North America Kidney Cancer Diagnostics Market, By Test Type (Imaging, Biomarker Test, Blood Test, Biopsy, Genetic Test, and Others), Cancer Stage (Stage I, Stage II, Stage III, and Stage IV), Tumor Type (Renal Cell Carcinoma, Clear Cell Renal Cell Carcinoma, Non Clear Cell Renal Cell Carcinoma), Product (Platform Based Products, Instrument Based Products, Kits and Reagents, and Other Consumables), Technology (Fluorescent In Situ Hybridization, Next Generation Sequencing, Fluorimmunoassay, Comparative Genomic Hybridization, Immunohistochemical, and Others), Application (Screening, Diagnostic and Predictive, Prognostic, and Research), End User (Hospitals, Diagnostic Centers, Cancer Research Centers, Academic Institutes, Ambulatory Surgical Centers, and Others), Distribution Channel (Direct Tender, Retail Sales, and Others), Industry Trends and Forecast to 2030.

North America Kidney Cancer Diagnostics Market Analysis and Size

Kidney cancer begins when healthy cells in one or both kidneys change and grow uncontrollably, forming a mass called a cortical tumor. The tumor can be malignant, indolent or benign. Malignancy is cancer, which means it can grow and spread to other parts of the body. An indolent tumor is also cancer, but this type of tumor rarely spreads to other parts of the body. A benign tumor means that the tumor can grow but not spread.

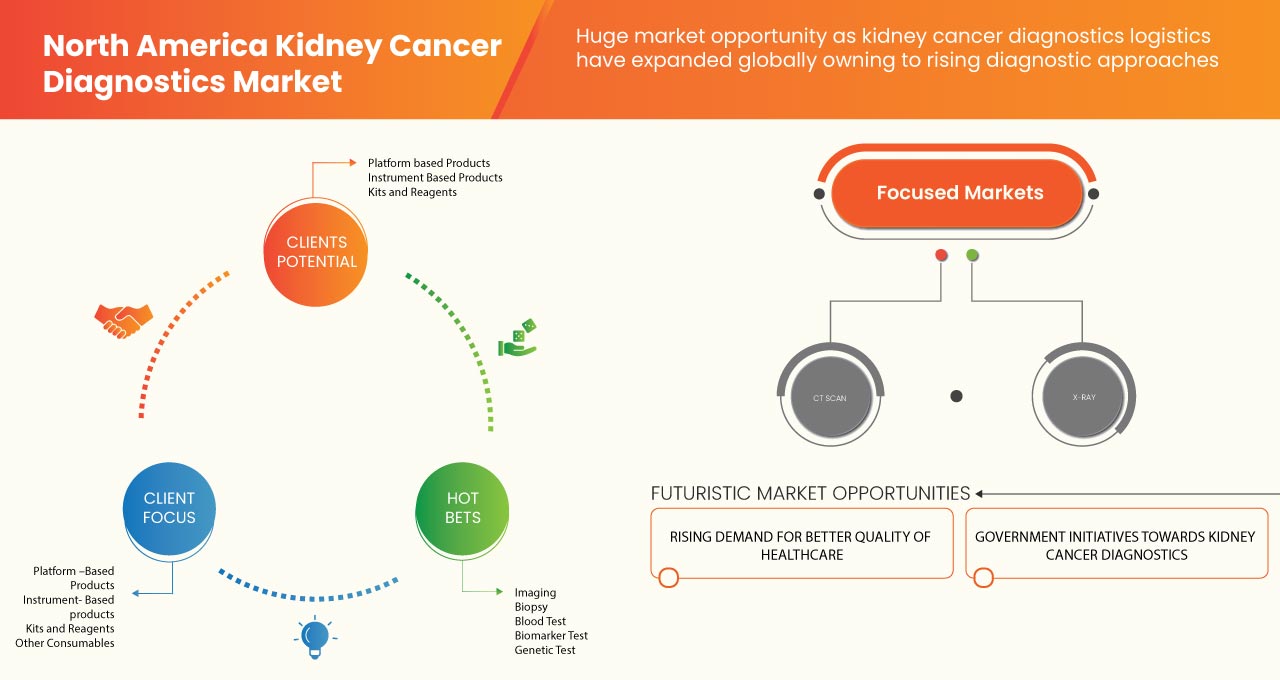

The rising awareness about kidney cancer North America has enhanced the demand for the market. The rising healthcare expenditure for better health services also contributes to the market's growth. The major market players focus on various service launches and approvals during this crucial period. In addition, the increase in improved diagnostic procedures for kidney cancer also contributes to the rising demand for kidney cancer diagnostics testing.

The North America kidney cancer diagnostics market is expected to grow in the forecast year due to the rise in market players and the availability of advanced services. Along with this, manufacturers are engaged in R&D activity for launching novel services in the market. The increasing research in the field of kidney diagnosis and development is expected to further boost the market growth. However, tissue damage due to high radiation exposure from imaging tests is expected to hamper the growth of the North America kidney cancer diagnostics market in the forecast period.

