North America Lipid Poct Market

Taille du marché en milliards USD

TCAC :

%

USD

396.07 Million

USD

580.74 Million

2025

2033

USD

396.07 Million

USD

580.74 Million

2025

2033

| 2026 –2033 | |

| USD 396.07 Million | |

| USD 580.74 Million | |

|

|

|

|

Segmentation du marché nord-américain des tests de diagnostic rapide des lipides (POCT), par type (instruments, consommables et kits), application (hyperlipidémie, hypertriglycéridémie, hyperlipoprotéinémie, hypercholestérolémie familiale, maladie de Tangier et autres), mode (tests sur ordonnance et tests en vente libre), marque (Roche Reflotron, Roche Cobas B 101, Alere Cholestech LDX, Alere Afinion, Samsung Labgeo, PTS Cardiochek et autres), plateforme (tests à flux latéral (tests d'immunochromatographie), diagnostics moléculaires, immunoessais, bandelettes réactives et microfluidique), utilisateur final (hôpitaux, centres de diagnostic professionnels, soins à domicile, laboratoires de recherche et autres utilisateurs finaux), canal de distribution (appel d'offres direct et ventes au détail) - Tendances du secteur et prévisions jusqu'en 2033.

Taille du marché nord-américain des tests de diagnostic rapide des lipides en Amérique du Nord

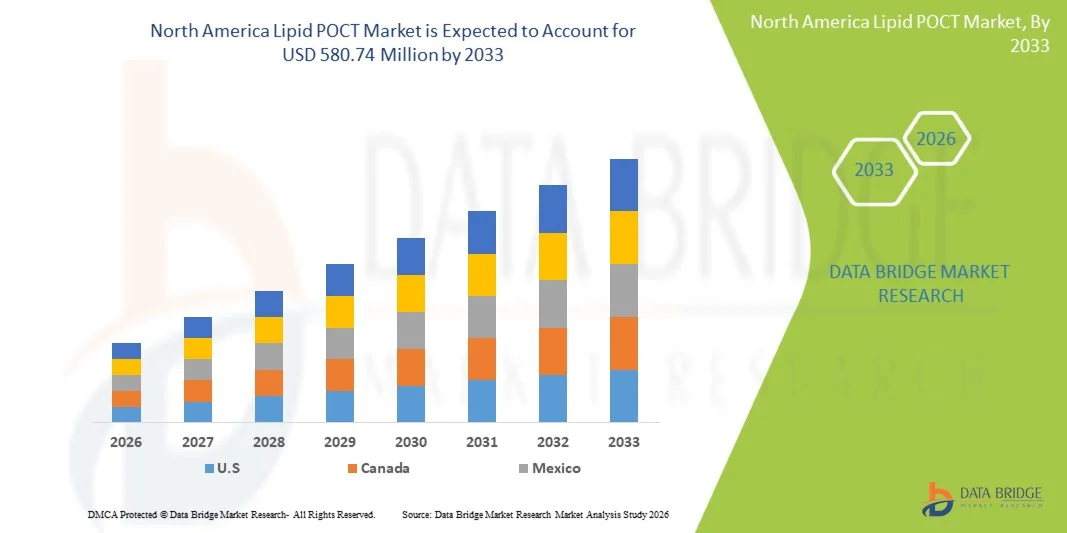

- Le marché nord-américain des tests de diagnostic rapide des lipides (POCT) était évalué à 396,07 millions de dollars américains en 2025 et devrait atteindre 580,74 millions de dollars américains d'ici 2033 , avec un taux de croissance annuel composé (TCAC) de 4,9 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la prévalence croissante des troubles cardiovasculaires et lipidiques, les progrès des technologies de diagnostic au point de service et l'adoption croissante de solutions de test rapides et décentralisées dans les établissements de soins cliniques et communautaires en Amérique du Nord.

- De plus, la demande croissante de profils lipidiques rapides et accessibles à des fins de prévention, la préférence des consommateurs pour des résultats en temps réel en clinique et à domicile, ainsi que la solidité des infrastructures de santé aux États-Unis et au Canada favorisent l'adoption des solutions de diagnostic lipidique au point de soins (POCT) comme outils clés de la gestion proactive du risque cardiovasculaire. Ces facteurs convergents accélèrent l'adoption des systèmes POCT lipidiques, stimulant ainsi considérablement la croissance du marché dans la région.

