North America Obsessive Compulsive Disorder Ocd Drugs Market

Taille du marché en milliards USD

TCAC :

%

USD

688.41 Million

USD

321.14 Million

2025

2033

USD

688.41 Million

USD

321.14 Million

2025

2033

| 2026 –2033 | |

| USD 688.41 Million | |

| USD 321.14 Million | |

|

|

|

|

Marché nord-américain des médicaments contre les troubles obsessionnels-compulsifs (TOC) : segmentation par gravité (légère à modérée et modérée à sévère), sous-type (obsessions de contamination avec compulsions de lavage/nettoyage, obsessions de nuire avec compulsions de vérification, obsessions sans compulsions visibles, obsessions de symétrie avec compulsions de rangement, d’agencement et de comptage, accumulation compulsive et autres), médicaments (antidépresseurs, antipsychotiques, antagonistes des récepteurs NMDA et autres), voie d’administration (orale et parentérale), population cible (enfants et adultes), utilisateur final (hôpitaux, cliniques spécialisées, soins à domicile et autres), canal de distribution (pharmacies hospitalières, pharmacies de détail, pharmacies en ligne et autres) – Tendances du secteur et prévisions jusqu’en 2033

Taille du marché des médicaments contre les troubles obsessionnels-compulsifs (TOC) en Amérique du Nord

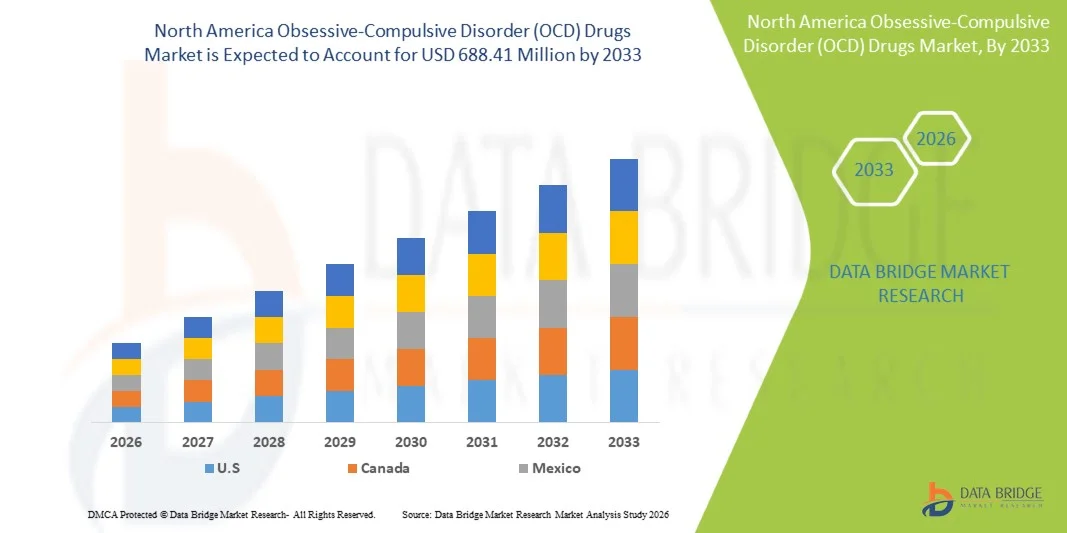

- Le marché nord-américain des médicaments contre les troubles obsessionnels-compulsifs (TOC) était évalué à 321,14 millions de dollars américains en 2025 et devrait atteindre 688,41 millions de dollars américains d'ici 2033 , avec un taux de croissance annuel composé (TCAC) de 10,0 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la prévalence croissante des TOC chez les adultes et les adolescents, associée aux progrès des traitements pharmacologiques et des approches thérapeutiques personnalisées.

