North America Medical Device Regulatory Affairs Outsourcing Market

Taille du marché en milliards USD

TCAC :

%

USD

2.93 Billion

USD

7.46 Billion

2025

2033

USD

2.93 Billion

USD

7.46 Billion

2025

2033

| 2026 –2033 | |

| USD 2.93 Billion | |

| USD 7.46 Billion | |

|

|

|

|

Segmentation du marché nord-américain de l'externalisation des affaires réglementaires pour les dispositifs médicaux, par services (affaires réglementaires, conseil en qualité et rédaction médicale), produit (produits finis, électronique et matières premières), type de dispositif (classe I, classe II et classe III), application (cardiologie, imagerie diagnostique, orthopédie, DIV, ophtalmologie, chirurgie générale et plastique, administration de médicaments, dentaire, endoscopie, soins du diabète et autres), utilisateur final (petites, moyennes et grandes entreprises de dispositifs médicaux) - Tendances et prévisions du secteur jusqu'en 2033

Taille du marché nord-américain de l'externalisation des affaires réglementaires relatives aux dispositifs médicaux

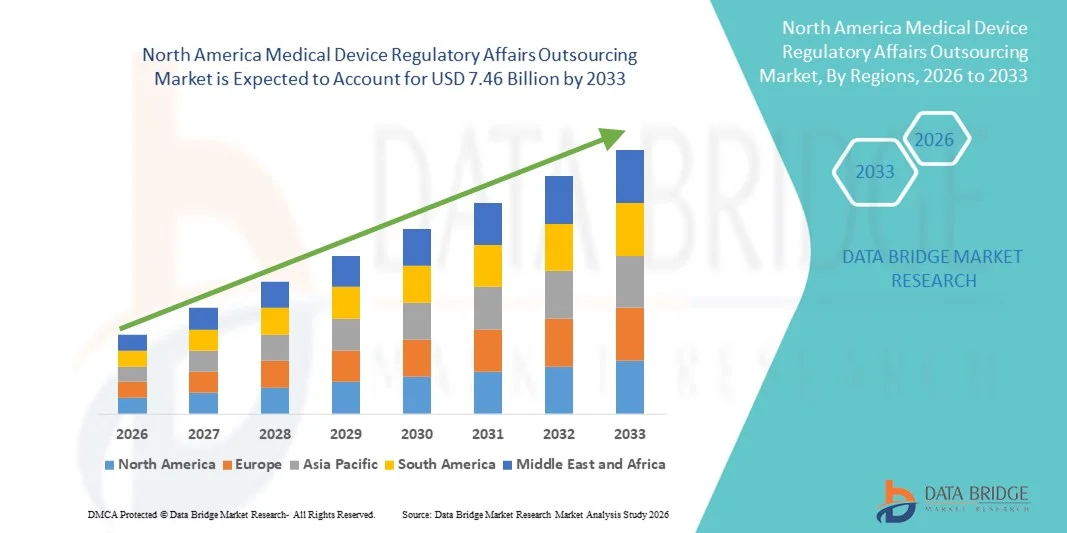

- Le marché nord-américain de l'externalisation des affaires réglementaires relatives aux dispositifs médicaux était évalué à 2,93 milliards de dollars américains en 2025 et devrait atteindre 7,46 milliards de dollars américains d'ici 2033 , soit un TCAC de 12,40 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la complexité croissante des exigences réglementaires dans les secteurs pharmaceutique, biotechnologique et des dispositifs médicaux, incitant les entreprises à rechercher des services d'externalisation spécialisés en matière de gestion de la conformité.

- Par ailleurs, la demande croissante de soumissions réglementaires rentables, efficaces et effectuées dans les délais impartis favorise l'adoption de solutions d'externalisation des affaires réglementaires. Ces facteurs convergents accélèrent le recours aux services d'externalisation des affaires réglementaires, contribuant ainsi de manière significative à la croissance du secteur à l'échelle mondiale.

Analyse du marché de l'externalisation des affaires réglementaires des dispositifs médicaux en Amérique du Nord

- Le marché de l'externalisation des affaires réglementaires relatives aux dispositifs médicaux, qui consiste à déléguer la stratégie réglementaire, la documentation de conformité, l'enregistrement des produits et les activités de surveillance post-commercialisation à des prestataires de services spécialisés, revêt une importance croissante pour les entreprises de dispositifs médicaux opérant dans des cadres réglementaires complexes et évolutifs au Moyen-Orient.

