North America Lymphedema Treatment Market

Taille du marché en milliards USD

TCAC :

%

USD

560.25 Million

USD

1,268.05 Million

2024

2032

USD

560.25 Million

USD

1,268.05 Million

2024

2032

| 2025 –2032 | |

| USD 560.25 Million | |

| USD 1,268.05 Million | |

|

|

|

|

Segmentation du marché du traitement du lymphœdème en Amérique du Nord, par type de traitement (thérapie par compression, chirurgie, pharmacothérapie, thérapie au laser et autres), type (lymphœdème secondaire et lymphœdème primaire), zone affectée (membre inférieur, membre supérieur et organes génitaux), groupe d'âge (adulte, gériatrique et pédiatrique), voie d'administration (orale, injectable et topique), utilisateur final (hôpital, cliniques spécialisées, centres de chirurgie ambulatoire et autres), canal de distribution (pharmacie, magasins, appel d'offres direct et autres) Tendances et prévisions de l'industrie jusqu'en 2032.

Taille du marché du traitement du lymphœdème en Amérique du Nord

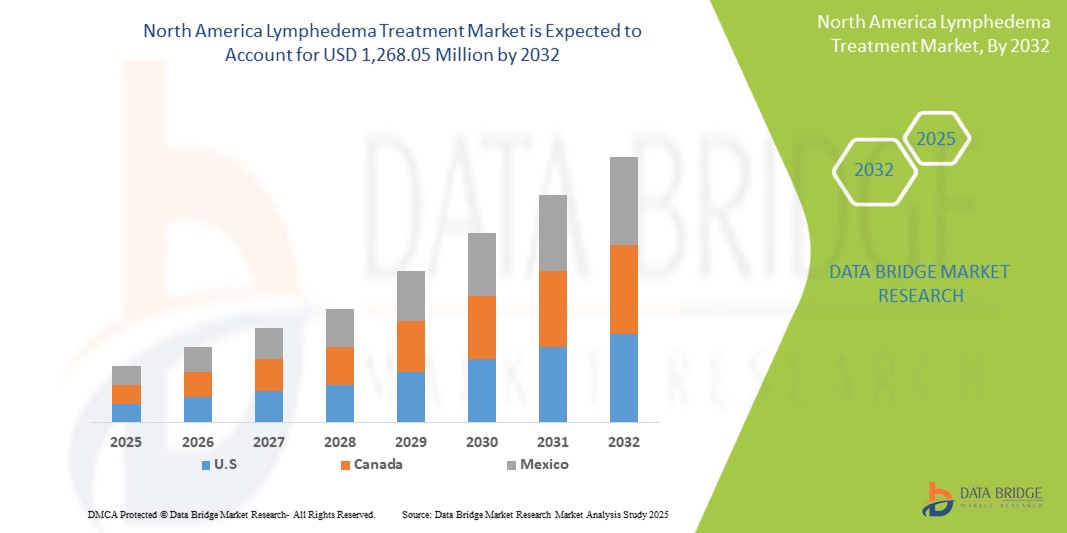

- La taille du marché du traitement du lymphœdème en Amérique du Nord était évaluée à 560,25 millions USD en 2024 et devrait atteindre 1 268,05 millions USD d'ici 2032 , à un TCAC de 11,0 % au cours de la période de prévision.

- La croissance du marché en Amérique du Nord est largement alimentée par la prévalence régionale croissante du lymphœdème et du lymphœdème lié au cancer, associée à des avancées technologiques significatives dans les modalités d’imagerie diagnostique et des approches de traitement innovantes, conduisant à une meilleure identification et gestion de la maladie.

- De plus, la demande croissante des patients et des cliniciens de la région pour des solutions plus efficaces, accessibles et intégrées pour gérer les œdèmes chroniques et améliorer la qualité de vie fait des thérapies de compression avancées, des techniques de drainage lymphatique et des interventions microchirurgicales la norme moderne de prise en charge du lymphœdème. Ces facteurs convergents accélèrent l'adoption de solutions de prise en charge du lymphœdème en Amérique du Nord, stimulant ainsi considérablement la croissance régionale du secteur.

Analyse du marché du traitement du lymphœdème en Amérique du Nord

- Le lymphœdème, caractérisé par un gonflement chronique causé par une altération de la fonction du système lymphatique, est un domaine d’intérêt de plus en plus vital dans les soins de santé nord-américains modernes en raison de son impact significatif sur la qualité de vie des patients, résultant souvent d’une complication du traitement du cancer ou de prédispositions génétiques.

- La demande croissante de traitements contre le lymphœdème en Amérique du Nord est principalement alimentée par la prévalence régionale croissante du lymphœdème et du lymphœdème lié au cancer, la sensibilisation croissante des professionnels de la santé et des patients, et les progrès technologiques continus dans les modalités diagnostiques et thérapeutiques.

- Les États-Unis ont dominé le marché du lymphœdème en 2024 et devraient connaître le taux de croissance le plus élevé au cours de la période de prévision, grâce à une forte prévalence de cas de lymphœdème (en particulier de lymphœdème lié au cancer), à une infrastructure de soins de santé avancée et à une forte sensibilisation des consommateurs et à l'adoption précoce de thérapies innovantes.

- Le segment de la thérapie par compression devrait dominer le marché nord-américain du traitement du lymphœdème, grâce à sa réputation établie en tant que traitement de première intention et le plus courant pour la gestion du gonflement, à sa nature non invasive et aux innovations continues dans les vêtements et dispositifs de compression offrant un confort, une accessibilité et une efficacité clinique améliorés.

