North America Personal Watercraft Market

Taille du marché en milliards USD

TCAC :

%

USD

932,197.71 million

USD

932,197.71 million

2022

2030

USD

932,197.71 million

USD

932,197.71 million

2022

2030

| 2023 –2030 | |

| USD 932,197.71 million | |

| USD 932,197.71 million | |

|

|

|

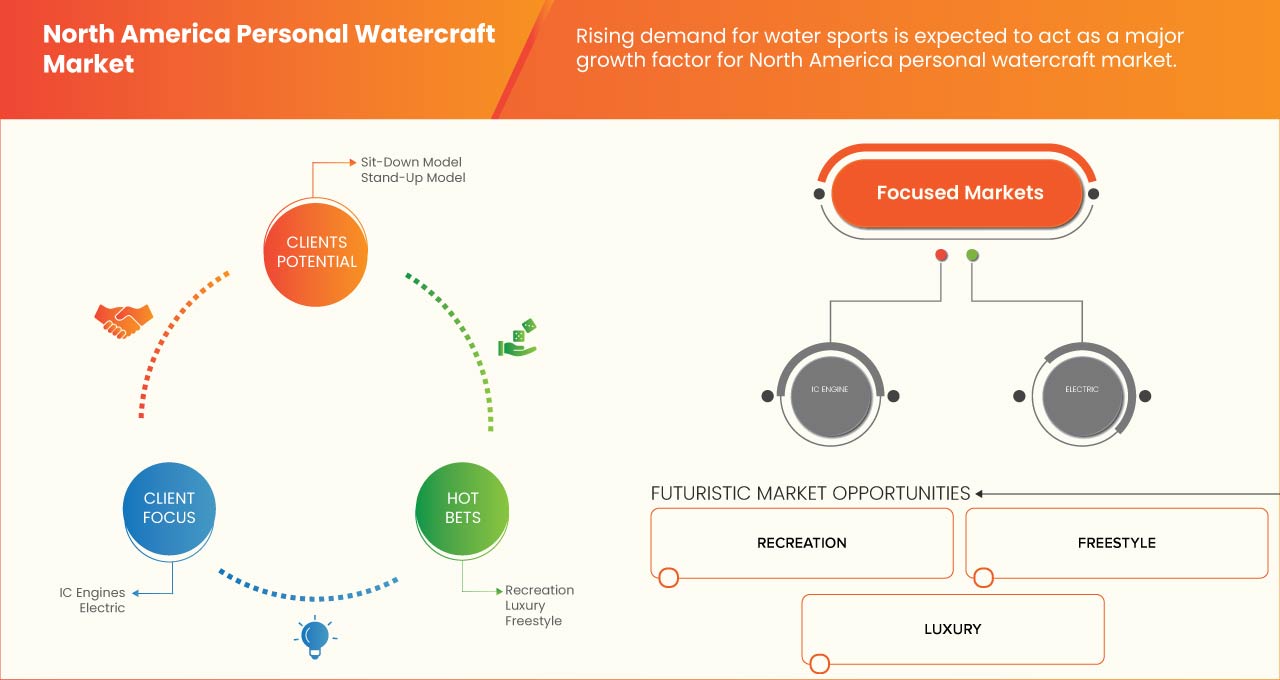

Marché nord-américain des motomarines, par type (modèle assis et modèle debout), composants (moteur, changement de vitesse, grille d'admission, turbine, buse de direction, commande de direction, compteur de vitesse, interrupteur de sécurité et autres), type de propulsion (moteurs à combustion interne et électriques), type de coque (plastique et composite), fonctionnalité (ensemble d'accessoires, garniture automatique, écran Connext, garniture électrique personnalisée, cales-pieds, haut-parleurs audio en option, Ride et autres), série (REC Lite, Recreation, Freestyle, Performance et Luxury), modèle de siège (double, simple, triple et autres), canal de distribution (canal direct et canal indirect), utilisateur final (location, gouvernement et particulier), tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des motomarines en Amérique du Nord

Le marché nord-américain des motomarines connaît une évolution positive dans le monde entier. Divers facteurs, tels que la popularité croissante des sports nautiques, soutiennent la croissance du marché. Cette popularité a donné lieu à l'organisation de nombreux championnats et événements locaux et régionaux. Des pays comme les États-Unis et bien d'autres ont développé un intérêt accru pour ces sports, et par conséquent, les habitants de la région ont adopté ces sports pendant leur temps libre.

