North America Pet Food Flavors and Ingredients Market, By Product Type (Flavors and Palatability Enhancer, Mold Inhibitors, Antimicrobials, Pellet Binder, Enzymes, Amino Acid, Feed Acidifiers, Probiotics, Vitamins, Nitrogen, Phytogenic, Carotenoids, Trace Minerals, Antioxidants, Mycotoxin Binders, Cocolorants, Preservatives, and others), Pet Food Type (Dog Food, Cat Food, Aqua Pets Food, Birds Food, and Others), Source (Animal Based, Plant Based, Yeast, and Others), Form (Dry and Liquid), Functionality (Preservation, Processing, Nutrition, and Others), Category (Organic and Conventional), Distribution Channel (Direct and Indirect) Industry Trends and Forecast to 2030.

North America Pet Food Flavors and Ingredients Market Analysis and Insights

The cost of owning pets and purchasing pet food has increased significantly in recent years, which is a major driver of the North America pet food flavors and ingredients market. As pet owners spend more money on different types of pet food, the North America pet food market has also grown with the increase in the number of pets. Some of the major drivers of the market are the growing adoption of dogs and cats and the growing emphasis on improving productivity and health. Due to affordability and availability, the safest pet foods are currently made with synthetic substances. In addition, overall demand has been boosted by a marked shift in consumer demand for grain-free and vegan pet foods. The industry is expected to continue to grow as pet food is readily available on multiple platforms, including retail stores, supermarkets, and online stores.

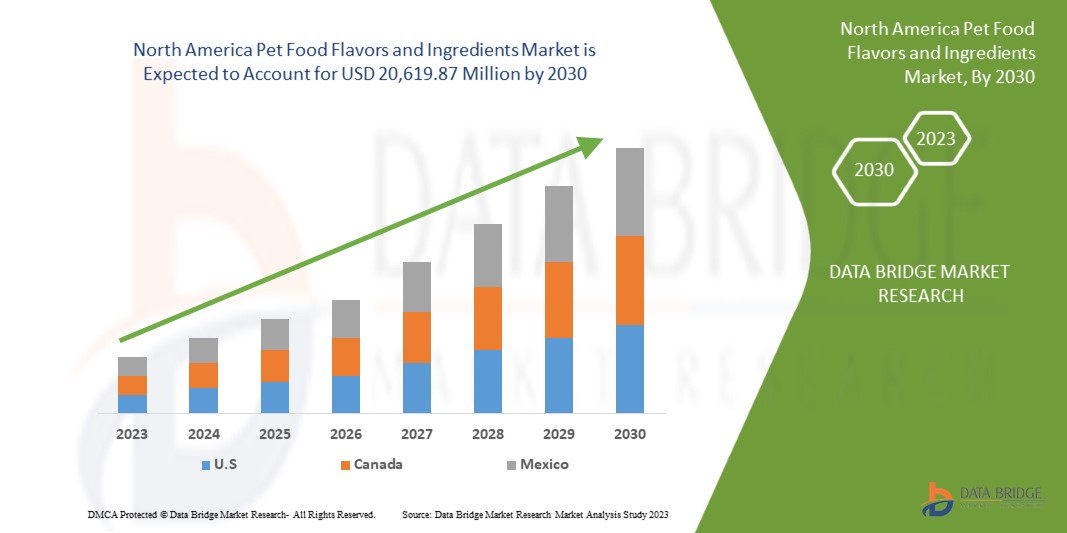

Data Bridge Market Research analyzes that the North America pet food flavors and ingredients market is expected to reach the value of USD 20,619.87 million by 2030, at a CAGR of 10.2% during the forecast period. Product type accounts for the largest type segment in the market due to increase in pet adoption and rising high quality of pet foods for pet North America. This market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customisable to 2020-2016) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Par type de produit (exhausteurs de saveurs et d'appétence, inhibiteurs de moisissures, antimicrobiens, liants pour granulés, enzymes, acides aminés , acidifiants alimentaires, probiotiques, vitamines, azote, phytogéniques, caroténoïdes, oligo-éléments, antioxydants, liants de mycotoxines, cocolorants, conservateurs et autres), type d'aliment pour animaux de compagnie (aliments pour chiens, aliments pour chats, aliments pour animaux aquatiques, aliments pour oiseaux et autres), source (d'origine animale, végétale, levure et autres), forme (sèche et liquide), fonctionnalité (conservation, transformation, nutrition et autres), catégorie (biologique et conventionnel), canal de distribution (direct et indirect). |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

Glanbia PLC, Ingredion, Barentz, Kerry Group plc., Cargill, Incorporated, ADM, BASF SE, International Flavors & Fragrances Inc., DSM, Symrise, Kemin Industries, Inc. et son groupe de sociétés, Chr. Hansen Holding A/S, Lallemand Inc., The Scoular Company, Roquette Frères, Balchem Inc., Wysong, The Peterson Company et Omega Protein Corporation, entre autres. |

Définition du marché

Les aliments pour animaux de compagnie sont des aliments spéciaux pour les animaux domestiques ou des aliments conçus pour répondre à leurs besoins nutritionnels. Les aliments pour animaux de compagnie sont des produits végétaux ou animaux, tels que la viande, utilisés pour nourrir les animaux de compagnie. Les fruits et légumes, les produits d'origine animale, les céréales et les oléagineux, les vitamines et les minéraux sont tous inclus dans les aliments pour animaux de compagnie. Les ingrédients des aliments pour animaux de compagnie sont riches en vitamines, fibres, protéines, glucides et calcium. Les céréales et les légumes sont généralement utilisés spécialement pour les aliments pour chiens. Chaque composant est essentiel pour enrichir le corps de l'animal. La teneur en protéines de la viande est généralement considérée comme élevée et ajoute également de la saveur aux aliments. De nombreux ingrédients, tels que la viande, la volaille et les céréales, sont considérés comme sûrs et ne nécessitent pas d'approbation préalable à la mise sur le marché. Des acides gras oméga-3 et oméga-6 sont également produits, qui sont essentiels au métabolisme et à la digestion des animaux. Les fabricants d'aliments pour animaux de compagnie utilisent différents ingrédients pour équilibrer la nutrition des animaux de compagnie. En plus d'agir comme conservateurs, conditionneurs, émulsifiants, stabilisateurs et substituts de couleur ou d'arôme, ils sont également utilisés dans les aliments pour animaux de compagnie.

