North America Melanoma Cancer Diagnostics Market

Taille du marché en milliards USD

TCAC :

%

USD

1,964.80 Million

USD

3,466.02 Million

2022

2030

USD

1,964.80 Million

USD

3,466.02 Million

2022

2030

| 2023 –2030 | |

| USD 1,964.80 Million | |

| USD 3,466.02 Million | |

|

|

|

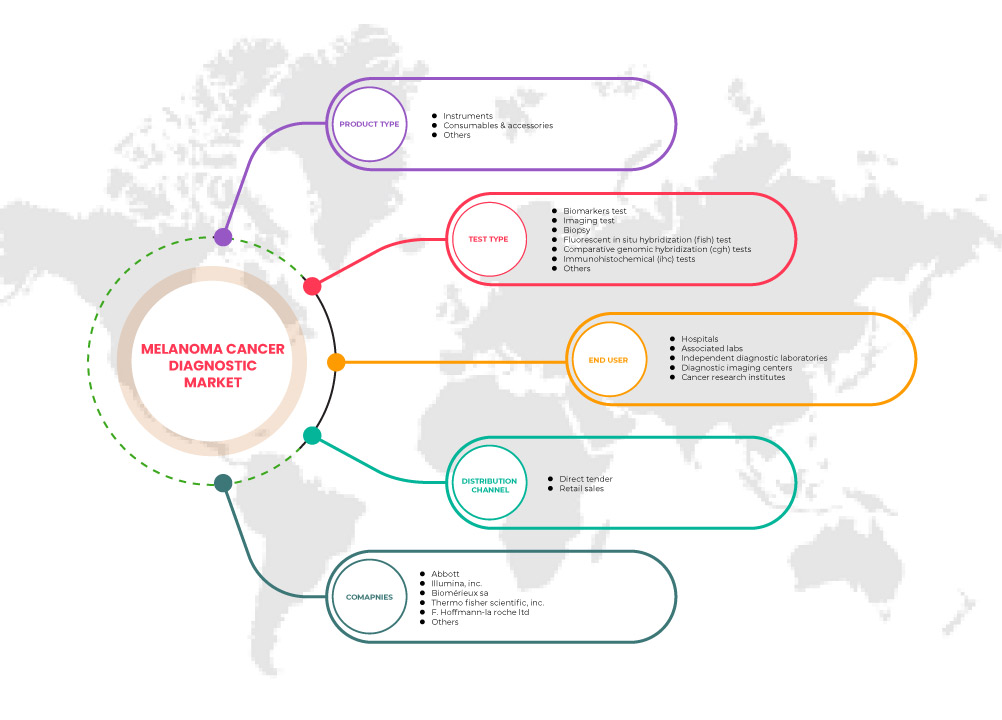

Marché nord-américain du diagnostic du cancer du mélanome, par type de produit (instruments, consommables et accessoires, et autres), type de test (test de biomarqueurs, test d'imagerie, biopsie, tests d'hybridation in situ fluorescente (FISH), tests d'hybridation génomique comparative (CGH), tests immunohistochimiques (IHC) et autres), utilisateur final (hôpitaux, laboratoires associés, laboratoires de diagnostic indépendants, centres d'imagerie diagnostique, instituts de recherche sur le cancer et autres), canal de distribution (appel d'offres direct et vente au détail) - Tendances et prévisions de l'industrie 2030.

Analyse et perspectives du marché du diagnostic du cancer du mélanome en Amérique du Nord

La demande croissante de méthodes de test non invasives à l'échelle mondiale a renforcé la demande du marché. L'augmentation des dépenses de santé pour de meilleurs services de santé contribue également à la croissance du marché. Les principaux acteurs du marché se concentrent fortement sur divers diagnostics plus rapides pendant cette période cruciale. En outre, les initiatives gouvernementales en matière de diagnostic du cancer du mélanome contribuent également à la demande croissante pour le marché du diagnostic du cancer du mélanome.

Les initiatives stratégiques des acteurs du marché en matière de dépenses de santé en hausse offrent des opportunités au marché. Cependant, le manque de professionnels qualifiés et certifiés et le coût élevé des procédures de diagnostic des cancers du mélanome dans les économies émergentes constituent des défis majeurs pour la croissance du marché.

