North America Lymphangioleiomyomatosis Lam Market

Taille du marché en milliards USD

TCAC :

%

USD

56.72 Million

USD

80.67 Million

2024

2032

USD

56.72 Million

USD

80.67 Million

2024

2032

| 2025 –2032 | |

| USD 56.72 Million | |

| USD 80.67 Million | |

|

|

|

|

Segmentation du marché nord-américain de la lymphangioleiomyomatose (LAM), par type de maladie (LAM associée à la sclérose tubéreuse et LAM sporadique), type (diagnostic et traitement), complications (pneumothorax, chylothorax, tumeur rénale, épanchements pleuraux, œdème et accumulation de liquide, et autres), voie d'administration (orale, parentérale et autres), utilisateur final (hôpitaux, cliniques spécialisées, centres de diagnostic, soins à domicile et autres), canal de distribution (appel d'offres direct, pharmacies hospitalières, pharmacies de détail, pharmacies en ligne et autres) - Tendances du secteur et prévisions jusqu'en 2032

Taille du marché nord-américain de la lymphangioleiomyomatose (LAM)

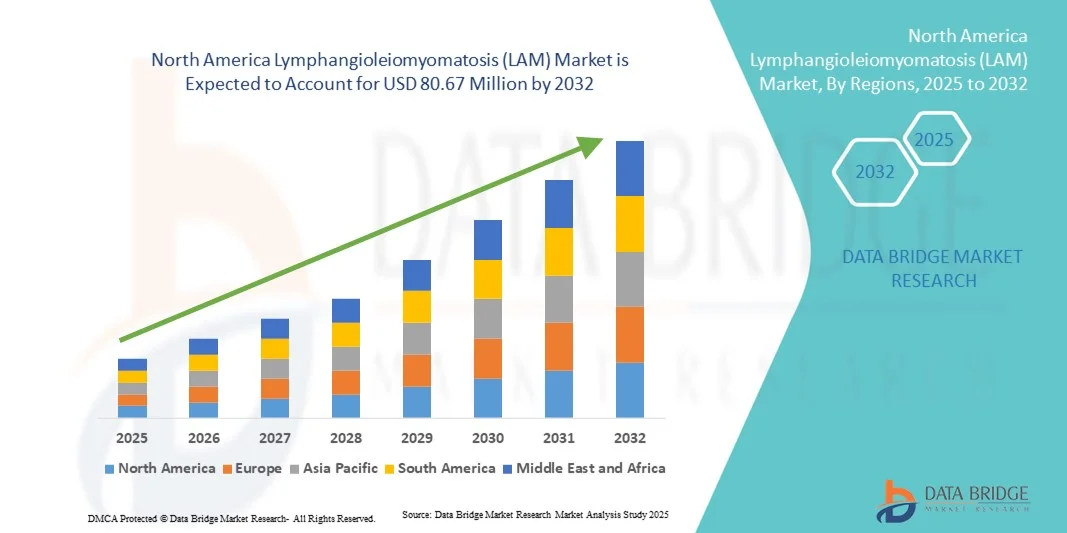

- Le marché nord-américain de la lymphangioléiomyomatose (LAM) était évalué à 56,72 millions de dollars américains en 2024 et devrait atteindre 80,67 millions de dollars américains d'ici 2032 , avec un TCAC de 4,50 % au cours de la période de prévision.

- La croissance du marché est principalement due à la prévalence croissante des maladies pulmonaires rares et à une meilleure sensibilisation au diagnostic chez les professionnels de la santé, ce qui permet un dépistage et un traitement plus précoces des cas de LAM dans toute la région.

- De plus, l'augmentation des investissements dans la recherche sur les maladies rares, les progrès des thérapies par inhibiteurs de mTOR et les cadres réglementaires favorables renforcent l'accessibilité aux traitements et l'innovation, stimulant ainsi l'expansion du marché nord-américain de la LAM.

Analyse du marché nord-américain de la lymphangioléiomyomatose (LAM)

- La lymphangioleiomyomatose (LAM), une maladie pulmonaire rare qui touche principalement les femmes, est de plus en plus souvent diagnostiquée en Amérique du Nord grâce à l'amélioration de l'imagerie diagnostique, des tests génétiques et d'une meilleure connaissance clinique chez les pneumologues et les spécialistes des maladies rares.

