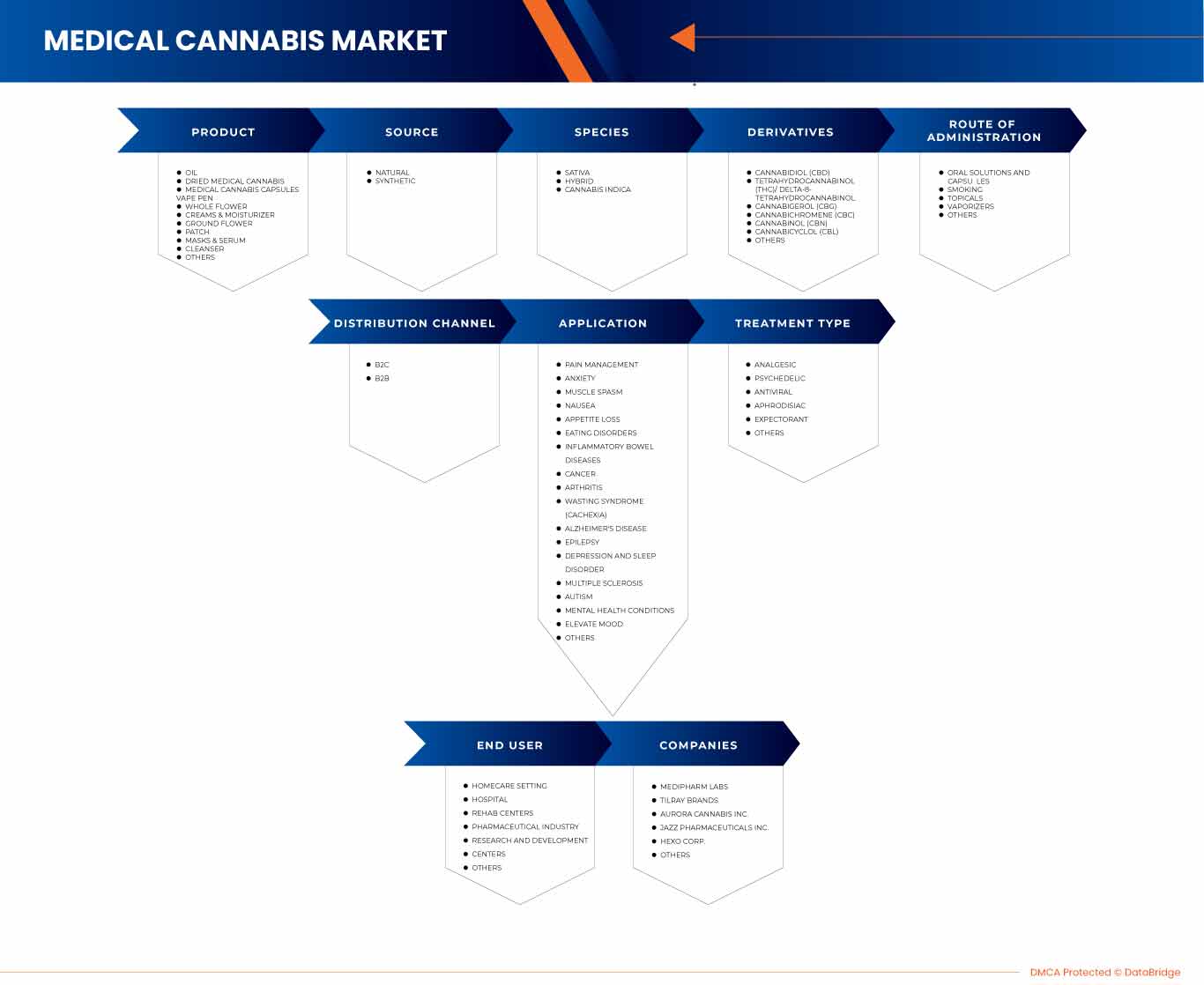

Marché du cannabis médical en Amérique du Nord, par produit (huile, capsules de cannabis médical, patch, fleur entière, fleur moulue, stylo à vapotage, cannabis médical séché, crèmes et hydratants, masques et sérum, nettoyant et autres), source (naturelle et synthétique), espèce (cannabis indica, sativa et hybride), application ( maladie d'Alzheimer , perte d'appétit, cancer, maladies inflammatoires de l'intestin, troubles de l'alimentation, épilepsie, autisme, problèmes de santé mentale, sclérose en plaques, gestion de la douleur, nausées, spasmes musculaires, syndrome de dépérissement (cachexie), amélioration de l'humeur, dépression et troubles du sommeil, anxiété et autres), dérivés (cannabidiol (CBD), tétrahydrocannabinol (THC)/delta-8-tétrahydrocannabinol, cannabinol (CBN), cannabicyclol (CBL), cannabichromène (CBC), cannabigérol (CBG) et autres, type de traitement (expectorant, antiviral, analgésique, aphrodisiaque, psychédélique et autres), voie d'administration (solutions orales et gélules, tabac, vaporisateurs, produits topiques et autres), utilisateur final (industrie pharmaceutique, centres de recherche et développement, soins à domicile, hôpitaux, centres de réadaptation et autres), canal de distribution (B2B et B2C) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché du cannabis médical en Amérique du Nord

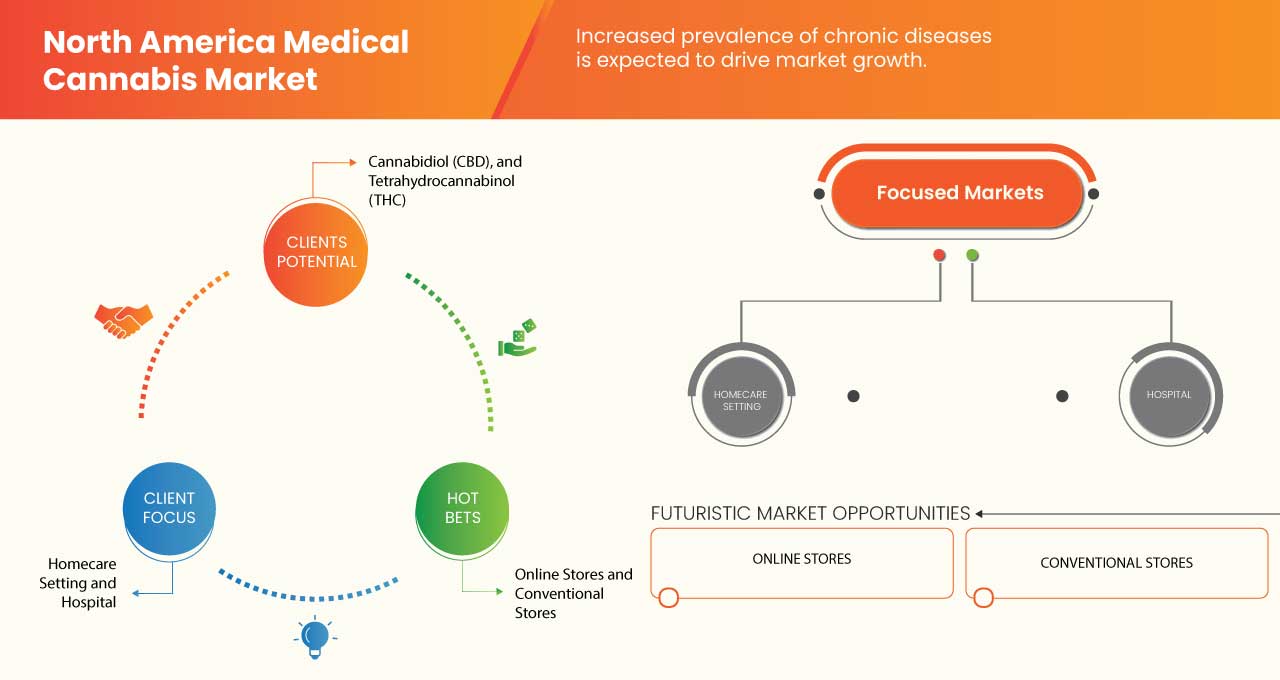

L’augmentation du nombre de patients atteints de maladies chroniques en Amérique du Nord et la tendance croissante à adopter un mode de vie sain sont quelques-uns des facteurs qui devraient stimuler la croissance du marché. En outre, l’augmentation du nombre d’approbations de produits et l’augmentation des activités de recherche et développement pour les dispositifs médicaux à base de cannabis devraient stimuler la croissance du marché. Cependant, le coût élevé des dispositifs et des procédures à base de cannabis médical, les médicaments médicinaux, les problèmes de sécurité et les effets indésirables associés aux procédures au laser, ainsi que le manque de sensibilisation au traitement par les dispositifs laser devraient freiner la croissance du marché. Les avancées technologiques supplémentaires dans le domaine du cannabis médical et les initiatives stratégiques des acteurs émergents devraient constituer des opportunités de croissance du marché. Cependant, les réglementations strictes et le manque de professionnels qualifiés devraient constituer un défi à la croissance du marché.

