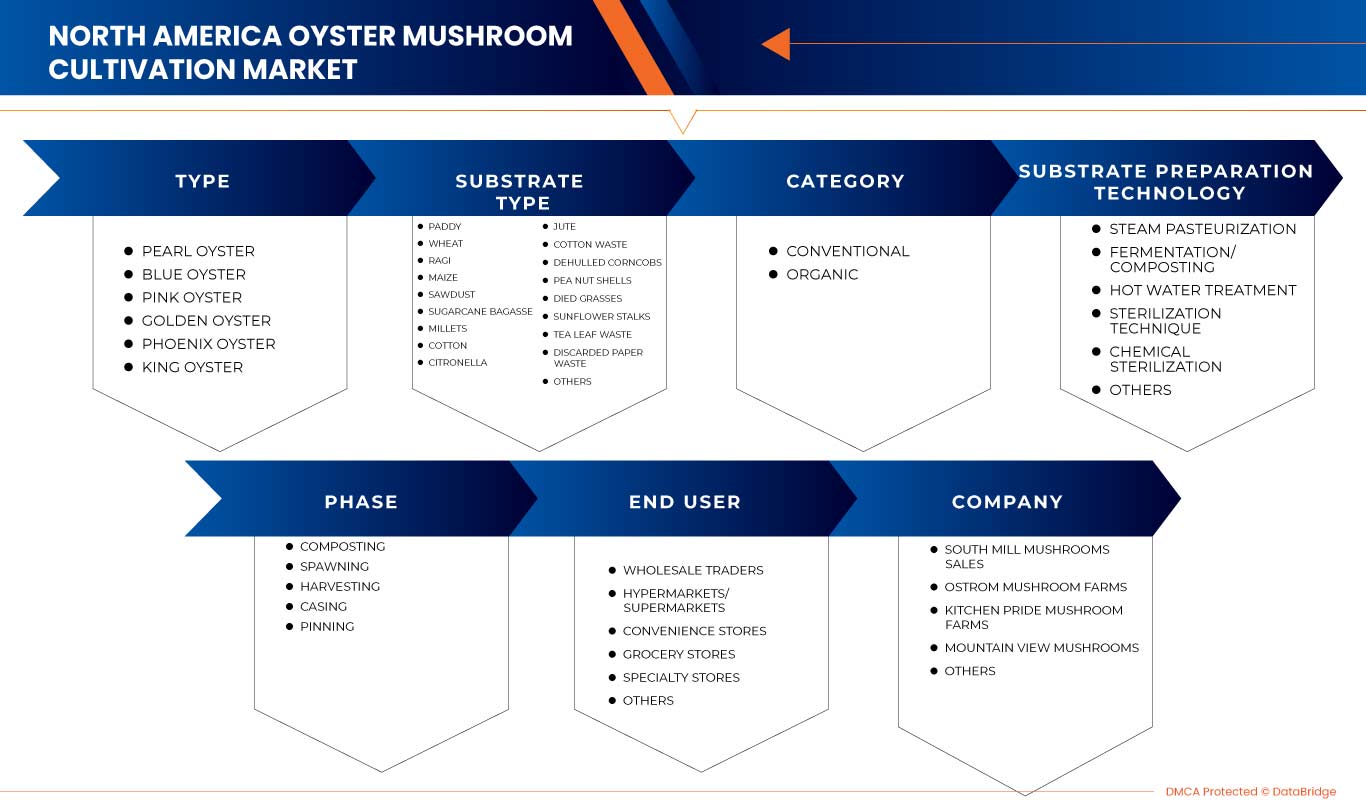

Marché de la culture des pleurotes en Amérique du Nord, par type (huître perlière, huître bleue, huître Phoenix, huître dorée, huître rose et huître royale), type de substrat (riz, blé, ragi, maïs, sciure, bagasse de canne à sucre, millets, coton, citronnelle, jute, déchets de coton, épis de maïs décortiqués, coquilles de pois, herbes mortes, tiges de tournesol, déchets de feuilles de thé, déchets de papier mis au rebut et autres), technologie de préparation du substrat (pasteurisation à la vapeur, traitement à l'eau chaude, technique de stérilisation, fermentation/compostage, stérilisation chimique et autres), phase (compostage, frai, boîtier, épinglage et récolte), catégorie (biologique et conventionnel), utilisateur final (grossistes, dépanneurs, hypermarchés/supermarchés, épiceries, magasins spécialisés et autres), tendances de l'industrie et prévisions jusqu'en 2030.