Portée du rapport et segmentation du marché du traitement du lymphœdème en Amérique du Nord

|

Attributs |

Informations clés sur le marché du traitement du lymphœdème |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché du traitement du lymphœdème en Amérique du Nord

Amélioration des soins aux patients grâce à l'IA et à l'intégration numérique

- Une tendance importante et croissante sur le marché nord-américain du lymphœdème est l'intégration croissante de l'intelligence artificielle (IA) et des plateformes de santé numérique, englobant la télésurveillance, les algorithmes de traitement personnalisés et les solutions de télésanté. Cette fusion des technologies améliore considérablement le confort des patients, l'observance du traitement et la prise en charge globale de leur maladie chronique.

- Par exemple, en novembre 2014, selon l’American Cancer Society, plus de 4 millions de survivantes du cancer du sein vivaient aux États-Unis, avec un risque estimé de 20 à 40 % de développer un lymphœdème après le traitement, ce qui met en évidence un segment critique de patients qui stimule la demande régionale pour des solutions de gestion du lymphœdème à long terme.

- L'intégration de l'IA dans la prise en charge du lymphœdème en Amérique du Nord permet notamment d'analyser de vastes données patients pour prédire les poussées potentielles, d'optimiser la pression des vêtements de compression en fonction des réponses individuelles et de fournir des alertes plus intelligentes pour une intervention précoce. Par exemple, de nouvelles solutions basées sur l'IA sont en cours de développement aux États-Unis et au Canada pour améliorer la précision de la détection précoce du lymphœdème grâce à l'analyse d'imagerie et pour guider les patients dans des exercices de rééducation personnalisés. De plus, des plateformes numériques dotées de capacités de communication intégrées offrent aux patients la possibilité de consulter virtuellement, leur permettant d'évoquer leurs symptômes et de recevoir des conseils à distance de la part des professionnels de santé.

- L'intégration transparente des dispositifs de surveillance du lymphœdème et des outils d'autogestion aux écosystèmes de santé numérique plus vastes en Amérique du Nord facilite le contrôle centralisé des différents aspects des soins aux patients. Grâce à une interface unique, les utilisateurs peuvent gérer les mesures de leurs membres, l'observance de leur traitement et communiquer avec leur équipe soignante, créant ainsi une expérience de gestion de la santé unifiée et plus proactive.

Dynamique du marché du traitement du lymphœdème en Amérique du Nord

Conducteur

Besoin croissant en raison de la prévalence croissante des maladies et des capacités de diagnostic améliorées

- La prévalence croissante du lymphœdème en Amérique du Nord, en particulier le lymphœdème secondaire résultant de traitements contre le cancer tels que les thérapies contre le cancer du sein, de la prostate et gynécologiques, combinée à l'accélération des progrès des technologies de diagnostic et à une sensibilisation croissante, est un facteur majeur de la demande croissante de solutions de gestion du lymphœdème dans la région.

- Par exemple, en avril 2020, un article publié par ResearchGate GmbH indiquait que la prévalence globale du lymphœdème du bras était de 27 %, avec une hétérogénéité considérable. L'incidence globale du lymphœdème du bras était de 21 %. Des données probantes ont également montré qu'un indice de masse corporelle élevé (> 25) – un problème courant aux États-Unis et au Canada – était associé à un risque accru de lymphœdème du bras.

- À mesure que les professionnels de santé et les patients nord-américains sont mieux informés sur les conséquences à long terme d'un lymphœdème non traité, l'accent est mis sur une intervention précoce. Des outils diagnostiques avancés, tels que la spectroscopie de bioimpédance (BIS) et l'imagerie par fluorescence proche infrarouge (par exemple, la lymphographie ICG), sont de plus en plus adoptés dans les cliniques américaines et canadiennes, offrant une précision supérieure et une détection plus précoce que les méthodes traditionnelles comme la mesure de la circonférence des membres.

- L'évolution vers des soins centrés sur le patient et l'amélioration de la qualité de vie des personnes atteintes de maladies chroniques favorisent l'intégration d'une prise en charge globale du lymphœdème dans les parcours de soins post-cancer et chroniques. Cette intégration favorise la continuité des soins grâce à des programmes de réadaptation coordonnés et des thérapies de soutien.

- La disponibilité d'outils de santé numériques permettant un diagnostic précoce, facilitant la planification personnalisée des traitements et favorisant l'autogestion des symptômes grâce à des dispositifs portables de compression avancés et à des programmes d'exercices guidés stimule considérablement leur adoption en milieu clinique et à domicile en Amérique du Nord. La tendance au dépistage proactif, combinée à un meilleur accès à des produits pour le lymphœdème faciles à utiliser et conviviaux pour les patients, accélère encore la croissance du marché dans la région.

Retenue/Défi

Préoccupations concernant le sous-diagnostic et les coûts élevés des traitements

- Les inquiétudes concernant le sous-diagnostic et les erreurs de diagnostic généralisés du lymphœdème en Amérique du Nord, conjuguées au lourd fardeau financier des traitements à long terme, constituent un obstacle majeur à une pénétration plus large du marché et à une prise en charge efficace des patients. Dans de nombreux cas, le lymphœdème se manifeste par des symptômes discrets à ses débuts et est souvent négligé ou mal diagnostiqué par les professionnels de santé, ce qui entraîne des retards d'intervention, une progression de la maladie et une anxiété accrue des patients quant à leurs conséquences à long terme.