Selon les analyses de Data Bridge Market Research, le marché nord-américain des motomarines devrait atteindre 932 197,71 milliers de dollars d'ici 2030, à un TCAC de 5,1 % au cours de la période de prévision. Le rapport sur le marché nord-américain des motomarines couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable pour 2020-2016) |

|

Unités quantitatives |

Chiffre d'affaires en milliers, prix en USD |

|

Segments couverts |

Par type (modèle assis et modèle debout), composants (moteur, changement de vitesse, grille d'admission, turbine, buse de direction, commande de direction, compteur de vitesse, interrupteur de sécurité et autres), type de propulsion (moteurs à combustion interne et électriques), type de coque (plastique et composite), fonctionnalité (ensemble d'accessoires, garniture automatique, écran Connext, garniture électrique personnalisée, cales-pieds, haut-parleurs audio en option, Ride et autres), série (REC Lite, Recreation, Freestyle, Performance et Luxury), modèle de siège (double, simple, triple et autres), canal de distribution (canal direct et canal indirect), utilisateur final (location, gouvernement et particulier). |

|

Pays couvert |

États-Unis, Canada et Mexique. |

|

Acteurs du marché couverts |

Français BRP, Yamaha Motor Co., Ltd., Kawasaki Heavy Industries, Ltd., NARKE, Gibbs Sports Amphibians, Inc., BELASSI GmbH, X Scream Inc, Mackinnon Marine Technologies, VQ yachts, Krash Industries, Nikola Corporation, Strand Craft Design LLC., E-DOLPHIN, Jiujiang Hison Motor Boat Manufacturing Co., Ltd, Pro Watercraft, Short Block Technologies, Inc. et TAIGA MOTORS INC. entre autres. |

Définition du marché

Les motomarines sont généralement appelées jet ski et bateaux à moteur. Ces embarcations ressemblent à un vélo associé à différents moteurs qui propulsent ou projettent de l'eau pour avancer. De plus, parallèlement aux progrès technologiques, ces embarcations sont développées avec une nouvelle technologie de propulsion, à savoir la propulsion électrique.

- En outre, le marché des motomarines est associé à divers sièges pour motomarines, à une série d'accessoires et de composants qui améliorent les performances et les fonctions de l'embarcation. Outre cet aspect technique, le marché est associé au canal de distribution et aux différents utilisateurs finaux.

Dynamique du marché des motomarines en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

Croissance rapide des championnats et événements de sports nautiques de surface

Partout dans le monde, les gens s'intéressent de plus en plus à ce sport, ce qui a conduit à l'organisation de nombreux championnats et événements locaux et régionaux. Des événements et des championnats de motomarines ont lieu chaque mois dans l'une ou l'autre région ou pays. Il est évident que ces événements et activités sportives sont en augmentation, ce qui a contribué à stimuler les ventes de motomarines dans le monde entier.

Augmentation du nombre de participants aux sports d'aventure

Les sports impliquent de multiples motivations telles que l'accomplissement d'objectifs, la prise de risques, la motivation sociale, l'évasion de l'ennui, le dépassement des limites personnelles, le dépassement de la peur et la connexion avec l'environnement naturel. De plus, les sports d'aventure font l'expérience de la mort imminente, ce qui contribue à accélérer l'adrénaline et offre des bienfaits pour la santé. Cela a contribué à motiver les gens du monde entier à adopter les sports d'aventure. Les gens du monde entier sont prêts à adopter les sports d'aventure en raison de divers avantages pour la santé. Cela contribuera à accroître l'intérêt pour les activités de sports nautiques. En conséquence, cela contribuera à stimuler le marché.

Opportunité

Augmentation de la reconnaissance des sports nautiques dans le sport international

Partout dans le monde, des gens et la plupart des pays participent à des championnats internationaux. Cela a créé une demande pour ces sports nautiques aventureux. L'augmentation de la demande pour ces sports stimulera les ventes d'équipements et de matériels sportifs. Ainsi, une reconnaissance accrue des sports nautiques dans les sports internationaux incitera les gens à adopter ces sports et offrira ainsi une grande opportunité de croissance du marché.

Retenue/Défi

Coûts élevés associés aux motomarines

Les coûts d'achat d'un jet ski sont très élevés. De plus, ils incluent divers coûts tels que l'entretien, le carburant et bien d'autres. Ces facteurs s'additionnent et devraient restreindre le marché des jet skis.