Dynamique du marché des arômes et des ingrédients des aliments pour animaux de compagnie en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

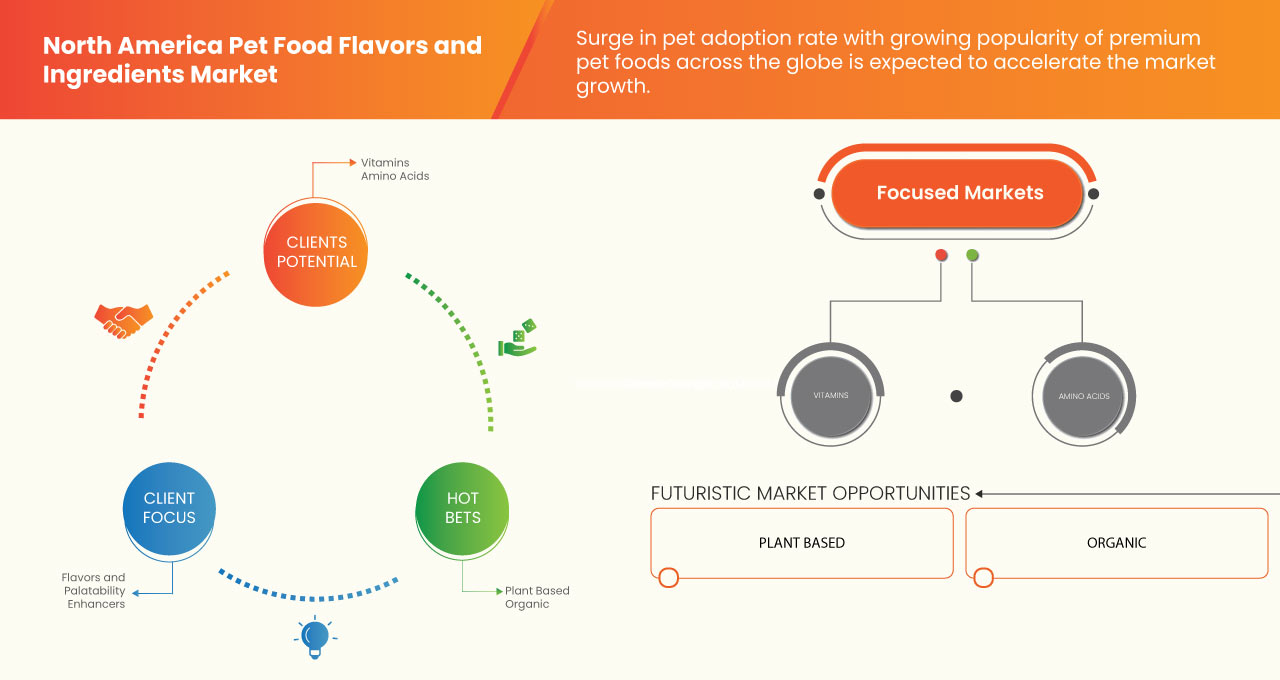

- Augmentation du taux d'adoption des animaux de compagnie avec la popularité croissante des aliments pour animaux de compagnie haut de gamme à travers le monde

Le marché nord-américain des ingrédients aromatiques pour aliments pour animaux de compagnie est sur le point d'afficher une forte croissance en raison de l'adoption accrue des animaux de compagnie, de l'augmentation des dépenses consacrées aux soins des animaux de compagnie, de la demande croissante d'aliments pour animaux de compagnie à base d'insectes et d'un marché des aliments pour animaux de compagnie en plein essor. L'industrie des animaux de compagnie a connu une croissance exponentielle ces dernières années. Selon l'American Pet Products Association, environ 85 millions de ménages possèdent un animal de compagnie et la possession d'animaux de compagnie est passée de 56 % à 68 % au cours des 30 dernières années. L'introduction de la technologie et des achats en ligne a contribué à certains des changements dans la possession d'animaux de compagnie. En raison des effets du COVID-19, de nombreuses personnes ont été obligées de rester chez elles pendant de longues périodes, soit en raison des ordres de confinement, soit en raison des conseils de télétravail. Peu de temps après, le temps passé à la maison a augmenté et les adoptions et les familles d'accueil ont été enregistrées dans les refuges pour animaux de compagnie. Depuis le début de la pandémie de COVID-19, le nombre d'animaux de compagnie dans le monde a considérablement augmenté. En outre, les nouvelles tendances du marché des ingrédients alimentaires pour animaux de compagnie, telles que la popularité croissante des aliments haut de gamme à travers le pays, stimulent la croissance du marché des arômes et des ingrédients alimentaires pour animaux de compagnie, et cette tendance devrait se poursuivre au cours de la période de prévision.

Ainsi, l’augmentation du taux d’adoption des animaux de compagnie et la popularité croissante des aliments haut de gamme pour animaux de compagnie dans le monde entier devraient constituer une opportunité pour la croissance du marché.

- Demande croissante d'aliments personnalisés pour animaux de compagnie de la part des propriétaires d'animaux de compagnie

Les propriétaires d'animaux de compagnie sont de plus en plus nombreux à penser que la personnalisation est une bonne chose et non un privilège. La possibilité pour les propriétaires d'animaux de compagnie d'avoir leur mot à dire sur ce qu'ils achètent a eu un impact sur l'industrie des aliments pour animaux de compagnie. Les propriétaires d'animaux de compagnie sont désormais prêts à payer plus cher pour des produits alimentaires personnalisés qui répondent aux besoins alimentaires particuliers de leur animal. Si l'on tient compte des différences générationnelles entre les propriétaires d'animaux de compagnie, on s'attend à ce que les jeunes propriétaires d'animaux de compagnie paient plus cher pour des friandises/aliments personnalisés que les propriétaires plus âgés. Cela montre que la tendance à la personnalisation devrait continuer à se développer à mesure que les jeunes acheteurs commencent leur parcours de parents d'animaux de compagnie et acquièrent un plus grand pouvoir d'achat.

Ainsi, la demande croissante d’aliments personnalisés pour animaux de compagnie de la part des propriétaires d’animaux de compagnie devrait constituer un facteur moteur de la croissance du marché.

