North America Nutraceutical Packaging Market

Taille du marché en milliards USD

TCAC :

%

USD

2.16 Billion

USD

3.39 Billion

2025

2033

USD

2.16 Billion

USD

3.39 Billion

2025

2033

| 2026 –2033 | |

| USD 2.16 Billion | |

| USD 3.39 Billion | |

|

|

|

|

Segmentation du marché nord-américain des emballages nutraceutiques : par type (bouteilles, boîtes et bocaux, plaquettes thermoformées, boîtes en plastique, sachets individuels, sachets, emballages en carton, présentoirs et autres), par matériau (plastique, papier et carton, métal, verre et autres), par type de produit (emballages à l’épreuve des enfants, kits de marque, emballages nomades, emballages à usage unique, sachets individuels, kits de démarrage et de démonstration et autres), par revêtement et impressions spéciales (effets métalliques, vernis brillant et UV en relief, marquage à chaud, gaufrage et débossage, revêtements nacrés, effets de réticulation, revêtements spéciaux et autres), par nature (conventionnel, écologique et recyclable), par catégorie (emballage standard et emballage personnalisé), par utilisateur final (détaillant et industriel) et par application (boissons fonctionnelles, aliments fonctionnels, compléments alimentaires, produits à base de plantes, nutricosmétiques, aliments médicinaux, suppléments de nutriments isolés et autres). Forme du produit fini (sec et liquide) - Tendances et prévisions du secteur jusqu'en 2033

Taille du marché des emballages nutraceutiques en Amérique du Nord

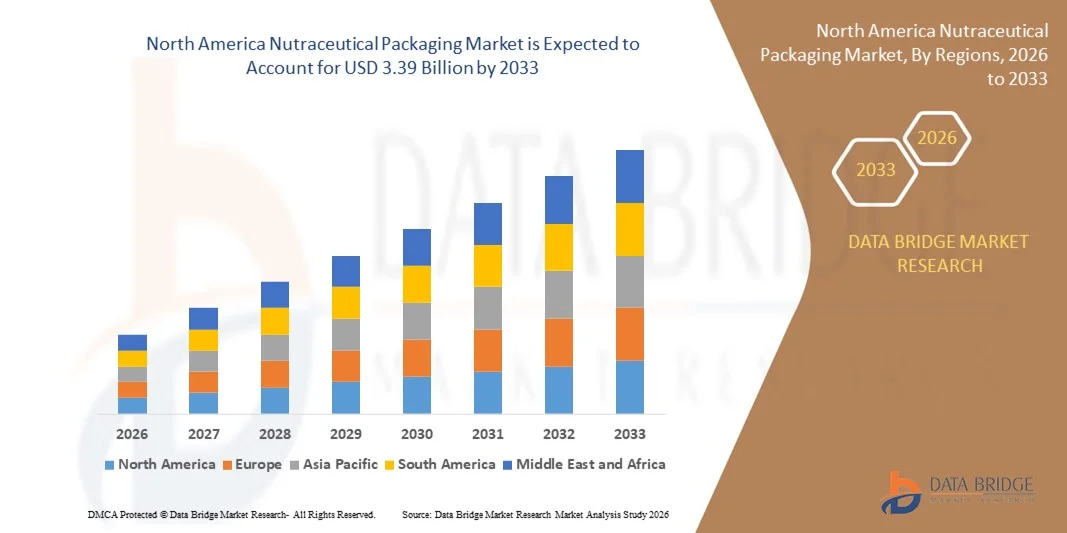

- Le marché nord-américain des emballages nutraceutiques était évalué à 2,16 milliards de dollars américains en 2025 et devrait atteindre 3,39 milliards de dollars américains d'ici 2033 , avec un TCAC de 5,80 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la demande croissante des consommateurs pour les compléments alimentaires, les aliments fonctionnels et les boissons enrichies aux États-Unis et au Canada.

- L'attention accrue portée à la sécurité des produits, à l'allongement de leur durée de conservation et au respect des normes réglementaires strictes favorise l'adoption de solutions d'emballage avancées et de haute qualité.

Analyse du marché des emballages nutraceutiques en Amérique du Nord

- Le marché connaît une croissance soutenue, stimulée par une sensibilisation accrue à la santé et une tendance à la prévention chez les consommateurs, ce qui encourage une consommation plus importante de produits nutraceutiques.