- De plus, la sensibilisation croissante à la santé mentale, l'augmentation des dépenses de santé et la préférence des patients pour des traitements médicamenteux efficaces, bien tolérés et accessibles favorisent l'adoption des médicaments contre les TOC dans toute la région. Ces facteurs accélèrent la commercialisation de ces traitements, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché des médicaments contre les troubles obsessionnels-compulsifs (TOC) en Amérique du Nord

- Les médicaments contre le TOC, comprenant les antidépresseurs, les antipsychotiques, les antagonistes des récepteurs NMDA et d'autres traitements pharmacologiques émergents, sont de plus en plus essentiels pour la prise en charge du trouble obsessionnel-compulsif chez les adultes et les enfants, en raison de leur efficacité à réduire les symptômes et à améliorer la qualité de vie.

- La demande croissante de médicaments contre le TOC est principalement alimentée par la prévalence croissante du TOC, la sensibilisation accrue à la santé mentale et la préférence grandissante pour les traitements pharmacologiques validés cliniquement par rapport aux interventions non médicales.

- Les États-Unis ont dominé le marché des médicaments contre le TOC avec la plus grande part de revenus (55,8 %) en 2025, caractérisé par une infrastructure de santé bien établie, des dépenses de santé élevées et une forte présence d'acteurs pharmaceutiques clés, avec une croissance substantielle des prescriptions, notamment dans les hôpitaux et les cliniques spécialisées, stimulée par les innovations dans les formulations de médicaments et les thérapies ciblées.

- Le Canada devrait connaître la croissance la plus rapide sur le marché des médicaments contre le TOC au cours de la période de prévision, grâce à la multiplication des programmes de sensibilisation, au développement des initiatives en santé mentale et à l'amélioration de l'accès aux soins psychiatriques.

- Le segment des antidépresseurs a dominé le marché des médicaments contre le TOC avec une part de marché de 52,9 % en 2025, grâce à leur efficacité prouvée, leur large adoption en tant que traitement de première intention et leur profil de sécurité établi chez les adultes et les enfants.

Portée du rapport et segmentation du marché nord-américain des médicaments contre les troubles obsessionnels-compulsifs (TOC)

|

Attributs |

Médicaments contre les troubles obsessionnels-compulsifs (TOC) en Amérique du Nord : principaux enseignements du marché |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research incluent également une analyse approfondie par des experts, des données épidémiologiques sur les patients, une analyse des projets en développement, une analyse des prix et un aperçu du cadre réglementaire. |

Tendances du marché des médicaments contre les troubles obsessionnels-compulsifs (TOC) en Amérique du Nord

« Approches thérapeutiques personnalisées et numériques »

- Une tendance importante et croissante sur le marché nord-américain des médicaments contre les TOC est l'intégration des outils de santé numérique et des approches thérapeutiques personnalisées, permettant un meilleur suivi des symptômes, de l'observance et de la réponse au traitement.

- Par exemple, les applications mobiles et les plateformes de télésanté permettent désormais aux patients de suivre la gravité de leurs symptômes de TOC, leur prise de médicaments et leurs progrès thérapeutiques, informations qui peuvent être partagées directement avec les psychiatres pour des ajustements de traitement personnalisés.

- Les progrès en pharmacogénomique et les recommandations de traitement basées sur l'IA permettent aux cliniciens d'optimiser le choix des médicaments pour chaque patient, minimisant ainsi les effets indésirables tout en maximisant les résultats thérapeutiques.

- Les consultations de télépsychiatrie associées à la gestion à distance des ordonnances élargissent l'accès aux médicaments contre le TOC, notamment dans les zones rurales ou mal desservies.

- Les outils numériques d'observance, les rappels et la surveillance à distance des patients améliorent l'observance thérapeutique, réduisent le risque de rechute et favorisent la continuité des soins chez les adultes et les enfants.

- Cette tendance vers une prise en charge numérique et personnalisée des TOC redéfinit les attentes des patients en matière de thérapie, des entreprises comme Biohaven et Axsome Therapeutics explorant des programmes de soutien intégrés aux patients, associés à un traitement pharmacologique.

