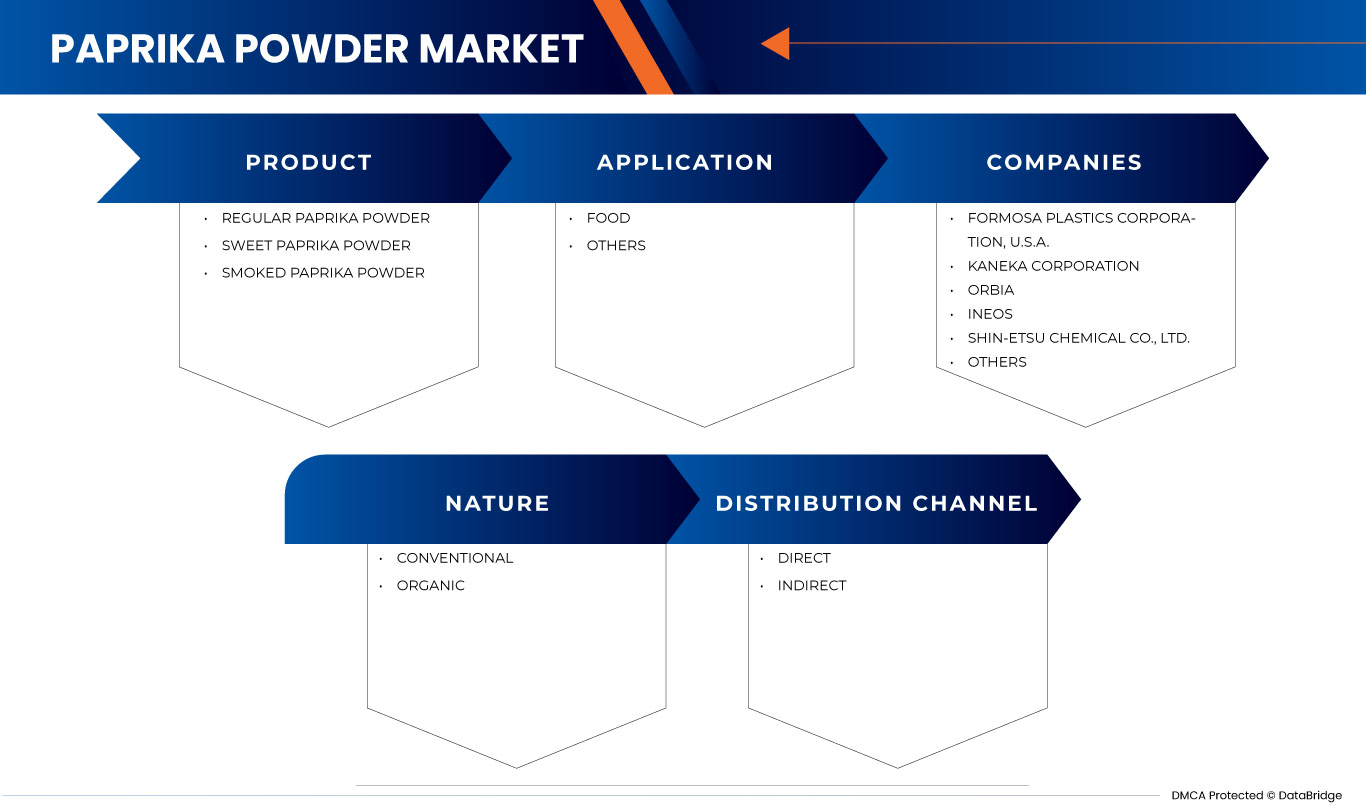

Marché de la poudre de paprika en Amérique du Nord par produit (poudre de paprika ordinaire, poudre de paprika doux et poudre de paprika fumé), nature (conventionnelle et biologique), application (alimentaire et autres), canal de distribution (direct et indirect) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché de la poudre de paprika en Amérique du Nord