Analyse du marché nord-américain des tests de diagnostic rapide des lipides en Amérique du Nord

- Les dispositifs de test lipidique au point de service (POCT), permettant une mesure rapide du cholestérol et d'autres paramètres lipidiques, sont des éléments de plus en plus essentiels des soins de santé préventifs modernes et de la gestion des risques cardiovasculaires, tant en milieu clinique qu'à domicile, en raison de leur commodité, de leurs résultats rapides et de leur intégration transparente aux flux de travail des soins de santé.

- La demande croissante de tests lipidiques au point de service est principalement alimentée par la prévalence accrue des troubles cardiovasculaires et lipidiques, la sensibilisation croissante aux soins préventifs et la préférence pour les tests en temps réel sur site par rapport aux méthodes de laboratoire conventionnelles.

- Les États-Unis ont dominé le marché nord-américain des tests de diagnostic au point de soins lipidiques (POCT) en 2025, avec la plus grande part de revenus (72,9 %). Cette domination s'explique par une infrastructure de santé avancée, une forte adoption des diagnostics au point de soins et une présence importante d'acteurs clés du secteur, avec une croissance substantielle dans les hôpitaux, les centres de diagnostic professionnels et les services de soins à domicile.

- Le Canada devrait connaître une croissance soutenue au cours de la période prévisionnelle, grâce aux initiatives gouvernementales promouvant les soins de santé préventifs, sensibilisant davantage les patients et élargissant l'accès aux diagnostics au point de service dans les hôpitaux et les cliniques.

- Le segment des instruments a dominé le marché avec la plus grande part de marché (55,2 %) en 2025, grâce au besoin crucial de tests lipidiques précis, rapides et fiables dans les hôpitaux, les centres de diagnostic professionnels et les services de soins à domicile, ainsi qu'à l'adoption croissante d'analyseurs de pointe au point de service proposés par les grandes marques.

Portée du rapport et segmentation du marché nord-américain des tests de diagnostic rapide des lipides (POCT)

|

Attributs |

Aperçus clés du marché nord-américain des tests de diagnostic rapide des lipides |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research incluent également une analyse approfondie par des experts, des données épidémiologiques sur les patients, une analyse des projets en développement, une analyse des prix et un aperçu du cadre réglementaire. |

Tendances du marché nord-américain des tests de diagnostic rapide des lipides en Amérique du Nord

« Adoption rapide des appareils de test portables et connectés »

- Une tendance importante et croissante sur le marché nord-américain des tests lipidiques au point de soins (POCT) est l'adoption croissante d'appareils de test portables et connectés permettant un profilage lipidique en temps réel dans les cliniques, les hôpitaux et à domicile.

- Par exemple, l'appareil Alere Cholestech LDX permet aux utilisateurs d'obtenir instantanément des mesures de cholestérol et de triglycérides en consultation externe, facilitant ainsi la prise de décision clinique immédiate.

- L'intégration aux plateformes de santé numérique permet le téléchargement automatique des données des patients vers les dossiers médicaux électroniques (DME), permettant ainsi aux professionnels de santé de suivre les tendances et de fournir des recommandations personnalisées. Par exemple, les analyseurs Roche Reflotron peuvent transmettre les résultats directement aux systèmes de gestion des patients pour un suivi efficace.

- Les dispositifs connectés et les applications mobiles permettent aux patients de surveiller leur taux de lipides à domicile, de recevoir des alertes et de partager leurs résultats avec les professionnels de santé, ce qui améliore leur implication et leur observance du traitement. Par exemple, les systèmes PTS Cardiochek offrent une connectivité mobile pour le partage et le suivi des données des patients.

- Cette tendance vers des dispositifs de diagnostic au point de soins (POCT) portables, connectés et intégrant les données redéfinit les attentes en matière de soins de santé préventifs, incitant des fabricants comme Samsung Labgeo à développer des analyseurs conviviaux connectés à des applications de gestion de la santé.

- La demande en dispositifs de diagnostic lipidique au point de soins (POCT) rapides, connectés et utilisables à domicile augmente tant chez les professionnels de santé que chez les patients, le suivi en temps réel et la facilité d'utilisation devenant des priorités essentielles.

