North America Non Phthalate Plasticizers Market

Taille du marché en milliards USD

TCAC :

%

USD

1.03 Billion

USD

1.62 Billion

2025

2033

USD

1.03 Billion

USD

1.62 Billion

2025

2033

| 2026 –2033 | |

| USD 1.03 Billion | |

| USD 1.62 Billion | |

|

|

|

|

Segmentation du marché nord-américain des plastifiants sans phtalates, par type (plastifiants monomères et polymères), compatibilité PVC (primaire et secondaire), application (revêtements de sol et muraux, câbles et fils électriques, films et feuilles, tissus enduits, adhésifs et mastics, et autres), utilisateur final (bâtiment et construction, automobile, biens de consommation, sports et loisirs, santé, électricité et électronique, agroalimentaire, et autres) - Tendances et prévisions du secteur jusqu'en 2033

Taille du marché des plastifiants sans phtalates en Amérique du Nord

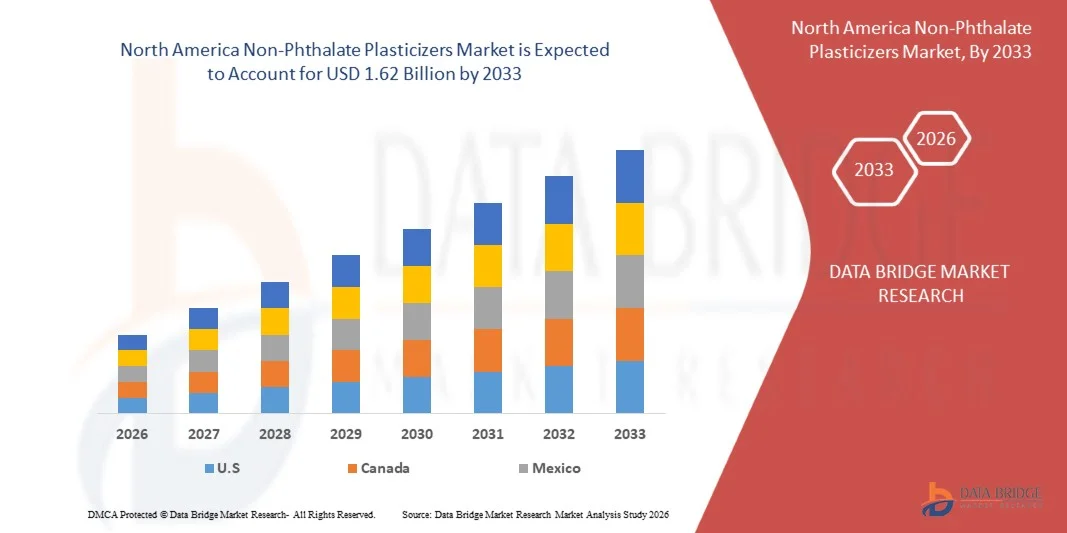

- Le marché nord-américain des plastifiants sans phtalates était évalué à 1,03 milliard de dollars américains en 2025 et devrait atteindre 1,62 milliard de dollars américains d'ici 2033 , avec un TCAC de 5,9 % au cours de la période de prévision.

- La croissance du marché est largement due au renforcement des restrictions réglementaires sur les plastifiants à base de phtalates et à l'importance croissante accordée à la sécurité environnementale et à la santé humaine, incitant les fabricants à se tourner vers des alternatives sans phtalates plus sûres dans de nombreux secteurs.

- De plus, la demande croissante de plastifiants durables, peu toxiques et biosourcés dans les secteurs de la construction, de l'automobile, de la santé et des biens de consommation accélère leur adoption, contribuant ainsi de manière significative à l'expansion globale du marché.

Analyse du marché des plastifiants sans phtalates en Amérique du Nord

- Les plastifiants sans phtalates, utilisés pour améliorer la flexibilité, la durabilité et les performances des polymères, deviennent des composants essentiels des produits en PVC souple en raison de leur profil de sécurité amélioré et de leur conformité aux réglementations environnementales strictes.

