North America Nutraceutical Excipients Market

Taille du marché en milliards USD

TCAC :

%

USD

1.42 Billion

USD

2.65 Billion

2024

2032

USD

1.42 Billion

USD

2.65 Billion

2024

2032

| 2025 –2032 | |

| USD 1.42 Billion | |

| USD 2.65 Billion | |

|

|

|

|

Segmentation du marché des excipients nutraceutiques en Amérique du Nord, par type (agents aromatisants, colorants, édulcorants, agents d'enrobage, tampons, solvants, supports, antimousses, agents de glissement, agents mouillants, épaississants/gélifiants, conservateurs, liants, désintégrants, lubrifiants, charges et diluants, etc.), produit final (prébiotiques, probiotiques , compléments protéiques et acides aminés, compléments minéraux, compléments vitaminiques, compléments oméga-3, etc.), forme (sèche et liquide), provenance des excipients (naturels et synthétiques), canal de distribution (vente directe, vente au détail, etc.) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des excipients nutraceutiques en Amérique du Nord

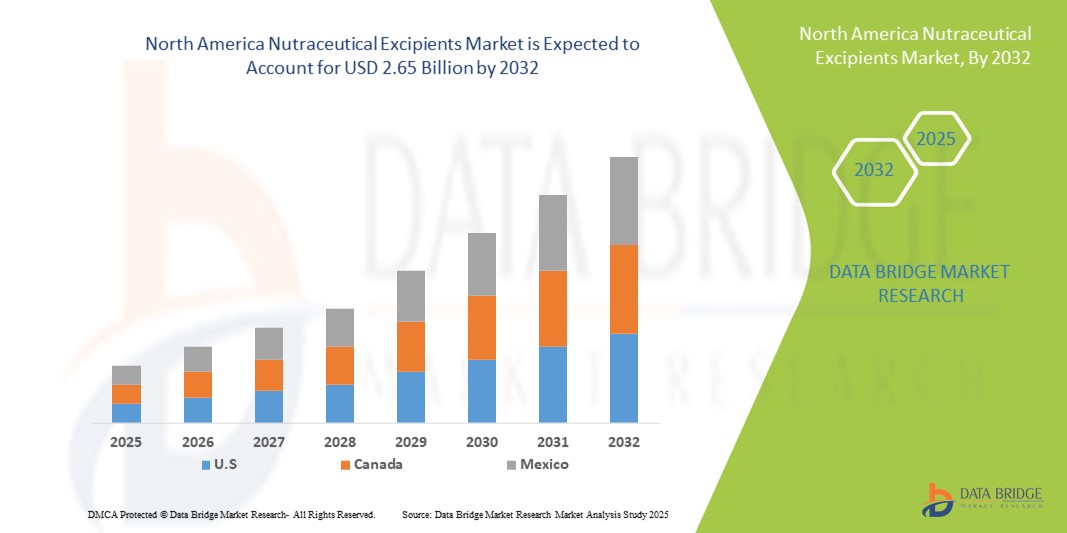

- La taille du marché nord-américain des excipients nutraceutiques était évaluée à 1,42 milliard USD en 2024 et devrait atteindre 2,65 milliards USD d'ici 2032 , à un TCAC de 8,00 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la demande croissante de produits nutraceutiques, associée aux avancées technologiques dans les formulations d'excipients, conduisant à une amélioration de la stabilité des produits, de la biodisponibilité et de l'acceptation des consommateurs dans les compléments alimentaires, les aliments fonctionnels et les boissons.

- Par ailleurs, la sensibilisation croissante des consommateurs aux questions de santé et de bien-être, ainsi que leur préférence croissante pour des solutions nutraceutiques sûres, efficaces et pratiques, incitent les fabricants à développer des excipients innovants. Ces facteurs convergents accélèrent l'adoption d'excipients nutraceutiques avancés, stimulant ainsi significativement la croissance globale du marché.

Analyse du marché nord-américain des excipients nutraceutiques

- Les excipients nutraceutiques, utilisés comme ingrédients fonctionnels dans les compléments alimentaires, les aliments fonctionnels et les formulations nutraceutiques, jouent un rôle de plus en plus crucial pour améliorer la stabilité, la biodisponibilité et l'efficacité globale des composés actifs. Leur adoption est motivée par l'intérêt croissant des consommateurs pour la santé et le bien-être, la demande croissante de produits enrichis et l'innovation continue des technologies de formulation.