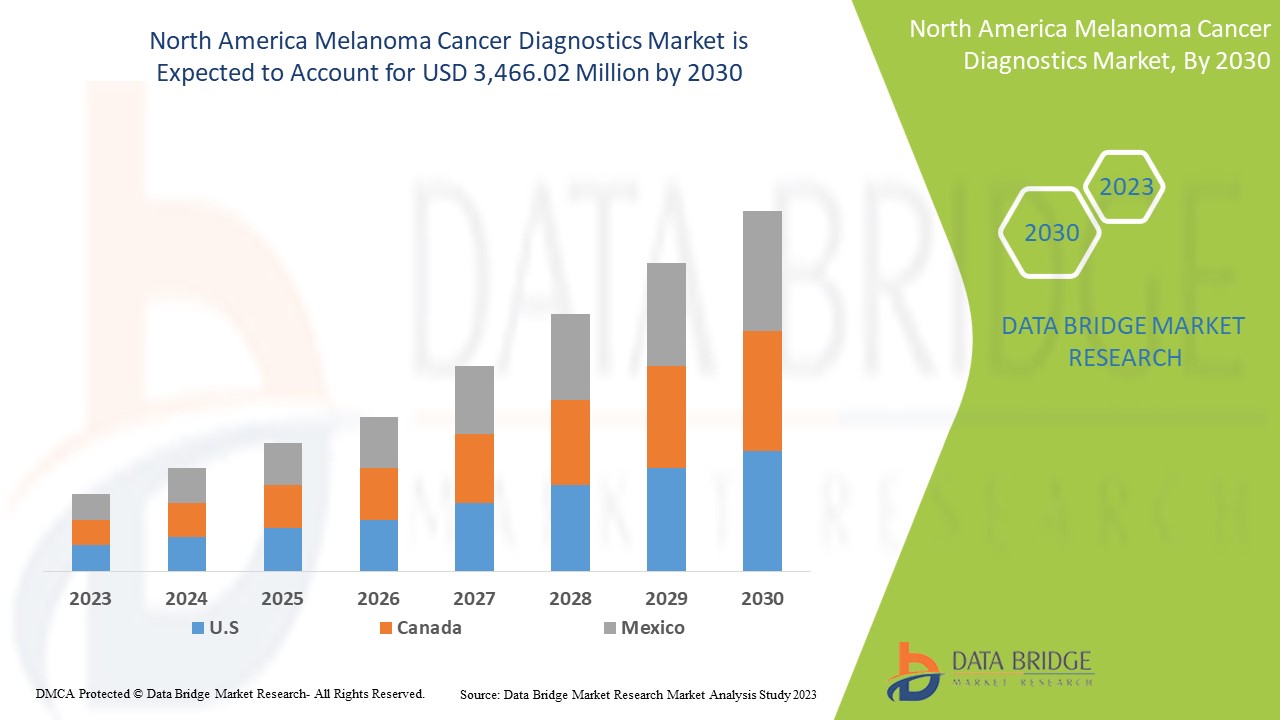

Le marché nord-américain du diagnostic du cancer du mélanome devrait connaître une croissance du marché au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 7,4 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 3 466,02 millions USD d'ici 2030 contre 1 964,80 millions USD en 2022.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable jusqu'au 2020-1015) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type de produit (instruments, consommables et accessoires, et autres), type de test (test de biomarqueurs, test d'imagerie, biopsie, tests d'hybridation in situ fluorescente (FISH), tests d'hybridation génomique comparative (CGH), tests immunohistochimiques (IHC) et autres), utilisateur final (hôpitaux, laboratoires associés, laboratoires de diagnostic indépendants, centres d'imagerie diagnostique, instituts de recherche sur le cancer et autres), canal de distribution (appel d'offres direct et vente au détail) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

Nanostring, Thermo Fisher Scientific Inc., Quest Diagnostics Incorporated, Agilent Technologies, Inc., QIAGEN, Inivata Ltd, F. Hoffman-La Roche Ltd, Abbott, AMLo Biosciences Limited, Myriad genetics Genetics Inc, Castle Biosciences, DermTech, Michael Diagnostics Ltd, Damae Medical, Skin Analytics, DermLite, DermaSensor, Skyline Dx, Neracare GmbH, VERISKIN INC., Illumina Inc et bioMérieux SA, entre autres |

Définition du marché

Le diagnostic du cancer du mélanome est connu comme le processus d'identification du cancer du mélanome par l'étude des cellules et des molécules de la peau. Ces diagnostics du cancer du mélanome sont utilisés comme stratégie pour rechercher, analyser et diagnostiquer certaines cellules ou molécules à l'aide de divers tests effectués en laboratoire. Il est notamment utilisé pour la mesure d'un biomarqueur spécifique ou l'identification du biomarqueur dans les cellules de la peau. Un diagnostic du cancer du mélanome est utilisé dans le but de fournir des tests plus efficaces et des diagnostics plus rapides.

