Marché des revêtements intumescents pour matériaux ignifuges et ignifuges appliqués par pulvérisation en Amérique du Nord, par type de produit (revêtements intumescents pour matériaux ignifuges et ignifuges appliqués par pulvérisation), type (couche épaisse et couche mince), résine (époxy, acrylique, alkyde, polyuréthane et autres), substrat (fonte structurelle et fonte, bois, éléments composites, autres), technologie (à base d'époxy, à base d'eau, à base de solvant et à base de poudre), application (hydrocarbures et cellulosiques), utilisateur final (bâtiment et constructions, pétrole et gaz, industrie, automobile, aérospatiale et autres), pays (États-Unis, Canada, Mexique), tendances du marché et prévisions jusqu'en 2028.

Analyse et perspectives du marché : Marché nord-américain des revêtements intumescents pour la protection contre le feu et des revêtements ignifuges appliqués par pulvérisation

Analyse et perspectives du marché : Marché nord-américain des revêtements intumescents pour la protection contre le feu et des revêtements ignifuges appliqués par pulvérisation

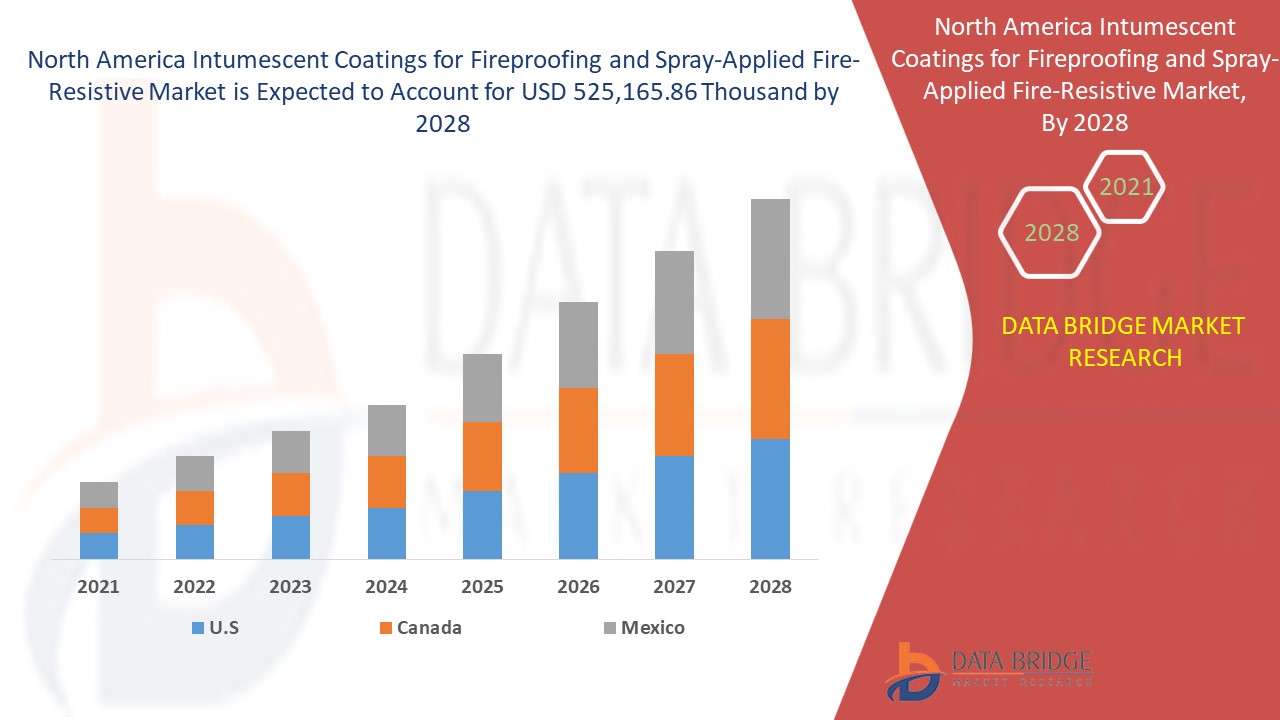

Les revêtements intumescents pour la protection contre le feu et le marché des produits ignifuges appliqués par pulvérisation devraient connaître une croissance du marché au cours de la période de prévision de 2021 à 2028. Data Bridge Market Research analyse que le marché croît à un TCAC de 4,9 % au cours de la période de prévision de 2020 à 2028 et devrait atteindre 525 165,86 milliers de dollars d'ici 2028.