- Le durcissement croissant des réglementations relatives aux dispositifs médicaux, la demande accrue d'approbations plus rapides et le besoin d'une expertise réglementaire locale sont autant de facteurs clés qui favorisent l'externalisation des affaires réglementaires liées aux dispositifs médicaux. Les entreprises font appel à des partenaires d'externalisation pour minimiser les risques de non-conformité, accélérer les délais d'approbation et se concentrer sur le développement et la commercialisation de leurs produits principaux.

- Les États-Unis ont dominé le marché de l'externalisation des affaires réglementaires pour les dispositifs médicaux, avec une part de revenus d'environ 42,5 % en 2025. Cette domination s'explique par un écosystème de santé et de dispositifs médicaux bien établi, un contrôle réglementaire strict de la FDA, un volume élevé d'interventions liées aux dispositifs médicaux et la présence de cabinets de conseil en réglementation de premier plan. L'accent mis par le pays sur la conformité, les approbations rapides et des processus d'autorisation de mise sur le marché rigoureux a considérablement stimulé la demande de services d'externalisation spécialisés.

- Le Canada devrait connaître la croissance la plus rapide sur le marché, avec un TCAC d'environ 10,1 % au cours de la période de prévision. Cette croissance est soutenue par une modernisation rapide du système de santé, la présence croissante de fabricants internationaux de dispositifs médicaux et l'évolution du cadre réglementaire sous Santé Canada. La sensibilisation accrue aux solutions d'externalisation efficaces et à la simplification des processus réglementaires contribue également à l'expansion du marché à travers le pays.

- Le segment des produits finis détenait la plus grande part de revenus du marché (52,1 %) en 2025, car les dispositifs médicaux finaux sont soumis à des exigences rigoureuses d'approbation avant commercialisation et de surveillance après commercialisation.

Portée du rapport et segmentation du marché de l'externalisation des affaires réglementaires relatives aux dispositifs médicaux

|

Attributs |

Externalisation des affaires réglementaires relatives aux dispositifs médicaux : principales perspectives du marché |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, l'épidémiologie des patients, l'analyse du pipeline, l'analyse des prix et le cadre réglementaire. |

Tendances du marché de l'externalisation des affaires réglementaires des dispositifs médicaux en Amérique du Nord

Complexité croissante des réglementations relatives aux dispositifs médicaux dans différentes régions

- Une tendance majeure et croissante du marché de l'externalisation des affaires réglementaires relatives aux dispositifs médicaux est la complexité grandissante et l'évolution constante des cadres réglementaires qui les régissent. Les pays de la région renforcent leurs procédures d'autorisation, leurs exigences en matière de surveillance post-commercialisation et leurs normes de conformité afin de se conformer davantage aux normes internationales.

- Par exemple, les autorités réglementaires des pays du Conseil de coopération du Golfe (CCG) et d'Afrique du Sud ont mis en place des systèmes d'enregistrement des dispositifs médicaux plus structurés, incitant les fabricants à faire appel à des partenaires d'externalisation spécialisés dans les affaires réglementaires afin de gérer efficacement les procédures de soumission et les exigences documentaires locales.

- L'adoption croissante de normes internationales, telles que l'ISO 13485 et les systèmes de classification basés sur les risques, stimule la demande d'expertise externe pour la gestion des dossiers réglementaires, de la documentation technique et des activités de conformité qualité. Les partenaires d'externalisation apportent des connaissances spécifiques à chaque région, contribuant ainsi à réduire les délais d'approbation et les risques réglementaires.

- En outre, l'expansion des entreprises multinationales de dispositifs médicaux sur les marchés du Moyen-Orient et d'Afrique encourage le recours à des services réglementaires externalisés pour gérer les enregistrements multinationaux grâce à une approche centralisée et rentable.

- Cette tendance vers des services professionnels d'assistance réglementaire redéfinit la manière dont les fabricants abordent l'entrée sur le marché et la conformité, l'externalisation devenant une nécessité stratégique plutôt qu'un service optionnel dans toute la région.

