North America Modular Data Center Market

Taille du marché en milliards USD

TCAC :

%

USD

9,698.19 Million

USD

39,162.45 Million

2022

2030

USD

9,698.19 Million

USD

39,162.45 Million

2022

2030

| 2023 –2030 | |

| USD 9,698.19 Million | |

| USD 39,162.45 Million | |

|

|

|

Marché des centres de données modulaires en Amérique du Nord, par composant (solution et services), type (centres de données entièrement fonctionnels, partiellement fabriqués et micro), application (centres de données plus intelligents, extension de capacité, informatique haute performance/de pointe , reprise après sinistre, déploiement d'urgence et temporaire et extension du centre de données), taille de déploiement (données de grande taille, centre de données de taille moyenne et centre de données de petite taille), type de niveau (niveau 4, niveau 3, niveau 2 et niveau 1), type d'emplacement (extérieur et intérieur), vertical (BFSI, informatique et télécommunications, énergie et services publics, industrie, gouvernement et défense, fabrication, soins de santé, transport et logistique, médias et divertissement, vente au détail, éducation et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des centres de données modulaires en Amérique du Nord

Un centre de données modulaire est une installation préfabriquée et pré-conçue construite à l'aide de composants standardisés. Il peut être facilement transporté, déployé et mis à l'échelle selon les besoins d'une organisation. Il est conçu pour fournir une solution flexible et efficace pour héberger l'infrastructure du centre de données, y compris les serveurs, le stockage, les équipements réseau et les systèmes de refroidissement.