- La croissance du marché est largement alimentée par la demande croissante d'excipients de haute qualité dans les compléments alimentaires, les aliments fonctionnels et les formulations nutraceutiques, stimulée par une sensibilisation croissante à la santé et des tendances en matière de soins de santé préventifs aux États-Unis.

- Les États-Unis ont dominé le marché des excipients nutraceutiques, enregistrant la plus forte part de chiffre d'affaires (71,5 %) en 2024, grâce à une infrastructure de santé solide, une forte sensibilisation des consommateurs aux questions de santé et de bien-être, et la présence de fournisseurs d'ingrédients de premier plan. La consommation croissante de compléments alimentaires et d'aliments fonctionnels, conjuguée aux innovations constantes en matière de formulations nutraceutiques, stimule la croissance du marché.

- Le Canada devrait être le pays connaissant la croissance la plus rapide sur le marché des excipients nutraceutiques au cours de la période de prévision, avec un TCAC prévu de 11,5 % de 2025 à 2032, soutenu par l'attention croissante du gouvernement sur la santé, la disponibilité croissante de produits nutraceutiques avancés et l'adoption croissante par les consommateurs de solutions de soins de santé préventifs.

- Le segment des formes sèches a dominé le marché des excipients nutraceutiques avec une part de 62,1 % en 2024, soutenu par sa facilité de manipulation, sa stabilité et sa durée de conservation plus longue.

Portée du rapport et segmentation du marché des excipients nutraceutiques

|

Attributs |

Informations clés sur le marché des excipients nutraceutiques |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des excipients nutraceutiques en Amérique du Nord

Formulation améliorée et intégration fonctionnelle

- Une tendance importante et croissante sur le marché nord-américain des excipients nutraceutiques est l'accent croissant mis sur le développement d'excipients améliorant la stabilité, la biodisponibilité et l'efficacité des ingrédients actifs nutraceutiques. Cette tendance stimule l'innovation dans les compléments alimentaires et les aliments fonctionnels.

- Par exemple, les entreprises introduisent des excipients avancés qui améliorent la solubilité, masquent les saveurs désagréables et soutiennent les formulations à libération contrôlée, augmentant ainsi la performance globale des produits nutraceutiques.

- Les excipients innovants permettent désormais aux formulateurs de combiner plusieurs ingrédients actifs sans compromettre la stabilité, ce qui facilite le développement de produits de santé multifonctionnels.

- L'intégration transparente de ces excipients dans les formulations nutraceutiques permet aux fabricants de répondre aux demandes des consommateurs en matière de produits de haute qualité, sûrs et efficaces, tout en respectant les normes réglementaires.

- Cette tendance vers des excipients plus efficaces, fonctionnels et polyvalents transforme en profondeur les stratégies de développement de produits dans l'industrie nutraceutique. Les entreprises investissent en R&D pour créer des excipients de nouvelle génération qui favorisent l'immunité, la santé cognitive, le bien-être digestif et d'autres bienfaits pour la santé.

- La demande d'excipients nutraceutiques avancés augmente rapidement dans les secteurs des compléments alimentaires et des aliments fonctionnels, car les consommateurs accordent de plus en plus d'importance à l'efficacité, à la sécurité et à la commodité des produits.

Dynamique du marché nord-américain des excipients nutraceutiques

Conducteur

Demande croissante en raison de la sensibilisation à la santé et de l'adoption des produits nutraceutiques

- L'intérêt croissant des consommateurs pour la santé, le bien-être et la nutrition préventive est un facteur majeur de la demande accrue d'excipients nutraceutiques. La sensibilisation croissante aux bienfaits des compléments alimentaires, des aliments fonctionnels et des boissons enrichies incite les fabricants à développer des excipients de haute qualité qui améliorent la biodisponibilité, la stabilité et l'attrait sensoriel.

- Par exemple, en avril 2024, Ingredion Incorporated a annoncé le lancement d'une nouvelle gamme d'excipients prébiotiques naturels conçus pour améliorer l'efficacité des compléments alimentaires. Ces innovations stratégiques, mises en œuvre par des entreprises clés, devraient stimuler la croissance du marché des excipients nutraceutiques durant la période de prévision.