- Le développement des partenariats entre les fabricants de dispositifs de diagnostic au point de soins (POCT) et les plateformes de télésanté permet les consultations à distance et le suivi en temps réel, stimulant ainsi l'adoption du marché. Par exemple, les systèmes Alere Afinion sont intégrés aux services de télésanté pour permettre aux cliniciens de consulter à distance les résultats des patients.

Dynamique du marché nord-américain des tests de diagnostic rapide des lipides (POCT)

Conducteur

« Prévalence croissante des troubles cardiovasculaires et lipidiques »

- La prévalence croissante des maladies cardiovasculaires et des dyslipidémies en Amérique du Nord est l'un des principaux facteurs stimulant la demande en dispositifs de diagnostic rapide des lipides.

- Par exemple, en 2024, Roche a signalé une augmentation de l'utilisation de ses appareils Reflotron dans les cliniques ambulatoires en raison du développement des initiatives de dépistage de l'hyperlipidémie.

- Alors que les patients et les professionnels de santé privilégient les soins préventifs, les tests lipidiques au point de service permettent un dépistage rapide, une évaluation immédiate des risques et une intervention opportune, offrant un avantage par rapport aux tests de laboratoire traditionnels.

- De plus, les programmes gouvernementaux et les incitations des assurances favorisant le dépistage précoce et la prise en charge des facteurs de risque cardiovasculaires contribuent à l'adoption croissante des dispositifs de diagnostic au point de service (POCT) dans les hôpitaux et les centres de diagnostic.

- La commodité des tests rapides au point de soins, l'intégration aux plateformes de santé numérique et l'adéquation aux contextes de soins cliniques et à domicile sont des facteurs clés qui favorisent l'adoption des solutions de test lipidique au point de soins.

- La sensibilisation croissante des patients à la surveillance personnalisée de leur santé et aux soins préventifs incite les professionnels de santé à adopter les tests de diagnostic au point de service (POCT) pour obtenir rapidement des résultats lipidiques exploitables. Par exemple, aux États-Unis, les cliniques proposent de plus en plus de tests de cholestérol dans le cadre des bilans de santé de routine.

- Les progrès réalisés dans le domaine des appareils compacts fonctionnant sur batterie permettent de réaliser des tests lipidiques dans les zones reculées et mal desservies, élargissant ainsi l'accès aux soins et contribuant à la croissance du marché. Par exemple, les analyseurs PTS Cardiochek et Samsung Labgeo sont utilisés dans les dispensaires ruraux et les programmes de santé communautaire.

Retenue/Défi

« Coûts élevés et obstacles à la conformité réglementaire »

- Le coût relativement élevé des dispositifs et consommables de pointe pour l'analyse lipidique au point de soins constitue un obstacle à leur adoption généralisée, notamment pour les petites cliniques ou les patients sensibles aux prix.

- Par exemple, les analyseurs haut de gamme tels que le Roche Cobas B 101 présentent un coût initial plus élevé que les analyses de laboratoire de base, ce qui limite leur accessibilité dans certains établissements de soins.

- Les exigences de conformité réglementaire, notamment les approbations de la FDA et les certifications de qualité, peuvent ralentir les délais de lancement des produits et augmenter les coûts de développement, ce qui a un impact sur la croissance du marché.

- Bien que les coûts diminuent progressivement, la perception d'un prix élevé pour les dispositifs de diagnostic au point de soins sophistiqués peut freiner leur adoption par les petits établissements de santé ou les particuliers.

- Pour une expansion durable du marché, il sera essentiel de surmonter ces obstacles grâce à des dispositifs abordables, des procédures d'approbation réglementaire simplifiées et une meilleure information des patients sur les avantages des tests lipidiques rapides.

- Le manque de formation et d'expertise technique du personnel dans les petites cliniques peut limiter l'utilisation optimale des dispositifs de diagnostic au point de soins (POCT) avancés, et donc impacter leur adoption. Par exemple, certains petits centres de diagnostic retardent leur mise en œuvre en raison de la complexité perçue de leur utilisation.

