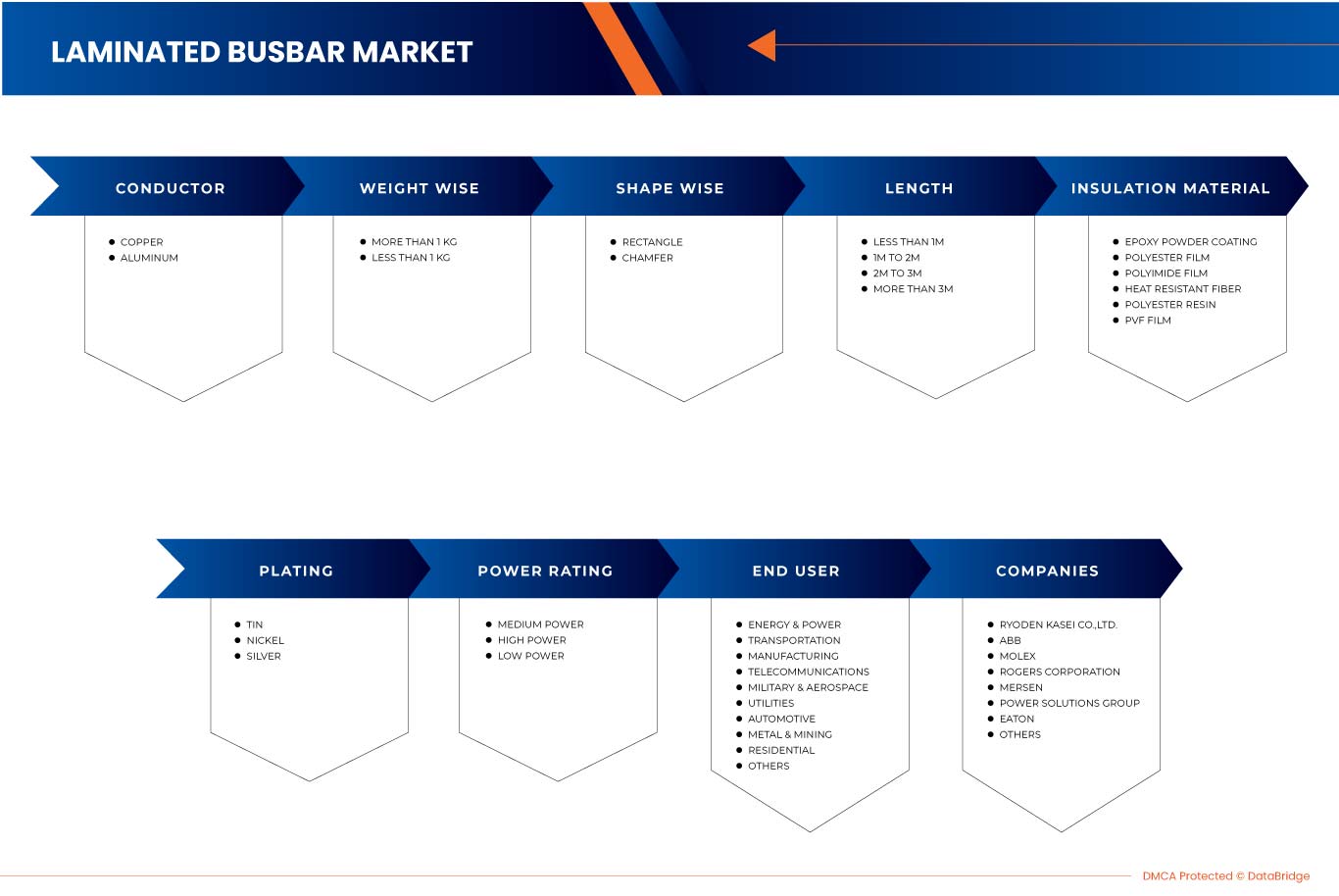

Marché des barres omnibus laminées en Amérique du Nord, par conducteur (cuivre et aluminium), poids (plus de 1 kg et moins de 1 kg), forme (rectangle et chanfrein), longueur (moins de 1 m, 1 m à 2 m, 2 m à 3 m et plus de 3 m), matériau isolant (revêtement en poudre époxy, film polyester, film polyimide , fibre résistante à la chaleur, résine polyester et film PVF), placage (étain, nickel et argent), puissance nominale (puissance moyenne, puissance élevée et faible puissance), utilisateur final (énergie et électricité, transport, fabrication, télécommunications, militaire et aérospatiale, services publics, automobile, métallurgie et mines, résidentiel et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des barres omnibus laminées en Amérique du Nord

Un jeu de barres laminé est un segment conçu comprenant des couches de métal séparées par des matériaux diélectriques minces et fusionnées. Ces jeux de barres ont une technologie améliorée pour intégrer des services conducteurs électriques et réduire les dépenses globales de la structure. De même, diverses caractéristiques avantageuses soutiennent la demande de véhicules hybrides et électriques. En outre, cela propulsera le taux de croissance du marché. De plus, le marché des jeux de barres laminés est stimulé par divers facteurs, tels que l'augmentation de la demande d'électricité et la demande croissante de systèmes de distribution électrique sûrs et sécurisés. En plus de cela, l'intégration croissante des énergies renouvelables élargira le marché des jeux de barres laminés. En outre, la sensibilisation croissante aux économies d'énergie et à l'efficacité énergétique sont des facteurs majeurs influençant la croissance du marché des jeux de barres laminés. Les facteurs importants qui amortiront le taux de croissance du marché des jeux de barres laminés sont l'industrialisation rapide et les progrès technologiques. Les avantages rentables et opérationnels des jeux de barres laminés stimuleront le taux de croissance du marché.

