North America Pet Equine Care E Commerce Market

Taille du marché en milliards USD

TCAC :

%

USD

936.76 Million

USD

2,948.35 Million

2025

2033

USD

936.76 Million

USD

2,948.35 Million

2025

2033

| 2026 –2033 | |

| USD 936.76 Million | |

| USD 2,948.35 Million | |

|

|

|

|

Segmentation du marché du commerce électronique des produits pour animaux de compagnie (équidés) en Amérique du Nord, par type (aliments et friandises, médicaments, produits de toilettage, accessoires et autres), par type d'équidé (chevaux/poneys, ânes, mules/bardots et autres) - Tendances et prévisions du secteur jusqu'en 2033

Taille du marché du commerce électronique des soins pour animaux de compagnie (équidés) en Amérique du Nord

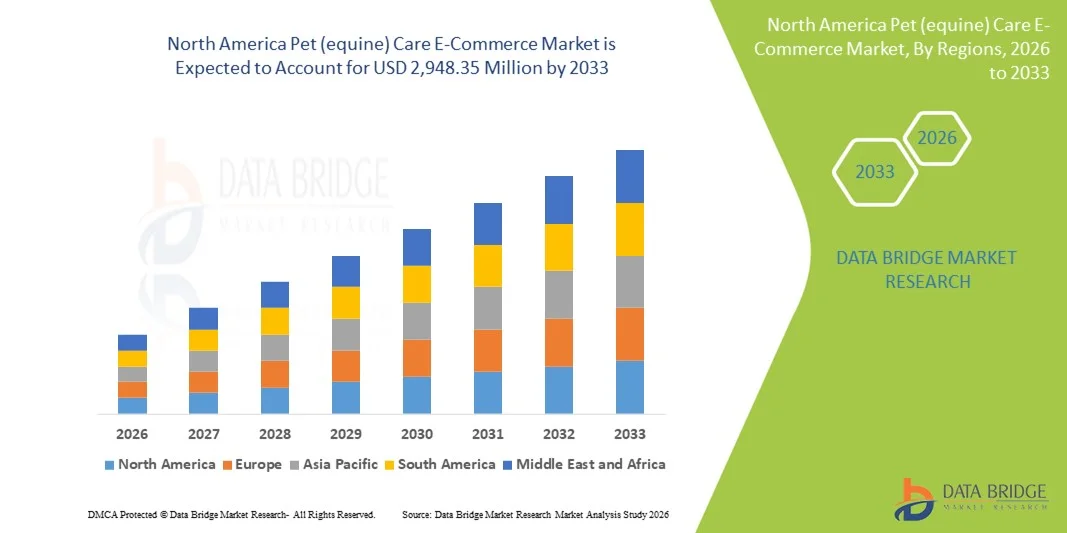

- Le marché nord-américain du commerce électronique des produits de soins pour animaux de compagnie (équidés) était évalué à 936,76 millions de dollars américains en 2025 et devrait atteindre 2 948,35 millions de dollars américains d’ici 2033 , avec un TCAC de 15,41 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par l'adoption croissante des plateformes numériques pour l'achat de produits de soins pour animaux de compagnie et chevaux, la hausse du nombre d'animaux de compagnie et la sensibilisation croissante à la santé et au bien-être des chevaux.

- La commodité offerte par les plateformes en ligne, notamment la livraison à domicile, les services d'abonnement et l'accès à une vaste gamme de produits, stimule la préférence des consommateurs pour les canaux de commerce électronique.

Analyse du marché du commerce électronique des soins pour animaux de compagnie (équidés) en Amérique du Nord

- La pénétration croissante du numérique et l'accessibilité à Internet transforment la façon dont les produits de soins équins sont achetés dans la région.

- Les plateformes de commerce électronique collaborent de plus en plus avec les vétérinaires, les entraîneurs et les magasins spécialisés afin d'élargir leur offre de produits et de fournir des conseils d'experts aux consommateurs.

- Les États-Unis ont dominé le marché nord-américain du commerce électronique des soins pour animaux de compagnie (équins) avec la plus grande part de revenus de 40,12 % en 2025, grâce à l'adoption croissante des achats en ligne de produits pour animaux de compagnie et à la sensibilisation accrue à la santé et au bien-être des équidés.