Retenue

- Des obligations strictes pour les fabricants d’aliments pour animaux de compagnie

Les fabricants d’aliments pour animaux de compagnie, les agences gouvernementales et les vétérinaires jouent un rôle essentiel pour garantir la sécurité des aliments pour animaux de compagnie et protéger les animaux et leurs propriétaires. Il incombe aux vétérinaires d’être au courant de la récente législation fédérale concernant la sécurité des aliments pour animaux de compagnie, du rôle du fabricant dans la production d’aliments sûrs et de leur propre rôle dans l’identification des maladies potentielles liées aux aliments pour animaux de compagnie, le signalement des cas suspects et l’éducation des propriétaires d’animaux de compagnie sur la sécurité des aliments pour animaux de compagnie. Étant donné que les aliments pour animaux de compagnie nécessitent une sécurité extrême lors de la production, plusieurs associations et gouvernements ont établi des normes strictes auxquelles les fabricants doivent se conformer, en particulier dans les pays occidentaux. La surveillance stricte des aliments pour animaux de compagnie, des ingrédients à la production et des ventes à la distribution, la rigidité du marché peuvent empêcher les grandes entreprises d’investir dans le secteur et entraver la croissance du marché nord-américain des arômes et des ingrédients pour aliments pour animaux de compagnie dans les années à venir.

Ainsi, les mandats stricts imposés aux fabricants d’aliments pour animaux de compagnie devraient constituer un facteur limitant la croissance du marché.

Opportunité

- Demande croissante d'aliments pour animaux de compagnie contenant du cannabidiol (CBD)

Les compléments alimentaires CBD pour animaux de compagnie sont un cannabinoïde sûr et bien traité dérivé du chanvre. Ils favorisent la santé des animaux en agissant sur leur système endocannabinoïde. Les principales raisons pour lesquelles de nombreux propriétaires d'animaux se tournent vers les aliments pour animaux de compagnie CBD sont qu'ils favorisent la santé des articulations, favorisent la fonction cardiovasculaire et préviennent la propagation des vers du cœur. En 2020, les ventes d'animaux de compagnie aux États-Unis ont atteint près de 800 millions de dollars, et les consommateurs sont prêts à payer plus cher pour les services de santé pour animaux de compagnie. Les compléments alimentaires CBD pour animaux de compagnie présentent un certain nombre d'allégations, notamment l'absence de blé, de maïs et de soja, ce qui signifie qu'ils sont entièrement naturels et contribuent à la croissance du marché.

De plus, la sensibilisation croissante des consommateurs aux avantages nutritionnels associés aux dérivés du chanvre et l’augmentation de la production de chanvre industriel ont orienté la croissance du marché des dérivés du chanvre. Les aliments à base de CBD devraient durer plus longtemps que les aliments traditionnels pour animaux de compagnie.

Ainsi, la demande croissante d’aliments pour animaux de compagnie à base de cannabidiol devrait constituer une opportunité de croissance du marché.

Défi

- Concurrence croissante sur le marché des arômes et des ingrédients pour aliments pour animaux de compagnie

Les entreprises du secteur devraient croître encore davantage à l'avenir, ce qui créera une forte concurrence sur le marché des arômes et ingrédients pour aliments pour animaux de compagnie. Les nouveaux acteurs du marché proposent des stratégies marketing innovantes, telles que l'offre de produits à moindre coût et l'utilisation d'ingrédients innovants, ce qui constitue un facteur de défi pour les acteurs de niveau 1 et 2. La concurrence entre les entreprises existe lorsqu'elles produisent et commercialisent des services et des produits similaires destinés au même groupe de consommateurs. Cela devient un facteur difficile pour les entreprises qui souhaitent gagner une part de marché significative. Les grands géants du marché des arômes et ingrédients pour aliments pour animaux de compagnie, tels qu'ADM, Koninklijke DSM NV et DuPont, entre autres, disposent de vastes réseaux de distribution, d'une forte présence en Amérique du Nord et d'une forte R&D, ce qui pose un problème aux petits acteurs pour concurrencer ces acteurs. Un grand nombre d'acteurs dans l'industrie européenne des aliments pour animaux de compagnie augmente la concurrence sur le marché des arômes et ingrédients pour aliments pour animaux de compagnie.

Ainsi, la concurrence croissante sur le marché des arômes et des ingrédients des aliments pour animaux de compagnie devrait constituer un défi pour la croissance du marché.

Impact post-COVID-19 sur le marché nord-américain des arômes et ingrédients pour aliments pour animaux de compagnie

La pandémie de COVID-19 a eu un impact plutôt positif sur le marché des arômes et ingrédients pour aliments pour animaux de compagnie. Depuis le début de la pandémie de COVID-19, le nombre d'animaux de compagnie adoptés à travers le monde a augmenté à un rythme soutenu. Cette augmentation de l'adoption d'animaux de compagnie agit comme un catalyseur pour la croissance du marché.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de multiples activités de R&D et de lancement de produits, ainsi que des partenariats stratégiques pour améliorer la technologie et les résultats des tests impliqués dans le marché des arômes et ingrédients pour aliments pour animaux de compagnie.

Développements récents

- En janvier 2022, Kerry Group Plc, leader mondial du goût et de la nutrition, a officiellement inauguré une nouvelle installation ultramoderne de 21 500 pieds carrés sur son site de Djeddah, au Royaume d'Arabie saoudite. L'entreprise a investi plus de 80 millions d'euros dans la région au cours des quatre dernières années et cette nouvelle installation, la plus grande de Kerry dans la région Moyen-Orient, Afrique du Nord et Turquie (MENAT), est l'une des plus modernes et des plus efficaces au monde et produira des ingrédients alimentaires savoureux, nutritifs et durables qui seront distribués dans tout le Moyen-Orient. Cela a aidé l'entreprise à se développer.

- En novembre 2022, ADM a dévoilé sa troisième perspective annuelle sur les tendances de consommation en Amérique du Nord qui façonneront les industries de l'alimentation, des boissons et de la nutrition animale et stimuleront la croissance du marché dans les années à venir. En décortiquant l'intersection entre la santé et le bien-être, la durabilité et la sécurité alimentaire, ADM a identifié huit domaines qui détaillent l'évolution des comportements, des attitudes et des aspirations des consommateurs. Ces huit domaines servent de points d'ancrage pour inspirer l'innovation, inaugurant une nouvelle vague de produits et de services pour 2023. Cela a aidé l'entreprise à développer son portefeuille de produits.