- L'adoption de solutions de traitement des TOC centrées sur le patient et facilitées par le numérique connaît une croissance rapide dans les cliniques ambulatoires, les hôpitaux spécialisés et les services de soins à domicile, car les patients et les aidants privilégient de plus en plus la commodité, la sécurité et la continuité des soins.

Dynamique du marché des médicaments contre les troubles obsessionnels-compulsifs (TOC) en Amérique du Nord

Conducteur

« Accroître la prévalence et la sensibilisation favorise l’adoption »

- La prévalence croissante des TOC chez les adultes et les enfants, associée à une sensibilisation accrue à la santé mentale, est un facteur important de la demande accrue de médicaments contre les TOC.

- Par exemple, les enquêtes nationales de santé indiquent une augmentation des taux de diagnostic, incitant les professionnels de la santé à prescrire activement des ISRS, des antipsychotiques et des antagonistes des récepteurs NMDA pour une prise en charge efficace des symptômes du TOC.

- À mesure que les patients et leurs aidants s'informent davantage sur les options de traitement, la demande de thérapies pharmacologiques validées cliniquement et fondées sur des données probantes a renforcé leur adoption dans les services de soins ambulatoires et spécialisés.

- De plus, l'augmentation de la couverture d'assurance et du remboursement des traitements de santé mentale facilite l'accès aux médicaments, faisant des traitements médicamenteux fondés sur des données probantes une option privilégiée par rapport aux interventions non pharmacologiques prises isolément.

- La facilité d'administration orale, la disponibilité de plusieurs classes de médicaments et les programmes de soutien aux patients sont des facteurs clés qui favorisent l'adoption des médicaments contre le TOC dans les hôpitaux, les cliniques spécialisées et les soins de santé à domicile.

- La tendance à l'intervention précoce, aux plans de traitement complets et aux parcours de soins intégrés favorise encore davantage l'adoption des médicaments contre le TOC chez les adultes et les enfants.

- Le développement de partenariats entre les entreprises pharmaceutiques et les fournisseurs de services de santé numérique permet de créer des programmes centrés sur le patient qui favorisent l'observance thérapeutique et optimisent les résultats des traitements. Les campagnes de sensibilisation et les initiatives en santé mentale contribuent à réduire la stigmatisation associée aux TOC, ce qui entraîne une augmentation du nombre de diagnostics et de traitements.

Retenue/Défi

« Problèmes d’irritation cutanée et obstacle à la conformité réglementaire »

- Les préoccupations liées aux effets secondaires, aux interactions médicamenteuses potentielles et à l'observance à long terme constituent un obstacle majeur à une plus large diffusion des médicaments contre le TOC sur le marché.

- Par exemple, des effets indésirables courants tels que des troubles gastro-intestinaux, des problèmes de sommeil ou des variations de poids peuvent entraîner l'arrêt du traitement et une diminution de l'observance du traitement par le patient.

- Les approbations réglementaires strictes, les exigences en matière d'essais cliniques et la surveillance post-commercialisation ajoutent de la complexité aux démarches des entreprises pharmaceutiques qui cherchent à lancer de nouveaux médicaments contre les TOC en Amérique du Nord.

- Les coûts élevés à la charge du patient pour certains traitements de marque et la disponibilité limitée des formulations médicamenteuses avancées dans certaines régions peuvent restreindre davantage l'accès des patients aux traitements et la croissance du marché.

- Bien que les médicaments génériques et les programmes d'aide aux patients améliorent l'accessibilité financière, la perception du fardeau du traitement et les préoccupations liées aux effets secondaires peuvent freiner son adoption généralisée chez les patients sensibles au prix ou hésitants.

- Les inquiétudes concernant les interactions médicamenteuses, en particulier chez les patients présentant des comorbidités psychiatriques ou médicales, peuvent limiter la confiance et l'utilisation des médicaments par les prescripteurs.

- La variabilité des politiques de couverture d'assurance et des exigences d'autorisation préalable peut retarder le début du traitement et réduire l'observance thérapeutique. Relever ces défis grâce à l'éducation des patients, aux programmes de soutien à l'observance, à des formulations médicamenteuses plus sûres et à une conformité réglementaire rigoureuse sera essentiel à la croissance durable du marché.

