North America Menstrual Cramps Treatment Market

Taille du marché en milliards USD

TCAC :

%

USD

2.39 Billion

USD

4.21 Billion

2024

2032

USD

2.39 Billion

USD

4.21 Billion

2024

2032

| 2025 –2032 | |

| USD 2.39 Billion | |

| USD 4.21 Billion | |

|

|

|

|

Segmentation du marché nord-américain du traitement des crampes menstruelles, par type (dysménorrhée primaire, dysménorrhée secondaire), type de traitement (médicament, thérapie, chirurgie, autres), mode de prescription (sans ordonnance, sur ordonnance), voie d'administration (orale, parentérale, implants, autres), utilisateur final (hôpitaux, centres spécialisés, centres de chirurgie ambulatoire, autres), canal de distribution (pharmacies, vente au détail, appel d'offres direct, autres), pays (États-Unis, Canada, Mexique), tendances et prévisions du secteur jusqu'en 2032

Taille du marché du traitement des crampes menstruelles

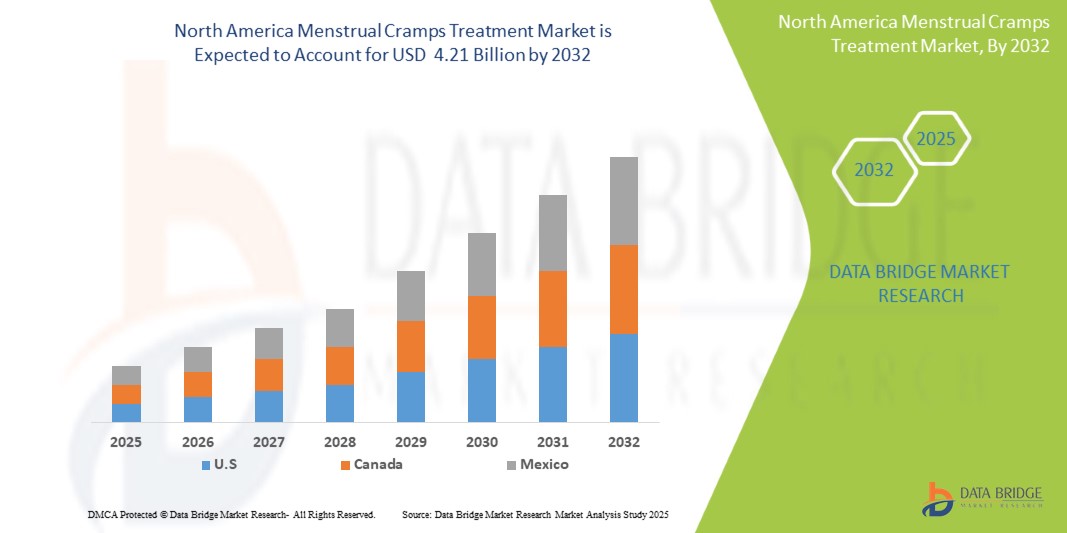

- La taille du marché nord-américain du traitement des crampes menstruelles était évaluée à 2,39 milliards USD en 2024 et devrait atteindre 4,21 milliards USD d'ici 2032 , à un TCAC de 7,6 % au cours de la période de prévision.

- La croissance du marché du traitement des crampes menstruelles en Amérique du Nord est largement alimentée par la prévalence croissante de la dysménorrhée et la sensibilisation croissante à la santé menstruelle, ce qui entraîne une demande accrue d'options de traitement efficaces dans toute la région.

- De plus, la demande croissante des consommateurs pour des solutions sûres, efficaces et facilement accessibles pour soulager les douleurs menstruelles fait de diverses modalités de traitement, notamment les médicaments sans ordonnance et les méthodes non pharmacologiques avancées, le choix moderne. Ces facteurs convergents accélèrent l'adoption de solutions pour le traitement des crampes menstruelles, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché du traitement des crampes menstruelles

- Les traitements contre les crampes menstruelles, qui soulagent la douleur et l’inconfort associés aux menstruations, sont des éléments de plus en plus essentiels de la gestion de la santé des femmes en Amérique du Nord en raison de leur efficacité prouvée, de leurs diverses options d’administration et de l’importance croissante accordée aux soins personnalisés.

- La demande croissante de traitements contre les crampes menstruelles aux États-Unis, au Canada et au Mexique est principalement due à la forte prévalence de la dysménorrhée, à la sensibilisation croissante à la santé menstruelle et à une forte préférence pour des solutions efficaces et pratiques de soulagement de la douleur.