- Face à un contrôle réglementaire accru, la demande de prestataires de services spécialisés en affaires réglementaires possédant une expertise régionale ne cesse de croître, tant chez les fabricants de dispositifs médicaux internationaux que locaux.

Dynamique du marché de l'externalisation des affaires réglementaires des dispositifs médicaux en Amérique du Nord

Conducteur

Expansion croissante du marché des dispositifs médicaux et renforcement de la réglementation

- L'expansion rapide du secteur des dispositifs médicaux à travers le monde, alimentée par l'augmentation des investissements dans les soins de santé, la croissance démographique et la prévalence croissante des maladies chroniques, est un facteur majeur du recours aux services d'externalisation des affaires réglementaires.

- Par exemple, le développement croissant des infrastructures de santé dans des pays comme l'Arabie saoudite, les Émirats arabes unis et l'Afrique du Sud a entraîné une demande accrue de dispositifs médicaux, augmentant ainsi la charge de travail réglementaire pour les fabricants qui cherchent à obtenir des autorisations de mise sur le marché en temps opportun.

- Face au durcissement des exigences de conformité imposées par les autorités réglementaires, les fabricants externalisent de plus en plus leurs activités réglementaires auprès d'entreprises spécialisées afin de garantir l'exactitude, la cohérence et l'accélération des approbations de produits.

- De plus, les petites et moyennes entreprises de dispositifs médicaux manquent souvent d'expertise réglementaire interne pour les diverses réglementations régionales, ce qui fait de l'externalisation une solution pratique pour gérer les coûts et réduire les risques de non-conformité.

- La nécessité de maintenir la conformité réglementaire tout au long du cycle de vie du produit, y compris les renouvellements, les variations et la surveillance après commercialisation, continue de soutenir une demande soutenue de services d'externalisation dans la région.

Retenue/Défi

Harmonisation réglementaire limitée et pénurie de professionnels qualifiés

- Un défi majeur du marché de l'externalisation des affaires réglementaires des dispositifs médicaux réside dans l'absence de cadres réglementaires harmonisés entre les pays, ce qui accroît la complexité et les besoins en ressources tant pour les prestataires de services que pour les fabricants.

- Par exemple, la diversité des formats de soumission, des délais d'approbation et des exigences réglementaires sur les marchés africains et du Moyen-Orient peut entraîner des retards et une augmentation des coûts opérationnels, même en cas d'externalisation des activités réglementaires.

- Une autre contrainte importante réside dans la disponibilité limitée de professionnels de la réglementation hautement qualifiés, possédant une connaissance approfondie des réglementations locales et des normes internationales, notamment sur les marchés émergents africains.

- De plus, les préoccupations liées à la confidentialité des données, aux lacunes de communication et à la dépendance à l'égard des prestataires de services tiers peuvent inciter certains fabricants à hésiter avant d'externaliser entièrement les fonctions réglementaires.

- Le renforcement des capacités réglementaires, les initiatives d'harmonisation régionale et l'investissement dans le développement d'une main-d'œuvre qualifiée seront essentiels à la croissance et à l'efficacité à long terme du marché de l'externalisation des affaires réglementaires des dispositifs médicaux au Moyen-Orient et en Afrique.

Portée du marché de l'externalisation des affaires réglementaires relatives aux dispositifs médicaux en Amérique du Nord

Le marché est segmenté en fonction des services, du produit, du type d'appareil, de l'application et de l'utilisateur final.