- Les fabricants d'emballages se concentrent sur des formats innovants tels que les emballages inviolables, résistants à l'humidité et à l'épreuve des enfants afin d'améliorer la protection des produits et le confort des consommateurs.

- Le marché américain des emballages pour produits nutraceutiques a généré la plus grande part de revenus en Amérique du Nord en 2025, porté par la consommation croissante de compléments alimentaires, de boissons fonctionnelles et de produits à base de plantes. Les consommateurs privilégient de plus en plus les emballages qui préservent la qualité du produit, facilitent le transport et offrent un confort d'utilisation au quotidien.

- Le Canada devrait connaître le taux de croissance annuel composé (TCAC) le plus élevé du marché nord-américain des emballages nutraceutiques, en raison de la tendance croissante des consommateurs à privilégier leur santé, de la demande accrue de solutions d'emballage durables et écologiques et des investissements croissants dans les aliments fonctionnels et les compléments alimentaires. L'expansion des circuits de distribution et du commerce électronique contribue également à accélérer la croissance du marché.

- En 2025, le segment des flacons a représenté la plus grande part de revenus du marché, grâce à leur praticité, leur facilité de transport et leur compatibilité avec les produits nutraceutiques, qu'ils soient secs ou liquides. Les flacons permettent également l'utilisation de bouchons inviolables, un étiquetage aisé et un dosage précis, ce qui les rend idéaux pour les compléments alimentaires et les produits à base de plantes. De plus, les fabricants privilégient les flacons pour la production en grande quantité et la présentation en rayon.

Portée du rapport et segmentation du marché des emballages nutraceutiques en Amérique du Nord

|

Attributs |

Aperçu du marché nord-américain des emballages nutraceutiques |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Tendances du marché des emballages nutraceutiques en Amérique du Nord

Demande croissante de solutions d'emballage innovantes et durables

- L'intérêt croissant pour la santé, le bien-être et la praticité influence fortement le marché des emballages nutraceutiques, les consommateurs privilégiant de plus en plus les produits garantissant sécurité, fraîcheur et facilité de consommation. Les solutions d'emballage avancées gagnent du terrain grâce à leur capacité à préserver la stabilité des produits, prolonger leur durée de conservation et améliorer la précision du dosage sans compromettre la qualité. Cette tendance favorise leur adoption dans les compléments alimentaires, les aliments fonctionnels et les boissons nutraceutiques, incitant les fabricants à innover et à proposer de nouveaux formats répondant aux attentes changeantes des consommateurs.

- La sensibilisation croissante à la médecine préventive, à la nutrition personnalisée et au bien-être par le mode de vie a accéléré la demande d'emballages innovants pour les gélules, comprimés, poudres et compléments liquides. Les consommateurs recherchent activement des emballages pratiques et sûrs, incitant les marques à privilégier des solutions fonctionnelles, inviolables et écologiques. Cette tendance encourage également les collaborations entre les fournisseurs de solutions d'emballage et les fabricants de compléments alimentaires afin d'améliorer la performance des produits et leur attrait pour les consommateurs.

- Les tendances en matière de durabilité et de praticité influencent les décisions d'achat, les fabricants privilégiant les matériaux recyclables, une production écoresponsable et des emballages facilitant le dosage. Ces facteurs permettent aux marques de se démarquer sur un marché concurrentiel, de renforcer la confiance des consommateurs et de soutenir des campagnes marketing mettant en avant les avantages fonctionnels et durables.

- Par exemple, en 2024, Nestlé Health Science a lancé des emballages écologiques et inviolables pour ses compléments alimentaires en poudre, améliorant ainsi la sécurité et la durée de conservation des produits tout en renforçant ses initiatives de développement durable et la confiance des consommateurs.

- Alors que la demande d'emballages pour produits nutraceutiques est en croissance, la pérennité du développement du marché repose sur des investissements continus en R&D, une production rentable et la mise au point de solutions innovantes alliant protection, praticité et respect de l'environnement. Les fabricants s'attachent également à optimiser leur production, à améliorer l'efficacité de leur chaîne d'approvisionnement et à innover en matière de matériaux afin de répondre à la demande mondiale.

