North America Orthopedic Implants Including Dental Implants Market

Taille du marché en milliards USD

TCAC :

%

USD

23.52 Billion

USD

66.62 Billion

2024

2032

USD

23.52 Billion

USD

66.62 Billion

2024

2032

| 2025 –2032 | |

| USD 23.52 Billion | |

| USD 66.62 Billion | |

|

|

|

|

Segmentation du marché des implants orthopédiques (y compris dentaires) en Amérique du Nord, par type de produit (remplacements articulaires reconstructifs, implants rachidiens, dispositifs de préservation de la mobilité/dispositifs sans fusion, implants dentaires, implants traumatiques, produits orthobiologiques et autres), biomatériaux (biomatériaux métalliques, biomatériaux céramiques , biomatériaux polymères, biomatériaux naturels et autres), procédures (chirurgie ouverte, chirurgie mini-invasive (CMI) et autres), type de fixation (implants orthopédiques cimentés, implants orthopédiques sans ciment et implants orthopédiques hybrides), utilisateur final (hôpitaux, cliniques, centres de chirurgie ambulatoire, établissements de soins à domicile, instituts universitaires et de recherche et autres), canal de distribution (appel d'offres direct, vente au détail et autres) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des implants orthopédiques en Amérique du Nord (y compris les implants dentaires)

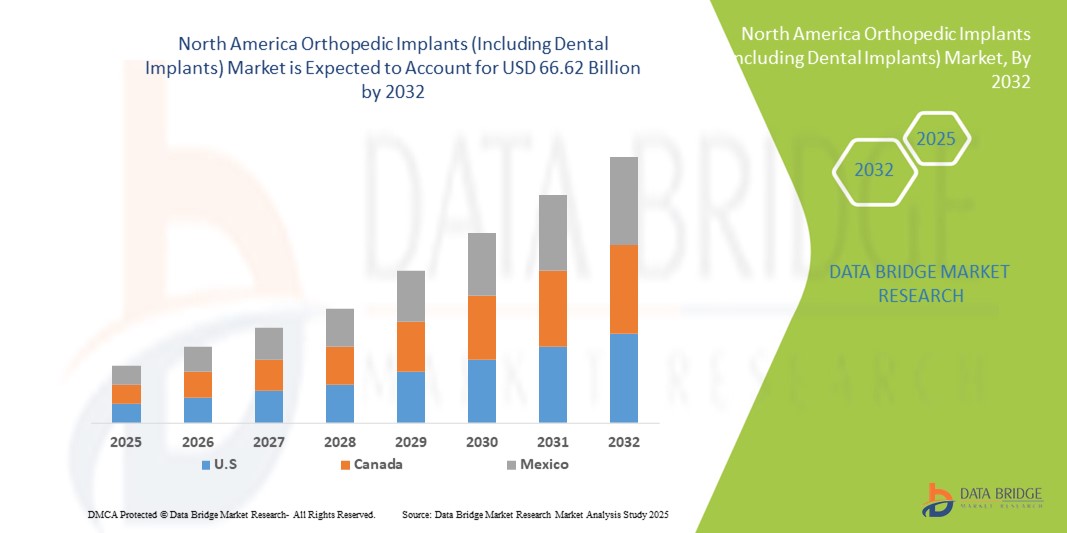

- La taille du marché des implants orthopédiques en Amérique du Nord (y compris les implants dentaires) était évaluée à 23,52 milliards USD en 2024 et devrait atteindre 66,62 milliards USD d'ici 2032 , à un TCAC de 13,90 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la prévalence croissante des troubles musculo-squelettiques, le vieillissement de la population et l'augmentation des incidences de traumatismes et de maladies dégénératives des articulations, ce qui stimule la demande d'implants orthopédiques.

- De plus, les progrès réalisés dans les matériaux implantaires, les techniques chirurgicales mini-invasives et les solutions implantaires personnalisées améliorent les résultats des patients et les temps de récupération, stimulant ainsi l'adoption de solutions d'implants orthopédiques (y compris les implants dentaires) et contribuant de manière significative à la croissance du secteur.