Portée du marché des médicaments contre les troubles obsessionnels-compulsifs (TOC) en Amérique du Nord

Le marché est segmenté en fonction de la gravité, du sous-type, des médicaments, de la voie d'administration, du type de population, de l'utilisateur final et du canal de distribution.

- Par gravité

En fonction de la gravité des TOC, le marché des médicaments les plus courants se divise en deux segments : légers à modérés et modérés à sévères. Le segment des TOC modérés à sévères dominait le marché en 2025, générant la plus grande part de revenus, du fait de la nécessité clinique accrue d’une intervention pharmacologique dans les cas les plus sévères. Les patients requièrent souvent des doses plus élevées ou une thérapie combinée avec des ISRS et des antipsychotiques, ce qui augmente la consommation globale de médicaments et les revenus du marché. Les hôpitaux et les cliniques spécialisées prennent en charge activement les cas modérés à sévères, en assurant un suivi structuré et un traitement à long terme. Les outils numériques de suivi des patients améliorent l’observance thérapeutique et les résultats du traitement. Les campagnes de sensibilisation aux risques liés à l’absence de traitement des TOC sévères encouragent la mise en place d’un traitement. Le diagnostic précoce et la prise en charge hospitalière favorisent également la continuité des soins, renforçant ainsi la position dominante du marché.

Le segment des symptômes légers à modérés devrait connaître la croissance la plus rapide au cours de la période prévisionnelle, grâce à l'accent mis sur le diagnostic précoce et les programmes d'intervention. La télépsychiatrie et les services de soins à domicile améliorent l'accès aux soins pour les patients présentant des symptômes légers à modérés. La sensibilisation croissante des parents, des écoles et des adultes favorise une prise en charge pharmacologique plus précoce. Les outils numériques de suivi des symptômes améliorent l'observance thérapeutique et le suivi. Les médicaments génériques et abordables rendent le traitement accessible à un plus grand nombre de personnes. L'intégration de la thérapie comportementale au traitement pharmacologique contribue également à son adoption dans ce segment.

- Par sous-type

Selon le sous-type, le marché est segmenté en obsessions de contamination avec compulsions de lavage/nettoyage, obsessions de danger avec compulsions de vérification, obsessions sans compulsions visibles, obsessions de symétrie avec compulsions de rangement/comptage, accumulation compulsive et autres. Le segment des obsessions de contamination avec compulsions de lavage/nettoyage domine le marché en raison de sa forte prévalence et de sa réponse prévisible aux ISRS. Les patients de ce sous-type nécessitent souvent un traitement à long terme pour gérer les rechutes, ce qui augmente la consommation de médicaments. Les hôpitaux et les cliniques spécialisées priorisent fréquemment le traitement de ce sous-type. Les outils de suivi numérique et les applications mobiles améliorent l'observance thérapeutique et la gestion des symptômes. La prise en charge et le remboursement par l'assurance maladie facilitent l'accès au traitement. Les campagnes de sensibilisation ciblant les compulsions liées à l'hygiène favorisent le dépistage précoce et la mise en place rapide d'un traitement.

Le segment des troubles obsessionnels compulsifs liés à la symétrie, avec des compulsions d'ordre, d'agencement et de comptage, devrait connaître la croissance la plus rapide, grâce à une meilleure reconnaissance chez les enfants et les adultes. Le diagnostic précoce et les approches thérapeutiques ciblées stimulent la demande. L'intégration d'un traitement pharmacologique aux interventions comportementales améliore les résultats. Les plateformes de télépsychiatrie facilitent l'accès aux soins spécialisés. Les outils numériques de suivi des symptômes améliorent l'observance thérapeutique et le suivi post-traitement. L'augmentation des recherches et des essais cliniques axés sur ce sous-type favorise son adoption par le marché. Le recours aux thérapies combinées contribue également à l'augmentation des prescriptions dans ce segment.