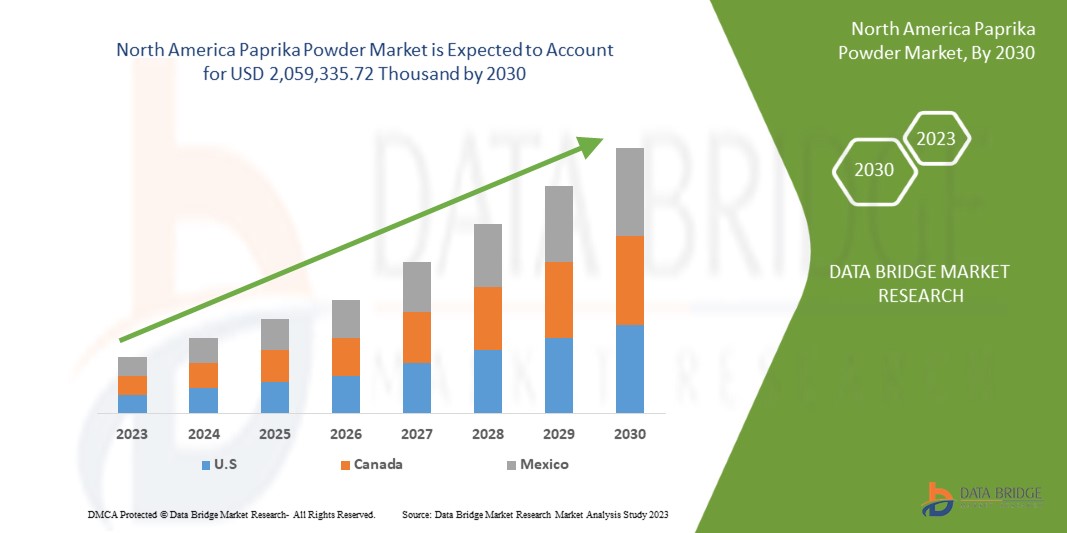

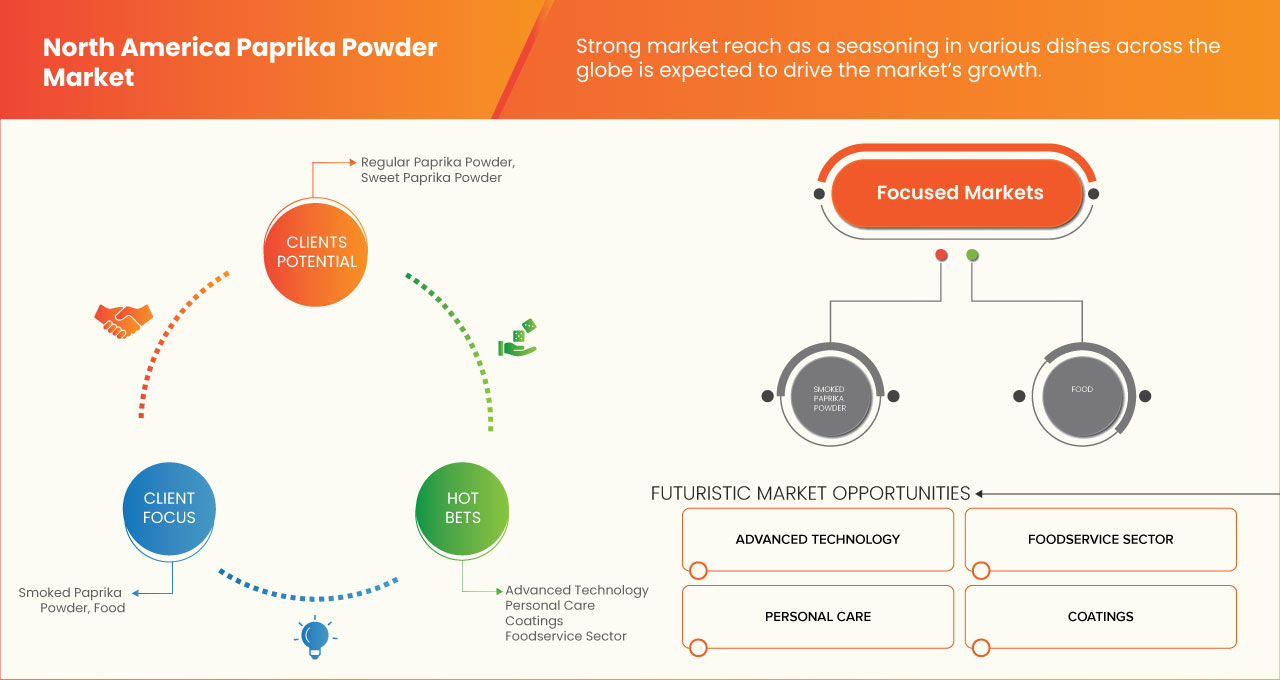

Le marché de la poudre de paprika en Amérique du Nord devrait connaître une croissance du marché au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît à un TCAC de 6,3 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 2 059 335,72 milliers USD d'ici 2030, car la poudre de paprika est utilisée comme assaisonnement dans divers plats à travers le monde, ce qui devrait stimuler la croissance du marché.