- Les préoccupations liées à la confidentialité des données concernant les dispositifs de diagnostic au point de soins connectés peuvent freiner leur adoption, car patients et professionnels de santé sont réticents à partager des informations de santé sensibles par voie numérique. Par exemple, l'intégration avec des applications mobiles ou des plateformes cloud exige des mesures de sécurité des données robustes pour maintenir la confiance.

Portée du marché des tests de diagnostic rapide des lipides en Amérique du Nord

Le marché est segmenté en fonction du type, de l'application, du mode, de la marque, de la plateforme, de l'utilisateur final et du canal de distribution.

- Par type

Le marché nord-américain des tests de diagnostic lipidique au point de soins (POCT) est segmenté, selon le type de test, en instruments et en consommables/kits. Le segment des instruments a dominé le marché en 2025, représentant 55,2 % des revenus. Cette domination est due au besoin crucial de mesures lipidiques précises, rapides et fiables dans les hôpitaux, les centres de diagnostic et à domicile. Les analyseurs tels que Roche Reflotron et Alere Cholestech LDX sont privilégiés pour leur précision, leur portabilité et leur intégration aux plateformes de santé numérique. La demande du marché est également soutenue par la prévalence croissante des troubles cardiovasculaires et lipidiques, qui nécessitent des tests fréquents et immédiats. Les hôpitaux et les cliniques privilégient les instruments pour le dépistage au point de soins, permettant ainsi aux médecins de prendre des décisions rapidement. Par ailleurs, la tendance croissante des dispositifs connectés qui transmettent les résultats aux dossiers médicaux électroniques renforce la position dominante du segment des instruments.

Le segment des consommables et des kits devrait connaître la croissance la plus rapide, avec un TCAC de 8,5 % entre 2026 et 2033, portée par la demande croissante d'autotests lipidiques et de suivi préventif de la santé. Les consommables, tels que les bandelettes réactives et les réactifs, permettent des tests répétés et pratiques, sans équipement encombrant. La croissance de ce segment est soutenue par la disponibilité croissante de kits abordables et d'appareils compatibles avec les appareils mobiles, rendant ainsi le suivi lipidique accessible aux patients en dehors des structures de soins. Les fabricants lancent des kits prêts à l'emploi qui simplifient les tests, séduisent les particuliers et favorisent leur adoption par les petits cabinets médicaux. La facilité d'utilisation, la simplicité de formation et le rapport coût-efficacité des consommables et des kits sont les principaux facteurs de leur forte croissance.

- Sur demande

Selon l'application, le marché est segmenté en hyperlipidémie, hypertriglycéridémie, hyperlipoprotéinémie, hypercholestérolémie familiale, maladie de Tangier et autres. Le segment de l'hyperlipidémie dominait le marché en 2025, représentant 38 % des revenus, grâce à la forte prévalence d'un taux de cholestérol élevé chez les adultes en Amérique du Nord. Le dépistage régulier de l'hyperlipidémie est essentiel à la gestion du risque cardiovasculaire, ce qui favorise son adoption croissante dans les hôpitaux et les centres de diagnostic. Les dispositifs permettant un test rapide de l'hyperlipidémie sont privilégiés pour les bilans de santé de routine et les programmes de prévention. Les fabricants s'attachent à développer des dispositifs portables et précis, spécialement conçus pour la détection de l'hyperlipidémie, ce qui contribue à l'essor de ce segment. L'intégration avec des applications mobiles et des plateformes de télémédecine renforce sa position dominante en permettant aux patients de suivre l'évolution de leur taux de cholestérol à distance. Les initiatives de prévention et les campagnes de sensibilisation contribuent également à sa position de leader sur le marché.

Le segment de l'hypercholestérolémie familiale devrait connaître la croissance la plus rapide, avec un TCAC de 9 % entre 2026 et 2033, portée par l'essor du dépistage génétique et des initiatives de diagnostic précoce. La détection précoce de l'hypercholestérolémie familiale réduit le risque cardiovasculaire et permet une prise en charge thérapeutique rapide. Les campagnes de sensibilisation et les recommandations des médecins incitent de plus en plus de patients à opter pour des tests de dépistage au point de soins. Des dispositifs spécialisés, plus sensibles aux dyslipidémies génétiques, sont utilisés en consultation externe et dans le cadre de la recherche. Le développement de la télémédecine et des dispositifs mobiles contribue également à améliorer l'accessibilité et la praticité des tests de dépistage de l'hypercholestérolémie familiale. Enfin, la multiplication des programmes d'éducation des patients et de tests génétiques accélère encore la croissance de ce segment.

