North America Parenteral Packaging Market

Taille du marché en milliards USD

TCAC :

%

USD

10.39 Billion

USD

17.71 Billion

2025

2033

USD

10.39 Billion

USD

17.71 Billion

2025

2033

| 2026 –2033 | |

| USD 10.39 Billion | |

| USD 17.71 Billion | |

|

|

|

|

Segmentation du marché nord-américain des emballages parentéraux, par type (ampoules, seringues préremplies, flacons, bouteilles, cartouches, poches, systèmes prêts à l'emploi et autres), type d'emballage (emballages parentéraux de petit et de grand volume), type de commande (commande personnalisée et commande standard), type de dosage (dose unique et doses multiples), canal de distribution (vente directe, pharmacies, commerce électronique et autres), domaines thérapeutiques (cardiovasculaire/métabolique, obstétrique/gynécologie, dermatologie, endocrinologie et maladies métaboliques, gastro-entérologie, ophtalmologie, gestion de la douleur, maladies rares, maladies infectieuses et autres), utilisateur final (fabricants pharmaceutiques, hôpitaux, dispensaires, cliniques, services ambulatoires, organismes de recherche sous contrat et autres) - Tendances du secteur et prévisions jusqu'en 2033

Taille du marché des emballages parentéraux en Amérique du Nord

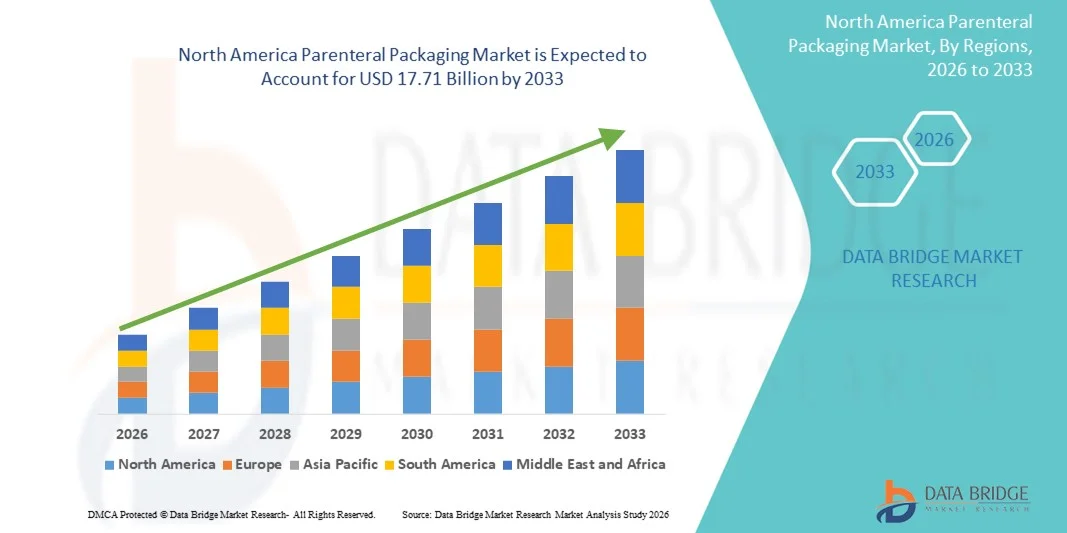

- Le marché nord-américain des emballages parentéraux était évalué à 10,39 milliards de dollars américains en 2025 et devrait atteindre 17,71 milliards de dollars américains d'ici 2033 , avec un TCAC de 6,9 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la demande croissante de systèmes d'administration de médicaments sûrs, efficaces et avancés, ainsi que par les progrès technologiques réalisés dans les matériaux d'emballage tels que le verre, les polymères et les polymères d'oléfines cycliques, permettant une meilleure stabilité des médicaments et une sécurité accrue pour les patients.