Le rapport sur le marché de la poudre de paprika en Amérique du Nord fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et localisé, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Par produit (poudre de paprika ordinaire, poudre de paprika doux et poudre de paprika fumé), nature (conventionnelle et biologique), application (alimentaire et autres), canal de distribution (direct et indirect) |

|

Pays couverts |

États-Unis, Canada, Mexique |

|

Acteurs du marché couverts |

EVESA, Le Comptoir Colonial, Botanic Healthcare, Santa Maria UK Ltd, Foodchem International Corporation, Qingdao Taifoong Foods Co., Ltd et Sri Ruthra Exports, entre autres |

Définition du marché

Le paprika ou la poudre de paprika est une épice utilisée pour ajouter de la saveur et de la couleur sous une forme naturelle aux aliments. Il est fabriqué à partir des gousses séchées d'un type de poivrier. Le paprika est largement utilisé comme assaisonnement dans de nombreuses cuisines, notamment les cuisines hongroise, espagnole et indienne, entre autres. Le produit est largement utilisé dans les produits à base de viande pour rehausser sa saveur. Il trouve également une application dans les produits de boulangerie pour conférer des saveurs telles que la vanille et le chocolat. De plus, il peut être utilisé pour ajouter du goût à des boissons telles que le thé et le café. Compte tenu de ses bienfaits antibactériens et antioxydants sur la santé, le paprika est utilisé à diverses fins médicales et est donc utilisé dans l'industrie pharmaceutique. Il est également utile pour les huiles et les shampooings antipelliculaires et est utilisé dans divers produits de soins capillaires et cutanés et comme colorant pour ceux-ci. Le paprika est largement utilisé comme colorant naturel dans les aliments tels que les produits culinaires, les produits à base de viande, l'huile et les fromages.

Dynamique du marché de la poudre de paprika en Amérique du Nord

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

-

Forte portée commerciale en tant qu'assaisonnement dans divers plats à travers le monde

Le paprika est largement utilisé comme assaisonnement dans de nombreuses cuisines, notamment hongroise, espagnole et indienne, entre autres. La croissance du marché peut être attribuée à la demande croissante de paprika comme assaisonnement alimentaire et colorant naturel pour les produits alimentaires. En outre, la demande croissante d'oléorésines de paprika comme colorant pour l'alimentation des volailles contribue également à la croissance du marché nord-américain de la poudre de paprika. De plus, le produit est largement utilisé dans les produits à base de viande pour rehausser sa saveur. Il trouve également une application dans les produits de boulangerie pour conférer des arômes tels que la vanille et le chocolat. De plus, il peut être utilisé pour ajouter du goût à des boissons telles que le thé et le café. Par conséquent, la demande croissante de poudre de paprika comme assaisonnement alimentaire et colorant naturel devrait stimuler la croissance du marché nord-américain de la poudre de paprika.

-

Importance croissante du paprika en tant qu’ingrédient fonctionnel dans diverses applications autres que alimentaires

La poudre de paprika présente divers avantages pour la santé, selon le poivre utilisé pour fabriquer l'épice ou la poudre. La consommation de poudre de paprika aide à prévenir l'hyperacidité et, grâce à son goût sucré, elle contribue à réduire les risques de régurgitation acide.

En outre, la prise de conscience croissante des consommateurs concernant les avantages médicaux de la poudre de paprika devrait stimuler le marché de la poudre de paprika en Amérique du Nord. En dehors de cela, la poudre de paprika a des applications dans l'industrie pharmaceutique. Ils aident à réduire la douleur, la tension et le stress lorsqu'ils sont utilisés dans des fixations et des concentrations appropriées dans un produit. Le paprika a également des propriétés naturelles telles que des propriétés analgésiques, calmantes et anti-obésité et peut donc être utilisé dans le traitement anticancéreux. L'incorporation de poudre de paprika contenant de la capsaïcine dans son alimentation peut offrir une protection contre une grande variété de cancers.