- L'expansion du marché est largement alimentée par les progrès du diagnostic moléculaire, la disponibilité des thérapies par inhibiteurs de mTOR et l'augmentation des financements de la recherche sur les maladies pulmonaires rares, contribuant ainsi à une meilleure prise en charge de la maladie et à de meilleurs résultats pour les patients.

- Les États-Unis ont dominé le marché nord-américain de la LAM avec la plus grande part de revenus (79,8 %) en 2024, grâce à une forte présence de centres de soins spécialisés, des essais cliniques actifs et des politiques de remboursement favorables facilitant l'accès aux traitements de pointe.

- Le Canada devrait connaître la croissance la plus rapide au cours de la période de prévision en raison de l'expansion des cadres nationaux relatifs aux maladies rares, d'un meilleur accès aux thérapies ciblées et du renforcement des collaborations entre les hôpitaux et les laboratoires de diagnostic.

- Le segment des traitements a dominé le marché nord-américain de la LAM avec une part de marché de 64,6 % en 2024, grâce à l'adoption clinique croissante de schémas thérapeutiques ciblés tels que le sirolimus et l'évérolimus, dont l'efficacité a été prouvée pour stabiliser la fonction pulmonaire et réduire les complications liées à la maladie.

Portée du rapport et segmentation du marché nord-américain de la lymphangioléiomyomatose (LAM)

|

Attributs |

Lymphangioleiomyomatose (LAM) en Amérique du Nord : Principaux enseignements du marché |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research incluent également une analyse approfondie par des experts, des données épidémiologiques sur les patients, une analyse des projets en développement, une analyse des prix et un aperçu du cadre réglementaire. |

Tendances du marché de la lymphangioléiomyomatose (LAM) en Amérique du Nord

Progrès dans les thérapies ciblées et la recherche génétique

- Une tendance importante et croissante sur le marché nord-américain de la LAM est l'intérêt grandissant porté au développement de thérapies ciblées et à la recherche génétique visant à comprendre les mécanismes moléculaires à l'origine de la maladie. Cette avancée redéfinit les stratégies de traitement et la prise en charge des patients.

- Par exemple, des institutions de recherche telles que les National Institutes of Health (NIH) et la Fondation LAM mènent des études approfondies sur les inhibiteurs de la voie mTOR et les mutations génétiques liées à TSC1 et TSC2, offrant ainsi de nouvelles perspectives sur la modulation de la maladie.

- L'adoption de la médecine de précision dans le traitement de la LAM permet des approches thérapeutiques personnalisées, améliorant ainsi les résultats pour les patients et ralentissant la progression de la maladie. Par exemple, l'utilisation du sirolimus et de l'évérolimus a démontré son efficacité pour stabiliser la fonction pulmonaire et minimiser les complications.

- De plus, les tests génétiques et l'identification des biomarqueurs facilitent le diagnostic précoce et la stratification des patients, permettant ainsi aux cliniciens de personnaliser plus efficacement les plans de soins. Cette intégration de la génomique transforme les paradigmes de traitement traditionnels.

- La collaboration croissante entre les centres de recherche universitaires, les entreprises pharmaceutiques et les associations de patients accélère les essais cliniques et l'innovation médicamenteuse pour la LAM, favorisant un écosystème de traitement davantage axé sur la recherche et centré sur le patient.

- Cette tendance vers les thérapies moléculaires avancées et les soins fondés sur la recherche redéfinit fondamentalement le paysage du traitement de la LAM en Amérique du Nord, positionnant la région comme un pôle d'innovation pour les maladies pulmonaires rares et le développement de la médecine personnalisée.

- L'intégration de l'intelligence artificielle (IA) en imagerie diagnostique améliore également la précision du dépistage et aide les cliniciens à différencier la LAM des autres affections pulmonaires à un stade plus précoce.

Dynamique du marché nord-américain de la lymphangioleiomyomatose (LAM)

Conducteur

Sensibilisation croissante, progrès en matière de diagnostic et collaborations de recherche

- La sensibilisation croissante des professionnels de la santé aux maladies pulmonaires rares, associée aux progrès de l'imagerie diagnostique et des tests génétiques, est un facteur important de croissance du marché de la LAM en Amérique du Nord.