Analyse du marché des implants orthopédiques (y compris les implants dentaires) en Amérique du Nord

- L'implantation orthopédique (y compris dentaire) est de plus en plus stimulée par la prévalence croissante des troubles musculo-squelettiques, le vieillissement de la population et l'adoption croissante de procédures chirurgicales avancées en orthopédie et en dentisterie. Ces facteurs favorisent l'essor des interventions implantaires et favorisent l'adoption d'implants technologiquement avancés, dotés d'une biocompatibilité et d'une fonctionnalité améliorées.

- Le besoin croissant de chirurgies mini-invasives, conjugué aux avancées technologiques en matière d'implants et de biomatériaux, stimule encore davantage le marché. La sensibilisation croissante aux résultats postopératoires et à l'amélioration de la récupération des patients a incité les hôpitaux et les cliniques spécialisées à adopter des implants orthopédiques et dentaires de haute qualité.

- Les États-Unis dominent le marché des implants orthopédiques (implants dentaires compris) avec une part de chiffre d'affaires record de 41,5 % en 2024. Ils se caractérisent par une infrastructure de santé de pointe, une forte sensibilisation des patients, un écosystème de santé bien établi et une forte présence des principaux fabricants d'implants. Le pays connaît une croissance substantielle des procédures d'implants orthopédiques et dentaires grâce aux innovations en matière d'impression 3D, de matériaux biorésorbables et d'implants sur mesure.

- Le Canada devrait être le pays connaissant la croissance la plus rapide sur le marché des implants orthopédiques (y compris les implants dentaires) au cours de la période de prévision, avec un TCAC prévu de 10,8 % de 2025 à 2032, soutenu par l'augmentation des initiatives gouvernementales en matière de soins de santé, la sensibilisation croissante des patients à la santé musculo-squelettique et l'adoption croissante de technologies d'implants avancées dans les soins orthopédiques et dentaires.

- Le segment des biomatériaux métalliques a dominé le marché des implants orthopédiques (y compris les implants dentaires) avec une part de marché de 58,7 % en 2024, en grande partie en raison de leur résistance mécanique inégalée, de leur durabilité et de leurs performances à long terme éprouvées.

Portée du rapport et segmentation du marché des implants orthopédiques (y compris les implants dentaires)

|

Attributs |

Implants orthopédiques (y compris les implants dentaires) : principales perspectives du marché |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des implants orthopédiques (y compris les implants dentaires) en Amérique du Nord

Progrès dans la technologie des implants et les techniques chirurgicales

- Une tendance importante et croissante sur le marché nord-américain des implants orthopédiques (y compris dentaires) est le développement de matériaux implantaires avancés et de techniques chirurgicales innovantes. Ces avancées améliorent considérablement les résultats pour les patients, réduisent les délais de récupération et optimisent la longévité et la fonctionnalité des implants.

- Par exemple, l'adoption d'implants personnalisés imprimés en 3D permet aux chirurgiens de personnaliser la forme et la taille des implants en fonction de l'anatomie du patient, ce qui se traduit par un meilleur ajustement, une réduction des complications et des résultats chirurgicaux plus prévisibles. De même, des implants biorésorbables et enduits sont introduits pour améliorer l'ostéointégration et réduire les infections postopératoires.

- Les innovations en matière de techniques chirurgicales mini-invasives et de chirurgies assistées par robot permettent une pose précise des implants, améliorant ainsi la précision et réduisant le traumatisme chirurgical. Une instrumentation et des systèmes de navigation avancés aident également les chirurgiens à obtenir un alignement optimal et une restauration fonctionnelle.

- L'intégration de nouveaux biomatériaux, tels que les alliages de titane, la zircone et le polyéthylène hautement réticulé, a amélioré la résistance, la durabilité et la biocompatibilité des implants orthopédiques et dentaires. Ces matériaux sont de plus en plus privilégiés pour les prothèses articulaires et les restaurations dentaires.