Analyse et perspectives du marché de la culture des pleurotes en Amérique du Nord

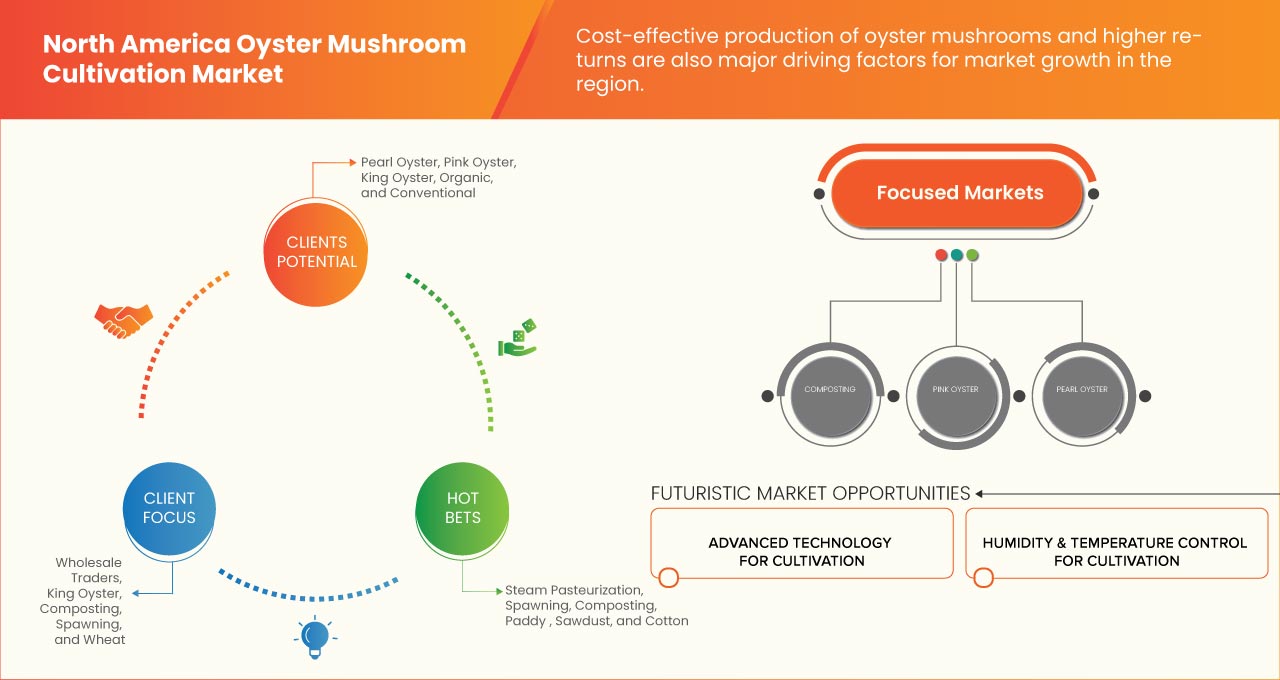

Le marché nord-américain de la culture des pleurotes connaît une croissance plus rapide en raison des nombreux bienfaits pour la santé de la consommation de champignons et de la préférence des consommateurs pour les produits végétaliens et à base de plantes pour répondre à leurs besoins en protéines et en nutriments. Le nombre croissant de personnes qui modifient leurs habitudes alimentaires et adoptent un régime végétalien et riche en protéines est un élément majeur de la croissance de l'industrie des champignons. Cependant, le développement d'allergies chez les consommateurs peut entraver la croissance du marché.

De nombreuses entreprises prennent des décisions stratégiques, comme le lancement de nouveaux types de champignons et l'acquisition d'autres entreprises pour améliorer leur part de marché. En conséquence, le marché de la culture des champignons connaît une croissance rapide. La consommation croissante de champignons ouvrira de nouvelles opportunités de croissance du marché. En revanche, la disponibilité de produits de substitution pourrait remettre en cause la croissance du marché.

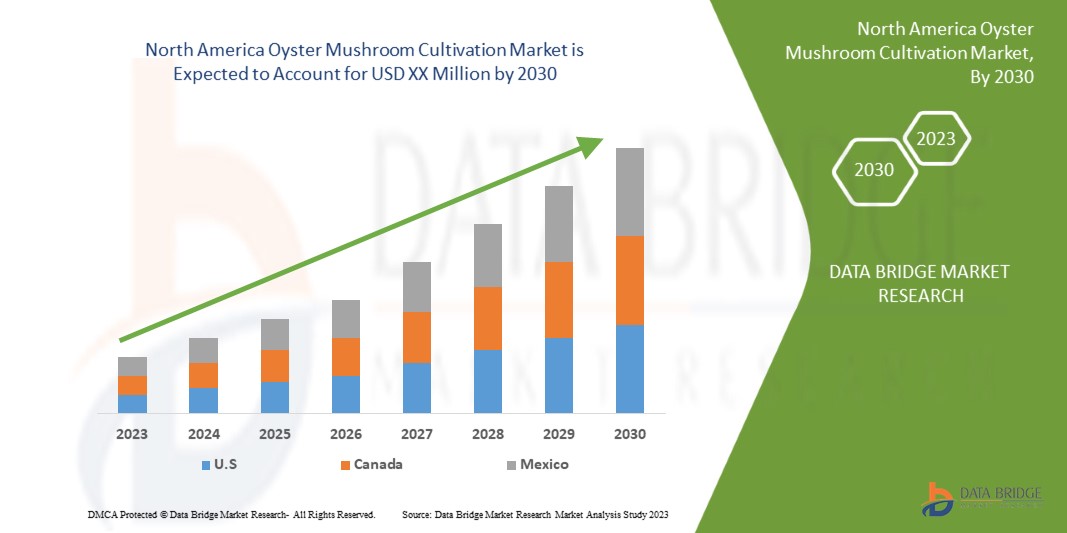

Data Bridge Market Research analyse que le marché nord-américain de la culture des pleurotes connaîtra un TCAC de 4,1 % au cours de la période de prévision de 2023 à 2030.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Année historique |