- Par les drogues

Le marché est segmenté, selon le type de médicament, en antidépresseurs, antipsychotiques, antagonistes des récepteurs NMDA et autres. En 2025, le segment des antidépresseurs dominait le marché avec une part de 52,9 %, les ISRS étant le traitement de première intention des TOC. Leur efficacité et leur innocuité avérées expliquent leur large prescription chez les adultes et les enfants. Les hôpitaux, les cliniques spécialisées et les soins à domicile ont largement recours aux antidépresseurs oraux pour les traitements de longue durée. Les programmes d'aide aux patients et la prise en charge par l'assurance maladie favorisent leur utilisation. Ce segment bénéficie d'une forte notoriété de marque et de nombreuses données cliniques. Les associations thérapeutiques avec des antipsychotiques ou des antagonistes des récepteurs NMDA renforcent encore sa position dominante.

Le segment des antagonistes des récepteurs NMDA devrait connaître la croissance la plus rapide au cours de la période prévisionnelle, grâce aux preuves émergentes de leur efficacité dans le traitement des TOC résistants. Les hôpitaux et les cliniques spécialisées ont de plus en plus recours aux antagonistes des récepteurs NMDA lorsque les traitements de première intention échouent. Les essais cliniques et les autorisations réglementaires favorisent cette adoption. Les outils numériques de suivi de l'observance et la téléconsultation en psychiatrie améliorent l'adhésion des patients. Les thérapies combinées avec les ISRS sont de plus en plus fréquentes. La sensibilisation croissante des cliniciens aux avantages des antagonistes des récepteurs NMDA stimule la prescription. Les programmes de soutien aux patients et l'intégration des soins à domicile accélèrent encore cette croissance.

- Par voie d'administration

Selon la voie d'administration, le marché se divise en deux segments : oral et parentéral. Le segment oral domine le marché grâce à sa praticité, sa facilité d'utilisation et sa large disponibilité. Patients et soignants privilégient l'administration orale, tant pour les adultes que pour les enfants. Les hôpitaux et les cliniques spécialisées recommandent les médicaments oraux pour la prise en charge au long cours. La couverture d'assurance maladie favorise l'accessibilité financière et un accès généralisé aux traitements. Les programmes numériques de suivi de l'observance et la surveillance des soins à domicile améliorent l'adhésion au traitement. Les formulations orales sont également privilégiées pour les thérapies combinées, contribuant ainsi à la croissance du chiffre d'affaires.

Le segment des traitements parentéraux devrait connaître la croissance la plus rapide, notamment grâce à leur utilisation dans les cas de TOC aigus ou résistants aux traitements. Les formulations injectables soulagent rapidement les symptômes lors des crises sévères. Les hôpitaux et les cliniques spécialisées adoptent de plus en plus ces formulations pour les patients en situation critique. La télésurveillance psychiatrique et les outils numériques de suivi de l'observance thérapeutique favorisent l'adhésion au traitement. L'amélioration des profils de sécurité et des technologies de surveillance encourage l'adoption par les cliniciens. L'association thérapeutique avec des médicaments oraux stimule la demande du marché. La sensibilisation des cliniciens et des aidants aux options injectables favorise leur adoption.

- Par type de population

Selon le type de population, le marché est segmenté en pédiatrie et adultes. Le segment des adultes dominait le marché en 2025 en raison d'une prévalence plus élevée, de durées de traitement plus longues et d'un diagnostic plus fiable. Les adultes nécessitent des doses plus importantes et une thérapie plus intensive, ce qui génère des revenus plus élevés. Les hôpitaux, les cliniques spécialisées et les centres psychiatriques ambulatoires représentent la majorité des prescriptions pour adultes. La couverture d'assurance et les programmes de santé mentale en entreprise favorisent l'accès aux traitements. Les programmes d'accompagnement des patients garantissent le respect du traitement à long terme. Les campagnes de sensibilisation encouragent l'intervention précoce et renforcent la position dominante du marché.