- Le Canada devrait connaître le taux de croissance annuel composé (TCAC) le plus élevé du marché nord-américain du commerce électronique des produits de soins pour animaux de compagnie (équidés) , en raison de l'augmentation du nombre d'animaux de compagnie, de la sensibilisation accrue à la santé et au bien-être des équidés et de l'expansion des plateformes numériques offrant des options d'achat en ligne pratiques.

- Le segment des aliments et friandises pour animaux de compagnie a représenté la plus grande part de chiffre d'affaires en 2025, grâce à la demande croissante en matière de nutrition spécialisée, à la commodité de la livraison à domicile et aux services d'abonnement. Les plateformes en ligne proposant une large gamme d'aliments haut de gamme, biologiques et thérapeutiques ont vu leur popularité croître auprès des propriétaires de chevaux.

Portée du rapport et segmentation du marché du commerce électronique des soins pour animaux de compagnie (équidés) en Amérique du Nord

|

Attributs |

Aperçu du marché nord-américain du commerce électronique des soins pour animaux de compagnie (équidés) |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Tendances du marché du commerce électronique des soins pour animaux de compagnie (équidés) en Amérique du Nord

Demande croissante de produits de soins pour animaux de compagnie et chevaux en ligne

- L'importance croissante accordée à la commodité et à l'accessibilité influence considérablement le marché nord-américain du commerce électronique des produits de soins pour animaux de compagnie (équidés), les consommateurs privilégiant de plus en plus les achats en ligne plutôt que les visites en magasin. Les plateformes de commerce électronique offrent une vaste gamme de produits, une livraison rapide et des services d'abonnement faciles, ce qui favorise leur adoption dans les domaines de la nutrition, du toilettage et des soins de santé équins.

- La sensibilisation croissante à la santé, au bien-être et aux soins préventifs des chevaux a accéléré la demande de produits spécialisés tels que les compléments alimentaires, les fournitures vétérinaires et les outils de toilettage. Les propriétaires de chevaux soucieux de la santé de leurs animaux recherchent activement des plateformes en ligne fiables proposant des produits certifiés et de haute qualité, incitant ainsi les places de marché à élargir leur offre et à améliorer leur logistique.

- Les tendances numériques et les recommandations personnalisées influencent les comportements d'achat, les détaillants privilégiant les interfaces conviviales, les applications mobiles et les promotions ciblées. Ces facteurs permettent aux plateformes de se démarquer sur un marché concurrentiel, de renforcer la confiance des consommateurs et de fidéliser la clientèle.

- Par exemple, en 2024, les principales plateformes en ligne de soins pour animaux de compagnie aux États-Unis ont élargi leur gamme de produits pour chevaux et introduit des formules d'abonnement pour l'alimentation, les compléments alimentaires et les produits de toilettage, répondant ainsi à la demande croissante de livraisons pratiques et régulières. Ces initiatives ont renforcé la fidélité des clients et accéléré leur pénétration du marché.

- Bien que la croissance du marché soit prometteuse, une expansion durable repose sur des investissements continus dans l'infrastructure, la logistique et les technologies du commerce électronique afin d'améliorer l'expérience client et d'optimiser l'efficacité des livraisons. Les détaillants misent également sur l'évolutivité, les partenariats avec les professionnels du secteur équin et l'adoption d'outils numériques avancés pour un service personnalisé.

Dynamique du marché du commerce électronique des soins pour animaux de compagnie (équidés) en Amérique du Nord

Conducteur

Préférence croissante pour les produits de soins équins en ligne et spécialisés

- L'adoption croissante des canaux numériques et des achats en ligne par les consommateurs est un moteur essentiel du marché du commerce électronique des soins pour animaux de compagnie (équidés) en Amérique du Nord. Les plateformes de commerce électronique offrent commodité, un choix de produits plus vaste, des prix compétitifs et un accès à des conseils d'experts, autant d'atouts très appréciés des propriétaires d'équidés.

- L'intérêt croissant porté à la santé équine, aux soins préventifs et aux produits nutritionnels haut de gamme influence la croissance du marché. Les propriétaires sont prêts à investir dans des produits certifiés de haute qualité disponibles en ligne, ce qui stimule les ventes de compléments alimentaires, de produits de toilettage et de soins vétérinaires.