Dynamique du marché des emballages nutraceutiques en Amérique du Nord

Conducteur

Préférence croissante pour les emballages sûrs, pratiques et durables

- La demande croissante des consommateurs pour des emballages fonctionnels, sûrs et pratiques est un moteur essentiel du marché des emballages pour produits nutraceutiques. Les fabricants adoptent de plus en plus des formats inviolables, à l'épreuve des enfants et à portions contrôlées afin de se conformer aux normes réglementaires, d'améliorer l'attrait des produits et de garantir la sécurité des consommateurs. Cette tendance stimule également la recherche sur de nouveaux matériaux durables, favorisant la différenciation des produits et le respect de l'environnement.

- L'expansion des applications dans les compléments alimentaires, les aliments fonctionnels, les boissons enrichies et les poudres nutraceutiques influence la croissance du marché. Les emballages avancés contribuent à améliorer la durée de conservation, la stabilité et la praticité pour le consommateur tout en préservant l'intégrité du produit, permettant ainsi aux fabricants de répondre aux attentes des consommateurs en matière de qualité et de sécurité.

- Les fabricants de produits nutraceutiques promeuvent activement des solutions d'emballage innovantes par le biais du développement de produits, de campagnes marketing et de certifications sectorielles. Ces efforts sont soutenus par la préférence croissante des consommateurs pour des produits axés sur la santé et respectueux de l'environnement, encourageant les partenariats entre les fournisseurs d'emballages et les marques afin d'améliorer la fonctionnalité et de réduire l'impact environnemental.

- Par exemple, en 2023, GSK Consumer Healthcare a lancé des plaquettes thermoformées à portions contrôlées pour les multivitamines, améliorant ainsi la précision et la praticité du dosage, tout en prolongeant la durée de conservation du produit et en améliorant la satisfaction des consommateurs.

- Bien que la demande croissante d'emballages sûrs, pratiques et durables soutienne la croissance du marché, leur adoption à plus grande échelle dépend de l'optimisation des coûts, de la disponibilité des matières premières et de procédés de fabrication adaptables. Investir dans l'automatisation des emballages, les matériaux durables et les technologies de formulation avancées sera essentiel pour répondre à la demande mondiale et conserver un avantage concurrentiel.

Retenue/Défi

Coût plus élevé et sensibilisation limitée par rapport aux emballages conventionnels

- Le coût relativement plus élevé des emballages nutraceutiques de pointe par rapport aux options conventionnelles demeure un défi majeur, limitant leur adoption par les fabricants sensibles aux prix. Le coût plus élevé des matériaux, la complexité des techniques de production et les exigences de conformité contribuent à l'augmentation des prix et affectent la pénétration du marché.

- La sensibilisation des consommateurs et des fabricants reste inégale, notamment sur les marchés où la demande d'emballages de haute qualité, sûrs et durables est encore en développement. Une compréhension limitée des avantages fonctionnels freine l'adoption de ces emballages dans certaines catégories de produits et ralentit l'innovation.

- Les défis liés à la chaîne d'approvisionnement et à la production ont également un impact sur la croissance du marché, car les emballages spécialisés exigent le respect de normes de qualité et de procédures de manutention strictes. La complexité logistique, les contraintes liées à la durée de conservation et les exigences de stockage augmentent les coûts opérationnels, ce qui nécessite des investissements dans des réseaux de manutention et de distribution adaptés.

- Par exemple, en 2024, une marque leader de produits nutraceutiques a retardé le lancement de sa gamme de gélules végétales en raison de coûts de production plus élevés et d'une sensibilisation limitée aux avantages des emballages écologiques, illustrant ainsi les difficultés liées à la maîtrise des coûts et à la sensibilisation du marché.

- Pour relever ces défis, il faudra une production rentable, des réseaux de distribution plus étendus et des initiatives éducatives ciblées à destination des fabricants et des consommateurs. La collaboration avec les fournisseurs de solutions d'emballage, les détaillants et les organismes de certification peut libérer un potentiel de croissance à long terme, tandis que le développement de formats d'emballage durables, fonctionnels et compétitifs en termes de coûts sera essentiel à leur adoption généralisée.