- Bien que les données sur les coûts varient en Amérique du Nord, les patients américains signalent fréquemment des dépenses importantes pour les soins du lymphœdème, notamment les vêtements de compression, le drainage lymphatique manuel et les dispositifs de compression pneumatique, qui peuvent s'élever à plusieurs milliers de dollars par an selon la gravité de la maladie et la couverture d'assurance. Si des mesures législatives, comme la loi sur le traitement du lymphœdème (adoptée en 2022), visent à améliorer le remboursement des traitements de compression par Medicare, les coûts de la prise en charge à vie restent un fardeau considérable pour de nombreux patients, notamment ceux qui ne bénéficient pas d'une assurance tous risques.

- Pour relever le défi du sous-diagnostic en Amérique du Nord, il est nécessaire d'améliorer la formation médicale des médecins généralistes, de standardiser les protocoles de dépistage en oncologie et en suivi postopératoire, et de développer les campagnes de sensibilisation du public. Les efforts de sensibilisation et de sensibilisation d'organisations comme le Lymphatic Education & Research Network (LE&RN) et le National Lymphedema Network (NLN) sont essentiels pour améliorer le dépistage précoce et les résultats à long terme des patients.

- De plus, le coût relativement élevé et récurrent des produits essentiels pour le lymphœdème demeure un obstacle à l'observance thérapeutique pour de nombreuses personnes, notamment dans les communautés à faibles revenus ou mal desservies. Ce défi financier peut décourager une prise en charge proactive et des soins de routine, notamment lorsque les patients ne bénéficient pas d'une assurance maladie adéquate ou n'ont pas accès à des cliniques spécialisées pour le lymphœdème.

- Bien que la sensibilisation s'améliore dans la région, la nature chronique du lymphœdème et l'absence de traitement définitif continuent d'influencer la motivation des patients et leur recours constant aux soins. Surmonter ces obstacles grâce à une meilleure formation des professionnels de santé, à l'amélioration des mécanismes de remboursement et au développement de solutions thérapeutiques plus abordables et évolutives sera essentiel pour soutenir la croissance à long terme du marché et améliorer la qualité de vie des patients en Amérique du Nord.

Portée du marché nord-américain du traitement du lymphœdème

Le marché du traitement du lymphœdème en Amérique du Nord est classé en sept segments notables qui sont basés sur le type de traitement, le type, la zone affectée, la tranche d'âge, la voie d'administration, l'utilisateur final et le canal de distribution.

Par type de traitement

En Amérique du Nord, le marché du lymphœdème est segmenté en fonction du type de traitement : compression, chirurgie, pharmacothérapie, laser, etc. Le segment de la compression devrait dominer la plus grande part de marché de la région (estimée à plus de 70 % en 2025 pour le marché de la compression, où le lymphœdème est une application majeure), grâce à sa réputation de référence en matière de prise en charge du lymphœdème et à son caractère non invasif. Cela le rend très accessible et privilégié par un large éventail de patients aux États-Unis et au Canada. Les patients nord-américains privilégient souvent la compression en raison de son efficacité prouvée pour réduire l'œdème, améliorer la mobilité des membres et optimiser le confort au quotidien. Le marché bénéficie également d'une forte demande de vêtements, de manchons et de pompes pneumatiques de compression, soutenue par des innovations constantes dans les technologies textiles et la conception de dispositifs portables, qui améliorent l'observance et le confort des patients.

Le segment des interventions chirurgicales devrait connaître la croissance la plus rapide en Amérique du Nord au cours de la période de prévision, grâce aux progrès des techniques microchirurgicales telles que l'anastomose lympho-veineuse (ALV) et le transfert de ganglions lymphatiques vascularisés (VLNT). La sensibilisation croissante des patients à ces options potentiellement curatives pour les cas de lymphœdème avancé ou réfractaire favorise l'acceptation du traitement chirurgical. La présence de centres spécialisés dans la chirurgie du lymphœdème aux États-Unis, ainsi que l'augmentation des recommandations des médecins et du soutien des assurances pour les options chirurgicales, contribuent également à la popularité croissante de ces interventions. Les interventions chirurgicales sont particulièrement intéressantes pour les patients qui recherchent une réduction du volume des membres à long terme et une amélioration de leur qualité de vie après un succès mitigé avec les traitements conservateurs.

Par type

En Amérique du Nord, le marché du traitement du lymphœdème est segmenté en deux catégories : le lymphœdème primaire et le lymphœdème secondaire. Ce segment devrait dominer le marché avec une part de marché estimée à 79,26 % en 2025, en raison de sa prévalence nettement plus élevée aux États-Unis et au Canada. Cette forme de lymphœdème est largement associée aux traitements contre le cancer, tels que le curage ganglionnaire, la mastectomie et la radiothérapie, interventions courantes dans la prise en charge des cancers du sein, de la prostate et des cancers gynécologiques.

Le segment du lymphœdème primaire devrait connaître la croissance la plus rapide au cours de la période de prévision, grâce à une meilleure sensibilisation et à des capacités diagnostiques accrues pour cette affection souvent héréditaire et précoce, ainsi qu'aux progrès des tests génétiques et des soins pédiatriques spécialisés dans le lymphœdème. Une meilleure compréhension des mutations génétiques liées au lymphœdème primaire permet un diagnostic plus précoce.