- Les États-Unis détiennent une part importante du marché nord-américain du traitement des crampes menstruelles, représentant 75 % des revenus régionaux, soutenus par des dépenses de santé élevées, une large couverture d'assurance et une disponibilité généralisée de médicaments sur ordonnance et en vente libre (OTC).

- Le Canada et le Mexique connaissent également une croissance constante, alimentée par l’élargissement de l’accès aux services de santé, l’intensification des campagnes d’éducation des consommateurs sur la santé des femmes et une population féminine croissante à la recherche d’options de traitement fiables.

- Le segment des médicaments, en particulier les anti-inflammatoires non stéroïdiens (AINS), devrait dominer le marché nord-américain du traitement des crampes menstruelles, représentant 60 % de la part de marché totale, grâce à leur réputation établie d'efficacité, d'abordabilité et de large disponibilité en tant que traitement de première intention pour la dysménorrhée.

Portée du rapport et segmentation du marché du traitement des crampes menstruelles

|

Attributs |

Aperçu du marché des clés de verrouillage intelligentes |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché du traitement des crampes menstruelles

« Gestion personnalisée de la douleur grâce à des solutions de santé numériques basées sur l'IA »

- Une tendance significative et croissante sur le marché nord-américain du traitement des crampes menstruelles est l'intégration croissante de l'intelligence artificielle (IA) et des plateformes de santé numérique. Cette fusion des technologies améliore considérablement le confort et le contrôle des utilisateurs sur leurs stratégies de gestion de la douleur.

- Par exemple, les applications de suivi des règles basées sur l'IA, comme Flo et Clue, s'intègrent parfaitement aux symptômes signalés par les utilisatrices et à l'historique des cycles, leur permettant de prédire les règles, l'ovulation et les périodes de fertilité avec une précision accrue, et offrant souvent des informations personnalisées pour gérer l'inconfort associé. De même, les appareils portables utilisant des technologies comme la neurostimulation électrique transcutanée (TENS) ou la thermothérapie s'intègrent à des applications intelligentes pour proposer des programmes de soulagement de la douleur personnalisables.

- L'intégration de l'IA dans le traitement des crampes menstruelles permet notamment d'apprendre les schémas de douleur des utilisateurs afin de suggérer des moments de traitement optimaux et de générer des alertes plus intelligentes en fonction de la gravité des symptômes. Par exemple, certaines thérapies numériques utilisent l'IA pour améliorer les recommandations de soulagement de la douleur au fil du temps et peuvent envoyer des alertes intelligentes en cas de douleur inhabituelle ou intense. De plus, les plateformes de santé numérique offrent aux utilisateurs la possibilité de suivre facilement leurs symptômes, leur prise de médicaments et leur mode de vie, leur permettant ainsi de mieux comprendre et gérer leur parcours de santé menstruelle.

- L'intégration transparente des solutions d'IA à des écosystèmes de santé numérique plus vastes facilite le contrôle centralisé des différents aspects du bien-être menstruel. Grâce à une interface unique, les utilisateurs peuvent gérer leurs stratégies de soulagement de la douleur, ainsi que le suivi de leur humeur, de leur niveau d'activité et d'autres données de santé, créant ainsi une approche unifiée et automatisée de la gestion de la santé menstruelle.

- Cette tendance vers des systèmes de gestion de la douleur plus intelligents, intuitifs et interconnectés transforme fondamentalement les attentes des utilisatrices en matière de soulagement des douleurs menstruelles. Par conséquent, les entreprises développent des solutions de santé numérique basées sur l'IA, dotées de fonctionnalités telles que des recommandations personnalisées automatiques pour soulager la douleur en fonction des symptômes signalés et une intégration avec d'autres applications de bien-être.

- La demande de traitements contre les crampes menstruelles offrant une intégration transparente de l’IA et de la santé numérique augmente rapidement sur le marché nord-américain, car les consommateurs privilégient de plus en plus la commodité, les soins personnalisés et les fonctionnalités complètes d’autogestion.

Dynamique du marché du traitement des crampes menstruelles

Conducteur

« Besoin croissant en raison de la prévalence croissante de la dysménorrhée et d'une sensibilisation accrue à la santé »

- La prévalence croissante des crampes menstruelles (dysménorrhée) chez les femmes, associée à la sensibilisation croissante et aux discussions ouvertes autour de la santé menstruelle, est un facteur important de la demande accrue de traitements efficaces contre les crampes menstruelles.