2021 (personnalisable pour 2020-2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type (huître perlière, huître bleue, huître Phoenix, huître dorée, huître rose et huître royale), type de substrat (riz, blé, ragi, maïs, sciure, bagasse de canne à sucre, millet, coton, citronnelle, jute, déchets de coton, épis de maïs décortiqués, coquilles de pois, herbes fanées, tiges de tournesol, déchets de feuilles de thé, déchets de papier mis au rebut et autres), technologie de préparation du substrat (pasteurisation à la vapeur, traitement à l'eau chaude, technique de stérilisation, fermentation/compostage, stérilisation chimique et autres), phase (compostage, frai, gobetage, épinglage et récolte), catégorie (biologique et conventionnel), utilisateur final (grossistes, dépanneurs, hypermarchés/supermarchés, épiceries, magasins spécialisés et autres). |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

Ventes de champignons South Mill, fermes de champignons Ostrom, fermes de champignons Kitchen Pride, champignons Mountain View, Farming Fungi, LLC, fermes de Kigali, Lambert Spawn., champignons Bluff City, champignons SKAGIT GOURMET, champignons Green Box, Sharondale LLC., champignons Ellijay, fermes de champignons Phillips, MycoTerraFarm. et Whole Earth Harvest, entre autres. |

Définition du marché

La culture des champignons est une méthode de culture de champignons qui utilise des déchets végétaux, animaux et industriels. En un mot, c'est une richesse créée grâce à la technologie des déchets. En raison de la valeur des fibres alimentaires et des protéines, cette technologie est devenue de plus en plus populaire dans le monde entier. Les champignons sont des basidiomycètes, qui sont des champignons. Ils contiennent beaucoup de protéines, de fibres, de vitamines et de minéraux. Il existe plus de 3000 types de champignons différents. Les champignons sont consommés frais, en conserve, congelés et séchés à diverses fins.

Dynamique du marché de la culture des pleurotes en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

CONDUCTEURS

-

Multifonctionnalité du pleurote

Les pleurotes contiennent beaucoup de protéines, de vitamine D , d'antioxydants et de fibres. Ils ont une faible valeur calorique et une teneur élevée en fibres. Ils peuvent également réduire le risque de développer de graves problèmes de santé tels que la maladie d'Alzheimer, les maladies cardiaques, le cancer et le diabète. Les consommateurs d'aujourd'hui préfèrent les aliments à la fois sains et faciles à consommer. À cet égard, les pleurotes apportent beaucoup de nutriments à la personne qui les consomme et peuvent être utilisés de diverses manières et recettes. Ils sont très demandés en raison de leurs diverses propriétés nutritionnelles et minérales.

En conséquence, la teneur élevée en protéines, vitamines et autres éléments nutritifs des pleurotes attire un grand nombre de consommateurs. Le marché nord-américain de la culture des pleurotes devrait croître à mesure que les gens prennent conscience de l'importance de manger des aliments sains.

-

Évolution des tendances en matière d'alimentation à base de plantes et végétalienne

La prise de conscience croissante des consommateurs quant à la consommation d'aliments à base de plantes et végétaliens s'avère être un facteur moteur important de la croissance du marché. Les produits à base de plantes, sans OGM et clean label se sont avérés sains. Les clients soucieux de leur santé qui se tournent vers des produits alimentaires durables augmentent la demande d'aliments biologiques et à base de plantes. Avec cette tendance, les fabricants produisent ces produits en vrac pour générer des revenus plus élevés. Avec cette tendance croissante à la consommation d'aliments biologiques, le marché devrait croître.

En conséquence, les tendances alimentaires à base de plantes et végétaliennes augmentent considérablement la demande de pleurotes. En raison de la forte demande pour ces produits parmi les consommateurs, le marché devrait connaître une expansion significative.

RETENUE

-

Durée de conservation limitée des pleurotes

Les champignons sont très périssables par nature, se détériorant dans la journée suivant leur récolte en raison de leur rythme respiratoire élevé et de la structure épidermique délicate. Leur courte durée de conservation peut être attribuée au rythme respiratoire élevé des champignons frais ainsi qu'à l'absence de cuticules pour les protéger des changements physiques ou microbiens ou de la déshydratation. Par conséquent, les champignons fraîchement récoltés ont une durée de conservation limitée.