Par zone touchée

En Amérique du Nord, le marché du traitement du lymphœdème est segmenté en fonction de la zone touchée : membres inférieurs, membres supérieurs et organes génitaux. Le segment des membres inférieurs devrait dominer le marché avec une part de marché estimée à 53,61 % en 2025, en raison de l'incidence plus élevée du lymphœdème des jambes aux États-Unis et au Canada. Ce phénomène est fréquemment associé à des pathologies sous-jacentes telles que l'insuffisance veineuse chronique, l'obésité et le traitement de cancers comme le cancer de la prostate et les tumeurs gynécologiques. Les patients atteints de lymphœdème des membres inférieurs ressentent souvent une mobilité réduite et une gêne importante, ce qui nécessite une prise en charge médicale plus précoce.

Le segment des membres supérieurs devrait connaître une croissance significative au cours de la période de prévision en Amérique du Nord, principalement grâce au nombre croissant de survivantes du cancer du sein, notamment aux États-Unis, où le lymphœdème du bras post-chirurgical et radiologique est fréquent après une dissection des ganglions axillaires. La sensibilisation croissante des professionnels de santé en oncologie et des patients aux signes précoces du lymphœdème a conduit au développement et à l'adoption de solutions sur mesure telles que des manchons de compression, des gants et des dispositifs de compression pneumatique avancés.

Par groupe d'âge

En fonction de la tranche d'âge, le marché du traitement du lymphœdème en Asie-Pacifique est segmenté en adultes, gériatriques et pédiatriques. Le segment adulte devrait continuer à dominer le marché en termes de chiffre d'affaires dans la région Asie-Pacifique. Cette situation s'explique principalement par la forte incidence du lymphœdème secondaire lié aux traitements contre le cancer, notamment ceux du sein, des cancers gynécologiques et de la prostate, dont la prévalence augmente dans la population adulte en Asie-Pacifique en raison de l'évolution des modes de vie, des facteurs environnementaux et de l'amélioration des diagnostics. De plus, diverses causes acquises, notamment les traumatismes, les infections (comme la filariose dans certaines zones d'endémie) et d'autres pathologies, contribuent au dysfonctionnement lymphatique chez l'adulte. Les patients adultes de la région Asie-Pacifique constituent le groupe démographique le plus demandeur de traitement du lymphœdème, en raison de l'ampleur de ce segment de population et de la connaissance croissante des options thérapeutiques disponibles. Le marché bénéficie également d'une large gamme de produits et de solutions spécifiquement adaptés à la prise en charge du lymphœdème chez l'adulte.

Le segment gériatrique devrait connaître la croissance la plus rapide de la région Asie-Pacifique au cours de la période de prévision. Cette croissance accélérée est alimentée par l'augmentation significative du vieillissement de la population en Asie-Pacifique, qui est intrinsèquement plus sensible au déclin lymphatique lié à l'âge, entraînant une diminution de la fonction lymphatique. La prévalence croissante de comorbidités telles que l'insuffisance veineuse chronique, l'obésité et d'autres maladies chroniques liées à l'âge contribue également à l'incidence accrue du lymphœdème chez les personnes âgées. L'espérance de vie continue d'augmenter dans de nombreux pays de l'Asie-Pacifique, tout comme le fardeau des maladies chroniques, dont le lymphœdème, chez les personnes âgées.

Par voie d'administration

En fonction de la voie d'administration, le marché du traitement du lymphœdème en Asie-Pacifique est segmenté en deux catégories : orale, injectable et topique. Le segment oral devrait détenir la plus grande part de marché avec 51,84 % dans la région Asie-Pacifique en 2025. Cette croissance s'explique par la commodité de l'utilisation à domicile de médicaments de soutien, tels que les diurétiques pour la gestion des symptômes de gonflement, les antibiotiques pour la prévention ou le traitement de la cellulite récurrente (une complication fréquente du lymphœdème) et divers anti-inflammatoires. On observe également un intérêt croissant pour les thérapies orales émergentes visant à améliorer la fonction lymphatique et la recherche de nouvelles thérapies. Les patients de la région Asie-Pacifique privilégient souvent les médicaments oraux en raison de leur facilité d'auto-administration, ce qui favorise une meilleure observance du traitement en dehors du cadre clinique.

Le segment des injectables devrait connaître la croissance la plus rapide de la région Asie-Pacifique au cours de la période de prévision. Cette expansion rapide est alimentée par les efforts continus de recherche et développement dans les thérapies biologiques innovantes, les facteurs de croissance (comme le VEGF-C, qui stimule la régénération lymphatique) et les thérapies géniques. Ces traitements avancés nécessitent souvent une administration parentérale (injectable) pour stimuler efficacement la régénération lymphatique, réduire l'inflammation ou moduler la progression de la maladie.

Par utilisateur final

En fonction de l'utilisateur final, le marché du traitement du lymphœdème est segmenté entre hôpitaux, cliniques spécialisées, centres de chirurgie ambulatoire (CVA) et autres. Le segment hospitalier devrait détenir la plus grande part de marché. Cette domination est attribuée à la capacité des hôpitaux à proposer une gamme complète d'options thérapeutiques pour le lymphœdème, des thérapies conservatrices précoces comme le drainage lymphatique manuel et la compression aux interventions chirurgicales avancées comme l'anastomose lympho-veineuse et le transfert de ganglions lymphatiques vascularisés. Les hôpitaux constituent également le principal point de contact pour les cas complexes ou à un stade avancé, nécessitant une prise en charge multidisciplinaire, incluant imagerie, diagnostic et intervention chirurgicale.