- Par ailleurs, l'augmentation de la production et de l'administration de vaccins, de produits biologiques et de médicaments injectables à haute activité alimente le besoin de solutions d'emballage parentéral fiables, stériles et adaptables à grande échelle. Ces facteurs convergents accélèrent l'adoption de formats d'emballage innovants, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché des emballages parentéraux en Amérique du Nord

- Le conditionnement parentéral, notamment les flacons, les seringues préremplies, les ampoules et les systèmes prêts à l'emploi, devient un élément essentiel de la fabrication pharmaceutique moderne et de la prestation de soins de santé, grâce à sa capacité à maintenir la stérilité des médicaments, à garantir un dosage précis et à faciliter l'administration de médicaments biologiques et de spécialités pharmaceutiques.

- La demande croissante d'emballages parentéraux est principalement alimentée par le développement des thérapies injectables, la prévalence accrue des maladies chroniques et infectieuses, et une préférence grandissante pour les formats préremplis et prêts à l'emploi qui améliorent la sécurité des patients, l'efficacité opérationnelle et la conformité aux normes réglementaires.

- Les États-Unis ont dominé le marché des emballages parentéraux en 2025, grâce à un secteur pharmaceutique et biotechnologique bien établi, à l'adoption précoce de formats d'emballage parentéraux avancés et à une forte demande de produits biologiques et de thérapies injectables.

- Le Canada devrait connaître la croissance la plus rapide sur le marché des emballages parentéraux au cours de la période de prévision, en raison de la production croissante de produits biologiques et de vaccins, du développement des infrastructures de santé et de l'adoption croissante des emballages préremplis et prêts à l'emploi.

- Le segment des flacons a dominé le marché avec une part de 43,3 % en 2025, grâce à leur utilisation répandue dans les formulations injectables et à leur grande compatibilité avec les systèmes automatisés de remplissage et de scellage. Les fabricants pharmaceutiques privilégient les flacons pour leur capacité à maintenir la stérilité et leur longue durée de conservation, garantissant ainsi la sécurité et l'efficacité des médicaments injectables. Cette domination est également confortée par l'adoption généralisée des flacons dans les vaccins, les produits biologiques et les injectables thérapeutiques, ce qui stimule la demande dans les hôpitaux et les cliniques. Les flacons offrent également une grande flexibilité pour les formulations à dose unique et à doses multiples, répondant ainsi à diverses exigences cliniques et commerciales.

Portée du rapport et segmentation du marché des emballages parentéraux

|

Attributs |

Emballages parentéraux : principaux enseignements du marché |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Tendances du marché des emballages parentéraux en Amérique du Nord

Adoption croissante des systèmes parentéraux préremplis et prêts à l'emploi

- Une tendance majeure du marché des emballages parentéraux est l'adoption croissante des systèmes préremplis et prêts à l'emploi, motivée par le besoin grandissant d'une administration des médicaments centrée sur le patient et d'une efficacité opérationnelle accrue dans les établissements de santé. Ces formats améliorent la précision du dosage, réduisent les erreurs médicamenteuses et simplifient l'administration dans les hôpitaux, les cliniques et à domicile.

- Par exemple, BD (Becton, Dickinson and Company) et Terumo Pharmaceutical Solutions fournissent des seringues préremplies de haute qualité et des seringues polymères prêtes à l'emploi, largement utilisées pour les vaccins, les produits biologiques et les injectables spécialisés. Ces solutions améliorent la sécurité des médicaments, rationalisent les flux de travail cliniques et renforcent la fiabilité des fabricants sur les différents marchés.

- L'adoption de systèmes préremplis et prêts à l'emploi progresse rapidement dans les programmes de vaccination et la prise en charge des maladies chroniques, où la réduction du temps de préparation et des risques de contamination est essentielle. De ce fait, le conditionnement parentéral s'impose comme un élément clé pour des soins de santé plus sûrs et plus efficaces.

- Les fabricants de produits pharmaceutiques intègrent de plus en plus des technologies de remplissage et de scellage avancées pour soutenir la production à grande échelle de systèmes préremplis et prêts à l'emploi, stimulant ainsi la croissance du marché.

- Les hôpitaux et les services de soins ambulatoires privilégient ces formats en raison de leur facilité de manipulation, de leurs besoins de stockage réduits et de leur compatibilité avec les systèmes de distribution automatisés.

