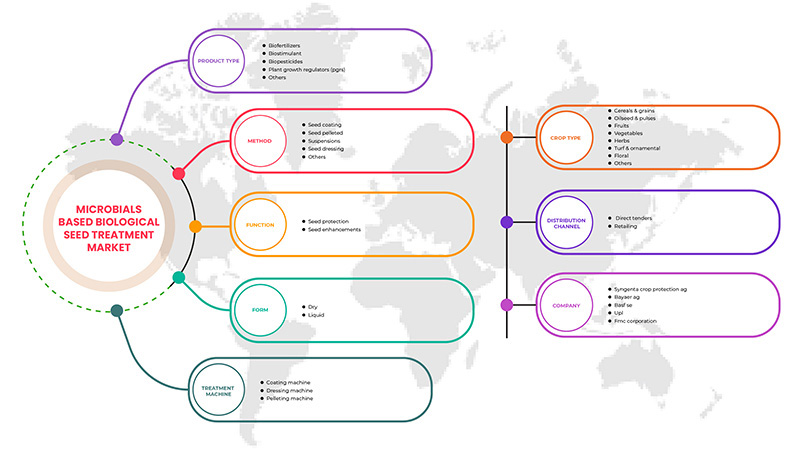

Marché nord-américain du traitement biologique des semences à base microbienne, par produit ( biofertilisants , biostimulants, biopesticides, régulateurs de croissance des plantes (PGR) et autres), forme (sec et liquide), méthode (enrobage des semences, granulés de semences, suspensions, traitement des semences et autres), machine de traitement (machine d'enrobage, machine de traitement et machine d'enrobage), fonction (protection des semences et enchantements des semences), canal de distribution (appels d'offres directs et vente au détail), type de culture (céréales et grains, oléagineux et légumineuses, fruits, légumes, herbes, gazon et plantes ornementales, fleurs et autres) Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché nord-américain du traitement biologique des semences à base microbienne

La prévalence croissante des allergies associées aux aliments cultivés chimiquement, l'augmentation des acquisitions et des fusions. Les lancements de produits de traitement des semences biologiques et biosourcés, tels que les biopesticides, les biostimulants et autres, par de nombreuses entreprises de premier plan à l'échelle mondiale, pour étendre leur présence et rendre le produit disponible dans toute la région, devraient stimuler la croissance du marché.

Par exemple,

- En février 2022, Valent BioSciences a créé une nouvelle unité opérationnelle de biostimulants soutenant l'objectif de neutralité carbone de la société mère Sumitomo Chemical d'ici 2050. Cette nouvelle unité opérationnelle est conçue pour élargir sa gamme de biostimulants avec de nouveaux produits développés en interne et en externe pour les marchés américains et mondiaux dans ce segment de production végétale important et en pleine croissance

Les acquisitions et les partenariats stimuleront la croissance du marché dans les années à venir. En revanche, les taux élevés d'aliments biologiques, cultivés naturellement et de pesticides d'origine biologique sont susceptibles de limiter la croissance du marché dans la région.