Le segment des cliniques spécialisées devrait connaître la croissance la plus rapide au cours de la période de prévision. Cette croissance est portée par le nombre croissant de centres de réadaptation et de soins ambulatoires spécialisés dans le lymphœdème, qui proposent des thérapies non invasives et la prise en charge des maladies chroniques. Ces cliniques s'adressent particulièrement aux patients atteints de lymphœdème léger à modéré nécessitant des séances de traitement régulières, ce qui en fait une alternative économique et pratique aux séjours hospitaliers. Leur essor est également soutenu par le développement des campagnes de sensibilisation et des initiatives gouvernementales en faveur de la prise en charge de l'œdème chronique, notamment en milieu urbain.

Par canal de distribution

En fonction des canaux de distribution, le marché mondial du traitement du lymphœdème est segmenté en pharmacies, magasins, appels d'offres directs et autres. Ce segment devrait dominer le marché. Cela s'explique principalement par l'achat en gros de dispositifs médicaux tels que les pompes de compression, les vêtements et les kits chirurgicaux par les hôpitaux publics, les centres de rééducation et les agences gouvernementales de santé. Les appels d'offres directs garantissent des processus d'approvisionnement simplifiés, le respect des normes réglementaires et des prix préférentiels, ce qui en fait l'option privilégiée des grands acheteurs institutionnels.

Le segment des magasins, qui comprend les canaux de vente au détail et en ligne, devrait connaître la croissance la plus rapide au cours de la période de prévision. Cette expansion rapide est attribuée à l'évolution du comportement des patients vers la prise en charge du lymphœdème à domicile, notamment après la COVID-19. La commodité des achats en ligne, la pénétration croissante du e-commerce et la disponibilité de dispositifs d'autogestion tels que les manchons et bandages de compression ont accéléré la croissance de ce segment. De plus, l'essor des services de télésanté a permis aux patients de gérer leur lymphœdème à un stade précoce à domicile, augmentant ainsi le recours aux outils de traitement en vente libre et en ligne.

Analyse régionale du marché nord-américain du traitement du lymphœdème

- L'Amérique du Nord devrait dominer le marché nord-américain du traitement du lymphœdème avec la plus grande part de revenus, se situant souvent autour de 53,56 % en 2025, grâce à une forte prévalence de cas de lymphœdème (en particulier de lymphœdème lié au cancer), une infrastructure de soins de santé robuste et des investissements importants dans la recherche et le développement médicaux.

- Les prestataires de soins de santé et les patients de la région apprécient grandement les outils de diagnostic avancés facilement disponibles, les options de traitement complètes et les campagnes de sensibilisation croissantes proposées par les cliniques et les hôpitaux spécialisés.

- Cette adoption généralisée est en outre soutenue par des revenus disponibles élevés, une forte pénétration de l'assurance maladie et une approche proactive de la gestion des maladies chroniques, établissant les soins du lymphœdème comme partie intégrante du parcours des patients, tant pour les survivants du cancer que pour ceux atteints d'autres troubles lymphatiques.

Aperçu du marché américain du traitement du lymphœdème

Le marché américain du lymphœdème a représenté une part significative du chiffre d'affaires en Amérique du Nord, dépassant souvent 92,24 % en 2024, grâce à l'adoption rapide d'outils de diagnostic avancés et à la tendance croissante à la prise en charge intégrée du lymphœdème. Les professionnels de santé et les patients accordent de plus en plus d'importance à la détection précoce et à la prise en charge efficace du lymphœdème grâce à des protocoles thérapeutiques complets. La reconnaissance croissante de cette pathologie par les cliniciens, combinée à une forte demande de thérapies de compression spécialisées, de pompes pneumatiques et de surveillance numérique de la santé, propulse encore davantage le secteur du lymphœdème. De plus, l'intégration croissante de politiques de soutien telles que la loi sur le traitement du lymphœdème (Lymphedema Treatment Act), ainsi que les avancées technologiques en matière de spectroscopie de bioimpédance (BIS) et de plateformes de surveillance à distance des patients, contribuent significativement à l'expansion du marché, améliorant l'accès et l'observance des patients aux soins de longue durée.

Aperçu du marché canadien du traitement du lymphœdème

Le marché canadien du lymphœdème a représenté une part de revenus notable de 4,53 % en Amérique du Nord, contribuant ainsi de manière significative à la croissance régionale en 2025, stimulée par l'adoption progressive d'outils diagnostiques avancés et l'importance croissante accordée aux soins intégrés du lymphœdème au sein des systèmes de santé provinciaux. Partout au Canada, les professionnels de la santé et les patients accordent de plus en plus d'importance au dépistage précoce et à la prise en charge globale du lymphœdème grâce à des protocoles de traitement coordonnés et à des approches de soins multidisciplinaires. La sensibilisation croissante des cliniciens à cette maladie, conjuguée à la demande croissante de vêtements de compression spécialisés, d'appareils de compression pneumatique et d'outils de santé numériques émergents, propulse progressivement le marché du lymphœdème au pays. De plus, le rôle de soutien des organismes nationaux de défense des droits, comme le Cadre canadien sur le lymphœdème, et des initiatives provinciales favorisant l'éducation et l'accès des patients, ainsi que les avancées technologiques dans les modalités diagnostiques comme la spectroscopie de bioimpédance (BIS) et les plateformes de gestion des patients à distance, contribuent à l'expansion du marché. Ces efforts améliorent l'accès à un diagnostic rapide et favorisent l'adhésion aux stratégies de soins de longue durée, améliorant ainsi les résultats pour les patients canadiens atteints de lymphœdème.