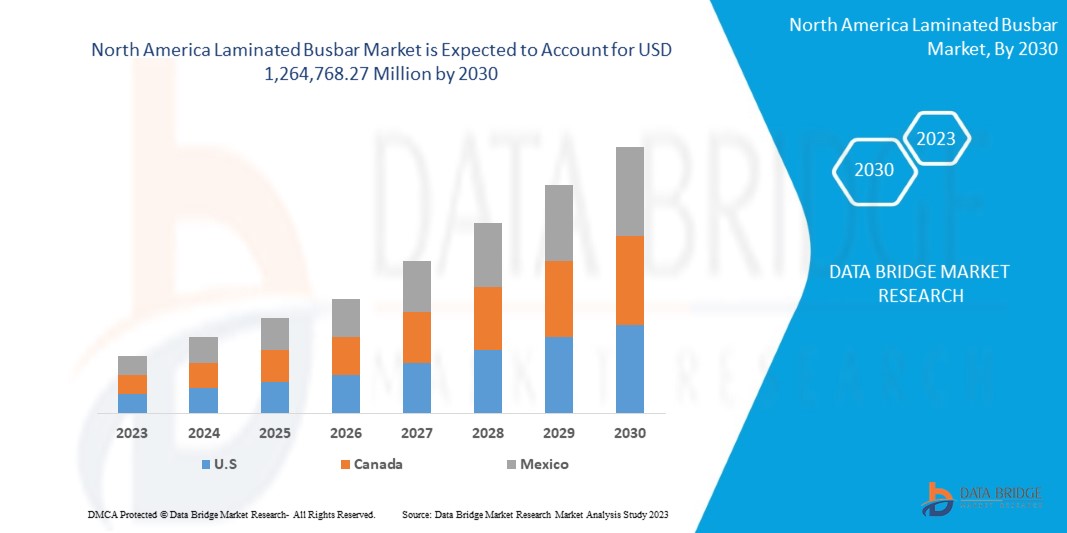

Selon les analyses de Data Bridge Market Research, le marché nord-américain des jeux de barres laminés devrait atteindre une valeur de 1 264 768,27 millions USD d'ici 2030, à un TCAC de 5,8 % au cours de la période de prévision. Le rapport sur le marché nord-américain des jeux de barres laminés couvre également de manière exhaustive l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions, prix en USD |

|

Segments couverts |

Conducteur (cuivre et aluminium), poids (plus de 1 kg et moins de 1 kg), forme (rectangle et chanfrein), longueur (moins de 1 m, de 1 m à 2 m, de 2 m à 3 m et plus de 3 m), matériau isolant (revêtement en poudre époxy, film polyester, film polyimide, fibre résistante à la chaleur, résine polyester et film PVF), placage (étain, nickel et argent), puissance nominale (puissance moyenne, puissance élevée et faible puissance), utilisateur final (énergie et électricité, transport, fabrication, télécommunications, militaire et aérospatiale, services publics, automobile, métallurgie et mines, résidentiel et autres) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

RYODEN KASEI CO., LTD., Rittal GmbH & Co. KG, Suzhou West Deane New Power Electric Co., Ltd (WDI), Eaton, EMS Elektro Metall Schwanenmühle GmbH, Baknor, espbus.com, Jans Copper Private Limited, Power Solutions Group, Segue Electronics, Inc., Shanghai Eagtop Electronic Technology Co., Ltd., Assemblage Paro Inc., ABB, Sun.King Technology Group Limited, Storm Power Components, MERSEN PROPERTY, Raychem RPG Private Limited., Rogers Corporation, Zhejiang RHI Electric Co., Ltd et AMPHENOL NORTH AMERICA INTERCONNECT SYSTEMS |

Définition du marché

Le jeu de barres est un composant électrique appelé jonction électrique qui agit comme un conducteur. Il peut être considéré comme un groupe de conducteurs utilisés pour collecter l'énergie électrique des lignes d'alimentation entrantes et la distribuer aux lignes d'alimentation sortantes. Les jeux de barres avec plusieurs matériaux conducteurs, tels que l'aluminium et le cuivre, sont considérés comme des jeux de barres laminés. Ces jeux de barres laminés sont constitués de plusieurs couches de métal conducteur, offrant plusieurs avantages en termes de performances par rapport aux jeux de barres monocouches et aux conducteurs de câbles. Ces jeux de barres sont conçus en fonction de la forme, de la longueur et du matériau utilisé pour isoler le jeu de barres. Cependant, ces jeux de barres ont été plaqués avec différents types de placage, ce qui aide à intégrer les services conducteurs. Bien que les jeux de barres laminés soient conçus en fonction d'autres conditions de puissance de travail, ils sont utilisés dans diverses applications.

Dynamique du marché des barres omnibus laminées en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

CONDUCTEURS

- DEMANDE CROISSANTE DE VÉHICULES ÉLECTRIQUES DANS LE MONDE

Les véhicules électriques (VE) sont conçus pour être une technologie prometteuse pour le transport durable avec zéro émission de carbone, un faible bruit et une efficacité élevée. De plus, les véhicules électriques ont évolué au 19e siècle, mais en raison d'un manque de progrès technologique, les moteurs à combustion interne ont eu une demande énorme par rapport aux véhicules électriques. Au cours du 20e siècle, les progrès technologiques ont été stimulés chaque année, ce qui a donné lieu à des développements et des innovations qui ont contribué à remodeler les véhicules électriques.