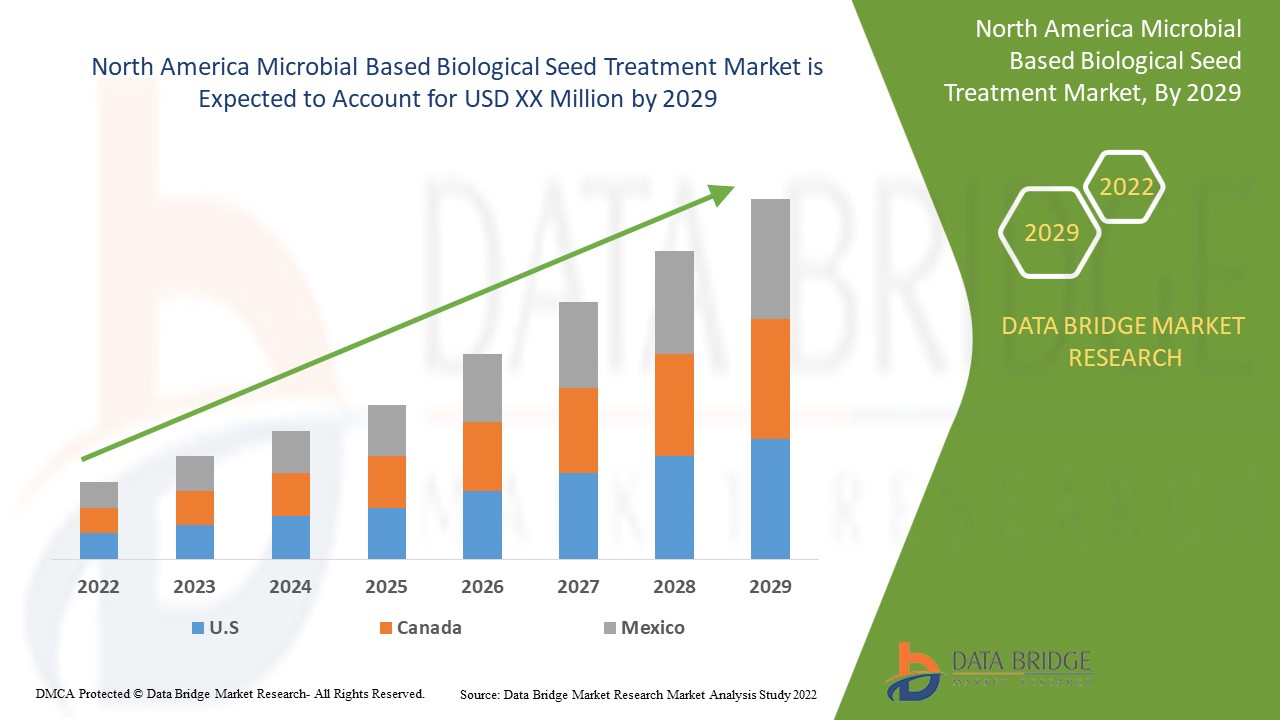

Data Bridge Market Research analyse que le marché nord-américain du traitement biologique des semences à base de microbes connaîtra un TCAC de 11,3 % au cours de la période de prévision de 2022 à 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par produit (biofertilisants, biostimulants, biopesticides, régulateurs de croissance des plantes (PGR) et autres), forme (sec et liquide), méthode (enrobage des semences, granulés de semences, suspensions, traitement des semences et autres), machine de traitement (machine d'enrobage, machine de traitement et machine d'enrobage), fonction (protection des semences et enchantements des semences), canal de distribution (offres directes et vente au détail), type de culture (céréales et grains, oléagineux et légumineuses, fruits, légumes, herbes, gazon et plantes ornementales, fleurs et autres). |

|

Régions couvertes |

États-Unis, Canada et Mexique. |

|

Acteurs du marché couverts |

Syngenta Crop Protection AG, Bayer AG, BASF SE, UPL, FMC Corporation, ADAMA, Albaugh, LLC., Arysta LifeScience Corporation, BioWorks Inc., Croda International Plc, Germains Seed Technology, Hello Nature International, Koppert, Marrone Bio Innovations, Inc., Novozymes, Plant Health Care plc., T. Stanes and Company Limited, Tagros Chemicals India Pvt. Ltd., Valent BioSciences LLC et Verdesian Life Sciences, entre autres. |

Définition du marché

Les traitements biologiques des semences sont une large classe de produits contenant des ingrédients actifs, notamment des microbes vivants, des extraits de plantes, des produits de fermentation, des phytohormones et même de la chimie dure. Les substances biologiques sont appliquées sur la graine sous forme de poudre ou de liquide. Un revêtement uniforme recouvre toute la graine. La graine est ainsi disponible pour les ingrédients bénéfiques lorsqu'elle en a besoin. Les agents actifs du traitement biologique des semences peuvent inclure des microbes tels que des champignons et des bactéries, ainsi que des extraits de plantes et d'algues. Des micro-organismes bénéfiques provenant de champignons mycorhiziens à arbuscules, de Trichoderma spp., de rhizobiums et d'autres bactéries sont appliqués aux semences avant le semis pour améliorer la germination. Une culture traitée avec des semences biologiques fonctionne comme un biostimulant, la rendant plus forte et plus productive. Le traitement augmente les rendements agricoles tout en aidant les plantes à lutter contre les maladies et à réduire le stress biotique. Les micro-organismes qui soutiennent la croissance des plantes colonisent les racines et protègent la culture pendant toute la saison de croissance. Les applications du traitement biologique des semences à base microbienne sont diverses.

Dynamique du marché nord-américain du traitement biologique des semences à base microbienne

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

-

Augmentation des lancements de produits de croissance biologique des plantes pour l'agriculture

L'augmentation du nombre de lancements par les fabricants de biopesticides tels que les bioinsecticides, les bionématicides, les biofongicides, les bioherbicides et autres est l'un des principaux facteurs de croissance du marché. La demande de produits biologiques ou naturels pour les pratiques agricoles augmente parmi les agriculteurs, avec une prise de conscience croissante de l'effet nocif des pesticides chimiques sur les cultures et l'environnement. Ce facteur propulsera la croissance du marché. Les agriculteurs adoptent des pesticides extraits de sources naturelles et se décomposant facilement pour augmenter la productivité et protéger l'environnement en réduisant la pollution.