- Par exemple, en février 2024, la Fondation LAM s'est associée à de grands centres hospitaliers universitaires pour élargir les registres de patientes atteintes de LAM et faciliter le dépistage précoce grâce à des directives diagnostiques améliorées et à des programmes de formation des médecins.

- À mesure que la sensibilisation augmente, les patients bénéficient d'un diagnostic plus précoce et d'une mise en place plus efficace du traitement, ce qui conduit à une meilleure prise en charge de la maladie et à une meilleure qualité de vie dans toute la région.

- De plus, une collaboration étroite entre les organismes gouvernementaux, les instituts de recherche et les entreprises de biotechnologie favorise l'innovation dans les protocoles de traitement, élargissant ainsi les options thérapeutiques pour les patients atteints de LAM.

- La multiplication des essais cliniques et l'accès accru aux thérapies à base d'inhibiteurs de mTOR favorisent également leur adoption, grâce à des politiques de remboursement avantageuses et à des programmes de financement pour les maladies rares aux États-Unis et au Canada. La reconnaissance croissante de la LAM comme une entité clinique distincte stimule davantage les investissements et l'engagement clinique.

- Le développement des organisations de défense des droits des patients et de soutien contribue à sensibiliser le public et à influencer les réformes politiques visant à améliorer l'accessibilité et le financement des maladies pulmonaires rares.

- Le développement des collaborations transfrontalières entre les groupes de recherche nord-américains et européens renforce le partage des données et accélère la mise au point des thérapies LAM de nouvelle génération.

Retenue/Défi

Options de traitement limitées et obstacles liés au diagnostic tardif

- L’absence de traitements curatifs spécifiques à la maladie et la connaissance limitée des symptômes de la LAM par les médecins généralistes demeurent des défis majeurs, retardant le diagnostic et l’accès à un traitement rapide.

- Par exemple, en raison de la rareté de la LAM et de la similitude de ses symptômes avec ceux d'autres affections pulmonaires comme la BPCO ou l'asthme, les patients subissent souvent des retards de diagnostic qui affectent la prise en charge et l'évolution de la maladie.

- Il est crucial de relever ces défis diagnostiques grâce à une meilleure formation clinique, des campagnes de sensibilisation et l'adoption de critères diagnostiques standardisés afin d'améliorer les taux de détection et la prise en charge des patients.

- De plus, le coût élevé de la prise en charge à long terme de la LAM, incluant l'imagerie, les traitements médicamenteux et les consultations spécialisées, peut représenter un fardeau financier pour les patients ne bénéficiant pas d'une couverture d'assurance complète.

- Bien que les initiatives en matière de santé améliorent l'accès aux soins, le faible nombre de patients limite les incitations commerciales à l'investissement pharmaceutique, freinant ainsi l'innovation rapide et le développement de nouveaux médicaments. Un renforcement de la défense des droits des patients, des financements accrus et un soutien réglementaire renforcé seront essentiels pour surmonter ces obstacles et garantir une croissance durable du marché.

- Les effets secondaires et les problèmes de tolérance associés à un traitement prolongé par inhibiteurs de mTOR peuvent limiter l'observance du traitement par les patients et affecter les résultats thérapeutiques, ce qui constitue un défi pour l'optimisation de la thérapie.

- De plus, la méconnaissance du caractère chronique de la LAM par les organismes payeurs peut retarder le remboursement des thérapies avancées, limitant ainsi l'accès des patients à des traitements innovants.

Portée du marché nord-américain de la lymphangioleiomyomatose (LAM)

Le marché est segmenté en fonction du type de maladie, du type de traitement, des complications, de la voie d'administration, de l'utilisateur final et du canal de distribution.