Part de marché du traitement du lymphœdème en Amérique du Nord

L’industrie du traitement du lymphœdème est principalement dirigée par des entreprises bien établies, notamment :

- Tactile Medical (États-Unis)

- Essity Aktiebolag (publ) (Suède)

- 3M (États-Unis)

- Cardinal Health (États-Unis)

- Lohmann & Rauscher GmbH & Co. KG (Allemagne)

- PAUL HARTMANN AG (Allemagne)

- medi GmbH & Co. KG (Allemagne)

- ConvaTec Inc. (Royaume-Uni)

- Juzo (Allemagne)

- Smith + Nephew (Royaume-Uni)

- GROUPE SIGVARIS (Suisse)

- Sanyleg Srl (Italie)

- Avet Pharmaceuticals Inc. (États-Unis)

- ThermoTek Inc. (États-Unis)

- Huntleigh Healthcare Limited (Royaume-Uni)

- KOYA MEDICAL (États-Unis)

- AIROS Medical, Inc. (États-Unis)

- SYSTÈMES DE BIOCOMPRESSION (États-Unis)

- Mego Afek ltd. (Israël)

- Thusane (France)

Derniers développements sur le marché nord-américain du traitement du lymphœdème

- En mars 2025, ConvaTec a annoncé une collaboration mondiale avec la Wound, Ostomy, and Continence Nurses Society (WOCN) afin d'améliorer la formation aux soins de stomie. Ce partenariat lance deux programmes gratuits : le programme de soins avancés en stomie et le programme d'associé en soins de stomie (OCA), qui formeront plus de 750 professionnels de santé dans le monde. Cette initiative vise à améliorer les normes de soins et à élargir l'accès des patients à des soins spécialisés en stomie.

- En avril 2025, le groupe Lohmann & Rauscher (L&R) a acquis Unisurge International Ltd., leader britannique de kits d'intervention personnalisés et de produits chirurgicaux. Cette acquisition stratégique renforce l'accès de L&R au marché hospitalier britannique. Unisurge fonctionnera de manière indépendante, conservant sa direction et ses équipes, tout en bénéficiant de l'expertise mondiale de L&R et de son engagement en faveur de l'innovation médicale.

- En février 2025, Tactile Medical a étendu le lancement aux États-Unis de son dispositif de compression pneumatique Nimbl pour le traitement du lymphœdème des membres inférieurs, après son lancement initial pour les affections des membres supérieurs. Nimbl est le plus petit dispositif de compression pneumatique (PCD) Bluetooth de sa catégorie, conçu pour le confort, la portabilité et une meilleure observance. Il s'intègre à l'application Kylee, améliorant ainsi l'expérience patient et l'autogestion des soins à domicile.

- En octobre 2024, Tactile Medical a lancé Nimbl, son dispositif de compression pneumatique nouvelle génération, pour le traitement du lymphœdème des membres supérieurs. Approuvé par la FDA et approuvé par le CMS, Nimbl est 68 % plus léger et 40 % plus compact que les modèles précédents. Conçu pour une utilisation à domicile et un confort quotidien, il s'intègre à l'application Kylee pour améliorer le suivi des patients. Une version pour les membres inférieurs devrait être bientôt disponible à l'échelle nationale.

- En juillet 2020, Tactile Medical a lancé les vêtements ComfortEase pour son système Flexitouch Plus, repensés pour un ajustement, un confort et une facilité d'utilisation améliorés. Parallèlement, l'entreprise a lancé l'application mobile Kylee, permettant aux patients de suivre leurs symptômes de lymphœdème, d'enregistrer leurs traitements et d'accéder à des ressources éducatives. Ces deux innovations visent à améliorer l'observance thérapeutique à domicile et l'engagement des patients dans la prise en charge des gonflements chroniques.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA LYMPHEDEMA TREATMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 INDUSTRY INSIGHTS –

4.3.1 MICRO AND MACROECONOMIC FACTORS

4.3.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.3.3 KEY PRICING STRATEGIES

4.3.4 ANALYSIS AND RECOMMENDATION

4.4 INNOVATION TRACKER & STRATEGIC ANALYSIS

4.4.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.4.1.1 MERGERS & ACQUISITIONS

4.4.1.2 TECHNOLOGY COLLABORATIONS

4.4.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.4.3 STAGE OF DEVELOPMENT