- Alors que les consommateurs recherchent de plus en plus des produits de santé fonctionnels et pratiques, les excipients qui permettent une libération prolongée, une solubilité et une appétence améliorées deviennent des composants essentiels dans les formulations de produits.

- En outre, la préférence croissante pour les ingrédients d'origine végétale, propres et naturels encourage l'adoption d'excipients spécialisés qui répondent aux attentes réglementaires et des consommateurs en matière de transparence et de sécurité.

- La polyvalence des excipients nutraceutiques dans divers formats de produits, y compris les poudres, les capsules, les liquides et les boissons fonctionnelles, et leur compatibilité avec les technologies de formulation avancées sont des facteurs clés qui stimulent l'expansion du marché.

- L'accent mis par les fabricants sur la recherche et le développement, combiné à des collaborations avec des producteurs de compléments alimentaires, garantit la disponibilité de solutions d'excipients innovantes et conviviales, stimulant ainsi davantage la croissance du marché.

Retenue/Défi

Conformité réglementaire et contraintes de coûts

- Les exigences réglementaires strictes pour les excipients de qualité alimentaire et nutraceutique constituent un défi pour les acteurs du marché, car la conformité aux normes de la FDA, de l'EFSA et d'autres normes nécessite des tests et une certification rigoureux.

- Les excipients de haute qualité impliquent souvent des processus de production et d’approvisionnement en matières premières complexes, ce qui peut augmenter les coûts de production et avoir un impact sur les prix des produits finis, les rendant moins accessibles aux fabricants à petite échelle ou aux consommateurs sensibles aux prix.

- Il est essentiel de garantir la cohérence des performances fonctionnelles, de la pureté et de la stabilité entre les lots, car les écarts peuvent affecter l'efficacité et la sécurité des produits nutraceutiques, créant ainsi un défi supplémentaire pour les fabricants.

- La croissance du marché peut également être entravée par les contraintes de la chaîne d’approvisionnement, en particulier pour les excipients naturels et à base de plantes, qui dépendent des productions agricoles et de la disponibilité saisonnière.

- La connaissance limitée des petits fabricants concernant les fonctionnalités et les innovations avancées en matière d'excipients peut ralentir l'adoption, en particulier pour les formulations spécialisées nécessitant une expertise technique.

- La pression concurrentielle exercée par les fournisseurs d’excipients génériques à bas prix peut réduire les marges bénéficiaires des fabricants d’excipients de qualité supérieure, ce qui rend difficile le maintien des investissements à long terme dans l’innovation et l’amélioration de la qualité.

- Surmonter ces défis grâce à des investissements dans la R&D, des technologies de fabrication avancées, un approvisionnement stratégique en matières premières et la formation des utilisateurs finaux sera essentiel pour garantir des offres d'excipients nutraceutiques de haute qualité, rentables et conformes pour une croissance soutenue du marché.

Portée du marché nord-américain des excipients nutraceutiques

Le marché est segmenté en fonction du type, du produit final, de la forme, de la source d’excipient et du canal de distribution.

- Par type

Le marché des excipients nutraceutiques est segmenté en fonction de leur type : arômes, colorants, édulcorants, agents d’enrobage, tampons, solvants, excipients, antimousses, agents de glissement, agents mouillants, épaississants/gélifiants, conservateurs, liants, désintégrants, lubrifiants, charges et diluants, entre autres. En 2024, le segment des édulcorants a dominé le marché avec 28,5 % de chiffre d’affaires, porté par la demande croissante de formulations nutraceutiques sans sucre et hypocaloriques. Les édulcorants améliorent les profils gustatifs tout en préservant la stabilité du produit, ce qui en fait des compléments alimentaires essentiels pour un usage facile. La préférence croissante pour les édulcorants « clean label » et naturels renforce encore cette position dominante. Les autorisations réglementaires et le respect des normes de sécurité favorisent également leur adoption généralisée. Les édulcorants sont compatibles avec de multiples formes d’administration, telles que les comprimés, les poudres et les boissons, ce qui favorise leur utilisation dans diverses gammes de produits. Les fabricants continuent d’innover avec de nouveaux agents édulcorants pour améliorer la solubilité, le masquage de la saveur et les avantages fonctionnels, renforçant ainsi la position de leader de ce sous-segment.