Portée du marché des arômes et ingrédients pour aliments pour animaux de compagnie en Amérique du Nord

Le marché nord-américain des arômes et ingrédients pour aliments pour animaux de compagnie est segmenté en type de produit, type d'aliment pour animaux de compagnie, source, forme, fonctionnalité, catégorie et canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

PAR TYPE DE PRODUIT

- Exhausteur de saveurs et de goût

- Inhibiteurs de moisissures

- Antimicrobiens

- Liant à granulés

- Enzymes

- Acide aminé

- Acidifiants alimentaires

- Probiotiques

- Vitamines

- Azote

- Phytogène

- Caroténoïdes

- Oligo-éléments

- Antioxydants

- Liants de mycotoxines

- Cocolorants

- Conservateurs

- Autres

Sur la base du type de produit, le marché nord-américain des arômes et des ingrédients des aliments pour animaux de compagnie est segmenté en arômes et exhausteurs de goût, inhibiteurs de moisissures, antimicrobiens, liants pour granulés, enzymes, acides aminés, acidifiants alimentaires, probiotiques, vitamines, azote, phytogéniques, caroténoïdes, oligo-éléments, antioxydants, liants de mycotoxines, cocolorants, conservateurs et autres.

PAR TYPE D'ALIMENT POUR ANIMAUX DE COMPAGNIE

- Nourriture pour chien

- Nourriture pour chat

- Nourriture pour animaux Aqua

- Nourriture pour oiseaux

- Autres

Sur la base du type d'aliments pour animaux de compagnie, le marché nord-américain des saveurs et des ingrédients des aliments pour animaux de compagnie est segmenté en aliments pour chiens, aliments pour chats, aliments pour animaux aquatiques, aliments pour oiseaux et autres.

PAR SOURCE

- À base d'animaux

- À base de plantes

- Levure

- Autres

Sur la base de la source, le marché nord-américain des arômes et des ingrédients des aliments pour animaux de compagnie est segmenté en produits d'origine animale, végétale, de levure et autres.

PAR FORMULAIRE

- Sec

- Liquide

Sur la base de la forme, le marché nord-américain des arômes et des ingrédients des aliments pour animaux de compagnie est segmenté en sec et liquide.

PAR FONCTIONNALITÉ

- Préservation

- Traitement

- Nutrition

- Autres

Sur la base de la fonctionnalité, le marché nord-américain des arômes et des ingrédients des aliments pour animaux de compagnie est segmenté en conservation, transformation, nutrition et autres.

PAR CATÉGORIE

- Organique

- Conventionnel

Sur la base de la catégorie, le marché nord-américain des arômes et des ingrédients des aliments pour animaux de compagnie est segmenté en biologique et conventionnel.

PAR CANAL DE DISTRIBUTION

- Direct

- Indirect

Sur la base du canal de distribution, le marché nord-américain des arômes et des ingrédients des aliments pour animaux de compagnie est segmenté en direct et indirect.

Analyse/perspectives régionales du marché des arômes et ingrédients des aliments pour animaux de compagnie en Amérique du Nord

Le marché nord-américain des saveurs et des ingrédients des aliments pour animaux de compagnie est analysé et des informations sur la taille du marché sont fournies par type de produit, type d'aliment pour animaux de compagnie, source, forme, fonctionnalité, catégorie et canal de distribution.

Les pays couverts par ce rapport de marché sont les États-Unis, le Canada et le Mexique.

- En 2023, les États-Unis devraient dominer le marché nord-américain des arômes et des ingrédients des aliments pour animaux de compagnie en raison de la forte présence d'acteurs clés tels que Kerry Group plc, Cargill, Incorporated, ADM, BASF SE et autres.

La section du rapport sur les pays fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des arômes et ingrédients des aliments pour animaux de compagnie en Amérique du Nord

Le paysage concurrentiel du marché des arômes et ingrédients pour aliments pour animaux de compagnie en Amérique du Nord fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'ampleur du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise vers le marché des arômes et ingrédients pour aliments pour animaux de compagnie en Amérique du Nord.

Certains des principaux acteurs opérant sur le marché nord-américain des arômes et ingrédients pour aliments pour animaux de compagnie sont Glanbia PLC, Ingredion, Barentz, Kerry Group plc., Cargill, Incorporated, ADM, BASF SE, International Flavors & Fragrances Inc., DSM, Symrise, Kemin Industries, Inc. et son groupe de sociétés, Chr. Hansen Holding A/S, Lallemand Inc., The Scoular Company, Roquette Frères, Balchem Inc., Wysong, The Peterson Company et Omega Protein Corporation, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER FIVE FORCES

4.2 FACTORS INFLUENCING PURCHASING DECISIONS OF END-USERS

4.3 GROWTH STRATEGIES ADOPTED BY THE KEY MARET PLAYERS

4.3.1 PARTICIPATING IN TRADE FAIRS AND BUSINESS EVENTS

4.3.2 ORGANIZING PET SHOWS TO GAIN VISIBILITY

4.3.3 PROVIDING QUALITY PRODUCT

4.3.4 ATTRACTIVE PACKAGING

4.3.5 SELLING THE PET FOOD PRODUCT ON E-COMMERCE WEBSITES

4.3.6 MARKETING THROUGH E-MAIL

4.3.7 HIRING A BRAND AMBASSADOR

4.3.8 FEEDBACK FROM CUSTOMER

4.4 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET- IMPORT & EXPORT ANALYSIS OF PET FOODS ACROSS THE GLOBE ACCORDING TO PER YEAR

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.5.1 FUTURE PERSPECTIVE:

4.5.2 CONCLUSION:

4.6 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.7 PRICING ANALYSIS – NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET

4.8 PRODUCTION CAPACITY OF KEY MANUFACTURERS

4.9 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: RAW MATERIAL SOURCING ANALYSIS