L'utilisation du cannabis comme médicament n'est pas rigoureusement testée en raison des restrictions gouvernementales et des recherches cliniques limitées visant à définir l'efficacité du cannabis dans les applications médicales et cliniques. Cependant, des études préliminaires suggèrent que le cannabis réduit les vomissements et les nausées chez les patients sous chimiothérapie et contribue à augmenter l'appétit.

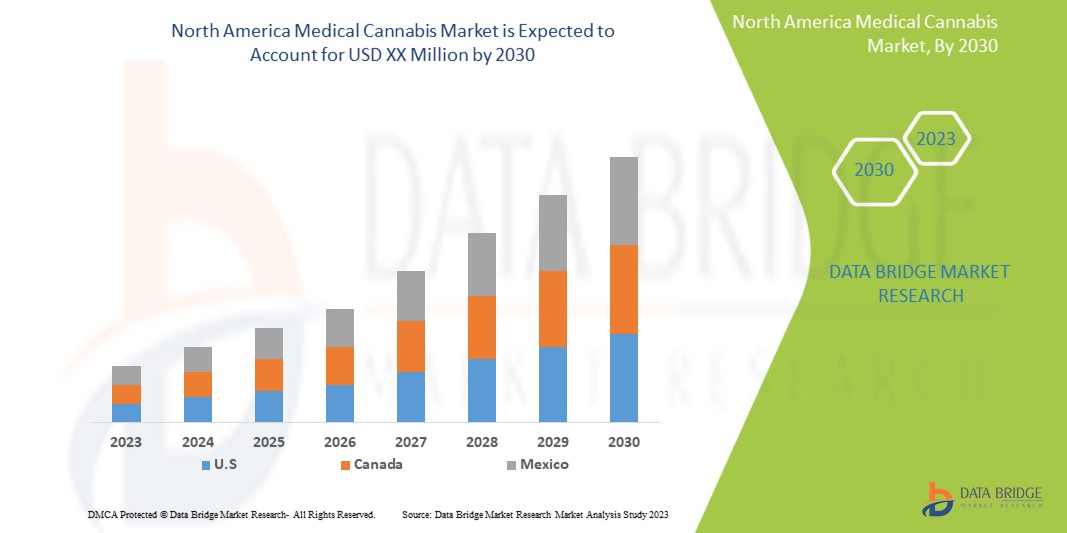

Data Bridge Market Research analyse que le marché nord-américain du cannabis médical devrait croître à un TCAC de 23,2 % au cours de la période de prévision de 2023 à 2030.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Année historique |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Produit (huile, capsules de cannabis médical, patch, fleur entière, fleur moulue, stylo à vapotage, cannabis médical séché, crèmes et hydratants, masques et sérum, nettoyant et autres), source (naturelle et synthétique), espèce (cannabis indica, sativa et hybride), application (maladie d'Alzheimer, perte d'appétit, cancer, maladies inflammatoires de l'intestin, troubles de l'alimentation, épilepsie, autisme, problèmes de santé mentale, sclérose en plaques, gestion de la douleur, nausées, spasmes musculaires, syndrome de dépérissement (cachexie), amélioration de l'humeur, dépression et troubles du sommeil, anxiété et autres), dérivés (cannabidiol (CBD), tétrahydrocannabinol (THC)/delta-8-tétrahydrocannabinol, cannabinol (CBN), cannabicyclol (CBL), cannabichromène (CBC), cannabigérol (CBG) et autres), type de traitement (Expectorant, antiviral, analgésique, aphrodisiaque, psychédélique et autres), voie d'administration (solutions orales et gélules, tabac, vaporisateurs, topiques et autres), utilisateur final (industrie pharmaceutique, centres de recherche et développement, soins à domicile, hôpitaux, centres de réadaptation et autres), canal de distribution (B2B et B2C) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

MediPharm Labs Inc., Tilray, Aurora Cannabis, JAZZ Pharmaceuticals Inc. (GW Pharmaceuticals plc), HEXO Corp. (Zenabis North America Ltd), Cresco Labs, Peace Naturals Project Inc., CANOPY GROWTH CORPORATION, Medical Marijuana, Inc., Seed Cellar, EcoGen Biosciences, CANNABIS SEEDS USA, Seeds For Me, HUMBOLDT SEED COMPANY, Extractas, World Class Cannabis Seeds (Crop King Seeds), BARNEY'S FARM, FOLIUM BIOSCIENCES, PharmaHemp, Elixinol North America Limited, ENDOCA, Harmony, MARY'S nutritionals, LLC, Pure Ratios, Greenwich Biosciences, Inc., Upstate Elevator Supply Co., Apothecanna, BOL Pharma et IDT Australia, entre autres |

Définition du marché

Le cannabis est une drogue psychoactive dérivée de la plante de cannabis de la famille des Cannabaceae. Depuis plusieurs années, il est utilisé à des fins médicinales et possède un large éventail d'applications dans le traitement de diverses maladies, notamment la douleur chronique, le cancer, la dépression, le diabète, l'arthrite, le glaucome, l'épilepsie, les migraines, le sida et la maladie d'Alzheimer, entre autres.

L’utilisation médicinale accrue du cannabis, la légalisation et l’utilisation contrôlées du cannabis dans diverses industries et les méthodologies avancées présentes dans le domaine sont quelques-uns des facteurs qui devraient stimuler la croissance du marché.

Dynamique du marché du cannabis médical en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Utilisation accrue du cannabis dans les médicaments

Le cannabis médicinal est dérivé de la plante de cannabis et peut être utilisé pour traiter les symptômes de certaines pathologies et les effets secondaires de certains traitements. La forme la plus courante d’utilisation médicinale du cannabis est la gestion de la douleur. L’acceptation et l’utilisation du cannabis médicinal ont été graduelles avec le nombre croissant de pays qui ont légalisé l’utilisation du cannabis pour diverses indications. Le cannabis médical a été approuvé par la FDA pour trois indications, à savoir les formes rares et graves d’épilepsie, le syndrome de Dravet et le syndrome de Lennox-Gastaut, ainsi que pour traiter la spasticité dans la sclérose en plaques (SEP).

Le cannabis médical utilise la plante de cannabis ou les produits chimiques qu'elle contient pour traiter des maladies ou des affections. Outre les médicaments approuvés, on s'intéresse de plus en plus à deux cannabinoïdes : le delta-9-tétrahydrocannabinol et le cannabidiol. Il a été démontré que le tétrahydrocannabinol améliore l'appétit, minimise la fatigue et gère les problèmes de fonction musculaire, tandis que le cannabidiol est efficace pour gérer les crises d'épilepsie, guérir les maladies psychiatriques et réduire l'inflammation.

- Légalisation du cannabis

L’utilisation et l’acceptation du cannabis médicinal continuent d’évoluer, car un nombre croissant d’États autorisent l’utilisation de la marijuana à des fins médicales spécifiques. De nombreux pays ont légalisé la marijuana à des fins médicales ou récréatives, tandis que d’autres en ont restreint l’usage. Ces dernières années, un nombre croissant d’États américains ont légalisé la drogue à des fins médicales ou récréatives. Avec la légalisation généralisée du cannabis, de nombreuses entreprises deviennent également proactives et prennent des initiatives pour la légalisation complète du cannabis.

La légalisation de la marijuana dans différentes parties du monde peut être considérée comme un effort pour augmenter les recettes supplémentaires, de cette façon, les recettes augmenteront sans augmenter les impôts. La légalisation du cannabis permettra une plus grande consommation à des fins médicinales ou récréatives. De plus, elle stimulera également le commerce du cannabis, créant ainsi une plus grande demande de cannabis. Par conséquent, la légalisation du cannabis devrait stimuler la croissance du marché.