- L'intérêt croissant porté aux produits biologiques et aux thérapies injectables à haute puissance renforce la demande d'emballages préremplis et prêts à l'emploi, car ces formats garantissent l'intégrité du produit, maintiennent la stérilité et répondent aux normes réglementaires strictes.

Dynamique du marché des emballages parentéraux en Amérique du Nord

Conducteur

Demande croissante de produits biologiques et de thérapies injectables

- L'augmentation de la production et de la consommation de produits biologiques, de vaccins et de médicaments injectables à haute activité est un moteur important du marché des emballages parentéraux, car ces traitements nécessitent des solutions d'emballage sûres, stériles et fiables qui préservent la stabilité et l'efficacité des médicaments.

- Par exemple, Gerresheimer et SCHOTT Pharma proposent des flacons spécialisés et des systèmes préremplis à base de polymères conçus pour les formulations sensibles, notamment les vaccins à ARNm et les anticorps monoclonaux. Ces solutions améliorent la sécurité des produits, facilitent leur distribution à grande échelle et permettent une administration efficace en milieu clinique et à domicile.

- La prévalence croissante des maladies chroniques, des maladies infectieuses et des thérapies spécialisées incite les professionnels de santé à adopter les traitements injectables, augmentant ainsi la demande en emballages parentéraux de haute qualité.

- Les entreprises pharmaceutiques investissent dans des solutions d'emballage innovantes pour répondre aux exigences réglementaires mondiales strictes tout en assurant la sécurité des patients, l'efficacité opérationnelle et une réduction au minimum du gaspillage de médicaments.

- L'intégration des technologies automatisées de remplissage, de scellage et d'inspection permet aux fabricants d'accroître efficacement leur production, de soutenir la croissance des filières de développement de produits biologiques et de répondre à la demande en formats prêts à l'emploi et préremplis.

Retenue/Défi

Coûts élevés de fabrication et de conformité réglementaire

- Le marché des emballages parentéraux est confronté à des défis importants en raison des coûts élevés associés à la production de systèmes d'emballage stériles et de haute qualité conformes aux normes réglementaires rigoureuses dans de nombreuses régions.

- Par exemple, des entreprises comme Terumo Pharmaceutical Solutions et BD investissent massivement dans des procédés de stérilisation, d'inspection et de contrôle qualité avancés afin de répondre aux exigences des pharmacopées internationales, ce qui accroît leurs coûts opérationnels et leur complexité.

- Garantir la stabilité, la stérilité et la compatibilité des médicaments avec les produits biologiques sensibles exige des matériaux de pointe, une ingénierie de précision et des équipements spécialisés, ce qui augmente encore les coûts de production et limite la flexibilité en matière de coûts.

- L'évolution constante du cadre réglementaire dans les différents pays alourdit les obligations de conformité, nécessitant une surveillance, des tests et une documentation continus pour maintenir l'approbation du marché.

- Augmenter la production tout en maintenant une qualité constante, en prévenant la contamination et en respectant les normes réglementaires demeure une contrainte majeure, influant sur la rentabilité et limitant la capacité des fabricants à baisser les prix ou à accroître rapidement leurs capacités.

Portée du marché des emballages parentéraux en Amérique du Nord

Le marché est segmenté en fonction du type de produit, du type d'emballage, du type de commande, du type de dosage, du canal de distribution, des domaines thérapeutiques et de l'utilisateur final.

- Par type

Le marché des emballages parentéraux est segmenté selon le type d'emballage : ampoules, seringues préremplies, flacons, bouteilles, cartouches, poches, systèmes prêts à l'emploi et autres. En 2025, le segment des flacons dominait le marché, générant la plus grande part de revenus grâce à leur utilisation répandue dans les formulations injectables et à leur grande compatibilité avec les systèmes automatisés de remplissage et de scellage. Les fabricants de produits pharmaceutiques privilégient les flacons pour leur capacité à maintenir la stérilité et leur longue durée de conservation, garantissant ainsi la sécurité et l'efficacité des médicaments injectables. Cette domination est également confortée par l'adoption généralisée des flacons pour les vaccins, les produits biologiques et les injectables thérapeutiques, ce qui stimule la demande dans les hôpitaux et les cliniques. Les flacons offrent par ailleurs une grande flexibilité pour les formulations à dose unique et à doses multiples, répondant ainsi à diverses exigences cliniques et commerciales.