- Par les services

Le marché de l'externalisation des affaires réglementaires pour les dispositifs médicaux est segmenté, selon les services proposés, en services d'affaires réglementaires, conseil en qualité et rédaction médicale. Le segment des services d'affaires réglementaires a généré la plus grande part de revenus (46,8 %) en 2025, en raison de la complexité croissante des réglementations relatives aux dispositifs médicaux dans des régions clés telles que l'Amérique du Nord, l'Europe et l'Asie-Pacifique. Les entreprises font appel à des services réglementaires externalisés pour les soumissions préalables à la mise sur le marché, la documentation technique et la gestion de la conformité après la mise sur le marché. Le renforcement des exigences réglementaires pour les dispositifs de classe II et III stimule la demande. La mondialisation des opérations liées aux dispositifs médicaux et les enregistrements transfrontaliers de produits contribuent également à la croissance de ce segment. L'externalisation des affaires réglementaires permet de réduire les coûts opérationnels tout en garantissant la conformité aux directives de la FDA, du règlement européen relatif aux dispositifs médicaux (MDR) et du règlement relatif aux dispositifs médicaux de l'IVDR. Ce segment bénéficie de la multiplication des audits réglementaires et des mises à jour fréquentes des normes de documentation. La gestion du cycle de vie des dispositifs, le signalement des incidents et l'atténuation des risques sont des facteurs clés. Les entreprises privilégient de plus en plus l'externalisation pour accélérer la mise sur le marché tout en réduisant la charge pesant sur leurs ressources internes. L'adoption croissante de dispositifs médicaux de pointe et l'innovation rapide des produits renforcent encore cette position dominante. L'expansion sur les marchés émergents crée une demande soutenue pour les services d'affaires réglementaires.

Le segment de la rédaction médicale devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, à 11,4 %, entre 2026 et 2033, porté par la demande mondiale croissante de rapports d'évaluation clinique, de dossiers techniques et de documents réglementaires de haute qualité. Les PME du secteur des dispositifs médicaux dépendent de plus en plus des rédacteurs médicaux externes. Les autorités réglementaires exigent une documentation précise et conforme pour l'approbation des dispositifs, ce qui stimule la croissance. L'adoption des plateformes de soumission électronique accélère l'externalisation. Le développement des essais cliniques, la collecte de données en vie réelle et la publication des données post-commercialisation renforcent la demande. La numérisation et les outils de rédaction médicale assistés par l'IA contribuent à une préparation plus rapide des documents. Les entreprises recherchent des contrats d'externalisation flexibles afin d'alléger la charge de travail de leurs équipes internes. L'expansion des domaines thérapeutiques, notamment la cardiologie, l'orthopédie et les dispositifs de diagnostic in vitro (DIV), contribue également à la croissance. L'harmonisation croissante des réglementations internationales soutient les besoins d'externalisation transfrontaliers. En définitive, ce segment bénéficie de la complexité réglementaire croissante et de l'importance grandissante d'une documentation médicale précise.

- Sous-produit

Le marché de l'externalisation des affaires réglementaires pour les dispositifs médicaux est segmenté, selon le type de produit, en produits finis, électronique et matières premières. Le segment des produits finis représentait la plus grande part de marché (52,1 %) en 2025, les dispositifs médicaux finaux étant soumis à des procédures d'approbation avant commercialisation et à une surveillance post-commercialisation rigoureuses. Les entreprises externalisent leurs processus réglementaires afin de garantir une conformité optimale avec la FDA, le règlement européen relatif aux dispositifs médicaux (MDR) et les autres réglementations régionales. Les produits finis comprennent des dispositifs en cardiologie, orthopédie, diagnostic in vitro (DIV) et ophtalmologie. L'externalisation permet de réduire la charge de travail interne tout en assurant le respect des normes de qualité et de sécurité. Les fabricants recherchent un soutien spécialisé pour l'étiquetage, la documentation, la validation et la préparation des données cliniques. Le contrôle accru des produits combinés, des dispositifs intégrant des logiciels et des dispositifs médicaux connectés contribue à la domination du marché. L'expansion mondiale des activités liées aux dispositifs médicaux favorise la conclusion de contrats d'externalisation à long terme. L'externalisation atténue les risques associés aux audits et aux sanctions pour non-conformité. Les entreprises privilégient la rapidité de mise sur le marché sans compromettre la conformité. La surveillance post-commercialisation et le signalement des effets indésirables constituent d'autres facteurs clés. Les fabricants cherchent à optimiser l'allocation des ressources et la rentabilité grâce à l'externalisation.