Impact de la pandémie de COVID-19 sur le marché nord-américain des motomarines

La COVID-19 a eu un impact négatif sur le marché nord-américain des motomarines en raison de l'arrêt de la logistique et du transport en Amérique du Nord et des instructions des gouvernements de ne pas participer aux événements sociaux.

La pandémie de COVID-19 a eu un impact négatif sur le marché nord-américain des motomarines. Cependant, la situation pandémique à travers le monde a contraint les gens à utiliser leur propre motomarine et à la louer. Cela a même eu un impact sur le secteur de la location de motomarines. De plus, cette révélation survient alors que de plus en plus de personnes se sont lancées dans la navigation de plaisance, les plages ont été fermées et les voyages internationaux ont été restreints en raison de la crise du coronavirus. Cela a entraîné une diminution significative des installations de jet ski en raison du nombre de décès par rapport au ratio de titulaires de permis.

Les acteurs du marché mènent de nombreuses activités de recherche et développement pour améliorer la technologie utilisée dans les accessoires. Grâce à cela, les entreprises apporteront des progrès et des innovations au marché. De plus, le soutien du gouvernement à l'électrification des embarcations a stimulé la croissance du marché.

Développements récents

- En octobre 2021, BRP a annoncé que l'entreprise avait été reconnue comme Good Design Japan pour la conception et les innovations liées aux Sea-Doo. Cette reconnaissance a permis de renforcer la confiance dans les produits et d'attirer de nouveaux clients pour accélérer la croissance des revenus de l'entreprise.

- En novembre 2018, Kawasaki Heavy Industries, Ltd. a annoncé un investissement de 3 millions de dollars dans la formation du Motorcycle Mechanics Institute (MMI). Cela comprendra le développement de modèles de motomarines et contribuera à soutenir les programmes de formation, ce qui a encore contribué à accélérer les ventes de motomarines.

Portée du marché nord-américain des motomarines

Le marché nord-américain des motomarines est segmenté en fonction du type, des composants, du modèle de siège, de la fonctionnalité, de la série, du type de propulsion, du type de coque, du canal de distribution et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de croissance limités dans les industries et à fournir aux utilisateurs un aperçu et des informations précieuses sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

TAPER

- MODÈLE ASSIS

- MODÈLE DEBOUT

Sur la base du type, le marché nord-américain des motomarines est segmenté en modèle assis et modèle debout.

COMPOSANTS

- MOTEUR

- CHANGEMENT DE VITESSE DE CONDUITE

- GRILLE D'ADMISSION

- IMPULSEUR

- BUSE DE DIRECTION

- COMMANDE DE DIRECTION

- COMPTEUR DE VITESSE

- INTERRUPTEUR DE SÉCURITÉ

- AUTRES

Sur la base des composants, le marché nord-américain des motomarines est segmenté en moteur, changement de vitesse, grille d'admission, turbine, buse de direction, commande de direction, compteur de vitesse, interrupteur de sécurité et autres.

TYPE DE PROPULSION

- Moteurs à combustion interne

- ÉLECTRIQUE

Sur la base du type de propulsion, le marché nord-américain des motomarines est segmenté en moteurs à combustion interne et électriques.

TYPE DE COQUE

- PLASTIQUE

- COMPOSITE

Sur la base du type de coque, le marché nord-américain des motomarines est segmenté en plastique et en composite.

FONCTIONNALITÉ

- ENSEMBLE D'ACCESSOIRES

- AJUSTEMENT AUTOMATIQUE

- CONNEXT SCREEN

- CUSTOM-TUNED ELECTRIC TRIM

- FOOT CHOCKS

- OPTIONAL AUDIO SPEAKERS

- RIDE

- OTHERS

On the basis of functionality, the North America personal watercraft market is segmented into accessory package, auto trim, connext screen, custom-tuned electric TRIM, foot chocks, optional audio speakers, ride and others.

SERIES

- REC LITE

- RECREATION

- FREESTYLE

- PERFORMANCE

- LUXURY

On the basis of the series, the North America personal watercraft market is segmented into REC lite, recreation, freestyle, performance and luxury.

SEAT MODEL

- DOUBLE

- SINGLE

- TRIPLE

- OTHERS

On the basis of the seat model, the North America personal watercraft market is segmented into double, single, triple and others.