- Par type de maladie

En fonction du type de maladie, le marché nord-américain de la LAM est segmenté en LAM associée à la sclérose tubéreuse de Bourneville (TSC-LAM) et en LAM sporadique. Le segment de la LAM sporadique dominait le marché en 2024, générant la plus grande part de revenus, du fait de sa prévalence plus élevée chez les femmes sans antécédents génétiques. Le diagnostic de la LAM sporadique est plus fréquent grâce à l'utilisation croissante de techniques d'imagerie avancées telles que la TDM-HR et l'IRM, qui permettent un dépistage précoce. La sensibilisation accrue des pneumologues et l'amélioration de l'accès aux programmes de conseil génétique ont contribué de manière significative à l'augmentation des taux de diagnostic. Par ailleurs, l'augmentation des financements de la recherche et le soutien des patients aux États-Unis ont accéléré la compréhension de la pathogenèse de la LAM sporadique. Les hôpitaux et les centres de recherche se concentrent sur la prise en charge à long terme de la maladie, améliorant ainsi les résultats du traitement pour ce segment prédominant.

Le segment de la LAM associée à la sclérose tubéreuse de Bourneville (STB) devrait connaître la croissance la plus rapide au cours de la période de prévision, grâce à une meilleure connaissance du lien entre la LAM et les mutations des gènes TSC1 et TSC2. Les progrès des tests génétiques et les programmes de dépistage exhaustifs pour les patients atteints de STB permettent un diagnostic plus précoce de la LAM dans ce sous-groupe. Les entreprises pharmaceutiques investissent dans des thérapies ciblées et des traitements combinés pour cette forme de LAM, avec le soutien d'études menées par les NIH et la Fondation LAM. Par ailleurs, le nombre croissant d'essais cliniques explorant des thérapies ciblant la voie mTOR, spécifiques à la LAM associée à la STB, devrait renforcer la croissance rapide de ce segment sur le marché nord-américain.

- Par type

Le marché est segmenté, selon le type de traitement, en diagnostic et traitement. Le segment du traitement a dominé le marché en 2024, représentant 64,6 % des revenus, principalement grâce à l'efficacité avérée des inhibiteurs de mTOR tels que le sirolimus et l'évérolimus pour ralentir la progression de la LAM. L'adoption clinique généralisée de ces médicaments, étayée par des données probantes solides en vie réelle et par la préférence des médecins, explique la forte performance de ce segment. La disponibilité de recommandations thérapeutiques émanant de sociétés savantes internationales de pneumologie et la prise en charge par les services de santé aux États-Unis favorisent l'observance du traitement par les patients. Les hôpitaux et les cliniques spécialisées demeurent les principaux centres de distribution de ces médicaments, garantissant un accès et un suivi constants. Par ailleurs, la multiplication des essais cliniques explorant les thérapies combinées et les inhibiteurs de mTOR de nouvelle génération devrait maintenir la position dominante de ce segment dans les années à venir.

Le segment du diagnostic devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce aux progrès des techniques de diagnostic non invasives, de l'analyse des biomarqueurs et des tests génétiques. Le recours croissant aux tests VEGF-D et à l'imagerie HRCT a considérablement amélioré la précision diagnostique. Par ailleurs, les initiatives de sensibilisation menées par les fondations de maladies rares encouragent le dépistage et l'identification précoces. La création de centres de diagnostic spécialisés et l'intégration d'outils d'imagerie basés sur l'IA transforment le paysage du dépistage précoce. Le renforcement de la collaboration entre pneumologues, radiologues et généticiens devrait accélérer encore la croissance de ce segment en Amérique du Nord.

- En raison de complications

En fonction des complications, le marché est segmenté en pneumothorax, chylothorax, tumeur rénale, épanchements pleuraux, œdème et accumulation de liquide, et autres. Le segment du pneumothorax dominait le marché en 2024, représentant la majorité des hospitalisations chez les patientes atteintes de LAM. Le pneumothorax, souvent l'un des premiers signes de la LAM, nécessite une intervention médicale immédiate et un suivi à long terme, engendrant des dépenses de santé importantes. L'incidence croissante des pneumothorax récurrents et l'adoption grandissante de techniques de pleurodèse avancées contribuent à la forte croissance de ce segment. Les hôpitaux d'Amérique du Nord sont de plus en plus équipés d'unités de chirurgie thoracique spécialisées et d'équipes multidisciplinaires pour prendre en charge efficacement ces cas. De plus, les progrès constants en imagerie diagnostique et en chirurgie mini-invasive contribuent à réduire les taux de récidive.