4.9.1 MEAT

4.9.2 SOYBEAN

4.9.3 SEA FOOD

4.1 SUPPLY CHAIN OF NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET

4.10.1 RAW MATERIAL PROCUREMENT

4.10.2 PET FOOD AND INGREDIENTS PRODUCTION/PROCESSING

4.10.3 MARKETING AND DISTRIBUTION

4.10.4 END USERS

4.11 VALUE CHAIN OF NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET

5 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: REGULATORY FRAMEWORK

5.1 CLASSIFICATION OF PET FOOD (CHINA)

5.2 LABELING REQUIREMENTS (NORTH AMERICA)

5.3 LABELING REQUIREMENTS (EUROPEAN UNION)

5.4 PET FOOD CERTIFICATIONS

5.4.1 ORGANIC

5.4.2 MARINE STEWARDSHIP COUNCIL (MSC)

5.4.3 VEGAN

5.4.4 GMP+ FSA

5.4.5 FAMI-QS CODE

5.4.6 SAFE FEED/SAFE FOOD CERTIFICATION PROGRAM

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 SURGE IN PET ADOPTION RATE WITH GROWING POPULARITY OF PREMIUM PET FOODS ACROSS THE GLOBE

6.1.2 SHIFT FROM PHYSICAL HEALTH TO HOLISTIC WELLNESS

6.1.3 INCREASING DEMAND FOR CUSTOMIZED PET FOODS FROM PET OWNERS

6.1.4 FOCUS ON MINI-MEALS INSTEAD OF MEALS PER DAY FOR PETS

6.2 RESTRAINTS

6.2.1 STRINGENT MANDATES FOR PET FOOD MANUFACTURERS

6.2.2 INTRODUCTION OF CHEMICALS IN THE PET FOOD

6.2.3 LINK BETWEEN CERTAIN PET FOODS AND HEART DISEASES

6.2.4 ADULTERATION IN PET FOOD PRODUCTS

6.3 OPPORTUNITIES

6.3.1 INCREASING DEMAND FOR CANNABIDIOL (CBD) PET FOOD

6.3.2 SUPER PREMIUM PET FOOD PRODUCTS IN THE MARKET

6.3.3 INTRODUCTION OF ALTERNATIVE PROTEIN INGREDIENTS IN PET FOODS

6.3.4 E-COMMERCE SECTOR CONTINUES TO CREATE OPPORTUNITIES IN THE PET FOOD FLAVORS AND INGREDIENTS MARKET

6.4 CHALLENGES

6.4.1 INCREASING COMPETITION IN THE PET FOOD FLAVORS AND INGREDIENTS MARKET

6.4.2 THREAT FROM COUNTERFEIT PRODUCTS

7 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 VITAMINS

7.2.1 FAT SOLUBLE

7.2.1.1 VITAMIN A

7.2.1.2 VITAMIN D

7.2.1.3 VITAMIN E

7.2.1.4 VITAMIN K

7.2.2 WATER SOLUBLE

7.2.2.1 VITAMIN B COMPLEX

7.2.2.2 VITAMIN C

7.2.2.2.1 ANIMAL BASED

7.2.2.2.2 PLANT BASED

7.2.2.2.3 YEAST

7.2.2.2.4 OTHERS

7.3 AMINO ACID

7.3.1 LYSINE

7.3.2 METHIONINE

7.3.3 TRYPTOPHAN

7.3.4 THREONINE

7.3.5 OTHERS

7.3.5.1 ANIMAL BASED

7.3.5.2 PLANT BASED

7.3.5.3 YEAST

7.3.5.4 OTHERS

7.4 TRACE MINERALS

7.4.1 IRON

7.4.2 COPPER

7.4.3 MANGANESE

7.4.4 ZINC

7.4.5 SELENIUM

7.4.6 OTHERS

7.4.6.1 PLANT BASED

7.4.6.2 ANIMAL BASED

7.4.6.3 YEAST

7.4.6.4 OTHERS

7.5 PRESERVATIVES

7.5.1 NATURAL

7.5.1.1 TOCOPHEROL

7.5.1.2 ASCORBATE

7.5.1.3 OTHERS

7.5.2 SYNTHETIC

7.5.2.1 PROPYLENE GLYCOL

7.5.2.2 BUTYLATED HYDROXYANISOLE (BHA)

7.5.2.3 BUTYLATED HYDROXYTOLUENE (BHT)

7.5.2.4 PROPYL GALLATE

7.5.2.5 THOXYQUIN

7.5.2.6 OTHERS

7.5.2.6.1 PLANT BASED

7.5.2.6.2 ANIMAL BASED

7.5.2.6.3 YEAST

7.5.2.6.4 OTHERS

7.6 FLAVORS AND PALATABILITY ENHANCER

7.6.1 REACTION FLAVORS/DIGESTS

7.6.2 COMPOUNDED FLAVORS

7.6.2.1 NATURAL FLAVORS

7.6.2.2 SYNTHETIC FLAVORS

7.6.2.2.1 ANIMAL BASED

7.6.2.2.2 PLANT BASED

7.6.2.2.3 YEAST

7.6.2.2.4 OTHERS

7.7 PROBIOTICS

7.7.1 LACTOBACILLI

7.7.2 BIFIDOBACTERIA

7.7.3 YEAST

7.7.4 STREPTOCOCCUS THERMOPHILUS

7.7.4.1 YEAST

7.7.4.2 PLANT BASED

7.7.4.3 ANIMAL BASED

7.7.4.4 OTHERS

7.8 ANTIOXIDANTS

7.8.1 BHA

7.8.2 BHT

7.8.3 ETHOXYQUIN

7.8.4 OTHERS

7.8.4.1 PLANT BASED

7.8.4.2 ANIMAL BASED

7.8.4.3 YEAST

7.8.4.4 OTHERS

7.9 PELLET BINDERS

7.9.1 LIGNIN BASED BINDERS/LIGNOSULFONATES

7.9.2 STARCHES

7.9.3 HEMI-CELLULOSE BINDERS

7.9.4 GUMS

7.9.5 OTHERS

7.9.5.1 PLANT BASED

7.9.5.2 ANIMAL BASED

7.9.5.3 YEAST

7.9.5.4 OTHERS

7.1 ENZYMES

7.10.1 AMYLASE

7.10.2 PROTEASE

7.10.3 CELLULASE

7.10.4 XYLANASE

7.10.5 GLUCANASE

7.10.6 PHYTASE

7.10.7 MANNASE

7.10.8 OTHERS

7.10.8.1 PLANT BASED

7.10.8.2 ANIMAL BASED

7.10.8.3 YEAST

7.10.8.4 OTHERS