DISTRIBUTION CHANNEL

- DIRECT CHANNEL

- INDIRECT CHANNEL

On the basis of distribution channel, the North America personal watercraft market is segmented into direct channel and indirect channel.

END-USER

- RENTAL

- INDIVIDUAL

- GOVERNMENT

On the basis of end-user, the North America personal watercraft market is segmented into rental, individual and government.

North America Personal Watercraft Market Regional Analysis/Insights

The North America personal watercraft market is analyzed, and market size insights and trends are provided by country, type, components, seat model, functionality, series, propulsion type, hull type, distribution channel, and end-user as referenced above.

Some countries covered in the North America personal watercraft market report are the U.S., Canada, and Mexico.

U.S. is expected to dominate the North America personal watercraft market due to the rise in adventure sports throughout the region.

The region section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North American brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Personal Watercraft Market Share Analysis

The North America personal watercraft market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, application dominance. The above data points provided are only related to the companies' focus related to the North America personal watercraft market.

Certains des principaux acteurs opérant sur le marché nord-américain des motomarines sont BRP, Yamaha Motor Co., Ltd., Kawasaki Heavy Industries, Ltd., NARKE, Gibbs Sports Amphibians, Inc., BELASSI GmbH, X Scream Inc, Mackinnon Marine Technologies, VQ yachts, Krash Industries, Nikola Corporation, Strand Craft Design LLC., E-DOLPHIN, Jiujiang Hison Motor Boat Manufacturing Co., Ltd, Pro Watercraft, Short Block Technologies, Inc. et TAIGA MOTORS INC. entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA PERSONAL WATERCRAFT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 TYPE TIMELINE CURVE