Par exemple,

-

En mars 2021, selon Meister Media Worldwide, Botanical Solution Inc. et Syngenta ont lancé au Mexique un produit biofongicide appelé BotriStop, qui aide à contrôler Botrytis cinerea

-

En mars 2020, selon AgroSpectrum India, Bayer AG a lancé Serenade, un biofongicide en Chine

-

En avril 2020, Syngenta a collaboré avec Novozymes pour commercialiser un biofongicide nommé TAEGRO

L’augmentation du nombre de lancements par les principaux fabricants avec la demande croissante de produits de traitement des semences naturels et biologiques parmi les agriculteurs pour soutenir la pratique agricole durable peut stimuler la croissance du marché du traitement biologique des semences à base de microbes.

Opportunités

- Initiatives stratégiques prises par les entreprises

L’utilisation de micro-organismes comme alternatives biologiques devient de plus en plus cruciale en raison de la pression croissante du public et des autorités réglementaires pour réduire l’utilisation de pesticides chimiques. Les micro-organismes peuvent fonctionner comme des biostimulants et lutter efficacement contre divers ravageurs en facilitant l’accès des plantes aux nutriments contenus dans le sol et leur absorption, en augmentant leur tolérance au stress environnemental et en les aidant pendant les différentes phases de croissance.

Les entreprises élaborent des stratégies, des lancements et des plans pour répondre aux demandes des consommateurs et sensibiliser à l’agriculture durable, offrant ainsi davantage d’opportunités de développement aux fabricants.

Les entreprises vietnamiennes ont toujours cherché à introduire des solutions innovantes pour aider les agriculteurs à relever les défis de leurs activités quotidiennes et, en même temps, à augmenter le rendement et la qualité des cultures tout en étant respectueuses de l'environnement. Le lancement de nouveaux produits et technologies permet de tirer parti de l'innovation et de relever les défis de l'agriculture.

Par exemple,

- En juin 2022, Syngenta a lancé son nouveau produit de traitement des semences VICTRATO. Le produit révolutionnaire de lutte contre les nématodes VICTRATO est basé sur la technologie TYMIRIUMTM de Syngenta et offre une approche créative de ce problème complexe. Toutes les principales espèces de nématodes et maladies fongiques sont efficacement contrôlées sans compromettre la santé du sol ou des plantes. Il s'agit d'un produit très simple avec un dosage minimal de principe actif

- En mars 2022, Evonik a lancé les produits BREAK-THRU pour les applications de traitement des semences. BREAK-THRU BP 787 est un substitut biodégradable et sans microplastique aux solutions de liant conventionnelles. BREAK-TRHU BP 787 fonctionne comme un composant liant lorsqu'il est combiné à de la silice (comme Aerosil 200) en raison de sa miscibilité avec l'eau

- En juillet 2021, Rizobacter et Marrone Bio ont élargi leur alliance stratégique pour proposer un nouveau traitement des semences au Brésil. Rizonem, un traitement biologique des semences contre les nématodes et les insectes vivant dans le sol, sera disponible dans les cultures en rangs du Brésil grâce à un accord de distribution élargi. L'efficacité de Rizonema contre d'importantes espèces de nématodes dans le soja et le maïs a été démontrée dans de nombreux essais réglementaires au Brésil.

Ainsi, les innovations stratégiques des entreprises et les nouveaux produits visant à répondre aux demandes des consommateurs favorisent la croissance du marché au cours de la période de prévision.

Contraintes/Défis

- Obstacles réglementaires gouvernementaux pour les produits de traitement des semences biologiques

Les réglementations en vigueur pour les composants biologiques actifs varient d'un pays à l'autre. Dans certains pays, les produits biologiques doivent être enregistrés en vertu de lois spécifiques ou peuvent l'être de la même manière que les produits phytosanitaires chimiques. Parfois, les exigences en matière de données sont moins nombreuses et, dans d'autres cas, il n'existe même pas de processus d'enregistrement clairement défini. L'UE exige que l'efficacité d'un produit biopesticide soit quantifiée et démontrée pour étayer les allégations figurant sur l'étiquette. Seuls les biopesticides autorisés peuvent être utilisés légalement pour la protection des cultures. Selon les recommandations de l'OCDE, les biopesticides ne devraient être approuvés que s'ils présentent peu de risques.

De plus, le portefeuille de données d’homologation des biopesticides exigé par l’organisme de réglementation est généralement une version modifiée de celui qui existe pour les pesticides chimiques conventionnels. Il est utilisé par l’organisme de réglementation pour effectuer une évaluation des risques. Il contient des détails sur le mode d’action, les évaluations toxicologiques et écotoxicologiques, les tests de gamme d’hôtes et d’autres facteurs. Le coût de production de ces données peut décourager les entreprises de commercialiser des biopesticides, qui sont souvent des produits de niche.