- Cette tendance vers des solutions implantaires plus efficaces, plus fiables et plus centrées sur le patient transforme profondément les attentes des chirurgiens orthopédistes et dentaires, ainsi que des patients. Par conséquent, les entreprises leaders du secteur investissent massivement dans la recherche et le développement afin de proposer des implants de nouvelle génération offrant des performances et une sécurité accrues.

- La demande d'implants orthopédiques et dentaires technologiquement avancés et performants augmente rapidement dans les hôpitaux, les cliniques spécialisées et les centres de chirurgie ambulatoire, en raison de la prévalence croissante des troubles musculo-squelettiques, du vieillissement de la population et d'une sensibilisation accrue aux options de traitement.

Dynamique du marché des implants orthopédiques (y compris les implants dentaires) en Amérique du Nord

Conducteur

Besoin croissant en raison de l'augmentation des troubles musculo-squelettiques et du vieillissement de la population

- La prévalence croissante des troubles musculosquelettiques, de l'ostéoporose, de l'arthrite et des affections dentaires, conjuguée à l'augmentation rapide de la population âgée en Amérique du Nord, explique en grande partie la forte demande d'implants orthopédiques et dentaires. Les personnes âgées sont plus sujettes à la dégénérescence articulaire, aux fractures et à la perte de dents, ce qui stimule le marché.

- Par exemple, en mars 2023, Zimmer Biomet Holdings, Inc. a lancé aux États-Unis des solutions avancées de remplacement de la hanche et du genou, conçues pour améliorer la précision chirurgicale et la récupération des patients. Ces innovations stratégiques et lancements de produits par des entreprises clés devraient stimuler la croissance du secteur des implants orthopédiques (y compris dentaires) au cours de la période de prévision.

- Alors que les patients privilégient de plus en plus une meilleure mobilité, une récupération plus rapide et une meilleure qualité de vie, la demande d'implants de pointe a fortement augmenté. Ces implants, souvent développés à partir de matériaux biocompatibles et de techniques chirurgicales mini-invasives, offrent des avantages incontestables par rapport aux traitements traditionnels.

- De plus, la popularité croissante des soins préventifs et des chirurgies électives contribue à l'adoption croissante des implants orthopédiques et dentaires. Une meilleure connaissance de l'esthétique dentaire et de la santé articulaire incite de plus en plus de personnes à recourir à des traitements implantaires avancés, tant en milieu hospitalier qu'en clinique spécialisée.

- La commodité des implants durables et résistants, associée à une couverture d'assurance croissante pour les interventions orthopédiques et dentaires, est un facteur clé de leur adoption sur le marché. Les efforts continus de recherche et développement des fabricants pour concevoir des implants sur mesure grâce à des technologies telles que l'impression 3D contribuent à l'expansion du marché.

Retenue/Défi

Coûts élevés et approbations réglementaires strictes

- Le coût relativement élevé des implants orthopédiques et dentaires de pointe constitue un obstacle majeur à leur adoption à grande échelle. Les implants haut de gamme dotés de revêtements avancés, de conceptions personnalisées ou compatibles avec la chirurgie robotique sont souvent plus chers, ce qui peut constituer un frein pour les patients sensibles au prix, notamment dans les régions en développement ou parmi les populations non assurées.

- De plus, les processus d'approbation réglementaire rigoureux requis pour les dispositifs médicaux implantables allongent considérablement les délais de lancement des produits. Les entreprises doivent respecter des normes rigoureuses de sécurité, de biocompatibilité et d'efficacité clinique, ce qui peut retarder la mise sur le marché et augmenter les coûts de développement.

- Les inquiétudes concernant les complications postopératoires, telles que le rejet d'implant, l'infection ou la défaillance du dispositif, suscitent également des réticences chez certains patients et professionnels de santé. Ces risques nécessitent une surveillance post-commercialisation rigoureuse et une innovation continue des produits pour garantir la sécurité et la fiabilité.