Opportunités

- Développement de nouveaux produits avec des activités de R&D croissantes

Le cannabis médicinal se présente sous de nombreuses formes différentes, notamment des capsules, des chewing-gums à mâcher, des crèmes, des cristaux, des fleurs, des pastilles, de l'huile et des sprays oro-muqueux. La forte croissance de la demande de cannabis avec la légalisation a accru la nécessité de proposer de meilleures souches de produits et de meilleurs systèmes d'administration. Cela a conduit de nombreuses entreprises à mener des activités de R&D pour vérifier les stratégies d'amélioration génétique du cannabis. Le Comité des produits du cannabis (CPC) de la FDA élabore et met en œuvre des stratégies et des politiques inter-agences pour la réglementation des produits du cannabis. Les nouveaux produits développés et en plein essor sont les poudres de protéines de chanvre, les barres énergétiques, le lait de chanvre, la farine de chanvre et le thé de chanvre, qui devraient créer des opportunités de croissance du marché.

- Adoption accrue du cannabis à des fins récréatives

La légalisation de la marijuana récréative permet de réguler efficacement une drogue sûre, sans augmenter les conséquences négatives potentielles. La légalisation de la marijuana présente divers avantages pour la société, comme la croissance de l’économie sans augmentation des impôts, la création de milliers d’emplois, la fin des différences raciales dans la lutte contre la marijuana et la libération de ressources policières limitées. La légalisation de la marijuana récréative peut mettre fin à l’application coûteuse des lois sur la marijuana et affaiblir le marché illégal de la marijuana.

En raison de ces avantages, la marijuana a été légalisée et est de plus en plus adoptée par des personnes de différents groupes d'âge. Cela crée une demande de marijuana de bonne qualité pour le plaisir et la détente. Par conséquent, l'adoption croissante du cannabis à des fins récréatives devrait créer des opportunités pour les fabricants sur le marché.

Retenue/Défi

- Achats coûteux et ruée vers la qualité supérieure

Les dispositifs médicaux à base de cannabis peuvent être coûteux à fabriquer et à acheter, et le coût de la procédure peut également être élevé en raison de l’équipement spécialisé et de la formation requise. Cela peut limiter l’accessibilité des traitements à base de cannabis médical pour les patients et les établissements de santé, en particulier dans les régions à faible revenu. De plus, le coût élevé des dispositifs et des procédures à base de cannabis médical peut dissuader certains patients de choisir ces traitements, surtout s’ils doivent les payer de leur poche. La couverture d’assurance pour les traitements à base de cannabis médical peut également être limitée, ce qui limite leur adoption.

Par conséquent, le coût élevé des dispositifs et procédures liés au cannabis médical peut constituer un obstacle important à la croissance du marché, en particulier dans les régions où le coût est un facteur majeur. Cependant, à mesure que la technologie progresse, le coût de ces dispositifs et procédures pourrait diminuer, les rendant plus accessibles aux patients et aux établissements de santé.

La complexité croissante des dispositifs à base de cannabis médical et le coût élevé du traitement au cannabis médical devraient freiner la croissance du marché.

Développement récent

- En mai 2018, conformément à la Loi sur le cannabis du gouvernement du Canada, la loi sur le cannabis créera un cadre juridique strict pour contrôler la production, la distribution, la vente et la possession de cannabis à travers le Canada, ce qui vise à garder le cannabis hors de portée des jeunes et les profits hors des poches du crime organisé en favorisant une industrie légale et réglementée robuste.

Portée du marché du cannabis médical en Amérique du Nord

Le marché nord-américain du cannabis médical est segmenté en neuf segments notables en fonction du produit, de la source, de l'espèce, des dérivés, de l'application, de la voie d'administration, du type de traitement, de l'utilisateur final et du canal de distribution. La croissance de ces segments vous aidera à analyser les segments de croissance du marché dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Produit

- Huile

- Cannabis médical séché

- Gélules de cannabis médical

- Stylo à vapotage

- Fleur entière

- Crèmes et hydratants

- Fleur de terre

- Correctif

- Masques et sérums

- Nettoyant

- Autres

Sur la base du produit, le marché est segmenté en huile, capsules de cannabis médical, patch, fleur entière, fleur moulue, stylo vape, cannabis médical séché, crèmes et hydratants, masques et sérum, nettoyant et autres .

Source

- Synthétique

- Naturel

Sur la base de la source, le marché est segmenté en synthétique et naturel.

Espèces

- Cannabis Indica

- Sativa

- Hybride

Sur la base des espèces, le marché est segmenté en cannabis indica, sativa et hybride.

Produits dérivés

- Cannabidiol (CBD)

- Tétrahydrocannabinol (THC)/ Delta-8-tétrahydrocannabinol

- Cannabigérol (CBG)

- Cannabichromène (CBC)

- Cannabinol (CBN)

- Cannabicyclol (CBL)

- Autres

Sur la base des produits dérivés, le marché est segmenté en Cannabidiol (CBD), tétrahydrocannabinol (THC)/delta-8-tétrahydrocannabinol, Cannabinol (CBN), Cannabicyclol (CBL), Cannabichromène (CBC), Cannabigérol (CBG) et autres.

Application

- Gestion de la douleur

- Anxiété

- Spasme musculaire

- Nausée

- Perte d'appétit

- Troubles de l'alimentation

- Maladies inflammatoires chroniques de l'intestin

- Cancer

- Arthrite

- Syndrome de dépérissement (cachexie)

- Maladie d'Alzheimer

- Épilepsie

- Dépression et troubles du sommeil

- Sclérose en plaques

- Autisme

- Problèmes de santé mentale

- Améliorer l'humeur

- Autres

Sur la base de l'application, le marché est segmenté en maladie d'Alzheimer, perte d'appétit, cancer, maladies inflammatoires de l'intestin, troubles de l'alimentation, épilepsie, autisme, problèmes de santé mentale, sclérose en plaques, gestion de la douleur, nausées, spasmes musculaires, syndrome de dépérissement (cachexie), élévation de l'humeur, sclérose en plaques, dépression et troubles du sommeil, anxiété, et autres.

Voie d'administration

- Solutions buvables et gélules

- Fumeur

- Vaporisateurs

- Sujets d'actualité

- Autres

Sur la base de la voie d'administration, le marché est segmenté en solutions orales et gélules, produits à fumer, vaporisateurs, produits topiques et autres.

Type de traitement

- Analgésique

- Psychédélique

- Antiviral

- Aphrodisiaque

- Expectorant

- Autres

Sur la base du type de traitement, le marché est segmenté en expectorant, antiviral, analgésique, aphrodisiaque, psychédélique et autres.

Utilisateur final

- Cadre de soins à domicile

- Hôpital

- Centres de réadaptation

- Industrie pharmaceutique

- Centres de recherche et développement

- Autres

Sur la base de l'utilisateur final, le marché est segmenté en industrie pharmaceutique, centres de recherche et développement, établissements de soins à domicile, hôpitaux, centres de réadaptation et autres.

Canal de distribution

- B2B

- B2C

Sur la base du canal de distribution, le marché est segmenté en B2B et B2C.

Analyse/perspectives régionales du marché du cannabis médical en Amérique du Nord

Le marché nord-américain du cannabis médical est segmenté en neuf segments notables en fonction du produit, de la source, de l’espèce, des dérivés, de l’application, de la voie d’administration, du type de traitement, de l’utilisateur final et du canal de distribution.

Les pays couverts dans ce rapport de marché sont les États-Unis, le Canada et le Mexique.

Les États-Unis devraient dominer le marché nord-américain du cannabis médical en raison de la légalisation de son utilisation.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie du pays, les actes réglementaires et les tarifs douaniers d'import-export sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques régionales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du cannabis médical en Amérique du Nord

Le paysage concurrentiel du marché nord-américain du cannabis médical fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, la présence régionale, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais cliniques, l'analyse de la marque, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications et la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises par rapport au marché.