Le segment des épaississants/gélifiants devrait connaître le TCAC le plus rapide, soit 19,6 %, entre 2025 et 2032, grâce à l'essor des applications dans les aliments et boissons fonctionnels. Ces agents améliorent la texture, la sensation en bouche et la stabilité des produits nutraceutiques, notamment dans les formulations prébiotiques et protéiques. La préférence croissante des consommateurs pour des boissons à haute viscosité et des compléments alimentaires prêts à boire, visuellement attrayants, accélère la demande. Les innovations dans le domaine des gélifiants végétaux et naturels stimulent également la croissance. Les épaississants/gélifiants permettent également une meilleure encapsulation des principes actifs, améliorant ainsi la biodisponibilité et la durée de conservation. Les acteurs du marché développent leurs activités de R&D pour développer des épaississants multifonctionnels qui agissent également comme stabilisants ou supports, renforçant ainsi leur potentiel commercial.

- Par produit final

En fonction du produit final, le marché des excipients nutraceutiques est segmenté en prébiotiques, probiotiques, compléments protéiques et acides aminés, compléments minéraux, compléments vitaminiques, compléments d'oméga-3 et autres. Le segment des compléments vitaminiques dominait avec une part de marché de 34,2 % en 2024, porté par une sensibilisation croissante aux carences en micronutriments et l'intérêt croissant des consommateurs pour l'immunité et le bien-être général. Les vitamines sont essentielles à tous les âges et sont largement incorporées dans les formules multivitaminées, ce qui favorise une forte pénétration du marché. Ce segment bénéficie d'une intégration aisée avec divers excipients et formats de compléments. Le soutien réglementaire à l'enrichissement et aux produits clean label renforce encore leur adoption. Les vitamines sont de plus en plus associées à d'autres ingrédients bioactifs pour offrir des bienfaits accrus pour la santé, stimulant ainsi la croissance du chiffre d'affaires.

Le segment des compléments alimentaires en protéines et acides aminés devrait connaître le TCAC le plus rapide, soit 17,8 % entre 2025 et 2032, grâce à une adoption croissante par les amateurs de fitness, les athlètes et les personnes âgées. Les régimes hyperprotéinés pour le développement musculaire, la récupération et la gestion du poids stimulent la demande. Le développement de protéines en poudre aromatisées et prêtes à l'emploi soutient la croissance. Les progrès réalisés dans les excipients protéiques naturels, améliorant la solubilité et la texture, accélèrent encore la pénétration du marché. Les compléments alimentaires en protéines se diversifient également dans les boissons fonctionnelles et les substituts de repas, améliorant ainsi leur visibilité sur le marché et stimulant une croissance rapide.

- Par formulaire

Sur le plan de la forme, le marché des excipients nutraceutiques est segmenté en excipients secs et excipients liquides. Le segment des excipients secs dominait le marché avec une part de 62,1 % en 2024, grâce à sa facilité de manipulation, sa stabilité et sa durée de conservation prolongée. Les excipients secs sont très polyvalents et conviennent aux comprimés, aux gélules et aux produits en poudre, tout en permettant un dosage précis et en améliorant l'efficacité de la fabrication. Ce segment bénéficie d'innovations continues en matière de techniques de granulation, de fluidité et de compressibilité, qui améliorent la consistance des produits et l'efficacité des procédés. La demande des fabricants de produits pharmaceutiques et de compléments alimentaires maintient la prédominance des excipients secs en Amérique du Nord, car ils constituent la base de la production à grande échelle.

Le segment des formes liquides devrait connaître le TCAC le plus rapide, soit 15,4 % entre 2025 et 2032, grâce à la popularité croissante des boissons nutraceutiques prêtes à boire et des sirops fonctionnels. Les excipients liquides offrent des avantages tels qu'une absorption plus rapide, une biodisponibilité améliorée et un masquage efficace du goût, ce qui les rend idéaux pour les produits de nutrition pédiatrique, gériatrique et sportive. Ils permettent également l'encapsulation et la stabilisation de composés bioactifs sensibles, élargissant ainsi les possibilités de formulation. La demande croissante de produits nutraceutiques pratiques et prêts à consommer accélère l'adoption des excipients liquides, soutenant ainsi la croissance rapide du marché.