- Par mode

Selon le mode de réalisation, le marché est segmenté en tests sur ordonnance et tests en vente libre. Le segment des tests sur ordonnance a dominé le marché en 2025, représentant 62 % des revenus, grâce à son rôle crucial dans le diagnostic clinique et l'évaluation des risques chez les patients atteints de maladies cardiovasculaires. Les hôpitaux et les centres de diagnostic spécialisés privilégient souvent les dispositifs sur ordonnance pour leur précision, leur fiabilité et leur intégration aux dossiers médicaux. Les cliniciens s'appuient sur ces tests pour suivre la réponse au traitement et orienter leurs décisions thérapeutiques. Ce segment bénéficie également de procédures d'approbation réglementaire et de remboursement par les assurances, ce qui le rend largement accessible en milieu clinique. Les progrès technologiques constants et l'automatisation des dispositifs renforcent encore sa position dominante. L'intégration aux dossiers médicaux électroniques et aux plateformes de télémédecine améliore l'efficacité des flux de travail et la gestion des patients.

Le segment des tests en vente libre devrait connaître la croissance la plus rapide, avec un TCAC de 10 % entre 2026 et 2033, portée par la demande croissante de soins de santé préventifs à domicile. Ces dispositifs permettent aux patients de mesurer facilement leur taux de cholestérol et de lipides chez eux, ce qui favorise leur adoption par les consommateurs soucieux de leur santé. Les fabricants développent des kits conviviaux, dotés d'une application mobile permettant de suivre les résultats et de partager les données avec les professionnels de santé. La sensibilisation accrue aux risques cardiovasculaires et la surveillance proactive de la santé soutiennent l'expansion de ce segment. La commodité, la confidentialité et la rapidité d'obtention des résultats offerts par les tests en vente libre constituent les principaux moteurs de croissance. Le développement du commerce électronique et des circuits de distribution accélère encore davantage l'adoption de ces tests.

- Par marque

Le marché est segmenté par marque, notamment en Roche Reflotron, Roche Cobas B 101, Alere Cholestech LDX, Alere Afinion, Samsung Labgeo, PTS Cardiochek et autres. En 2025, le segment Roche Reflotron dominait le marché avec une part de revenus de 29 %, grâce à son adoption généralisée dans les hôpitaux et les centres de diagnostic aux États-Unis et au Canada. Ses appareils sont reconnus pour leur précision, leur portabilité et leur intégration aux plateformes numériques, permettant une surveillance en temps réel et la connectivité aux dossiers médicaux électroniques. Roche investit dans la R&D pour améliorer la facilité d'utilisation et la fiabilité des résultats, renforçant ainsi la fidélité à la marque. Les cliniciens privilégient les analyseurs Roche Reflotron pour le dépistage systématique de l'hyperlipidémie et l'évaluation du risque cardiovasculaire. Son vaste réseau de service et son assistance produit consolident également sa position dominante. La réputation établie de la marque auprès des professionnels de santé favorise sa croissance continue et son leadership sur le marché.

Le segment Alere Cholestech LDX devrait connaître la croissance la plus rapide, avec un TCAC de 11 % entre 2026 et 2033, portée par son adoption dans les soins à domicile et les petites cliniques. La portabilité de l'appareil, son interface intuitive et la rapidité des résultats en font un outil idéal pour les soins de proximité. Son intégration avec les applications mobiles et les plateformes de télémédecine favorise également son adoption. La sensibilisation croissante des consommateurs à la prévention et aux programmes de surveillance cardiovasculaire accélère la croissance. La disponibilité sans ordonnance et le coût abordable des consommables contribuent à l'expansion des parts de marché. L'accent mis par Alere sur les fonctionnalités innovantes, notamment le suivi des tendances en temps réel, soutient la croissance rapide de ce segment.