Les revêtements intumescents pour matériaux ignifuges et ignifuges appliqués par pulvérisation sont des systèmes polymères de protection partielle contre l'incendie qui sont utilisés pour préserver l'intégrité structurelle des substrats en cas d'incendie. Ces revêtements intumescents pour matériaux ignifuges et ignifuges appliqués par pulvérisation peuvent réagir à la chaleur et former des charbons qui peuvent contrôler la propagation du feu pendant une courte période, comprise entre 15 et 120 minutes, afin que les personnes puissent être mises en sécurité par les pompiers et les responsables de la sécurité en cas d'incendie.

Les revêtements intumescents pour matériaux ignifuges et ignifuges appliqués par pulvérisation sont principalement fabriqués à partir de systèmes chimiques tels que les époxydes, le polyuréthane , les alkydes, entre autres, et sont généralement capables de former des revêtements minces et épais. Ces matériaux sont généralement capables de protéger des substrats tels que l'acier, le bois, les matériaux composites , entre autres. Ils sont généralement utilisés dans le bâtiment et la construction, les industries, l'aérospatiale, entre autres, où le risque d'incendie est nettement plus élevé.

Ce rapport sur le marché des revêtements intumescents pour l'ignifugation et les produits ignifuges appliqués par pulvérisation fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Amérique du Nord Revêtements intumescents pour l'ignifugation et revêtements ignifuges appliqués par pulvérisation Portée et taille du marché

Amérique du Nord Revêtements intumescents pour l'ignifugation et revêtements ignifuges appliqués par pulvérisation Portée et taille du marché

Le marché des revêtements intumescents pour la protection contre le feu et des revêtements ignifuges appliqués par pulvérisation en Amérique du Nord est segmenté en fonction du type de produit, du type, de la résine, du substrat, de la technologie, de l'application et de l'utilisateur final. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

- Sur la base du type de produit, le marché des revêtements intumescents pour matériaux ignifuges et ignifuges appliqués par pulvérisation est segmenté en revêtements intumescents pour matériaux ignifuges et ignifuges appliqués par pulvérisation. En 2021, le segment des revêtements intumescents pour matériaux ignifuges domine le marché en raison de l'adoption massive de revêtements intumescents pour matériaux ignifuges dans les nouveaux projets de construction.

- Sur la base du type, le marché des revêtements intumescents pour matériaux ignifuges et ignifuges appliqués par pulvérisation est segmenté en couches épaisses et couches minces. En 2021, le segment des couches épaisses domine le marché en raison de l'épaisseur plus élevée du film sec par rapport au film mince.

- Sur la base des résines, le marché des revêtements intumescents pour l'ignifugation et des matériaux ignifuges appliqués par pulvérisation est segmenté en époxy, acrylique, alkyde, polyuréthane et autres. En 2021, le segment époxy domine le marché en raison de la résistance élevée à la corrosion offerte par le segment.

- Sur la base du substrat, le marché des revêtements intumescents pour les matériaux ignifuges et ignifuges appliqués par pulvérisation est segmenté en acier de construction et fonte, bois, éléments composites et autres. En 2021, la demande de revêtements intumescents pour les applications sur l'acier de construction et la fonte augmente sur le marché en raison des énormes constructions résidentielles et commerciales dans la région.