- Par exemple, ces dernières années, des entreprises ont lancé des solutions non pharmacologiques innovantes, telles que des appareils de thermothérapie portables ou des unités TENS, visant à soulager la douleur de manière pratique et sans médicament. Ces avancées, réalisées par des entreprises clés, devraient stimuler la croissance du secteur du traitement des crampes menstruelles au cours de la période de prévision.

- À mesure que les individus deviennent plus conscients de l’impact des douleurs menstruelles sur leur vie quotidienne et recherchent des options de soulagement et de gestion améliorées, les traitements modernes offrent des fonctionnalités avancées telles qu’un soulagement ciblé de la douleur, des approches personnalisées et des effets secondaires réduits, offrant une alternative ou un complément convaincant aux méthodes traditionnelles.

- De plus, la popularité croissante des approches de santé holistiques et le désir d’un bien-être global font des traitements des crampes menstruelles un élément essentiel de ces stratégies de santé plus larges, offrant une intégration transparente avec les modifications du mode de vie et les pratiques d’autosoins.

- La commodité des médicaments en vente libre, l'accessibilité à une diversité d'options thérapeutiques et la possibilité de gérer les symptômes grâce à des applications de santé numériques conviviales sont des facteurs clés qui favorisent l'adoption des traitements contre les crampes menstruelles. La tendance à l'autogestion et la disponibilité croissante d'options thérapeutiques variées contribuent également à la croissance du marché.

Retenue/Défi

« Préoccupations concernant les effets secondaires et la stigmatisation associés aux traitements »

- Les inquiétudes concernant les effets secondaires potentiels des traitements pharmaceutiques et la stigmatisation sociale associée aux problèmes de santé menstruelle constituent un obstacle majeur à une pénétration plus large du marché. Les traitements des crampes menstruelles impliquant souvent des médicaments ou des thérapies, ils peuvent être associés à des effets indésirables ou à une réticence à demander de l'aide pour des raisons de confidentialité, suscitant des inquiétudes chez les consommateurs potentiels quant à la sécurité et à la pertinence de ces options.

- Par exemple, la sensibilisation du public aux effets secondaires potentiels de certains médicaments ou le caractère invasif perçu de certaines thérapies ont rendu certains consommateurs hésitants à adopter des solutions de traitement conventionnelles.

- Répondre à ces préoccupations par des recherches solides, une communication claire sur les bénéfices et les risques, et le développement de thérapies plus ciblées est essentiel pour gagner la confiance des consommateurs. Les entreprises mettent en avant la rigueur de leurs essais cliniques et leurs programmes d'accompagnement des patients afin de rassurer les acheteurs potentiels. De plus, le coût relativement élevé de certains traitements avancés ou à long terme, ou l'insuffisance des politiques de remboursement, peuvent constituer un frein à l'adoption par les consommateurs sensibles au prix, notamment ceux qui recherchent des soins spécialisés. Si les analgésiques de base en vente libre sont abordables, les fonctionnalités haut de gamme, telles que les dispositifs portables avancés ou les plans de traitement personnalisés, sont souvent plus onéreuses.

- Bien que l’accessibilité à divers traitements s’améliore, le fardeau perçu de la gestion continue ou la préférence pour les alternatives non pharmacologiques peuvent encore entraver une adoption généralisée, en particulier pour ceux qui recherchent des approches plus naturelles ou moins invasives.

- Surmonter ces défis grâce à une meilleure éducation des patients, des informations transparentes sur les résultats des traitements et le développement d’options thérapeutiques plus abordables et plus accessibles sera essentiel pour une croissance soutenue du marché.

Portée du marché du traitement des crampes menstruelles

Le marché est segmenté en fonction du type, du type de traitement, du mode de prescription, de la voie d’administration, de l’utilisateur final et du canal de distribution.

Par type

En Amérique du Nord, le marché du traitement des crampes menstruelles est segmenté en dysménorrhée primaire et dysménorrhée secondaire. Le segment de la dysménorrhée primaire devrait représenter la plus grande part de marché, soit 68 % en 2025, en raison de sa forte prévalence chez les adolescentes et les jeunes femmes. L'intensification des campagnes de sensibilisation et l'amélioration de l'accès aux médicaments sans ordonnance contribuent à la demande de traitements efficaces contre les douleurs menstruelles primaires. Ce segment devrait connaître une croissance annuelle composée (TCAC) de 6,5 % entre 2025 et 2032.