4.4.4 TIMELINES & MILESTONES

4.4.5 INNOVATION STRATEGIES & METHODOLOGIES

4.4.6 RISK ASSESSMENT & MITIGATION

4.4.7 FUTURE OUTLOOK

4.5 PIPELINE ANALYSIS – NORTH AMERICA LYMPHEDEMA TREATMENT MARKET

4.5.1 CLINICAL TRIALS AND PHASE ANALYSIS

4.5.2 DRUG THERAPY PIPELINE

4.5.3 PHASE III CANDIDATES

4.5.4 PHASE II CANDIDATES

4.5.5 PHASE I CANDIDATES

4.5.6 OTHERS (PRE-CLINICAL AND RESEARCH)

4.5.7 CONCLUSION

4.6 EPIDEMIOLOGY–

4.6.1 INCIDENCE OF LYMPHEDEMA (NORTH AMERICA & BY GENDER)

4.6.2 INCIDENCE OF LYMPHEDEMA BY GENDER

4.6.3 TREATMENT RATE

4.6.4 MORTALITY RATE

4.6.5 DRUG ADHERENCE AND THERAPY SWITCH MODEL

4.6.6 PATIENT TREATMENT SUCCESS RATES

4.7 TARIFF

4.7.1 OVERVIEW

4.7.2 TARIFF STRUCTURES

4.7.2.1 North America vs. Regional Tariff Structures

4.7.2.2 United States: Medicare/Medicaid Tariff Policies, CMS Pricing Models

4.7.2.3 European Union: Cross-border Tariff Regulations and Reimbursement Policies

4.7.2.4 Asia-Pacific: Government-imposed Tariffs on Imported Medical Products

4.7.2.5 Emerging Markets: Challenges in Tariff Implementation

4.7.3 PHARMACEUTICAL TARIFFS AND TRADE BARRIERS

4.7.3.1 Import Duties on Prescription Drugs vs. Generics

4.7.3.2 Impact on Drug Affordability and Access

4.7.3.3 Key Trade Agreements Affecting Pharmaceutical Tariffs

4.7.4 IMPACT OF HEALTHCARE TARIFFS ON PROVIDERS AND PATIENTS

4.7.4.1 Cost Burden on Hospitals and Healthcare Facilities

4.7.4.2 Effect on Patient Affordability and Insurance Coverage

4.7.4.3 Tariffs and Their Role in Medical Tourism

4.7.5 TRADE AGREEMENTS AND HEALTHCARE TARIFFS

4.7.5.1 WTO Regulations on Healthcare Tariffs

4.7.5.2 Impact of Trade Wars on the Healthcare Supply Chain

4.7.5.3 Role of Free Trade Agreements (FTAs) in Reducing Tariffs

4.7.6 IMPACT OF TARIFFS ON HEALTHCARE COSTS AND ACCESSIBILITY

4.7.7 IMPORTANCE OF TARIFFS IN THE HEALTHCARE SECTOR

5 REGULATORY FRAMEWORK–

5.1 NORTH AMERICA

5.2 SOUTH AMERICA

5.3 EUROPE

5.4 ASIA-PACIFIC

5.5 MIDDLE EAST & AFRICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN THE NUMBER OF LYMPHEDEMA CASES GLOBALLY

6.1.2 INCREASE IN THE PREVALENCE OF CANCERS

6.1.3 INCREASING NUMBER OF HEALTHCARE FACILITIES

6.1.4 AVAILABILITY AND ADVANCEMENT OF MULTIPLE THERAPEUTIC OPTIONS

6.2 RESTRAINTS

6.2.1 SIGNIFICANT COST BURDEN ASSOCIATED WITH LYMPHEDEMA MANAGEMENT

6.2.2 LACK OF AWARENESS ABOUT THE DISEASE

6.3 OPPORTUNITIES

6.3.1 EXPANDING OPPORTUNITIES FOR DRUG DEVELOPMENT AND REGULATORY APPROVALS

6.3.2 STRATEGIC COLLABORATIONS AND ALLIANCES AMONG INDUSTRY STAKEHOLDERS

6.4 CHALLENGES

6.4.1 ABSENCE OF A DEFINITIVE CURATIVE TREATMENT

6.4.2 RESTRICTIVE AND INCONSISTENT REIMBURSEMENT POLICIES

7 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE

7.1 OVERVIEW

7.2 COMPRESSION THERAPY

7.3 SURGERY

7.4 DRUG THERAPY

7.5 LASER THERAPY

7.6 OTHERS

8 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TYPE

8.1 OVERVIEW

8.2 SECONDARY LYMPHEDEMA

8.3 PRIMARY LYMPHEDEMA

9 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA

9.1 OVERVIEW

9.2 LOWER EXTREMITY

9.3 UPPER EXTREMITY

9.4 GENITALIA

10 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP

10.1 OVERVIEW

10.2 ADULT

10.3 GERIATRIC

10.4 PEDIATRIC

11 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION

11.1 OVERVIEW

11.2 ORAL

11.3 INJECTABLE

11.4 TOPICAL

12 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITAL

12.3 SPECIALTY CLINICS

12.4 AMBULATORY SURGICAL CENTERS

12.5 OTHERS

13 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 PHARMACY STORES

13.3 DIRECT TENDER

13.4 OTHERS

14 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 TACTILE MEDICAL

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 ESSITY AKTIEBOLAG (PUBL)

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 3M

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 CARDINAL HEALTH

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 LOHMANN & RAUSCHER GMBH & CO. KG

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 AIROS MEDICAL, INC.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 ARJO

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 AVET PHARMACEUTICALS INC.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 BAUERFEIND

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 BIOCOMPRESSION SYSTEMS

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 CONVATEC INC.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 ENOVIS CORPORATION

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 HUNTLEIGH HEALTHCARE LIMITED

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 IMPEDIMED LIMITED

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENT/NEWS

17.15 JODAS EXPOIM PVT. LTD.

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 JUZO

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 KOYA MEDICAL

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 LLC BINNOPHARM GROUP

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 MCKESSON MEDICAL-SURGICAL INC.