2.1 END-USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PATENT ANALYSIS

4.3 COMPANY COMPARATIVE ANALAYSIS

4.4 CASE STUDY

4.5 VALUE CHAIN ANALYSIS

4.5.1 OVERVIEW OF VALUE CHAIN ANALYSIS OF THE NORTH AMERICA PERSONAL WATERCRAFT MARKET

4.5.2 PRIMARY ACTIVITIES

4.5.3 SUPPORTING ACTIVITIES

4.6 TECHNOLOGY TREND ANALYSIS

4.7 REGULATORY FRAMEWORK

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RAPID GROWTH IN SURFACE WATER SPORTS CHAMPIONSHIPS AND EVENTS

5.1.2 INCREASE IN THE NUMBER OF ADVENTURE SPORTS PARTICIPATION

5.1.3 UPSURGE IN THE ADVANCEMENT OF TECHNOLOGY AND ADOPTION OF CLEAN AND QUITTER WATERCRAFT

5.1.4 RISE IN THE DEVELOPMENT OF THE RENTAL BUSINESS

5.2 RESTRAINT

5.2.1 LACK OF SKILLED AND EXPERIENCED PROFESSIONALS

5.3 OPPORTUNITIES

5.3.1 INCREASE IN RECOGNITION OF WATER SPORTS IN INTERNATIONAL SPORTS

5.3.2 CHANGE IN THE LIFESTYLES AND DEMOGRAPHICS OF PEOPLE

5.3.3 INCREASE IN THE ADOPTION OF NORTH AMERICA TRENDS AMONG YOUNGSTERS

5.4 CHALLENGE

5.4.1 HIGH COSTS ASSOCIATED WITH PERSONAL WATERCRAFTS

6 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY TYPE

6.1 OVERVIEW

6.2 SIT-DOWN MODEL

6.3 STAND-UP MODEL

7 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY COMPONENTS

7.1 OVERVIEW

7.2 ENGINE

7.3 DRIVE SHIFT

7.4 INTAKE GRATE

7.5 IMPELLER

7.6 STEERING NOZZLE

7.7 STEERING CONTROL

7.8 SPEEDOMETER

7.9 SAFETY SWITCH

7.1 OTHERS

8 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY PROPULSION TYPE

8.1 OVERVIEW

8.2 IC ENGINES

8.2.1 LESS THAN 100 HP

8.2.2 100-250 HP

8.2.3 ABOVE 250 HP

8.3 ELECTRIC

9 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY HULL TYPE

9.1 OVERVIEW

9.2 PLASTIC

9.2.1 SIT-DOWN MODEL

9.2.2 STAND-UP MODEL

9.3 COMPOSITE

9.3.1 SIT-DOWN MODEL

9.3.2 STAND-UP MODEL

10 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY FUNCTIONALITY

10.1 OVERVIEW

10.2 ACCESSORY PACKAGE

10.3 AUTO TRIM

10.4 CONNEXT SCREEN

10.5 CUSTOM-TUNED ELECTRIC TRIM

10.6 FOOT CHOCKS

10.7 OPTIONAL AUDIO SPEAKERS

10.8 RIDE

10.9 OTHERS

11 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY SERIES

11.1 OVERVIEW

11.2 REC LITE

11.2.1 SIT-DOWN MODEL

11.2.2 STAND-UP MODEL

11.3 RECREATION

11.3.1 SIT-DOWN MODEL

11.3.2 STAND-UP MODEL

11.4 FREESTYLE

11.4.1 SIT-DOWN MODEL

11.4.2 STAND-UP MODEL

11.5 PERFORMANCE

11.5.1 SIT-DOWN MODEL

11.5.2 STAND-UP MODEL

11.6 LUXURY

11.6.1 SIT-DOWN MODEL

11.6.2 STAND-UP MODEL

12 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY SEAT MODEL

12.1 OVERVIEW

12.2 DOUBLE

12.3 SINGLE

12.4 TRIPLE

12.5 OTHERS

13 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT CHANNEL

13.2.1 COMPANY WEBSITE

13.2.2 E-COMMERCE WEBSITE

13.3 INDIRECT CHANNEL

13.3.1 RETAILER

13.3.2 DISTRIBUTER

13.3.3 OTHERS

14 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY END-USER

14.1 OVERVIEW

14.2 RENTAL

14.3 INDIVIDUAL

14.4 GOVERNMENT

15 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 NORTH AMERICA PERSONAL WATERCRAFT MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 BRP

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 KAWASAKI HEAVY INDUSTRIES, LTD.

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENT

18.3 YAMAHA MOTOR CO., LTD.

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENT

18.4 JIUJIANG HISON MOTOR BOAT MANUFACTURING CO., LTD

18.4.1 COMPANY SNAPSHOT

18.4.2 COMPANY SHARE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENT

18.5 SHORT BLOCK TECHNOLOGIES, INC.

18.5.1 COMPANY SNAPSHOT

18.5.2 COMPANY SHARE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENT

18.6 BELASSI GMBH

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENTS

18.7 E-DOLPHIN

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 GIBBS SPORTS AMPHIBIANS, INC.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 KRASH INDUSTRIES

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 MACKINNON MARINE TECHNOLOGIES

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.11 NARKE

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENT

18.12 NIKOLA CORPORATION

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 PRO WATERCRAFT

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 STRAND CRAFT DESIGN LLC.

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 TAIGA MOTORS INC.

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENTS

18.16 VQ YACHTS

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 X SCREAM INC

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 2 NORTH AMERICA SIT-DOWN MODEL IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 3 NORTH AMERICA STAND-UP MODEL IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY COMPONENTS, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA ENGINE IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA DRIVE SHIFT IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA INTAKE GRATE IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA IMPELLER IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA STEERING NOZZLE IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA STEERING CONTROL IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA SPEEDOMETER IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA SAFETY SWITCH IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA OTHERS IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY PROPULSION TYPE, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA IC ENGINES IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA IC ENGINES IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA ELECTRIC IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY HULL TYPE, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA PLASTIC IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA PLASTIC IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA COMPOSITE IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA COMPOSITE IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY FUNCTIONALITY, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA ACCESSORY PACKAGE IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA AUTO TRIM IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA CONNEXT SCREEN IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA CUSTOM-TUNED ELECTRIC TRIM IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA FOOT CHOCKS IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA OPTIONAL AUDIO SPEAKERS IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA RIDE IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA OTHERS IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY SERIES, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA REC LITE IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA REC LITE IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA RECREATION IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA RECREATION IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 NORTH AMERICA FREESTYLE IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA FREESTYLE IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 NORTH AMERICA PERFORMANCE IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA PERFORMANCE IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 41 NORTH AMERICA LUXURY IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA LUXURY IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY SEAT MODEL, 2021-2030 (USD THOUSAND)