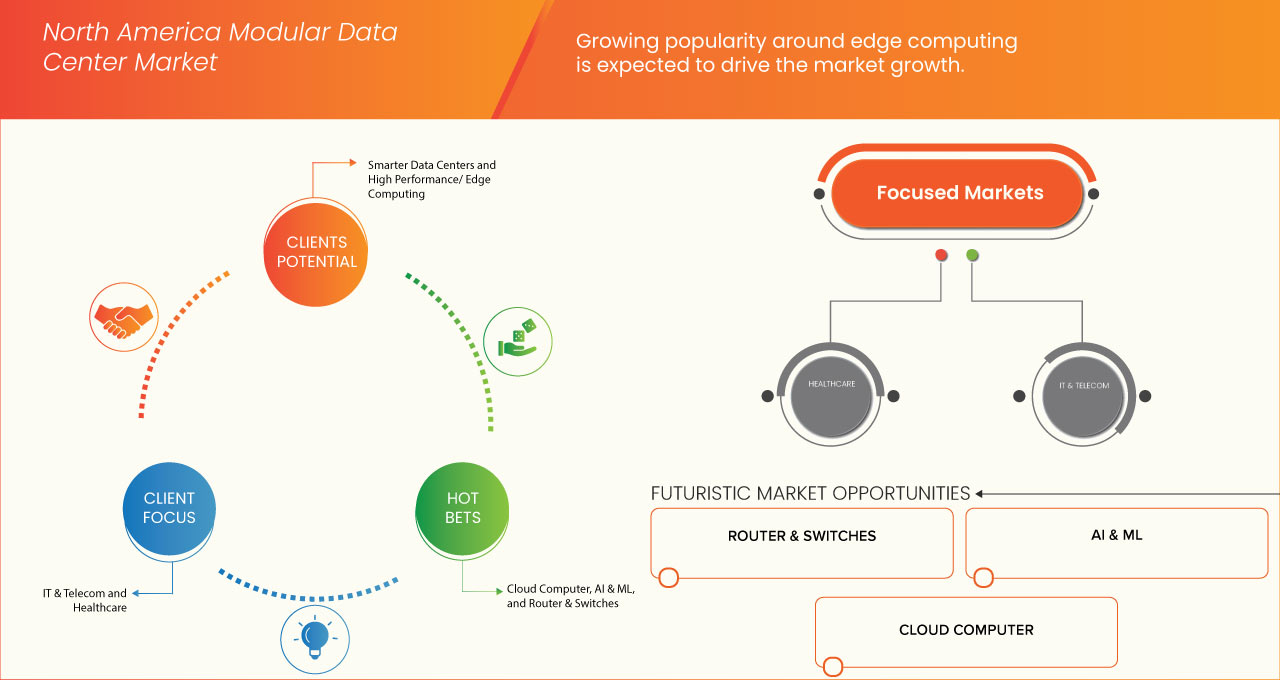

La popularité croissante de l'informatique de pointe, le besoin croissant de centres de données évolutifs de la part des industries de tous les domaines, l'augmentation de la demande de centres de données préfabriqués et la nécessité d'obtenir une visibilité de bout en bout pour prévoir les besoins en gestion de la capacité sont les principaux facteurs qui devraient stimuler la croissance du marché. Cependant, le manque de fiabilité des infrastructures dans les pays en développement, la complexité de l'intégration de différents outils de centres de données et les coûts initiaux élevés des infrastructures devraient freiner la croissance du marché. L'augmentation des tendances en matière de numérisation, les progrès du secteur informatique, la demande croissante d'installations de travail à distance et l'essor de l'adoption de l'IA et du ML offrent des opportunités de croissance du marché. Cependant, le manque de sécurité des données devrait constituer un défi pour la croissance du marché.

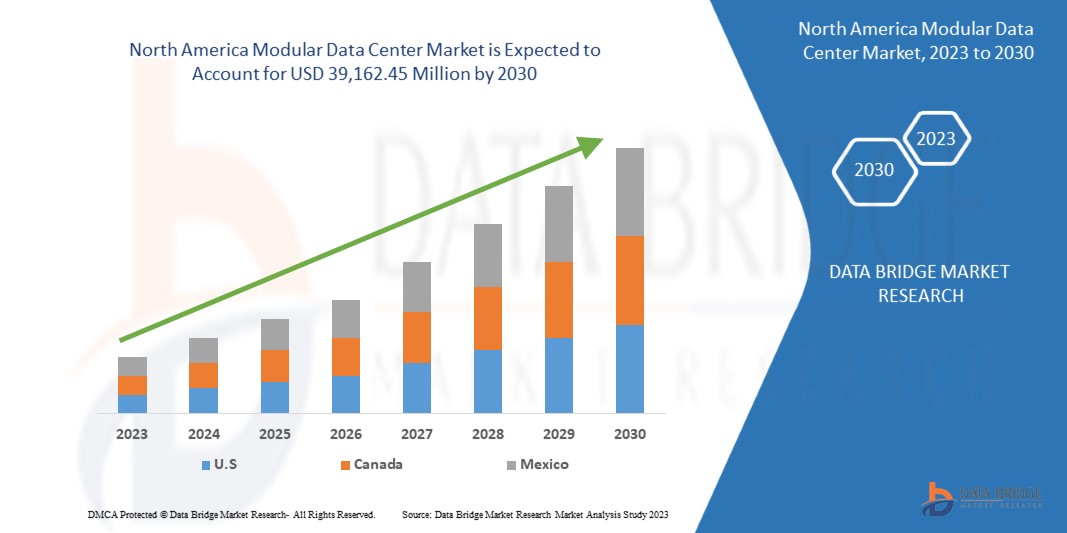

Data Bridge Market Research analyse que le marché des centres de données modulaires en Amérique du Nord devrait atteindre 39 162,45 millions USD d'ici 2030, contre 9 698,19 millions USD en 2022, avec un TCAC de 19,3 % au cours de la période de prévision de 2023 à 2030. Divers acteurs du marché participent à des expositions, des remises de prix et des lancements de produits pour développer leurs activités sur le marché, qui n'a cessé de croître au fil des ans.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Année historique |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Composant (solution et services), type (centres de données entièrement fonctionnels, partiellement fabriqués et micro), application (centres de données plus intelligents, extension de capacité, informatique haute performance/de pointe, reprise après sinistre, déploiement d'urgence et temporaire et extension de centre de données), taille de déploiement (données de grande taille, centre de données de taille moyenne et centre de données de petite taille), type de niveau (niveau 4, niveau 3, niveau 2 et niveau 1), type d'emplacement (extérieur et intérieur), vertical (BFSI, informatique et télécommunications, énergie et services publics, industrie, gouvernement et défense, fabrication, soins de santé, transport et logistique, médias et divertissement, vente au détail, éducation et autres) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

Dell Inc., Hewlett Packard Enterprise Development LP, IBM, Schneider Electric, Vertiv Group Corp., Cisco Systems, Inc., ZTE Corporation, Baselayer Technology, LLC., PCX Holding LLC, Box Modul, Eaton, Rittal GmbH & Co. KG, Cupertino Electric, Inc., Delta Electronics, Inc., Huawei Technologies Co., Ltd. et FiberHome, entre autres |