Le segment pédiatrique devrait connaître la croissance la plus rapide grâce à une sensibilisation accrue à l'intervention et au diagnostic précoces. La télépsychiatrie et les services de soins à domicile améliorent l'accès aux soins pour les enfants. Les programmes de psychiatrie pédiatrique intègrent la thérapie comportementale au traitement pharmacologique. Le suivi numérique des symptômes améliore l'observance thérapeutique et le suivi du traitement. Les programmes scolaires et les campagnes de sensibilisation des parents favorisent le dépistage précoce. Les formulations médicamenteuses spécialisées pour enfants stimulent davantage l'adoption de ces traitements. Les thérapies combinées gagnent en popularité, accélérant ainsi la croissance de ce segment.

- Par l'utilisateur final

En fonction de l'utilisateur final, le marché est segmenté en hôpitaux, cliniques spécialisées, soins à domicile et autres. Le segment hospitalier domine le marché grâce à un volume élevé de patients et à une prise en charge intégrée des adultes et des enfants. Les hôpitaux offrent un traitement complet incluant la pharmacothérapie, le suivi et la surveillance. La présence de psychiatres spécialistes, concentrée dans les hôpitaux, contribue à un volume important de prescriptions. La couverture d'assurance garantit l'accessibilité financière aux patients. Les programmes de soutien aux patients et les options de thérapie combinée favorisent l'observance thérapeutique. Les hôpitaux pilotent également la gestion des traitements à long terme, ce qui explique leur position dominante en termes de revenus.

Le secteur des soins à domicile devrait connaître la croissance la plus rapide grâce à l'adoption de la télépsychiatrie, de la surveillance à distance et à la recherche de commodité. Les patients peuvent accéder aux traitements sans se rendre fréquemment à l'hôpital. Les applications de suivi numérique et mobile améliorent l'observance thérapeutique à long terme. Les parents et les aidants privilégient les soins à domicile pour les enfants. Les services de livraison de médicaments par abonnement assurent la continuité des soins. L'intégration de la thérapie comportementale aux traitements pharmacologiques favorise l'adoption de ces thérapies. Les plateformes de télésanté étendent l'accès aux régions éloignées, stimulant ainsi la croissance.

- Par canal de distribution

Selon le canal de distribution, le marché se segmente en pharmacies hospitalières, pharmacies de détail, pharmacies en ligne et autres. Le segment des pharmacies de détail domine le marché grâce à une large disponibilité, une accessibilité aisée et la prise en charge des achats par l'assurance maladie. Adultes et enfants peuvent ainsi se procurer facilement leurs traitements. Les hôpitaux et les cliniques spécialisées collaborent souvent avec les pharmacies de détail pour l'approvisionnement. Les programmes de fidélisation et le renouvellement des ordonnances garantissent des revenus stables. Une forte notoriété de la marque favorise les achats répétés. La proximité et la présence locale renforcent la position dominante des pharmacies de détail sur le marché.

Le segment des pharmacies en ligne devrait connaître la croissance la plus rapide grâce à l'essor du numérique et du commerce électronique. Les patients peuvent commander leurs médicaments à distance et se les faire livrer à domicile. L'intégration des prescriptions de télémédecine et de la délivrance des médicaments en ligne accélère cette adoption. Les systèmes d'abonnement et de rappels favorisent l'observance thérapeutique. La confidentialité et la discrétion des achats renforcent la préférence des patients. Les plateformes numériques permettent le suivi du traitement et de l'observance. Les campagnes de sensibilisation et la confiance croissante envers les pharmacies en ligne stimulent encore davantage leur adoption.

Analyse régionale du marché des médicaments contre les troubles obsessionnels-compulsifs (TOC) en Amérique du Nord

- Les États-Unis ont dominé le marché des médicaments contre le TOC avec la plus grande part de revenus (55,8 %) en 2025, caractérisé par une infrastructure de santé bien établie, des dépenses de santé élevées et une forte présence d'acteurs pharmaceutiques clés, avec une croissance substantielle des prescriptions, notamment dans les hôpitaux et les cliniques spécialisées, stimulée par les innovations dans les formulations de médicaments et les thérapies ciblées.