TABLE 44 NORTH AMERICA DOUBLE IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 45 NORTH AMERICA SINGLE IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 46 NORTH AMERICA TRIPLE IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 47 NORTH AMERICA OTHERS IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 48 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 49 NORTH AMERICA DIRECT CHANNEL IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 50 NORTH AMERICA DIRECT CHANNEL IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 NORTH AMERICA INDIRECT CHANNEL IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 52 NORTH AMERICA INDIRECT CHANNEL IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 54 NORTH AMERICA RENTAL IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 55 NORTH AMERICA INDIVIDUAL IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 56 NORTH AMERICA GOVERNMENT IN PERSONAL WATERCRAFT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 57 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 58 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY COMPONENTS, 2021-2030 (USD THOUSAND)

TABLE 60 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY PROPULSION TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 NORTH AMERICA IC ENGINES IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 62 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY HULL TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 NORTH AMERICA PLASTIC IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 NORTH AMERICA COMPOSITE IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY FUNCTIONALITY, 2021-2030 (USD THOUSAND)

TABLE 66 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY SERIES, 2021-2030 (USD THOUSAND)

TABLE 67 NORTH AMERICA REC LITE IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 68 NORTH AMERICA RECREATION IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 69 NORTH AMERICA FREESTYLE IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 NORTH AMERICA PERFORMANCE IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 NORTH AMERICA LUXURY IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 72 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY SEAT MODEL, 2021-2030 (USD THOUSAND)

TABLE 73 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 74 NORTH AMERICA DIRECT CHANNEL IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 75 NORTH AMERICA INDIRECT CHANNEL IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 76 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 77 U.S. PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 78 U.S. PERSONAL WATERCRAFT MARKET, BY COMPONENTS, 2021-2030 (USD THOUSAND)

TABLE 79 U.S. PERSONAL WATERCRAFT MARKET, BY PROPULSION TYPE, 2021-2030 (USD THOUSAND)

TABLE 80 U.S. IC ENGINES IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 81 U.S. PERSONAL WATERCRAFT MARKET, BY HULL TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 U.S. PLASTIC IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 U.S. COMPOSITE IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 84 U.S. PERSONAL WATERCRAFT MARKET, BY FUNCTIONALITY, 2021-2030 (USD THOUSAND)

TABLE 85 U.S. PERSONAL WATERCRAFT MARKET, BY SERIES, 2021-2030 (USD THOUSAND)

TABLE 86 U.S. REC LITE IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 87 U.S. RECREATION IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 U.S. FREESTYLE IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 89 U.S. PERFORMANCE IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 90 U.S. LUXURY IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 U.S. PERSONAL WATERCRAFT MARKET, BY SEAT MODEL, 2021-2030 (USD THOUSAND)

TABLE 92 U.S. PERSONAL WATERCRAFT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 93 U.S. DIRECT CHANNEL IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 94 U.S. INDIRECT CHANNEL IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 95 U.S. PERSONAL WATERCRAFT MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 96 CANADA PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 97 CANADA PERSONAL WATERCRAFT MARKET, BY COMPONENTS, 2021-2030 (USD THOUSAND)

TABLE 98 CANADA PERSONAL WATERCRAFT MARKET, BY PROPULSION TYPE, 2021-2030 (USD THOUSAND)

TABLE 99 CANADA IC ENGINES IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 CANADA PERSONAL WATERCRAFT MARKET, BY HULL TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 CANADA PLASTIC IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 102 CANADA COMPOSITE IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 103 CANADA PERSONAL WATERCRAFT MARKET, BY FUNCTIONALITY, 2021-2030 (USD THOUSAND)

TABLE 104 CANADA PERSONAL WATERCRAFT MARKET, BY SERIES, 2021-2030 (USD THOUSAND)

TABLE 105 CANADA REC LITE IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 106 CANADA RECREATION IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 107 CANADA FREESTYLE IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 108 CANADA PERFORMANCE IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 109 CANADA LUXURY IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 110 CANADA PERSONAL WATERCRAFT MARKET, BY SEAT MODEL, 2021-2030 (USD THOUSAND)

TABLE 111 CANADA PERSONAL WATERCRAFT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 112 CANADA DIRECT CHANNEL IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 113 CANADA INDIRECT CHANNEL IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 114 CANADA PERSONAL WATERCRAFT MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 115 MEXICO PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 116 MEXICO PERSONAL WATERCRAFT MARKET, BY COMPONENTS, 2021-2030 (USD THOUSAND)