Le segment des seringues préremplies devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par la demande croissante de solutions d'administration de médicaments centrées sur le patient et facilitant l'auto-administration. Par exemple, des entreprises comme Becton Dickinson élargissent leur gamme de seringues préremplies pour accompagner les thérapies par produits biologiques et anticorps monoclonaux. Les seringues préremplies réduisent les erreurs de dosage, améliorent le confort d'utilisation et l'observance thérapeutique, ce qui explique leur popularité croissante dans les soins à domicile. Leur adoption progresse également dans les économies émergentes grâce à un coût de fabrication avantageux et à la réduction du gaspillage de médicaments. La combinaison de la sécurité, de la praticité et de l'acceptation réglementaire est le moteur de la croissance rapide de ce segment.

- Par type d'emballage

Selon le type de conditionnement, le marché se divise en conditionnements parentéraux de petit volume et de grand volume. En 2025, les conditionnements de petit volume détenaient la plus grande part de marché, grâce à leur utilisation répandue dans les vaccins, l'insuline et les produits biologiques nécessitant un dosage précis. Les contenants de plus petite taille réduisent les risques de contamination et permettent une administration contrôlée en milieu hospitalier et ambulatoire. Les hôpitaux et les centres de soins ambulatoires privilégient les formats de petit volume pour leur facilité de manipulation, de stockage et d'administration rapide. Ce segment bénéficie également des progrès technologiques réalisés dans le domaine des matériaux à base de verre et de polymères, qui améliorent la stabilité du médicament et l'intégrité du conditionnement.

Le conditionnement parentéral de grand volume devrait connaître la croissance la plus rapide, soutenu par la demande croissante de solutions intraveineuses, de nutrition parentérale et de produits biologiques à forte dose. Par exemple, Fresenius Kabi s'est concentré sur l'élargissement de sa gamme de poches de grand volume pour perfusions, destinées aux hôpitaux et aux soins à domicile. Le conditionnement de grand volume améliore l'efficacité de l'administration de médicaments à volume élevé et réduit la fréquence des interventions. La croissance dans la prise en charge des maladies chroniques et les services de soins intensifs stimulent davantage la demande. L'adaptabilité de ce segment et son adéquation à un usage hospitalier sont les principaux facteurs de son expansion rapide.

- Par type de commande

Le marché des emballages parentéraux se divise en deux catégories : les commandes personnalisées et les commandes standard. Ces dernières ont dominé le marché en 2025, portées par la production pharmaceutique à grande échelle et les formulations injectables courantes. L’emballage standardisé garantit une production plus rapide, des coûts réduits et une conformité réglementaire simplifiée pour les fabricants de produits pharmaceutiques. Ces commandes répondent à une demande constante du marché et facilitent la gestion de la chaîne d’approvisionnement mondiale. Ce segment bénéficie d’une adoption généralisée pour les vaccins, les produits biologiques et les médicaments à petites molécules, ce qui améliore l’efficacité de la production et de la distribution.

Les commandes personnalisées devraient connaître la croissance la plus rapide, portée par la demande croissante de médicaments personnalisés et de produits biologiques de spécialité nécessitant des solutions d'emballage sur mesure. Par exemple, West Pharmaceutical Services propose des solutions d'emballage personnalisées répondant aux exigences spécifiques de compatibilité médicamenteuse et aux normes réglementaires. L'emballage personnalisé améliore la sécurité des patients, réduit le gaspillage de médicaments et soutient les domaines thérapeutiques de niche. Les entreprises pharmaceutiques optent de plus en plus pour des formats personnalisés afin de différencier leurs produits et de répondre aux besoins spécifiques des utilisateurs finaux. La croissance de ce segment est accélérée par le développement de nouveaux produits biologiques et de médicaments de spécialité.