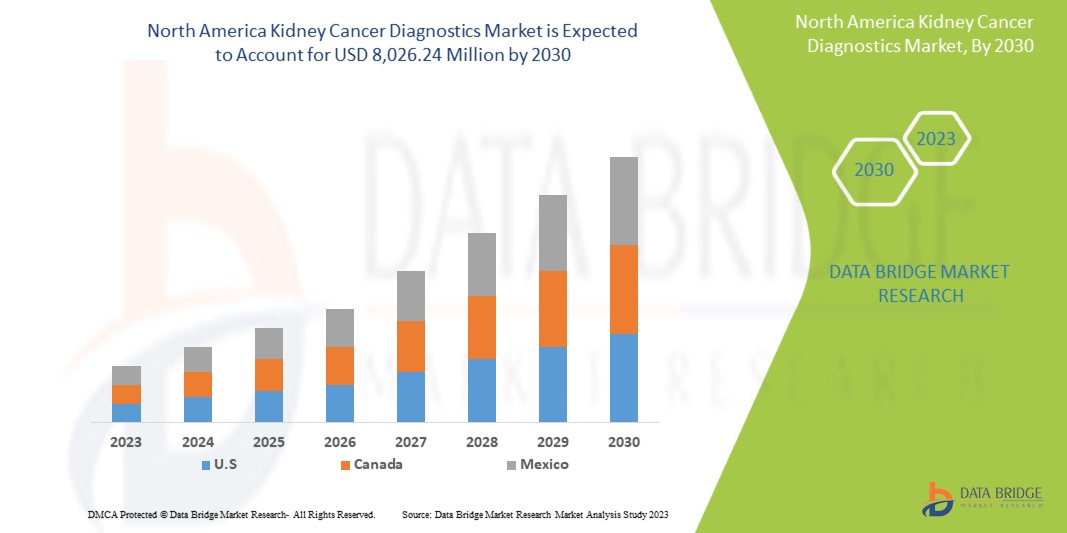

Data Bridge Market Research analyzes that the kidney cancer diagnostics market is expected to reach a value of USD 8,026.24 million by 2030, at a CAGR of 6.7% during the forecast period. Imaging accounts for the largest test type segment in the market due to the rising demand for smart devices, and increasing health expenditure has accelerated the demand for smart medical devices.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Années historiques |

2021 (personnalisable pour 2020-2016) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Par type de test (imagerie, test de biomarqueur, test sanguin, biopsie, test génétique et autres), stade du cancer (stade I, stade II, stade III et stade IV), type de tumeur (carcinome rénal, carcinome rénal à cellules claires, carcinome rénal à cellules non claires), produit (produits basés sur une plateforme, produits basés sur un instrument, kits et réactifs et autres consommables), technologie (hybridation in situ fluorescente, séquençage de nouvelle génération, fluoroimmuno-essai, hybridation génomique comparative, immunohistochimique et autres), application (dépistage, diagnostic et prédictif, pronostic et recherche), utilisateur final (hôpitaux, centres de diagnostic, centres de recherche sur le cancer, instituts universitaires, centres de chirurgie ambulatoire et autres), canal de distribution (appel d'offres direct, vente au détail et autres). |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

Siemens Healthcare GmbH, Koninklijke Philips NV, FUJIFILM Corporation, Grail, Laboratory Corporation of America Holdings, Thermo Fisher Scientific, Myriad Genetics, Inc., CANON MEDICAL SYSTEMS CORPORATION, QIAGEN, Illumina Inc., Ambry Genetics, Invitae Corporation, General Electric Company, Centogene NV, GenPath, Creative Diagnostics, GeneDx LLC, Blueprint Genetics Oy, BioVendor R&D, et CD Genomics, et BD, entre autres |

Définition du marché

Le cancer du rein, communément appelé cancer du rein, est une maladie dans laquelle les cellules rénales se développent en tumeurs malignes (cancéreuses) et se développent de manière incontrôlable. L'un des 10 cancers les plus répandus est le cancer du rein. Le cancer du rein est mortel et le processus de diagnostic présente également des problèmes de sécurité ; il n'est pas rentable. Les patients cancéreux peuvent être hospitalisés et recevoir une variété de thérapies, telles que la chirurgie, la radiothérapie et la thérapie systémique. Environ 40 % des excroissances rénales sont de minuscules masses localisées. Localisé fait référence à une tumeur qui ne s'est pas propagée à partir de son emplacement d'origine. Les masses rénales ne peuvent pas être détectées par des procédures de laboratoire régulières. Le diagnostic du cancer du rein comprend des procédures de biopsie, des analyses de sang et des tests d'imagerie. Des thérapies avancées contre le cancer du rein, comme l'immunothérapie, la radiothérapie, etc., sont conseillées. En raison de méthodes de pointe, des procédures non chirurgicales comme la cryoablation (qui gèle les cellules cancéreuses) et l'ablation par radiofréquence sont parfois utilisées pour traiter les tumeurs rénales mineures (chaleur des cellules cancéreuses).

Le cancer du rein peut être difficile à diagnostiquer car, malgré la grande diversité de ses signes et symptômes, ils ne sont pas spécifiques et peuvent être liés à d’autres pathologies plus répandues. Plus de 43 000 hommes et 25 000 femmes reçoivent un diagnostic de cancer du rein et du bassinet chaque année, et 9 000 hommes et 5 000 femmes décèdent des suites de cette maladie. Cependant, les réglementations et normes strictes concernant l’approbation et la commercialisation des produits de diagnostic du cancer du rein devraient freiner la croissance du marché.

Dynamique du marché du diagnostic du cancer du rein en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Prévalence croissante du cancer du rein

Tous les âges peuvent être touchés par ce type de cancer. Le cancer du rein peut être difficile à diagnostiquer car, malgré sa large gamme de signes et de symptômes, ils ne sont pas spécifiques et peuvent être liés à d’autres pathologies plus répandues. Le cancer du rein ne présente généralement aucun signe ni symptôme à ses débuts. Au fil du temps, des signes et symptômes peuvent apparaître, notamment du sang dans les urines, qui peut paraître rose, rouge ou de couleur cola, des douleurs au dos ou au côté qui ne disparaissent pas, une perte d’appétit, une perte de poids inexpliquée, de la fatigue et de la fièvre. Chez l’adulte, le cancer du rein est le type de cancer le plus courant. Les jeunes enfants sont plus susceptibles de développer un type de cancer du rein appelé tumeur de Wilms. Le cancer du rein (également appelé cancer du rein ou adénocarcinome à cellules rénales) est le 14e cancer le plus courant dans le monde. Il est 9e chez les hommes et 14e chez les femmes. En 2020, plus de 30 000 nouveaux cas de cancer du rein ont été diagnostiqués.