- La demande croissante de plastifiants sans phtalates est principalement soutenue par la croissance des activités de construction et d'infrastructures, l'expansion de la production automobile et le développement des applications dans les secteurs de la santé et des produits en contact avec les aliments, où la sécurité des matériaux et la performance à long terme sont essentielles.

- Les États-Unis ont dominé le marché nord-américain des plastifiants sans phtalates en 2025, grâce à des cadres réglementaires stricts en matière de sécurité chimique, à une forte adoption des matériaux durables et à une demande soutenue des secteurs de la construction, de la santé et des biens de consommation.

- Le Canada devrait connaître la croissance la plus rapide sur le marché nord-américain des plastifiants sans phtalates au cours de la période de prévision, en raison de l'importance croissante accordée au développement durable, de l'augmentation des activités de construction et de l'adoption croissante de matériaux plus sûrs dans les applications grand public et industrielles.

- Le segment des plastifiants monomères a dominé le marché avec une part de 55,6 % en 2025, grâce à leur forte efficacité de plastification et à leur utilisation répandue dans les applications PVC souples. Les fabricants privilégient les variantes monomères pour leur rapport coût-efficacité et leur capacité à offrir la souplesse, la durabilité et les performances de transformation souhaitées. Ces plastifiants sont largement utilisés dans les revêtements de sol, les câbles et les films, où un équilibre entre flexibilité et résistance mécanique est requis. Leur compatibilité avec les formulations PVC existantes favorise leur adoption à grande échelle dans les applications industrielles et grand public.

Portée du rapport et segmentation du marché des plastifiants sans phtalates en Amérique du Nord

|

Attributs |

Plastifiants sans phtalates : principales perspectives du marché |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Tendances du marché des plastifiants sans phtalates en Amérique du Nord

« Adoption croissante de plastifiants biosourcés et durables »

- Une tendance majeure du marché nord-américain des plastifiants sans phtalates est l'adoption croissante de plastifiants biosourcés et durables, sous l'impulsion d'une prise de conscience environnementale accrue et de réglementations internationales plus strictes concernant l'utilisation de produits chimiques dangereux. Les fabricants se tournent activement vers des alternatives renouvelables et peu toxiques afin d'atteindre leurs objectifs de développement durable tout en maintenant les normes de performance pour les applications en PVC souple.

- Par exemple, BASF a élargi sa gamme de plastifiants biosourcés sans phtalates sous ses marques Hexamoll et Palatinol, contribuant ainsi à réduire l'empreinte carbone et à améliorer la conformité aux normes de sécurité des produits de consommation et industriels. Ces solutions sont de plus en plus utilisées dans les revêtements de sol, les câbles et les matériaux d'intérieur, domaines où les certifications de durabilité deviennent obligatoires.

- Le secteur de la construction observe une adoption croissante des plastifiants durables, les normes de construction écologique mettant l'accent sur les matériaux à faibles émissions et recyclables. Cette tendance renforce la demande d'options sans phtalates pour les revêtements muraux, les sols et les membranes de toiture utilisés dans les infrastructures résidentielles et commerciales.

- Les constructeurs automobiles intègrent des plastifiants biosourcés pour alléger les composants intérieurs et garantir leur conformité aux normes environnementales. Ceci renforce le rôle des plastifiants sans phtalates pour une durabilité accrue et le respect des exigences de développement durable.

- Les secteurs de la santé et des biens de consommation privilégient de plus en plus les plastifiants durables afin de réduire l'exposition aux substances nocives. Cette évolution accélère l'innovation dans les formulations biosourcées qui répondent aux exigences de sécurité et réglementaires.

- L'intérêt croissant porté aux pratiques de l'économie circulaire renforce encore cette tendance, les fabricants investissant dans des solutions de plastifiants durables qui concilient performance, sécurité et responsabilité environnementale dans l'ensemble des industries utilisatrices finales mondiales.