- BESOIN CROISSANT EN ÉQUIPEMENT DE TÉLÉCOMMUNICATION

L'industrie des télécommunications est associée à la fourniture de services de communication à distance. Cette industrie regroupe les services de câble, de téléphone, d'Internet et les installations par satellite. Ainsi, cette industrie se concentre sur l'audio et la vidéo haute résolution, les services de données et la connectivité.

OPPORTUNITÉ

- AUGMENTATION DE LA DEMANDE D'ÉLECTRIFICATION

La plupart des fabricants industriels accordent de plus en plus d'importance à la durabilité, et ce, en s'orientant vers l'électrification des flottes, des processus et des espaces industriels, conformément à la transition énergétique plus large de l'économie. La demande croissante d'électrification augmente partout dans le monde en raison de plusieurs facteurs, notamment l'augmentation de la consommation d'électricité et la réduction des émissions de dioxyde de carbone, qui ont décarboné l'économie et atténué le changement climatique. Le gouvernement contribue également à l'approvisionnement en électricité des zones rurales ou à la connexion au programme des villes intelligentes.

RETENUE/DÉFI

- FORTE VOLATILITÉ DES PRIX ASSOCIÉS AUX MATIÈRES PREMIÈRES

Le jeu de barres laminé est constitué de couches alternées d'une couche conductrice et d'une couche diélectrique en mousse. La couche diélectrique en mousse augmente les niveaux de tension d'apparition et d'extinction des décharges partielles. De plus, la construction laminée est utile pour les systèmes de distribution d'énergie et les modules à transistors haute puissance.

- IMPLICATION DANS UN PROCESSUS DE FABRICATION SOPHISTIQUÉ

Un jeu de barres est une barre métallique généralement fabriquée en cuivre ou en aluminium qui agit comme un conducteur. Un jeu de barres agit comme un point central qui collecte l'énergie à un seul endroit, permettant une distribution transparente dans le système. Dans de nombreux secteurs, un jeu de barres en cuivre est très apprécié par les entreprises en raison de sa conductivité et de sa résistance plus élevées et agit comme un minéral abondant dans la croûte terrestre.

Développements récents

- En septembre 2022, Molex a annoncé l'agrandissement de son usine de fabrication au Vietnam. Cette expansion contribuera à soutenir la demande croissante de ses produits qui sont utilisés dans de nombreuses applications différentes, ce qui aidera l'entreprise à offrir 200 nouveaux emplois et à gérer la demande et l'offre du produit sur le marché en accélérant les installations de fabrication de produits.

- En mars 2021, Rittal GmbH & Co. KG a annoncé son partenariat avec Stulz pour fournir une infrastructure de centre de données sur mesure, des conseils, une assistance et des services. Ce partenariat a permis à l'entreprise de développer ses activités dans le domaine des systèmes de distribution d'énergie, ce qui a renforcé sa croissance de chiffre d'affaires.

Portée du marché des barres omnibus laminées en Amérique du Nord

Le marché nord-américain des jeux de barres laminés est segmenté en huit segments notables basés sur le conducteur, le poids, la forme, la longueur, le matériau isolant, le placage, la puissance nominale et l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de croissance limités dans les industries et fournira aux utilisateurs un aperçu et des informations précieuses sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Conducteur

- Cuivre

- Aluminium

Sur la base du conducteur, le marché est segmenté en aluminium et en cuivre.

En termes de poids

- Plus de 1 kg

- Moins de 1 kg

Sur la base du poids, le marché est segmenté en moins de 1 kg et plus de 1 kg.

Forme sage

- Rectangle

- Chanfreiner

Sur la base de la forme, le marché est segmenté en rectangle et en chanfrein.

Longueur

- Moins de 1M

- 1M à 2M

- 2M à 3M

- Plus de 3 millions

Sur la base de la longueur, le marché est segmenté en moins de 1 m, 1 m à 2 m, 2 m à 3 m et plus de 3 m.

Matériau isolant

- Revêtement en poudre époxy

- Film polyester

- Film polyimide

- Fibre résistante à la chaleur

- Résine polyester

- Film PVF

Sur la base du matériau isolant, le marché est segmenté en revêtement en poudre époxy, film polyester, film PVF, résine polyester, fibre résistante à la chaleur et film polyimide.

Placage

- Étain

- Nickel

- Argent

Sur la base du placage, le marché est segmenté en étain, nickel et argent.

Puissance nominale

- Puissance moyenne

- Haute puissance

- Faible puissance

Sur la base de la puissance nominale, le marché est segmenté en faible puissance, moyenne puissance et haute puissance.

Utilisateur final

- Énergie et électricité

- Transport

- Fabrication

- Télécommunications

- Militaire et aérospatiale

- Utilitaires

- Automobile

- Métallurgie et mines

- Résidentiel

- Autres

Sur la base de l'utilisateur final, le marché est segmenté en services publics, métaux et mines, fabrication, résidentiel, télécommunications, militaire et aérospatiale, transport, énergie et électricité, automobile et autres.