Opportunités

-

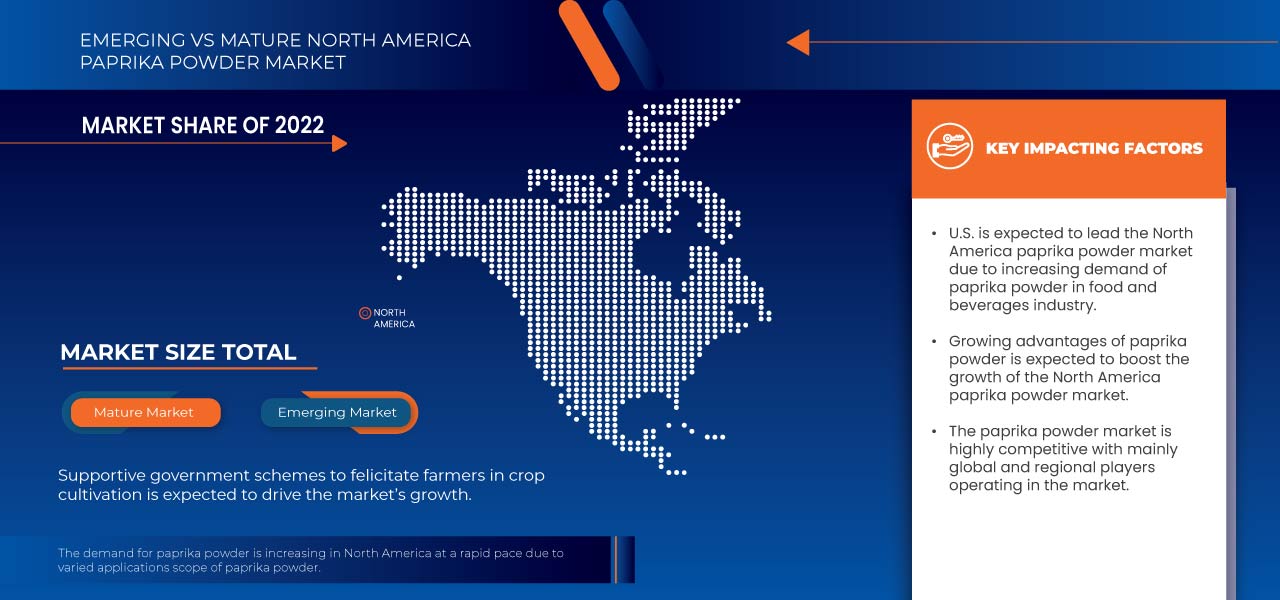

Programmes gouvernementaux de soutien pour encourager les agriculteurs à cultiver leurs cultures

L’agriculture est l’épine dorsale économique de nombreux pays en développement et contribue à environ 25 % du PIB dans les pays à faible revenu et à 80 % de la population pauvre vivant dans les zones rurales. Divers pays et régions ont renforcé leur soutien à l’agriculture en ajoutant de nouveaux programmes et en étendant la couverture à davantage de régions et de produits. Les programmes de gestion de la production proposés par les gouvernements pour une productivité accrue contribuent à accroître la production de divers produits, notamment les céréales, les légumineuses, les épices, les légumes et les fruits, grâce à l’expansion des superficies et à l’amélioration de la productivité de manière durable. La promotion de bonnes pratiques agricoles en matière de stratégies et de techniques de protection des végétaux contribue également à promouvoir l’uniformité de la commercialisation des produits agricoles en rationalisant les procédures sur les marchés intégrés, en supprimant l’asymétrie d’information entre acheteurs et vendeurs et en favorisant la découverte des prix en temps réel en fonction de l’offre et de la demande réelles.

En outre, les décideurs politiques peuvent également soutenir les agriculteurs en adoptant des réglementations qui permettent un approvisionnement plus efficace en intrants agricoles tels que les semences, les engrais, les aliments pour animaux, les médicaments vétérinaires et l’eau, qui favorisent l’accès au financement et qui facilitent les transactions sur le marché. Ces mesures, politiques et réglementations de soutien concernant les agriculteurs et les pratiques et installations agricoles offriront de nombreuses opportunités pour la croissance du marché nord-américain de la poudre de paprika.

-

Augmentation des dépenses consacrées à l'incorporation d'ingrédients naturels dans le traitement de la poudre de paprika

La demande d'additifs alimentaires naturels, tels que les colorants alimentaires naturels, n'a jamais été aussi élevée. Cette tendance est à l'origine de l'expansion du marché de la poudre de paprika. Pour transformer la poudre de paprika, les fabricants dépensent des sommes considérables pour incorporer des ingrédients naturels afin de produire différentes variétés et types de poudre de paprika. De plus, certains des principaux producteurs cherchent à mettre en œuvre des technologies de pointe pour améliorer l'efficacité des processus. Les organisations ont commencé à utiliser la microencapsulation pour les systèmes de distribution de couleurs et la formulation du produit final.

Par conséquent, avec l'importance et la demande croissantes d'ingrédients naturels, la demande de poudre de paprika extraite naturellement devrait augmenter. Cela créera une opportunité pour la croissance et le développement du marché de la poudre de paprika en Amérique du Nord.

Retenue

- Menace de substitution par d'autres assaisonnements

Il existe de nombreuses épices différentes qui donnent le même effet que la poudre de paprika dans divers aliments et plats. Parmi les substituts fumés à la poudre de paprika, on trouve la poudre de piment chipotle (pour le paprika doux fumé), la poudre de poivre de Cayenne (pour le paprika piquant), la poudre de piment ancho (pour le paprika doux), la poudre de piment guajillo (pour le paprika piquant) et la poudre de chili (pour le paprika piquant) parmi tant d'autres.