Dynamique du marché des plastifiants sans phtalates en Amérique du Nord

Conducteur

« Demande croissante de matériaux sûrs et non toxiques »

- La demande croissante de matériaux sûrs et non toxiques dans de nombreux secteurs est un moteur essentiel du marché nord-américain des plastifiants sans phtalates, car les organismes de réglementation et les consommateurs accordent une importance croissante à la santé humaine et à la sécurité environnementale. Cette demande redéfinit le choix des matériaux dans les applications impliquant un contact humain étroit et une exposition prolongée.

- Par exemple, Eastman Chemical Company fournit des plastifiants sans phtalates, tels que l'Eastman 168, largement utilisés dans les emballages alimentaires, les dispositifs médicaux et les produits de puériculture en raison de leur innocuité avérée. Ces matériaux aident les fabricants à se conformer aux réglementations établies par des organismes comme la FDA américaine et l'Agence européenne des produits chimiques (ECHA).

- Le secteur de la santé est un moteur important de cette demande, les hôpitaux et les fabricants de dispositifs médicaux recherchant des matériaux à faible lixiviation et à faible toxicité. Les plastifiants sans phtalates sont de plus en plus utilisés dans les tubulures médicales, les poches de perfusion et les dispositifs à usage unique afin d'améliorer la sécurité des patients.

- Les fabricants de biens de consommation se tournent également vers des plastifiants plus sûrs afin de répondre aux attentes croissantes des consommateurs en matière de produits ménagers et d'hygiène personnelle non toxiques. Cette évolution se traduit par une adoption à grande échelle dans les jouets, le mobilier et les objets en plastique du quotidien.

- De manière générale, la demande croissante de matériaux non toxiques dans les secteurs réglementés et ceux destinés aux consommateurs positionne les plastifiants sans phtalates comme des composants essentiels des formulations polymères modernes.

Retenue/Défi

« Coûts de production élevés et disponibilité limitée des matières premières »

- Le marché nord-américain des plastifiants sans phtalates est confronté à des défis liés aux coûts de production élevés et à la disponibilité limitée de matières premières appropriées, ce qui peut freiner leur adoption à grande échelle dans les applications sensibles aux coûts. La production de formulations sans phtalates avancées nécessite souvent des matières premières spécialisées et des techniques de traitement complexes.

- Par exemple, Evonik Industries utilise des alcools de haute pureté et des intermédiaires spéciaux pour fabriquer ses plastifiants sans phtalates, ce qui accroît sa dépendance à l'égard de chaînes d'approvisionnement stables en matières premières. Les fluctuations de la disponibilité et du prix de ces intrants peuvent avoir un impact direct sur les coûts de fabrication.

- Le recours à des matières premières biosourcées ou spécialisées accentue encore les pressions sur les coûts, car ces ressources sont souvent soumises à la variabilité agricole et les options d'approvisionnement sont limitées. Cela peut affecter la régularité de l'approvisionnement et la stabilité des prix pour les fabricants.

- Des exigences strictes en matière de qualité et de performance accroissent également la complexité de la production, nécessitant des contrôles de traitement et des normes de test avancés. Ces facteurs contribuent à des cycles de production plus longs et à des coûts d'exploitation plus élevés.

- Le défi que représente l'équilibre entre performance, conformité réglementaire et rentabilité continue de freiner l'expansion du marché dans les régions sensibles aux prix. L'optimisation de l'approvisionnement en matières premières et de la production demeure essentielle pour améliorer l'accessibilité financière et favoriser une adoption plus large des plastifiants sans phtalates.

Portée du marché des plastifiants sans phtalates en Amérique du Nord

Le marché est segmenté en fonction du type, de la compatibilité avec le PVC, de l'application et de l'utilisateur final.