En raison de divers facteurs de risque tels que le tabagisme, l'obésité, l'hypertension artérielle ou les antécédents familiaux de cancer du rein, le nombre de patients atteints d'un cancer du rein est en hausse en Amérique du Nord et constitue un problème socio-économique majeur. Ainsi, le nombre croissant de patients atteints d'un cancer du rein augmente la demande de produits de diagnostic du cancer du rein, qui agissent comme un moteur sur le marché du diagnostic du cancer du rein en Amérique du Nord.

- Augmentation des procédures de diagnostic du cancer du rein

Les techniques utilisées pour diagnostiquer le cancer du rein comprennent l'échographie, la tomodensitométrie (TDM), l'imagerie par résonance magnétique (IRM) et, parfois, la tomographie par émission de positons (TEP). Le traitement du cancer du rein à croissance lente peut nécessiter une surveillance. La chimiothérapie pour les tumeurs malignes est parfois associée à une radiothérapie et à une greffe de cellules souches. L'augmentation des taux de cancer a été un facteur favorisant l'approbation croissante de produits diagnostiques.

L'augmentation du nombre d'approbations de produits de diagnostic a conduit à une augmentation du nombre de produits hautement efficaces sur le marché du traitement diagnostique du cancer du rein. Cela devrait servir de moteur à la croissance du marché nord-américain du diagnostic du cancer du rein.

Opportunité

-

Augmentation de la préférence pour les examens de santé préventifs

Les examens de santé préventifs sont des mesures préventives réalisées pour la détection initiale d'un cancer du rein. De plus, la préférence croissante pour les examens de santé préventifs offre une protection contre une exposition probable à une quelconque maladie à l'avenir.

La sensibilisation au dépistage est l'élément le plus important de la prévention du cancer du rein. Le bilan comprend l'identification du cancer et l'examen des facteurs de risque pour limiter la perte à un stade précoce.

Le contrôle préventif du cancer du rein est effectué à l'aide de divers tests diagnostiques, qui comprennent la biopsie, l'immunohistochimie, le dépistage du cancer, l'IRM et autres.

Les gens sont relativement plus exposés aux maladies du cancer du rein. Par conséquent, ils doivent se soumettre à des examens réguliers pour permettre aux médecins de mieux comprendre les maladies et de fournir un meilleur traitement aux patients atteints de cancer. C'est pourquoi la préférence croissante pour les examens de santé préventifs devrait agir comme un moteur de la croissance du marché nord-américain du diagnostic du cancer du rein.

Retenue/Défi

- Réglementations et normes strictes pour l'approbation et la commercialisation des produits de diagnostic du cancer du rein

Les réglementations strictes pour la commercialisation de tout produit sur le marché s'avèrent être un grand défi pour les fabricants de produits de diagnostic du cancer en Amérique du Nord qui ont des réglementations et un organisme différent pour les procédures réglementaires.

Les fabricants doivent d'abord vérifier l'approbation du marquage CE pour la commercialisation de leur produit sur le marché nord-américain. Les politiques réglementaires strictes devraient entraver le développement du marché du diagnostic du cancer. L'exigence réglementaire d'approbation de la commercialisation ou de la certification CE et l'application des lois et réglementations pourraient entraîner des changements commerciaux majeurs ou des pénalités, y compris la perte potentielle de licences commerciales. Les ressources et les coûts nécessaires pour se conformer à ces lois, règles et réglementations sont élevés.

Les exigences réglementaires en matière d'approbation de mise sur le marché, de déclaration de conformité et de délai d'examen réglementaire peuvent varier selon les produits. L'entreprise qui n'obtient pas l'approbation réglementaire porte préjudice à son activité car sans l'approbation ou sans l'approbation du marquage CE sur les produits, les fabricants ne sont pas en mesure de lancer leur produit sur le marché nord-américain. Pour cette raison, des réglementations et des normes strictes pour l'approbation et la commercialisation des produits de diagnostic du cancer du rein devraient constituer un frein pour le marché nord-américain du diagnostic du cancer du rein.

Développements récents

- En novembre 2022, Koninklijke Philips NV a annoncé le lancement en Amérique du Nord d'une solution d'échographie portable compacte de nouvelle génération lors de la réunion annuelle de la Radiological Society of North America (RSNA) afin d'apporter la qualité diagnostique associée aux systèmes d'échographie sur chariot haut de gamme à un plus grand nombre de patients. Elle est portable et polyvalente avec une bonne qualité d'image ou de performances. Elle est compatible avec les systèmes d'échographie Philips Affiniti et la sonde EPIQ. Cela a aidé l'entreprise à élargir son portefeuille de produits.

- En octobre 2022, General Electric Company a collaboré avec plusieurs instituts de recherche comme les hôpitaux de l'Université de Cambridge, Sophia Genetics et auparavant avec Optellum pour utiliser les données d'imagerie en collaboration avec l'intelligence artificielle. Cela contribuera à réduire le temps de diagnostic de plusieurs cancers et à fournir des soins personnalisés aux patients. Cela a aidé l'entreprise à élargir ses horizons en matière de diagnostic du cancer.

- En juillet 2022, Canon Medical Systems USA Inc. a annoncé la finalisation de l'acquisition de NXC Imaging, un distributeur d'équipements d'imagerie médicale et fournisseur de services situé dans le Minnesota, aux États-Unis. Cela se traduit par l'élargissement de la portée des services sur le marché nord-américain.