Définition du marché

Les centres de données modulaires sont conçus pour offrir flexibilité, déploiement rapide et rentabilité par rapport aux centres de données traditionnels. Ils sont souvent utilisés lorsque les organisations ont besoin d'une extension rapide de la capacité de leur centre de données, de solutions de centre de données temporaires ou dans des emplacements avec un espace et une infrastructure limités. Le marché des centres de données modulaires englobe divers aspects, notamment la fabrication, la distribution, l'installation et la maintenance de ces unités modulaires et des services associés, tels que le conseil, la conception et l'intégration. Il implique divers acteurs du secteur, notamment des fournisseurs de solutions de centres de données, des fabricants d'équipements, des intégrateurs de systèmes et des fournisseurs de services.

Dynamique du marché des centres de données modulaires en Amérique du Nord

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Popularité croissante de l'informatique de pointe

L'edge computing est un nouveau paradigme informatique qui fait référence à une gamme de réseaux et d'appareils. Cette technologie informatique rapproche le calcul et le stockage des données de l'appareil sur lequel elles sont collectées. De plus, les entreprises qui utilisent des données en temps réel ne souffrent pas de problèmes de latence et peuvent économiser de l'argent.

Les entreprises s'appuient de plus en plus sur l'edge computing pour prendre en charge plusieurs types d'applications et de systèmes. Une quantité considérable de données est générée pour la prise de décision. Cependant, l'envoi de toutes les données vers le cloud peut entraîner une latence. L'edge computing peut générer des réponses en moins d'une seconde en rapprochant à la fois le calcul et les données de l'utilisateur. Cela réduira la latence, minimisera les menaces sur les données et augmentera la bande passante.

- Besoin croissant de centres de données évolutifs dans tous les secteurs d'activité

À l’ère de la numérisation, un centre de données est très important, car presque toutes les entreprises et tous les bureaux gouvernementaux modernes ont besoin de leur propre centre de données. En fonction des besoins, chaque institution gouvernementale et entreprise peut choisir de construire et de gérer son propre centre de données. Même les secteurs tels que l’éducation, la finance, les télécommunications, la vente au détail et les services de réseaux sociaux, qui génèrent et traitent des tonnes d’informations chaque jour, ont besoin d’un centre de données. Par conséquent, ces secteurs ont besoin de centres de données pour gérer leurs opérations. S’ils ne parviennent pas à se déployer, cela peut entraîner une perte de clients et de bénéfices. Il existe quatre types de centres de données : les centres de données de colocation, les centres de données d’entreprise, les centres de données de services gérés et les centres de données cloud.

Un centre de données efficace doit disposer de systèmes qui fonctionnent ensemble pour atteindre de meilleures capacités. L'entreprise peut fonctionner efficacement et contribuer à l'économie lorsque des systèmes tels que les systèmes de lutte contre les incendies, la gestion de l'intégration, le câblage intégré, les systèmes de refroidissement, les systèmes d'alimentation électrique, les décorations intérieures, les systèmes d'armoires et la protection contre les surtensions sont tous combinés.

Opportunité

- Tendance croissante à la numérisation

La numérisation ou l'utilisation de processus numériques pour améliorer les opérations commerciales augmente avec l'utilisation de composants pertinents pour moderniser l'entreprise, ce qui conduit à l'évolution du processus de travail et à la croissance des revenus pour atteindre le succès futur. La conversion d'éléments non numériques en formats numériques facilite le partage, l'enregistrement et la recherche d'informations, ce qui conduit à l'automatisation des opérations commerciales en développant des flux de travail automatiques ou des séquences de sensibilisation marketing.

La numérisation présente de nombreux avantages et nécessite une maintenance adéquate ainsi que des équipements et infrastructures supplémentaires pour gérer correctement le système de travail. Ainsi, ce processus comprend la gestion des données collectées, la sauvegarde, le traitement, l'analyse, le partage et la mise en œuvre de nombreuses autres opérations. Cependant, la numérisation simplifie et automatise les opérations de travail de base de l'entreprise, mais crée un besoin de technologie et d'infrastructure avancées.