- La dépendance à l'égard de chirurgiens qualifiés et d'infrastructures de pointe constitue une autre limite. De nombreuses interventions orthopédiques et implantaires complexes nécessitent une formation spécialisée et des installations de pointe, souvent peu disponibles dans les établissements de santé de petite taille.

- Surmonter ces défis grâce à des stratégies d’optimisation des coûts, à l’harmonisation réglementaire, à une meilleure formation des chirurgiens et au développement de technologies d’implants plus accessibles sera essentiel pour une croissance soutenue du marché.

Portée du marché nord-américain des implants orthopédiques (y compris les implants dentaires)

Le marché est segmenté en fonction du type de produit, du biomatériau, des procédures, du type de fixation, de l'utilisateur final et du canal de distribution.

- Par type de produit

En fonction du type de produit, le marché est segmenté en prothèses articulaires reconstructives, implants rachidiens, dispositifs de préservation de la mobilité/dispositifs sans fusion, implants dentaires, implants traumatiques, produits orthobiologiques, etc. Le segment des prothèses articulaires reconstructives a dominé le marché avec la plus grande part de chiffre d'affaires (41,5 %) en 2024, soutenu par le vieillissement rapide de la population et la forte prévalence de l'arthrose et de la polyarthrite rhumatoïde. Les prothèses de hanche et de genou sont les interventions les plus courantes en Amérique du Nord, des millions de patients optant pour des solutions chirurgicales pour restaurer leur mobilité et leur qualité de vie. Les progrès réalisés dans le domaine des biomatériaux implantaires, notamment le polyéthylène hautement réticulé et les alliages de titane, ont considérablement amélioré la longévité des implants. L'adoption de techniques mini-invasives a encore élargi le bassin de candidats, favorisant des interventions plus précoces. Les politiques de remboursement aux États-Unis et au Canada favorisent également l'augmentation du volume d'interventions, favorisant ainsi une plus grande pénétration du marché. La sensibilisation croissante à l’amélioration du mode de vie après une intervention chirurgicale et les initiatives gouvernementales de soutien en matière de santé continuent de faire des remplacements articulaires reconstructifs l’épine dorsale du marché des implants orthopédiques.

Le segment des implants dentaires devrait connaître la croissance la plus rapide, avec un TCAC de 8,9 % entre 2025 et 2032, alimenté par la demande croissante en dentisterie restauratrice et esthétique. L'augmentation de la perte de dents due au vieillissement, aux traumatismes et aux maladies parodontales accroît le besoin de solutions dentaires durables. L'acceptation croissante des implants dentaires par rapport aux prothèses dentaires traditionnelles reflète une évolution vers des alternatives permanentes et plus naturelles. L'intégration des technologies de dentisterie numérique telles que la CFAO, l'imagerie 3D et la chirurgie guidée a simplifié la pose d'implants et amélioré les résultats cliniques. Les tendances en dentisterie esthétique influencent également la croissance, les patients accordant de plus en plus d'importance à l'esthétique et à la fonctionnalité. Le tourisme dentaire en Amérique du Nord, ainsi que l'élargissement de la couverture d'assurance pour certaines procédures implantaires, accélèrent encore l'adoption de ces solutions. Ensemble, ces facteurs font des implants dentaires la catégorie de produits connaissant la croissance la plus rapide au sein du secteur des implants orthopédiques.

- Par biomatériau

En termes de biomatériaux, le marché est segmenté en biomatériaux métalliques, biomatériaux céramiques, biomatériaux polymères, biomatériaux naturels, etc. Le segment des biomatériaux métalliques détenait la plus grande part de chiffre d'affaires du marché, avec 58,7 % en 2024, principalement grâce à sa résistance mécanique, sa durabilité et ses performances éprouvées à long terme. Le titane et ses alliages restent la référence absolue pour les implants orthopédiques et dentaires grâce à leur excellente biocompatibilité et ostéointégration. L'acier inoxydable et les alliages cobalt-chrome sont également largement utilisés, notamment pour les implants traumatiques et reconstructifs, en raison de leur capacité de charge. Des décennies de données cliniques valident la sécurité et la fiabilité des implants métalliques, ce qui en fait le choix privilégié des chirurgiens. La polyvalence des biomatériaux métalliques, tant pour les implants permanents que temporaires, renforce leur domination dans le secteur orthopédique. De plus, les fabricants proposent des implants métalliques poreux et à surface modifiée pour améliorer l'intégration osseuse. Ces innovations garantissent que les biomatériaux métalliques continuent de jouer un rôle central en implantologie.