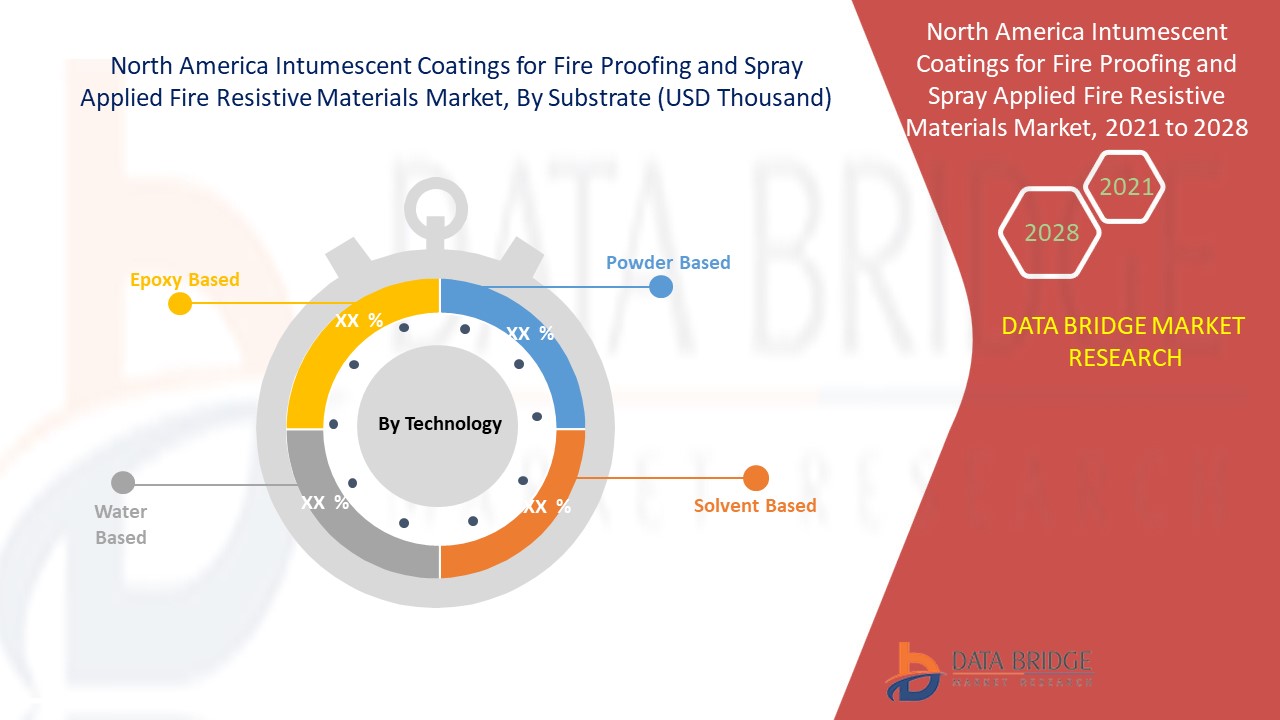

- Sur la base de la technologie, le marché des revêtements intumescents pour l'ignifugation et des matériaux ignifuges appliqués par pulvérisation est segmenté en revêtements à base d'époxy, à base d'eau, à base de solvant et à base de poudre. En 2021, le segment à base d'époxy domine le marché car les revêtements à base d'époxy offrent une excellente protection contre les incendies d'hydrocarbures, même dans les environnements les plus difficiles de la région.

- En fonction de l'application, le marché des revêtements intumescents pour matériaux ignifuges et ignifuges appliqués par pulvérisation est segmenté en hydrocarbures et cellulosiques. En 2021, le segment des hydrocarbures domine le marché car les revêtements en matériaux intumescents offrent une protection pour les structures en acier également dans un environnement à haut risque comme les plates-formes offshore et les usines pétrochimiques, où les incendies d'hydrocarbures sont fréquents.

- En fonction de l'utilisateur final, le marché des revêtements intumescents pour matériaux ignifuges et ignifuges appliqués par pulvérisation est segmenté en bâtiment et construction, pétrole et gaz, industrie, automobile, aérospatiale et autres. En 2021, le segment du bâtiment et de la construction domine le marché en raison du nombre croissant de constructions résidentielles et commerciales dans la région.

Analyse du marché des revêtements intumescents pour l'ignifugation et les revêtements ignifuges appliqués par pulvérisation au niveau des pays

Le marché nord-américain est analysé et des informations sur la taille du marché sont fournies par pays, type, qualité, application et utilisateur final.

Les pays couverts par les rapports sur le marché des revêtements intumescents pour la protection contre le feu et les produits ignifuges appliqués par pulvérisation sont les États-Unis, le Canada et le Mexique en Amérique du Nord.

Les États-Unis dominent le marché des revêtements intumescents pour la résistance au feu en Amérique du Nord, et le marché des revêtements ignifuges appliqués par pulvérisation domine le marché en raison de l'augmentation des activités aérospatiales et de construction de la région.