Le diagnostic du cancer du mélanome aide les médecins à déterminer les stades du cancer afin de traiter efficacement les patients à différents stades. De plus, grâce au potentiel de la pratique clinique, plusieurs tests sont utilisés pour apporter un soutien supplémentaire afin d'améliorer l'efficacité du diagnostic du cancer du mélanome, et la présence d'acteurs majeurs du marché contribue également à la croissance du marché.

Dynamique du marché du diagnostic du cancer du mélanome en Amérique du Nord

Conducteurs

-

Demande croissante de diagnostic précoce du mélanome

Le mélanome est un cancer potentiellement mortel qui se manifeste le plus souvent sur la peau. Son incidence a augmenté de manière significative à l'échelle de l'Amérique du Nord. Son incidence est la plus élevée chez les populations à peau claire et à basse latitude. Il s'agit de l'un des cancers entraînant le plus grand nombre moyen d'années perdues par décès. Le mélanome représente un lourd fardeau personnel et économique en raison de son incidence et de sa mortalité accrues. Diverses régions à haut risque ont adopté des mesures préventives avec plus ou moins de succès. La genèse de la maladie et les facteurs de risque doivent être mieux compris grâce à des initiatives de recherche.

-

Augmentation de la préférence pour les examens de santé préventifs

Les examens de santé préventifs sont des mesures préventives réalisées pour la détection initiale du mélanome. De plus, la préférence croissante pour les examens de santé préventifs offre une protection contre une exposition probable à toute maladie dans le futur.

La sensibilisation au dépistage est l'élément le plus important de la prévention du cancer du mélanome. Le bilan comprend l'identification du cancer et l'examen des facteurs de risque pour limiter la perte à un stade précoce.

Opportunités

-

Augmentation des dépenses de santé pour le traitement du cancer du mélanome

La croissance des infrastructures de soins de santé constitue une opportunité pour le marché, car si l’investissement dans les soins de santé augmente, davantage de personnes sont sensibilisées au cancer et diagnostiquent leur santé à des fins de précaution et de guérison.

L’augmentation des dépenses de santé pour le traitement du cancer permet également au patient de suivre un traitement avancé sans tracas pour obtenir un meilleur diagnostic et un meilleur traitement pour une guérison rapide. Les dépenses de santé sont constituées d’une combinaison de paiements directs (les personnes paient pour leurs propres soins), de dépenses publiques et de sources, notamment l’assurance maladie et les activités des organisations non gouvernementales. De ce fait, l’augmentation des dépenses de santé pour le traitement du cancer constitue une opportunité pour accroître la demande du marché.

-

Initiatives stratégiques des principaux acteurs

L’augmentation des taux de divers types de maladies et de leur gravité est largement observée dans le monde entier. L’augmentation spectaculaire de la qualité de la recherche et l’augmentation des opportunités de recherche sont dues à diverses initiatives stratégiques prises par les acteurs du marché. Ils prennent des initiatives telles que le lancement de produits, des collaborations, des fusions, des acquisitions et bien d’autres au fil des ans et devraient ouvrir la voie et créer davantage d’opportunités sur le marché. Par exemple, Evonik a investi dans la croissance à court terme de sa production de diagnostics spécialisés du cancer du mélanome sur ses sites de Hanau et de Dossenheim en Allemagne, qui ont fourni deux des quatre diagnostics du cancer du mélanome pour le vaccin Pfizer/BioNTech. Selon Spencer, les premiers lots ont été livrés à BioNTech en avril 2021, des mois plus tôt que prévu.

Contraintes/Défis

- Réglementations et normes strictes pour l'approbation et la commercialisation des produits de diagnostic du cancer du mélanome

Les réglementations strictes pour la commercialisation de tout produit sur le marché s'avèrent être un grand défi pour les fabricants de produits de diagnostic du cancer à l'échelle mondiale qui ont leurs propres réglementations et un organisme différent pour les procédures réglementaires.

Approbation des fabricants pour la commercialisation des produits sur le marché. De ce fait, dans la région de l'Amérique du Nord, des politiques réglementaires strictes devraient entraver le développement du marché du diagnostic du cancer.

Les exigences réglementaires en matière d'approbation de la commercialisation ou de certification CE et l'application des lois et réglementations peuvent conduire à des changements majeurs dans l'entreprise ou à des pénalités, y compris la perte potentielle de licences commerciales. Les ressources et les coûts nécessaires pour se conformer à ces lois, règles et réglementations sont assez élevés. Différents défis de fabrication pour la production de nanoparticules lipidiques

Impact post-COVID-19 sur le marché nord-américain du diagnostic du cancer du mélanome

La COVID-19 a eu un impact positif sur le marché. La demande de diagnostics ayant augmenté, les bilans de santé préventifs étaient très demandés. Ainsi, la COVID-19 a eu un impact positif sur le marché du diagnostic du cancer du mélanome.