- Par plateforme

Le marché est segmenté, selon la plateforme utilisée, en tests de flux latéral (tests immunochromatographiques), diagnostics moléculaires, immunoessais, bandelettes réactives et microfluidique. En 2025, le segment des tests de flux latéral dominait le marché avec une part de revenus de 41 %, grâce à sa simplicité, sa rapidité d'exécution et son adéquation aux tests au chevet du patient. Ces dispositifs sont largement utilisés dans les hôpitaux, les centres de diagnostic et à domicile pour un profilage lipidique rapide. Ils ne nécessitent qu'une formation minimale, sont portables et fournissent des résultats fiables. Leur prix abordable et leur compatibilité avec les systèmes de compte-rendu numérique contribuent également à leur position dominante. Cliniciens et patients privilégient les tests de flux latéral pour leur facilité d'utilisation et leur efficacité. L'intégration de ce segment aux applications mobiles et aux plateformes cloud favorise son adoption.

Le segment de la microfluidique devrait connaître la croissance la plus rapide, avec un TCAC de 12 % entre 2026 et 2033, portée par l'innovation technologique dans les systèmes de tests miniaturisés à haut débit. Les dispositifs microfluidiques permettent un profilage lipidique multi-analytes rapide avec un volume d'échantillon minimal. Leur adoption se développe dans les laboratoires de recherche et les centres cliniques de pointe. Leur précision accrue, leur automatisation et leur portabilité les rendent particulièrement attractifs pour les tests de diagnostic au point de soins (POCT) de nouvelle génération. L'intégration aux plateformes de santé mobiles et numériques accélère leur utilisation à domicile et en ambulatoire. L'augmentation des investissements en R&D dans la technologie microfluidique stimule l'expansion rapide de ce segment.

- Par l'utilisateur final

En fonction de l'utilisateur final, le marché est segmenté en hôpitaux, centres de diagnostic professionnels, soins à domicile, laboratoires de recherche et autres utilisateurs. Le segment des hôpitaux a dominé le marché en 2025, représentant 48 % des revenus, grâce à un volume élevé de patients, à la fréquence des dépistages lipidiques et à l'intégration aux flux de travail cliniques. Les hôpitaux privilégient les instruments fiables pour des tests rapides et un diagnostic précis. Les analyseurs avancés connectés aux systèmes de dossiers médicaux électroniques (DME) renforcent encore cette position dominante. Les hôpitaux réalisent des dépistages préventifs réguliers de l'hyperlipidémie et des risques cardiovasculaires. Les programmes gouvernementaux et les remboursements d'assurance favorisent également une adoption accrue en milieu hospitalier. La modernisation continue des infrastructures hospitalières contribue au leadership de ce segment.

Le segment des soins à domicile devrait connaître la croissance la plus rapide, avec un TCAC de 13 % entre 2026 et 2033, portée par une sensibilisation accrue des consommateurs à la prévention et par la commodité de l'autosurveillance. Les dispositifs de diagnostic rapide des lipides à domicile permettent aux patients de suivre leurs taux de cholestérol et de triglycérides sans consultation médicale. L'intégration avec des applications mobiles et des plateformes de télésanté facilite le suivi à distance et le suivi médical. Des dispositifs abordables et faciles d'utilisation favorisent leur adoption par les consommateurs soucieux de leur santé. L'adoption des soins à domicile est stimulée par les programmes de gestion du mode de vie et le suivi des maladies chroniques. La commodité, la confidentialité et l'accessibilité sont des facteurs clés de croissance.

- Par canal de distribution

En fonction du canal de distribution, le marché est segmenté en appels d'offres directs et ventes au détail. Le segment des appels d'offres directs a dominé le marché en 2025, représentant 57 % du chiffre d'affaires, grâce aux achats groupés effectués par les hôpitaux, les centres de diagnostic spécialisés et les programmes gouvernementaux. Les accords d'appel d'offres directs garantissent une livraison rapide, la maintenance et une maîtrise des coûts pour les grandes institutions. Les fournisseurs proposent souvent des formations et un accompagnement dans le cadre de ces contrats, ce qui favorise l'adoption des produits. Les hôpitaux et les cliniques privilégient l'achat direct pour un approvisionnement fiable en instruments et consommables. Les commandes groupées permettent de réduire le coût unitaire, incitant ainsi les grandes institutions à investir. Des relations solides entre les fabricants et les acheteurs institutionnels contribuent au maintien de cette position dominante.