- Dans la région, les patients et leurs aidants accordent une importance croissante aux traitements pharmacologiques validés cliniquement, notamment les ISRS, les antipsychotiques et les antagonistes des récepteurs NMDA, pour une prise en charge efficace des symptômes du TOC.

- Cette adoption généralisée est également favorisée par des infrastructures de soins de santé de pointe, des services de télépsychiatrie, la couverture d'assurance et des programmes de soutien aux patients, faisant de la thérapie pharmacologique la solution privilégiée pour les populations adultes et pédiatriques.

Aperçu du marché des médicaments contre les troubles obsessionnels-compulsifs (TOC) aux États-Unis et en Amérique du Nord

Le marché américain des médicaments contre le TOC a représenté la plus grande part de revenus (55,8 %) en Amérique du Nord en 2025, grâce à la forte prévalence du TOC et à un système de santé bien établi. Les patients et leurs aidants privilégient de plus en plus les traitements pharmacologiques efficaces à base d'ISRS, d'antipsychotiques et d'antagonistes des récepteurs NMDA pour la gestion des symptômes. L'adoption croissante des services de télépsychiatrie, du suivi de santé mobile et des outils numériques de suivi de l'observance thérapeutique contribue également à la croissance du marché. Par ailleurs, la prise en charge par les assurances et les programmes de soutien aux patients facilitent l'accès aux médicaments. Les campagnes de sensibilisation et les initiatives de diagnostic précoce participent activement à l'expansion du marché. L'attention accrue portée aux soins de santé mentale, tant pédiatriques qu'adultes, soutient une forte demande de médicaments contre le TOC dans les hôpitaux, les cliniques spécialisées et les services de soins à domicile.

Aperçu du marché des médicaments contre les troubles obsessionnels-compulsifs (TOC) au Canada et en Amérique du Nord

Le marché canadien des médicaments contre le TOC devrait connaître une croissance annuelle composée stable au cours de la période de prévision, portée par une sensibilisation accrue à la santé mentale et l'augmentation des taux de diagnostic du TOC. Les patients canadiens privilégient de plus en plus les approches thérapeutiques intégrées combinant traitement pharmacologique et thérapie comportementale. Le système de santé performant du pays et les initiatives gouvernementales en faveur des services de santé mentale facilitent l'accès aux médicaments contre le TOC. La télépsychiatrie et les services de soins à domicile améliorent la disponibilité des traitements dans les régions éloignées. De plus, une couverture d'assurance et des programmes de remboursement avantageux encouragent une plus grande utilisation des médicaments prescrits contre le TOC. Les campagnes de santé publique mettant en lumière les symptômes du TOC et l'importance du dépistage précoce soutiennent une croissance soutenue du marché.

Aperçu du marché des médicaments contre les troubles obsessionnels compulsifs (TOC) au Mexique et en Amérique du Nord

Le marché mexicain des médicaments contre les TOC devrait connaître une croissance annuelle composée (TCAC) notable au cours de la période de prévision, portée par une sensibilisation accrue aux troubles de santé mentale et l'amélioration des infrastructures de santé. Les patients mexicains sont de plus en plus réceptifs aux traitements pharmacologiques fondés sur des données probantes, notamment les antidépresseurs, les antipsychotiques et les antagonistes des récepteurs NMDA. L'intégration des plateformes de télémédecine facilite l'accès aux traitements des TOC, en particulier dans les zones rurales. Les initiatives gouvernementales croissantes visant à promouvoir la sensibilisation à la santé mentale soutiennent l'adoption du marché. L'augmentation du nombre de cliniques spécialisées et de professionnels de la santé mentale contribue également à faciliter l'accès aux traitements. Enfin, la pénétration croissante des assurances et les programmes d'aide aux patients améliorent l'accès aux médicaments et soutiennent la croissance du marché.