Développement récent

- En octobre 2022, Quest Diagnostics Incorporated a annoncé que la société avait collaboré avec Decode Health pour obtenir des données basées sur des biomarqueurs qui peuvent aider à réduire le temps et le coût de développement de nouveaux tests de diagnostic et de cibles médicamenteuses pour différents types de cancer. Cela aidera l'entreprise à trouver des voies innovantes dans le domaine de la R&D et augmentera la présence de l'entreprise en Amérique du Nord sur le marché

- En mai 2022, Myriad Genetics, Inc. a annoncé l'élargissement de son partenariat stratégique avec Intermountain Precision Genomics, un service d'Intermountain Healthcare, pour ajouter un nouveau test de sélection de thérapie par biopsie liquide au portefeuille croissant de l'entreprise en oncologie. Cela se traduit par un espace croissant de biopsie liquide pour le test tumoral précis

Portée du marché nord-américain du diagnostic du cancer du mélanome

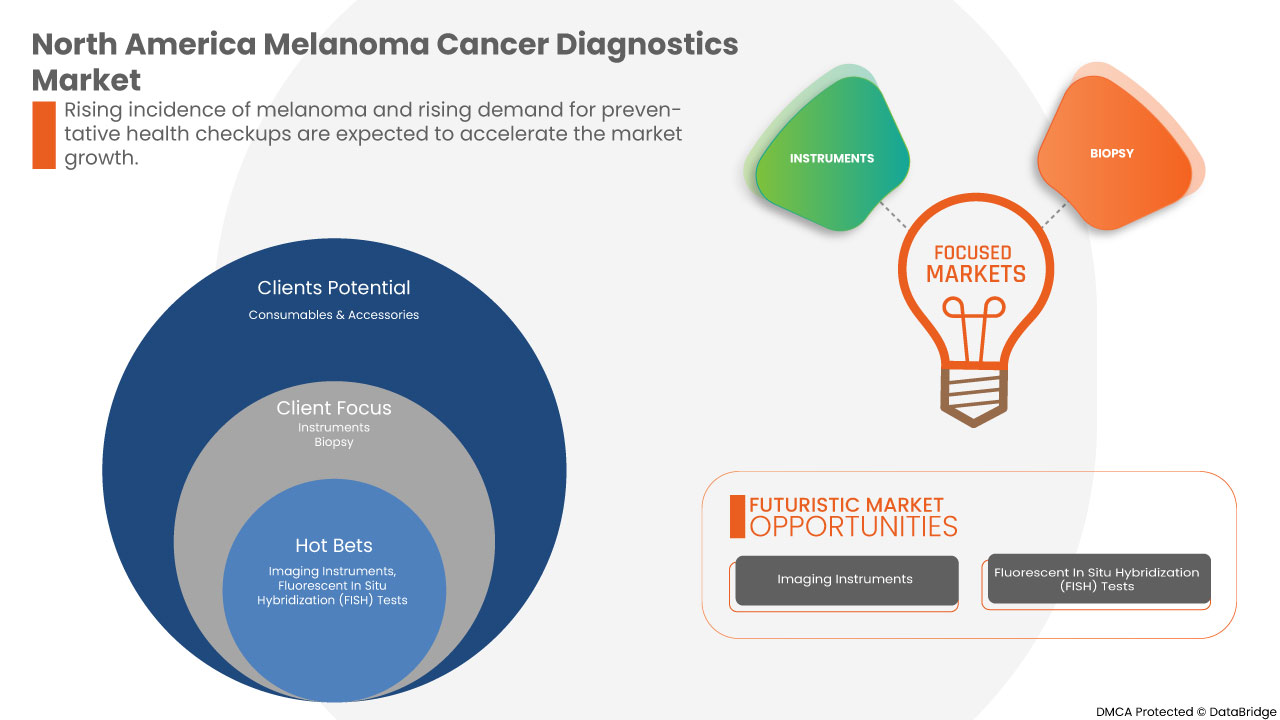

Le marché nord-américain du diagnostic du cancer du mélanome est segmenté en type de produit, type de test, utilisateur final et canal de distribution. La croissance parmi ces segments vous aidera à analyser les segments de croissance limités dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Type de produit

- Instruments

- Consommables et accessoires

- Autres

Sur la base du type, le marché nord-américain du diagnostic du cancer du mélanome est segmenté en instruments, consommables et accessoires, et autres.