Portée du marché du diagnostic du cancer du rein en Amérique du Nord

Le marché nord-américain du diagnostic du cancer du rein est segmenté en huit segments notables en fonction du type de test, du stade du cancer, du type de tumeur, du produit, de l'application, de la technologie, de l'utilisateur final et du canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Type de test

- TEST D'IMAGERIE

- TEST DE BIOMARQUEURS

- ANALYSE DE SANG

- BIOPSIE

- TEST GÉNÉTIQUE

- AUTRES

Sur la base du type de test, le marché nord-américain du diagnostic du cancer du rein est segmenté en imagerie, test de biomarqueurs, test sanguin, biopsie, tests génétiques et autres.

Stade du cancer

- ÉTAPE I

- PHASE II

- PHASE III

- STADE IV

Sur la base du stade du cancer, le marché nord-américain du diagnostic du cancer du rein est segmenté en stade I, stade II, stade III et stade IV.

Type de tumeur

- CARCINOME RÉNAL

- CARCINOME RÉNAL À CELLULES CLAIRES

- CARCINOME RÉNAL À CELLULES NON CLAIRES

Sur la base du type de tumeur, le marché nord-américain du diagnostic du cancer du rein est segmenté en carcinome à cellules rénales, carcinome à cellules claires et carcinome à cellules rénales non claires.

Produit

- PRODUITS BASÉS SUR UNE PLATEFORME

- PRODUITS BASÉS SUR DES INSTRUMENTS

- KITS ET REACTIFS

- AUTRES CONSOMMABLES

Sur la base du produit, le marché nord-américain du diagnostic du cancer du rein est segmenté en produits basés sur des instruments, produits basés sur des plates-formes, kits et réactifs et autres consommables.

Technologie

- HYBRIDATION IN SITU FLUORESCENTE

- SÉQUENÇAGE DE NOUVELLE GÉNÉRATION

- DOSAGE PAR FLUOROIMMUNO-ESSAI

- HYBRIDATION GÉNOMIQUE COMPARATIVE

- IMMUNOHISTOCHIMIQUE

- AUTRES

Sur la base de la technologie, le marché nord-américain du diagnostic du cancer du rein est segmenté en hybridation fluorescente in situ, séquençage de nouvelle génération, dosage immunofluorescent, hybridation génomique comparative, immunohistochimie et autres.

Application

- DÉPISTAGE

- DIAGNOSTIC ET PRÉDICTION

- PRONOSTIC

- RECHERCHE

Sur la base des applications, le marché nord-américain du diagnostic du cancer du rein est segmenté en dépistage, diagnostic et prédiction, pronostic et recherche.

Utilisateur final

- HÔPITAUX

- CENTRES DE RECHERCHE SUR LE CANCER

- INSTITUTS ACADÉMIQUES

- CENTRES DE DIAGNOSTIC

- CENTRES DE CHIRURGIES AMBULATOIRES

- AUTRES

Sur la base des utilisateurs finaux, le marché nord-américain du diagnostic du cancer du rein est segmenté en hôpitaux, centres de diagnostic, centres de recherche sur le cancer, instituts universitaires, centres de chirurgie ambulatoire et autres.

Canal de distribution

- APPELS D'OFFRES DIRECTS

- VENTES AU DÉTAIL

- AUTRES

Sur la base du canal de distribution, le marché nord-américain du diagnostic du cancer du rein est segmenté en appels d'offres directs, ventes au détail et autres.

Analyse/perspectives régionales du marché du diagnostic du cancer du rein en Amérique du Nord

Le marché nord-américain du diagnostic du cancer du rein est analysé et des informations sur la taille du marché sont fournies en fonction du pays, du type de test, du stade du cancer, du type de tumeur, du produit, de l'application, de la technologie, de l'utilisateur final et du canal de distribution.

Les pays couverts dans ce rapport de marché sont les États-Unis, le Canada et le Mexique.

L'Amérique du Nord domine le marché grâce à la présence d'acteurs clés sur le plus grand marché de consommation avec un PIB élevé. Les États-Unis devraient connaître une croissance grâce à l'augmentation des progrès technologiques dans le secteur de la santé.

La section du rapport sur les pays fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs douaniers d'import-export sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du diagnostic du cancer du rein en Amérique du Nord

Le paysage concurrentiel du marché du diagnostic du cancer du rein fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les approbations de produits, la largeur et l'étendue du produit, la domination des applications et la courbe de survie du type de produit. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise vers le marché du diagnostic du cancer du rein.

Some of the major players operating in the market are Siemens Healthcare GmbH, Koninklijke Philips N.V., FUJIFILM Corporation, Grail, Laboratory Corporation of America Holdings, Thermo Fisher Scientific, Myriad Genetics, Inc., CANON MEDICAL SYSTEMS CORPORATION, QIAGEN, Illumina Inc., Ambry Genetics, Invitae Corporation, General Electric Company, Centogene N.V., GenPath, Creative Diagnostics, GeneDx LLC, Blueprint Genetics Oy, BioVendor R&D, and CD Genomics, and BD, among others.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 TEST TYPE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S 5 FORCES

4.3 EPIDEMIOLOGY

4.3.1 KIDNEY CANCER INCIDENCES, 2020, BY BOTH SEXES

4.3.2 KIDNEY CANCER MORTALITY, 2020, BY BOTH SEXES

5 INDUSTRY INSIGHTS

6 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET, REGULATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWING PREVALENCE OF KIDNEY CANCER