Les champignons ont une durée de conservation plus courte que la plupart des légumes prêts à consommer en raison de leur rythme de respiration rapide et de l'absence de barrière pour les protéger de la perte d'eau ou des attaques microbiennes. Le brunissement enzymatique se produit lorsque l'enzyme tyrosinase entre en contact avec son substrat et déclenche une chaîne de réactions qui donne naissance à des pigments de mélanine bruns. Cela réduit la valeur marchande du produit. Il est sujet aux attaques microbiennes. Ce facteur de risque dans la culture des pleurotes peut entraver la croissance du marché.

OPPORTUNITÉ

-

Demande croissante d'aliments à faible teneur en calories et à haute teneur en protéines

De nos jours, les régimes hypocaloriques et riches en protéines sont très demandés, en particulier en raison de l’augmentation du nombre de personnes qui cherchent à perdre du poids et à gagner en masse musculaire. Les protéines sont un macronutriment essentiel qui favorise la croissance musculaire et la récupération, et qui permet de rester rassasié, alors évitez les excès alimentaires. Cependant, tous les aliments n’apportent pas au corps la même quantité de protéines. Contrairement à ce que tout le monde pourrait croire, tout le monde n’a pas besoin des mêmes quantités de protéines. Pour ceux qui essaient de perdre du poids, de développer leur masse musculaire maigre pour soutenir leurs talents athlétiques ou d’augmenter leur endurance dans le sport, un régime riche en protéines est nécessaire. Les pleurotes font partie de ces aliments riches en protéines et faibles en calories, c’est pourquoi ils sont souvent inclus comme ingrédients principaux dans les aliments sportifs végétaliens. Ainsi, en augmentant le nombre de lancements de nouveaux produits dans le secteur du sport et du fitness, des opportunités sont créées.

Des opportunités devraient se présenter en raison de leurs qualités de renforcement du système immunitaire et de leurs excellentes valeurs nutritionnelles et hypocaloriques dans le secteur des aliments et des boissons pour les pleurotes en Amérique du Nord.

DÉFI

- Disponibilité de produits de substitution

La disponibilité de substituts aux pleurotes tels que le tofu, le tempeh, les courgettes, les courges, les cœurs d'artichaut, les lentilles, les poireaux et autres pose un défi important à la croissance du marché. Il existe un grand nombre de produits de substitution aux pleurotes qui sont comparativement moins chers et facilement disponibles sur le marché, car le processus de culture d'autres substituts est moins compliqué et ne nécessite pas de travailleurs hautement qualifiés, ce qui posera un défi à la croissance du marché. En outre, l'exigence d'un niveau élevé de compétences en gestion pendant le processus de culture des pleurotes est un défi important car cela rend la culture difficile, ce qui a un impact direct sur les prix des pleurotes, ce qui rend difficile l'accès des petits fabricants. En conséquence, ils optent pour des produits de substitution moins chers et plus facilement disponibles tels que le tofu, le tempeh, les courgettes, les courges, les cœurs d'artichaut et autres, ce qui pose un défi important à la croissance du marché.

La disponibilité des substituts pose donc un défi important à l'expansion du marché. En conséquence, les fabricants d'aliments et de boissons, de nutraceutiques et de produits pharmaceutiques sont plus susceptibles de choisir des produits de substitution ayant une valeur nutritionnelle et des propriétés médicinales comparables. De plus, certains substituts offrent des saveurs et des nutriments comparables à un coût inférieur. Par conséquent, cela posera un défi important et entravera la croissance du marché.

Impact de la pandémie de COVID-19 sur le marché nord-américain de la culture des pleurotes

Après la pandémie, la demande de champignons a augmenté car il n'y aura plus de restrictions de mouvement. Par conséquent, l'approvisionnement en produits serait facile. La persistance de la COVID-19 pendant une période plus longue a affecté la chaîne d'approvisionnement car elle a été perturbée, et il est devenu difficile de fournir des produits alimentaires aux consommateurs, ce qui a initialement augmenté la demande de produits. Cependant, après la COVID-19, la demande de champignons a augmenté de manière significative en raison de la bonne teneur en protéines et d'autres nutriments disponibles.

Développements récents

- En avril 2020, l’article « Effet de la consommation de pleurotes (Pleurotus ostreatus) sur les paramètres cardiométaboliques – Une revue systématique des essais cliniques » mentionnait les bienfaits de la consommation de P. ostreatus sur le métabolisme des lipides et du glucose, ainsi que dans une certaine mesure sur la tension artérielle. La santé cardiométabolique des personnes pourrait en bénéficier.

Portée du marché de la culture des pleurotes en Amérique du Nord

Le marché de la culture des pleurotes en Amérique du Nord est segmenté en six segments notables en fonction du type, du type de substrat, de la technologie de préparation du substrat, de la phase, de la catégorie et de l'utilisateur final.