7.11 FEED ACIDIFIERS

7.11.1 PROPIONIC ACID

7.11.2 CITRIC ACID

7.11.3 LACTIC ACID

7.11.4 SORBIC ACID

7.11.5 FORMALDEHYDE

7.11.6 MALIC ACID

7.11.7 OTHERS

7.11.7.1 ANIMAL BASED

7.11.7.2 PLANT BASED

7.11.7.3 YEAST

7.11.7.4 OTHERS

7.12 MOLD INHIBITORS

7.12.1 SORBATES, SODIUM BENZOATE

7.12.2 SODIUM PROPIONATE

7.12.3 ACETIC ACID

7.12.4 OTHERS

7.12.4.1 PLANT BASED

7.12.4.2 ANIMAL BASED

7.12.4.3 YEAST

7.12.4.4 OTHERS

7.13 MYCOTOXIN BINDERS

7.13.1 SILICATES

7.13.2 CLAYS

7.13.3 CHEMICAL POLYMERS

7.13.4 GLUCAN PRODUCTS

7.13.5 OTHERS

7.14 NITROGEN

7.14.1 UREA

7.14.2 AMMONIA

7.14.3 OTHERS

7.14.3.1 PLANT BASED

7.14.3.2 ANIMAL BASED

7.14.3.3 YEAST

7.14.3.4 OTHERS

7.15 PHYTOGENIC

7.15.1 ESSENTIAL OILS

7.15.2 HERBS & SPICES

7.15.3 OLEORESIN

7.15.4 OTHERS

7.16 CAROTENOIDS

7.16.1 BETA-CAROTENE

7.16.2 LUTEIN

7.16.3 ASTAXANTHIN

7.16.4 CANTHAXANTHIN

7.16.4.1 PLANT BASED

7.16.4.2 ANIMAL BASED

7.16.4.3 YEAST

7.16.4.4 OTHERS

7.17 ANTIMICROBIALS

7.17.1 PLANT BASED

7.17.2 ANIMAL BASED

7.17.3 YEAST

7.17.4 OTHERS

7.18 COLORANTS

7.18.1 ANNATTO EXTRACT

7.18.2 DEHYDRATED BEETS

7.18.3 CARAMEL

7.18.4 TURMERIC

7.18.5 PAPRIKA

7.18.6 SAFFRON

7.18.7 OTHERS

7.18.7.1 PLANT BASED

7.18.7.2 ANIMAL BASED

7.18.7.3 YEAST

7.18.7.4 OTHERS

7.19 OTHERS

8 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE

8.1 OVERVIEW

8.2 DOG FOOD

8.2.1 VITAMINS

8.2.2 AMINO ACID

8.2.3 FLAVORS AND PALATABILITY ENHANCER

8.2.4 PELLET BINDERS

8.2.5 TRACE MINERALS

8.2.6 ANTIOXIDANTS

8.2.7 PROBIOTICS

8.2.8 ENZYMES

8.2.9 PRESERVATIVES

8.2.10 FEED ACIDIFIERS

8.2.11 PHYTOGENIC

8.2.12 MOLD INHIBITORS

8.2.13 MYCOTOXIN BINDERS

8.2.14 COLORANTS

8.2.15 ANTIMICROBIALS

8.2.16 NITROGEN

8.2.17 CAROTENOIDS

8.2.18 OTHERS

8.3 CAT FOOD

8.3.1 VITAMINS

8.3.2 AMINO ACID

8.3.3 FLAVORS AND PALATABILITY ENHANCER

8.3.4 PELLET BINDERS

8.3.5 TRACE MINERALS

8.3.6 ANTIOXIDANTS

8.3.7 PROBIOTICS

8.3.8 ENZYMES

8.3.9 PRESERVATIVES

8.3.10 FEED ACIDIFIERS

8.3.11 PHYTOGENIC

8.3.12 MOLD INHIBITORS

8.3.13 MYCOTOXIN BINDERS

8.3.14 COLORANTS

8.3.15 ANTIMICROBIALS

8.3.16 NITROGEN

8.3.17 CAROTENOIDS

8.3.18 OTHERS

8.4 BIRDS FOOD

8.4.1 AMINO ACID

8.4.2 VITAMINS

8.4.3 TRACE MINERALS

8.4.4 ANTIOXIDANTS

8.4.5 PRESERVATIVES

8.4.6 PROBIOTICS

8.4.7 PELLET BINDERS

8.4.8 CAROTENOIDS

8.4.9 ENZYMES

8.4.10 COLORANTS

8.4.11 PHYTOGENIC

8.4.12 FLAVORS AND PALATABILITY ENHANCER

8.4.13 NITROGEN

8.4.14 MOLD INHIBITORS

8.4.15 MYCOTOXIN BINDERS

8.4.16 ANTIMICROBIALS

8.4.17 FEED ACIDIFIERS

8.4.18 OTHERS

8.5 AQUA PETS FOOD

8.5.1 VITAMINS

8.5.2 AMINO ACID

8.5.3 TRACE MINERALS

8.5.4 PELLET BINDERS

8.5.5 ANTIOXIDANTS

8.5.6 CAROTENOIDS

8.5.7 PRESERVATIVES

8.5.8 FLAVORS AND PALATABILITY ENHANCER

8.5.9 PROBIOTICS

8.5.10 ENZYMES

8.5.11 ANTIMICROBIALS

8.5.12 FEED ACIDIFIERS

8.5.13 NITROGEN

8.5.14 COLORANTS

8.5.15 PHYTOGENIC

8.5.16 MOLD INHIBITORS

8.5.17 MYCOTOXIN BINDERS

8.5.18 OTHERS

8.6 OTHERS

9 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE

9.1 OVERVIEW

9.2 PLANT BASED

9.2.1 CEREAL & GRAINS

9.2.2 FRUITS & NUTS

9.2.3 VEGETABLES

9.2.4 OILSEEDS

9.2.5 OTHERS

9.3 ANIMAL BASED

9.3.1 BEEF

9.3.2 POULTRY

9.3.3 PORK

9.3.4 OTHERS

9.4 YEAST

9.5 OTHERS

10 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FORM

10.1 OVERVIEW

10.2 DRY

10.3 LIQUID

11 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FUNCTIONALITY

11.1 OVERVIEW

11.2 NUTRITION

11.3 PROCESSING

11.4 PRESERVATION

11.5 OTHERS

12 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY CATEGORY

12.1 OVERVIEW

12.2 ORGANIC

12.3 CONVENTIONAL

13 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT

13.3 INDIRECT

14 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA.