Le segment des biomatériaux céramiques devrait connaître la croissance la plus rapide, avec un TCAC de 9,4 % entre 2025 et 2032, grâce à une utilisation croissante dans les applications orthopédiques et implantaires dentaires. Les céramiques en zircone, en particulier, gagnent du terrain grâce à leur résistance supérieure à l'usure, leur biocompatibilité et leur esthétique naturelle. Leur capacité à minimiser l'adhésion bactérienne et à offrir des solutions hypoallergéniques les rend très attractives pour les implants dentaires. En orthopédie, les couples de frottement céramique-céramique sont de plus en plus utilisés dans les prothèses de hanche afin de réduire l'usure et de prolonger la longévité des implants. La tendance vers des alternatives sans métal pour les patients allergiques ou sensibles stimule encore la demande. La recherche et l'innovation dans le domaine des céramiques bioactives capables de favoriser la régénération osseuse élargissent leur utilité clinique. Ensemble, ces avantages positionnent la céramique comme un moteur de croissance transformateur dans le secteur des biomatériaux.

- Par procédures

En fonction des procédures, le marché est segmenté en chirurgie ouverte, chirurgie mini-invasive (CMI) et autres. Le segment de la chirurgie ouverte représentait la plus grande part de marché, avec 54,1 % en 2024, et demeure la norme pour les interventions orthopédiques complexes telles que la réparation des traumatismes, les corrections vertébrales et les reconstructions articulaires majeures. La chirurgie ouverte permet une visualisation directe du site chirurgical, offrant aux chirurgiens un meilleur contrôle lors des poses d'implants complexes. Malgré la croissance rapide de la CMI, de nombreux cas nécessitent encore des interventions ouvertes en raison de la complexité anatomique et des spécificités des patients. La large disponibilité de chirurgiens formés et expérimentés en méthodes ouvertes renforce encore cette domination. De plus, les chirurgies ouvertes sont souvent nécessaires en cas d'urgence traumatique, qui représentent une part importante des interventions orthopédiques. Les hôpitaux d'Amérique du Nord sont également bien équipés pour les approches ouvertes, ce qui garantit la continuité des interventions. Par conséquent, malgré l'innovation dans les méthodes mini-invasives, la chirurgie ouverte conserve sa position de leader sur le marché.

Le segment de la chirurgie mini-invasive (CMI) devrait connaître une croissance annuelle composée (TCAC) record de 10,2 % entre 2025 et 2032, les patients exigeant une convalescence plus rapide et une réduction des complications postopératoires. Les techniques de CMI permettent des incisions plus petites, réduisant ainsi les pertes sanguines, le risque d'infection et la durée d'hospitalisation. Les progrès des systèmes robotisés, de la navigation par ordinateur et de l'imagerie peropératoire ont rendu la CMI plus sûre et plus précise. La préférence croissante des patients plus jeunes et plus actifs pour des interventions avec un temps d'arrêt minimal confirme cette tendance. Les chirurgiens sont de plus en plus formés aux techniques de CMI, ce qui élargit l'accessibilité dans les établissements de santé. Les politiques de remboursement avantageuses pour les interventions ambulatoires et les interventions en ambulatoire encouragent également leur adoption. Avec l'évolution constante de la technologie, la CMI devrait transformer considérablement le paysage des implants orthopédiques au cours de la prochaine décennie.