Revêtements intumescents pour la protection contre le feu et les produits ignifuges appliqués par pulvérisation, par substrat

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Croissance du secteur des revêtements intumescents pour l'ignifugation et des revêtements ignifuges appliqués par pulvérisation

Le marché nord-américain des revêtements intumescents pour l'ignifugation et les produits ignifuges appliqués par pulvérisation vous fournit également une analyse détaillée du marché pour chaque pays, la croissance de la base installée de différents types de produits pour le marché des revêtements intumescents pour l'ignifugation et les produits ignifuges appliqués par pulvérisation, l'impact de la technologie utilisant des courbes de vie et les changements dans les scénarios réglementaires des préparations pour nourrissons et leur impact sur le marché des revêtements intumescents pour l'ignifugation et les produits ignifuges appliqués par pulvérisation. Les données sont disponibles pour la période historique de 2010 à 2019.

Analyse du paysage concurrentiel et des parts de marché des revêtements intumescents pour l'ignifugation et les revêtements ignifuges appliqués par pulvérisation

Le paysage concurrentiel du marché des revêtements intumescents pour l'ignifugation et la résistance au feu par pulvérisation en Amérique du Nord fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais cliniques, l'analyse de la marque, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise liée au marché nord-américain des revêtements intumescents pour l'ignifugation et la résistance au feu par pulvérisation.

Les principaux acteurs couverts par le rapport sont : Jotun (une filiale d'Orkla), PPG Industries, Inc., AKZO NOBEL NV, The Sherwin-Williams Company, Hempel A/S, 3M, Etex Group, Flame Control, Isolatek International, MBCC Group, GCP Applied Technologies Inc., Contego International Inc., Teknos Group, Carboline (une filiale de RPM international Inc.), Arabian vermiculite industries., Sika AG, No-Burn, Inc., entre autres acteurs sur le marché national et en Amérique du Nord. Les analystes de DBMR comprennent les atouts de la concurrence et fournissent une analyse concurrentielle pour chaque concurrent séparément.

Par exemple,

- En juin 2021, Carboline a annoncé l'acquisition de Dudick Inc., un leader mondial de premier plan dans le domaine des revêtements hautes performances. Grâce à cette acquisition, l'entreprise prévoit de diversifier son portefeuille de produits et d'étendre ses activités globales.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING NUMBER OF FIRE INCIDENTS ACROSS THE WORLD

5.1.2 FAVOURABLE REGULATIONS, AND EMPHASIS ON FIRE PROTECTION MEASURES

5.1.3 SIZEABLE GROWTH IN THE CONSTRUCTION INDUSTRY ACROSS THE GLOBE

5.1.4 AVAILABILITY OF CUSTOMIZED PRODUCTS SPECIFICALLY MANUFACTURED FOR VARIOUS SUBSTRATES

5.1.5 HUGE CONSUMER DEMAND OF INTUMESCENT COATING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS FOR FIRE PROTECTING

5.2 RESTRAINTS

5.2.1 FLUCTUATIONS IN RAW MATERIALS PRICE

5.2.2 COMMERCIALIZATION OF LOW-COST ALTERNATIVES OF FIRE PROTECTION MATERIALS

5.2.3 GROWING ENVIRONMENTAL AND HEALTH CONCERNS REGARDING THE USAGE OF FIRE PROTECTION MATERIALS

5.3 OPPORTUNITIES

5.3.1 IMPROVEMENT IN THE TECHNOLOGY OF OVERALL FIRE PROOFING AND RESISTIVE MATERIALS

5.3.2 GROWING PREFERENCE FOR LIGHTWEIGHT FIRE PROOFING AND RESISTIVE MATERIALS IN THE BUILDING & CONSTRUCTION INDUSTRY

5.3.3 CONSIDERABLE GROWTH IN THE REQUIREMENT OF OIL AND GAS AND THE GROWING OFF-SHORE AND ON-SHORE PETROLEUM MINING

5.3.4 SIGNIFICANT GROWTH IN USAGES OF FIRE PROTECTION COATING IN AEROSPACE INDUSTRY

5.4 CHALLENGES

5.4.1 LACK OF AWARENESS AND NON-COMPLIANCE TO THE REGULATIONS IN THE EMERGING MARKETS

5.4.2 CONCERNS RELATED TO THE COATING APPLICATION AND DURABILITY

6 ANALYSIS ON IMPACT OF COVID-19 ON THE NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON PRICE

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 INTUMESCENT COATINGS FOR FIRE PROOFING