- Par type de dosage

Selon le type de dosage, le marché se divise en doses unitaires et doses multiples. Les doses unitaires dominaient le marché en 2025, grâce à leur sécurité accrue, leur faible risque de contamination et leur facilité d'administration en ambulatoire. Les conditionnements unidoses sont largement utilisés pour les vaccins, l'insuline et les produits biologiques à haute activité, garantissant un dosage précis et un gaspillage minimal. Les hôpitaux et les cliniques privilégient les emballages unidoses pour simplifier la manipulation et réduire les erreurs d'administration. Les progrès technologiques en matière de matériaux et de systèmes de scellage renforcent encore la position dominante de ce segment.

Le segment des doses multiples devrait connaître la croissance la plus rapide, portée par la demande croissante de solutions économiques pour les traitements à grande échelle et l'administration en milieu hospitalier. À titre d'exemple, les systèmes de flacons multidoses de BD facilitent la prise en charge des maladies chroniques et les campagnes de vaccination de masse. Les formats multidoses permettent de réduire les besoins de stockage et les coûts globaux de traitement, tout en préservant la stérilité et l'efficacité. Ce segment est de plus en plus utilisé en soins intensifs et dans les applications thérapeutiques à grande échelle, ce qui stimule l'expansion du marché.

- Par canal de distribution

Selon le canal de distribution, le marché se segmente en vente directe, pharmacies/magasins de matériel médical, commerce électronique et autres. La vente directe a dominé le marché en 2025, grâce aux relations étroites entre les fabricants de produits pharmaceutiques et les hôpitaux, les cliniques et les organismes de recherche sous contrat. La distribution directe garantit l'intégrité des produits, le respect de la chaîne du froid et la livraison rapide des médicaments parentéraux essentiels. Les fabricants tirent également parti de la vente directe pour maîtriser les prix, la qualité et la conformité réglementaire.

Le commerce électronique devrait connaître la croissance la plus rapide, soutenue par l'adoption croissante des plateformes numériques pour l'approvisionnement pharmaceutique. Par exemple, les canaux de distribution en ligne de McKesson offrent aux hôpitaux et aux pharmacies un accès simplifié aux emballages pour produits parentéraux. Le commerce électronique offre praticité, rapidité de traitement des commandes et une meilleure visibilité des produits, notamment sur les marchés émergents. Le développement de la vente au détail de produits pharmaceutiques en ligne et des solutions d'approvisionnement B2B accélère la croissance de ce segment.

- Par domaines thérapeutiques

Le marché est segmenté par domaine thérapeutique en maladies cardiovasculaires et métaboliques, obstétrique et gynécologie, dermatologie, endocrinologie et maladies métaboliques, gastro-entérologie, ophtalmologie, prise en charge de la douleur, maladies rares, maladies infectieuses et autres. En 2025, le segment des maladies infectieuses dominait le marché, porté par une forte demande de vaccins et d'antibiotiques injectables dans les pays développés et émergents. Les hôpitaux, les cliniques et les programmes de vaccination privilégient les formes parentérales pour garantir une efficacité rapide et un dosage précis. Ce segment bénéficie des initiatives gouvernementales de vaccination et de l'attention croissante portée à la prise en charge des maladies infectieuses à l'échelle mondiale.

Les maladies rares devraient connaître la croissance la plus rapide, alimentée par le développement croissant de médicaments orphelins et de produits biologiques de spécialité nécessitant une administration parentérale précise. Par exemple, Novartis a élargi sa gamme de solutions parentérales pour le traitement des maladies rares, facilitant l'administration en milieu hospitalier et à domicile. L'intérêt grandissant pour les thérapies ciblées et la médecine personnalisée stimule la demande de formulations injectables à faible volume et à forte concentration. La croissance de ce segment est accélérée par les incitations réglementaires et l'augmentation des investissements dans les traitements en développement pour les maladies rares.