Le segment du chylothorax devrait connaître la croissance la plus rapide au cours de la période prévisionnelle, grâce à une meilleure compréhension des anomalies lymphatiques dans la pathogenèse de la LAM. L'adoption d'interventions nutritionnelles ciblées et de procédures de radiologie interventionnelle, telles que l'embolisation du canal thoracique, améliore la survie des patients. L'intensification des recherches sur la prise en charge des épanchements chyleux par de nouvelles thérapies contribue à l'amélioration de la prise en charge clinique. Par ailleurs, l'augmentation du nombre d'essais cliniques portant sur l'atteinte lymphatique dans la LAM élargit les options thérapeutiques. Les hôpitaux et les centres spécialisés dotés de capacités d'imagerie et d'intervention avancées constatent une augmentation du nombre de patients présentant des complications liées au chylothorax, ce qui dynamise la croissance de ce segment.

- Par voie d'administration

Selon la voie d'administration, le marché est segmenté en voie orale, parentérale et autres. Le segment oral a dominé le marché en 2024, grâce à la préférence pour les inhibiteurs de mTOR oraux tels que le sirolimus et l'évérolimus, qui offrent un confort d'utilisation et une efficacité prolongée. L'administration orale assure le confort du patient, facilite l'utilisation à long terme et réduit la fréquence des consultations, ce qui améliore l'observance du traitement. Ce segment bénéficie de la grande confiance des médecins dans les protocoles posologiques oraux et de profils pharmacocinétiques favorables. De plus, la disponibilité croissante de formulations orales génériques et les programmes d'éducation des patients mis en place par les fondations de maladies rares contribuent à améliorer l'accessibilité. La voie orale demeure la méthode la plus courante et la plus approuvée cliniquement pour la prise en charge des symptômes de la LAM en Amérique du Nord.

Le segment des traitements parentéraux devrait connaître la croissance la plus rapide au cours de la période de prévision, principalement grâce aux innovations continues dans les thérapies biologiques et injectables ciblant les maladies pulmonaires rares. L'introduction de l'administration intraveineuse de médicaments dans les cas de LAM sévères ou réfractaires devrait améliorer l'efficacité thérapeutique. Les hôpitaux et les centres de recherche étudient des formulations injectables pour les patients intolérants aux médicaments oraux. De plus, les essais cliniques évaluant les anticorps monoclonaux et les produits biologiques immunomodulateurs s'accélèrent en Amérique du Nord. L'évolution vers des thérapies de précision administrées en milieu hospitalier devrait favoriser l'adoption de ce segment dans les services de soins avancés au cours de la prochaine décennie.

- Par l'utilisateur final

En fonction de l'utilisateur final, le marché se divise en hôpitaux, cliniques spécialisées, centres de diagnostic, soins à domicile et autres. Le segment hospitalier dominait le marché nord-américain de la LAM en 2024, grâce à la disponibilité d'infrastructures diagnostiques et thérapeutiques complètes. Les hôpitaux constituent les principaux centres de traitement, offrant la réadaptation pulmonaire, les soins chirurgicaux et l'accès aux essais cliniques. L'approche multidisciplinaire en milieu hospitalier assure une meilleure coordination entre pneumologues, radiologues et généticiens pour une prise en charge optimale de la maladie. De plus, les hôpitaux prennent en charge la majorité des urgences liées à la LAM, telles que les pneumothorax et les épanchements pleuraux, ce qui renforce leur part de marché. L'augmentation des financements hospitaliers alloués aux unités de maladies rares et les partenariats avec les fondations LAM contribuent également à la position dominante de ce segment.

Le segment des cliniques spécialisées devrait connaître la croissance la plus rapide entre 2025 et 2032, portée par le nombre croissant de centres spécialisés en maladies rares et en pneumologie en Amérique du Nord. Ces cliniques offrent des soins personnalisés, un suivi à long terme et la possibilité de participer à des programmes de recherche sur les maladies rares. Le rôle grandissant des centres de pneumologie spécialisés et la mise en place de programmes dédiés à la LAM alimentent cette croissance. Par ailleurs, les initiatives de sensibilisation des patients et l'accès à des consultations d'experts favorisent le recours à ces établissements. L'intégration technologique, notamment la téléconsultation et la surveillance à distance, renforce encore l'attrait des cliniques spécialisées pour la prise en charge de la LAM chronique.