La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

TAPER

- Huître perlière

- Huître bleue

- Huître Phœnix

- Huître dorée

- Huître rose

- Huître royale

Based on type, the market is segmented into pearl oyster, blue oyster, phoenix oyster, golden oyster, pink oyster, and king oyster.

SUBSTRATE TYPE

- Paddy

- Wheat

- Ragi

- Maize

- Sawdust

- Sugarcane Bagasse

- Millets

- Cotton

- Citronella

- Jute

- Cotton Waste

- Dehulled Corncobs

- Pea Nut Shells

- Died Grasses

- Sunflower Stalks

- Tea Leaf Waste

- Discarded Paper Waste

- Others

Based on substrate type, the market is segmented into paddy, wheat, ragi, maize, sawdust, sugarcane bagasse, millets, cotton, citronella, jute, cotton waste, dehulled corncobs, pea nut shells, died grasses, sunflower stalks, tea leaf waste, discarded paper waste, and others.

SUBSTRATE PREPARATION TECHNOLOGY

- Steam Pasteurization

- Hot Water Treatment

- Sterilization Technique

- Fermentation/Composting

- Chemical Sterilization

- Others

Based on substrate preparation technology, the market is segmented into steam pasteurization, hot water treatment, sterilization technique, fermentation/composting, chemical sterilization, and others.

PHASE

- Composting

- Spawning

- Casing

- Pinning

- Harvesting

Based on phase, the market is segmented into Composting, Spawning, Casing, Pinning, and Harvesting.

CATEGORY

- Organic

- Conventional

Based on category, the market is segmented into organic and conventional.

END USER

- Wholesale Traders

- Convenience Stores

- Hypermarkets/Supermarkets

- Grocery Stores

- Specialty Stores

- Others

Based on end user, the market is segmented into wholesale traders, convenience stores, hypermarkets/supermarkets, grocery stores, specialty stores, and others.

North America Oyster Mushroom Cultivation Markets Regional Analysis/Insights

The North America oyster mushroom cultivation market is analyzed and market size insights and trends are provided based on type, substrate type, substrate preparation technology, phase, category, and end user as referenced above.

The country covered in the North America oyster mushroom cultivation market report is North America.

The country section of the report also provides individual market-impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of North America brands, their challenges faced due to high competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Oyster Mushroom Cultivation Market Share Analysis

Le marché concurrentiel de la culture des pleurotes en Amérique du Nord détaille les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que l'orientation des entreprises sur le marché.

Certains des principaux acteurs opérant sur le marché de la culture des pleurotes en Amérique du Nord sont South Mill Mushrooms Sales, Ostrom Mushroom Farms, Kitchen Pride Mushroom Farms, Mountain View Mushrooms, Farming Fungi, LLC, Kigali Farms, Lambert Spawn., Bluff City Fungi, SKAGIT GOURMET MUSHROOMS, Green Box Mushrooms, Sharondale LLC., Ellijay Mushrooms, Phillips Mushroom Farms, MycoTerraFarm., et Whole Earth Harvest, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 MUSHROOM STORAGE AND HANDLING