Le segment de l'électronique devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, à 10,7 %, entre 2026 et 2033, grâce à l'intégration croissante des logiciels et des composants numériques dans les dispositifs médicaux. La conformité réglementaire en matière de logiciels, de micrologiciels et de cybersécurité des dispositifs connectés est complexe et en constante évolution. L'externalisation est privilégiée pour garantir la conformité réglementaire et accélérer les approbations. La croissance des dispositifs portables, des systèmes de télésurveillance et des solutions de santé numérique soutient ce segment. Les startups et les PME font de plus en plus appel à des partenaires experts en réglementation pour les dispositifs à forte composante électronique. L'adoption de l'IA et de l'apprentissage automatique dans les dispositifs médicaux accroît les exigences en matière de documentation et de tests. La commercialisation transfrontalière stimule la demande de documentation réglementaire standardisée. L'essor des solutions de santé connectée accélère l'externalisation des activités de conformité. Les entreprises cherchent à réduire leur charge opérationnelle interne tout en respectant les normes réglementaires internationales. Le développement des dispositifs de télémédecine et des dispositifs médicaux connectés contribue également à la croissance du segment.

- Par type d'appareil

Le marché de l'externalisation des affaires réglementaires pour les dispositifs médicaux est segmenté en fonction du type de dispositif : dispositifs de classe I, II et III. Le segment des dispositifs de classe II dominait le marché en 2025, représentant 41,6 % des revenus, grâce à l'arrivée sur le marché d'un grand nombre de dispositifs modérément réglementés. Les dossiers réglementaires pour les dispositifs de classe II comprennent la documentation, les dossiers techniques et la conformité aux directives FDA 510(k) ou au marquage CE. L'externalisation permet aux fabricants de rationaliser les procédures d'approbation et de réduire leur charge de travail interne. Les dispositifs orthopédiques, de diagnostic et de surveillance constituent une part importante des produits de classe II. Les entreprises tirent parti de l'expertise externalisée pour gérer le cycle de vie des produits, la surveillance post-commercialisation et les audits réglementaires. La mondialisation des opérations liées aux dispositifs et l'innovation croissante stimulent la demande. La réduction des coûts, l'efficacité et la mise sur le marché rapide sont des atouts majeurs. La complexité réglementaire dans de nombreuses régions renforce le recours à l'externalisation. Les activités de gestion du cycle de vie, notamment les modifications, les mises à jour et le reporting des dispositifs, alimentent ce segment. L'adoption croissante des dispositifs médicaux sur les marchés émergents contribue également à sa position dominante. Les dispositifs de classe II présentent un équilibre entre innovation et complexité réglementaire, ce qui rend l'externalisation essentielle.

Le segment des dispositifs de classe III devrait connaître la croissance annuelle composée la plus rapide (12,8 %) entre 2026 et 2033, portée par le développement croissant des dispositifs implantables, vitaux et à haut risque. Ces dispositifs nécessitent des données cliniques approfondies, des études de validation et des autorisations réglementaires. L'externalisation des affaires réglementaires permet de minimiser les délais d'approbation et de garantir la conformité aux normes internationales. L'examen minutieux des dispositifs à haut risque, notamment les implants cardiaques et les dispositifs de neuromodulation, stimule la croissance du marché. Les fabricants s'appuient sur des partenaires réglementaires pour la documentation, les rapports d'évaluation clinique et les dossiers techniques. La tendance croissante des produits combinés accroît la demande d'externalisation. La surveillance post-commercialisation continue et les exigences de notification des effets indésirables contribuent également à cette expansion. Les mises à jour réglementaires des règlements MDR et IVDR renforcent la croissance du segment. Les petites et moyennes entreprises externalisent de plus en plus la conformité des dispositifs de classe III en raison de leur complexité. L'innovation dans les matériaux biocompatibles et les implants intelligents soutient l'accélération du segment. La forte valeur ajoutée des produits et les risques réglementaires associés alimentent une demande d'externalisation soutenue.