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENT

17.2 MEDI GMBH & CO. KG

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 MEDTRONIC

17.21.1 COMPANY SNAPSHOT

17.21.2 REVENUE ANALYSIS

17.21.3 PRODUCT PORTFOLIO

17.21.4 RECENT DEVELOPMENTS

17.22 MEGO AFEK LTD

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 PAUL HARTMANN AG

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENT

17.24 PERFORMANCE HEALTH

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENTS

17.25 PURETECH HEALTH INC

17.25.1 COMPANY SNAPSHOT

17.25.2 PIPELINE PORTFOLIO

17.25.3 RECENT DEVELOPMENT

17.26 SANYLEG SRL A SOCIO UNICO

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENT

17.27 SIGVARIS GROUP

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENTS

17.28 SMITH+NEPHEW

17.28.1 COMPANY SNAPSHOT

17.28.2 REVENUE ANALYSIS

17.28.3 PRODUCT PORTFOLIO

17.28.4 RECENT DEVELOPMENT

17.29 THERMOTEK

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT DEVELOPMENT

17.3 THUASNE

17.30.1 COMPANY SNAPSHOT

17.30.2 PRODUCT PORTFOLIO

17.30.3 RECENT DEVELOPMENT

17.31 VIATRIS INC.

17.31.1 COMPANY SNAPSHOT

17.31.2 REVENUE ANALYSIS

17.31.3 PRODUCT PORTFOLIO

17.31.4 RECENT DEVELOPMENT

17.32 WHITE SWAN PHARMACEUTICAL

17.32.1 COMPANY SNAPSHOT

17.32.2 PRODUCT PORTFOLIO

17.32.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 PRODUCTS AND THEIR STAGES IN DEVELOPMENT.

TABLE 2 PHASE-WISE DISTRIBUTION: CLINICAL TRIALS

TABLE 3 PHASE 2 CANDIDATES

TABLE 4 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 6 NORTH AMERICA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY REGION 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA LASER THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA OTHERS IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA SECONDARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA LOWER EXTREMITY IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA UPPER EXTREMITY IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA GENITALIA IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA ADULT IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA GERIATRIC IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA PEDIATRIC IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA ORAL IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA INJECTABLE IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA TOPICAL IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA HOSPITAL IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA SPECIALITY CLINICS IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA OTHERS IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA PHARMACY STORES IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA DIRECT TENDER IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA OTHERS IN LYMPHEDEMA TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 44 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 45 NORTH AMERICA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 57 U.S. LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 U.S. LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 59 U.S. LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 60 U.S. COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 61 U.S. COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 62 U.S. COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 63 U.S. SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 U.S. DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 U.S. LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 U.S. PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 U.S. LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 68 U.S. LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 69 U.S. LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 70 U.S. LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 71 U.S. LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 72 CANADA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 CANADA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 74 CANADA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 75 CANADA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 76 CANADA COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 77 CANADA COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 78 CANADA SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 CANADA DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 CANADA LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 CANADA PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 CANADA LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 83 CANADA LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 84 CANADA LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 85 CANADA LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 86 CANADA LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 87 MEXICO LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 MEXICO LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 89 MEXICO LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 90 MEXICO COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 91 MEXICO COMPRESSION GARMENTS IN LYMPHEDEMA TREATMENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 92 MEXICO COMPRESSION THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 93 MEXICO SURGERY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 MEXICO DRUG THERAPY IN LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 MEXICO LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 MEXICO PRIMARY LYMPHEDEMA IN LYMPHEDEMA TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 MEXICO LYMPHEDEMA TREATMENT MARKET, BY AFFECTED AREA, 2018-2032 (USD THOUSAND)

TABLE 98 MEXICO LYMPHEDEMA TREATMENT MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 99 MEXICO LYMPHEDEMA TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 100 MEXICO LYMPHEDEMA TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 101 MEXICO LYMPHEDEMA TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 FIVE SEGMENTS COMPRISE THE NORTH AMERICA LYMPHEDEMA TREATMENT MARKET, BY TREATMENT TYPE (2024)

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: SEGMENTATION

FIGURE 14 INCREASE IN THE PREVALENCE OF CANCERS IS EXPECTED TO DRIVE THE NORTH AMERICA LYMPHEDEMA TREATMENT MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 15 THE COMPRESSION THERAPY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA LYMPHEDEMA TREATMENT MARKET IN 2025 AND 2032

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF INDONESIA ZEOLITE MARKET

FIGURE 17 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY TREATMENT TYPE, 2024

FIGURE 18 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY TREATMENT TYPE, 2025-2032 (USD THOUSAND)

FIGURE 19 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY TREATMENT TYPE, CAGR (2025-2032)

FIGURE 20 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY TREATMENT TYPE, LIFELINE CURVE

FIGURE 21 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY TYPE, 2024

FIGURE 22 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY TYPE, 2025-2032 (USD THOUSAND)

FIGURE 23 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY TYPE, CAGR (2025-2032)

FIGURE 24 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY TYPE, LIFELINE CURVE

FIGURE 25 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY AFFECTED AREA, 2024

FIGURE 26 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY AFFECTED AREA, 2025-2032 (USD THOUSAND)

FIGURE 27 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY AFFECTED AREA, CAGR (2025-2032)

FIGURE 28 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY AFFECTED AREA, LIFELINE CURVE

FIGURE 29 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY AGE GROUP, 2024

FIGURE 30 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY AGE GROUP, 2025-2032 (USD THOUSAND)

FIGURE 31 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY AGE GROUP, CAGR (2025-2032)

FIGURE 32 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 33 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY ROUTE OF ADMINISTRATION, 2024

FIGURE 34 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY ROUTE OF ADMINISTRATION, 2025-2032 (USD THOUSAND)

FIGURE 35 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2025-2032)

FIGURE 36 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 37 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY END USER, 2024

FIGURE 38 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 39 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY END USER, CAGR (2025-2032)

FIGURE 40 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY END USER, LIFELINE CURVE

FIGURE 41 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 42 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 43 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 44 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 45 NORTH AMERICA LYMPHEDEMA TREATMENT MARKET: SNAPSHOT (2024)

FIGURE 46 North America Lymphedema Treatment Market: COMPANY SHARE 2024 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.