Français Certains des principaux acteurs du marché opérant sur ce marché sont MediPharm Labs Inc., Tilray, Aurora Cannabis, JAZZ Pharmaceuticals Inc. (GW Pharmaceuticals plc), HEXO Corp. (Zenabis North America Ltd), Cresco Labs, Peace Naturals Project Inc., CANOPY GROWTH CORPORATION, Medical Marijuana, Inc., Seed Cellar, EcoGen Biosciences, CANNABIS SEEDS USA, Seeds For Me, HUMBOLDT SEED COMPANY, Extractas, World Class Cannabis Seeds (Crop King Seeds), BARNEY'S FARM, FOLIUM BIOSCIENCES, PharmaHemp, Elixinol North America Limited, ENDOCA, Harmony, MARY'S nutritionals, LLC, Pure Ratios, Greenwich Biosciences, Inc., Upstate Elevator Supply Co., Apothecanna, BOL Pharma et IDT Australia, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA MEDICAL CANNABIS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 INDUSTRY INSIGHTS

5.1 INDUSTRY INSIGHTS PATENT ANALYSIS

5.2 DRUG TREATMENT RATE BY MATURED MARKETS

5.3 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

5.4 PATIENT FLOW DIAGRAM

5.5 KEY PRICING STRATEGIES

5.6 KEY PATIENT ENROLLMENT STRATEGIES

6 REGULATORY SCENARIO

6.1 U.S.

6.2 CANADA

6.3 MEXICO

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASED USE OF CANNABIS IN MEDICINES