- Sur demande

Le marché de l'externalisation des affaires réglementaires relatives aux dispositifs médicaux est segmenté, selon l'application, en cardiologie, imagerie diagnostique, orthopédie, DIV, ophtalmologie, chirurgie générale et plastique, administration de médicaments, dentaire, endoscopie, diabétologie et autres. Le segment du DIV représentait la plus grande part de marché (30,2 %) en 2025, portée par la demande croissante de tests diagnostiques et de médecine personnalisée. L'externalisation est essentielle en raison des exigences strictes de conformité au règlement européen IVDR et aux normes de la FDA. Les fabricants s'appuient sur des experts en réglementation pour l'approbation, la validation, l'étiquetage et la surveillance post-commercialisation de leurs dispositifs. Le développement des centres de diagnostic, des laboratoires d'analyses médicales et des plateformes de diagnostic moléculaire soutient la croissance. La prévalence croissante des maladies chroniques stimule la demande de dispositifs de diagnostic précis. Les entreprises cherchent à réduire leurs coûts opérationnels et à atténuer les risques réglementaires. La mondialisation de la distribution des dispositifs de DIV renforce encore le besoin d'externalisation. L'innovation rapide des produits exige un soutien réglementaire réactif. La classification des DIV basée sur les risques favorise le recours à l'externalisation. Les audits réglementaires, le marquage CE et les autorisations de la FDA dynamisent le marché. Ce segment bénéficie de l'augmentation des investissements dans le dépistage précoce des maladies et la médecine de précision.

Le segment des soins du diabète devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, soit 13,3 %, entre 2026 et 2033, porté par l'augmentation mondiale de la prévalence du diabète et l'adoption des systèmes connectés de surveillance de la glycémie. La complexité des exigences réglementaires relatives aux dispositifs de surveillance continue de la glycémie et aux systèmes intelligents d'administration d'insuline accroît la demande d'externalisation. Les jeunes entreprises et les PME s'appuient sur des partenaires experts pour la documentation, les dossiers techniques et la conformité. Les dispositifs de gestion du diabète intégrant l'intelligence artificielle nécessitent un soutien réglementaire supplémentaire. La croissance des dispositifs portables et des solutions de soins à domicile soutient l'expansion du segment. L'entrée sur les marchés transfrontaliers exige des soumissions réglementaires harmonisées. L'intégration des thérapies numériques et de la télémédecine stimule davantage l'externalisation. La vigilance post-commercialisation et la gestion des risques sont des facteurs essentiels. L'attention portée par les gouvernements et les professionnels de santé à la prise en charge du diabète renforce le marché. L'augmentation des investissements en capital-risque dans les solutions numériques pour le diabète accélère la croissance. Les petits fabricants bénéficient de coûts de conformité internes réduits. Le manque de connaissances réglementaires chez les nouvelles entreprises favorise un recours important à l'externalisation.

- Par l'utilisateur final

Le marché de l'externalisation des affaires réglementaires pour les dispositifs médicaux est segmenté, selon l'utilisateur final, en petites, moyennes et grandes entreprises. Le segment des grandes entreprises a dominé le marché en 2025 avec une part de revenus de 44,9 %, grâce à leurs vastes portefeuilles de produits et à leurs activités internationales. L'externalisation facilite les soumissions réglementaires dans de nombreux pays et garantit la conformité aux différentes normes. Les lancements fréquents de produits et les activités de gestion du cycle de vie nécessitent l'expertise de spécialistes. Les entreprises ont recours à l'externalisation pour optimiser l'allocation de leurs ressources et réduire la charge liée à la conformité interne. Les grands acteurs sont soumis à un contrôle réglementaire rigoureux pour les dispositifs de classe II et III, ce qui stimule la croissance du segment. La surveillance post-commercialisation, les évaluations cliniques et la documentation technique sont externalisées auprès de sociétés spécialisées. Les audits réglementaires, le marquage CE et les autorisations FDA 510(k) favorisent l'adoption de l'externalisation. La réduction des risques, la maîtrise des coûts et une entrée plus rapide sur le marché sont des facteurs clés de la domination du segment. L'expansion sur les marchés émergents requiert une expertise en externalisation. L'intégration de logiciels et de dispositifs connectés renforce encore la demande. L'externalisation permet aux grandes entreprises de se concentrer sur la R&D tout en garantissant la conformité réglementaire.