Alors que le paprika fumé donne de la profondeur à un plat, le paprika doux est un aliment de base classique et peut être utilisé dans presque tous les plats aux côtés de l'ail et de l'oignon. De la poudre de chili douce et de la poudre de tomate ont été utilisées à la place de la poudre de paprika pour obtenir également la saveur du paprika.

La disponibilité facile d’un certain nombre de substituts à divers types de poudre de paprika sur le marché nord-américain devrait constituer un frein majeur à la croissance et au développement du marché nord-américain de la poudre de paprika.

DÉFIS

- Culture d'autres alternatives de cultures rentables

Le marché de la poudre de paprika dépend généralement de l'agriculture contractuelle pour l'approvisionnement en matières premières, où les fabricants signent des contrats avec les agriculteurs pour fournir du paprika pour la transformation et la fabrication de poudre de paprika. Dans ce type d'agriculture, le producteur produit du paprika uniquement pour l'acheteur. Le producteur ne doit pas vendre ni donner le paprika sous contrat à un tiers. Cependant, certains inconvénients incitent les agriculteurs à se tourner vers d'autres modes d'agriculture ou à cultiver d'autres cultures. Le principal inconvénient de l'agriculture contractuelle est qu'elle ne permet pas la vente parallèle de cultures à d'autres acheteurs. Cela limite la croissance de l'agriculteur ainsi que de l'industrie.

Les cultures spécialisées sont des cultures nouvelles et émergentes qui ont été cultivées commercialement dans une région particulière, et il est nécessaire de diffuser la croissance de ces cultures spécialisées. Allant des pommes de terre violettes exotiques aux cultures plus connues comme la laitue, la production de cultures spécialisées initie généralement les agriculteurs à une nouvelle façon de cultiver et offre diverses opportunités. Par conséquent, avec la disponibilité de diverses autres options de culture pour les agriculteurs, cela devrait constituer un défi majeur pour la croissance du marché de la poudre de paprika en Amérique du Nord.

Développement récent

- En février 2023, Botanic Healthcare a obtenu la certification NSF/ANSI 173, Section 8 de la National Sanitation Foundation (NSF) des États-Unis. Cette certification permettra de nouer de nouvelles relations commerciales ainsi que des partenariats. Elle attirera également l'attention de clients plus importants du monde entier.

Portée et taille du marché de la poudre de paprika en Amérique du Nord

Le marché nord-américain de la poudre de paprika est classé en produits, nature, application et canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Produit

- Poudre de paprika ordinaire

- Poudre de paprika doux

- Poudre de paprika fumé

Sur la base du produit, le marché est segmenté en poudre de paprika ordinaire, poudre de paprika doux et poudre de paprika fumé.

Nature

- Conventionnel

- Organique

Sur la base de la nature, le marché est segmenté en conventionnel et biologique.

Application

- Nourriture

- Autres

En fonction des applications, le marché est segmenté en produits alimentaires et autres.

Canal de distribution

- Direct

- Indirect

Sur la base du canal de distribution, le marché est segmenté en direct et indirect.

Analyse régionale/au niveau des pays du marché de la poudre de paprika en Amérique du Nord

Le marché nord-américain de la poudre de paprika est analysé et des informations sur la taille du marché sont fournies par pays, produit, nature, application et canal de distribution comme référencé ci-dessus.

Les pays couverts par le marché de la poudre de paprika en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Les États-Unis devraient dominer le marché nord-américain de la poudre de paprika, car la poudre de paprika en fait un choix privilégié pour une application dans diverses autres industries en dehors de l'industrie alimentaire, telles que les cosmétiques et les soins de la peau, les produits pharmaceutiques et les soins de la santé, et autres.

La section pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie du pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des joints et des joints d'étanchéité

Le paysage concurrentiel du marché de la poudre de paprika en Amérique du Nord fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais cliniques, l'analyse de la marque, les approbations de produits, les brevets, la largeur et l'ampleur du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise par rapport au marché de la poudre de paprika en Amérique du Nord.

Les principaux acteurs couverts dans le rapport sur le marché de la poudre de paprika en Amérique du Nord sont EVESA, Le Comptoir Colonial, Botanic Healthcare, Santa Maria UK Ltd, Foodchem International Corporation, Qingdao Taifoong Foods Co., Ltd et Sri Ruthra Exports, entre autres.