Retenue/Défi

- Infrastructures peu fiables dans les pays en développement

Un centre de données joue un rôle important dans les besoins informatiques pour gérer et stocker les énormes ressources qui sont importantes pour le travail continu de toute association. MDC est un élément unique, mais il joue un rôle colossal dans l'industrie actuelle. Il a été conçu avec divers composants spécialisés. Le travail principal d'un centre de données est le calcul, le stockage et l'organisation. La fiabilité, l'efficacité, la sécurité et le développement continu sont les tâches importantes des centres de données.

Les volumes d’investissement importants ainsi que la qualité et l’adéquation des services d’infrastructure varient généralement d’un pays à l’autre. L’expérience de millions de personnes dans le monde entier montre que le simple fait d’être associé à des réseaux de base ne garantit pas des services fiables. En particulier, les communautés urbaines en développement rapide dans les pays émergents sont confrontées aux conséquences difficiles de systèmes inadéquats, souvent à des coûts énormes. Le vieillissement du matériel, le sous-financement, le manque de soutien et l’expansion rapide sont quelques-uns des facteurs clés à l’origine des systèmes d’alimentation en électricité, d’eau et de désinfection capricieux.

Développements récents

- En juillet 2023, Digital Realty a choisi le logiciel de développement durable Envizi d'IBM Corporation pour révolutionner l'analyse des données dans ses centres de données et bureaux mondiaux. Ce hub central a facilité la collecte, la gestion et l'extraction d'informations sur les facteurs ESG, facilitant ainsi le suivi des progrès, l'identification des améliorations, la création de rapports sur les performances et la satisfaction des besoins en matière de divulgation. IBM a obtenu un avantage précieux en aidant ses clients, tels que Digital Realty, à prendre des décisions durables et fondées sur les données grâce à la suite Envizi ESG.

- En juin 2023, Hewlett Packard Enterprise Development LP a annoncé l'élargissement du partenariat avec Equinix pour étendre le portefeuille de cloud privé HPE GreenLake dans les centres de données Equinix International Business Exchange (IBX). Ce partenariat aidera l'entreprise à offrir la meilleure expérience cloud pour les centres de données et à améliorer les performances du système.

- En mai 2023, Dell Inc. a présenté la plateforme logicielle Dell NativeEdge pour sécuriser les déploiements Edge. Cette nouvelle solution aidera l'entreprise à simplifier, sécuriser et automatiser le déploiement des infrastructures et des applications Edge. En outre, elle facilitera la gestion des centres de données et des clouds publics.

Portée du marché des centres de données modulaires en Amérique du Nord

Le marché des centres de données modulaires en Amérique du Nord est segmenté en sept segments notables en fonction du composant, du type, de l'application, de la taille du déploiement, du type de niveau, du type d'emplacement et du secteur vertical. La croissance parmi ces segments vous aidera à analyser les segments de croissance limités dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Composant

- Solution

- Services

Sur la base des composants, le marché est segmenté en solutions et services.

Taper

- Entièrement fonctionnel

- Fabrication partielle

- Microcentres de données

Sur la base du type, le marché est segmenté en centres de données entièrement fonctionnels, partiellement fabriqués et micro.

Application

- Des centres de données plus intelligents

- Extension de capacité

- Calcul haute performance/informatique de pointe

- Reprise après sinistre

- Déploiement d'urgence et temporaire

- Extension du centre de données

Sur la base des applications, le marché est segmenté en centres de données plus intelligents, extension de capacité, calcul haute performance/edge computing, reprise après sinistre, déploiement d'urgence et temporaire et extension de centre de données.

Taille du déploiement

- Données de grande taille

- Centre de données de taille moyenne

- Centre de données de petite taille

Sur la base de la taille du déploiement, le marché est segmenté en centres de données de grande taille, centres de données de taille moyenne et centres de données de petite taille.

Type de niveau

- Niveau 1

- Niveau 2

- Niveau 3

- Niveau 4

Sur la base du type de niveau, le marché est segmenté en niveau 4, niveau 3, niveau 2 et niveau 1.

Type d'emplacement

- De plein air

- Intérieur

En fonction du type d’emplacement, le marché est segmenté en extérieur et intérieur.

Verticale

- BFSI

- Informatique et Télécoms

- Énergie et services publics

- Industriel

- Gouvernement et défense

- Fabrication

- Soins de santé

- Transport et logistique

- Médias et divertissement

- Vente au détail

- Éducation

- Autres

Sur la base de la verticale, le marché est segmenté en BFSI, informatique et télécommunications, énergie et services publics, industrie, gouvernement et défense, fabrication, santé, transport et logistique, médias et divertissement, vente au détail, éducation et autres.