7.3 SPRAY APPLIED FIRE RESISTIVE MATERIALS

8 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY TYPE

8.1 OVERVIEW

8.2 THICK-FILM

8.3 THIN-FILM

9 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY RESIN

9.1 OVERVIEW

9.2 EPOXY

9.3 ACRYLIC

9.4 ALKYD

9.5 POLYURETHANE

9.6 OTHERS

10 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY SUBSTRATE

10.1 OVERVIEW

10.2 STRUCTURAL STEEL & CAST IRON

10.3 WOOD

10.4 COMPOSITE ELEMENTS

10.5 OTHERS

11 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY TECHNOLOGY

11.1 OVERVIEW

11.2 EPOXY BASED

11.3 WATER BASED

11.4 SOLVENT BASED

11.5 POWDER BASED

12 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 HYDROCARBON

12.3 CELLULOSIC

13 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY END-USER

13.1 OVERVIEW

13.2 BUILDING & CONSTRUCTION

13.2.1 BUILDING & CONSTRUCTION, BY END-USER

13.2.1.1 ROOFS

13.2.1.2 COLUMNS

13.2.1.3 FLOORS

13.2.1.4 OTHERS

13.2.2 BUILDING & CONSTRUCTION, BY TYPE

13.2.2.1 THICK-FILM

13.2.2.2 THIN-FILM

13.3 OIL & GAS

13.3.1 OIL & GAS, BY TYPE

13.3.1.1 THICK-FILM

13.3.1.2 THIN-FILM

13.4 INDUSTRIAL

13.4.1 INDUSTRIAL, BY TYPE

13.4.1.1 THICK-FILM

13.4.1.2 THIN-FILM

13.5 AUTOMOTIVE

13.5.1 AUTOMOTIVE, BY TYPE

13.5.1.1 THICK-FILM

13.5.1.2 THIN-FILM

13.6 AEROSPACE

13.6.1 AEROSPACE, BY TYPE

13.6.1.1 THICK-FILM

13.6.1.2 THIN-FILM

13.7 OTHERS

13.7.1 OTHERS, BY TYPE

13.7.1.1 THICK-FILM

13.7.1.2 THIN-FILM

14 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 PPG INDUSTRIES, INC.

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT UPDATE

17.2 AKZO NOBEL N.V.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT UPDATES

17.3 3M

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT UPDATES

17.4 THE SHERWIN-WILLIAMS COMPANY

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT UPDATES

17.5 ETEX GROUP

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT UPDATES

17.6 SIKA AG

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT UPDATES

17.7 CARBOLINE (A SUBSIDIARY OF RPM INTERNATIONAL INC.)

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT UPDATES

17.8 JOTUN (A SUBSIDIARY OF ORKLA)

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT UPDATE

17.9 HEMPEL A/S

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT UPDATES

17.1 GCP APPLIED TECHNOLOGIES INC.

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT UPDATE

17.11 ALBI PROTECTIVE COATINGS

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT UPDATES

17.12 ARABIAN VERMICULITE INDUSTRIES

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT UPDATES

17.13 CONTEGO INTERNATIONAL INC.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT UPDATE

17.14 CPG EUROPE

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT UPDATES

17.15 FLAME CONTROL

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT UPDATE

17.16 ISOLATEK INTERNATIONAL

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT UPDATE

17.17 MBCC GROUP

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT UPDATES

17.18 NO-BURN, INC.

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT UPDATE

17.19 RUDOLF HENSEL GMBH

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT UPDATE

17.2 TEKNOS GROUP

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT UPDATES

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

LIST OF TABLES

TABLE 1 IMPORT DATA OF CHEMICAL PRODUCTS AND PREPARATIONS OF THE CHEMICAL OR ALLIED INDUSTRIES, INCL. THOSE CONSISTING OF MIXTURES OF NATURAL PRODUCTS, N.E.S.; HS CODE - 382490 (USD THOUSAND)