Type de test

- Biopsie

- Test d'imagerie

- Tests immunohistochimiques (IHC)

- Test de biomarqueurs

- Tests d'hybridation in situ fluorescente (FISH)

- Tests d'hybridation génomique comparative (CGH)

- Autres

En fonction du type de test, le marché nord-américain du diagnostic du cancer du mélanome est segmenté en tests de biomarqueurs, tests d'imagerie, biopsie, tests d'hybridation in situ fluorescente (FISH), tests d'hybridation génomique comparative (CGH), tests immunohistochimiques (IHC) et autres.

Utilisateur final

- Hôpitaux

- Laboratoires associés

- Laboratoires de diagnostic indépendants

- Centres d'imagerie diagnostique

- Instituts de recherche sur le cancer

- Autres

En fonction de l’utilisateur final, le marché nord-américain du diagnostic du cancer du mélanome est segmenté en hôpitaux, laboratoires associés, laboratoires de diagnostic indépendants, centres d’imagerie diagnostique, instituts de recherche sur le cancer et autres.

Canal de distribution

- Appel d'offres direct

- Ventes au détail

- Autres

En fonction du canal de distribution, le marché nord-américain du diagnostic du cancer du mélanome est segmenté en appels d'offres directs, ventes au détail et autres.

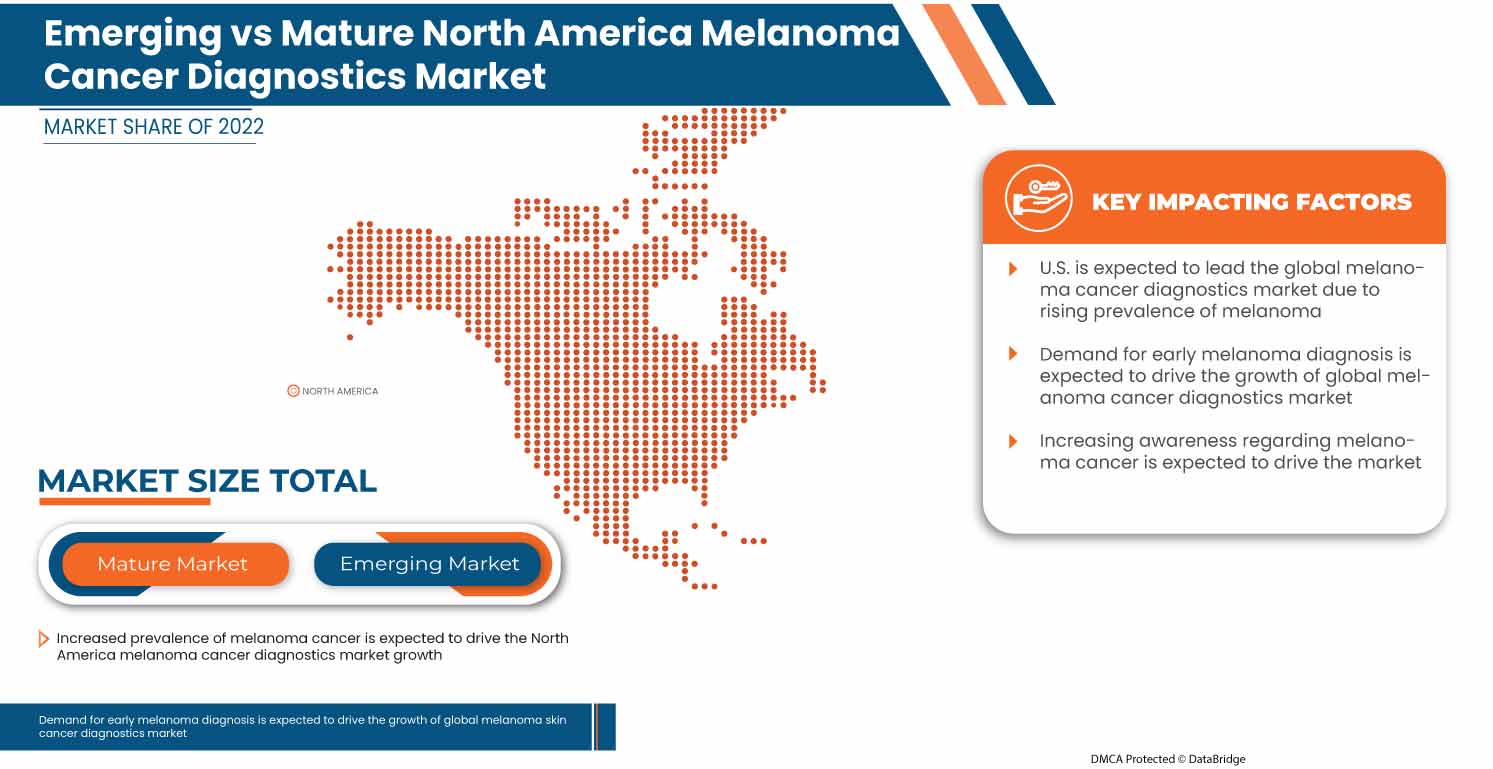

Analyse/perspectives régionales du marché du diagnostic du cancer du mélanome

Le marché du cancer du mélanome en Amérique du Nord est analysé et des informations sur la taille du marché et les tendances sont fournies par type de produit, type de test, utilisateur final et canal de distribution.