- Par canal de distribution

Selon le canal de distribution, le marché est segmenté en appels d'offres directs, pharmacies hospitalières, pharmacies de détail, pharmacies en ligne et autres. Le segment des pharmacies hospitalières a dominé le marché en 2024 grâce à l'approvisionnement centralisé et à la distribution réglementée des médicaments anti-LAM au sein des établissements hospitaliers. Ces pharmacies assurent le stockage adéquat, le contrôle posologique et le conseil aux patients pour les traitements de longue durée tels que le sirolimus. Elles gèrent également l'approvisionnement en médicaments pour les essais cliniques et les programmes de recherche hospitaliers. De plus, les partenariats entre les hôpitaux et les fournisseurs pharmaceutiques garantissent une disponibilité constante des médicaments pour les patients hospitalisés et ambulatoires. L'augmentation des hospitalisations pour la prise en charge des anti-LAM a renforcé la part de marché globale de ce segment.

Le segment des pharmacies en ligne devrait connaître la croissance la plus rapide au cours de la période de prévision, portée par l'adoption croissante des soins de santé numériques et du commerce électronique dans la livraison de produits pharmaceutiques. La tendance grandissante à la gestion des maladies chroniques via des plateformes virtuelles favorise la livraison à domicile. Les patients bénéficient du renouvellement automatique des ordonnances, de l'intégration de la téléconsultation et du téléchargement numérique des ordonnances. Par ailleurs, les collaborations entre les entreprises biopharmaceutiques et les distributeurs en ligne agréés améliorent l'accès aux médicaments pour les maladies rares. Le développement de l'infrastructure de santé numérique aux États-Unis et au Canada devrait également stimuler la croissance rapide de ce segment dans les années à venir.

Analyse régionale du marché nord-américain de la lymphangioléiomyomatose (LAM)

- Les États-Unis ont dominé le marché nord-américain de la LAM avec la plus grande part de revenus (79,8 %) en 2024, grâce à une forte présence de centres de soins spécialisés, des essais cliniques actifs et des politiques de remboursement favorables facilitant l'accès aux traitements de pointe.

- Le leadership du pays est renforcé par de solides collaborations entre les entreprises pharmaceutiques, les centres de recherche universitaires et les programmes financés par le gouvernement, tels que le réseau de recherche clinique sur les maladies rares des NIH.

- La large disponibilité de thérapies ciblées telles que le sirolimus et l'évérolimus, ainsi que l'adoption croissante des approches de médecine de précision, ont amélioré l'accessibilité aux traitements et les résultats pour les patients.

Aperçu du marché américain de la lymphangioleiomyomatose (LAM)

Le marché américain de la LAM a généré 79,8 % des revenus en Amérique du Nord en 2024, principalement grâce à des capacités de diagnostic avancées, une activité de recherche clinique soutenue et une sensibilisation croissante des patients. La présence d'organismes de recherche de premier plan, tels que les National Institutes of Health (NIH) et la LAM Foundation, a accéléré le développement d'approches thérapeutiques innovantes. L'adoption accrue de traitements ciblés, comme les inhibiteurs de mTOR (sirolimus et everolimus), a amélioré le pronostic des patients et la prise en charge à long terme de la LAM. Par ailleurs, la solidité des infrastructures de santé, les initiatives de financement pour les maladies rares et un cadre réglementaire favorable aux médicaments orphelins continuent de stimuler la croissance du marché aux États-Unis.

Aperçu du marché canadien de la lymphangioleiomyomatose (LAM)

Le marché canadien de la LAM devrait connaître une croissance annuelle composée stable tout au long de la période de prévision, grâce à une sensibilisation accrue du public et à un meilleur accès aux programmes de diagnostic des maladies rares. Le système de santé universel du pays et les collaborations avec les réseaux internationaux de maladies rares facilitent le dépistage précoce et l'amélioration des parcours de soins. La participation accrue aux études et essais cliniques internationaux sur la LAM stimule également les progrès thérapeutiques. De plus, le soutien gouvernemental, notamment par le biais du financement des maladies pulmonaires rares et la mobilisation croissante des patients, contribuent au développement du marché au Canada, en particulier dans des provinces importantes comme l'Ontario et la Colombie-Britannique.