- Par l'utilisateur final

En fonction de l'utilisateur final, le marché est segmenté en fabricants de produits pharmaceutiques, hôpitaux, dispensaires, cliniques, services ambulatoires, organismes de recherche sous contrat et autres. Les hôpitaux dominaient le marché en 2025, portés par un volume élevé de patients et une utilisation intensive des médicaments parentéraux pour les soins intensifs, la chirurgie et les traitements ambulatoires. Les hôpitaux ont besoin de différents formats de conditionnement pour prendre en charge les traitements à dose unique, à doses multiples et en grand volume, tout en garantissant la stérilité et la conformité réglementaire. Ce segment bénéficie également de l'adoption rapide des technologies de conditionnement avancées et des systèmes de distribution automatisés.

Le secteur pharmaceutique devrait connaître la croissance la plus rapide, portée par l'externalisation croissante des besoins en emballage et l'expansion de la production de produits biologiques et de vaccins. Pfizer, par exemple, a considérablement augmenté sa capacité d'emballage pour les produits parentéraux afin de répondre efficacement à la demande mondiale de vaccins. Les fabricants privilégient de plus en plus les seringues préremplies, les flacons et les systèmes prêts à l'emploi pour optimiser la production et la distribution. L'accent mis sur des solutions d'emballage de haute qualité et évolutives pour les nouveaux médicaments en développement accélère la croissance de ce segment.

Analyse régionale du marché des emballages parentéraux en Amérique du Nord

- Les États-Unis ont dominé le marché des emballages parentéraux en 2025, avec la plus grande part de revenus, grâce à un secteur pharmaceutique et biotechnologique bien établi, à l'adoption précoce de formats d'emballage parentéraux avancés et à une forte demande de produits biologiques et de thérapies injectables.

- Les réglementations fédérales et les normes de qualité relatives au conditionnement stérile, à la fabrication de produits biologiques et à la production de vaccins renforcent la position de leader du pays dans la région. La présence de grands fournisseurs de solutions de conditionnement parentéral, les progrès technologiques constants en matière de seringues préremplies, de flacons et de systèmes prêts à l'emploi, ainsi que l'expansion des réseaux hospitaliers et cliniques, stimulent la croissance du marché dans les établissements de santé urbains et périurbains.

- L'adoption croissante des systèmes automatisés de remplissage et d'inspection, la demande grandissante de produits injectables à haute concentration et l'importance accrue accordée à la sécurité des patients garantissent que les États-Unis conservent leur rôle régional dominant tout au long de la période de prévision.

Aperçu du marché canadien des emballages parentéraux

Le Canada devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide du marché nord-américain des emballages parentéraux entre 2026 et 2033, grâce à la croissance de la production de produits biologiques et de vaccins, au développement des infrastructures de santé et à l'adoption croissante des emballages préremplis et prêts à l'emploi. Les fabricants pharmaceutiques canadiens mettent de plus en plus en œuvre des technologies automatisées de remplissage, de scellage et d'inspection afin d'améliorer l'efficacité de la production et de garantir la stabilité des médicaments. L'expansion des hôpitaux, des cliniques et des services de soins ambulatoires, conjuguée aux partenariats entre les fabricants locaux et les fournisseurs mondiaux de solutions d'emballage, accélère l'adoption des systèmes parentéraux de pointe à l'échelle nationale. L'accent mis sur la sécurité des patients, la conformité réglementaire et l'efficacité opérationnelle positionne le Canada comme le marché à la croissance la plus rapide de la région.

Analyse du marché mexicain des emballages parentéraux

Le Mexique devrait connaître une croissance soutenue entre 2026 et 2033, portée par l'augmentation de ses capacités de production pharmaceutique, une meilleure connaissance des thérapies injectables et l'adoption progressive de solutions d'emballage parentéral avancées. Les initiatives gouvernementales soutenant la production de vaccins, la fabrication de produits biologiques et le développement des infrastructures de santé contribuent à une expansion constante du marché. La présence de fournisseurs d'emballages régionaux, le développement des réseaux hospitaliers et cliniques et l'amélioration de la logistique de la chaîne du froid renforcent l'accessibilité et la fiabilité des emballages parentéraux. L'attention croissante portée par le Mexique à la sécurité des patients, à l'efficacité opérationnelle et au respect des normes de qualité internationales soutient une croissance soutenue tout au long de la période de prévision.