Analyse/perspectives régionales du marché des barres omnibus laminées en Amérique du Nord

Le marché des barres omnibus laminées en Amérique du Nord est analysé et des informations sur la taille du marché et les tendances sont fournies par région et segments comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des barres omnibus laminées en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Les États-Unis dominent la région Amérique du Nord en raison d’un besoin croissant en énergie renouvelable, ce qui entraîne une demande de réseaux de transmission et de distribution d’électricité efficaces et fiables.

La section régionale du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces de Porter, ainsi que des études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données régionales.

Analyse du paysage concurrentiel et des parts de marché des barres omnibus laminées en Amérique du Nord

Le paysage concurrentiel du marché des barres omnibus laminées en Amérique du Nord fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché des barres omnibus laminées en Amérique du Nord.

Français Certains des principaux acteurs opérant sur le marché des jeux de barres laminés en Amérique du Nord sont, RYODEN KASEI CO., LTD., Rittal GmbH & Co. KG, Suzhou West Deane New Power Electric Co., Ltd (WDI), Eaton, EMS Elektro Metall Schwanenmühle GmbH, Baknor, espbus.com, Jans Copper Private Limited, Power Solutions Group, Segue Electronics, Inc., Shanghai Eagtop Electronic Technology Co., Ltd., Assemblage Paro Inc., ABB, Sun.King Technology Group Limited, Storm Power Components, MERSEN PROPERTY, Raychem RPG Private Limited., Rogers Corporation, Zhejiang RHI Electric Co., Ltd et AMPHENOL NORTH AMERICA INTERCONNECT SYSTEMS, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA LAMINATED BUSBAR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 CONDUCTOR TIMELINE CURVE