Analyse du marché mexicain de la lymphangioleiomyomatose (LAM)

Le marché mexicain de la LAM devrait connaître une croissance modérée au cours de la période prévisionnelle, principalement grâce au renforcement progressif des infrastructures de santé et à l'expansion des cliniques spécialisées dans les maladies rares. L'augmentation des investissements publics et privés dans le secteur de la santé, ainsi que l'amélioration des technologies de diagnostic, contribuent à remédier au sous-diagnostic historique de la LAM dans la région. Le renforcement des collaborations transfrontalières avec les institutions de recherche américaines et la disponibilité croissante d'inhibiteurs de mTOR génériques abordables améliorent l'accès aux traitements. Par ailleurs, les initiatives de sensibilisation menées par les associations de patients et les professionnels de santé devraient permettre d'améliorer encore le diagnostic précoce et la prise en charge des patients atteints de LAM au Mexique.

Part de marché de la lymphangioleiomyomatose (LAM) en Amérique du Nord

L’industrie nord-américaine de la lymphangioleiomyomatose (LAM) est principalement dominée par des entreprises bien établies, notamment :

- Pfizer Inc. (États-Unis)

- Novartis AG (Suisse)

- Intas Pharmaceuticals Ltd. (Inde)

- Apotex Inc. (Canada)

- Amneal Pharmaceuticals LLC (États-Unis)

- Laboratoires Dr. Reddy's Ltd (Inde)

- Hikma Pharmaceuticals PLC (Royaume-Uni)

- Zydus Pharmaceuticals, Inc. (Inde)

- TransMedics, Inc. (États-Unis)

- Terumo Corporation (Japon)

- Inogen, Inc. (États-Unis)

- CareDx, Inc. (États-Unis)

- XVIVO Perfusion AB (Suède)

- Morgan Scientific Inc (États-Unis)

- Taj Pharmaceuticals Limited (Inde)

- AstraZeneca (Royaume-Uni)

- Mallinckrodt Pharmaceuticals (États-Unis)

- Catalent, Inc. (États-Unis)

Quels sont les développements récents sur le marché nord-américain de la lymphangioleiomyomatose (LAM) ?

- En janvier 2025, la Fondation LAM a annoncé les résultats d'une étude montrant que la voie de signalisation du récepteur de l'urotensine II (UT)-Gαq est hyperactive dans les cellules LAM déficientes en TSC2 et fonctionne indépendamment de mTORC1, une découverte majeure en biologie de la LAM

- En novembre 2024, la Fondation LAM a annoncé la finalisation de la phase d'enquête LAM-PREP, avec plus de 750 réponses de membres de la communauté, marquant ainsi une étape importante en matière d'engagement des patients. Les résultats préliminaires ont révélé que, si les nouveaux traitements demeurent la priorité absolue en matière de recherche, les patients accordent également une grande importance à la compréhension des influences hormonales sur la maladie, au soutien en santé mentale et à un meilleur accès à des soins complets.

- En mai 2024, les résultats précliniques de l'inhibiteur bistérique sélectif de mTORC1, le RMC-5552, ont été publiés. Ils ont démontré que cet inhibiteur inhibe plus durablement la croissance des fibroblastes associés à la LAM que la rapamycine et qu'il pourrait éradiquer les cellules souches cancéreuses de type LAM.

- En mars 2024, la Fondation LAM (TLF) a lancé la deuxième phase de l’enquête « Recherche et priorités des patients atteints de LAM » (LAM-PREP), invitant la communauté LAM au sens large (patients, aidants, cliniciens) à classer les priorités en matière de recherche et de soins de santé.

- En février 2022, des chercheurs du National Heart, Lung, and Blood Institute (NHLBI) ont rapporté que les nodules pulmonaires de la LAM contiennent des cellules présentant un « phénotype mixte de cellules endothéliales vasculaires sanguines et lymphatiques », ce qui signifie que les mêmes cellules expriment simultanément des marqueurs typiques des cellules endothéliales vasculaires sanguines et lymphatiques.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.