TABLE 117 MEXICO PERSONAL WATERCRAFT MARKET, BY PROPULSION TYPE, 2021-2030 (USD THOUSAND)

TABLE 118 MEXICO IC ENGINES IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 119 MEXICO PERSONAL WATERCRAFT MARKET, BY HULL TYPE, 2021-2030 (USD THOUSAND)

TABLE 120 MEXICO PLASTIC IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 121 MEXICO COMPOSITE IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 MEXICO PERSONAL WATERCRAFT MARKET, BY FUNCTIONALITY, 2021-2030 (USD THOUSAND)

TABLE 123 MEXICO PERSONAL WATERCRAFT MARKET, BY SERIES, 2021-2030 (USD THOUSAND)

TABLE 124 MEXICO REC LITE IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 125 MEXICO RECREATION IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 126 MEXICO FREESTYLE IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 127 MEXICO PERFORMANCE IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 128 MEXICO LUXURY IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 129 MEXICO PERSONAL WATERCRAFT MARKET, BY SEAT MODEL, 2021-2030 (USD THOUSAND)

TABLE 130 MEXICO PERSONAL WATERCRAFT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 131 MEXICO DIRECT CHANNEL IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 132 MEXICO INDIRECT CHANNEL IN PERSONAL WATERCRAFT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 133 MEXICO PERSONAL WATERCRAFT MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA PERSONAL WATERCRAFT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PERSONAL WATERCRAFT MARKET: DROC ANALYSIS

FIGURE 3 NORTH AMERICA PERSONAL WATERCRAFT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PERSONAL WATERCRAFT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PERSONAL WATERCRAFT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PERSONAL WATERCRAFT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA PERSONAL WATERCRAFT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA PERSONAL WATERCRAFT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA PERSONAL WATERCRAFT MARKET: MULTIVARIATE MODELLING

FIGURE 10 NORTH AMERICA PERSONAL WATERCRAFT MARKET: TYPE TIMELINE CURVE

FIGURE 11 NORTH AMERICA PERSONAL WATERCRAFT MARKET: MARKET END-USER COVERAGE GRID

FIGURE 12 NORTH AMERICA PERSONAL WATERCRAFT MARKET: SEGMENTATION

FIGURE 13 INCREASE IN THE NUMBER OF ADVENTURE SPORTS PARTICIPATION IS EXPECTED TO BE A KEY DRIVER FOR NORTH AMERICA PERSONAL WATERCRAFT MARKET GROWTH IN THE FORECAST PERIOD 2023 TO 2030

FIGURE 14 SIT-DOWN MODEL IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PERSONAL WATERCRAFT MARKET FROM 2023 TO 2030

FIGURE 15 VALUE CHAIN ANALYSIS FRAMEWORK

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA PERSONAL WATERCRAFT MARKET

FIGURE 17 POPULARITY OF ADVENTURE SPORTS IN INDIA

FIGURE 18 PERCENTAGE OF EUROPEAN TOUR OPERATORS SEEK ADVENTURE TOURISM

FIGURE 19 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY TYPE, 2022

FIGURE 20 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY COMPONENTS, 2022

FIGURE 21 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY PROPULSION TYPE, 2022

FIGURE 22 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY HULL TYPE, 2022

FIGURE 23 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY FUNCTIONALITY, 2022

FIGURE 24 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY SERIES, 2022

FIGURE 25 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY SEAT MODEL, 202

FIGURE 26 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY DISTRIBUTION CHANNEL, 2022

FIGURE 27 NORTH AMERICA PERSONAL WATERCRAFT MARKET, BY END-USER, 2022

FIGURE 28 NORTH AMERICA PERSONAL WATERCRAFT MARKET: BY SNAPSHOT (2022)

FIGURE 29 NORTH AMERICA PERSONAL WATERCRAFT MARKET: BY COUNTRY (2022)

FIGURE 30 NORTH AMERICA PERSONAL WATERCRAFT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 31 NORTH AMERICA PERSONAL WATERCRAFT MARKET: COUNTRY COMPONENT (2022 & 2030)

FIGURE 32 NORTH AMERICA PERSONAL WATERCRAFT MARKET: BY TYPE (2023 & 2030)

FIGURE 33 NORTH AMERICA PERSONAL WATERCRAFT MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.