Le segment des petites entreprises de dispositifs médicaux devrait connaître la croissance annuelle composée la plus rapide (13,1 %) entre 2026 et 2033, portée par des compétences réglementaires internes limitées. Les startups et les entreprises en phase de démarrage dépendent fortement des services externalisés pour se conformer aux exigences réglementaires internationales. L'externalisation contribue à réduire les délais d'approbation et les coûts opérationnels. L'innovation croissante dans les dispositifs portables, de diagnostic et de soins à domicile soutient cette croissance. La complexité de la documentation, des évaluations cliniques et des exigences post-commercialisation rend l'externalisation essentielle. Les entreprises financées par du capital-risque recherchent des solutions réglementaires rentables. L'expansion sur le marché mondial exige une expertise des réglementations régionales. L'évolution rapide des exigences des règlements MDR et IVDR accélère l'adoption de l'externalisation. Les outils réglementaires assistés par l'IA aident les petites entreprises à optimiser leur documentation. La réduction des risques de non-conformité est un moteur important de la croissance de ce segment. Les startups tirent parti de l'externalisation pour accélérer la mise sur le marché et réduire leur charge de travail interne. Le développement de partenariats avec des CRO et des consultants en réglementation renforce les perspectives de croissance.

Analyse régionale du marché de l'externalisation des affaires réglementaires des dispositifs médicaux en Amérique du Nord

- Le marché nord-américain de l'externalisation des affaires réglementaires relatives aux dispositifs médicaux devrait connaître une croissance régulière au cours de la période de prévision, soutenu par le renforcement des cadres réglementaires, l'augmentation des approbations de dispositifs médicaux et l'expansion des infrastructures de soins de santé dans toute la région.

- Les gouvernements insistent de plus en plus sur la conformité réglementaire, l'enregistrement des produits et la surveillance post-commercialisation afin de garantir la sécurité des patients et le respect des normes de qualité. Par conséquent, les fabricants de dispositifs médicaux externalisent de plus en plus leurs activités liées aux affaires réglementaires auprès de prestataires de services spécialisés afin de gérer efficacement des exigences réglementaires complexes et en constante évolution.

- L'augmentation des investissements dans la modernisation des soins de santé, conjuguée à l'adoption croissante des technologies médicales de pointe, accélère encore la demande de services d'externalisation des affaires réglementaires en Amérique du Nord.

Analyse du marché américain de l'externalisation des affaires réglementaires pour les dispositifs médicaux :

Le marché américain de l'externalisation des affaires réglementaires pour les dispositifs médicaux a dominé le marché du secteur, représentant environ 42,5 % des revenus régionaux en 2025. Cette position dominante s'explique principalement par un écosystème de santé et de dispositifs médicaux bien établi, un contrôle réglementaire strict de la FDA, un volume important de procédures liées aux dispositifs médicaux et la présence de cabinets de conseil en réglementation de premier plan. L'accent mis par le pays sur la conformité, les approbations rapides et des processus d'autorisation de mise sur le marché rigoureux a considérablement stimulé la demande de services d'externalisation spécialisés.

Aperçu du marché canadien de l’externalisation des affaires réglementaires pour les dispositifs médicaux :

Le marché canadien de l’externalisation des affaires réglementaires pour les dispositifs médicaux devrait connaître la croissance la plus rapide en Amérique du Nord, avec un TCAC projeté d’environ 10,1 % au cours de la période de prévision. Cette croissance est soutenue par la modernisation rapide du système de santé, la présence croissante de fabricants internationaux de dispositifs médicaux et l’évolution des cadres réglementaires de Santé Canada. La sensibilisation accrue aux solutions d’externalisation efficaces et aux processus réglementaires simplifiés contribue également à l’expansion du marché à travers le pays.

Part de marché de l'externalisation des affaires réglementaires relatives aux dispositifs médicaux en Amérique du Nord

Le secteur de l'externalisation des affaires réglementaires relatives aux dispositifs médicaux est principalement dominé par des entreprises bien établies, notamment :

- Accell Clinical Research, LLC (États-Unis)

- Genpact (États-Unis)

- CRITERIUM, INC. (États-Unis)

- Promedica International (États-Unis)

- WuXiAppTec (Chine)

- Medpace (États-Unis)

- PPD Inc. (États-Unis)

- Laboratoires Charles River (États-Unis)

- ICON plc (États-Unis)

- Covance (États-Unis)

- Parexel International Corporation (États-Unis)

- Freyr

- Navitas Clinical Research, Inc. (États-Unis)

- Medelis, Inc. (États-Unis)

- Sciformix (États-Unis)

- Tech Tammina (États-Unis)

- Acorn Regulatory Consultancy Services Ltd. (Irlande)

- BIOMAPAS (Lituanie)

- PROFESSIONNELS DE LA RÉGLEMENTATION (Australie)