- Les détaillants exploitent activement les applications mobiles, les recommandations personnalisées et les modèles d'abonnement pour promouvoir les produits de soins équins et améliorer l'expérience client. Cette tendance encourage également les collaborations entre vétérinaires, entraîneurs et plateformes de commerce électronique afin de garantir la crédibilité des produits et d'améliorer la qualité des services.

- Par exemple, en 2023, les principaux détaillants en ligne nord-américains de produits équins ont constaté une augmentation des commandes d'aliments et de suppléments par abonnement, stimulée par la commodité et la disponibilité constante des produits. Les efforts marketing ont mis l'accent sur la qualité des produits, leurs bienfaits pour la santé et la fiabilité de la livraison, renforçant ainsi la confiance envers la marque et encourageant les achats répétés.

- Bien que l'adoption du numérique favorise la croissance, une plus large pénétration du marché dépend des investissements technologiques, d'une gestion efficace de la chaîne d'approvisionnement et d'interfaces conviviales. L'innovation continue dans la logistique, les recommandations basées sur l'IA et le service client seront essentiels pour assurer une croissance durable.

Retenue/Défi

Frais de livraison élevés et connaissance limitée des produits équins spécialisés en ligne

- Le coût relativement élevé du transport de produits équins volumineux, tels que l'alimentation et la litière, demeure un obstacle majeur, freinant leur adoption par les consommateurs soucieux des coûts. La logistique nécessaire à la livraison rapide des denrées périssables complexifie également les opérations et augmente les coûts globaux.

- La notoriété et la confiance envers les produits de soins équins en ligne restent inégales, notamment chez les nouveaux acheteurs ou les propriétaires en zone rurale. Le manque de connaissances sur les avantages des produits et la fiabilité des plateformes peut freiner l'adoption du commerce électronique.

- Les défis liés à la chaîne d'approvisionnement et à la distribution, notamment les conditions de stockage, l'emballage et les exigences de la chaîne du froid pour certains compléments alimentaires, freinent la croissance du marché. Les acteurs du e-commerce doivent investir dans des systèmes logistiques et de manutention performants afin de garantir la qualité des produits et leur livraison dans les délais.

- Par exemple, en 2024, certains distributeurs nord-américains de produits pour chevaux ont constaté un ralentissement de l'adoption des abonnements en ligne à l'alimentation et aux compléments alimentaires, en raison de coûts d'expédition plus élevés et d'une méconnaissance des options d'achat numériques. Des difficultés opérationnelles ont également entraîné des retards de livraison dans les régions éloignées, affectant la satisfaction client.

- Pour surmonter ces défis, il faudra améliorer la logistique, mettre en place des modèles de livraison rentables et mener des campagnes de sensibilisation auprès des propriétaires de chevaux. Des partenariats stratégiques avec des fournisseurs locaux, des investissements dans les plateformes numériques et des initiatives de soutien à la clientèle sont essentiels pour libérer le potentiel de croissance à long terme du marché nord-américain du commerce électronique des produits de soins pour animaux de compagnie (équidés).

Portée du marché du commerce électronique des soins pour animaux de compagnie (équidés) en Amérique du Nord

Le marché du commerce électronique des soins pour animaux de compagnie (équidés) en Amérique du Nord est segmenté en fonction du type et du type équin.

- Par type

Le marché est segmenté par type de produit en aliments et friandises pour animaux, médicaments pour animaux, produits de toilettage, accessoires et autres. Le segment des aliments et friandises pour animaux détenait la plus grande part de chiffre d'affaires en 2025, grâce à la demande croissante en nutrition spécialisée, à la commodité de la livraison à domicile et aux services d'abonnement. Les plateformes en ligne proposant un large choix d'aliments haut de gamme, biologiques et thérapeutiques ont vu leur popularité croître auprès des propriétaires de chevaux.

Le segment des médicaments vétérinaires devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par une sensibilisation accrue à la santé équine, aux soins préventifs et à la nécessité d'un accès rapide aux médicaments homologués par les vétérinaires. Les plateformes de commerce électronique, de plus en plus prisées pour leur simplicité de commande, la livraison à domicile et l'accès à des produits certifiés, garantissent des soins et une gestion optimaux de la santé équine.