Le marché du cancer du mélanome en Amérique du Nord comprend les États-Unis, le Canada et le Mexique.

Les États-Unis devraient dominer le marché nord-américain du diagnostic du cancer du mélanome en raison de la demande croissante de soins de santé de qualité et de la demande croissante de méthodes de test non invasives.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales et l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du diagnostic du cancer du mélanome

Le paysage concurrentiel du marché du diagnostic du cancer du mélanome en Amérique du Nord fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché du diagnostic du cancer du mélanome en Amérique du Nord.

Certains des principaux acteurs opérant sur le marché du diagnostic du cancer du mélanome en Amérique du Nord sont Nanostring, Thermo Fisher Scientific Inc., Quest Diagnostics Incorporated, Agilent Technologies, Inc, QIAGEN, Inivata Ltd, F. Hoffman-La Roche Ltd, Abbott, AMLo Biosciences Limited, Myriad genetics Genetics Inc, Castle Biosciences, DermTech, Michael Diagnostics Ltd, Damae Medical, Skin Analytics, DermLite, DermaSensor, Skyline Dx, Neracare GmbH, VERISKIN INC., Illumina Inc et bioMerieux SA, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL'S MODEL

4.2 PORTER'S FIVE FORCES MODEL

5 EPIDEMIOLOGY

6 INDUSTRY INSIGHTS

6.1 DEMOGRAPHIC TRENDS

6.2 KEY PRICING STRATEGIES

6.2.1 PRODUCT INNOVATION

6.2.2 CONSUMER AWARNESS

6.2.3 A VAST NETWORK OF DISTRIBUTION

6.2.4 PARTNERSHIP WITH POPULAR BRANDS BY MAJOR PLAYERS

6.2.5 OTHERS

6.3 KEY PATIENT ENROLLMENT STRATEGIES

6.3.1 IDENTIFICATION OF CUSTOMERS NEED FOR INNOVATIVE DIAGOSTIC PRODUCTS

6.3.2 INCREASING SPECIFIC TACTICS FOR EVERY STEP

6.3.3 EDUCATE AND COMMUNICATE

6.3.4 IMPROVING DIAGNOSIS SEEKING RATE

6.4 INTERVIEWS WITH MANUFACTURING COMPANIES

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWING PREVALENCE OF MELANOMA CANCER

