North America pharmacogenetic testing in psychiatry/depression market: SEGMENTATION

FIGURE 10 initiatives taken by manufacturers is expected to drive THE North America pharmacogenetic testing in psychiatry/depression market IN THE FORECAST PERIOD of 2021 to 2028

FIGURE 11 whole genome sequencing segment is expected to account for the largest share of the North America pharmacogenetic testing in psychiatry/depression market in 2021 & 2028

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF North America pharmacogenetic testing IN PSYCHIATRY/DEPRESSION MARKET

FIGURE 13 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY TYPE, 2021-2028

FIGURE 14 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY TYPE, 2019-2028 (USD MILLION)

FIGURE 15 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY TYPE, CAGR (2021-2028)

FIGURE 16 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY TYPE, LIFELINE CURVE

FIGURE 17 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY GENES, 2019-2028 (USD MILLION)

FIGURE 18 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY GENES, 2019-2028 (USD MILLION)

FIGURE 19 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY GENES, CAGR 2019-2028 (USD MILLION)

FIGURE 20 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY GENES, LIFELINE CURVE

FIGURE 21 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY DRUG TYPE, 2021-2028

FIGURE 22 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY DRUG TYPE, 2019-2028 (USD MILLION)

FIGURE 23 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY DRUG TYPE, CAGR 2019-2028 (USD MILLION)

FIGURE 24 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY DRUG TYPE, LIFELINE CURVE

FIGURE 25 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY SAMPLE TYPE, 2019-2028 (USD MILLION)

FIGURE 26 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY SAMPLE TYPE, 2019-2028 (USD MILLION)

FIGURE 27 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY DRUG TYPE, CAGR (2021-2028)

FIGURE 28 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY SAMPLE TYPE, LIFELINE CURVE

FIGURE 29 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY APPLICATION, 2019-2028 (USD MILLION)

FIGURE 30 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY APPLICATION, 2019-2028 (USD MILLION)

FIGURE 31 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY APPLICATION, CAGR 2019-2028 (USD MILLION)

FIGURE 32 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 33 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY END USER, 2019-2028 (USD MILLION)

FIGURE 34 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY END USER, 2019-2028 (USD MILLION)

FIGURE 35 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY END USER, CAGR 2019-2028 (USD MILLION)

FIGURE 36 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY END USER, LIFELINE CURVE

FIGURE 37 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

FIGURE 38 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

FIGURE 39 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY DISTRIBUTION CHANNEL, CAGR 2019-2028 (USD MILLION)

FIGURE 40 NORTH AMERICA PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 41 North America PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: SNAPSHOT (2020)

FIGURE 42 North America PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY COUNTRY (2020)

FIGURE 43 North America PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY COUNTRY (2021 & 2028)

FIGURE 44 North America PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY COUNTRY (2020 & 2028)

FIGURE 45 North America PHARMACOGENETIC TESTING IN PSYCHIATRY/DEPRESSION MARKET: BY type (2021-2028)

FIGURE 46 North America pharmacogenetic TESTING IN psychiatry/depression market: company share 2020 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.