7.1.2 LEGALIZATION OF CANNABIS

7.1.3 STRATEGIC INITIATIVES TAKEN BY KEY PLAYERS

7.1.4 RISE IN THE PREVALENCE OF DISEASES THAT REQUIRE THE USE OF CANNABIS

7.2 RESTRAINTS

7.2.1 COMPLEX REGULATORY STRUCTURE FOR THE USAGE OF CANNABIS

7.2.2 ADVERSE EFFECTS DUE TO LONG-TERM USE

7.2.3 HIGH-COST PURCHASING AND RUSH FOR PREMIUM QUALITY

7.3 OPPORTUNITIES

7.3.1 NOVEL PRODUCT DEVELOPMENT WITH INCREASING R&D ACTIVITIES

7.3.2 INCREASED ADOPTION OF CANNABIS FOR RECREATIONAL PURPOSES

7.3.3 GROWING GERIATRIC POPULATION

7.4 CHALLENGES

7.4.1 RISE OF THE CANNABIS BLACK MARKET

7.4.2 SIDE EFFECTS RELATED TO THE USE OF CANNABIS

7.4.3 SHORTAGE OF SKILLED PERSONNEL

8 NORTH AMERICA MEDICAL CANNABIS MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 OIL

8.2.1 OIL, BY TYPE

8.2.1.1 CBD OIL CONCENTRATES

8.2.1.2 CBD VAPE OIL

8.2.1.3 CBD TINCTURES

8.2.2 OIL, BY SOURCE

8.2.2.1 HEMP BASED

8.2.2.2 MARIJUANA BASED

8.2.3 OIL, BY SPECIES

8.2.3.1 SATIVA

8.2.3.2 HYBRID

8.2.3.3 CANNABIS INDICA

8.2.4 OIL, BY PRODUCT TYPE

8.2.4.1 BRANDED

8.2.4.1.1 PENGUIN CBD OIL

8.2.4.1.2 FAB CBD OIL

8.2.4.1.3 GREEN ROADS BROAD SPECTRUM CBD OIL

8.2.4.1.4 OTHERS

8.2.4.2 GENERIC

8.3 DRIED MEDICAL CANNABIS

8.3.1 CANNABIS INDICA

8.3.2 SATIVA

8.3.3 HYBRID

8.4 MEDICAL CANNABIS CAPSULES

8.4.1 MEDICAL CANNABIS CAPSULES, BY TYPE

8.4.1.1 OIL BASED CANNABIS CAPSULES

8.4.1.2 POWDER BASED CANNABIS CAPSULES

8.4.1.3 LIQUID BASED CANNABIS CAPSULES

8.4.1.4 OTHERS

8.4.2 MEDICAL CANNABIS CAPSULES, BY CONCENTRATES

8.4.2.1 HIGH CBD CAPSULES DIGITAL

8.4.2.2 HIGH THC CAPSULE

8.4.2.3 THC/CBD BALANCED CAPSULE

8.4.2.4 CBD ISOLATE CAPSULE

8.4.3 MEDICAL CANNABIS CAPSULES, BY SPECIES

8.4.3.1 SATIVA

8.4.3.2 CANNABIS INDICA

8.4.4 MEDICAL CANNABIS CAPSULES, BY PRODUCT TYPE

8.4.4.1 BRANDED

8.4.4.1.1 JOY NUTRITION

8.4.4.1.2 MEDTERRA ISOLATE CBD GEL CAPSULES

8.4.4.1.3 LAZARUS NATURALS

8.4.4.1.4 OTHERS

8.4.4.2 GENERIC

8.5 VAPE PEN

8.5.1 VAPE PEN, BY SPECIES

8.5.1.1 SATIVA

8.5.1.2 HYBRID

8.5.1.3 CANNABIS INDICA

8.5.2 VAPE PEN, BY PRODUCT TYPE

8.5.2.1 BRANDED

8.5.2.1.1 KANDYPENS RUBI

8.5.2.1.2 SOL E-NECTAR COLLECTOR

8.5.2.1.3 PAX ERA PRO-OIL VAPE PEN

8.5.2.2 GENERIC

8.6 WHOLE FLOWER

8.6.1 WHOLE FLOWER, SPECIES

8.6.1.1 SATIVA

8.6.1.2 HYBRID

8.6.1.3 CANNABIS INDICA

8.6.2 WHOLE FLOWER, PRODUCT TYPE

8.6.2.1 BRANDED

8.6.2.1.1 ASTER FARMS

8.6.2.1.2 RA FLOWER

8.6.2.1.3 BAD APPLE

8.6.2.2 GENERIC

8.7 CREAMS & MOISTURIZER

8.7.1 CREAMS & MOISTURIZER, BY SPECIES

8.7.1.1 SATIVA

8.7.1.2 HYBRID

8.7.1.3 CANNABIS INDICA

8.7.2 CREAMS & MOISTURIZER, BY PRODUCT TYPE

8.7.2.1 BRANDED

8.7.2.1.1 CBDFX MUSCLE & JOINT

8.7.2.1.2 ASPEN GREEN MUSCLE RELIEF COOLING CREAM

8.7.2.1.3 MEDTERRA PAIN CREAM

8.7.2.2 GENERIC

8.8 GROUND FLOWER

8.8.1 GROUND FLOWER, BY SPECIES

8.8.1.1 SATIVA

8.8.1.2 HYBRID

8.8.1.3 CANNABIS INDICA

8.8.2 GROUND FLOWER, BY PRODUCT TYPE

8.8.2.1 BRANDED

8.8.2.1.1 ASTER FARMS

8.8.2.1.2 RA FLOWER

8.8.2.1.3 BAD APPLE

8.8.2.2 GENERIC

8.9 PATCH

8.9.1 PATCH, BY TYPE

8.9.1.1 RESERVOIR

8.9.1.2 LAYER DRUG-IN-ADHESIVE

8.9.1.3 OTHERS

8.9.2 PATCH, BY SPECIES

8.9.2.1 SATIVA

8.9.2.2 CANNABIS INDICA

8.9.2.3 HYBRID

8.9.3 PATCH, BY PRODUCT TYPE

8.9.3.1 BRANDED

8.9.3.1.1 HEMP BOMBS

8.9.3.1.2 PUREKANA

8.9.3.1.3 PURE RATIOS

8.9.3.1.4 RESERVOIR

8.9.3.2 GENERIC

8.1 MASKS & SERUM

8.10.1 MASKS & SERUM, BY SPECIES

8.10.1.1 SATIVA

8.10.1.2 CANNABIS INDICA

8.10.1.3 HYBRID

8.10.2 MASKS & SERUM, BY PRODUCT TYPE

8.10.2.1 BRANDED

8.10.2.1.1 BUMP & SMOOTH CBD

8.10.2.1.2 FACIAL ESSENCE

8.10.2.1.3 OTHERS

8.10.2.2 GENERIC

8.11 CLEANSER

8.11.1 CLEANSER, BY SPECIES

8.11.1.1 SATIVA

8.11.1.2 HYBRID

8.11.1.3 CANNABIS INDICA

8.11.2 CLEANSER, BY PRODUCT TYPE

8.11.2.1 BRANDED

8.11.2.1.1 KIEHL’S

8.11.2.1.2 CBD 101

8.11.2.1.3 OTHERS

8.11.2.2 GENERIC

8.12 OTHERS

9 NORTH AMERICA MEDICAL CANNABIS MARKET, BY SPECIES

9.1 OVERVIEW

9.2 SATIVA

9.3 HYBRID

9.4 CANNABIS INDICA

10 NORTH AMERICA MEDICAL CANNABIS MARKET, BY DERIVATIVES

10.1 OVERVIEW

10.2 CANNABIDIOL (CBD)

10.3 TETRAHYDROCANNABINOL (THC)/DELTA-8-TETRAHYDROCANNABINOL

10.4 CANNABIGEROL (CBG)

10.5 CANNABICHROMENE (CBC)

10.6 CANNABINOL (CBN)

10.7 CANNABICYCLOL (CBL)

10.8 OTHERS

11 NORTH AMERICA MEDICAL CANNABIS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 PAIN MANAGEMENT

11.2.1 PAIN MANAGEMENT, BY TYPE

11.2.1.1 CHRONIC PAIN

11.2.1.2 NON-CANCER CHRONIC PAIN

11.2.1.3 NEUROLOGICAL PAIN

11.2.2 PAIN MANAGEMENT, BY PRODUCT

11.2.2.1 OIL

11.2.2.2 DRIED MEDICAL CANNABIS

11.2.2.3 MEDICAL CANNABIS CAPSULES

11.2.2.4 PATCH

11.2.2.5 GROUND FLOWER

11.2.2.6 CREAMS & MOISTURIZER

11.2.2.7 VAPE PEN

11.2.2.8 WHOLE FLOWER

11.2.2.9 MASKS & SERUM

11.2.2.10 CLEANSER

11.2.2.11 OTHERS

11.3 ANXIETY

11.3.1 OIL

11.3.2 DRIED MEDICAL CANNABIS

11.3.3 MEDICAL CANNABIS CAPSULES

11.3.4 PATCH

11.3.5 GROUND FLOWER

11.3.6 CREAMS & MOISTURIZER

11.3.7 VAPE PEN

11.3.8 WHOLE FLOWER

11.3.9 MASKS & SERUM

11.3.10 CLEANSER

11.3.11 OTHERS

11.4 MUSCLE SPASM

11.4.1 OIL

11.4.2 DRIED MEDICAL CANNABIS

11.4.3 MEDICAL CANNABIS CAPSULES

11.4.4 PATCH

11.4.5 GROUND FLOWER

11.4.6 CREAMS & MOISTURIZER

11.4.7 VAPE PEN

11.4.8 WHOLE FLOWER

11.4.9 MASKS & SERUM

11.4.10 CLEANSER

11.4.11 OTHERS

11.5 NAUSEA

11.5.1 OIL

11.5.2 DRIED MEDICAL CANNABIS

11.5.3 MEDICAL CANNABIS CAPSULES

11.5.4 PATCH

11.5.5 GROUND FLOWER

11.5.6 CREAMS & MOISTURIZER

11.5.7 VAPE PEN

11.5.8 WHOLE FLOWER

11.5.9 MASKS & SERUM

11.5.10 CLEANSER

11.5.11 OTHERS

11.6 APPETITE LOSS

11.6.1 OIL

11.6.2 DRIED MEDICAL CANNABIS

11.6.3 MEDICAL CANNABIS CAPSULES

11.6.4 PATCH

11.6.5 GROUND FLOWER

11.6.6 CREAMS & MOISTURIZER

11.6.7 VAPE PEN

11.6.8 WHOLE FLOWER

11.6.9 MASKS & SERUM

11.6.10 CLEANSER

11.6.11 OTHERS

11.7 EATING DISORDERS

11.7.1 OIL

11.7.2 DRIED MEDICAL CANNABIS

11.7.3 MEDICAL CANNABIS CAPSULES

11.7.4 PATCH

11.7.5 GROUND FLOWER

11.7.6 CREAMS & MOISTURIZER

11.7.7 VAPE PEN

11.7.8 WHOLE FLOWER

11.7.9 MASKS & SERUM

11.7.10 CLEANSER

11.7.11 OTHERS

11.8 INFLAMMATORY BOWEL DISEASES

11.8.1 OIL

11.8.2 DRIED MEDICAL CANNABIS

11.8.3 MEDICAL CANNABIS CAPSULES

11.8.4 PATCH

11.8.5 GROUND FLOWER

11.8.6 CREAMS & MOISTURIZER

11.8.7 VAPE PEN

11.8.8 WHOLE FLOWER

11.8.9 MASKS & SERUM

11.8.10 CLEANSER

11.8.11 OTHERS

11.9 CANCER

11.9.1 OIL

11.9.2 DRIED MEDICAL CANNABIS

11.9.3 MEDICAL CANNABIS CAPSULES

11.9.4 PATCH

11.9.5 GROUND FLOWER

11.9.6 CREAMS & MOISTURIZER

11.9.7 VAPE PEN

11.9.8 WHOLE FLOWER

11.9.9 MASKS & SERUM

11.9.10 CLEANSER

11.9.11 OTHERS

11.1 ARTHRITIS

11.10.1 OIL

11.10.2 DRIED MEDICAL CANNABIS

11.10.3 MEDICAL CANNABIS CAPSULES

11.10.4 PATCH

11.10.5 GROUND FLOWER

11.10.6 CREAMS & MOISTURIZER

11.10.7 VAPE PEN

11.10.8 WHOLE FLOWER

11.10.9 MASKS & SERUM

11.10.10 CLEANSER

11.10.11 OTHERS

11.11 WASHING SYNDROME (CACHEXIA)

11.11.1 OIL

11.11.2 DRIED MEDICAL CANNABIS

11.11.3 MEDICAL CANNABIS CAPSULES

11.11.4 PATCH

11.11.5 GROUND FLOWER

11.11.6 CREAMS & MOISTURIZER

11.11.7 VAPE PEN

11.11.8 WHOLE FLOWER

11.11.9 MASKS & SERUM

11.11.10 CLEANSER

11.11.11 OTHERS

11.12 ALZHEIMER’S DISEASE

11.12.1 OIL

11.12.2 DRIED MEDICAL CANNABIS

11.12.3 MEDICAL CANNABIS CAPSULES

11.12.4 PATCH

11.12.5 GROUND FLOWER

11.12.6 CREAMS & MOISTURIZER

11.12.7 VAPE PEN

11.12.8 WHOLE FLOWER

11.12.9 MASKS & SERUM

11.12.10 CLEANSER

11.12.11 OTHERS

11.13 EPILEPSY

11.13.1 OIL

11.13.2 DRIED MEDICAL CANNABIS

11.13.3 MEDICAL CANNABIS CAPSULES

11.13.4 PATCH

11.13.5 GROUND FLOWER

11.13.6 CREAMS & MOISTURIZER

11.13.7 VAPE PEN

11.13.8 WHOLE FLOWER

11.13.9 MASKS & SERUM

11.13.10 CLEANSER

11.13.11 OTHERS

11.14 DEPRESSION AND SLEEP DISORDER

11.14.1 OIL

11.14.2 DRIED MEDICAL CANNABIS

11.14.3 MEDICAL CANNABIS CAPSULES

11.14.4 PATCH

11.14.5 GROUND FLOWER

11.14.6 CREAMS & MOISTURIZER

11.14.7 VAPE PEN

11.14.8 WHOLE FLOWER

11.14.9 MASKS & SERUM

11.14.10 CLEANSER

11.14.11 OTHERS

11.15 MULTIPLE SCLEROSIS

11.15.1 OIL

11.15.2 DRIED MEDICAL CANNABIS

11.15.3 MEDICAL CANNABIS CAPSULES

11.15.4 PATCH

11.15.5 GROUND FLOWER

11.15.6 CREAMS & MOISTURIZER

11.15.7 VAPE PEN

11.15.8 WHOLE FLOWER

11.15.9 MASKS & SERUM

11.15.10 CLEANSER

11.15.11 OTHERS

11.16 AUTISM

11.16.1 OIL

11.16.2 DRIED MEDICAL CANNABIS

11.16.3 MEDICAL CANNABIS CAPSULES

11.16.4 PATCH

11.16.5 GROUND FLOWER

11.16.6 CREAMS & MOISTURIZER

11.16.7 VAPE PEN

11.16.8 WHOLE FLOWER

11.16.9 MASKS & SERUM

11.16.10 CLEANSER

11.16.11 OTHERS

11.17 MENTAL HEALTH CONDITIONS

11.17.1 MENTAL HEALTH CONDITIONS, BY TYPE

11.17.1.1 POSTTRAUMATIC STRESS DISORDER (PTSD)

11.17.1.2 SCHIZOPHRENIA

11.17.1.3 OTHERS

11.17.2 MENTAL HEALTH CONDITIONS, BY TYPE

11.17.2.1 OIL

11.17.2.2 DRIED MEDICAL CANNABIS

11.17.2.3 MEDICAL CANNABIS CAPSULES

11.17.2.4 PATCH

11.17.2.5 GROUND FLOWER

11.17.2.6 CREAMS & MOISTURIZER

11.17.2.7 VAPE PEN

11.17.2.8 WHOLE FLOWER

11.17.2.9 MASKS & SERUM

11.17.2.10 CLEANSER

11.17.2.11 OTHERS

11.18 ELEVATE MOOD

11.18.1 OIL

11.18.2 DRIED MEDICAL CANNABIS

11.18.3 MEDICAL CANNABIS CAPSULES

11.18.4 PATCH

11.18.5 GROUND FLOWER

11.18.6 CREAMS & MOISTURIZER

11.18.7 VAPE PEN

11.18.8 WHOLE FLOWER

11.18.9 MASKS & SERUM

11.18.10 CLEANSER

11.18.11 OTHERS

11.19 OTHERS

12 NORTH AMERICA MEDICAL CANNABIS MARKET, BY ROUTE OF ADMINISTRATION

12.1 OVERVIEW

12.2 ORAL SOLUTIONS AND CAPSULES

12.3 SMOKING

12.4 TOPICALS

12.5 VAPORIZERS

12.6 OTHERS

13 NORTH AMERICA MEDICAL CANNABIS MARKET, BY TREATMENT TYPE

13.1 OVERVIEW

13.2 ANALGESIC

13.3 PSYCHEDELIC

13.4 ANTIVIRAL

13.5 APHRODISIAC

13.6 EXPECTORANT

13.7 OTHERS

14 NORTH AMERICA MEDICAL CANNABIS MARKET, BY END USER

14.1 OVERVIEW

14.2 HOMECARE SETTING

14.3 HOSPITAL

14.4 REHAB CENTERS

14.5 PHARMACEUTICAL INDUSTRY

14.6 RESEARCH AND DEVELOPMENT CENTERS

14.7 OTHERS