4.2 PRODUCTION ANALYSIS

4.3 PRODUCTION COST ANALYSIS

4.4 SUPPLY CHAIN OF THE NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET

4.4.1 RAW MATERIAL PROCUREMENT

4.4.2 CULTIVATION AND PROCESSING

4.4.3 MARKETING AND DISTRIBUTION

4.4.4 END USERS

4.5 UPCOMING CULTIVATION TECHNOLOGIES

4.6 VALUE CHAIN ANALYSIS: NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET

4.6.1 OVERVIEW

4.6.2 PROCUREMENT

4.6.3 MANUFACTURING

4.6.4 MARKETING & DISTRIBUTION

4.6.5 CONCLUSION

5 IMPACT OF COVID-19

5.1 ANALYSIS OF THE IMPACT OF COVID-19 ON THE NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET

5.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

5.3 PRICE IMPACT

5.4 IMPACT ON DEMAND

5.5 IMPACT ON SUPPLY CHAIN

5.6 CONCLUSION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 MULTI-FUNCTIONALITY OF OYSTER MUSHROOM

6.1.2 DEVELOPMENT IN TRENDS OF PLANT-BASED AS WELL AS VEGAN FOOD

6.1.3 COST-EFFECTIVENESS OF OYSTER MUSHROOM CULTIVATION

6.1.4 RISING THERAPEUTIC APPLICATIONS OF OYSTER MUSHROOM

6.2 RESTRAINTS

6.2.1 LIMITED SHELF LIFE OF OYSTER MUSHROOM

6.2.2 CHANCES OF ALLERGIES AMONG CONSUMERS

6.2.3 HIGH PRICES OF OYSTER MUSHROOMS IN COMPARISON TO OTHER OYSTER MUSHROOMS

6.3 OPPORTUNITIES

6.3.1 RISING DEMAND FOR LOW-CALORIE AND HIGH-PROTEIN FOOD

6.3.2 THE RISE IN THE INTRODUCTION OF THE LATEST TECHNOLOGIES

6.3.3 THE RISE IN ONLINE PLATFORMS AND DISTRIBUTION CHANNELS

6.4 CHALLENGES

6.4.1 HIGH REQUIREMENT FOR SKILLED LABOR

6.4.2 AVAILABILITY OF SUBSTITUTE PRODUCTS

7 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET, BY TYPE

7.1 OVERVIEW

7.2 PEARL OYSTER

7.3 KING OYSTER

7.4 BLUE OYSTER

7.5 GOLDEN OYSTER

7.6 PHOENIX OYSTER

7.7 PINK OYSTER

8 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE

8.1 OVERVIEW

8.2 PADDY

8.3 SAWDUST

8.4 WHEAT

8.5 COTTON

8.6 COTTON WASTE

8.7 DEHULLED CORNCOBS

8.8 RAGI

8.9 MAIZE

8.1 JUTE

8.11 MILLETS

8.12 SUGARCANE BAGASSE

8.13 TEA LEAF WASTE

8.14 SUNFLOWER STALKS

8.15 CITRONELLA

8.16 PEA NUT SHELLS

8.17 DIED GRASSES

8.18 DISCARDED PAPER WASTE

8.19 OTHERS

9 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE PREPARATION TECHNOLOGY

9.1 OVERVIEW

9.2 STEAM PASTEURIZATION

9.2.1 PADDY

9.2.2 SAWDUST

9.2.3 WHEAT

9.2.4 COTTON

9.2.5 COTTON WASTE

9.2.6 DEHULLED CORNCOBS

9.2.7 RAGI

9.2.8 MAIZE

9.2.9 JUTE

9.2.10 MILLETS

9.2.11 SUGARCANE BAGASSE

9.2.12 TEA LEAF WASTE

9.2.13 SUNFLOWER STALKS

9.2.14 CITRONELLA

9.2.15 PEA NUT SHELLS

9.2.16 DIED GRASSES

9.2.17 DISCARDED PAPER WASTE

9.2.18 OTHERS

9.3 FERMENTATION/COMPOSTING

9.3.1 PADDY

9.3.2 SAWDUST

9.3.3 WHEAT

9.3.4 COTTON

9.3.5 COTTON WASTE

9.3.6 DEHULLED CORNCOBS

9.3.7 RAGI

9.3.8 MAIZE

9.3.9 JUTE

9.3.10 MILLETS

9.3.11 SUGARCANE BAGASSE

9.3.12 TEA LEAF WASTE

9.3.13 SUNFLOWER STALKS

9.3.14 CITRONELLA

9.3.15 PEA NUT SHELLS

9.3.16 DIED GRASSES

9.3.17 DISCARDED PAPER WASTE

9.3.18 OTHERS

9.4 HOT WATER TREATMENT

9.4.1 PADDY

9.4.2 SAWDUST

9.4.3 WHEAT

9.4.4 COTTON

9.4.5 COTTON WASTE

9.4.6 DEHULLED CORNCOBS

9.4.7 RAGI

9.4.8 MAIZE

9.4.9 JUTE

9.4.10 MILLETS

9.4.11 SUGARCANE BAGASSE

9.4.12 TEA LEAF WASTE

9.4.13 SUNFLOWER STALKS

9.4.14 CITRONELLA

9.4.15 PEA NUT SHELLS

9.4.16 DIED GRASSES

9.4.17 DISCARDED PAPER WASTE

9.4.18 OTHERS

9.5 STERILIZATION TECHNIQUE

9.5.1 PADDY

9.5.2 SAWDUST

9.5.3 WHEAT

9.5.4 COTTON

9.5.5 COTTON WASTE

9.5.6 DEHULLED CORNCOBS

9.5.7 RAGI

9.5.8 MAIZE

9.5.9 JUTE

9.5.10 MILLETS

9.5.11 SUGARCANE BAGASSE

9.5.12 TEA LEAF WASTE

9.5.13 SUNFLOWER STALKS

9.5.14 CITRONELLA

9.5.15 PEA NUT SHELLS

9.5.16 DIED GRASSES

9.5.17 DISCARDED PAPER WASTE

9.5.18 OTHERS

9.6 CHEMICAL STERILIZATION

9.6.1 PADDY

9.6.2 SAWDUST

9.6.3 WHEAT

9.6.4 COTTON

9.6.5 COTTON WASTE

9.6.6 DEHULLED CORNCOBS

9.6.7 RAGI

9.6.8 MAIZE

9.6.9 JUTE

9.6.10 MILLETS

9.6.11 SUGARCANE BAGASSE

9.6.12 TEA LEAF WASTE

9.6.13 SUNFLOWER STALKS

9.6.14 CITRONELLA

9.6.15 PEA NUT SHELLS

9.6.16 DIED GRASSES

9.6.17 DISCARDED PAPER WASTE

9.6.18 OTHERS

9.7 OTHERS

10 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET, BY PHASE

10.1 OVERVIEW

10.2 COMPOSTING

10.3 SPAWNING

10.4 HARVESTING

10.5 CASING

10.6 PINNING

11 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET, BY CATEGORY

11.1 OVERVIEW

11.2 CONVENTIONAL

11.3 ORGANIC

12 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET, BY END USER

12.1 OVERVIEW

12.2 WHOLESALE TRADERS

12.3 CONVENIENCE STORES

12.4 HYPERMARKETS/SUPERMARKETS

12.5 GROCERY STORES

12.6 SPECIALITY STORES

12.7 OTHERS

13 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET, BY COUNTRY

13.1 OVERVIEW

13.2 U.S.

13.2.1 SOUTHEAST U.S.

13.2.2 REST OF U.S.

13.3 CANADA

13.4 MEXICO

14 SWOT

15 COMPANY LANDSCAPE: NORTH AMERICA OUSTER MUSHROOM CULTIVATION MARKET