Par conséquent, l’absence d’un système approprié d’enregistrement des biopesticides garantit la sécurité et n’inhibe pas la commercialisation qui pourrait avoir un impact négatif sur le marché du traitement biologique des semences à base de microbes.

Impact de la pandémie de COVID-19 sur le marché nord-américain du traitement biologique des semences à base microbienne

Après la pandémie, la demande de traitement biologique des semences a augmenté, car il n'y aura plus de restrictions de mouvement, ce qui facilitera l'approvisionnement en produits. En outre, la tendance croissante à utiliser des produits de traitement des semences biologiques et naturels pourrait stimuler la croissance du marché.

La demande croissante de traitement biologique des semences à base de microbes permet aux fabricants de lancer des produits de traitement des semences innovants et multifonctionnels, ce qui augmente finalement la demande de traitement biologique des semences à base de microbes et a contribué à la croissance du marché.

De plus, la forte demande de produits de traitement biologique des semences stimulera la croissance du marché. En outre, la demande accrue de produits biologiques et naturels après la pandémie de COVID-19 a entraîné une croissance du marché, les consommateurs étant plus soucieux de leur santé. De plus, l'intérêt des consommateurs pour les nouvelles technologies et les produits polyvalents devrait alimenter la croissance du marché nord-américain du traitement biologique des semences à base microbienne.

Développements récents

- En mars 2022, UPL s'est associée au centre d'innovation MAAVi de Kimitec pour commercialiser des produits biostimulants nord-américains. Cette collaboration avec l'entreprise et son centre de R&D MAAVi élargit l'offre qu'UPL proposera pour soutenir une production alimentaire durable tout en générant une plus grande rentabilité pour les producteurs

- En février 2022, Valent BioSciences a créé une nouvelle unité opérationnelle de biostimulants soutenant l'objectif de neutralité carbone de la société mère Sumitomo Chemical d'ici 2050. Cette nouvelle unité opérationnelle est conçue pour élargir sa gamme de biostimulants avec de nouveaux produits développés en interne et en externe pour les marchés américains et mondiaux dans ce segment de production végétale important et en pleine croissance.

Portée du marché nord-américain du traitement biologique des semences à base microbienne

Le marché nord-américain du traitement biologique des semences à base microbienne est segmenté en fonction du produit, de la forme, de la méthode, de la machine de traitement, de la fonction, du canal de distribution et du type de culture. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Produit

- Biofertilisants

- Biostimulants

- Biopesticides

- Régulateurs de croissance des plantes (RPG)

- Autres

Sur la base du produit, le marché nord-américain du traitement biologique des semences à base microbienne est segmenté en biofertilisants, biostimulants, biopesticides, régulateurs de croissance des plantes (PGR) et autres.

Formulaire

- Sec

- Liquide

Sur la base de la forme, le marché nord-américain du traitement biologique des semences à base microbienne est segmenté en sec et liquide.

Méthode

- Enrobage des semences

- Graines enrobées

- Suspensions

- Traitement des semences

- Autres

Sur la base de la méthode, le marché nord-américain du traitement biologique des semences à base microbienne est segmenté en enrobage des semences, enrobage des semences, en suspensions, en traitement des semences et autres.

Machines de traitement

- Machine de revêtement

- Machine à dresser

- Machine à granuler

Sur la base des machines de traitement, le marché nord-américain du traitement biologique des semences à base microbienne est segmenté en machines d'enrobage, machines d'habillage et machines de granulation.

Fonction

- Protection des semences

- Améliorations des semences

Sur la base de la fonction, le marché nord-américain du traitement biologique des semences à base microbienne est segmenté en protection des semences et en amélioration des semences.

Canal de distribution

- Appels d'offres directs

- Commerce de détail

Sur la base du canal de distribution, le marché nord-américain du traitement biologique des semences à base microbienne est segmenté en appels d'offres directs et en vente au détail.

Type de culture

- Céréales et grains

- Oléagineux et légumineuses

- Fruits

- Légumes

- Herbes

- Gazon et plantes ornementales

- Floral

- Autres

Sur la base du type de culture, le marché nord-américain du traitement biologique des semences à base microbienne est segmenté en céréales et grains, oléagineux et légumineuses, fruits, légumes, herbes, gazon et plantes ornementales, fleurs et autres.

Analyse/perspectives régionales du marché nord-américain du traitement biologique des semences à base microbienne

Le marché nord-américain du traitement biologique des semences à base microbienne est analysé et des informations sur la taille et les tendances du marché sont fournies sur la base des références ci-dessus.