7.1.2 INCREASE IN DIAGNOSTIC PROCEDURES FOR KIDNEY CANCER

7.1.3 RISE IN HEALTHCARE EXPENDITURE FOR CANCER DIAGNOSIS AND TREATMENT

7.1.4 RISING AWARENESS TOWARDS KIDNEY CANCER

7.2 RESTRAINTS

7.2.1 STRICT REGULATIONS AND STANDARDS FOR THE APPROVAL AND COMMERCIALIZATION OF KIDNEY CANCER DIAGNOSTIC PRODUCTS

7.2.2 TISSUE DAMAGE DUE TO HIGH RADIATION EXPOSURE FROM IMAGING TESTS

7.3 OPPORTUNITIES

7.3.1 RISING PREFERENCE FOR PREVENTIVE HEALTH CHECK-UPS

7.3.2 GOVERNMENT INITIATIVES TOWARD KIDNEY CANCER DIAGNOSTICS

7.3.3 GROWING DEMAND FOR BETTER QUALITY HEALTHCARE

7.3.4 INCREASED DEMAND FOR NON-INVASIVE TESTING METHODS

7.4 CHALLENGES

7.4.1 LACK OF SKILLED AND CERTIFIED PROFESSIONALS

7.4.2 HIGH COST OF DIAGNOSTICS PROCEDURE FOR KIDNEY CANCERS

8 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE

8.1 OVERVIEW

8.2 IMAGING

8.2.1 COMPUTED TOMOGRAPHY

8.2.2 ULTRASOUND

8.2.3 MAGNETIC RESONANCE IMAGING (MRI)

8.2.4 ANGIOGRAPHY

8.2.5 X-RAY

8.2.6 OTHERS

8.3 BLOOD TEST

8.4 BIOPSY

8.4.1 FINE NEEDLE ASPIRATION

8.4.2 NEEDLE CORE BIOPSY

8.5 BIOMARKER TEST

8.5.1 AQUAPORIN 1 (AQP1)

8.5.2 PERILIPIN (PLIN2)

8.5.3 N-METHYLTRANSFERASE (NMNT)

8.5.4 L-PLASTIN (LCP-1)

8.5.5 NM23A

8.6 GENETIC TEST

8.7 OTHERS

9 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET, BY CANCER STAGE

9.1 OVERVIEW

9.2 STAGE I

9.3 STAGE II

9.4 STAGE III

9.5 STAGE IV

10 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET, BY TUMOR TYPE

10.1 OVERVIEW

10.2 RENAL CELL CARCINOMA

10.2.1 IMAGING

10.2.2 BLOOD TEST

10.2.3 BIOPSY

10.2.4 BIOMARKER TEST

10.2.5 GENETIC TEST

10.2.6 OTHERS

10.3 CLEAR CELL RENAL CELL CARCINOMA

10.3.1 IMAGING

10.3.2 BLOOD TEST

10.3.3 BIOPSY

10.3.4 BIOMARKER TEST

10.3.5 GENETIC TEST

10.3.6 OTHERS

10.4 NON CLEAR CELL RENAL CELL CARCINOMA

10.4.1 PAPILLARY RENAL CELL CARCINOMA

10.4.1.1 IMAGING

10.4.1.2 BLOOD TEST

10.4.1.3 BIOPSY

10.4.1.4 BIOMARKER TEST

10.4.1.5 GENETIC TEST

10.4.1.6 OTHERS

10.4.2 CHROMOPHOBE RENAL CELL CARCINOMA

10.4.2.1 IMAGING

10.4.2.2 BLOOD TEST

10.4.2.3 BIOPSY

10.4.2.4 BIOMARKER TEST

10.4.2.5 GENETIC TEST

10.4.2.6 OTHERS

11 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT

11.1 OVERVIEW

11.2 INSTRUMENT BASED PRODUCTS

11.2.1 IMAGING

11.2.2 BIOPSY

11.3 PLATFORM BASED PRODUCTS

11.3.1 NEXT GENERATION SEQUENCING

11.3.2 MICROARRAYS

11.3.3 PCR

11.3.4 OTHERS

11.4 KITS AND REAGENTS

11.4.1 RENAL CANCER PANELS

11.4.2 RENAL CANCER ANTIBODIES

11.5 OTHER CONSUMABLES

12 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET, BY TECHNOLOGY

12.1 OVERVIEW

12.2 FLUORESCENT IN SITU HYBRIDIZATION

12.3 NEXT GENERATION SEQUENCING

12.4 FLUORIMMUNOASSAY

12.5 COMPARATIVE GENOMIC HYBRIDIZATION

12.6 IMMUNOHISTOCHEMICAL

12.7 OTHERS

13 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 SCREENING

13.2.1 INSTRUMENT BASED PRODUCTS

13.2.2 PLATFORM BASED PRODUCTS

13.2.3 KITS AND REAGENTS

13.2.4 OTHER CONSUMABLES

13.3 DIAGNOSTIC AND PREDICTIVE

13.3.1 INSTRUMENT BASED PRODUCTS

13.3.2 PLATFORM BASED PRODUCTS

13.3.3 KITS AND REAGENTS

13.3.4 OTHER CONSUMABLES

13.4 PROGNOSTIC

13.4.1 INSTRUMENT BASED PRODUCTS

13.4.2 PLATFORM BASED PRODUCTS

13.4.3 KITS AND REAGENTS

13.4.4 OTHER CONSUMABLES

13.5 RESEARCH

13.5.1 INSTRUMENT BASED PRODUCTS

13.5.2 PLATFORM BASED PRODUCTS

13.5.3 KITS AND REAGENTS

13.5.4 OTHER CONSUMABLES

14 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET, BY END USER

14.1 OVERVIEW

14.2 HOSPITALS

14.3 DIAGNOSTIC CENTERS

14.4 CANCER RESEARCH CENTERS

14.5 ACADEMIC INSTITUTES

14.6 AMBULATORY SURGICAL CENTERS

14.7 OTHERS

15 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 DIRECT TENDER

15.3 RETAIL SALES

15.4 OTHERS

16 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

17 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 CANON MEDICAL SYSTEMS CORPORATION