2.1 MARKET END-USE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES

4.2 CASE STUDY

4.3 REGULATORY FRAMEWORK

4.4 PATENT ANALYSIS

4.5 TECHNOLOGICAL TRENDS

4.6 VALUE CHAIN ANALYSIS

4.7 COMPANY COMPARATIVE ANALYSIS

4.8 TOP COMPANY MARKET SHARES BY END-USERS

5 REGIONAL REASONING

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 NCREASING DEMAND FOR ELECTRIC VEHICLES ACROSS THE GLOBE

6.1.2 RISING NEED FOR TELECOMMUNICATION EQUIPMENT

6.1.3 INCREASING NUMBER OF HYPER-SCALE DATA CENTERS

6.1.4 RISING DEMAND FOR SAFE AND SECURE ELECTRICAL DISTRIBUTION SYSTEMS

6.1.5 GROWING IMPORTANCE TOWARDS THE ADOPTION OF INSULATING AND PLATING METHODS

6.2 RESTRAINT

6.2.1 HIGH PRICE VOLATILITY ASSOCIATED WITH RAW MATERIALS

6.3 OPPORTUNITIES

6.3.1 RISE IN THE DEMAND FOR ELECTRIFICATION

6.3.2 INCREASE IN INVESTMENTS IN R&D TO DEVELOP EFFICIENT ELECTRIC COMPONENTS

6.3.3 UPSURGE IN THE ADOPTION OF RENEWABLE ENERGY

6.4 CHALLENGES

6.4.1 INVOLVEMENT IN SOPHISTICATED MANUFACTURING PROCESS

6.4.2 POWER DISTRIBUTION CHALLENGES IN SMALL AND MEDIUM-SIZED PC BOARDS AND CIRCUITS

7 NORTH AMERICA LAMINATED BUSBAR MARKET, BY CONDUCTOR

7.1 OVERVIEW

7.2 COPPER

7.2.1 TRANSFORMERS

7.2.2 RECTIFIERS

7.2.3 GENERATORS

7.2.4 OTHERS

7.3 ALUMINUM

8 NORTH AMERICA LAMINATED BUSBAR MARKET, BY WEIGHT WISE

8.1 OVERVIEW

8.2 MORE THAN 1 KG

8.3 LESS THAN 1 KG

9 NORTH AMERICA LAMINATED BUSBAR MARKET, BY SHAPE WISE

9.1 OVERVIEW

9.2 RECTANGLE

9.3 CHAMFER

10 NORTH AMERICA LAMINATED BUSBAR MARKET, BY END USER

10.1 OVERVIEW

10.2 ENERGY & POWER

10.2.1 POWER TRANSMISSION

10.2.1.1 HVDC CONVERTER STATIONS

10.2.1.2 SUBSTATIONS

10.2.1.3 MAIN STATIONS

10.2.1.4 SWITCHGEARS

10.2.1.5 TRANSFORMER STATIONS

10.2.1.6 OFF-SHORE

10.2.1.7 DISTRIBUTION STATIONS

10.2.1.8 OTHERS

10.2.2 HYDROPOWER

10.2.3 SOLAR POWER

10.2.4 WIND POWER

10.2.5 OTHERS

10.2.6 COPPER

10.2.7 ALUMINUM

10.2.8 EPOXY POWDER COATING

10.2.9 POLYESTER FILM

10.2.10 POLYIMIDE FILM

10.2.11 HEAT RESISTANT FIBER

10.2.12 POLYESTER RESIN

10.2.13 PVF FILM

10.3 TRANSPORTATION

10.3.1 COPPER

10.3.2 ALUMINUM

10.3.3 EPOXY POWDER COATING

10.3.4 POLYESTER FILM

10.3.5 POLYIMIDE FILM

10.3.6 HEAT RESISTANT FIBER

10.3.7 POLYESTER RESIN

10.3.8 PVF FILM

10.4 MANUFACTURING

10.4.1 COPPER

10.4.2 ALUMINUM

10.4.3 EPOXY POWDER COATING

10.4.4 POLYESTER FILM

10.4.5 POLYIMIDE FILM

10.4.6 HEAT RESISTANT FIBER

10.4.7 POLYESTER RESIN

10.4.8 PVF FILM

10.5 TELECOMMUNICATIONS

10.5.1 BASE STATIONS

10.5.2 NETWORK SERVERS

10.5.3 TELEPHONE EXCHANGE SYSTEMS

10.5.4 CELLULAR COMMUNICATIONS

10.5.5 OTHERS

10.5.6 COPPER

10.5.7 ALUMINUM

10.5.8 EPOXY POWDER COATING

10.5.9 POLYESTER FILM

10.5.10 POLYIMIDE FILM

10.5.11 HEAT RESISTANT FIBER

10.5.12 POLYESTER RESIN

10.5.13 PVF FILM

10.6 MILITARY & AEROSPACE

10.6.1 AIRCRAFT CARRIER

10.6.2 UNMANNED AERIAL VEHICLE

10.6.3 DEFENSE EQUIPMENT

10.6.4 OTHERS

10.6.5 COPPER

10.6.6 ALUMINUM

10.6.7 EPOXY POWDER COATING

10.6.8 POLYESTER FILM

10.6.9 POLYIMIDE FILM

10.6.10 HEAT RESISTANT FIBER

10.6.11 POLYESTER RESIN

10.6.12 PVF FILM

10.7 UTILITIES

10.7.1 COPPER

10.7.2 ALUMINUM

10.7.3 EPOXY POWDER COATING

10.7.4 POLYESTER FILM

10.7.5 POLYIMIDE FILM

10.7.6 HEAT RESISTANT FIBER

10.7.7 POLYESTER RESIN

10.7.8 PVF FILM

10.8 AUTOMOTIVE

10.8.1 BATTERY ELECTRIC VEHICLE

10.8.2 HYBRID ELECTRIC VEHICLE

10.8.3 PLUG-IN HYBRID VEHICLE

10.8.4 COPPER

10.8.5 ALUMINUM

10.8.6 EPOXY POWDER COATING

10.8.7 POLYESTER FILM

10.8.8 POLYIMIDE FILM

10.8.9 HEAT RESISTANT FIBER

10.8.10 POLYESTER RESIN

10.8.11 PVF FILM

10.9 METAL & MINING

10.9.1 COPPER

10.9.2 ALUMINUM

10.9.3 EPOXY POWDER COATING

10.9.4 POLYESTER FILM

10.9.5 POLYIMIDE FILM

10.9.6 HEAT RESISTANT FIBER

10.9.7 POLYESTER RESIN

10.9.8 PVF FILM

10.1 RESIDENTIAL

10.10.1 COPPER

10.10.2 ALUMINUM

10.10.3 EPOXY POWDER COATING

10.10.4 POLYESTER FILM

10.10.5 POLYIMIDE FILM

10.10.6 HEAT RESISTANT FIBER

10.10.7 POLYESTER RESIN

10.10.8 PVF FILM

10.11 OTHERS

11 NORTH AMERICA LAMINATED BUSBAR MARKET, BY LENGTH

11.1 OVERVIEW

11.2 LESS THAN 1M

11.3 1M TO 2M

11.4 2M TO 3M

11.5 MORE THAN 3M

12 NORTH AMERICA LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL

12.1 OVERVIEW

12.2 EPOXY POWDER COATING

12.3 POLYESTER FILM

12.4 POLYIMIDE FILM

12.5 HEAT RESISTANT FIBER

12.6 POLYESTER RESIN

12.7 PVF FILM

13 NORTH AMERICA LAMINATED BUSBAR MARKET, BY PLATING

13.1 OVERVIEW

13.2 TIN

13.3 NICKEL

13.4 SILVER

14 NORTH AMERICA LAMINATED BUSBAR MARKET, BY POWER RATING

14.1 OVERVIEW

14.2 MEDIUM POWER

14.2.1 400 AMP TO 800 AMP

14.2.2 200 AMP TO 400 AMP

14.2.3 125 AMP TO 200 AMP

14.3 HIGH POWER

14.3.1 1000 AMP TO 1200 AMP

14.3.2 800 AMP TO 1000 AMP

14.4 LOW POWER

14.4.1 100 AMP TO 125 AMP

14.4.2 60 AMP TO 100 AMP

14.4.3 40 TO 60 AMP

14.4.4 LESS THAN 40 AMP

15 NORTH AMERICA LAMINATED BUSBAR MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 NORTH AMERICA LAMINATED BUSBAR MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 RYODEN KASEI CO., LTD.

18.1.1 COMPANY SNAPSHOT

18.1.2 COMPANY SHARE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT DEVELOPMENTS

18.2 ABB

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 MOLEX (A SUBSIDIAIRY OF KOCH INDUSTRIES)

18.3.1 COMPANY SNAPSHOT

18.3.2 COMPANY SHARE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT DEVELOPMENTS

18.4 ROGERS CORPORATION

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 MERSEN

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 AMPHENOL NORTH AMERICA INTERCONNECT SYSTEMS (SUBSIDIARY OF AMPHENOL CORPORATION)

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENTS

18.7 ASSEMBLAGE PARO INC.

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 BAKNOR

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 EATON

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 EMS ELEKTRO METALL SCHWANENMÜHLE GMBH

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 ESPBUS.COM

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENT

18.12 JANS COPPER PRIVATE LIMITED

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 POWER SOLUTIONS GROUP

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 COMPANY SHARE ANALYSIS

18.13.4 PRODUCT PORTFOLIO

18.13.5 RECENT DEVELOPMENTS

18.14 RAYCHEM RPG PRIVATE LIMITED

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENTS

18.15 RITTAL GMBH & CO. KG

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENTS

18.16 SEGUE ELECTRONICS, INC.

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 SHANGHAI EAGTOP ELECTRONIC TECHNOLOGY CO., LTD.