15 NORTH AMERICA MEDICAL CANNABIS MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 B2C

15.2.1 PHARMACIES

15.2.2 CONVENTIONAL STORES

15.2.3 ONLINE STORES

15.2.4 OTHERS

15.3 B2B

16 NORTH AMERICA MEDICAL CANNABIS MARKET, BY REGION

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

17 NORTH AMERICA MEDICAL CANNABIS MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

18 COMPANY PROFILE

18.1 MEDIPHARM LABS INC.

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 TILRAY

18.2.1 COMPANY SNAPSHOT

18.2.2 COMPANY SHARE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT DEVELOPMENTS

18.3 AURORA CANNABIS

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 JAZZ PHARMACEUTICALS INC. (GW PHARMACEUTICALS PLC)

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 HEXO CORP. (ZENABIS NORTH AMERICA LTD)

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 APOTHECANNA

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 BOL PHARMA

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENTS

18.8 BARNEY’S FARM

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 CANOPY GROWTH CORPORATION

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 CANNABIS SEEDS USA

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 CRESCO LABS

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 ECOGEN BIOSCIENCES

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENTS

18.13 ELIXINOL NORTH AMERICA LIMITED

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENTS

18.14 ENDOCA

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 EXTRACTAS

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENT

18.16 FOLIUM BIOSCIENCES

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENTS

18.17 GREENWICH BIOSCIENCES, INC.

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENTS

18.18 HARMONY

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENTS

18.19 HUMBOLDT SEED COMPANY

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 IDT AUSTRALIA

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT DEVELOPMENTS

18.21 MARY’S NUTRITIONALS, LLC

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

18.22 MEDICAL MARIJUANA, INC.

18.22.1 COMPANY SNAPSHOT

18.22.2 REVENUE ANALYSIS

18.22.3 PRODUCT PORTFOLIO

18.22.4 RECENT DEVELOPMENTS

18.23 PEACE NATURALS PROJECT INC.

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENT

18.24 PHARMAHEMP

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENT

18.25 PURE RATIOS

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENT

18.26 SEEDS FOR ME

18.26.1 COMPANY SNAPSHOT

18.26.2 PRODUCT PORTFOLIO

18.26.3 RECENT DEVELOPMENT

18.27 SEED CELLAR

18.27.1 COMPANY SNAPSHOT

18.27.2 PRODUCT PORTFOLIO

18.27.3 RECENT DEVELOPMENT

18.28 UPSTATE ELEVATOR SUPPLY CO.

18.28.1 COMPANY SNAPSHOT

18.28.2 PRODUCT PORTFOLIO

18.28.3 RECENT DEVELOPMENT

18.29 WORLD CLASS CANNABIS SEEDS (CROP KING SEEDS)

18.29.1 COMPANY SNAPSHOT

18.29.2 PRODUCT PORTFOLIO

18.29.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA MEDICAL CANNABIS MARKET, BY TREATMENT TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA OIL IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA OIL IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA OIL IN MEDICAL CANNABIS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA OIL IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA OIL IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA DRIED MEDICAL CANNABIS IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA DRIED MEDICAL CANNABIS IN MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY CONCENTRATES, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA VAPE PEN IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA VAPE PEN IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA VAPE PEN IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA WHOLE FLOWER IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA WHOLE FLOWER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA WHOLE FLOWER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA CREAMS & MOISTURIZER IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA CREAMS & MOISTURIZER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA CREAMS & MOISTURIZER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA GROUND FLOWER IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA GROUND FLOWER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA GROUND FLOWER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA PATCH IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA PATCH IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA PATCH IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA PATCH IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA MASKS & SERUM IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA MASKS & SERUM IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA MASKS & SERUM IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA CLEANSER IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA CLEANSER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA CLEANSER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA OTHERS IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA SATIVA IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA HYBRID IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA CANNABIS INDICA IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA MEDICAL CANNABIS MARKET, BY DERIVATIVES, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA CANNABIDIOL (CBD) IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA TETRAHYDROCANNABINOL (THC)/DELTA-8-TETRAHYDROCANNABINOL IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA CANNABIGEROL (CBG) IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA CANNABICHROMENE (CBC) IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA CANNABINOL (CBN) IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA CANNABICYCLOL (CBL) IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA OTHERS IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 59 NORTH AMERICA PAIN MANAGEMENT IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA PAIN MANAGEMENT IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA PAIN MANAGEMENT IN MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA ANXIETY IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 63 NORTH AMERICA ANXIETY IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA MUSCLE SPASM IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 65 NORTH AMERICA MUSCLE SPASM IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA NAUSEA IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 67 NORTH AMERICA NAUSEA IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 68 NORTH AMERICA APPETITE LOSS IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 69 NORTH AMERICA APPETITE LOSS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA EATING DISORDERS IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 71 NORTH AMERICA EATING DISORDERS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 72 NORTH AMERICA INFLAMMATORY BOWEL DISEASES IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 73 NORTH AMERICA INFLAMMATORY BOWEL DISEASES IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 74 NORTH AMERICA CANCER IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 75 NORTH AMERICA CANCER IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 76 NORTH AMERICA ARTHRITIS IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 77 NORTH AMERICA ARTHRITIS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 78 NORTH AMERICA WASHING SYNDROME (CACHEXIA) IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 79 NORTH AMERICA WASHING SYNDROME (CACHEXIA) IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 80 NORTH AMERICA ALZHEIMER’S DISEASE IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 81 NORTH AMERICA ALZHEIMER’S DISEASE IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 82 NORTH AMERICA EPILEPSY IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 83 NORTH AMERICA EPILEPSY IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 84 NORTH AMERICA DEPRESSION AND SLEEP DISORDER IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 85 NORTH AMERICA DEPRESSION AND SLEEP DISORDER IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 86 NORTH AMERICA MULTIPLE SCLEROSIS IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 87 NORTH AMERICA MULTIPLE SCLEROSIS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 88 NORTH AMERICA AUTISM IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 89 NORTH AMERICA AUTISM IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 90 NORTH AMERICA MENTAL HEALTH CONDITIONS IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 91 NORTH AMERICA MENTAL HEALTH CONDITIONS IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 92 NORTH AMERICA MENTAL HEALTH CONDITIONS IN MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 93 NORTH AMERICA ELEVATE MOOD IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 94 NORTH AMERICA ELEVATE MOOD IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 95 NORTH AMERICA OTHERS IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 96 NORTH AMERICA MEDICAL CANNABIS MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 97 NORTH AMERICA ORAL SOLUTIONS AND CAPSULES IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 98 NORTH AMERICA SMOKING IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 99 NORTH AMERICA TOPICALS IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 100 NORTH AMERICA VAPORIZERS IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 101 NORTH AMERICA OTHERS IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 102 NORTH AMERICA MEDICAL CANNABIS MARKET, BY TREATMENT TYPE, 2021-2030 (USD MILLION)