- Par type de fixation

Selon le type de fixation, le marché est segmenté en implants orthopédiques cimentés, implants orthopédiques sans ciment et implants orthopédiques hybrides. Le segment des implants orthopédiques sans ciment dominait le marché avec une part de 46,8 % en 2024, principalement en raison de leur capacité à favoriser la croissance osseuse naturelle et à assurer une fixation biologique durable. Les chirurgiens recommandent de plus en plus les implants sans ciment aux patients plus jeunes et plus actifs, compte tenu de leur durabilité et de la réduction des taux de révision. Les revêtements poreux et les modifications de surface ont considérablement amélioré l'ostéointégration, favorisant ainsi une plus large acceptation. Les patients privilégient également les implants sans ciment, car ils réduisent les complications liées à la dégradation du ciment au fil du temps. Les progrès de l'imagerie et de la précision chirurgicale ont encore amélioré les résultats de la fixation sans ciment. La forte présence de fabricants leaders proposant des conceptions sans ciment innovantes renforce la domination de ce segment. Avec l'évolution vers des solutions biologiquement intégrées, les implants sans ciment resteront probablement le type de fixation le plus privilégié.

Le segment des implants orthopédiques hybrides devrait connaître la croissance la plus rapide avec un TCAC de 8,1 % entre 2025 et 2032, car ils offrent un équilibre optimal entre les techniques cimentées et sans ciment. La fixation hybride est particulièrement précieuse pour les chirurgies de révision et les cas complexes où une seule méthode peut ne pas suffire. En combinant la stabilité immédiate de la fixation cimentée aux avantages à long terme de l'intégration sans ciment, les implants hybrides offrent des résultats cliniques supérieurs. Les chirurgiens adoptent de plus en plus les méthodes hybrides pour les prothèses de genou et de hanche chez les patients présentant des besoins anatomiques variés. La demande croissante de solutions sur mesure dans les cas complexes soutient également leur adoption. L'innovation continue dans la conception d'implants compatibles avec la fixation hybride stimule également ce segment. Avec la montée en puissance des approches personnalisées, les implants hybrides sont promis à une forte croissance.

- Par utilisateur final

En fonction de l'utilisateur final, le marché est segmenté en hôpitaux, cliniques, centres de chirurgie ambulatoire, services de soins à domicile, instituts universitaires et de recherche, entre autres. Le segment hospitalier a représenté la plus grande part de chiffre d'affaires (62,3 %) en 2024, demeurant des plateformes centrales pour les chirurgies orthopédiques et dentaires de pointe. Les hôpitaux bénéficient d'infrastructures complètes, de spécialistes hautement qualifiés et d'une capacité à gérer des procédures complexes que les établissements plus petits ne peuvent pas prendre en charge. Leurs relations étroites avec les fabricants d'implants garantissent un approvisionnement régulier en produits et un accès aux technologies les plus récentes. En Amérique du Nord, les modèles de remboursement sont conçus autour des procédures hospitalières, ce qui renforce leur domination. L'afflux accru de patients hospitalisés pour des soins de traumatologie et d'urgence contribue également à ce leadership. De plus, les hôpitaux universitaires et les centres de recherche sont à l'avant-garde de l'introduction de nouvelles technologies implantaires, renforçant ainsi leur influence. Pour ces raisons, les hôpitaux resteront leaders dans l'adoption des implants orthopédiques.

Le segment des centres de chirurgie ambulatoire (CCA) devrait connaître une croissance annuelle composée (TCAC) record de 9,8 % entre 2025 et 2032, à mesure que les soins de santé évoluent vers des modèles de soins ambulatoires plus rentables. Les CCA sont équipés de technologies de pointe permettant des interventions orthopédiques et dentaires mini-invasives, ce qui en fait des alternatives intéressantes aux structures hospitalières traditionnelles. Les patients privilégient les CCA pour leurs délais d'attente plus courts, leurs coûts réduits et la praticité de leurs soins. Les assureurs encouragent également le recours aux CCA afin de réduire les dépenses globales de santé. Cette croissance est également soutenue par la tendance croissante aux arthroplasties ambulatoires et aux chirurgies rachidiennes ambulatoires. La capacité des CCA à fournir des soins de haute qualité dans un environnement moins gourmand en ressources accélère leur expansion. Avec l'harmonisation des préférences des patients et des organismes payeurs, les CCA devraient connaître une croissance rapide de l'utilisation des implants orthopédiques.