- Par source d'excipient

En fonction de la source des excipients, le marché des excipients nutraceutiques est segmenté en excipients naturels et synthétiques. Le segment d'origine naturelle dominait avec une part de marché de 56,3 % en 2024, porté par la préférence croissante des consommateurs pour les produits clean label et à base de plantes. Les excipients naturels offrent sécurité, conformité réglementaire et attrait marketing accru. Ils sont largement utilisés dans les formulations de compléments alimentaires biologiques et fonctionnels. Ce segment bénéficie d'innovations constantes en matière de technologies d'extraction et de transformation, garantissant homogénéité et pureté. La sensibilisation des consommateurs aux effets secondaires potentiels des ingrédients synthétiques renforce encore cette domination.

Le segment des sources synthétiques devrait connaître le TCAC le plus rapide, soit 16,1 %, entre 2025 et 2032, porté par la demande croissante d'excipients nutraceutiques rentables, évolutifs et hautement fonctionnels. Les excipients synthétiques offrent des avantages tels qu'une solubilité contrôlée, une stabilité accrue et une uniformité constante dans diverses formulations, ce qui les rend particulièrement précieux pour la production commerciale à grande échelle. Leur performance prévisible garantit des résultats de fabrication fiables et contribue au maintien des normes de qualité des produits. La recherche et le développement continus de supports, liants, stabilisants et autres excipients fonctionnels synthétiques haute performance favorisent leur adoption rapide sur le marché. Les fabricants exploitent de plus en plus les sources synthétiques pour optimiser l'efficacité des formulations, réduire la variabilité de la production et répondre à la demande croissante de produits nutraceutiques dans le monde entier. La possibilité de personnaliser les excipients synthétiques pour répondre aux exigences spécifiques des produits renforce leur attrait et accélère la croissance du marché.

- Par canal de distribution

En fonction du canal de distribution, le marché des excipients nutraceutiques est segmenté en appels d'offres directs, ventes au détail et autres. Le segment des appels d'offres directs a dominé le marché avec une part de chiffre d'affaires de 48,7 % en 2024, principalement grâce à des accords d'approvisionnement à grande échelle avec d'importants fabricants de compléments alimentaires et des laboratoires pharmaceutiques. Ce segment garantit un approvisionnement constant et fiable en excipients nutraceutiques, permettant aux entreprises de maintenir des cycles de production ininterrompus. Les appels d'offres directs offrent des avantages tarifaires compétitifs, une stabilité contractuelle à long terme et des gains d'efficacité en matière de commandes groupées, très appréciés par les principaux acteurs du secteur. Des relations B2B solides, des processus d'approvisionnement rationalisés et la capacité à répondre à des demandes importantes renforcent encore la domination de ce segment. De plus, ce segment bénéficie d'un accès privilégié aux nouvelles formulations et innovations en matière d'excipients, permettant aux entreprises de conserver une longueur d'avance sur un marché concurrentiel.

Le segment des ventes au détail devrait connaître le TCAC le plus rapide, soit 14,9 %, entre 2025 et 2032, grâce à l'expansion rapide des canaux de vente en ligne et hors ligne destinés aux fabricants de nutraceutiques de petite et moyenne taille. La disponibilité au détail permet à un plus large public d'accéder facilement aux préparations pré-mélangées, aux gélules, aux poudres et autres produits nutraceutiques. La popularité croissante des plateformes de commerce électronique, conjuguée à la préférence croissante des consommateurs pour les produits prêts à l'emploi et pratiques, accélère la croissance de ce segment. Les canaux de vente au détail permettent également une visibilité accrue des produits, une pénétration plus rapide du marché et une meilleure pénétration des marchés de niche et régionaux. La demande croissante de solutions nutraceutiques personnalisées et en petites quantités renforce l'adoption des modèles de distribution au détail.

Analyse régionale du marché nord-américain des excipients nutraceutiques

- L'Amérique du Nord a dominé le marché des excipients nutraceutiques avec la plus grande part de revenus en 2024, grâce à la sensibilisation croissante des consommateurs à la santé et au bien-être, à la demande croissante de compléments alimentaires et d'aliments fonctionnels et à la présence de fournisseurs clés d'ingrédients nutraceutiques dans la région.

- La croissance du marché est également alimentée par les innovations continues dans les technologies d'excipients qui améliorent la biodisponibilité, la stabilité, le goût et la solubilité des produits nutraceutiques. Les fabricants investissent en R&D pour développer des excipients clean-label, naturels et à base de plantes, répondant ainsi à l'évolution des préférences des consommateurs.