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY PROFILE

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENT

19.2 KONINKLIJKE PHILIPS N.V.

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY PROFILE

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENTS

19.3 GENERAL ELECTRIC COMPANY

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 COMPANY PROFILE

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENTS

19.4 SIEMENS HEALTHCARE GMBH

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY PROFILE

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENT

19.5 GRAIL

19.5.1 COMPANY SNAPSHOT

19.5.2 PRODUCT PORTFOLIO

19.5.3 RECENT DEVELOPMENTS

19.6 AMBRY GENETICS

19.6.1 COMPANY SNAPSHOT

19.6.2 PRODUCT PORTFOLIO

19.6.3 RECENT DEVELOPMENT

19.7 BIOVENDOR R&D

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENT

19.8 BLUEPRINT GENETICS OY.

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENT

19.9 CD GENOMICS

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENT

19.1 CENTOGENE N.V.

19.10.1 COMPANY SNAPSHOT

19.10.2 REVENUE ANALYSIS

19.10.3 PRODUCT PORTFOLIO

19.10.4 RECENT DEVELOPMENT

19.11 CREATIVE DIAGNOSTICS

19.11.1 COMPANY SNAPSHOT

19.11.2 PRODUCT PORTFOLIO

19.11.3 RECENT DEVELOPMENT

19.12 FUJIFILM CORPORATION

19.12.1 COMPANY SNAPSHOT

19.12.2 REVENUE ANALYSIS

19.12.3 PRODUCT PORTFOLIO

19.12.4 RECENT DEVELOPMENTS

19.13 GENEDX, LLC

19.13.1 COMPANY SNAPSHOT

19.13.2 REVENUE ANALYSIS

19.13.3 PRODUCT PORTFOLIO

19.13.4 RECENT DEVELOPMENT

19.14 GENPATH, A DIVISION OF BIOREFERENCE LABORATORIES, AN OPKO HEALTH INC. COMPANY

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENT

19.15 ILLUMINA, INC.

19.15.1 COMPANY SNAPSHOT

19.15.2 REVENUE ANALYSIS

19.15.3 PRODUCT PORTFOLIO

19.15.4 RECENT DEVELOPMENT

19.16 INVITAE CORPORATION

19.16.1 COMPANY SNAPSHOT

19.16.2 REVENUE ANALYSIS

19.16.3 PRODUCT PORTFOLIO

19.16.4 RECENT DEVELOPMENT

19.17 LABORATORY CORPORATION OF AMERICA HOLDINGS

19.17.1 COMPANY SNAPSHOT

19.17.2 REVENUE ANALYSIS

19.17.3 PRODUCT PORTFOLIO

19.17.4 RECENT DEVELOPMENTS

19.18 MYRIAD GENETICS, INC.

19.18.1 COMPANY SNAPSHOT

19.18.2 REVENUE ANALYSIS

19.18.3 PRODUCT PORTFOLIO

19.18.4 RECENT DEVELOPMENT

19.19 THERMO FISHER SCIENTIFIC INC.

19.19.1 COMPANY SNAPSHOT

19.19.2 REVENUE ANALYSIS

19.19.3 PRODUCT PORTFOLIO

19.19.4 RECENT DEVELOPMENT

19.2 QIAGEN

19.20.1 COMPANY SNAPSHOT

19.20.2 REVENUE ANALYSIS

19.20.3 PRODUCT PORTFOLIO

19.20.4 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

Liste des tableaux

TABLE 1 ESTIMATED NEW CANCER CASES AND DEATHS

TABLE 2 APPROVED DIAGNOSTICS OF KIDNEY CANCER

TABLE 3 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA IMAGING IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA IMAGING IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA BLOOD TEST IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA BIOPSY IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA BIOPSY IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA BIOMARKER TEST IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA BIOMARKER TEST IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA GENETIC TEST IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA OTHERS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET, BY CANCER STAGE, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA STAGE I IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA STAGE II IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA STAGE III IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA STAGE IV IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET, BY TUMOR TYPE, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA RENAL CELL CARCINOMA IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA RENAL CELL CARCINOMA IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA CLEAR CELL RENAL CELL CARCINOMA IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA CLEAR CELL RENAL CELL CARCINOMA IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA NON CLEAR CELL RENAL CELL CARCINOMA IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA NON CLEAR CELL RENAL CELL CARCINOMA IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TUMOR TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA PAPILLARY RENAL CELL CARCINOMA IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA CHROMOPHOBE RENAL CELL CARCINOMA IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA INSTRUMENT BASED PRODUCTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA INSTRUMENT BASED PRODUCTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA INSTRUMENT BASED PRODUCTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 31 NORTH AMERICA INSTRUMENT BASED PRODUCTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD)

TABLE 32 NORTH AMERICA PLATFORM BASED PRODUCTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA PLATFORM BASED PRODUCTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA PLATFORM BASED PRODUCTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 35 NORTH AMERICA PLATFORM BASED PRODUCTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD)