Par type de traitement

En fonction du type de traitement, le marché est segmenté en médicaments, thérapie, chirurgie et autres. Le segment des médicaments, en particulier les anti-inflammatoires non stéroïdiens (AINS), représentait la plus grande part de chiffre d'affaires du marché en 2025, reflétant leur rôle établi comme traitement de première intention, leur accessibilité financière et leur large disponibilité. Le segment des thérapies, y compris la thermothérapie et la neurostimulation électrique transcutanée (TENS), devrait connaître le TCAC le plus rapide de 2025 à 2032, stimulé par l'intérêt croissant des consommateurs pour les solutions non pharmacologiques de gestion de la douleur.

Par mode de prescription

, le marché se divise en traitements en vente libre (OTC) et sur ordonnance. Le segment des médicaments en vente libre domine le marché, soutenu par l'utilisation généralisée des AINS et des analgésiques sans ordonnance et par une forte pénétration des pharmacies de détail. Le segment des médicaments sur ordonnance est également en expansion, stimulé par la demande de thérapies hormonales et de traitements ciblés pour la dysménorrhée secondaire.

Par voie d'administration

. Le marché comprend les voies d'administration orale, parentérale, les implants et autres. Le segment oral détenait la plus grande part de chiffre d'affaires en 2025, en raison de sa facilité d'utilisation, de sa rapidité d'action et de la familiarité des consommateurs avec les analgésiques oraux. Le segment des implants devrait connaître une croissance régulière à mesure que les dispositifs intra-utérins hormonaux gagnent en popularité pour la prise en charge à long terme de la dysménorrhée.

Par utilisateur final

, le marché est segmenté en hôpitaux, centres spécialisés, centres de chirurgie ambulatoire et autres. Les hôpitaux représentent la plus grande part du chiffre d'affaires, reflétant le volume élevé de consultations et de traitements administrés par les services hospitaliers ambulatoires et hospitaliers. Les centres spécialisés devraient connaître une croissance rapide, stimulés par le rôle croissant des cliniques de gynécologie dans la fourniture de plans de traitement personnalisés et d'interventions mini-invasives.

Par canal de distribution :

Le segment des canaux de distribution comprend les pharmacies, la vente au détail, les appels d’offres directs et autres. Les pharmacies restent le principal canal de distribution, soutenues par de fortes ventes de médicaments en vente libre et l’exécution des ordonnances. Les ventes au détail, y compris les plateformes de commerce électronique, connaissent une forte croissance en raison de la préférence des consommateurs pour un accès pratique et la livraison à domicile.

Analyse régionale du marché du traitement des crampes menstruelles

- L'Amérique du Nord devrait détenir une part de marché significative dans le traitement des crampes menstruelles, grâce à la forte prévalence de la dysménorrhée chez les femmes et à une infrastructure de santé bien établie. Les États-Unis sont le principal contributeur à ce marché, soutenus par une sensibilisation croissante, une couverture d'assurance solide et une large gamme de traitements, en vente libre et sur ordonnance. Le Canada et le Mexique connaissent également une croissance constante grâce à l'amélioration de l'accès aux services de santé pour les femmes et à une meilleure éducation aux soins menstruels.

- Les consommateurs de la région apprécient particulièrement l'efficacité du soulagement de la douleur, la commodité et la possibilité de choisir parmi de multiples options de traitement, notamment des thérapies non pharmacologiques et des médicaments de pointe. La recherche proactive de solutions médicales pour les troubles menstruels est de plus en plus acceptée, encouragée par des campagnes de sensibilisation ciblées et des initiatives qui positionnent la santé menstruelle comme un aspect essentiel du bien-être général.

- Cette adoption généralisée est en outre soutenue par des dépenses de santé élevées, une population engagée dans la technologie et la popularité croissante du commerce électronique et des canaux de pharmacie de détail, établissant la gestion complète des douleurs menstruelles comme une approche privilégiée dans les pays d'Amérique du Nord.

Aperçu du marché américain du traitement des crampes menstruelles

Les États-Unis sont le marché dominant en Amérique du Nord pour le traitement des crampes menstruelles, représentant la plus grande part de chiffre d'affaires (75 %). La croissance est tirée par une forte sensibilisation à la santé menstruelle, une large disponibilité des traitements en vente libre et sur ordonnance, et une couverture d'assurance solide. Les consommateurs privilégient de plus en plus des solutions efficaces de soulagement de la douleur, y compris des options pharmaceutiques et non pharmacologiques, soutenues par de solides réseaux de pharmacies de détail et des plateformes de commerce électronique en expansion. Les initiatives de santé publique, les programmes de bien-être soutenus par les employeurs et l'intégration de la santé menstruelle dans des politiques plus larges de santé des femmes stimulent encore la demande du marché.