Part de marché des médicaments contre les troubles obsessionnels-compulsifs (TOC) en Amérique du Nord

L'industrie des médicaments contre les troubles obsessionnels-compulsifs (TOC) en Amérique du Nord est principalement dominée par des entreprises bien établies, notamment :

- Eli Lilly and Company (États-Unis)

- Axsome Therapeutics, Inc. (États-Unis)

- Pfizer Inc. (États-Unis)

- Services Johnson & Johnson, Inc. (États-Unis)

- GSK plc (Royaume-Uni)

- Lundbeck A/S (Danemark)

- Otsuka Pharmaceutical Co., Ltd. (Japon)

- Novartis AG (Suisse)

- AstraZeneca (Royaume-Uni)

- AbbVie (États-Unis)

- Teva Pharmaceutical Industries Ltd. (Israël)

- Amneal Pharmaceuticals LLC (États-Unis)

- Groupe Zydus (États-Unis)

- Sun Pharmaceutical Industries Ltd. (Inde)

- Aurobindo Pharma Limited (États-Unis)

- Mallinckrodt (États-Unis)

- Lannett. (États-Unis)

- Par Health, Inc. (États-Unis)

- Alvogen (États-Unis)

- Apotex Inc. (Canada)

Quels sont les développements récents sur le marché des médicaments contre les troubles obsessionnels-compulsifs (TOC) en Amérique du Nord ?

- En septembre 2025, un essai clinique a rapporté que l'ondansétron, un antiémétique approuvé par la FDA, utilisé en association avec un inhibiteur de la recapture de la sérotonine (IRS), réduisait significativement la gravité des symptômes du trouble obsessionnel-compulsif (TOC). Les résultats de cet essai soulignent le rôle potentiel de l'ondansétron comme traitement d'appoint dans le TOC, notamment chez les patients présentant des symptômes résiduels malgré un traitement de première intention.

- En avril 2025, les médias ont souligné que les thérapies électroceutiques, notamment la stimulation cérébrale profonde (SCP), la stimulation magnétique transcrânienne (SMT), la stimulation du nerf vague (SNV) et les ultrasons focalisés, sont de plus en plus reconnues pour le traitement des TOC résistants aux traitements médicamenteux aux États-Unis. Plus précisément, près de 60 % des Américains atteints de TOC sont considérés comme résistants aux traitements, ce qui rend ces options non médicamenteuses d'autant plus pertinentes.

- En mars 2025, un résumé de recherche publié par l'Association américaine de psychiatrie a souligné la publication d'un essai contrôlé randomisé sur l'ondansétron à forte dose pour le traitement des TOC et des troubles de tics. Cet essai a examiné non seulement l'évolution des symptômes cliniques, mais aussi les modifications de la connectivité neuronale par IRMf. Ceci marque une avancée significative vers une pharmacothérapie ciblée sur les mécanismes et les biomarqueurs dans la prise en charge des TOC, et ouvre la voie à l'évaluation future des médicaments à l'aide de critères d'évaluation par imagerie cérébrale.

- En août 2024, le paysage réglementaire et de recherche américain concernant les composés psychédéliques a connu un tournant notable. Un article soulignait que, malgré des résultats préliminaires prometteurs, la thérapie assistée par MDMA pour le traitement du syndrome de stress post-traumatique (SSPT) n'avait pas été approuvée par la FDA (Food and Drug Administration). Cette situation a soulevé des questions quant à l'avenir des psychédéliques dans des applications plus larges en santé mentale, notamment pour les troubles obsessionnels compulsifs (TOC).

- En juin 2023, il a été annoncé que l'État de Washington avait autorisé un essai clinique majeur sur la psilocybine à la faculté de médecine de l'Université de Washington afin d'étudier son potentiel thérapeutique, notamment pour l'anxiété, la dépression et, par extension, potentiellement les TOC. Ceci témoigne d'un intérêt croissant, tant sur le plan législatif que clinique, pour les thérapies alternatives susceptibles d'influencer la pharmacothérapie des TOC à l'avenir, même en l'absence d'autorisation de mise sur le marché de médicaments spécifiques pour cette pathologie.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.