TABLE 36 NORTH AMERICA KITS AND REAGENTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA KITS AND REAGENTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA KITS AND REAGENTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA KITS AND REAGENTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA OTHER CONSUMABLES IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA FLUORESCENT IN SITU HYBRIDIZATION IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA NEXT GENERATION SEQUENCING IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA FLUORIMMUNOASSAY IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA COMPARATIVE GENOMIC HYBRIDIZATION IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA IMMUNOHISTOCHEMICAL IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA OTHERS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA SCREENING IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA SCREENING IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA DIAGNOSTIC AND PREDICTIVE IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA DIAGNOSTIC AND PREDICTIVE IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA PROGNOSTIC IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA PROGNOSTIC IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA RESEARCH IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA RESEARCH IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA HOSPITALS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 59 NORTH AMERICA DIAGNOSTIC CENTERS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA CANCER RESEARCH CENTERS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA ACADEMIC INSTITUTES IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 63 NORTH AMERICA OTHERS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 65 NORTH AMERICA DIRECT TENDER IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA RETAIL SALES IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 67 NORTH AMERICA OTHERS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 68 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 69 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA IMAGING IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 71 NORTH AMERICA BIOPSY IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 72 NORTH AMERICA BIOMARKER TEST IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 73 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET, BY CANCER STAGE, 2021-2030 (USD MILLION)

TABLE 74 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET, BY TUMOR TYPE, 2021-2030 (USD MILLION)

TABLE 75 NORTH AMERICA RENAL CELL CARCINOMA IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 76 NORTH AMERICA CLEAR CELL RENAL CELL CARCINOMA IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 77 NORTH AMERICA NON CLEAR CELL RENAL CELL CARCINOMA IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TUMOR TYPE, 2021-2030 (USD MILLION)

TABLE 78 NORTH AMERICA PAPILLARY RENAL CELL CARCINOMA IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 79 NORTH AMERICA CHROMOPHOBE RENAL CELL CARCINOMA IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 80 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 81 NORTH AMERICA INSTRUMENT BASED PRODUCTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 82 NORTH AMERICA INSTRUMENT BASED PRODUCTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 83 NORTH AMERICA INSTRUMENT BASED PRODUCTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD)

TABLE 84 NORTH AMERICA PLATFORM BASED PRODUCTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 85 NORTH AMERICA PLATFORM BASED PRODUCTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 86 NORTH AMERICA PLATFORM BASED PRODUCTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD)

TABLE 87 NORTH AMERICA KITS AND REAGENTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 88 NORTH AMERICA KITS AND REAGENTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 89 NORTH AMERICA KITS AND REAGENTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 90 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 91 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 92 NORTH AMERICA SCREENING IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 93 NORTH AMERICA DIAGNOSTIC AND PREDICTIVE IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 94 NORTH AMERICA PROGNOSTIC IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 95 NORTH AMERICA RESEARCH IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 96 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 97 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 98 U.S. KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 99 U.S. IMAGING IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 100 U.S. BIOPSY IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 101 U.S. BIOMARKER TEST IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 102 U.S. KIDNEY CANCER DIAGNOSTICS MARKET, BY CANCER STAGE, 2021-2030 (USD MILLION)

TABLE 103 U.S. KIDNEY CANCER DIAGNOSTICS MARKET, BY TUMOR TYPE, 2021-2030 (USD MILLION)

TABLE 104 U.S. RENAL CELL CARCINOMA IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 105 U.S. CLEAR CELL RENAL CELL CARCINOMA IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 106 U.S. NON CLEAR CELL RENAL CELL CARCINOMA IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TUMOR TYPE, 2021-2030 (USD MILLION)

TABLE 107 U.S. PAPILLARY RENAL CELL CARCINOMA IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 108 U.S. CHROMOPHOBE RENAL CELL CARCINOMA IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 109 U.S. KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 110 U.S. INSTRUMENT BASED PRODUCTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 111 U.S. INSTRUMENT BASED PRODUCTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 112 U.S. INSTRUMENT BASED PRODUCTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD)

TABLE 113 U.S. PLATFORM BASED PRODUCTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 114 U.S. PLATFORM BASED PRODUCTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 115 U.S. PLATFORM BASED PRODUCTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD)

TABLE 116 U.S. KITS AND REAGENTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 117 U.S. KITS AND REAGENTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 118 U.S. KITS AND REAGENTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD)

TABLE 119 U.S. KIDNEY CANCER DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 120 U.S. KIDNEY CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 121 U.S. SCREENING IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 122 U.S. DIAGNOSTIC AND PREDICTIVE IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 123 U.S. PROGNOSTIC IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 124 U.S. RESEARCH IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 125 U.S. KIDNEY CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 126 U.S. KIDNEY CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 127 CANADA KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 128 CANADA IMAGING IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 129 CANADA BIOPSY IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 130 CANADA BIOMARKER TEST IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 131 CANADA KIDNEY CANCER DIAGNOSTICS MARKET, BY CANCER STAGE, 2021-2030 (USD MILLION)

TABLE 132 CANADA KIDNEY CANCER DIAGNOSTICS MARKET, BY TUMOR TYPE, 2021-2030 (USD MILLION)

TABLE 133 CANADA RENAL CELL CARCINOMA IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 134 CANADA CLEAR CELL RENAL CELL CARCINOMA IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 135 CANADA NON CLEAR CELL RENAL CELL CARCINOMA IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TUMOR TYPE, 2021-2030 (USD MILLION)

TABLE 136 CANADA PAPILLARY RENAL CELL CARCINOMA IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 137 CANADA CHROMOPHOBE RENAL CELL CARCINOMA IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 138 CANADA KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 139 CANADA INSTRUMENT BASED PRODUCTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 140 CANADA INSTRUMENT BASED PRODUCTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 141 CANADA INSTRUMENT BASED PRODUCTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD)

TABLE 142 CANADA PLATFORM BASED PRODUCTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 143 CANADA PLATFORM BASED PRODUCTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 144 CANADA PLATFORM BASED PRODUCTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD)