• Par type

Le marché nord-américain des plastifiants sans phtalates est segmenté, selon leur type, en plastifiants monomères et plastifiants polymères. En 2025, le segment des plastifiants monomères dominait le marché avec une part de revenus de 55,6 %, grâce à leur forte efficacité de plastification et à leur utilisation répandue dans les applications de PVC souple. Les fabricants privilégient les plastifiants monomères pour leur rapport coût-efficacité et leur capacité à offrir la souplesse, la durabilité et les performances de transformation souhaitées. Ces plastifiants sont largement utilisés dans les revêtements de sol, les câbles et les films, où un équilibre entre flexibilité et résistance mécanique est requis. Leur compatibilité avec les formulations de PVC existantes favorise leur adoption à grande échelle dans les applications industrielles et grand public.

Le segment des plastifiants polymères devrait connaître la croissance la plus rapide entre 2026 et 2033, porté par la demande croissante de matériaux à faible migration et hautes performances. Offrant une résistance supérieure à la volatilité, à l'extraction et au vieillissement, les plastifiants polymères conviennent parfaitement aux applications à longue durée de vie et à haute température. Le renforcement des réglementations en matière de sécurité et de durabilité des matériaux accélère leur adoption dans les secteurs de l'automobile, du médical et des produits PVC spéciaux.

• Compatibilité PVC

En fonction de leur compatibilité avec le PVC, le marché est segmenté en plastifiants primaires et secondaires. Le segment des plastifiants primaires détenait la part de marché dominante en 2025, grâce à leur capacité à assurer l'effet plastifiant principal tout en conservant une forte compatibilité avec la résine PVC. Ces plastifiants sont largement utilisés comme composant essentiel des formulations de PVC souple pour les matériaux de construction, les câbles et les textiles enduits. Leur efficacité à améliorer l'élasticité, la maniabilité et la durabilité du produit alimente une demande soutenue. La disponibilité de nombreuses options primaires biosourcées et non toxiques renforce encore leur position sur le marché.

Le segment des plastifiants secondaires devrait connaître la croissance la plus rapide au cours de la période de prévision, grâce à leur utilisation croissante comme agents d'amélioration des performances, en complément des plastifiants primaires. Les plastifiants secondaires contribuent à améliorer la résistance au feu, à optimiser les coûts et à optimiser certaines propriétés mécaniques. La personnalisation croissante des composés de PVC pour des applications industrielles de niche soutient l'expansion rapide de ce segment.

• Sur demande

Selon l'application, le marché nord-américain des plastifiants sans phtalates se segmente en revêtements de sol et muraux, câbles et fils électriques, films et feuilles, textiles enduits, adhésifs et mastics, et autres. Le segment des revêtements de sol et muraux dominait le marché en 2025, porté par une forte consommation de PVC souple dans la construction résidentielle et commerciale. Les plastifiants sans phtalates sont de plus en plus privilégiés dans ce secteur en raison des préoccupations liées à la qualité de l'air intérieur et aux normes de sécurité plus strictes. Leur durabilité, leur flexibilité et leur résistance aux taches favorisent une utilisation à grande échelle. Le développement et la rénovation continus des infrastructures soutiennent également la demande.

Le segment des fils et câbles devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par le développement des réseaux de transport d'électricité, des télécommunications et des énergies renouvelables. Les plastifiants sans phtalates améliorent l'isolation, la résistance à la chaleur et la conformité aux normes de sécurité des câbles. L'augmentation des investissements dans les réseaux intelligents et les véhicules électriques contribue également à accélérer la croissance de ce secteur.

• Par l'utilisateur final

En fonction de l'utilisateur final, le marché est segmenté en bâtiment et construction, automobile, biens de consommation, sports et loisirs, santé, électronique et électricité, agroalimentaire, et autres. Le segment du bâtiment et de la construction détenait la plus grande part de marché en 2025, grâce à l'utilisation intensive de produits en PVC souple pour les revêtements de sol, les membranes d'étanchéité, les canalisations et les revêtements muraux. Les plastifiants sans phtalates sont de plus en plus utilisés pour répondre aux normes de construction écologique et aux exigences réglementaires. Leur longue durée de vie et la stabilité de leurs performances favorisent leur utilisation généralisée dans les projets de grande envergure.