Portée du marché des emballages nutraceutiques en Amérique du Nord

Le marché est segmenté en fonction du type, du type de matériau, du type de produit, du revêtement d'emballage et des impressions spéciales, de la nature, de la catégorie, de l'utilisateur final, de l'application et de la forme du produit final.

- Par type

Le marché nord-américain des emballages pour produits nutraceutiques est segmenté, selon le type d'emballage, en flacons, boîtes et pots, plaquettes thermoformées, emballages en flacons, sachets individuels, sachets, cartons, présentoirs et autres. En 2025, le segment des flacons représentait la plus grande part de marché en termes de chiffre d'affaires, grâce à leur praticité, leur facilité de transport et leur compatibilité avec les produits nutraceutiques secs et liquides. Les flacons offrent également la possibilité d'utiliser des bouchons inviolables, un étiquetage aisé et un dosage précis, ce qui les rend idéaux pour les compléments alimentaires et les produits à base de plantes. De plus, les fabricants privilégient les flacons pour la production en grande quantité et la présentation en rayon.

Le segment des sachets et poches devrait connaître la croissance la plus rapide entre 2026 et 2033, porté par la demande croissante de solutions d'emballage souples et de portions individuelles. Ces formats offrent des options de fermeture refermables, une meilleure portabilité et une protection accrue contre l'humidité et l'air. Les sachets et poches sont de plus en plus utilisés pour les sticks, les kits de mobilité et les aliments fonctionnels, améliorant ainsi le confort d'utilisation et l'attractivité des marques.

- Par type de matériau

Le marché nord-américain des emballages nutraceutiques est segmenté selon le type de matériau : plastique, papier et carton, métal, verre et autres. En 2025, le plastique représentait la part la plus importante grâce à sa polyvalence, sa durabilité et son rapport coût-efficacité. Il offre une excellente barrière contre l’humidité et l’oxygène, prolongeant ainsi la durée de conservation, et est compatible avec de nombreux types de fermetures et techniques d’impression. Les fabricants privilégient également le plastique pour la production à grande échelle et sa légèreté, qui réduit les coûts logistiques.

Le secteur du papier et du carton devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par la préférence croissante des consommateurs pour les emballages écologiques et recyclables. Les matériaux à base de papier sont largement utilisés pour les cartons, les présentoirs et les emballages secondaires, offrant une esthétique haut de gamme et de nombreuses opportunités de valorisation de la marque. Les tendances en matière d'emballage durable et les réglementations gouvernementales encourageant la réduction de l'utilisation du plastique contribuent également à accélérer son adoption.

- Par type de produit

Le marché nord-américain des emballages nutraceutiques est segmenté, selon le type de produit, en emballages à l'épreuve des enfants, coffrets de marque, emballages nomades, emballages à usage unique, sachets individuels, kits de démarrage et de démonstration, et autres. Les emballages à l'épreuve des enfants ont dominé le marché en 2025, en raison des exigences réglementaires et des préoccupations liées à la sécurité, notamment pour les compléments alimentaires et les médicaments. Ce type d'emballage garantit un stockage sûr, réduit les risques d'ingestion accidentelle et préserve la confiance des consommateurs.

Le segment de la mobilité nomade devrait connaître la croissance la plus rapide entre 2026 et 2033, porté par la demande de produits portables et pratiques. Ces solutions répondent aux besoins des consommateurs actifs qui privilégient les portions individuelles pour leurs déplacements, le bureau ou la salle de sport. Ce segment s'inscrit également dans les tendances actuelles axées sur la santé, le bien-être et la consommation immédiate.

- Par revêtement d'emballage et impressions spéciales

Le marché nord-américain des emballages nutraceutiques est segmenté, en fonction des revêtements et impressions spéciales, en finitions métallisées, vernis brillant et UV en relief, marquage à chaud, gaufrage et débossage, vernis nacrés, effets réticulés, et autres. Les finitions brillantes et UV en relief ont dominé le marché en 2025 grâce à leur capacité à optimiser l'attractivité en rayon et la visibilité de la marque. Ces revêtements améliorent l'esthétique, ajoutent de la texture et protègent les impressions contre l'abrasion et la décoloration.