Les pays couverts par le rapport sur le marché du traitement biologique des semences à base microbienne en Amérique du Nord sont les États-Unis, le Canada et le Mexique

Les États-Unis devraient dominer le marché nord-américain du traitement biologique des semences à base de microbes en termes de part de marché et de chiffre d'affaires. Ils devraient maintenir leur domination au cours de la période de prévision en raison de l'augmentation des allergies associées aux aliments cultivés chimiquement, de l'augmentation des acquisitions et des fusions dans la région Amérique du Nord.

La section régionale du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements de réglementation qui ont un impact sur les tendances actuelles et futures du marché. Des points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales et de l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du traitement biologique des semences à base microbienne en Amérique du Nord

Le marché concurrentiel du traitement biologique des semences à base microbienne en Amérique du Nord fournit des détails sur les concurrents. Les détails comprennent un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que l'accent mis par les entreprises sur le marché nord-américain du traitement biologique des semences à base microbienne.

Français Certains des principaux acteurs opérant sur le marché nord-américain du traitement biologique des semences à base microbienne sont Syngenta Crop Protection AG, Bayer AG, BASF SE, UPL, FMC Corporation, ADAMA, Albaugh, LLC., Arysta LifeScience Corporation, BioWorks Inc., Croda International Plc, Germains Seed Technology, Hello Nature International, Koppert, Marrone Bio Innovations, Inc., Novozymes, Plant Health Care plc. , T.Stanes and Company Limited, Tagros Chemicals India Pvt. Ltd., Valent BioSciences LLC et Verdesian Life Sciences, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND COMPARATIVE ANALYSIS

4.2 CONSUMER BUYING BEHAVIOR

4.2.1 RECOMMENDATIONS FROM FAMILY, FRIENDS, AND DEALERS -

4.2.2 RESEARCH

4.2.3 IMPULSIVE

4.2.4 ADVERTISEMENT:

4.2.4.1 TELEVISION ADVERTISEMENT

4.2.4.2 ONLINE ADVERTISEMENT

4.2.4.3 IN-STORE ADVERTISEMENT

4.2.4.4 OUTDOOR ADVERTISEMENT

4.3 FACTORS INFLUENCING PURCHASING DECISION

4.3.1 SUSTAINABLE AGRICULTURE

4.3.2 NEW COMBINATIONS

4.3.3 BIOSTIMULANTS

4.4 NEW PRODUCT LAUNCH STRATEGY

4.4.1 OVERVIEW

4.4.2 NUMBER OF PRODUCT LAUNCHES

4.4.2.1 LINE EXTENSION

4.4.2.2 NEW PACKAGING

4.4.2.3 RE-LAUNCHED

4.4.2.4 NEW FORMULATION

4.4.3 DIFFERENTIAL PRODUCT OFFERING

4.4.4 MEETING CONSUMER REQUIREMENT

4.4.5 PACKAGE DESIGNING

4.4.6 PRODUCT POSITIONING

4.4.7 CONCLUSION

5 SUPPLY CHAIN ANALYSIS

5.1 RAW MATERIAL PROCUREMENT

5.2 MANUFACTURING PROCESS

5.3 MARKETING AND DISTRIBUTION

5.4 END USERS

6 REGULATORY FRAMEWORK

6.1 BIOSCIENCE SOLUTIONS

6.1.1 U.S.

6.1.2 NCBI

6.1.3 FSSAI

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASE IN THE NUMBER OF APPROVALS FOR BIOPESTICIDES BY GOVERNMENTAL BODIES