- Par type équin

Le marché est segmenté selon le type d'équidé : chevaux/poneys, ânes, mules/bardots et autres. Le segment des chevaux/poneys détenait la plus grande part de marché en 2025, en raison de la forte présence de chevaux en Amérique du Nord et de leur utilisation récréative, ainsi que des investissements croissants dans les compétitions et les sports équestres.

Le segment des ânes et des mules/bardots devrait connaître la croissance la plus rapide entre 2026 et 2033, porté par l'intérêt croissant pour l'élevage à petite échelle, les programmes de thérapie assistée par les chevaux et les activités récréatives. Les plateformes de commerce électronique proposant des produits adaptés à ces animaux, tels que des aliments spécialisés, des outils de toilettage et des compléments alimentaires, stimulent l'adoption de ce segment.

Analyse régionale du marché du commerce électronique des soins pour animaux de compagnie (équidés) en Amérique du Nord

- Les États-Unis ont dominé le marché nord-américain du commerce électronique des produits de soins pour animaux de compagnie (équidés) avec la plus grande part de revenus (40,12 %) en 2025, grâce à l'adoption croissante des achats en ligne de produits pour animaux de compagnie et à une sensibilisation accrue à la santé et au bien-être des équidés.

- Les consommateurs du pays apprécient particulièrement la commodité, la grande variété de produits et la livraison à domicile offertes par les plateformes de commerce électronique, ainsi que l'accès à des produits spécialisés pour les soins équins.

- Cette adoption généralisée est également favorisée par la hausse des revenus disponibles, une population à l'aise avec les outils numériques et la préférence croissante pour des solutions de soins personnalisées pour animaux de compagnie, faisant du commerce électronique un canal privilégié pour les produits équins, tant au détail qu'à usage professionnel.

Analyse du marché du commerce électronique des soins pour animaux de compagnie (équidés) au Canada

Le marché canadien du commerce électronique de produits pour animaux de compagnie (équidés) devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par l'intérêt croissant des consommateurs pour les achats en ligne, synonymes de commodité et de sécurité. Les consommateurs privilégient un accès rapide à des aliments, des médicaments et des produits de toilettage de haute qualité, ainsi qu'à des articles spécifiques aux équidés. L'expansion des plateformes en ligne, l'amélioration de la logistique et les campagnes promotionnelles des principaux détaillants en ligne contribuent également à la croissance du marché. De plus, l'adoption d'applications mobiles et de services par abonnement pour les besoins réguliers en soins équins participe significativement à cette expansion rapide.

Part de marché du commerce électronique des soins pour animaux de compagnie (équidés) en Amérique du Nord

Le secteur du commerce électronique des soins pour animaux de compagnie (équidés) en Amérique du Nord est principalement dominé par des entreprises bien établies, notamment :

- Chewy Inc (États-Unis)

- Petco Health and Wellness Company Inc (États-Unis)

- PetSmart Inc (États-Unis)

- Zoetis Inc (États-Unis)

- Manna Pro Products Inc (États-Unis)

- Valley Vet Supply (États-Unis)

- Sellerie Dover (États-Unis)

- SmartPak Equine (États-Unis)

- Jeffers Pet (États-Unis)

- Absorbine Inc (États-Unis)

- Cavalor Amérique du Nord (États-Unis)

- Magasins TSC (Canada)

- Animaux de compagnie de Ren (Canada)

- Aliments pour animaux de compagnie mondiaux (Canada)

- Topline Equine (Canada)

Dernières évolutions du marché du commerce électronique des soins pour animaux de compagnie (équidés) en Amérique du Nord

- En juillet 2021, Purina a conclu un partenariat stratégique avec Natures Crops pour développer des compléments alimentaires d'origine végétale pour chevaux. Cette collaboration vise à créer des solutions de supplémentation naturelles et innovantes, contribuant ainsi à améliorer la santé et la nutrition globales des chevaux. L'initiative s'appuie sur l'expertise de Purina en nutrition animale et sur les formulations végétales de Natures Crops pour proposer des alternatives plus sûres et durables. Le lancement de ces compléments devrait répondre à la demande croissante de produits de soins naturels pour chevaux, renforcer la confiance des consommateurs et stimuler la croissance du marché nord-américain du commerce électronique des soins pour animaux de compagnie (équidés).

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.