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 COMPANY PROFILES

16.1 SOUTH MILL MUSHROOMS SALES

16.1.1 COMPANY SNAPSHOT

16.1.2 PRODUCT PORTFOLIO

16.1.3 RECENT UPDATE

16.2 OSTROM MUSHROOM FARMS

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 RECENT UPDATE

16.3 KITCHEN PRIDE MUSHROOM FARMS

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 RECENT UPDATE

16.4 MOUNTAIN VIEW MUSHROOMS

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT UPDATES

16.5 FARMING FUNGI, LLC

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT UPDATES

16.6 BLUFF CITY FUNGI

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT UPDATE

16.7 ELLIJAY MUSHROOMS

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT UPDATE

16.8 GREEN BOX MUSHROOMS

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT UPDATES

16.9 KIGALI FARMS

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT UPDATE

16.1 LAMBERT SPAWN

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT UPDATE

16.11 MYCOTERRAFARM.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT UPDATE

16.12 PHILLIPS MUSHROOM FARMS

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT UPDATE

16.13 SHARONDALE LLC.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT UPDATE

16.14 SKAGIT GOURMET MUSHROOMS

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT UPDATES

16.15 WHOLE EARTH HARVEST

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT UPDATE

17 QUESTIONNAIRE:

18 RELATED REPORTS

Liste des tableaux

TABLE 1 PRICE OF VARIOUS SHIITAKE OYSTER MUSHROOM PRODUCTS

TABLE 2 PRICE OF VARIOUS OTHER OYSTER MUSHROOM PRODUCTS

TABLE 1 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 3 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET, BY TYPE, 2021-2030 (ASP PRICE PER TON)

TABLE 4 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE PREPARATION TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA STEAM PASTEURIZATION IN OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA FERMENTATION/COMPOSTING IN OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA HOT WATER TREATMENT IN OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA STERILIZATION TECHNIQUE IN OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA CHEMICAL STERILIZATION IN OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET, BY PHASE, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 16 U.S. OYSTER MUSHROOM CULTIVATION MARKET, BY STATE, 2021-2030 (USD MILLION)

TABLE 17 U.S. OYSTER MUSHROOM CULTIVATION MARKET, BY STATE, 2021-2030 (TONS)

TABLE 18 U.S. OYSTER MUSHROOM CULTIVATION MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 U.S. OYSTER MUSHROOM CULTIVATION MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 20 U.S. OYSTER MUSHROOM CULTIVATION MARKET, BY TYPE, 2021-2030 (ASP PRICE PER TON)

TABLE 21 U.S. OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 22 U.S. OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE PREPARATION TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 23 U.S. STEAM PASTEURIZATION IN OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 24 U.S. FERMENTATION/COMPOSTING IN OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 25 U.S. HOT WATER TREATMENT IN OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 26 U.S. STERILIZATION TECHNIQUE IN OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 27 U.S. CHEMICAL STERILIZATION IN OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 28 U.S. OYSTER MUSHROOM CULTIVATION MARKET, BY PHASE, 2021-2030 (USD MILLION)

TABLE 29 U.S. OYSTER MUSHROOM CULTIVATION MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 30 U.S. OYSTER MUSHROOM CULTIVATION MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 31 SOUTHEAST U.S. OYSTER MUSHROOM CULTIVATION MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 SOUTHEAST U.S. OYSTER MUSHROOM CULTIVATION MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 33 SOUTHEAST U.S. OYSTER MUSHROOM CULTIVATION MARKET, BY TYPE, 2021-2030 (ASP PRICE PER TON)

TABLE 34 SOUTHEAST U.S. OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 35 SOUTHEAST U.S. OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE PREPARATION TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 36 SOUTHEAST U.S. STEAM PASTEURIZATION IN OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 37 SOUTHEAST U.S. FERMENTATION/COMPOSTING IN OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 38 SOUTHEAST U.S. HOT WATER TREATMENT IN OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 39 SOUTHEAST U.S. STERILIZATION TECHNIQUE IN OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 40 SOUTHEAST U.S. CHEMICAL STERILIZATION IN OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 41 SOUTHEAST U.S. OYSTER MUSHROOM CULTIVATION MARKET, BY PHASE, 2021-2030 (USD MILLION)