Le secteur de la santé devrait enregistrer la croissance la plus rapide au cours de la période prévisionnelle, soutenu par une demande croissante de produits médicaux sûrs et biocompatibles. Les plastifiants sans phtalates sont privilégiés dans les tubulures médicales, les poches de sang et les dispositifs à usage unique en raison de leur faible toxicité et des risques de lixiviation réduits. L'augmentation des dépenses de santé et le renforcement des réglementations en matière de sécurité des matériaux accélèrent leur adoption dans l'ensemble des applications médicales.

Analyse régionale du marché des plastifiants sans phtalates en Amérique du Nord

- Les États-Unis ont dominé le marché nord-américain des plastifiants sans phtalates en 2025, avec la plus grande part de revenus, grâce à des cadres réglementaires stricts en matière de sécurité chimique, à une forte adoption des matériaux durables et à une demande soutenue des secteurs de la construction, de la santé et des biens de consommation.

- Des réglementations environnementales strictes, appliquées par des organismes tels que l'Agence américaine de protection de l'environnement (EPA), ainsi que des investissements continus dans la recherche avancée sur les polymères et la fabrication durable, favorisent l'adoption généralisée des plastifiants sans phtalates. La forte présence de grands fabricants de produits chimiques, l'innovation constante des produits et les accords d'approvisionnement à long terme avec les transformateurs de PVC en aval renforcent encore la position de leader du pays sur le marché régional.

- L'intérêt croissant porté aux matériaux à faible toxicité, au respect des normes relatives au contact alimentaire et aux matériaux médicaux, ainsi qu'à l'utilisation accrue de plastifiants sans phtalates dans les applications en PVC souple, garantissent que les États-Unis conservent leur rôle dominant tout au long de la période de prévision.

Aperçu du marché des plastifiants sans phtalates au Canada et en Amérique du Nord

Le Canada devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide du marché nord-américain des plastifiants sans phtalates entre 2026 et 2033. Cette croissance est soutenue par l'importance accrue accordée au développement durable, la croissance du secteur de la construction et l'adoption croissante de matériaux plus sûrs dans les applications industrielles et de consommation. La demande croissante de plastifiants sans phtalates dans les matériaux de construction, les fils et câbles et les emballages accélère la croissance du marché. Les collaborations entre les formulateurs canadiens et les multinationales de la chimie, ainsi que les investissements dans le développement de matériaux durables, renforcent les capacités d'approvisionnement. Le soutien gouvernemental aux normes de construction écologique et à la réglementation sur la sécurité chimique positionne le Canada comme le marché à la croissance la plus rapide de la région.

Aperçu du marché des plastifiants sans phtalates au Mexique et en Amérique du Nord

Le marché mexicain devrait connaître une croissance soutenue entre 2026 et 2033, portée par le développement du secteur manufacturier, l'augmentation des exportations de produits à base de PVC et une meilleure sensibilisation aux normes de sécurité chimique. La croissance des secteurs de l'automobile, de la construction et des biens de consommation alimente une demande constante de plastifiants sans phtalates. Les initiatives gouvernementales visant à renforcer la production industrielle, ainsi que l'harmonisation progressive avec la réglementation environnementale nord-américaine, favorisent une expansion régulière du marché. La présence de compoundeurs de plastiques régionaux et le développement de partenariats avec des fournisseurs de produits chimiques américains contribuent à cette croissance soutenue tout au long de la période de prévision.