Le segment des ventes au détail devrait connaître la croissance la plus rapide, avec un TCAC de 14 % entre 2026 et 2033, portée par le développement du marché des soins à domicile et des canaux de vente en ligne. La disponibilité en magasin des dispositifs de test lipidique en vente libre permet aux consommateurs d'accéder à des kits de test abordables et faciles à utiliser. Les plateformes de commerce électronique étendent encore davantage la portée de ces dispositifs aux zones périurbaines et rurales. La sensibilisation croissante des consommateurs aux soins de santé préventifs favorise l'adoption de ces solutions en magasin. Les dispositifs et kits compatibles avec les appareils mobiles, accompagnés d'instructions simples, attirent les nouveaux utilisateurs. La commodité, l'accessibilité financière et la présence en ligne croissante contribuent à la croissance rapide de ce segment.

Analyse régionale du marché nord-américain des tests de diagnostic rapide des lipides en Amérique du Nord

- Les États-Unis ont dominé le marché nord-américain des tests de diagnostic au point de soins lipidiques (POCT) en 2025, avec la plus grande part de revenus (72,9 %). Cette domination s'explique par une infrastructure de santé avancée, une forte adoption des diagnostics au point de soins et une présence importante d'acteurs clés du secteur, avec une croissance substantielle dans les hôpitaux, les centres de diagnostic professionnels et les services de soins à domicile.

- Les professionnels de santé et les patients de la région apprécient particulièrement la commodité, la rapidité des résultats et les capacités de surveillance en temps réel offertes par les dispositifs de diagnostic lipidique au point de soins (POCT), ainsi que leur intégration aux applications mobiles et aux systèmes de dossiers médicaux électroniques (DME) pour une gestion fluide des données des patients.

- Cette forte adoption est également favorisée par une infrastructure de soins de santé bien établie, une sensibilisation accrue aux soins préventifs, des programmes de dépistage gouvernementaux et des investissements croissants dans les technologies de diagnostic au point de service, faisant des tests lipidiques au point de service une solution privilégiée pour la gestion du risque cardiovasculaire, tant en milieu clinique qu'à domicile.

Aperçu du marché américain des tests de diagnostic rapide des lipides aux États-Unis

Le marché américain des tests lipidiques au point de soins (POCT) a représenté la plus grande part de revenus (72,9 %) en Amérique du Nord en 2025, porté par la forte prévalence des troubles cardiovasculaires et lipidiques et l'importance croissante accordée à la prévention. Patients et professionnels de santé privilégient de plus en plus les tests rapides de cholestérol et de triglycérides au point de soins pour une prise de décision clinique immédiate. L'essor de l'autosurveillance, conjugué à l'intégration d'applications mobiles et de plateformes de télémédecine, stimule davantage l'adoption de ces tests. Par ailleurs, les hôpitaux et les centres de diagnostic adoptent des analyseurs de pointe de marques leaders telles que Roche Reflotron et Alere Cholestech LDX pour optimiser le dépistage. La sensibilisation accrue des patients et les initiatives gouvernementales de dépistage cardiovasculaire contribuent significativement à la croissance du marché.

Aperçu du marché canadien des tests de diagnostic rapide des lipides au Canada

Le marché canadien des tests de diagnostic rapide des lipides (POCT) devrait connaître une croissance importante en 2025, stimulée par les programmes gouvernementaux encourageant le dépistage précoce des troubles cardiovasculaires et lipidiques. Les professionnels de la santé canadiens privilégient la précision, la portabilité et l'intégration aux systèmes de dossiers médicaux électroniques (DME) lors du choix de leurs appareils POCT. La sensibilisation croissante à la prévention et les campagnes de dépistage favorisent l'adoption d'analyseurs et de trousses de test connectés dans les hôpitaux et les centres de diagnostic professionnels. La disponibilité d'appareils de test sur ordonnance et en vente libre améliore l'accessibilité dans les zones urbaines et périurbaines. De plus, des fabricants comme Samsung Labgeo et PTS Cardiochek lancent des appareils conviviaux compatibles avec des applications mobiles, facilitant ainsi la télésurveillance. Le marché canadien bénéficie d'une infrastructure de santé bien développée et de politiques de remboursement avantageuses.