Analyse/perspectives régionales du marché des centres de données modulaires en Amérique du Nord

Le marché des centres de données modulaires en Amérique du Nord est analysé et des informations sur la taille du marché et les tendances sont fournies par pays, composant, type, application, taille de déploiement, type de niveau, type d'emplacement et vertical, comme référencé ci-dessus.

Les pays couverts dans ce rapport de marché sont les États-Unis, le Canada et le Mexique.

Les États-Unis devraient dominer le marché des centres de données modulaires en Amérique du Nord en raison de leur solide infrastructure technologique, de leur forte demande de stockage de données et de la présence de grandes entreprises technologiques. Son économie numérique en plein essor, son urbanisation rapide et les initiatives gouvernementales soutiennent la construction de centres de données et le développement de l'infrastructure numérique.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques régionales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données régionales.

Analyse du paysage concurrentiel et des parts de marché des centres de données modulaires en Amérique du Nord

Le paysage concurrentiel du marché des centres de données modulaires en Amérique du Nord fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence régionale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises par rapport au marché.

Certains des principaux acteurs du marché opérant sur le marché des centres de données modulaires en Amérique du Nord sont Dell Inc., Hewlett Packard Enterprise Development LP, IBM Corp., Schneider Electric, Vertiv Group Corp., Cisco Systems, Inc., ZTE Corporation, Baselayer Technology, LLC., PCX Holding LLC, Box Modul, Eaton, Rittal GmbH & Co. KG, Cupertino Electric, Inc., Delta Electronics, Inc., Huawei Technologies Co., Ltd. et FiberHome, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA MODULAR DATA CENTER MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 MULTIVARIATE MODELLING