7.1.2 INCREASE IN LAUNCHES OF BIOLOGICAL PLANT GROWTH PRODUCTS FOR AGRICULTURE

7.1.3 INCLINATION TOWARD THE SUSTAINABLE AGRICULTURE

7.1.4 GROWING ADOPTION OF ORGANIC FARMING

7.2 RESTRAINTS

7.2.1 LIMITED SHELF LIFE OF MICROBES

7.2.2 GOVERNMENT REGULATORY BARRIERS FOR BIOLOGICAL SEED TREATMENT PRODUCTS

7.3 OPPORTUNITIES

7.3.1 BIOENCAPSULATION TECHNOLOGY FOR BIOLOGICAL SEED TREATMENT

7.3.2 RISE IN ENVIRONMENTAL POLLUTION CAUSED BY CHEMICAL PESTICIDES

7.3.3 RISE IN AWARENESS ABOUT BIOSTIMULANTS

7.3.4 STRATEGIC INITIATIVES TAKEN BY COMPANIES

7.4 CHALLENGES

7.4.1 HIGH PRICES OF BIOPESTICIDES

7.4.2 AVAILABILITY OF CHEMICAL-BASED SUBSTITUTES

8 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 BIO PESTICIDES

8.2.1 BIO INSECTICIDES

8.2.1.1 BACILLUS THURINGIENSIS

8.2.1.2 METARHIZIUM ANISOPLIAE

8.2.1.3 BEAUVERIA BASSIANA

8.2.1.4 VERTICILLIUM LECANII

8.2.1.5 BACULOVIRUS

8.2.1.6 OTHERS

8.2.2 BIO FUNGICIDES

8.2.2.1 BACILLUS

8.2.2.2 TRICHODERMA VIRIDE

8.2.2.3 PSEUDOMONAS

8.2.2.4 STREPTOMYCES

8.2.2.5 TRICHODERMA HARZIANUM

8.2.2.6 OTHERS

8.2.3 BIONEMATICIDES

8.2.3.1 BACILLUS FIRMUS

8.2.3.2 OTHERS

8.2.4 BIO HERBICIDES

8.3 BIO STIMULANTS

8.4 BIO FERTILIZERS

8.4.1 NITROGEN FIXING BIO FERTILIZERS

8.4.1.1 RHIZOBIA BACTERIA

8.4.1.2 AZOSPIRILLUM

8.4.1.3 FRAMKIA

8.4.2 OTHERS

8.5 PLANT GROWTH REGULATORS (PGRS)

8.6 OTHERS

9 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM

9.1 OVERVIEW

9.2 DRY

9.2.1 WETTABLE POWDER

9.2.2 DRY GRANULES

9.2.3 WATER DIPS

9.3 LIQUID

9.3.1 SUSPENSION CONCENTRATE

9.3.2 EMULSIFIABLE CONCENTRATE

9.3.3 SOLUBLE LIQUID CONCENTRATE

10 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD

10.1 OVERVIEW

10.2 SEED DRESSING

10.3 SEED COATING

10.3.1 FILM COATED

10.3.2 BIOPRIMED

10.3.3 SLURRY COATED

10.4 SEED PELLETED

10.5 SUSPENSIONS

10.5.1 BACTERIAL SUSPENSION

10.5.2 SPORE SUSPENSION

10.5.3 CONIDIAL SUSPENSION

10.6 OTHERS

11 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY TREATMENT MACHINE

11.1 OVERVIEW

11.2 DRESSING MACHINE

11.3 COATING MACHINE

11.4 PELLETING MACHINE

12 NORTH AMERICA MICROBIAL BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION

12.1 OVERVIEW

12.2 SEED PROTECTION

12.2.1 DISEASE CONTROL

12.2.2 INVERTEBRATE PEST CONTROL

12.2.3 WEED CONTROL

12.3 SEED ENHANCEMENTS

12.3.1 SEED PRIMING

12.3.1.1 IMPROVED YIELD

12.3.1.2 DROUGHT RESISTANCE

12.3.1.3 SALINITY RESISTANCE

12.3.1.4 OTHERS

12.3.2 SEED DISINFECTION

13 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDERS

13.3 RETAILING

14 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE

14.1 OVERVIEW

14.2 CEREALS & GRAINS

14.2.1 WHEAT

14.2.2 RICE

14.2.3 MAIZE

14.2.4 BARLEY

14.2.5 OTHER

14.3 OILSEED & PULSES

14.3.1 SOYBEAN

14.3.2 COTTONSEED

14.3.3 PEANUT

14.3.4 RAPESEED

14.3.5 PEA

14.3.6 GRAM

14.3.7 CHICKPEAS

14.3.8 LENTIL

14.3.9 OTHERS

14.4 FRUITS

14.4.1 BANANA

14.4.2 APPLE

14.4.3 ORANGE

14.4.4 GRAPES

14.4.5 STRAWBERRIES

14.4.6 PINEAPPLE

14.4.7 MANGOES

14.4.8 POMEGRANATE

14.4.9 PEACH

14.4.10 PASSIONFRUIT

14.4.11 WATERMELON

14.4.12 OTHERS

14.5 VEGETABLES

14.5.1 SOLANAECEOUS

14.5.1.1 EGGPLANT

14.5.1.2 PEPPER

14.5.1.3 TOMATO

14.5.1.4 OTHERS

14.5.2 CUCURBITS

14.5.2.1 CUCUMBER

14.5.2.2 ZUCCHINI

14.5.2.3 BITTERGOURD

14.5.2.4 BOTTLEGOURD

14.5.2.5 SQUASH

14.5.2.6 OTHERS

14.5.3 ROOT & BULB

14.5.3.1 CARROTS

14.5.3.2 BEET ROUTE

14.5.3.3 ONION

14.5.3.3.1 RED ONION

14.5.3.3.2 WHITE ONION

14.5.3.4 RADISHES

14.5.3.5 RUTABAGA

14.5.3.6 OTHERS

14.5.4 BRASSICA

14.5.4.1 CABBAGE

14.5.4.2 PAK CHOI

14.5.4.3 SPINACH

14.5.4.4 CAULIFLOWER

14.5.4.5 LETTUCE

14.5.4.6 BROCCOLI

14.5.4.7 ARUGULA

14.5.4.8 MUSTARD

14.5.4.9 OTHERS

14.5.5 LARGE CROPS

14.5.5.1 BEAN

14.5.5.2 SWEETCORN

14.5.5.3 BABYCORN

14.5.5.4 OTHERS

14.6 HERBS

14.6.1 BASIL

14.6.2 CILANTRO

14.6.3 PARSLEY

14.6.4 DILL

14.6.5 OTHERS

14.7 FLORAL

14.8 TURF & ORNAMENTAL

14.9 OTHERS

15 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 SYNGENTA CROP PROTECTION AG

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 BAYER AG

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 BASF SE

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 UPL

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENT

18.5 FMC CORPORATION

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENT

18.6 ADAMA

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENT

18.7 ALBAUGH, LLC.

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENTS

18.8 ARYSTA LIFESCIENCE CORPORATION

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 BIOWORKS INC.

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENTS

18.1 CRODA INTERNATIONAL PLC

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCT PORTFOLIO

18.10.4 RECENT DEVELOPMENT

18.11 GERMAINS SEED TECHNOLOGY

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 HELLO NATURE INTERNATIONAL

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENTS

18.13 KOPPERT

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 MARRONE BIO INNOVATIONS, INC.

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENTS

18.15 NOVOZYMES

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 PLANT HEALTH CARE PLC.

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT DEVELOPMENT

18.17 TAGROS CHEMICALS INDIA PVT. LTD.

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENTS

18.18 T.STANES AND COMPANY LIMITED

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 RECENT DEVELOPMENTS

18.19 VALENT BIOSCIENCES LLC

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 VERDESIAN LIFE SCIENCES

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

Liste des tableaux

TABLE 1 PRICES OF BIOPESTICIDES

TABLE 2 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA BIO PESTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA BIO PESTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA BIO INSECTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA BIO FUNGICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA BIONEMATICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA BIO STIMULANTS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA NITROGEN FIXING BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA PLANT GROWTH REGULATORS (PGRS) IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA OTHERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION))