TABLE 2 EXPORT DATA OF CHEMICAL PRODUCTS AND PREPARATIONS OF THE CHEMICAL OR ALLIED INDUSTRIES, INCL. THOSE CONSISTING OF MIXTURES OF NATURAL PRODUCTS, N.E.S.; HS CODE - 382490 (USD THOUSAND)

TABLE 3 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY PRODUCT TYPE, 2019-2028 (USD THOUSAND)

TABLE 4 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 5 NORTH AMERICA SPRAY APPLIED FIRE RESISTIVE MATERIALS IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 6 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 7 NORTH AMERICA THICK-FILM IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 8 NORTH AMERICA THIN-FILM IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 9 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 10 NORTH AMERICA EPOXY IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 11 NORTH AMERICA ARCYLIC IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 12 NORTH AMERICA ALKYD IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 13 NORTH AMERICA POLYURETHANE IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 14 NORTH AMERICA OTHERS IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 15 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY SUBSTRATE, 2019-2028 (USD THOUSAND)

TABLE 16 NORTH AMERICA STRUCTURAL STEEL & CAST IRON IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 17 NORTH AMERICA WOOD IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 18 NORTH AMERICA COMPOSITE ELEMENTS IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 19 NORTH AMERICA OTHERS IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 20 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TECHNOLOGY, 2019-2028 (USD THOUSAND))

TABLE 21 NORTH AMERICA EPOXY BASED IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 22 NORTH AMERICA WATER BASED IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 23 NORTH AMERICA SOLVENT BASED IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 24 NORTH AMERICA POWDER BASED IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 25 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 26 NORTH AMERICA HYDROCARBON IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 27 NORTH AMERICA CELLULOSIC IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 28 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY END-USER, 2019-2028 (USD THOUSAND)

TABLE 29 NORTH AMERICA BUILDING & CONSTRUCTION IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 30 NORTH AMERICA BUILDING & CONSTRUCTION IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY END-USER, 2019-2028 (USD THOUSAND)

TABLE 31 NORTH AMERICA BUILDING & CONSTRUCTION IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 32 NORTH AMERICA OIL & GAS IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 33 NORTH AMERICA OIL & GAS IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 34 NORTH AMERICA INDUSTRIAL IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 35 NORTH AMERICA INDUSTRIAL IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 36 NORTH AMERICA AUTOMOTIVE IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 37 NORTH AMERICA AUTOMOTIVE IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 38 NORTH AMERICA AEROSPACE IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 39 NORTH AMERICA AEROSPACE IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 40 NORTH AMERICA OTHERS IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 41 NORTH AMERICA OTHERS IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 42 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY COUNTRY, 2019-2028 (USD THOUSAND)

TABLE 43 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY PRODUCT TYPES, 2019-2028 (USD THOUSAND)

TABLE 44 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 45 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY RESIN, 2019-2028 (USD THOUSAND)

TABLE 46 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY SUBSTRATE, 2019-2028 (USD THOUSAND)

TABLE 47 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TECHNOLOGY, 2019-2028 (USD THOUSAND)

TABLE 48 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 49 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY END-USER, 2019-2028 (USD THOUSAND)

TABLE 50 NORTH AMERICA BUILDING & CONSTRUCTION IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY END-USER, 2019-2028 (USD THOUSAND)

TABLE 51 NORTH AMERICA BUILDING & CONSTRUCTION IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 52 NORTH AMERICA OIL & GAS IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 53 NORTH AMERICA INDUSTRIAL IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 54 NORTH AMERICA AUTOMOTIVE IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 55 NORTH AMERICA AEROSPACE IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 56 NORTH AMERICA OTHERS IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 57 U.S. INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY PRODUCT TYPE, 2019-2028 (USD THOUSAND)

TABLE 58 U.S. INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 59 U.S. INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY RESIN, 2019-2028 (USD THOUSAND)

TABLE 60 U.S. INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY SUBSTRATE, 2019-2028 (USD THOUSAND)

TABLE 61 U.S. INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TECHNOLOGY, 2019-2028 (USD THOUSAND)