Les analystes DBMR comprennent les atouts concurrentiels et fournissent une analyse concurrentielle pour chaque concurrent séparément.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA PAPRIKA POWDER MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 THREAT OF SUBSTITUTE PRODUCTS

4.1.3 BARGAINING POWER OF BUYERS/CONSUMERS

4.1.4 BARGAINING POWER OF SUPPLIERS

4.1.5 INTENSITY OF COMPETITIVE RIVALRY

4.2 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

4.3 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.4 IMPACT OF ECONOMIC SLOWDOWN

4.4.1 IMPACT ON PRICE

4.4.2 IMPACT ON SUPPLY CHAIN

4.4.3 IMPACT ON SHIPMENT

4.4.4 IMPACT ON COMPANY'S STRATEGIC DECISIONS

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVES

4.6 OVERVIEW ON TECHNOLOGICAL INNOVATIONS

4.7 PAPRIKA POWDER SUBSTITUTE AND RISK ASSOCIATED OF BEING SUBSTITUTED FOR PAPRIKA POWDER

4.8 PRICING ANALYSIS

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.1 VALUE CHAIN ANALYSIS

4.11 REGULATORY FRAMEWORK AND GUIDLINES

4.11.1 REGULATORY FRAMEWORK AND GUIDELINES

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 STRONG MARKET REACH AS A SEASONING IN VARIOUS DISHES ACROSS THE GLOBE