Aperçu du marché mexicain des tests de diagnostic rapide des lipides au Mexique

Le marché mexicain des tests de diagnostic rapide des lipides (POCT) connaît une croissance significative en 2025, portée par la prévalence croissante de l'hyperlipidémie et des maladies cardiovasculaires, notamment en milieu urbain. Les établissements de santé adoptent de plus en plus les dispositifs de test portables et rapides pour obtenir des résultats immédiats et améliorer la prise en charge des patients. Les campagnes de sensibilisation menées par les pouvoirs publics et les organisations à but non lucratif encouragent le dépistage préventif, contribuant ainsi à la croissance du marché. Les solutions de test en vente libre et à domicile gagnent en popularité auprès des consommateurs en quête de praticité et de dépistage précoce. Des marques telles qu'Alere Afinion et PTS Cardiochek renforcent leur présence en proposant des dispositifs POCT accessibles et fiables. L'augmentation des investissements dans les infrastructures de santé urbaines et l'intégration de la télémédecine stimulent encore davantage l'adoption des tests POCT des lipides au Mexique.

Part de marché des tests lipidiques POCT en Amérique du Nord

Le secteur des tests de diagnostic rapide des lipides en Amérique du Nord est principalement dominé par des entreprises bien établies, notamment :

- Abbott (États-Unis)

- PTS Diagnostics (États-Unis)

- Laboratoires ACON (États-Unis)

- Nova Biomedical (États-Unis)

- F. Hoffmann La Roche Ltd. (Suisse)

- SD Biosensor, Inc. (Corée du Sud)

- Sinocare Inc. (Chine)

- Callegari Srl (Italie)

- MiCo BioMed (Corée du Sud)

- Menarini Diagnostics (Italie)

- EKF Diagnostics Holdings plc (Royaume-Uni)

- Siemens Healthineers AG (Allemagne)

- Danaher (États-Unis)

- BD (États-Unis)

- Quidel Corporation (États-Unis)

- ARKRAY Inc. (Japon)

- Trinity Biotech plc (Irlande)

- Laboratoires Bio-Rad Inc. (États-Unis)

- Guilin Urit Electronic Group Co., Ltd. (Chine)

Quels sont les développements récents sur le marché nord-américain des tests de diagnostic rapide des lipides (POCT) ?

- En août 2025, Abbott aurait lancé aux États-Unis son test lipidique Afinion™ 2 de nouvelle génération pour les diagnostics au point de soins, fournissant des résultats de cholestérol et de lipides aussi précis qu'en laboratoire en moins de 8 minutes, accélérant considérablement la prise de décision clinique pour l'évaluation du risque cardiovasculaire dans les centres de soins décentralisés.

- En juin 2025, Quest Diagnostics s'est associé à des centres de santé communautaires pour mettre en place des programmes pilotes de tests lipidiques au point de soins, visant à améliorer le dépistage précoce de la dyslipidémie chez les populations défavorisées des États-Unis et à élargir l'accès au dépistage rapide des lipides au-delà des laboratoires d'analyses cliniques traditionnels.

- En janvier 2025, Roche Diagnostics a reçu l'autorisation 510(k) de la FDA pour le test Tina-quant® Lipoprotein (a) Gen.2 Molarity, devenant ainsi le premier test sanguin autorisé aux États-Unis à mesurer la lipoprotéine (a) en nanomoles par litre, permettant une évaluation plus précise du risque cardiovasculaire et une meilleure évaluation du métabolisme lipidique en pratique clinique.

- En septembre 2024, la Family Heart Foundation a lancé Cholesterol Connect, un programme offrant des dépistages lipidiques gratuits à domicile et des conseils personnalisés, élargissant ainsi l'accès aux tests lipidiques au point de service et à l'éducation en matière de gestion des risques cardiovasculaires.

- En mai 2024, la FDA américaine a accordé la désignation de dispositif révolutionnaire au test Tina-quant® Lp(a) RxDx de Roche, accélérant le développement d'un test permettant d'identifier les patients présentant un taux élevé de Lp(a) susceptibles de bénéficier des nouvelles thérapies visant à réduire le taux de Lp(a), faisant ainsi progresser le diagnostic personnalisé des lipides.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.