Le segment des revêtements spéciaux devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par la demande croissante d'emballages haut de gamme aux finitions uniques. Le gaufrage, le débossage, les reflets métalliques et les revêtements nacrés permettent aux produits de se démarquer sur les étagères saturées. L'importance accrue accordée à l'identité de marque et à une expérience client de qualité supérieure favorise l'adoption de ces innovations en matière d'emballage.

- Par nature

Selon leur nature, le marché nord-américain des emballages nutraceutiques se divise en trois catégories : conventionnels, écologiques et recyclables. En 2025, les emballages conventionnels détenaient la part de marché la plus importante grâce à des procédés de production éprouvés, une large disponibilité et des coûts plus faibles. Ils restent prédominants pour les compléments alimentaires classiques et les aliments fonctionnels ne nécessitant pas d’étiquetage durable.

Le marché des emballages écologiques devrait connaître la croissance la plus rapide entre 2026 et 2033, porté par la sensibilisation des consommateurs et les politiques réglementaires favorisant les matériaux durables. Parmi les solutions envisagées figurent les plastiques biodégradables, le carton recyclable et les contenants réutilisables. L'importance croissante accordée par les marques aux initiatives écologiques et à la réduction de leur impact environnemental contribue également à cette adoption.

- Par catégorie

Le marché nord-américain des emballages nutraceutiques se divise, selon la catégorie, en emballages standards et emballages personnalisés. En 2025, les emballages standards représentaient la part de marché la plus importante grâce à leur standardisation, leur facilité de production en série et leur rentabilité. Ils conviennent à la plupart des compléments alimentaires, aliments fonctionnels et produits à base de plantes sans modifications majeures.

Le marché des emballages personnalisés devrait connaître la croissance la plus rapide entre 2026 et 2033, porté par les marques en quête de différenciation et d'expériences client personnalisées. Les options incluent des graphismes, des couleurs, des formats et des coffrets en édition limitée sur mesure. La demande croissante de produits nutraceutiques par abonnement et de campagnes promotionnelles de marques soutient cette tendance.

- Par l'utilisateur final

Selon l'utilisateur final, le marché nord-américain des emballages nutraceutiques se divise en deux segments : la vente au détail et l'industrie. Le segment de la vente au détail a dominé en 2025 grâce aux fortes ventes directes aux consommateurs de compléments alimentaires, d'aliments fonctionnels et de produits à base de plantes. Les solutions d'emballage sont conçues pour séduire les consommateurs, en garantissant visibilité, praticité et sécurité.

Le segment industriel devrait connaître la croissance la plus rapide entre 2026 et 2033, en raison des besoins en emballages en vrac des fabricants et des distributeurs. Ces emballages privilégient généralement la durabilité, l'efficacité du transport et l'optimisation des coûts. Le développement de la sous-traitance et des marques de distributeur contribue également à cette croissance.

- Sur demande

Selon l'application, le marché nord-américain des emballages nutraceutiques se segmente en boissons fonctionnelles, aliments fonctionnels, compléments alimentaires, produits à base de plantes, nutricosmétiques, aliments médicinaux, suppléments de nutriments isolés et autres. Les compléments alimentaires détenaient la plus grande part de marché en 2025, grâce à leur forte popularité pour renforcer l'immunité, gérer le poids et améliorer le bien-être général.

Le secteur des nutricosmétiques devrait connaître la croissance la plus rapide entre 2026 et 2033, porté par l'intérêt croissant des consommateurs pour l'anti-âge, la santé de la peau et la nutrition personnalisée. Les boissons fonctionnelles et les produits à base de plantes connaissent également une demande accrue, dans le contexte de l'essor des tendances bien-être liées au mode de vie.

- Forme du produit final

Selon la forme du produit fini, le marché nord-américain des emballages nutraceutiques se divise en deux catégories : les produits secs et les produits liquides. Les produits secs dominaient le marché en 2025 grâce à leur longue durée de conservation, leur facilité de manipulation et leur compatibilité avec de nombreux formats d’emballage. Les poudres, les gélules et les comprimés restent largement utilisés dans les compléments alimentaires et les aliments fonctionnels.