- Par canal de distribution

En fonction du canal de distribution, le marché est segmenté en appels d'offres directs, ventes au détail et autres. Le segment des appels d'offres directs a dominé le marché avec une part de 49,6 % en 2024, les hôpitaux et les grands réseaux de santé privilégiant les modèles d'approvisionnement centralisés pour bénéficier de remises sur les quantités et garantir un approvisionnement fiable. De solides partenariats fabricants-hôpitaux font des appels d'offres directs le canal le plus efficace pour l'acquisition d'implants. Ces accords incluent souvent des forfaits de formation, de service et de maintenance, ce qui les rend plus attractifs pour les prestataires de soins. Les processus d'appels d'offres directs garantissent également le respect des normes réglementaires et des critères de qualité. Pour les implants orthopédiques complexes, ce canal offre aux établissements de santé une confiance dans la traçabilité et la sécurité des produits. L'ampleur et la régularité de la demande des hôpitaux renforcent la force de ce segment. La rentabilité restant une priorité absolue, les appels d'offres directs continueront de dominer les stratégies d'approvisionnement.

Le segment des ventes au détail devrait connaître la croissance la plus rapide, avec un TCAC de 7,6 % entre 2025 et 2032, soutenu par l'augmentation des achats d'implants dentaires et d'accessoires associés par les patients. La présence croissante des plateformes de commerce électronique et des pharmacies de détail a rendu les implants et les consommables plus accessibles aux patients. Les patients souhaitant des interventions non urgentes, notamment en soins dentaires, stimulent la demande via les canaux de distribution. Cette tendance est également soutenue par la notoriété et la commercialisation croissantes des solutions dentaires en vente directe. La disponibilité au détail offre également une plus grande flexibilité pour l'achat de composants de remplacement ou de produits implantaires complémentaires. Avec l'augmentation des dépenses de santé des consommateurs, les ventes au détail joueront un rôle plus important dans la croissance du marché.

Analyse régionale du marché nord-américain des implants orthopédiques (y compris les implants dentaires)

- L'Amérique du Nord a dominé le marché des implants orthopédiques (y compris dentaires) avec la plus grande part de chiffre d'affaires en 2024, portée par l'augmentation des cas de troubles musculo-squelettiques, le vieillissement de la population et la demande croissante de solutions thérapeutiques avancées. La région bénéficie d'une forte présence de fabricants d'implants de premier plan, de dépenses de santé élevées et d'une innovation continue dans les technologies orthopédiques et dentaires.

- Les patients nord-américains apprécient grandement la disponibilité des chirurgies mini-invasives, des biomatériaux avancés et des implants sur mesure, qui améliorent les délais de récupération et les résultats à long terme. L'adoption croissante de l'impression 3D, de la chirurgie assistée par robot et des solutions de dentisterie numérique accélère encore l'expansion du marché dans la région.

- Cette croissance généralisée est également soutenue par une infrastructure de santé solide, des politiques de remboursement avantageuses et une sensibilisation croissante aux traitements préventifs et correctifs pour les affections orthopédiques et dentaires. Ensemble, ces facteurs font de l'Amérique du Nord le leader mondial des implants orthopédiques, y compris dentaires.

Aperçu du marché des implants orthopédiques (y compris les implants dentaires) aux États-Unis

Le marché américain des implants orthopédiques (implants dentaires inclus) a dominé le marché avec une part de chiffre d'affaires de 41,5 % en 2024. Ce marché se caractérise par une infrastructure de soins de santé de pointe, une forte sensibilisation des patients, un écosystème de soins de santé bien établi et la présence de fabricants d'implants leaders tels que Zimmer Biomet, Stryker et Dentsply Sirona. Le pays connaît une croissance substantielle des procédures d'implants orthopédiques et dentaires, portée par l'intégration de l'impression 3D, des matériaux biorésorbables, des outils de planification assistée par IA et des implants personnalisés qui améliorent la précision chirurgicale et les résultats pour les patients.