TABLE 14 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA DRY IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA DRY IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA LIQUID IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA LIQUID IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA SEED DRESSING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA SEED COATING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA SEED COATING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA SEED PELLETED IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA SUSPENSION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA SUSPENSIONS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA OTHERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY TREATMENT MACHINES, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA DRESSING MACHINE IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA COATING MACHINE IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA PELLETING MACHINE IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA MICROBIAL BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA SEED PROTECTION IN MICROBIAL BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA SEED PROTECTION IN MICROBIAL BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA SEED ENHANCEMENTS IN MICROBIAL BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA SEED ENHANCEMENTS IN MICROBIAL BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA SEED PRIMING IN MICROBIAL BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA DIRECT TENDERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA RETAILING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA CEREALS & GRAINS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA CEREALS & GRAINS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA OILSEED & PULSES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA OILSEED & PULSES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION))

TABLE 45 NORTH AMERICA FRUITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA FRUITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA VEGETABLES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA VEGETABLES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA SOLANAECEOUS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA CUCURBITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA ROOT & BULB IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA ONION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA BRASSICA IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA LARGE CROPS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA HERBS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA HERBS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA FLORAL IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA TURF & ORNAMENTAL IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA OTHERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION))

TABLE 60 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA NITROGEN FIXING BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA BIO PESTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA BIO INSECTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA BIO FUNGICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA BIONEMATICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA DRY IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA LIQUID IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA SEED COATING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA SUSPENSIONS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY TREATMENT MACHINES, 2020-2029 (USD MILLION)

TABLE 75 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 76 NORTH AMERICA SEED PROTECTION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 77 NORTH AMERICA SEED ENHANCEMENTS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA SEED PRIMING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 79 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 80 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 81 NORTH AMERICA CEREALS & GRAINS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 82 NORTH AMERICA OILSEED & PULSES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 83 NORTH AMERICA FRUITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 84 NORTH AMERICA VEGETABLES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 85 NORTH AMERICA SOLANAECEOUS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 86 NORTH AMERICA CUCURBITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 87 NORTH AMERICA ROOT & BULB IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 88 NORTH AMERICA ONION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 89 NORTH AMERICA BRASSICA IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 90 NORTH AMERICA LARGE CROPS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 91 NORTH AMERICA HERBS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 92 U.S. MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 93 U.S. BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 94 U.S. NITROGEN FIXING BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 95 U.S. BIO PESTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 96 U.S. BIO INSECTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 97 U.S. BIO FUNGICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 98 U.S. BIONEMATICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 99 U.S. MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 100 U.S. DRY IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 101 U.S. LIQUID IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 102 U.S. MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 103 U.S. SEED COATING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 104 U.S. SUSPENSIONS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 105 U.S. MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY TREATMENT MACHINES, 2020-2029 (USD MILLION)