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 STORM POWER COMPONENTS

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENTS

18.19 SUN.KING TECHNOLOGY GROUP LIMITED

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENTS

18.2 SUZHOU WEST DEANE NEW POWER ELECTRIC CO., LTD (WDI)

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 ZHEJIANG RHI ELECTRIC CO., LTD

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 2 NORTH AMERICA COPPER IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 3 NORTH AMERICA COPPER IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA ALUMINUM IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA LAMINATED BUSBAR MARKET, BY WEIGHT WISE, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA MORE THAN 1 KG IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA LESS THAN 1 KG IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA LAMINATED BUSBAR MARKET, BY SHAPE WISE, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA RECTANGLE IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA CHAMFER IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA LAMINATED BUSBAR MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA ENERGY & POWER IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA ENERGY & POWER IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA POWER TRANSMISSION IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA ENERGY & POWER IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA ENERGY & POWER IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA TRANSPORTATION IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA TRANSPORTATION IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA TRANSPORTATION IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA MANUFACTURING IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA MANUFACTURING IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA MANUFACTURING IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA TELECOMMUNICATIONS IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA TELECOMMUNICATION IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA TELECOMMUNICATION IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA TELECOMMUNICATION IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA MILITARY & AEROSPACE IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA MILITARY & AEROSPACE IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA MILITARY & AEROSPACE IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA MILITARY & AEROSPACE IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA UTILITIES IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA UTILITIES IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA UTILITIES IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA AUTOMOTIVE IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA AUTOMOTIVE IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA AUTOMOTIVE IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 37 NORTH AMERICA AUTOMOTIVE IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA METAL & MINING IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 39 NORTH AMERICA METAL & MINING IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA METAL & MINING IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 41 NORTH AMERICA RESIDENTIAL IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA RESIDENTIAL IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 43 NORTH AMERICA RESIDENTIAL IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 44 NORTH AMERICA OTHERS IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 45 NORTH AMERICA LAMINATED BUSBAR MARKET, BY LENGTH, 2021-2030 (USD THOUSAND)

TABLE 46 NORTH AMERICA LESS THAN 1M IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 47 NORTH AMERICA 1M TO 2M IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 48 NORTH AMERICA 2M TO 3M IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 49 NORTH AMERICA MORE THAN 3M IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 50 NORTH AMERICA LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 51 NORTH AMERICA EPOXY POWDER COATING IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 52 NORTH AMERICA POLYESTER FILM IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 53 NORTH AMERICA POLYIMIDE FILM IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 54 NORTH AMERICA HEAT RESISTANT FIBER IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 55 NORTH AMERICA POLYESTER RESIN IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 56 NORTH AMERICA PVF FILM IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 57 NORTH AMERICA LAMINATED BUSBAR MARKET, BY PLATING, 2021-2030 (USD THOUSAND)

TABLE 58 NORTH AMERICA TIN IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 59 NORTH AMERICA NICKEL IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 60 NORTH AMERICA SILVER IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 61 NORTH AMERICA LAMINATED BUSBAR MARKET, BY POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 62 NORTH AMERICA MEDIUM POWER IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 63 NORTH AMERICA MEDIUM POWER IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 NORTH AMERICA HIGH POWER IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 65 NORTH AMERICA HIGH POWER IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 NORTH AMERICA LOW POWER IN LAMINATED BUSBAR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 67 NORTH AMERICA HIGH POWER IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 68 NORTH AMERICA LAMINATED BUSBAR MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 69 NORTH AMERICA LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 70 NORTH AMERICA COPPER IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 71 NORTH AMERICA LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 72 NORTH AMERICA LAMINATED BUSBAR MARKET, BY SHAPE WISE, 2021-2030 (USD THOUSAND)

TABLE 73 NORTH AMERICA LAMINATED BUSBAR MARKET, BY LENGTH, 2021-2030 (USD THOUSAND)

TABLE 74 NORTH AMERICA LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 75 NORTH AMERICA LAMINATED BUSBAR MARKET, BY PLATING, 2021-2030 (USD THOUSAND)