Aperçu du marché canadien du traitement des crampes menstruelles :

Le Canada occupe une place importante sur le marché nord-américain du traitement des crampes menstruelles, grâce à des investissements croissants dans les soins de santé, à une couverture universelle des soins de santé et à une sensibilisation accrue du public à la santé menstruelle. L’accent est mis de plus en plus sur l’accès équitable aux produits menstruels et à l’éducation, ce qui soutient indirectement la demande de solutions de gestion de la douleur. Le marché bénéficie d’un mélange de médicaments traditionnels et de thérapies alternatives, ainsi que d’un intérêt croissant pour des solutions holistiques et durables pour le soulagement des douleurs menstruelles.

Aperçu du marché mexicain du traitement des crampes menstruelles.

Le marché mexicain du traitement des crampes menstruelles connaît une croissance constante, soutenue par le développement des infrastructures de santé, une sensibilisation accrue aux problèmes de santé menstruelle et des efforts visant à réduire la stigmatisation liée au recours au traitement des douleurs menstruelles. Les consommateurs se tournent de plus en plus vers des solutions pharmaceutiques et non médicamenteuses à mesure que l'accès aux services de santé s'améliore. Les initiatives gouvernementales et non gouvernementales en faveur de la santé des femmes et de l'hygiène menstruelle contribuent également à l'expansion du marché, parallèlement à la croissance de l'urbanisation et à l'augmentation des revenus disponibles.

Part de marché du traitement des crampes menstruelles

L'industrie des serrures intelligentes est principalement dirigée par des entreprises bien établies, notamment :

- Bayer AG (Leverkusen, Allemagne)

- GlaxoSmithKline plc (Londres, Royaume-Uni)

- Pfizer Inc. (New York, États-Unis)

- Teva Pharmaceuticals USA, Inc. (Parsippany, New Jersey, États-Unis)

- Color Seven Co., Ltd. (Séoul, Corée du Sud)

- Beurer GmbH (Ulm, Allemagne)

- Mylan NV (Canonsburg, Pennsylvanie, États-Unis)

- Boehringer Ingelheim International GmbH (Ingelheim am Rhein, Allemagne)

- PMS4PMS, LLC (les informations sur le siège social ne sont pas facilement disponibles)

- Sanofi (Paris, France)

- Nobelpharma Co., Ltd. (Les informations sur le siège social ne sont pas facilement disponibles)

- ObsEva (Genève, Suisse)

- Myovant Sciences Ltd. (Bâle, Suisse)

- AbbVie Inc. (North Chicago, Illinois, États-Unis)

- BioElectronics Corporation (Frederick, Maryland, États-Unis)

- LIVIA (Informations sur le siège social non disponibles)

- Alvogen (Pine Brook, New Jersey, États-Unis)

- Cumberland Pharmaceuticals Inc. (Nashville, Tennessee, États-Unis)

- Lupin Pharmaceuticals, Inc. (Baltimore, Maryland, États-Unis)

- Janssen Pharmaceuticals, Inc. (Titusville, New Jersey, États-Unis)

- Sun Pharmaceutical Industries Ltd. (Bombay, Inde)

Derniers développements sur le marché nord-américain du traitement des crampes menstruelles

- En mars 2025, Samphire Neuroscience, pionnier des neurotechnologies, a officiellement lancé Nettle™, son dispositif cérébral certifié CE conçu pour soulager les symptômes mentaux et physiques associés aux menstruations. Cette initiative souligne la volonté de l'entreprise de proposer des solutions innovantes et non pharmacologiques de soulagement de la douleur, adaptées à la demande croissante en Amérique du Nord pour une gestion alternative et technologique de la santé menstruelle. En s'appuyant sur son expertise en stimulation transcrânienne à courant continu (tDCS), Samphire Neuroscience s'attaque non seulement à l'inconfort, mais renforce également sa position sur le marché en pleine expansion de la femtech et des thérapies numériques.

- En 2024, Bayer AG a poursuivi sa stratégie visant à développer des traitements contre les douleurs pelviennes associées à l'endométriose, une cause importante de dysménorrhée secondaire en Amérique du Nord. Cet engagement continu, illustré par la recherche et la commercialisation soutenues de produits comme Visanne, souligne la volonté de l'entreprise de proposer des solutions médicales efficaces et adaptées aux douleurs gynécologiques complexes. En s'appuyant sur ses vastes capacités de R&D et son expertise pharmaceutique reconnue, Bayer AG s'attaque non seulement à la douleur chronique, mais renforce également sa position dominante dans le secteur en pleine évolution de la santé féminine.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.