2.9 COMPONENT LIFELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING POPULARITY AROUND EDGE COMPUTING

5.1.2 RISING NEED FOR SCALABLE DATA CENTERS FROM INDUSTRIES ACROSS ALL DOMAINS

5.1.3 INCREASE IN DEMAND FOR PREFABRICATED DATA FACILITY CENTERS

5.1.4 NEED FOR GAINING END-TO-END VISIBILITY FOR PREDICTING CAPACITY MANAGEMENT REQUIREMENTS

5.2 RESTRAINTS

5.2.1 UNRELIABLE INFRASTRUCTURE IN DEVELOPING COUNTRIES

5.2.2 COMPLEXITIES INVOLVED IN THE INTEGRATION OF DIFFERENT DATA CENTER TOOLS

5.2.3 HIGH INITIAL INFRASTRUCTURE COSTS

5.3 OPPORTUNITIES

5.3.1 RISE IN THE DIGITALIZATION TREND

5.3.2 RISING ADVANCEMENTS IN THE IT SECTOR

5.3.3 RISING DEMAND FOR REMOTE WORKING FACILITIES

5.3.4 SURGE IN THE ADOPTION OF AI AND ML

5.4 CHALLENGES

5.4.1 LACK OF DATA SECURITY

6 NORTH AMERICA MODULAR DATA CENTER MARKET, BY COMPONENT

6.1 OVERVIEW

6.2 SOLUTION

6.2.1 ALL IN ONE

6.2.1.1 IT MODULE

6.2.1.2 ELECTRICAL MODULE

6.2.1.3 MECHANICAL MODULE

6.2.1.4 COOLING MODULE

6.2.1.5 POWER MODULE

6.2.2 INDIVIDUAL

6.2.2.1 20 FEET

6.2.2.2 20 TO 40 FEET

6.2.2.3 MORE THAN 40 FEET

6.3 SERVICES

6.3.1 INSTALLATION & DEPLOYMENT

6.3.2 MAINTENANCE & SUPPORT

6.3.3 CONSULTING

7 NORTH AMERICA MODULAR DATA CENTER MARKET, BY TYPE

7.1 OVERVIEW

7.2 FULL FUNCTIONAL

7.3 PARTIAL FABRICATED

7.4 MICRO DATA CENTERS

8 NORTH AMERICA MODULAR DATA CENTER MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 SMARTER DATA CENTERS

8.3 CAPACITY EXPANSION

8.4 HIGH PERFORMANCE/ EDGE COMPUTING

8.5 DISASTER RECOVERY

8.6 EMERGENCY AND TEMPORARY DEPLOYMENT

8.7 DATA CENTER EXPANSION

9 NORTH AMERICA MODULAR DATA CENTER MARKET, BY DEPLOYMENT SIZE

9.1 OVERVIEW

9.2 LARGE SIZE DATA

9.3 MEDIUM SIZE DATA CENTER

9.4 SMALL SIZE DATA CENTER

10 NORTH AMERICA MODULAR DATA CENTER MARKET, BY TIER TYPE

10.1 OVERVIEW

10.2 TIER 4

10.3 TIER 3

10.4 TIER 2

10.5 TIER 1

11 NORTH AMERICA MODULAR DATA CENTER MARKET, BY LOCATION TYPE

11.1 OVERVIEW

11.2 OUTDOOR

11.3 INDOOR

12 NORTH AMERICA MODULAR DATA CENTER MARKET, BY VERTICAL

12.1 OVERVIEW

12.2 BFSI

12.2.1 SOLUTION

12.2.2 SERVICES

12.3 IT & TELECOM

12.3.1 SOLUTION

12.3.1.1 FREE COOLING

12.3.1.2 CHILLED WATER SYSTEMS

12.3.1.3 INDIRECT AIR EVAPORATIVE SYSTEM

12.3.1.4 OTHERS

12.3.2 SERVICES

12.4 ENERGY & UTILITIES

12.4.1 SOLUTION

12.4.2 SERVICES

12.5 INDUSTRIAL

12.5.1 SOLUTION

12.5.2 SERVICES

12.6 GOVERNMENT & DEFENSE

12.6.1 SOLUTION

12.6.2 SERVICES

12.7 MANUFACTURING

12.7.1 SOLUTION

12.7.2 SERVICES

12.8 HEALTHCARE

12.8.1 SOLUTION

12.8.2 SERVICES

12.9 TRANSPORT & LOGISTICS

12.9.1 SOLUTION

12.9.2 SERVICES

12.1 MEDIA & ENTERTAINMENT

12.10.1 SOLUTION

12.10.2 SERVICES

12.11 RETAIL

12.11.1 SOLUTION

12.11.2 SERVICES

12.12 EDUCATION

12.12.1 SOLUTION

12.12.2 SERVICES

12.13 OTHERS

13 NORTH AMERICA MODULAR DATA CENTER MARKET, BY COUNTRY

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA MODULAR DATA CENTER MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENT

16.2 VERTIV GROUP CORP.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 SOLUTION PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 DELL INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 SOLUTION PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 IBM CORPORATION

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 SOLUTION PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 CISCO SYSTEMS, INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 BASELAYER TECHNOLOGY, LLC (A SUBSIDIARY OF IE CORP.)

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 BOX MODUL

16.7.1 COMPANY SNAPSHOT

16.7.2 SOLUTION PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 CUPERTINO ELECTRIC, INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 DELTA ELECTRONICS, INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 SOLUTION PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 EATON

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 FIBERHOME

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 HUAWEI TECHNOLOGIES CO., LTD.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 PCX HOLDING LLC

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 RITTAL GMBH & CO. KG

16.14.1 COMPANY SNAPSHOT

16.14.2 SOLUTION PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 SCHNEIDER ELECTRIC

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 SOLUTION PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 ZTE CORPORATION

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 SOLUTION PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 COSTING OF DIFFERENT DATA CENTER COMPONENTS