TABLE 76 NORTH AMERICA LAMINATED BUSBAR MARKET, BY POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 77 NORTH AMERICA MEDIUM POWER IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 78 NORTH AMERICA HIGH POWER IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 NORTH AMERICA LOW POWER IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 80 NORTH AMERICA LAMINATED BUSBAR MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 81 NORTH AMERICA ENERGY & POWER IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 82 NORTH AMERICA POWER TRANSMISSION IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 NORTH AMERICA ENERGY & POWER IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 84 NORTH AMERICA ENERGY & POWER IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 85 NORTH AMERICA TRANSPORTATION IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 86 NORTH AMERICA TRANSPORTATION IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 87 NORTH AMERICA MANUFACTURING IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 88 NORTH AMERICA MANUFACTURING IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 89 NORTH AMERICA TELECOMMUNICATION IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 90 NORTH AMERICA TELECOMMUNICATION IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 91 NORTH AMERICA TELECOMMUNICATION IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 92 NORTH AMERICA MILITARY & AEROSPACE IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 93 NORTH AMERICA MILITARY & AEROSPACE IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 94 NORTH AMERICA MILITARY & AEROSPACE IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 95 NORTH AMERICA UTILITIES IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 96 NORTH AMERICA UTILITIES IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 97 NORTH AMERICA AUTOMOTIVE IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 98 NORTH AMERICA AUTOMOTIVE IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 99 NORTH AMERICA AUTOMOTIVE IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 100 NORTH AMERICA METAL & MINING IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 101 NORTH AMERICA METAL & MINING IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 102 NORTH AMERICA RESIDENTIAL IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 103 NORTH AMERICA RESIDENTIAL IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 104 U.S. LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 105 U.S. COPPER IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 106 U.S. LAMINATED BUSBAR MARKET, BY WEIGHT WISE, 2021-2030 (USD THOUSAND)

TABLE 107 U.S. LAMINATED BUSBAR MARKET, BY SHAPE WISE, 2021-2030 (USD THOUSAND)

TABLE 108 U.S. LAMINATED BUSBAR MARKET, BY LENGTH, 2021-2030 (USD THOUSAND)

TABLE 109 U.S. LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 110 U.S. LAMINATED BUSBAR MARKET, BY PLATING, 2021-2030 (USD THOUSAND)

TABLE 111 U.S. LAMINATED BUSBAR MARKET, BY POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 112 U.S. MEDIUM POWER IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 113 U.S. HIGH POWER IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 114 U.S. LOW POWER IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 115 U.S. LAMINATED BUSBAR MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 116 U.S. ENERGY & POWER IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 117 U.S. POWER TRANSMISSION IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 118 U.S. ENERGY & POWER IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 119 U.S. ENERGY & POWER IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 120 U.S. TRANSPORTATION IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 121 U.S. TRANSPORTATION IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 122 U.S. MANUFACTURING IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 123 U.S. MANUFACTURING IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 124 U.S. TELECOMMUNICATION IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 125 U.S. TELECOMMUNICATION IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 126 U.S. TELECOMMUNICATION IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 127 U.S. MILITARY & AEROSPACE IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 128 U.S. MILITARY & AEROSPACE IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 129 U.S. MILITARY & AEROSPACE IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 130 U.S. UTILITIES IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 131 U.S. UTILITIES IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 132 U.S. AUTOMOTIVE IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 133 U.S. AUTOMOTIVE IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 134 U.S. AUTOMOTIVE IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 135 U.S. METAL & MINING IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 136 U.S. METAL & MINING IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 137 U.S. RESIDENTIAL IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 138 U.S. RESIDENTIAL IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 139 CANADA LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 140 CANADA COPPER IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 141 CANADA LAMINATED BUSBAR MARKET, BY WEIGHT WISE, 2021-2030 (USD THOUSAND)

TABLE 142 CANADA LAMINATED BUSBAR MARKET, BY SHAPE WISE, 2021-2030 (USD THOUSAND)

TABLE 143 CANADA LAMINATED BUSBAR MARKET, BY LENGTH, 2021-2030 (USD THOUSAND)

TABLE 144 CANADA LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 145 CANADA LAMINATED BUSBAR MARKET, BY PLATING, 2021-2030 (USD THOUSAND)

TABLE 146 CANADA LAMINATED BUSBAR MARKET, BY POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 147 CANADA MEDIUM POWER IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 148 CANADA HIGH POWER IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 149 CANADA LOW POWER IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 150 CANADA LAMINATED BUSBAR MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 151 CANADA ENERGY & POWER IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 152 CANADA POWER TRANSMISSION IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 153 CANADA ENERGY & POWER IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 154 CANADA ENERGY & POWER IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 155 CANADA TRANSPORTATION IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 156 CANADA TRANSPORTATION IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 157 CANADA MANUFACTURING IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 158 CANADA MANUFACTURING IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 159 CANADA TELECOMMUNICATION IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 160 CANADA TELECOMMUNICATION IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 161 CANADA TELECOMMUNICATION IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 162 CANADA MILITARY & AEROSPACE IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 163 CANADA MILITARY & AEROSPACE IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 164 CANADA MILITARY & AEROSPACE IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 165 CANADA UTILITIES IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 166 CANADA UTILITIES IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 167 CANADA AUTOMOTIVE IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 168 CANADA AUTOMOTIVE IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 169 CANADA AUTOMOTIVE IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 170 CANADA METAL & MINING IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 171 CANADA METAL & MINING IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 172 CANADA RESIDENTIAL IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 173 CANADA RESIDENTIAL IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 174 MEXICO LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 175 MEXICO COPPER IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 176 MEXICO LAMINATED BUSBAR MARKET, BY WEIGHT WISE, 2021-2030 (USD THOUSAND)

TABLE 177 MEXICO LAMINATED BUSBAR MARKET, BY SHAPE WISE, 2021-2030 (USD THOUSAND)

TABLE 178 MEXICO LAMINATED BUSBAR MARKET, BY LENGTH, 2021-2030 (USD THOUSAND)

TABLE 179 MEXICO LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 180 MEXICO LAMINATED BUSBAR MARKET, BY PLATING, 2021-2030 (USD THOUSAND)