14.1.3 MEXICO.

15 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 CARGILL, INCORPORATED

17.1.1 COMPANY SNAPSHOT

17.1.2 COMAPNT SHARE ANAKYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 ADM

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMAPNT SHARE ANAKYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 SYMRISE

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMAPNT SHARE ANAKYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 DSM

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMAPNT SHARE ANAKYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 BASF SE

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMAPNT SHARE ANAKYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 BALCHEM INC.

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 BARENTZ

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 CHR. HANSEN HOLDING A/S

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 GLANBIA PLC

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

17.1 INGREDION

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 COMAPNT SHARE ANAKYSIS

17.10.5 RECENT DEVELOPMENT

17.11 INTERNATIONAL FLAVORS & FRAGRANCES INC.

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 COMAPNT SHARE ANAKYSIS

17.11.4 PRODUCT PORTFOLIO

17.11.5 RECENT DEVELOPMENTS

17.12 KEMIN INDUSTRIES, INC. AND ITS GROUP OF COMPANIES

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 KERRY GROUP PLC.

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 COMAPNT SHARE ANAKYSIS

17.13.4 PRODUCT PORTFOLIO

17.13.5 RECENT DEVELOPMENTS

17.14 LALLEMAND INC.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 OMEGA PROTEIN CORPORATION

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 ROQUETTE FRÈRES

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 THE PETERSON COMPANY

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 THE SCOULAR COMPANY

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 WYSONG

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 EXPORT VALUE OF PET FOOD PER YEAR

TABLE 2 IMPORT OF PET FOOD

TABLE 3 EXPORT OF ANIMAL-ORIGIN PET FOOD PRODUCTS

TABLE 4 VOLUME OF PET FOOD PRODUCED WORLDWIDE / YEAR, BY REGION

TABLE 5 SUPPLY CHAIN OF NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET

TABLE 6 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA FAT-SOLUBLE IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA WATER-SOLUBLE IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA NATURAL IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA SYNTHETIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA MYCOTOXIN BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA MYCOTOXIN BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA PHYTOGENIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA PHYTOGENIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA CAROTENOIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA CAROTENOIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA CAROTENOIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA ANTIMICROBIALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA ANTIMICROBIALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA COLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA COLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 NORTH AMERICA COLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA OTHERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA DOG FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 63 NORTH AMERICA DOG FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA CAT FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 65 NORTH AMERICA CAT FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA BIRDS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 67 NORTH AMERICA BIRDS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 68 NORTH AMERICA AQUA PETS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 69 NORTH AMERICA AQUA PETS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA OTHERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 71 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 72 NORTH AMERICA PLANT BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 73 NORTH AMERICA MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 74 NORTH AMERICA ANIMAL BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 75 NORTH AMERICA ANIMAL BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 76 NORTH AMERICA YEAST IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 77 NORTH AMERICA OTHERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 78 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 79 NORTH AMERICA DRY IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 80 NORTH AMERICA LIQUID IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 81 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FUNCTIONALITY, 2021-2030 (USD MILLION)

TABLE 82 NORTH AMERICA NUTRITION IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 83 NORTH AMERICA PROCESSING IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 84 NORTH AMERICA PRESERVATION IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 85 NORTH AMERICA OTHERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 86 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 87 NORTH AMERICA ORGANIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 88 NORTH AMERICA CONVENTIONAL IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 89 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 90 NORTH AMERICA DIRECT IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 91 NORTH AMERICA INDIRECT IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 92 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, 2021-2030 (USD MILLION)

TABLE 93 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 94 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 95 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 (UNITS)

TABLE 96 NORTH AMERICA VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 NORTH AMERICA FAT-SOLUBLE IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 NORTH AMERICA WATER-SOLUBLE IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 NORTH AMERICA VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 100 NORTH AMERICA AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 101 NORTH AMERICA AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 102 NORTH AMERICA TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 103 NORTH AMERICA TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 104 NORTH AMERICA PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 105 NORTH AMERICA NATURAL IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 106 NORTH AMERICA SYNTHETIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 NORTH AMERICA PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 108 NORTH AMERICA FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 NORTH AMERICA FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 110 NORTH AMERICA FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 111 NORTH AMERICA PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 112 NORTH AMERICA PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 113 NORTH AMERICA ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 114 NORTH AMERICA ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 115 NORTH AMERICA PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 116 NORTH AMERICA PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 117 NORTH AMERICA ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 118 NORTH AMERICA ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 119 NORTH AMERICA FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 120 NORTH AMERICA FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 121 NORTH AMERICA MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 122 NORTH AMERICA MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 123 NORTH AMERICA MYCOTOXIN BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 124 NORTH AMERICA NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 125 NORTH AMERICA NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 126 NORTH AMERICA PHYTOGENIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 127 NORTH AMERICA ANTIMICROBIALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 128 NORTH AMERICA COCOLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 129 NORTH AMERICA COCOLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 130 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 131 NORTH AMERICA DOG FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 132 NORTH AMERICA CAT FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 133 NORTH AMERICA BIRDS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 134 NORTH AMERICA AQUA PETS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 135 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 136 NORTH AMERICA PLANT BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 137 NORTH AMERICA ANIMAL BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 138 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 139 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FUNCTIONALITY, 2021-2030 (USD MILLION)

TABLE 140 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 141 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 142 U.S. PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 143 U.S. PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 ASP

TABLE 144 U.S. PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 (UNITS)