Part de marché des emballages parentéraux en Amérique du Nord

L'industrie du conditionnement parentéral est principalement dominée par des entreprises bien établies, notamment :

- SCHOTT AG (Allemagne)

- Smithers (États-Unis)

- WILCO AG (Suisse)

- Technologies d'emballage Genesis (États-Unis)

- Baxter (États-Unis)

- RONDO BURGORF AG (Suisse)

- ISOVOLTA AG (Autriche)

- NNE (Danemark)

- Tekni-Plex, Inc. (États-Unis)

- Catalent, Inc. (États-Unis)

- Groupe Wipak (Finlande)

- ProAmpac (États-Unis)

- Nolato AB (Suède)

- Science des matériaux SiO2 (États-Unis)

Dernières évolutions du marché nord-américain des emballages parentéraux

- En décembre 2023, SCHOTT Pharma a annoncé l'expansion de ses activités avec la création d'un nouveau site de production en Serbie. Cet investissement stratégique vise à accroître significativement la capacité de production de l'entreprise afin de répondre à la demande mondiale croissante d'emballages parentéraux. Ce développement devrait améliorer l'efficacité de la chaîne d'approvisionnement, réduire les délais de livraison et renforcer la position concurrentielle de SCHOTT sur les principaux marchés internationaux. Ce nouveau site témoigne également de l'engagement de l'entreprise à soutenir les secteurs pharmaceutique et biotechnologique en pleine croissance en leur fournissant des solutions d'emballage fiables et de haute qualité.

- En 2023, Gerresheimer a lancé des flacons en polymère d'oléfine cyclique (COP) spécialement conçus pour les produits biologiques sensibles, notamment les médicaments à base d'ARNm. Ces flacons offrent une sécurité accrue grâce à une stabilité chimique supérieure et une interaction réduite avec les formulations à haute activité, garantissant ainsi l'intégrité des thérapies de nouvelle génération. Cette innovation répond au besoin croissant de matériaux avancés pour le conditionnement parentéral et permet aux entreprises pharmaceutiques de relever les défis liés à l'administration de produits biologiques et de vaccins. Ce lancement renforce la position de Gerresheimer en tant que fournisseur leader de solutions d'emballage technologiquement avancées sur le marché mondial.

- En 2023, BD (Becton, Dickinson and Company) a lancé une seringue préremplie avec système de rinçage et unité de désinfection intégrée, destinée à simplifier l'administration des médicaments en milieu clinique. Cette solution améliore la sécurité des opérations en minimisant les risques de contamination lors des injections et optimise l'efficacité en réduisant le nombre d'étapes de préparation. Cette innovation enrichit l'offre de BD dans le secteur du conditionnement parentéral et aide les professionnels de santé à administrer des traitements plus sûrs et plus fiables, notamment dans les environnements hospitaliers et ambulatoires à forte activité.

- En 2022, Terumo Pharmaceutical Solutions (TPS) a lancé une seringue polymère prête à l'emploi, spécialement conçue pour les médicaments biotechnologiques à haut volume de production. Cette innovation répond à des enjeux majeurs du secteur, tels que le maintien de la stabilité du médicament, la garantie de sa stérilité et la prise en compte des formulations biologiques complexes. Cette solution offre aux fabricants de produits pharmaceutiques une option de conditionnement robuste et évolutive, renforçant ainsi la position de TPS sur le marché concurrentiel du conditionnement biopharmaceutique et permettant une production plus efficace de thérapies injectables de pointe.

- En 2021, SCHOTT AG a entamé la construction d'un deuxième four de fusion pour tubes en verre pharmaceutique afin d'accroître sa capacité de production. Cette extension vise à répondre à la demande croissante d'emballages en verre parentéraux de haute qualité, notamment pour les vaccins, les produits biologiques et les médicaments injectables. Cette capacité supplémentaire permet à SCHOTT de mieux servir ses clients pharmaceutiques internationaux tout en soutenant sa stratégie de croissance à long terme dans le secteur de la santé. Cette initiative témoigne de l'investissement continu de l'entreprise dans ses infrastructures afin de garantir la fiabilité, la précision et l'évolutivité de ses solutions d'emballage en verre.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.