Aperçu du marché canadien des implants orthopédiques (y compris les implants dentaires)

Le marché canadien des implants orthopédiques (y compris les implants dentaires) devrait connaître la croissance la plus rapide au cours de la période de prévision, avec un TCAC de 10,8 % prévu de 2025 à 2032. Cette croissance est soutenue par l'augmentation des initiatives gouvernementales en matière de santé, l'augmentation des investissements dans les infrastructures hospitalières de pointe et la sensibilisation croissante des patients à la santé musculosquelettique. De plus , l'adoption de technologies implantaires de nouvelle génération, notamment dans les procédures orthopédiques mini-invasives et l'implantologie dentaire numérique, accélère l'expansion du marché au pays.

Part de marché des implants orthopédiques (y compris les implants dentaires) en Amérique du Nord

L’industrie des implants orthopédiques (y compris les implants dentaires) est principalement dirigée par des entreprises bien établies, notamment :

- Zimmer Biomet (États-Unis)

- Smith + Nephew (Royaume-Uni)

- Medtronic (Irlande)

- Stryker (États-Unis)

- B. Braun SE (Allemagne)

- Integra LifeSciences Corporation (États-Unis)

- Narang Medical Limited (Inde)

- WL Gore & Associates, Inc. (États-Unis)

- 3M (États-Unis)

- Arthrex, Inc. (États-Unis)

- General Electric Company (États-Unis)

- DJO, LLC (États-Unis)

- Samay Surgical (Inde)

- BioHorizons (États-Unis)

- Envista (États-Unis)

- Egifix (Inde)

- Institut Straumann AG (Suisse)

- Canwell Medical Co., Ltd. (Chine)

- Groupe Corin (Royaume-Uni)

- Globus Medical (États-Unis)

- CONMED Corporation (États-Unis)

- Bonetech Medisys Pvt. (Inde)

- EgiFix Medical (Inde)

Développements récents sur le marché nord-américain des implants orthopédiques (y compris les implants dentaires)

- En juillet 2024, ZimVie a annoncé l'autorisation 510(k) de la FDA et le lancement aux États-Unis de GentekR Restorative, élargissant ainsi son portefeuille d'offres prothétiques et renforçant sa position dans les solutions de restauration et d'implants dentaires.

- En décembre 2024, Zimmer Biomet a reçu l'autorisation de la FDA pour son composant fémur Persona SoluTion PPS, qui, associé à ses composants Persona OsseoTi Tibia et OsseoTi Patella, offre une compatibilité améliorée des implants et de meilleurs résultats cliniques pour les procédures de remplacement articulaire.

- En mars 2025, Johnson & Johnson MedTech a présenté une nouvelle ère de l'orthopédie numérique lors de la réunion annuelle de l'AAOS 2025 à San Diego, en introduisant des innovations dans les secteurs de la reconstruction articulaire, des traumatismes, de la colonne vertébrale et des extrémités, notamment des technologies habilitantes basées sur les données et des implants avancés pour améliorer la précision et l'efficacité de la chirurgie.

- En janvier 2025, Zimmer Biomet a annoncé l'acquisition de Paragon 28 pour environ 1,1 milliard de dollars américains. Cette acquisition vise à élargir l'offre d'implants chirurgicaux de Zimmer pour les pathologies du pied et de la cheville, ainsi qu'à renforcer sa présence dans les domaines des fractures, des traumatismes et des prothèses articulaires.

- En mai 2025, RevBio a reçu l'autorisation de la FDA d'étendre son essai clinique et le remboursement par la CMS de son adhésif osseux régénératif pour la fixation des lambeaux crâniens. Il s'agit d'une avancée significative pour ses technologies de stabilisation d'implants à base de biomatériaux.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.