7.1.2 RISING PREFERENCE FOR PREVENTIVE HEALTH CHECK-UPS

7.1.3 NOVEL TECHNOLOGIES IN MELANOMA CANCER DIAGNOSTICS

7.1.4 INCREASING AWARENESS REGARDING MELANOMA CANCER

7.2 RESTRAINTS

7.2.1 LACK OF SKILLED AND CERTIFIED PROFESSIONALS

7.2.2 HIGH COST OF DIAGNOSTICS PROCEDURE FOR MELANOMA CANCERS

7.3 OPPORTUNITIES

7.3.1 INCREASING HEALTHCARE EXPENDITURE FOR MELANOMA CANCER TREATMENT

7.3.2 GOVERNMENT INITIATIVES TOWARD MELANOMA CANCER DIAGNOSTICS

7.3.3 INCREASED DEMAND FOR NON-INVASIVE TESTING METHODS

7.3.4 GROWING DEMAND FOR BETTER QUALITY HEALTHCARE

7.4 CHALLENGES

7.4.1 STRICT REGULATIONS AND STANDARDS FOR THE APPROVAL AND COMMERCIALIZATION OF MELANOMA CANCER DIAGNOSTIC PRODUCTS

7.4.2 RADIATION RISKS FROM IMAGING TESTS

8 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 INSTRUMENTS

8.2.1 IMAGING INSTRUMENTS

8.2.1.1 ULTRASOUND SYSTEMS

8.2.1.2 MRI SYSTEMS

8.2.1.3 CT SYSTEMS

8.2.1.4 OTHERS

8.2.2 BIOPSY INSTRUMENTS

8.2.3 PATHOLOGY-BASED INSTRUMENTS

8.2.3.1 PCR INSTRUMENTS

8.2.3.2 CELL PROCESSORS

8.2.3.3 SLIDE STAINING SYSTEMS

8.2.3.4 TISSUE PROCESSING SYSTEMS

8.2.3.5 OTHER PATHOLOGY-BASED INSTRUMENTS

8.3 CONSUMABLES & ACCESSORIES

8.3.1 KITS

8.3.1.1 PCR KITS

8.3.1.2 NUCLEIC ACID ISOLATION KITS

8.3.1.3 DNA POLYMERASE KITS

8.3.1.4 OTHERS

8.3.2 PROBES

8.3.2.1 Q FISH

8.3.2.2 FLOW FISH

8.3.2.3 OTHERS

8.3.3 REAGENTS

8.3.3.1 ASSAYS

8.3.3.2 BUFFERS

8.3.3.3 PRIMERS

8.3.3.4 OTHERS

8.3.4 OTHER CONSUMABLES

8.4 OTHERS

9 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET, BY TEST TYPE

9.1 OVERVIEW

9.2 IMAGING TEST

9.2.1 ULTRASOUND

9.2.2 MRI

9.2.3 CHEST X-RAY

9.2.4 LYMPHOSCINTIGRAPHY

9.2.5 COMPUTED TOMOGRAPHY (CT) SCAN

9.2.6 POSITRON EMISSION TOMOGRAPHY (PET) SCAN

9.2.7 OTHERS

9.3 BIOPSY

9.3.1 OPTICAL BIOPSY

9.3.2 EXCISIONAL BIOPSY

9.3.3 INCISIONAL BIOPSY

9.3.4 SHAVE BIOPSY

9.3.5 PUNCH BIOPSY

9.3.6 OTHERS

9.4 IMMUNOHISTOCHEMICAL (IHC) TESTS

9.4.1 S100 PROTEIN FAMILY BIOPSY

9.4.2 MELAN-A

9.4.3 PMEL/PMEL17/SILV/GP100

9.4.4 TYROSINASE

9.4.5 MITF

9.4.6 SM5-1

9.4.7 CSPG4/HMW-MAA

9.5 BIOMARKER TEST

9.5.1 BRAF MUTATION TEST

9.5.2 NRAS MUTATION TEST

9.5.3 CKIT TEST

9.5.4 OTHERS

9.6 FLUORESCENT IN SITU HYBRIDIZATION (FISH) TESTS

9.7 COMPARATIVE GENOMIC HYBRIDIZATION (CGH) TESTS

9.8 OTHERS

10 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITALS

10.3 ASSOCIATED LABS

10.4 DIAGNOSTIC IMAGING CENTERS

10.5 INDEPENDENT DIAGNOSTIC LABORATORIES

10.6 CANCER RESEARCH INSTITUTES

10.7 OTHERS

11 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TENDER

11.3 RETAIL SALES

12 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 ABBOTT

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 ILLUMINA, INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 BIOMÉRIEUX SA

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 THERMO FISHER SCIENTIFIC INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 F. HOFFMANN-LA ROCHE LTD.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 AGILENT TECHNOLOGIES, INC.

15.6.1 COMPANY PROFILE

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 AMLO BIOSCIENCES LIMITED

15.7.1 COMPANY PROFILE

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 CASTLE BIOSCIENCES INC

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 DAMAE MEDICAL

15.9.1 COMPANY PROFILE

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 DERMLITE.

15.10.1 COMPANY PROFILE

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 DERMASENSOR

15.11.1 COMPANY PROFILE

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 DERMTECH

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 INIVATA LTD.

15.13.1 COMPANY PROFILE

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 MICHAEL DIAGNOSTICS LTD

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 MYRIAD GENETICS, INC.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 NANOSTRING

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 NERACARE GMBH

15.17.1 COMPANY PROFILE

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 SKIN ANALYTICS

15.18.1 COMPANY PROFILE

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 SKYLINEDX

15.19.1 COMPANY PROFILE

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 VERISKIN INC.