TABLE 62 U.S. INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 63 U.S. INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY END-USER, 2019-2028 (USD THOUSAND)

TABLE 64 U.S. BUILDING & CONSTRUCTION IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY END-USER, 2019-2028 (USD THOUSAND)

TABLE 65 U.S. BUILDING & CONSTRUCTION IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 66 U.S. OIL & GAS IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 67 U.S. INDUSTRIAL IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 68 U.S. AUTOMOTIVE IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 69 U.S. AEROSPACE IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 70 U.S. OTHERS IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 71 CANADA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY PRODUCT TYPE, 2019-2028 (USD THOUSAND)

TABLE 72 CANADA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 73 CANADA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY RESIN, 2019-2028 (USD THOUSAND)

TABLE 74 CANADA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY SUBSTRATE, 2019-2028 (USD THOUSAND)

TABLE 75 CANADA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TECHNOLOGY, 2019-2028 (USD THOUSAND)

TABLE 76 CANADA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 77 CANADA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY END-USER, 2019-2028 (USD THOUSAND)

TABLE 78 CANADA BUILDING & CONSTRUCTION IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY END-USER, 2019-2028 (USD THOUSAND)

TABLE 79 CANADA BUILDING & CONSTRUCTION IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 80 CANADA OIL & GAS IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 81 CANADA INDUSTRIAL IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 82 CANADA AUTOMOTIVE IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 83 CANADA AEROSPACE IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 84 CANADA OTHERS IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 85 MEXICO INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY PRODUCT TYPE, 2019-2028 (USD THOUSAND)

TABLE 86 MEXICO INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 87 MEXICO INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY RESIN, 2019-2028 (USD THOUSAND)

TABLE 88 MEXICO INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY SUBSTRATE, 2019-2028 (USD THOUSAND)

TABLE 89 MEXICO INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TECHNOLOGY, 2019-2028 (USD THOUSAND)

TABLE 90 MEXICO INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 91 MEXICO INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY END-USER, 2019-2028 (USD THOUSAND)

TABLE 92 MEXICO BUILDING & CONSTRUCTION IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY END-USER, 2019-2028 (USD THOUSAND)

TABLE 93 MEXICO BUILDING & CONSTRUCTION IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 94 MEXICO OIL & GAS IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 95 MEXICO INDUSTRIAL IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 96 MEXICO AUTOMOTIVE IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 97 MEXICO AEROSPACE IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 98 MEXICO OTHERS IN INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

Liste des figures

LIST OF FIGURES

FIGURE 1 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET: THE PRODUCT TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET: SEGMENTATION

FIGURE 14 GROWING NUMBER OF FIRE INCIDENTS ACROSS THE WORLD IS EXPECTED TO DRIVE THE NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 15 INTUMESCENT COATINGS FOR FIRE PROOFING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET IN 2021 & 2028

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET

FIGURE 17 PRIVATE NEW HOUSING CONTRIBUTED THE MOST TO THE RISE IN NEW WORK IN RECENT YEAR

FIGURE 18 PRIVATE NEW HOUSING CONTRIBUTED THE MOST TO THE RISE IN NEW WORK IN RECENT YEAR

FIGURE 19 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET: BY PRODUCT TYPE, 2020

FIGURE 20 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET: BY TYPE, 2020

FIGURE 21 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET: BY RESIN, 2020

FIGURE 22 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET: BY SUBSTRATE, 2020

FIGURE 23 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET: BY TECHNOLOGY, 2020

FIGURE 24 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET: BY APPLICATION, 2020

FIGURE 25 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET: BY END USER, 2020

FIGURE 26 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET: SNAPSHOT (2020)

FIGURE 27 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET: BY COUNTRY (2020)

FIGURE 28 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET: BY COUNTRY (2021 & 2028)

FIGURE 29 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET: BY COUNTRY (2020 & 2028)

FIGURE 30 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MARKET: BY PRODUCT TYPE (2021-2028)

FIGURE 31 NORTH AMERICA INTUMESCENT COATINGS FOR FIRE PROOFING AND SPRAY APPLIED FIRE RESISTIVE MATERIALS MARKET: COMPANY SHARE 2020 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.