5.1.2 RISING IMPORTANCE OF PAPRIKA AS A FUNCTIONAL INGREDIENT IN VARIOUS APPLICATIONS OTHER THAN FOOD

5.1.3 POSITIVE OUTLOOK TOWARDS FOODSERVICE SECTOR IN EMERGING ECONOMIES

5.2 RESTRAINTS

5.2.1 SUBSTITUTIONAL THREAT FROM OTHER SEASONINGS

5.2.2 ADVERSE EFFECTS OF PAPRIKA POWDER ON SENSITIVE SKIN

5.3 OPPORTUNITIES

5.3.1 SUPPORTIVE GOVERNMENT SCHEMES TO FELICITATE FARMERS IN CROP CULTIVATION

5.3.2 RISING SPENDING TOWARD INCORPORATING NATURAL INGREDIENTS WHILE PROCESSING PAPRIKA POWDER

5.4 CHALLENGES

5.4.1 CULTIVATION OF OTHER PROFITABLE CROP ALTERNATIVES

5.4.2 FOOD SAFETY AND QUALITY ISSUES

5.4.3 VOLATILITY IN RAW MATERIAL AND LACK OF RELIABLE SUPPLY OF PAPRIKA

6 NORTH AMERICA PAPRIKA POWDER MARKET, BY REGION

6.1 NORTH AMERICA

6.1.1 U.S.

6.1.2 CANADA

6.1.3 MEXICO

7 NORTH AMERICA PAPRIKA POWDER MARKET: COMPANY LANDSCAPE

7.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

7.2 CERTIFICATION

7.3 FACILITY EXPANSION

8 SWOT ANALYSIS

9 COMPANY PROFILES

9.1 BOTANIC HEALTHCARE

9.1.1 COMPANY SNAPSHOT

9.1.2 COMPANY SHARE ANALYSIS

9.1.3 PRODUCT PORTFOLIO

9.1.4 RECENT DEVELOPMENTS

9.2 EVESA

9.2.1 COMPANY SNAPSHOT

9.2.2 COMPANY SHARE ANALYSIS

9.2.3 PRODUCT PORTFOLIO

9.2.4 RECENT DEVELOPMENTS

9.3 SRI RUTHRA EXPORTS

9.3.1 COMPANY SNAPSHOT

9.3.2 COMPANY SHARE ANALYSIS

9.3.3 PRODUCT PORTFOLIO

9.3.4 RECENT DEVELOPMENTS

9.4 LE COMPTOIR COLONIAL

9.4.1 COMPANY SNAPSHOT

9.4.2 COMPANY SHARE ANALYSIS

9.4.3 PRODUCT PORTFOLIO

9.4.4 RECENT DEVELOPMENTS

9.5 QINGDAO TAIFOONG FOODS CO., LTD.

9.5.1 COMPANY SNAPSHOT

9.5.2 COMPANY SHARE ANALYSIS

9.5.3 PRODUCT PORTFOLIO

9.5.4 RECENT DEVELOPMENTS

9.6 BRITISH AQUA FEEDS

9.6.1 COMPANY SNAPSHOT

9.6.2 PRODUCT PORTFOLIO

9.6.3 RECENT DEVELOPMENTS

9.7 FOODCHEM INTERNATIONAL CORPORATION

9.7.1 COMPANY SNAPSHOT

9.7.2 PRODUCT PORTFOLIO

9.7.3 RECENT DEVELOPMENTS

9.8 LAXCORN

9.8.1 COMPANY SNAPSHOT

9.8.2 PRODUCT PORTFOLIO

9.8.3 RECENT DEVELOPMENTS

9.9 LÓPEZ MATENCIO S.A.

9.9.1 COMPANY SNAPSHOT

9.9.2 PRODUCT PORTFOLIO

9.9.3 RECENT DEVELOPMENTS

9.1 LIZAZ FOOD PROCESSING INDUSTRIES

9.10.1 COMPANY SNAPSHOT

9.10.2 PRODUCT PORTFOLIO

9.10.3 RECENT DEVELOPMENTS

9.11 NATURAL SPICES

9.11.1 COMPANY SNAPSHOT

9.11.2 PRODUCT PORTFOLIO

9.11.3 RECENT DEVELOPMENTS

9.12 NATURESMITH FOODS LLP

9.12.1 COMPANY SNAPSHOT

9.12.2 PRODUCT PORTFOLIO

9.12.3 RECENT DEVELOPMENTS

9.13 QINGDAO FUMANXIN FOODS CO., LTD.

9.13.1 COMPANY SNAPSHOT

9.13.2 PRODUCT PORTFOLIO

9.13.3 RECENT DEVELOPMENTS

9.14 QINGDAO MEIRUYUAN FOODS CO., LTD.

9.14.1 COMPANY SNAPSHOT

9.14.2 PRODUCT PORTFOLIO

9.14.3 RECENT DEVELOPMENTS

9.15 RUBIN PAPRIKA PROCESSING LTD

9.15.1 COMPANY SNAPSHOT

9.15.2 PRODUCT PORTFOLIO

9.15.3 RECENT DEVELOPMENTS

9.16 SANTA MARIA UK LTD

9.16.1 COMPANY SNAPSHOT

9.16.2 PRODUCT PORTFOLIO

9.16.3 RECENT DEVELOPMENTS

9.17 SINOPAPRIKA CO., LTD

9.17.1 COMPANY SNAPSHOT

9.17.2 PRODUCT PORTFOLIO

9.17.3 RECENT DEVELOPMENTS

9.18 SILVERLINE CHEMICALS

9.18.1 COMPANY SNAPSHOT

9.18.2 PRODUCT PORTFOLIO

9.18.3 RECENT DEVELOPMENTS

9.19 SUNRISE SPICES EXPORTERS

9.19.1 COMPANY SNAPSHOT

9.19.2 PRODUCT PORTFOLIO

9.19.3 RECENT DEVELOPMENTS

9.2 WESTMILL FOODS

9.20.1 COMPANY SNAPSHOT

9.20.2 PRODUCT PORTFOLIO

9.20.3 RECENT DEVELOPMENTS

10 QUESTIONNAIRE

11 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF FRUITS OF THE GENUS CAPSICUM OR OF THE GENUS PIMENTA, CRUSHED OR GROUND; HS CODE – 090422 (USD THOUSAND)

TABLE 2 EXPORT DATA OF FRUITS OF THE GENUS CAPSICUM OR OF THE GENUS PIMENTA, CRUSHED OR GROUND; HS CODE – 090422 (USD THOUSAND)

TABLE 3 NORTH AMERICA PAPRIKA POWDER MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA PAPRIKA POWDER MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 5 NORTH AMERICA PAPRIKA POWDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA PAPRIKA POWDER MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 7 NORTH AMERICA REGULAR PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA REGULAR PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (TONS)

TABLE 9 NORTH AMERICA SWEET PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA SWEET PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (TONS)

TABLE 11 NORTH AMERICA SMOKED PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA SMOKED PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (TONS)

TABLE 13 NORTH AMERICA PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (TONS)

TABLE 15 NORTH AMERICA PAPRIKA POWDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA PAPRIKA POWDER MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 17 NORTH AMERICA FOOD IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA FOOD IN PAPRIKA POWDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA MEAT PRODUCTS IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA FISH PRODUCTS IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA SAVOURY BAKERY IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA SNACKS IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA CONVENIENCE FOODS IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA PAPRIKA POWDER MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA PAPRIKA POWDER MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (TONS)

TABLE 26 U.S. PAPRIKA POWDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 27 U.S. PAPRIKA POWDER MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 28 U.S. REGULAR PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 29 U.S. REGULAR PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (TONS)

TABLE 30 U.S. SWEET PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 31 U.S. SWEET PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (TONS)

TABLE 32 U.S. SMOKED PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 33 U.S. SMOKED PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (TONS)

TABLE 34 U.S. PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 35 U.S. PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (TONS)