15.20.1 COMPANY PROFILE

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 QIAGEN

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENT

15.22 QUEST DIAGNOSTICS INCORPORATED (2022)

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 PRODUCT PORTFOLIO

15.22.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA INSTRUMENTS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA INSTRUMENTS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA IMAGING INSTRUMENTS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA PATHOLOGY-BASED INSTRUMENTS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA CONSUMERS & ACCESSORIES IN MELANOMA CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA CONSUMABLES & ACCESSORIES IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA KITS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA PROBES IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA REAGENTS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA OTHERS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA IMAGING TEST IN MELANOMA CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA IMAGING TEST IN MELANOMA CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA BIOPSY IN MELANOMA CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA BIOPSY IN MELANOMA CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA IMMUNOHISTOCHEMICAL (IHC) TESTS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA IMMUNOHISTOCHEMICAL (IHC) TESTS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA BIOMARKERS TEST IN MELANOMA CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA BIOMARKERS TEST IN MELANOMA CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA FLUORESCENT IN SITU HYBRIDIZATION (FISH) TESTS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA COMPARATIVE GENOMIC HYBRIDIZATION (CGH) TESTS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA OTHERS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA HOSPITALS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA ASSOCIATED LABS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA DIAGNOSTIC IMAGING CENTERS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA INDEPENDENT DIAGNOSTIC LABORATORIES IN MELANOMA CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA CANCER RESEARCH INSTITUTES IN MELANOMA CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA OTHERS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA DIRECT TENDER IN MELANOMA CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA RETAIL SALES IN MELANOMA CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA INSTRUMENTS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA PATHOLOGY-BASED INSTRUMENTS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA IMAGING INSTRUMENTS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA CONSUMABLES & ACCESSORIES IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA KITS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA REAGENTS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA PROBES IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA BIOMARKERS TEST IN MELANOMA CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA IMAGING TEST IN MELANOMA CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA BIOPSY IN MELANOMA CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA IMMUNOHISTOCHEMICAL (IHC) TESTS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 50 U.S. MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 51 U.S. INSTRUMENTS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 52 U.S. PATHOLOGY-BASED INSTRUMENTS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 53 U.S. IMAGING INSTRUMENTS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 54 U.S. CONSUMABLES & ACCESSORIES IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 55 U.S. KITS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 56 U.S. REAGENTS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 57 U.S. PROBES IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 58 U.S. MELANOMA CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 59 U.S. BIOMARKERS TEST IN MELANOMA CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 60 U.S. IMAGING TEST IN MELANOMA CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 61 U.S. BIOPSY IN MELANOMA CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 62 U.S. IMMUNOHISTOCHEMICAL (IHC) TESTS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 63 U.S. MELANOMA CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 64 U.S. MELANOMA CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 65 CANADA MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 66 CANADA INSTRUMENTS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 67 CANADA PATHOLOGY-BASED INSTRUMENTS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 68 CANADA IMAGING INSTRUMENTS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 69 CANADA CONSUMABLES & ACCESSORIES IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 70 CANADA KITS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 71 CANADA REAGENTS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 72 CANADA PROBES IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 73 CANADA MELANOMA CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 74 CANADA BIOMARKERS TEST IN MELANOMA CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 75 CANADA IMAGING TEST IN MELANOMA CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 76 CANADA BIOPSY IN MELANOMA CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 77 CANADA IMMUNOHISTOCHEMICAL (IHC) TESTS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 78 CANADA MELANOMA CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 79 CANADA MELANOMA CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 80 MEXICO MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 81 MEXICO INSTRUMENTS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 82 MEXICO PATHOLOGY-BASED INSTRUMENTS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 83 MEXICO IMAGING INSTRUMENTS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 84 MEXICO CONSUMABLES & ACCESSORIES IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 85 MEXICO KITS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 86 MEXICO REAGENTS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 87 MEXICO PROBES IN MELANOMA CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 88 MEXICO MELANOMA CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 89 MEXICO BIOMARKERS TEST IN MELANOMA CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 90 MEXICO IMAGING TEST IN MELANOMA CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 91 MEXICO BIOPSY IN MELANOMA CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 92 MEXICO IMMUNOHISTOCHEMICAL (IHC) TESTS IN MELANOMA CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 93 MEXICO MELANOMA CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 94 MEXICO MELANOMA CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 11 THE GROWING PREVALENCE OF MELANOMA CANCER AND THE INCREASING AWARENESS REGARDING MELANOMA CANCER ARE EXPECTED TO DRIVE THE NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 INSTRUMENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET IN 2023 & 2030

FIGURE 13 ESTIMATED PREVALENCE OF MELANOMA CANCER IN 2020

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET

FIGURE 15 NUMBER OF NEW CASES IN 2018 IN FEMALES OF ALL AGES

FIGURE 16 AGEING EUROPE POPULATION (IN MILLION)

FIGURE 17 ESTIMATED LIFETIME CARE SPENDING

FIGURE 18 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE, 2022

FIGURE 19 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET: BY TEST TYPE, 2022

FIGURE 23 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET: BY TEST TYPE, 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET: BY TEST TYPE, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET: BY TEST TYPE, LIFELINE CURVE

FIGURE 26 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET: BY END USER, 2022

FIGURE 27 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET: BY END USER, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 31 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 32 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 33 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 34 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET: SNAPSHOT (2022)

FIGURE 35 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET: BY COUNTRY (2022)

FIGURE 36 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 37 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 38 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET: PRODUCT TYPE (2023-2030)

FIGURE 39 NORTH AMERICA MELANOMA CANCER DIAGNOSTICS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.