TABLE 145 CANADA KITS AND REAGENTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 146 CANADA KITS AND REAGENTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 147 CANADA KITS AND REAGENTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD)

TABLE 148 CANADA KIDNEY CANCER DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 149 CANADA KIDNEY CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 150 CANADA SCREENING IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 151 CANADA DIAGNOSTIC AND PREDICTIVE IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 152 CANADA PROGNOSTIC IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 153 CANADA RESEARCH IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 154 CANADA KIDNEY CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 155 CANADA KIDNEY CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 156 MEXICO KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 157 MEXICO IMAGING IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 158 MEXICO BIOPSY IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 159 MEXICO BIOMARKER TEST IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 160 MEXICO KIDNEY CANCER DIAGNOSTICS MARKET, BY CANCER STAGE, 2021-2030 (USD MILLION)

TABLE 161 MEXICO KIDNEY CANCER DIAGNOSTICS MARKET, BY TUMOR TYPE, 2021-2030 (USD MILLION)

TABLE 162 MEXICO RENAL CELL CARCINOMA IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 163 MEXICO CLEAR CELL RENAL CELL CARCINOMA IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 164 MEXICO NON CLEAR CELL RENAL CELL CARCINOMA IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TUMOR TYPE, 2021-2030 (USD MILLION)

TABLE 165 MEXICO PAPILLARY RENAL CELL CARCINOMA IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 166 MEXICO CHROMOPHOBE RENAL CELL CARCINOMA IN KIDNEY CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 167 MEXICO KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 168 MEXICO INSTRUMENT BASED PRODUCTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 169 MEXICO INSTRUMENT BASED PRODUCTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 170 MEXICO INSTRUMENT BASED PRODUCTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD)

TABLE 171 MEXICO PLATFORM BASED PRODUCTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 172 MEXICO PLATFORM BASED PRODUCTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 173 MEXICO PLATFORM BASED PRODUCTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD)

TABLE 174 MEXICO KITS AND REAGENTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 175 MEXICO KITS AND REAGENTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 176 MEXICO KITS AND REAGENTS IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD)

TABLE 177 MEXICO KIDNEY CANCER DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 178 MEXICO KIDNEY CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 179 MEXICO SCREENING IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 180 MEXICO DIAGNOSTIC AND PREDICTIVE IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 181 MEXICO PROGNOSTIC IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 182 MEXICO RESEARCH IN KIDNEY CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 183 MEXICO KIDNEY CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 184 MEXICO KIDNEY CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 11 GROWING AWARENESS OF KIDNEY CANCER AND INCREASING HEALTHCARE EXPENDITURE ARE EXPECTED TO DRIVE THE GROWTH OF THE NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET FROM 2023 TO 2030

FIGURE 12 THE IMAGING TEST SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET

FIGURE 14 KIDNEY CANCER INCIDENCE, BOTH SEXES, BY REGION (2020)

FIGURE 15 KIDNEY CANCER MORTALITY, BOTH SEXES, BY REGION (2020)

FIGURE 16 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET : BY TEST TYPE, 2022

FIGURE 17 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET : BY TEST TYPE, 2023-2030 (USD MILLION)

FIGURE 18 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET : BY TEST TYPE, CAGR (2023-2030)

FIGURE 19 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET : BY TEST TYPE, LIFELINE CURVE

FIGURE 20 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET : BY CANCER STAGE , 2022

FIGURE 21 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET : BY CANCER STAGE, 2023-2030 (USD MILLION)

FIGURE 22 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET : BY CANCER STAGE, CAGR (2023-2030)

FIGURE 23 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET : BY CANCER STAGE, LIFELINE CURVE

FIGURE 24 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET : BY TUMOR TYPE, 2022

FIGURE 25 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET : BY TUMOR TYPE, 2023-2030 (USD MILLION)

FIGURE 26 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET : BY TUMOR TYPE, CAGR (2023-2030)

FIGURE 27 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET : BY TUMOR TYPE, LIFELINE CURVE

FIGURE 28 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET : BY PRODUCT, 2022

FIGURE 29 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET : BY PRODUCT, 2023-2030 (USD MILLION)

FIGURE 30 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET : BY PRODUCT, CAGR (2023-2030)

FIGURE 31 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET : BY PRODUCT, LIFELINE CURVE

FIGURE 32 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET : BY TECHNOLOGY, 2022

FIGURE 33 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET : BY TECHNOLOGY, 2023-2030 (USD MILLION)

FIGURE 34 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET : BY TECHNOLOGY, CAGR (2023-2030)

FIGURE 35 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET : BY TECHNOLOGY, LIFELINE CURVE

FIGURE 36 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET : BY APPLICATION, 2022

FIGURE 37 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET : BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 38 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET : BY APPLICATION, CAGR (2023-2030)

FIGURE 39 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET : BY APPLICATION, LIFELINE CURVE

FIGURE 40 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET : BY END USER, 2022

FIGURE 41 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET : BY END USER, 2023-2030 (USD MILLION)

FIGURE 42 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET : BY END USER, CAGR (2023-2030)

FIGURE 43 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET : BY END USER, LIFELINE CURVE

FIGURE 44 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET : BY DISTRIBUTION CHANNEL, 2022

FIGURE 45 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET : BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 46 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET : BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 47 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET : BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 48 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET: SNAPSHOT (2022)

FIGURE 49 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET: BY COUNTRY (2022)

FIGURE 50 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 51 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 52 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET: TEST TYPE (2023-2030)

FIGURE 53 NORTH AMERICA KIDNEY CANCER DIAGNOSTICS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.