La forme liquide devrait connaître la croissance la plus rapide entre 2026 et 2033, en raison de la demande croissante de boissons prêtes à consommer et de compléments alimentaires liquides. Pratiques et à absorption rapide, les produits liquides sont de plus en plus plébiscités par les consommateurs actifs.

Analyse régionale du marché des emballages nutraceutiques en Amérique du Nord

- Le marché américain des emballages pour produits nutraceutiques a généré la plus grande part de revenus en Amérique du Nord en 2025, porté par la consommation croissante de compléments alimentaires, de boissons fonctionnelles et de produits à base de plantes. Les consommateurs privilégient de plus en plus les emballages qui préservent la qualité du produit, facilitent le transport et offrent un confort d'utilisation au quotidien.

- La tendance croissante de la nutrition personnalisée, des produits de bien-être par abonnement et des solutions d'emballage prêtes à la vente au détail stimule davantage la croissance du marché.

- De plus, des normes réglementaires strictes, des technologies d'emballage innovantes et l'adoption généralisée de matériaux écologiques contribuent de manière significative à l'expansion du marché.

Aperçu du marché canadien de l'emballage nutraceutique

Le marché canadien des emballages nutraceutiques devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par la demande croissante d'aliments fonctionnels, de suppléments nutraceutiques et de produits nutraceutiques liquides. Les consommateurs privilégient les emballages durables, à l'épreuve des enfants et pratiques à emporter, qui allient commodité et sécurité. L'essor des modes de vie axés sur la santé, la pénétration croissante du commerce électronique et l'adoption de matériaux d'emballage souples et recyclables stimulent davantage l'expansion du marché. De plus, les initiatives gouvernementales encourageant les produits de bien-être et les solutions d'emballage écologiques contribuent à cette croissance rapide.

Part de marché des emballages nutraceutiques en Amérique du Nord

L'industrie nord-américaine de l'emballage des produits nutraceutiques est principalement dominée par des entreprises bien établies, notamment :

• MJS Packaging (États-Unis)

• Comar Packaging Solutions (États-Unis)

• Glenroy, Inc. (États-Unis)

• JohnsByrne Company (États-Unis)

• Amgraph Packaging, Inc. (États-Unis) •

Birchwood Contract Manufacturing

(États-Unis) • Alpha Packaging (États-Unis)

• TricorBraun Inc. (États-Unis) •

Sonoco Products Company (

États-Unis) • AptarGroup, Inc. (États-Unis)

• Maco PKG (États-Unis)

• Berlin Packaging (États-Unis)

• Sealed Air Corporation (États-Unis)

• PolyOne Corporation (États-Unis)

• CCL Industries (Canada)

Dernières évolutions du marché nord-américain de l'emballage des produits nutraceutiques

- En juin 2024, Keystone Folding Box, spécialiste nord-américain de l'emballage carton, a lancé un blister en carton sous la marque Push-Pak pour les comprimés médicaux. Ce nouveau système d'ouverture par simple pression simplifie l'utilisation en éliminant les instructions d'ouverture complexes, tandis que la conception encastrée à ouverture par pression réduit la taille de l'emballage. Cette innovation améliore le confort du consommateur et optimise l'utilisation de l'espace en rayon, renforçant ainsi la position de l'entreprise sur le marché des emballages médicaux et nutraceutiques.

- En avril 2024, Berry Global, fournisseur américain de solutions d'emballage, a lancé deux emballages légers pour poudre protéinée, conçus pour réduire la quantité de matériaux utilisés et minimiser l'impact environnemental. Ces nouveaux emballages intègrent une technologie cellulaire exclusive et une expertise en ingénierie, réduisant ainsi l'impact environnemental et offrant des solutions durables. Cette innovation renforce l'avantage concurrentiel de Berry Global sur les marchés des compléments protéinés et des nutraceutiques en Amérique du Nord.

- En avril 2022, Amcor plc, entreprise mondiale d'emballage présente en Amérique du Nord, a enrichi sa gamme d'emballages pharmaceutiques et nutraceutiques avec de nouveaux laminés High Shield durables. Ces laminés à faible empreinte carbone et recyclables offrent une haute performance de barrière tout en favorisant le recyclage, ce qui profite aux fabricants soucieux de l'environnement et renforce la position de leader d'Amcor sur le marché nord-américain des solutions d'emballage durables.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.