TABLE 2 NORTH AMERICA MODULAR DATA CENTER MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA SOLUTION IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA ALL IN ONE IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA INDIVIDUAL IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA SERVICES IN MODULAR DATA CENTER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA MODULAR DATA CENTER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA MODULAR DATA CENTER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA MODULAR DATA CENTER MARKET, BY DEPLOYMENT SIZE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA MODULAR DATA CENTER MARKET, BY TIER TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA MODULAR DATA CENTER MARKET, BY LOCATION TYPE, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA MODULAR DATA CENTER MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA BFSI IN MODULAR DATA CENTER MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA IT & TELECOM IN MODULAR DATA CENTER MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA SOLUTION IN MODULAR DATA CENTER MARKET, BY COOLING TYPE, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA ENERGY & UTILITIES IN MODULAR DATA CENTER MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA INDUSTRIAL IN MODULAR DATA CENTER MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA GOVERNMENT & DEFENSE IN MODULAR DATA CENTER MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA MANUFACTURING IN MODULAR DATA CENTER MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA HEALTHCARE IN MODULAR DATA CENTER MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA TRANSPORT & LOGISTICS IN MODULAR DATA CENTER MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA MEDIA & ENTERTAINMENT IN MODULAR DATA CENTER MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA RETAIL IN MODULAR DATA CENTER MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA EDUCATION IN MODULAR DATA CENTER MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA MODULAR DATA CENTER MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA MODULAR DATA CENTER MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA SOLUTION IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA ALL IN ONE IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA INDIVIDUAL IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA SERVICES IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA MODULAR DATA CENTER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA MODULAR DATA CENTER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA MODULAR DATA CENTER MARKET, BY DEPLOYMENT SIZE, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA MODULAR DATA CENTER MARKET, BY TIER TYPE, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA MODULAR DATA CENTER MARKET, BY LOCATION TYPE, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA MODULAR DATA CENTER MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA BFSI IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA IT & TELECOM IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA SOLUTION IN MODULAR DATA CENTER MARKET, BY COOLING TYPE, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA ENERGY & UTILITIES IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA INDUSTRIAL IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA GOVERNMENT & DEFENSE IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA MANUFACTURING IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA HEALTHCARE IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA TRANSPORT & LOGISTICS IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA MEDIA & ENTERTAINMENT IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA RETAIL IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA EDUCATION IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 49 U.S. MODULAR DATA CENTER MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 50 U.S. SOLUTION IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 51 U.S. ALL IN ONE IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 52 U.S. INDIVIDUAL IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 53 U.S. SERVICES IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 54 U.S. MODULAR DATA CENTER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 55 U.S. MODULAR DATA CENTER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 56 U.S. MODULAR DATA CENTER MARKET, BY DEPLOYMENT SIZE, 2021-2030 (USD MILLION)

TABLE 57 U.S. MODULAR DATA CENTER MARKET, BY TIER TYPE, 2021-2030 (USD MILLION)

TABLE 58 U.S. MODULAR DATA CENTER MARKET, BY LOCATION TYPE, 2021-2030 (USD MILLION)

TABLE 59 U.S. MODULAR DATA CENTER MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 60 U.S. BFSI IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 61 U.S. IT & TELECOM IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 62 U.S. SOLUTION IN MODULAR DATA CENTER MARKET, BY COOLING TYPE, 2021-2030 (USD MILLION)

TABLE 63 U.S. ENERGY & UTILITIES IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 64 U.S. INDUSTRIAL IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 65 U.S. GOVERNMENT & DEFENSE IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 66 U.S. MANUFACTURING IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 67 U.S. HEALTHCARE IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 68 U.S. TRANSPORT & LOGISTICS IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 69 U.S. MEDIA & ENTERTAINMENT IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 70 U.S. RETAIL IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 71 U.S. EDUCATION IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 72 CANADA MODULAR DATA CENTER MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 73 CANADA SOLUTION IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 74 CANADA ALL IN ONE IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 75 CANADA INDIVIDUAL IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 76 CANADA SERVICES IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 77 CANADA MODULAR DATA CENTER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 CANADA MODULAR DATA CENTER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 79 CANADA MODULAR DATA CENTER MARKET, BY DEPLOYMENT SIZE, 2021-2030 (USD MILLION)

TABLE 80 CANADA MODULAR DATA CENTER MARKET, BY TIER TYPE, 2021-2030 (USD MILLION)

TABLE 81 CANADA MODULAR DATA CENTER MARKET, BY LOCATION TYPE, 2021-2030 (USD MILLION)

TABLE 82 CANADA MODULAR DATA CENTER MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 83 CANADA BFSI IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 84 CANADA IT & TELECOM IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 85 CANADA SOLUTION IN MODULAR DATA CENTER MARKET, BY COOLING TYPE, 2021-2030 (USD MILLION)