TABLE 181 MEXICO LAMINATED BUSBAR MARKET, BY POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 182 MEXICO MEDIUM POWER IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 183 MEXICO HIGH POWER IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 184 MEXICO LOW POWER IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 185 MEXICO LAMINATED BUSBAR MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 186 MEXICO ENERGY & POWER IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 187 MEXICO POWER TRANSMISSION IN LAMINATED BUSBAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 188 MEXICO ENERGY & POWER IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 189 MEXICO ENERGY & POWER IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 190 MEXICO TRANSPORTATION IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 191 MEXICO TRANSPORTATION IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 192 MEXICO MANUFACTURING IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 193 MEXICO MANUFACTURING IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 194 MEXICO TELECOMMUNICATION IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 195 MEXICO TELECOMMUNICATION IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 196 MEXICO TELECOMMUNICATION IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 197 MEXICO MILITARY & AEROSPACE IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 198 MEXICO MILITARY & AEROSPACE IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 199 MEXICO MILITARY & AEROSPACE IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 200 MEXICO UTILITIES IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 201 MEXICO UTILITIES IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 202 MEXICO AUTOMOTIVE IN LAMINATED BUSBAR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 203 MEXICO AUTOMOTIVE IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 204 MEXICO AUTOMOTIVE IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 205 MEXICO METAL & MINING IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 206 MEXICO METAL & MINING IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 207 MEXICO RESIDENTIAL IN LAMINATED BUSBAR MARKET, BY CONDUCTOR, 2021-2030 (USD THOUSAND)

TABLE 208 MEXICO RESIDENTIAL IN LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA LAMINATED BUSBAR MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA LAMINATED BUSBAR MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA LAMINATED BUSBAR MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA LAMINATED BUSBAR MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA LAMINATED BUSBAR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA LAMINATED BUSBAR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA LAMINATED BUSBAR MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA LAMINATED BUSBAR MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA LAMINATED BUSBAR MARKET: MULTIVARIATE MODELING

FIGURE 10 NORTH AMERICA LAMINATED BUSBAR MARKET: TIMELINE CURVE

FIGURE 11 NORTH AMERICA LAMINATED BUSBAR MARKET: MARKET END-USE COVERAGE GRID

FIGURE 12 NORTH AMERICA LAMINATED BUSBAR MARKET: SEGMENTATION

FIGURE 13 RISING DEMAND FOR SAFE AND SECURE ELECTRICAL DISTRIBUTION SYSTEMS IS EXPECTED TO DRIVE THE NORTH AMERICA LAMINATED BUSBAR MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 THE COPPER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA LAMINATED BUSBAR MARKET IN 2023 & 2030

FIGURE 15 COMPANY COMPARISON

FIGURE 16 COMPANY MARKET SHARES BY END-USERS FOR RYODEN KASEI CO., LTD.

FIGURE 17 COMPANY MARKET SHARES BY END-USERS FOR ABB

FIGURE 18 COMPANY MARKET SHARES BY END-USERS FOR MOLEX

FIGURE 19 COMPANY MARKET SHARES BY END-USERS FOR ROGERS CORPORATION

FIGURE 20 COMPANY MARKET SHARES BY END-USERS FOR MERSEN

FIGURE 21 DRIVERS, RESTRAINT, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA LAMINATED BUSBAR MARKET

FIGURE 22 ELECTRIC CAR SALES (2016-2021)

FIGURE 23 INTERNET USERS WORLDWIDE

FIGURE 24 PUBLIC CLOUD ADOPTION FOR BUSINESS OPERATIONS

FIGURE 25 INNOVATIVE METHODOLOGY TO COLLECT THE OPERATING CONDITIONS

FIGURE 26 PRICE FLUCTUATION OF COPPER MATERIAL (JAN 2022 TO MARCH 2023)

FIGURE 27 NORTH AMERICA LAMINATED BUSBAR MARKET: BY CONDUCTOR, 2022

FIGURE 28 NORTH AMERICA LAMINATED BUSBAR MARKET: BY WEIGHT WISE, 2022

FIGURE 29 NORTH AMERICA LAMINATED BUSBAR MARKET: BY SHAPE WISE, 2022

FIGURE 30 NORTH AMERICA LAMINATED BUSBAR MARKET: BY END USER, 2022

FIGURE 31 NORTH AMERICA LAMINATED BUSBAR MARKET: BY LENGTH, 2022

FIGURE 32 NORTH AMERICA LAMINATED BUSBAR MARKET: BY INSULATION MATERIAL, 2022

FIGURE 33 NORTH AMERICA LAMINATED BUSBAR MARKET: BY PLATING, 2022

FIGURE 34 NORTH AMERICA LAMINATED BUSBAR MARKET: BY POWER RATING, 2022

FIGURE 35 NORTH AMERICA LAMINATED BUSBAR MARKET: SNAPSHOT (2022)

FIGURE 36 NORTH AMERICA LAMINATED BUSBAR MARKET: BY COUNTRY (2022)

FIGURE 37 NORTH AMERICA LAMINATED BUSBAR MARKET: BY COUNTRY (2023 & 2030)

FIGURE 38 NORTH AMERICA LAMINATED BUSBAR MARKET: BY COUNTRY (2022 & 2030)

FIGURE 39 NORTH AMERICA LAMINATED BUSBAR MARKET: BY CONDUCTOR (2023-2030)

FIGURE 40 NORTH AMERICA LAMINATED BUSBAR MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.