- Des revenus disponibles élevés, une infrastructure de santé solide et des réseaux de distribution bien établis dans la région favorisent l'adoption généralisée des excipients nutraceutiques, tant dans les secteurs des compléments alimentaires que des aliments fonctionnels. L'importance croissante accordée aux soins de santé préventifs et à la nutrition fonctionnelle renforce la position de leader du marché en Amérique du Nord.

Aperçu du marché américain des excipients nutraceutiques

Le marché américain des excipients nutraceutiques a dominé le marché avec une part de chiffre d'affaires record de 71,5 % en 2024, grâce à une infrastructure de santé solide, une forte sensibilisation des consommateurs aux questions de santé et de bien-être, et la présence de fournisseurs d'excipients et d'ingrédients de premier plan. La consommation croissante de compléments alimentaires, de formulations à base de protéines et d'acides aminés, de vitamines et d'aliments fonctionnels, ainsi que les innovations continues dans les technologies d'excipients améliorant la biodisponibilité, la stabilité et l'attrait sensoriel, stimulent la croissance du marché. Ce marché est également stimulé par l'intensification des activités de R&D des fabricants visant à développer des excipients clean label, naturels et à base de plantes, adaptés à l'industrie nutraceutique américaine.

Aperçu du marché canadien des excipients nutraceutiques

Le marché canadien des excipients nutraceutiques devrait connaître la croissance la plus rapide au Canada durant la période de prévision, avec un TCAC de 11,5 % de 2025 à 2032. Cette croissance est soutenue par l'intensification des initiatives gouvernementales favorisant les soins de santé préventifs, la disponibilité croissante de produits nutraceutiques de pointe et l'adoption croissante des aliments fonctionnels et des compléments alimentaires par les consommateurs. L'intérêt croissant pour les excipients « clean label », naturels et à base de plantes, combiné à une forte concentration sur une consommation soucieuse de sa santé, devrait favoriser une expansion soutenue du marché au Canada.

Part de marché des excipients nutraceutiques en Amérique du Nord

L’industrie des excipients nutraceutiques est principalement dirigée par des entreprises bien établies, notamment :

- BASF SE (Allemagne)

- DuPont (États-Unis)

- Ingredion (États-Unis)

- WR Grace and Co (États-Unis)

- Kerry Group plc (Irlande)

- Sensient Technologies Corporation (États-Unis)

- Roquette Frères (France)

- Cargill, Incorporated (États-Unis)

- Ashland (États-Unis)

- SEPPIC (France)

- Gatefosse (France)

- Pioma Chemicals (Inde)

- Omya International AG (Suisse)

- Gangwal Chemicals Private Limited (Inde)

- Grain Processing Corporation (États-Unis)

- IMCD (Pays-Bas)

- JRS PHARMA (Allemagne)

- Azelis (Belgique)

- Jigs Chemical (Inde)

- Sigaichi Industries (Japon)

- Beneo (Allemagne)

- ABITEC (États-Unis)

Derniers développements sur le marché nord-américain des excipients nutraceutiques

- En mars 2024, International Flavors & Fragrances (IFF) a annoncé la cession de son activité Pharma Solutions, qui comprend les excipients pharmaceutiques et la division Global Specialty Solutions, au fabricant français d'ingrédients Roquette pour un montant maximal de 2,85 milliards de dollars, dette comprise. Cette opération stratégique permet à IFF de se concentrer sur ses axes de croissance clés. La transaction devrait être finalisée au premier semestre 2025.

- En avril 2024, Glanbia plc, une société alimentaire mondiale irlandaise, a annoncé l'acquisition d'Aroma Holding Company, une entreprise d'arômes basée aux États-Unis, pour 300 millions de dollars (281 millions d'euros) plus une contrepartie différée pouvant atteindre 55 millions de dollars, sous réserve des performances en 2024. Cette acquisition renforce les capacités de Glanbia sur le marché des excipients nutraceutiques, en particulier au sein de sa division Glanbia Nutritionals.

- En août 2023, Akums Drugs and Pharmaceuticals, une société pharmaceutique indienne, a lancé une formule pour la prise en charge du diabète de type 2 chez les personnes âgées, associant plusieurs médicaments pour aider à contrôler la glycémie. L'entreprise a également commencé à fabriquer des gummies nutraceutiques, élargissant ainsi son offre de produits dans le secteur des excipients nutraceutiques.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.