TABLE 106 U.S. MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 107 U.S. SEED PROTECTION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 108 U.S. SEED ENHANCEMENTS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 109 U.S. SEED PRIMING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 110 U.S. MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 111 U.S. MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 112 U.S. CEREALS & GRAINS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 113 U.S. OILSEED & PULSES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 114 U.S. FRUITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 115 U.S. VEGETABLES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 116 U.S. SOLANAECEOUS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 117 U.S. CUCURBITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 118 U.S. ROOT & BULB IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 119 U.S. ONION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 120 U.S. BRASSICA IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 121 U.S. LARGE CROPS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 122 U.S. HERBS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 123 CANADA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 124 CANADA BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 125 CANADA NITROGEN FIXING BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 126 CANADA BIO PESTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 127 CANADA BIO INSECTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 128 CANADA BIO FUNGICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 129 CANADA BIONEMATICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 130 CANADA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 131 CANADA DRY IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 132 CANADA LIQUID IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 133 CANADA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 134 CANADA SEED COATING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 135 CANADA SUSPENSIONS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 136 CANADA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY TREATMENT MACHINES, 2020-2029 (USD MILLION)

TABLE 137 CANADA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 138 CANADA SEED PROTECTION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 139 CANADA SEED ENHANCEMENTS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 140 CANADA SEED PRIMING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 141 CANADA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 142 CANADA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 143 CANADA CEREALS & GRAINS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 144 CANADA OILSEED & PULSES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 145 CANADA FRUITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 146 CANADA VEGETABLES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 147 CANADA SOLANAECEOUS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 148 CANADA CUCURBITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 149 CANADA ROOT & BULB IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 150 CANADA ONION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 151 CANADA BRASSICA IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 152 CANADA LARGE CROPS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 153 CANADA HERBS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 154 MEXICO MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 155 MEXICO BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 156 MEXICO NITROGEN FIXING BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 157 MEXICO BIO PESTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 158 MEXICO BIO INSECTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 159 MEXICO BIO FUNGICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 160 MEXICO BIONEMATICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 161 MEXICO MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 162 MEXICO DRY IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 163 MEXICO LIQUID IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 164 MEXICO MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 165 MEXICO SEED COATING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 166 MEXICO SUSPENSIONS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 167 MEXICO MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY TREATMENT MACHINES, 2020-2029 (USD MILLION)

TABLE 168 MEXICO MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 169 MEXICO SEED PROTECTION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 170 MEXICO SEED ENHANCEMENTS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 171 MEXICO SEED PRIMING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 172 MEXICO MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 173 MEXICO MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 174 MEXICO CEREALS & GRAINS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 175 MEXICO OILSEED & PULSES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 176 MEXICO FRUITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 177 MEXICO VEGETABLES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 178 MEXICO SOLANAECEOUS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 179 MEXICO CUCURBITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 180 MEXICO ROOT & BULB IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 181 MEXICO ONION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 182 MEXICO BRASSICA IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 183 MEXICO LARGE CROPS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 184 MEXICO HERBS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: DBMR SAFETY MARKET POSITION GRID

FIGURE 8 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: SEGMENTATION

FIGURE 10 INCREASE IN THE NUMBER OF APPROVALS FOR BIOPESTICIDES BY GOVERNMENTAL BODIES DRIVING THE NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET IN THE FORECAST PERIOD 2022-2029

FIGURE 11 BIOPESTICIDES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET IN 2022 & 2029

FIGURE 12 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: FACTORS AFFECTING NEW PRODUCT LAUNCHES STRATEGY

FIGURE 13 SUPPLY CHAIN ANALYSIS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET

FIGURE 15 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY PRODUCT, 2021

FIGURE 16 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY FORM, 2021

FIGURE 17 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY METHOD, 2021

FIGURE 18 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY TREATMENT MACHINES, 2021

FIGURE 19 NORTH AMERICA MICROBIAL BASED BIOLOGICAL SEED TREATMENT MARKET: BY FUNCTION, 2021

FIGURE 20 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 21 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY CROP TYPE, 2021

FIGURE 22 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: SNAPSHOT (2021)

FIGURE 23 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY COUNTRY (2021)

FIGURE 24 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY PRODUCT (2022-2029)

FIGURE 27 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.