TABLE 86 CANADA ENERGY & UTILITIES IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 87 CANADA INDUSTRIAL IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 88 CANADA GOVERNMENT & DEFENSE IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 89 CANADA MANUFACTURING IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 90 CANADA HEALTHCARE IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 91 CANADA TRANSPORT & LOGISTICS IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 92 CANADA MEDIA & ENTERTAINMENT IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 93 CANADA RETAIL IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 94 CANADA EDUCATION IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 95 MEXICO MODULAR DATA CENTER MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 96 MEXICO SOLUTION IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 97 MEXICO ALL IN ONE IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 98 MEXICO INDIVIDUAL IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 99 MEXICO SERVICES IN MODULAR DATA CENTER MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 100 MEXICO MODULAR DATA CENTER MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 101 MEXICO MODULAR DATA CENTER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 102 MEXICO MODULAR DATA CENTER MARKET, BY DEPLOYMENT SIZE, 2021-2030 (USD MILLION)

TABLE 103 MEXICO MODULAR DATA CENTER MARKET, BY TIER TYPE, 2021-2030 (USD MILLION)

TABLE 104 MEXICO MODULAR DATA CENTER MARKET, BY LOCATION TYPE, 2021-2030 (USD MILLION)

TABLE 105 MEXICO MODULAR DATA CENTER MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 106 MEXICO BFSI IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 107 MEXICO IT & TELECOM IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 108 MEXICO SOLUTION IN MODULAR DATA CENTER MARKET, BY COOLING TYPE, 2021-2030 (USD MILLION)

TABLE 109 MEXICO ENERGY & UTILITIES IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 110 MEXICO INDUSTRIAL IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 111 MEXICO GOVERNMENT & DEFENSE IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 112 MEXICO MANUFACTURING IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 113 MEXICO HEALTHCARE IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 114 MEXICO TRANSPORT & LOGISTICS IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 115 MEXICO MEDIA & ENTERTAINMENT IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 116 MEXICO RETAIL IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

TABLE 117 MEXICO EDUCATION IN MODULAR DATA CENTER MARKET, BY COMPONENTS, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA MODULAR DATA CENTER MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA MODULAR DATA CENTER MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA MODULAR DATA CENTER MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA MODULAR DATA CENTER MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA MODULAR DATA CENTER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA MODULAR DATA CENTER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA MODULAR DATA CENTER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA MODULAR DATA CENTER MARKET: MULTIVARIATE MODELLING

FIGURE 9 NORTH AMERICA MODULAR DATA CENTER MARKET: COMPONENT LIFELINE CURVE

FIGURE 10 NORTH AMERICA MODULAR DATA CENTER MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA MODULAR DATA CENTER MARKET: SEGMENTATION

FIGURE 12 RISING NEED FOR SCALABLE DATA CENTERS FROM INDUSTRIES ACROSS ALL DOMAINS AND INCREASE IN DEMAND FOR PRE-FABRICATED DATA FACILITY CENTERS ARE DRIVING THE MODULAR DATA CENTER MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 SOLUTION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA MODULAR DATA CENTER MARKET IN 2023 & 2030

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL MODULAR DATA CENTER MARKET

FIGURE 15 NUMBER OF INTERNET USERS GLOBALLY

FIGURE 16 NORTH AMERICA MODULAR DATA CENTER MARKET: BY COMPONENT, 2022

FIGURE 17 NORTH AMERICA MODULAR DATA CENTER MARKET, BY TYPE, 2022

FIGURE 18 NORTH AMERICA MODULAR DATA CENTER MARKET, BY APPLICATION, 2022

FIGURE 19 NORTH AMERICA MODULAR DATA CENTER MARKET, BY DEPLOYMENT SIZE, 2022

FIGURE 20 NORTH AMERICA MODULAR DATA CENTER MARKET: BY TIER TYPE, 2022

FIGURE 21 NORTH AMERICA MODULAR DATA CENTER MARKET: BY LOCATION TYPE, 2022

FIGURE 22 NORTH AMERICA MODULAR DATA CENTER MARKET: BY VERTICAL, 2022

FIGURE 23 NORTH AMERICA MODULAR DATA CENTER MARKET: SNAPSHOT (2022)

FIGURE 24 NORTH AMERICA MODULAR DATA CENTER MARKET: BY COUNTRY (2022)

FIGURE 25 NORTH MODULAR DATA CENTER MARKET: BY COUNTRY (2023 & 2030)

FIGURE 26 NORTH MODULAR DATA CENTER MARKET: BY COUNTRY (2022 & 2030)

FIGURE 27 NORTH AMERICA MODULAR DATA CENTER MARKET: BY COMPONENT (2023-2030)

FIGURE 28 NORTH AMERICA MODULAR DATA CENTER MARKET:2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.