- CompareNetworks, Inc. (États-Unis)

Dernières évolutions du marché nord-américain de l'externalisation des affaires réglementaires relatives aux dispositifs médicaux

- En janvier 2023, Medistri SA, société suisse de services pour le secteur des technologies médicales, a lancé une solution intégrée de conseil en affaires réglementaires et gestion de la qualité, conçue pour les PME fabricants de dispositifs médicaux. Cette offre simplifie les démarches de mise en conformité en proposant un accompagnement rentable pour le marquage CE, la préparation des dossiers techniques et la surveillance post-commercialisation, répondant ainsi à un besoin essentiel des entreprises ne disposant pas d'équipes réglementaires internes complètes.

- En mars 2023, ICON plc a lancé une nouvelle plateforme de veille réglementaire destinée à aider les entreprises de dispositifs médicaux à suivre l'évolution des réglementations internationales, à gérer leurs stratégies de soumission et à accéder à des modèles de conformité. Cette plateforme visait à améliorer la stratégie réglementaire et l'efficacité opérationnelle des dossiers complexes dans plusieurs juridictions.

- En mars 2023, Freyr Solutions a inauguré un nouveau centre mondial de services réglementaires dans la région Asie-Pacifique, renforçant ainsi sa capacité à accompagner les entreprises de dispositifs médicaux dans l'obtention des autorisations réglementaires spécifiques à chaque pays. Cette offre de services régionale enrichie témoigne de la forte croissance de la demande d'externalisation des services réglementaires sur les marchés émergents.

- En avril 2023, Parexel International Corporation a étendu ses services de conseil en réglementation à l'échelle mondiale afin de mieux accompagner les développeurs de dispositifs médicaux et de produits combinés confrontés aux exigences de plus en plus complexes du Règlement européen relatif aux dispositifs médicaux (RDM) et du Règlement relatif aux dispositifs médicaux de diagnostic in vitro (RDIV). Ce renforcement stratégique témoigne de la demande accrue du secteur pour une expertise spécialisée en matière de RDM/RDIV.

- En mars 2024, Emergo by UL a ouvert un nouveau centre de conseil en réglementation à Singapour, dédié au marché en pleine croissance des dispositifs médicaux en Asie-Pacifique, et plus particulièrement aux initiatives d'harmonisation réglementaire de l'ASEAN et aux homologations multinationales. Cette initiative témoigne de sa forte expansion géographique dans le domaine des services réglementaires externalisés.

- En juillet 2024, Parexel International a lancé sa plateforme de réglementation numérique, intégrant l'intelligence artificielle et l'apprentissage automatique pour rationaliser les soumissions réglementaires des dispositifs médicaux, fournir une gestion documentaire basée sur le cloud et améliorer la collaboration entre les promoteurs et les organismes de réglementation.

- En septembre 2024, IQVIA a renforcé ses capacités en matière d'affaires réglementaires grâce à l'acquisition de la division de conseil réglementaire de Pharm-Olam, consolidant ainsi son expertise mondiale en matière de réglementation des dispositifs médicaux et améliorant ses services dans la région Asie-Pacifique et en Amérique latine, notamment pour les stratégies réglementaires des marchés émergents.

- En janvier 2025, ProPharma Group s'est associé à MedTech Europe pour développer des programmes de formation réglementaire spécialisés destinés aux professionnels de la réglementation des dispositifs médicaux, afin de combler les lacunes critiques en matière de compétences suite à la mise en œuvre de cadres réglementaires plus stricts tels que le MDR.

- En février 2025, IQVIA a annoncé un partenariat stratégique avec un fabricant européen de dispositifs médicaux afin de soutenir la préparation des dossiers réglementaires et la rédaction des rapports d'évaluation clinique conformément au règlement européen relatif aux dispositifs médicaux (MDR), renforçant ainsi la dépendance du secteur à l'égard de l'expertise externe pour la documentation complexe de conformité.

- En mars 2025, les études de marché ont indiqué qu'ICON plc avait étendu ses services d'externalisation des affaires réglementaires dans la région Asie-Pacifique, répondant ainsi à la demande locale croissante de conseils réglementaires et de soutien aux essais cliniques sur des marchés à forte croissance tels que la Chine et l'Inde.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.