Part de marché des plastifiants sans phtalates en Amérique du Nord

L'industrie des plastifiants sans phtalates est principalement dominée par des entreprises bien établies, notamment :

- Plastics Corp (États-Unis)

- Harman Corporation (États-Unis)

- Evonik Industries AG (Allemagne)

- Eastman Chemical Company (États-Unis)

- DIC CORPORATION (Japon)

- Société Kao (Japon)

- LG Chem (Corée du Sud)

- Perstorp (Suède)

- Société technologique UPC (Taïwan)

- Kaifeng Jiuhong Chemical Co., Ltd. (Chine)

- Henan GO Biotech Co., Ltd (Chine)

- Valtris Specialty Chemicals (États-Unis)

- Velsicol Chemical LLC (États-Unis)

- Ferro Corporation (États-Unis)

- Société chimique Mitsubishi (Japon)

Dernières évolutions du marché des plastifiants sans phtalates en Amérique du Nord

- En janvier 2024, Evonik Industries a enrichi son portefeuille de produits chimiques durables avec le lancement d'un plastifiant sans phtalate haute performance, conçu pour des applications sensibles telles que les tubulures médicales et les films alimentaires. Cette innovation s'inscrit dans l'engagement d'Evonik en faveur de solutions respectueuses de l'environnement, offrant une sécurité et des performances accrues tout en réduisant la dépendance aux phtalates traditionnels. Ce nouveau plastifiant garantit une faible migration et une grande durabilité, ce qui le rend idéal pour les industries exigeant des normes de matériaux rigoureuses.

- En janvier 2024, Perstorp a lancé Pevalen Pro 100, un plastifiant révolutionnaire sans phtalates, composé à 100 % de carbone renouvelable selon les principes du bilan massique. Cette innovation améliore considérablement la durabilité des applications PVC souples, réduisant l'empreinte carbone du produit d'environ 80 % par rapport aux alternatives issues de ressources fossiles. Conçu pour maintenir des performances élevées tout en minimisant l'impact environnemental, Pevalen Pro 100 redéfinit la technologie de plastification du PVC. Son développement témoigne de l'engagement de Perstorp en faveur de solutions durables, garantissant durabilité et efficacité sans compromis sur la sécurité ni la qualité.

- En décembre 2023, le groupe sud-coréen Aekyung Chemical a acquis 50 % des parts de VPCHEM, filiale vietnamienne de LG Chem spécialisée dans la production et la vente de plastifiants. Cette opération stratégique vise à renforcer la présence d'Aekyung Chemical sur le marché des plastifiants, notamment des alternatives sans phtalates. Grâce à cette acquisition, Aekyung Chemical accroît sa capacité de production et se positionne ainsi pour répondre à la demande mondiale croissante de plastifiants respectueux de l'environnement. Cet accord renforce sa capacité à fournir des solutions durables aux marchés nord-américain et européen, tout en lui permettant de maintenir une forte présence en Asie.

- En décembre 2022, Hanwha Solutions a lancé Eco-DEHCH, un plastifiant sans phtalates conçu pour une résistance exceptionnelle aux températures extrêmes, idéal pour les applications extérieures. Cette innovation s'inscrit dans l'engagement de Hanwha Solutions en faveur des matériaux durables, offrant une alternative écologique aux plastifiants traditionnels. En élargissant sa gamme de produits, l'entreprise vise à répondre à la demande mondiale croissante de plastifiants plus sûrs et plus performants. Eco-DEHCH est reconnu pour sa durabilité et ses avantages environnementaux, renforçant ainsi la position de Hanwha sur le marché.

- En avril 2021, Eastman Chemical Company a fait l'acquisition de 3F Feed & Food, leader européen des additifs pour l'alimentation animale et humaine. Cette acquisition stratégique renforce l'activité d'Eastman en nutrition animale, en intégrant l'expertise de 3F à son segment Additifs et Produits Fonctionnels. Cette opération permet à Eastman de développer des solutions de nouvelle génération, contribuant ainsi aux enjeux mondiaux du développement durable et à l'amélioration de la productivité agricole. Grâce aux dérivés d'acides organiques et aux phytogéniques de 3F, Eastman élargit son portefeuille pour répondre à la demande croissante d'additifs plus sûrs et plus performants.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.