TABLE 103 NORTH AMERICA ANALGESIC IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 104 NORTH AMERICA PSYCHEDELIC IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 105 NORTH AMERICA ANTIVIRAL IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 106 NORTH AMERICA APHRODISIAC IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 107 NORTH AMERICA EXPECTORANT IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 108 NORTH AMERICA OTHERS IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 109 NORTH AMERICA MEDICAL CANNABIS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 110 NORTH AMERICA HOMECARE SETTING IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 111 NORTH AMERICA HOSPITAL IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 112 NORTH AMERICA REHAB CENTERS IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 113 NORTH AMERICA PHARMACEUTICAL INDUSTRY IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 114 NORTH AMERICA RESEARCH AND DEVELOPMENT CENTERS IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 115 NORTH AMERICA OTHERS IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 116 NORTH AMERICA MEDICAL CANNABIS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 117 NORTH AMERICA B2C IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 118 NORTH AMERICA B2C IN MEDICAL CANNABIS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 119 NORTH AMERICA B2B IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 120 NORTH AMERICA MEDICAL CANNABIS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 121 NORTH AMERICA MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 122 NORTH AMERICA OIL IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 123 NORTH AMERICA OIL IN MEDICAL CANNABIS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 124 NORTH AMERICA OIL IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 125 NORTH AMERICA OIL IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 126 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 127 NORTH AMERICA DRIED MEDICAL CANNABIS IN MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 128 NORTH AMERICA MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 129 NORTH AMERICA MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY CONCENTRATES, 2021-2030 (USD MILLION)

TABLE 130 NORTH AMERICA MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 131 NORTH AMERICA MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 132 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 133 NORTH AMERICA VAPE PEN IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 134 NORTH AMERICA VAPE PEN IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 135 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 136 NORTH AMERICA WHOLE FLOWER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 137 NORTH AMERICA WHOLE FLOWER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 138 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 139 NORTH AMERICA CREAMS & MOISTURIZER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 140 NORTH AMERICA CREAMS & MOISTURIZER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 141 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 142 NORTH AMERICA GROUND FLOWER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 143 NORTH AMERICA GROUND FLOWER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 144 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 145 NORTH AMERICA PATCH IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 146 NORTH AMERICA PATCH IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 147 NORTH AMERICA PATCH IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 148 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 149 NORTH AMERICA MASKS & SERUM IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 150 NORTH AMERICA MASKS & SERUM IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 151 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 152 NORTH AMERICA CLEANSER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 153 NORTH AMERICA CLEANSER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 154 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 155 NORTH AMERICA MEDICAL CANNABIS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 156 NORTH AMERICA SYNTHETIC IN MEDICAL CANNABIS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 157 NORTH AMERICA MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 158 NORTH AMERICA MEDICAL CANNABIS MARKET, BY DERIVATIVES, 2021-2030 (USD MILLION)

TABLE 159 NORTH AMERICA MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 160 NORTH AMERICA PAIN MANAGEMENT IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 161 NORTH AMERICA PAIN MANAGEMENT IN MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 162 NORTH AMERICA ANXIETY IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 163 NORTH AMERICA MUSCLE SPASM IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 164 NORTH AMERICA NAUSEA IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 165 NORTH AMERICA APPETITE LOSS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 166 NORTH AMERICA EATING DISORDERS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 167 NORTH AMERICA INFLAMMATORY BOWEL DISEASES IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 168 NORTH AMERICA CANCER IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 169 NORTH AMERICA ARTHRITIS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 170 NORTH AMERICA WASTING SYNDROME (CACHEXIA) IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 171 NORTH AMERICA ALZHEIMER'S DISEASE IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 172 NORTH AMERICA EPILEPSY IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 173 NORTH AMERICA DEPRESSION AND SLEEP DISORDER IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 174 NORTH AMERICA MULTIPLE SCLEROSIS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 175 NORTH AMERICA AUTISM IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 176 NORTH AMERICA MENTAL HEALTH CONDITIONS IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 177 NORTH AMERICA MENTAL HEALTH CONDITIONS IN MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 178 NORTH AMERICA ELEVATE MOOD IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 179 NORTH AMERICA MEDICAL CANNABIS MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 180 NORTH AMERICA MEDICAL CANNABIS MARKET, BY TREATMENT TYPE, 2021-2030 (USD MILLION)

TABLE 181 NORTH AMERICA MEDICAL CANNABIS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 182 NORTH AMERICA MEDICAL CANNABIS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 183 NORTH AMERICA B2C IN MEDICAL CANNABIS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 184 U.S. MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 185 U.S. OIL IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 186 U.S. OIL IN MEDICAL CANNABIS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 187 U.S. OIL IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 188 U.S. OIL IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 189 U.S. BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 190 U.S. DRIED MEDICAL CANNABIS IN MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 191 U.S. MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 192 U.S. MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY CONCENTRATES, 2021-2030 (USD MILLION)

TABLE 193 U.S. MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 194 U.S. MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 195 U.S. BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 196 U.S. VAPE PEN IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 197 U.S. VAPE PEN IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 198 U.S. BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 199 U.S. WHOLE FLOWER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 200 U.S. WHOLE FLOWER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 201 U.S. BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 202 U.S. CREAMS & MOISTURIZER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 203 U.S. CREAMS & MOISTURIZER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 204 U.S. BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 205 U.S. GROUND FLOWER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 206 U.S. GROUND FLOWER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 207 U.S. BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 208 U.S. PATCH IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 209 U.S. PATCH IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 210 U.S. PATCH IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 211 U.S. BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 212 U.S. MASKS & SERUM IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 213 U.S. MASKS & SERUM IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 214 U.S. BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 215 U.S. CLEANSER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 216 U.S. CLEANSER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 217 U.S. BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 218 U.S. MEDICAL CANNABIS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 219 U.S. SYNTHETIC IN MEDICAL CANNABIS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 220 U.S. MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 221 U.S. MEDICAL CANNABIS MARKET, BY DERIVATIVES, 2021-2030 (USD MILLION)

TABLE 222 U.S. MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 223 U.S. PAIN MANAGEMENT IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 224 U.S. PAIN MANAGEMENT IN MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 225 U.S. ANXIETY IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 226 U.S. MUSCLE SPASM IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 227 U.S. NAUSEA IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 228 U.S. APPETITE LOSS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 229 U.S. EATING DISORDERS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 230 U.S. INFLAMMATORY BOWEL DISEASES IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 231 U.S. CANCER IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 232 U.S. ARTHRITIS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 233 U.S. WASTING SYNDROME (CACHEXIA) IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 234 U.S. ALZHEIMER'S DISEASE IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 235 U.S. EPILEPSY IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 236 U.S. DEPRESSION AND SLEEP DISORDER IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 237 U.S. MULTIPLE SCLEROSIS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 238 U.S. AUTISM IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 239 U.S. MENTAL HEALTH CONDITIONS IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 240 U.S. MENTAL HEALTH CONDITIONS IN MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 241 U.S. ELEVATE MOOD IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 242 U.S. MEDICAL CANNABIS MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 243 U.S. MEDICAL CANNABIS MARKET, BY TREATMENT TYPE, 2021-2030 (USD MILLION)

TABLE 244 U.S. MEDICAL CANNABIS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 245 U.S. MEDICAL CANNABIS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 246 U.S. B2C IN MEDICAL CANNABIS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 247 CANADA MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 248 CANADA OIL IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 249 CANADA OIL IN MEDICAL CANNABIS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 250 CANADA OIL IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 251 CANADA OIL IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 252 CANADA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 253 CANADA DRIED MEDICAL CANNABIS IN MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 254 CANADA MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 255 CANADA MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY CONCENTRATES, 2021-2030 (USD MILLION)