TABLE 36 U.S. PAPRIKA POWDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 37 U.S. PAPRIKA POWDER MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 38 U.S. FOOD IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 U.S. FOOD IN PAPRIKA POWDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 40 U.S. MEAT PRODUCTS IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 41 U.S. FISH PRODUCTS IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 U.S. SAVOURY BAKERY IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 U.S. SNACKS IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 44 U.S. CONVENIENCE FOODS IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 U.S. PAPRIKA POWDER MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 46 U.S. PAPRIKA POWDER MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (TONS)

TABLE 47 CANADA PAPRIKA POWDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 48 CANADA PAPRIKA POWDER MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 49 CANADA REGULAR PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 50 CANADA REGULAR PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (TONS)

TABLE 51 CANADA SWEET PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 52 CANADA SWEET PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (TONS)

TABLE 53 CANADA SMOKED PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 54 CANADA SMOKED PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (TONS)

TABLE 55 CANADA PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 56 CANADA PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (TONS)

TABLE 57 CANADA PAPRIKA POWDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 58 CANADA PAPRIKA POWDER MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 59 CANADA FOOD IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 60 CANADA FOOD IN PAPRIKA POWDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 61 CANADA MEAT PRODUCTS IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 62 CANADA FISH PRODUCTS IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 CANADA SAVOURY BAKERY IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 CANADA SNACKS IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 CANADA CONVENIENCE FOODS IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 CANADA PAPRIKA POWDER MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 67 CANADA PAPRIKA POWDER MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (TONS)

TABLE 68 MEXICO PAPRIKA POWDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 69 MEXICO PAPRIKA POWDER MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 70 MEXICO REGULAR PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 71 MEXICO REGULAR PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (TONS)

TABLE 72 MEXICO SWEET PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 73 MEXICO SWEET PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (TONS)

TABLE 74 MEXICO SMOKED PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 75 MEXICO SMOKED PAPRIKA POWDER IN PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (TONS)

TABLE 76 MEXICO PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 77 MEXICO PAPRIKA POWDER MARKET, BY NATURE, 2021-2030 (TONS)

TABLE 78 MEXICO PAPRIKA POWDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 79 MEXICO PAPRIKA POWDER MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 80 MEXICO FOOD IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 81 MEXICO FOOD IN PAPRIKA POWDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 82 MEXICO MEAT PRODUCTS IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 MEXICO FISH PRODUCTS IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 84 MEXICO SAVOURY BAKERY IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 85 MEXICO SNACKS IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 MEXICO CONVENIENCE FOODS IN PAPRIKA POWDER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 87 MEXICO PAPRIKA POWDER MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 88 MEXICO PAPRIKA POWDER MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (TONS)

Liste des figures

FIGURE 1 NORTH AMERICA PAPRIKA POWDER MARKET

FIGURE 2 NORTH AMERICA PAPRIKA POWDER MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PAPRIKA POWDER MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PAPRIKA POWDER MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PAPRIKA POWDER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PAPRIKA POWDER MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 NORTH AMERICA PAPRIKA POWDER MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA PAPRIKA POWDER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA PAPRIKA POWDER MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA PAPRIKA POWDER MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA PAPRIKA POWDER MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA PAPRIKA POWDER MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA PAPRIKA POWDER MARKET: SEGMENTATION

FIGURE 14 STRONG MARKET REACH AS A SEASONING IN VARIOUS DISHES ACROSS THE GLOBE IS EXPECTED TO DRIVE THE NORTH AMERICA PAPRIKA POWDER MARKET GROWTH IN THE FORECAST PERIOD

FIGURE 15 REGULAR PAPRIKA POWDER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PAPRIKA POWDER MARKET IN 2023 & 2030

FIGURE 16 PRICE ANALYSIS FOR NORTH AMERICA PAPRIKA POWDER (USD/TONS)

FIGURE 17 VALUE CHAIN OF THE NORTH AMERICA PAPRIKA POWDER MARKET

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE NORTH AMERICA PAPRIKA POWDER MARKET

FIGURE 19 NORTH AMERICA PAPRIKA POWDER MARKET: SNAPSHOT (2022)

FIGURE 20 NORTH AMERICA PAPRIKA POWDER MARKET: BY COUNTRY (2022)

FIGURE 21 NORTH AMERICA PAPRIKA POWDER MARKET: BY COUNTRY (2023 & 2030)

FIGURE 22 NORTH AMERICA PAPRIKA POWDER MARKET: BY COUNTRY (2022 & 2030)

FIGURE 23 NORTH AMERICA PAPRIKA POWDER MARKET: BY PRODUCT (2023-2030)

FIGURE 24 NORTH AMERICA PAPRIKA POWDER MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.