TABLE 42 SOUTHEAST U.S. OYSTER MUSHROOM CULTIVATION MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 43 SOUTHEAST U.S. OYSTER MUSHROOM CULTIVATION MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 44 REST OF U.S. OYSTER MUSHROOM CULTIVATION MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 REST OF U.S. OYSTER MUSHROOM CULTIVATION MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 46 REST OF U.S. OYSTER MUSHROOM CULTIVATION MARKET, BY TYPE, 2021-2030 (ASP PRICE PER TON)

TABLE 47 REST OF U.S. OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 48 REST OF U.S. OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE PREPARATION TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 49 REST OF U.S. STEAM PASTEURIZATION IN OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 50 REST OF U.S. FERMENTATION/COMPOSTING IN OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 51 REST OF U.S. HOT WATER TREATMENT IN OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 52 REST OF U.S. STERILIZATION TECHNIQUE IN OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 53 REST OF U.S. CHEMICAL STERILIZATION IN OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 54 REST OF U.S. OYSTER MUSHROOM CULTIVATION MARKET, BY PHASE, 2021-2030 (USD MILLION)

TABLE 55 REST OF U.S. OYSTER MUSHROOM CULTIVATION MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 56 REST OF U.S. OYSTER MUSHROOM CULTIVATION MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 57 CANADA OYSTER MUSHROOM CULTIVATION MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 CANADA OYSTER MUSHROOM CULTIVATION MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 59 CANADA OYSTER MUSHROOM CULTIVATION MARKET, BY TYPE, 2021-2030 (ASP PRICE PER TON)

TABLE 60 CANADA OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 61 CANADA OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE PREPARATION TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 62 CANADA STEAM PASTEURIZATION IN OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 63 CANADA FERMENTATION/COMPOSTING IN OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 64 CANADA HOT WATER TREATMENT IN OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 65 CANADA STERILIZATION TECHNIQUE IN OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 66 CANADA CHEMICAL STERILIZATION IN OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 67 CANADA OYSTER MUSHROOM CULTIVATION MARKET, BY PHASE, 2021-2030 (USD MILLION)

TABLE 68 CANADA OYSTER MUSHROOM CULTIVATION MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 69 CANADA OYSTER MUSHROOM CULTIVATION MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 70 MEXICO OYSTER MUSHROOM CULTIVATION MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 MEXICO OYSTER MUSHROOM CULTIVATION MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 72 MEXICO OYSTER MUSHROOM CULTIVATION MARKET, BY TYPE, 2021-2030 (ASP PRICE PER TON)

TABLE 73 MEXICO OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 74 MEXICO OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE PREPARATION TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 75 MEXICO STEAM PASTEURIZATION IN OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 76 MEXICO FERMENTATION/COMPOSTING IN OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 77 MEXICO HOT WATER TREATMENT IN OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 78 MEXICO STERILIZATION TECHNIQUE IN OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 79 MEXICO CHEMICAL STERILIZATION IN OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2021-2030 (USD MILLION)

TABLE 80 MEXICO OYSTER MUSHROOM CULTIVATION MARKET, BY PHASE, 2021-2030 (USD MILLION)

TABLE 81 MEXICO OYSTER MUSHROOM CULTIVATION MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 82 MEXICO OYSTER MUSHROOM CULTIVATION MARKET, BY END USER, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET: SEGMENTATION

FIGURE 9 INCREASED AWARENESS ABOUT THE MULTI-FUNCTIONALITY OF OYSTER MUSHROOMS IS EXPECTED TO DRIVE THE NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET IN THE FORECAST PERIOD

FIGURE 10 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET IN 2023 AND 2030

FIGURE 11 SUPPLY CHAIN OF THE NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET

FIGURE 12 VALUE CHAIN ANALYSIS OF THE NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET

FIGURE 14 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET, BY TYPE, 2022

FIGURE 15 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE TYPE, 2022

FIGURE 16 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET, BY SUBSTRATE PREPARATION TECHNOLOGY, 2022

FIGURE 17 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET, BY PHASE, 2022

FIGURE 18 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET, BY CATEGORY, 2022

FIGURE 19 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET, BY END USER, 2022

FIGURE 20 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET: SNAPSHOT (2022)

FIGURE 21 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET: BY COUNTRY (2022)

FIGURE 22 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET: BY COUNTRY (2023 & 2030)

FIGURE 23 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET: BY COUNTRY (2022 & 2030)

FIGURE 24 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET: BY TYPE (2023-2030)

FIGURE 25 NORTH AMERICA OYSTER MUSHROOM CULTIVATION MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.