TABLE 145 U.S. VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 146 U.S. FAT-SOLUBLE IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 147 U.S. WATER-SOLUBLE IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 148 U.S. VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 149 U.S. AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 150 U.S. AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 151 U.S. TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 152 U.S. TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 153 U.S. PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 154 U.S. NATURAL IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 155 U.S. SYNTHETIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 156 U.S. PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 157 U.S. FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 158 U.S. FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 159 U.S. FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 160 U.S. PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 161 U.S. PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 162 U.S. ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 163 U.S. ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 164 U.S. PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 165 U.S. PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 166 U.S. ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 167 U.S. ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 168 U.S. FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 169 U.S. FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 170 U.S. MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 171 U.S. MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 172 U.S. MYCOTOXIN BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 173 U.S. NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 174 U.S. NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 175 U.S. PHYTOGENIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 176 U.S. CAROTENOIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 177 U.S. CAROTENOIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 178 U.S. ANTIMICROBIALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 179 U.S. COCOLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 180 U.S. COCOLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 181 U.S. PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 182 U.S. DOG FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 183 U.S. CAT FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 184 U.S. BIRDS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 185 U.S. AQUA PETS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 186 U.S. PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 187 U.S. PLANT BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 188 U.S. ANIMAL BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 189 U.S. PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 190 U.S. PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FUNCTIONALITY, 2021-2030 (USD MILLION)

TABLE 191 U.S. PET FOOD FLAVORS AND INGREDIENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 192 U.S. PET FOOD FLAVORS AND INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 193 CANADA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 194 CANADA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 ASP

TABLE 195 CANADA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 (UNITS)

TABLE 196 CANADA VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 197 CANADA FAT-SOLUBLE IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 198 CANADA WATER-SOLUBLE IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 199 CANADA VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 200 CANADA AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 201 CANADA AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 202 CANADA TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 203 CANADA TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 204 CANADA PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 205 CANADA NATURAL IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 206 CANADA SYNTHETIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 207 CANADA PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 208 CANADA FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 209 CANADA FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 210 CANADA FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 211 CANADA PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 212 CANADA PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 213 CANADA ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 214 CANADA ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 215 CANADA PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 216 CANADA PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 217 CANADA ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 218 CANADA ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 219 CANADA FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 220 CANADA FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 221 CANADA MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 222 CANADA MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 223 CANADA MYCOTOXIN BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 224 CANADA NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 225 CANADA NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 226 CANADA PHYTOGENIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 227 CANADA CAROTENOIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 228 CANADA CAROTENOIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 229 CANADA ANTIMICROBIALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 230 CANADA COCOLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 231 CANADA COCOLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 232 CANADA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 233 CANADA DOG FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 234 CANADA CAT FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 235 CANADA BIRDS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 236 CANADA AQUA PETS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 237 CANADA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 238 CANADA PLANT BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 239 CANADA ANIMAL BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 240 CANADA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 241 CANADA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FUNCTIONALITY, 2021-2030 (USD MILLION)

TABLE 242 CANADA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 243 CANADA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 244 MEXICO PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 245 MEXICO PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 ASP

TABLE 246 MEXICO PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 (UNITS)

TABLE 247 MEXICO VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 248 MEXICO FAT-SOLUBLE IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 249 MEXICO WATER-SOLUBLE IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 250 MEXICO VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 251 MEXICO AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 252 MEXICO AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 253 MEXICO TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 254 MEXICO TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 255 MEXICO PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 256 MEXICO NATURAL IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 257 MEXICO SYNTHETIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 258 MEXICO PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 259 MEXICO FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 260 MEXICO PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 261 MEXICO PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 262 MEXICO ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 263 MEXICO ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 264 MEXICO PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 265 MEXICO PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 266 MEXICO ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 267 MEXICO ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 268 MEXICO FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 269 MEXICO FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 270 MEXICO MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 271 MEXICO MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 272 MEXICO MYCOTOXIN BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 273 MEXICO NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 274 MEXICO NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 275 MEXICO PHYTOGENIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 276 MEXICO CAROTENOIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 277 MEXICO CAROTENOIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 278 MEXICO ANTIMICROBIALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 279 MEXICO COCOLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 280 MEXICO COCOLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 281 MEXICO PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 282 MEXICO DOG FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 283 MEXICO CAT FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 284 MEXICO BIRDS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 285 MEXICO AQUA PETS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 286 MEXICO PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 287 MEXICO PLANT BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 288 MEXICO ANIMAL BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 289 MEXICO PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 290 MEXICO PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FUNCTIONALITY, 2021-2030 (USD MILLION)

TABLE 291 MEXICO PET FOOD FLAVORS AND INGREDIENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 292 MEXICO PET FOOD FLAVORS AND INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: MARKET DISTRIBUTION CHANNEL COVERAGE GRID

FIGURE 8 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: SEGMENTATION

FIGURE 11 THE GROWING RISING TREND OF PET HUMANIZATION AROUND THE WORLD IS EXPECTED TO DRIVE THE GROWTH OF THE NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET FROM 2023 TO 2030

FIGURE 12 VITAMINS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET

FIGURE 14 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY PRODUCT TYPE, 2022

FIGURE 15 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 16 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 17 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY PET FOOD TYPE, 2022

FIGURE 19 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY PET FOOD TYPE, 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY PET FOOD TYPE, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY PET FOOD TYPE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY SOURCE, 2022

FIGURE 23 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY SOURCE, 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY SOURCE, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY SOURCE, LIFELINE CURVE

FIGURE 26 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY FORM, 2022

FIGURE 27 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY FORM, 2023-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY FORM, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY FORM, LIFELINE CURVE

FIGURE 30 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY FUNCTIONALITY, 2022

FIGURE 31 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY FUNCTIONALITY, 2023-2030 (USD MILLION)

FIGURE 32 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY FUNCTIONALITY, CAGR (2023-2030)

FIGURE 33 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY FUNCTIONALITY, LIFELINE CURVE

FIGURE 34 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY CATEGORY, 2022

FIGURE 35 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY CATEGORY, 2023-2030 (USD MILLION)

FIGURE 36 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY CATEGORY, CAGR (2023-2030)

FIGURE 37 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY CATEGORY, LIFELINE CURVE

FIGURE 38 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY DISTRIBUTION CHANNEL, 2022

FIGURE 39 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 40 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 41 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 42 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: SNAPSHOT (2022)

FIGURE 43 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: BY COUNTRY (2022)

FIGURE 44 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 45 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 46 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: BY PRODUCT TYPE (2021-2030)

FIGURE 47 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.