TABLE 256 CANADA MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 257 CANADA MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 258 CANADA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 259 CANADA VAPE PEN IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 260 CANADA VAPE PEN IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 261 CANADA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 262 CANADA WHOLE FLOWER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 263 CANADA WHOLE FLOWER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 264 CANADA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 265 CANADA CREAMS & MOISTURIZER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 266 CANADA CREAMS & MOISTURIZER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 267 CANADA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 268 CANADA GROUND FLOWER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 269 CANADA GROUND FLOWER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 270 CANADA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 271 CANADA PATCH IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 272 CANADA PATCH IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 273 CANADA PATCH IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 274 CANADA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 275 CANADA MASKS & SERUM IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 276 CANADA MASKS & SERUM IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 277 CANADA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 278 CANADA CLEANSER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 279 CANADA CLEANSER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 280 CANADA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 281 CANADA MEDICAL CANNABIS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 282 CANADA SYNTHETIC IN MEDICAL CANNABIS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 283 CANADA MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 284 CANADA MEDICAL CANNABIS MARKET, BY DERIVATIVES, 2021-2030 (USD MILLION)

TABLE 285 CANADA MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 286 CANADA PAIN MANAGEMENT IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 287 CANADA PAIN MANAGEMENT IN MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 288 CANADA ANXIETY IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 289 CANADA MUSCLE SPASM IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 290 CANADA NAUSEA IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 291 CANADA APPETITE LOSS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 292 CANADA EATING DISORDERS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 293 CANADA INFLAMMATORY BOWEL DISEASES IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 294 CANADA CANCER IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 295 CANADA ARTHRITIS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 296 CANADA WASTING SYNDROME (CACHEXIA) IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 297 CANADA ALZHEIMER'S DISEASE IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 298 CANADA EPILEPSY IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 299 CANADA DEPRESSION AND SLEEP DISORDER IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 300 CANADA MULTIPLE SCLEROSIS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 301 CANADA AUTISM IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 302 CANADA MENTAL HEALTH CONDITIONS IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 303 CANADA MENTAL HEALTH CONDITIONS IN MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 304 CANADA ELEVATE MOOD IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 305 CANADA MEDICAL CANNABIS MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 306 CANADA MEDICAL CANNABIS MARKET, BY TREATMENT TYPE, 2021-2030 (USD MILLION)

TABLE 307 CANADA MEDICAL CANNABIS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 308 CANADA MEDICAL CANNABIS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 309 CANADA B2C IN MEDICAL CANNABIS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 310 MEXICO MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 311 MEXICO OIL IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 312 MEXICO OIL IN MEDICAL CANNABIS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 313 MEXICO OIL IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 314 MEXICO OIL IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 315 MEXICO BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 316 MEXICO DRIED MEDICAL CANNABIS IN MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 317 MEXICO MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 318 MEXICO MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY CONCENTRATES, 2021-2030 (USD MILLION)

TABLE 319 MEXICO MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 320 MEXICO MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 321 MEXICO BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 322 MEXICO VAPE PEN IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 323 MEXICO VAPE PEN IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 324 MEXICO BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 325 MEXICO WHOLE FLOWER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 326 MEXICO WHOLE FLOWER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 327 MEXICO BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 328 MEXICO CREAMS & MOISTURIZER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 329 MEXICO CREAMS & MOISTURIZER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 330 MEXICO BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 331 MEXICO GROUND FLOWER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 332 MEXICO GROUND FLOWER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 333 MEXICO BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 334 MEXICO PATCH IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 335 MEXICO PATCH IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 336 MEXICO PATCH IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 337 MEXICO BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 338 MEXICO MASKS & SERUM IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 339 MEXICO MASKS & SERUM IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 340 MEXICO BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 341 MEXICO CLEANSER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 342 MEXICO CLEANSER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 343 MEXICO BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 344 MEXICO MEDICAL CANNABIS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 345 MEXICO SYNTHETIC IN MEDICAL CANNABIS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 346 MEXICO MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 347 MEXICO MEDICAL CANNABIS MARKET, BY DERIVATIVES, 2021-2030 (USD MILLION)

TABLE 348 MEXICO MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 349 MEXICO PAIN MANAGEMENT IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 350 MEXICO PAIN MANAGEMENT IN MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 351 MEXICO ANXIETY IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 352 MEXICO MUSCLE SPASM IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 353 MEXICO NAUSEA IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 354 MEXICO APPETITE LOSS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 355 MEXICO EATING DISORDERS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 356 MEXICO INFLAMMATORY BOWEL DISEASES IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 357 MEXICO CANCER IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 358 MEXICO ARTHRITIS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 359 MEXICO WASTING SYNDROME (CACHEXIA) IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 360 MEXICO ALZHEIMER'S DISEASE IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 361 MEXICO EPILEPSY IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 362 MEXICO DEPRESSION AND SLEEP DISORDER IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 363 MEXICO MULTIPLE SCLEROSIS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 364 MEXICO AUTISM IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 365 MEXICO MENTAL HEALTH CONDITIONS IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 366 MEXICO MENTAL HEALTH CONDITIONS IN MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 367 MEXICO ELEVATE MOOD IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 368 MEXICO MEDICAL CANNABIS MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 369 MEXICO MEDICAL CANNABIS MARKET, BY TREATMENT TYPE, 2021-2030 (USD MILLION)

TABLE 370 MEXICO MEDICAL CANNABIS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 371 MEXICO MEDICAL CANNABIS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 372 MEXICO B2C IN MEDICAL CANNABIS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA MEDICAL CANNABIS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA MEDICAL CANNABIS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA MEDICAL CANNABIS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA MEDICAL CANNABIS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA MEDICAL CANNABIS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA MEDICAL CANNABIS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA MEDICAL CANNABIS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA MEDICAL CANNABIS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA MEDICAL CANNABIS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA MEDICAL CANNABIS MARKET: SEGMENTATION

FIGURE 11 INCREASING MEDICINAL USE AND LEGALIZATION OF MEDICAL CANNABIS ARE EXPECTED TO DRIVE THE NORTH AMERICA MEDICAL CANNABIS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA MEDICAL CANNABIS MARKET IN 2023 AND 2030

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE NORTH AMERICA MEDICAL CANNABIS MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 NORTH AMERICA IS THE FASTEST-GROWING MARKET FOR MEDICAL CANNABIS MANUFACTURERS IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA MEDICAL CANNABIS MARKET

FIGURE 16 NORTH AMERICA MEDICAL CANNABIS MARKET: BY PRODUCT, 2022

FIGURE 17 NORTH AMERICA MEDICAL CANNABIS MARKET: BY PRODUCT, 2023-2030 (USD MILLION)

FIGURE 18 NORTH AMERICA MEDICAL CANNABIS MARKET: BY PRODUCT, CAGR (2023-2030)

FIGURE 19 NORTH AMERICA MEDICAL CANNABIS MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 20 NORTH AMERICA MEDICAL CANNABIS MARKET: BY SPECIES, 2022

FIGURE 21 NORTH AMERICA MEDICAL CANNABIS MARKET: BY SPECIES, 2023-2030 (USD MILLION)

FIGURE 22 NORTH AMERICA MEDICAL CANNABIS MARKET: BY SPECIES, CAGR (2023-2030)

FIGURE 23 NORTH AMERICA MEDICAL CANNABIS MARKET: BY SPECIES, LIFELINE CURVE

FIGURE 24 NORTH AMERICA MEDICAL CANNABIS MARKET: BY DERIVATIVES, 2022

FIGURE 25 NORTH AMERICA MEDICAL CANNABIS MARKET: BY DERIVATIVES, 2023-2030 (USD MILLION)

FIGURE 26 NORTH AMERICA MEDICAL CANNABIS MARKET: BY DERIVATIVES, CAGR (2023-2030)

FIGURE 27 NORTH AMERICA MEDICAL CANNABIS MARKET: BY DERIVATIVES, LIFELINE CURVE

FIGURE 28 NORTH AMERICA MEDICAL CANNABIS MARKET: BY APPLICATION, 2022

FIGURE 29 NORTH AMERICA MEDICAL CANNABIS MARKET: BY APPLICATION , 2023-2030 (USD MILLION)

FIGURE 30 NORTH AMERICA MEDICAL CANNABIS MARKET: BY APPLICATION , CAGR (2023-2030)

FIGURE 31 NORTH AMERICA MEDICAL CANNABIS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 32 NORTH AMERICA MEDICAL CANNABIS MARKET: BY ROUTE OF ADMINISTRATION, 2022

FIGURE 33 NORTH AMERICA MEDICAL CANNABIS MARKET: BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

FIGURE 34 NORTH AMERICA MEDICAL CANNABIS MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2023-2030)

FIGURE 35 NORTH AMERICA MEDICAL CANNABIS MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 36 NORTH AMERICA MEDICAL CANNABIS MARKET: BY TREATMENT TYPE, 2022