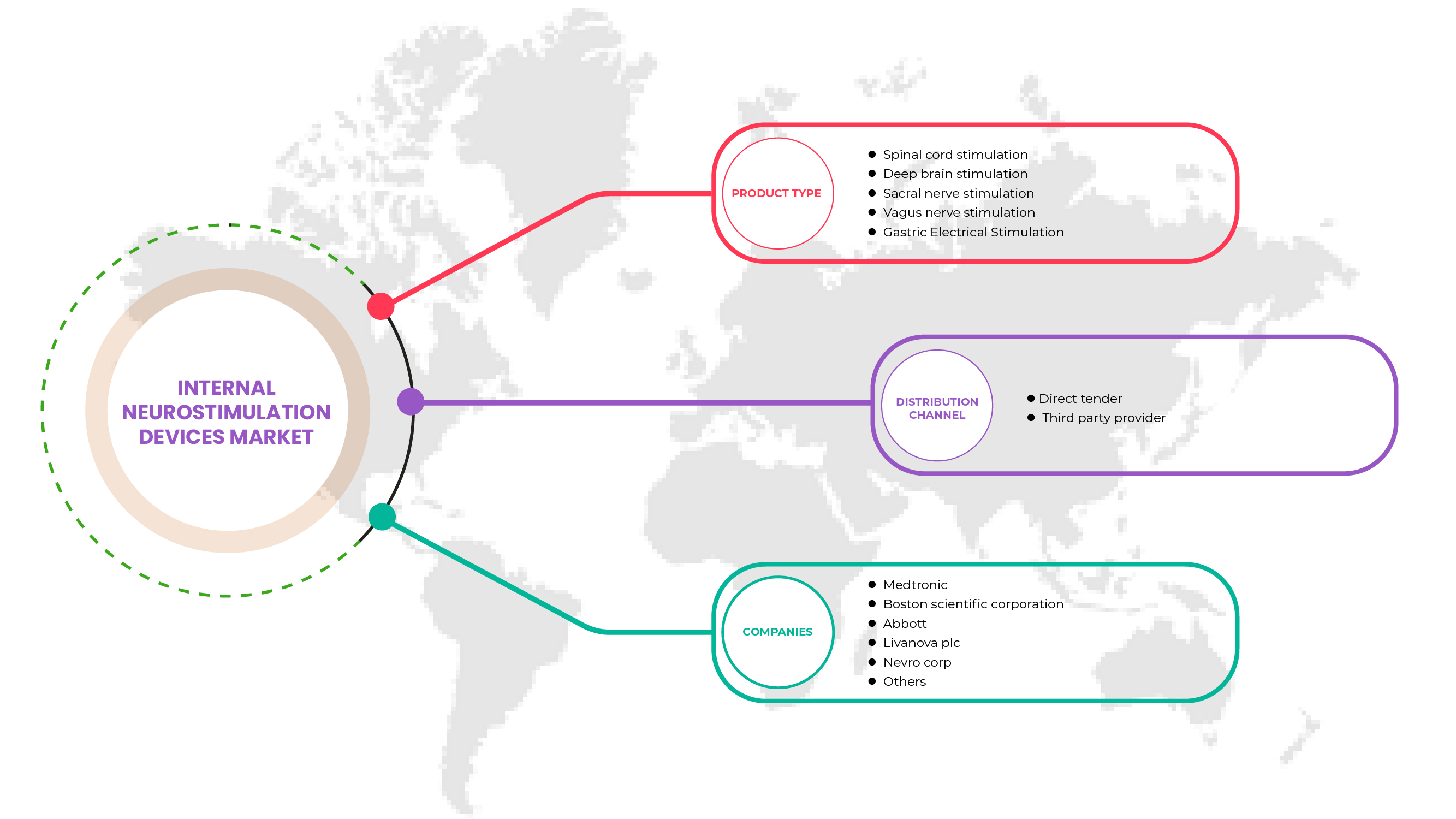

Marché des dispositifs de neurostimulation interne en Amérique du Nord, par type de produit ( stimulation de la moelle épinière (SCS), stimulation cérébrale profonde , stimulation du nerf vague, stimulation du nerf sacré et stimulation électrique gastrique ), canal de distribution (appel d'offres direct et fournisseur de services tiers) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché des dispositifs de neurostimulation interne en Amérique du Nord

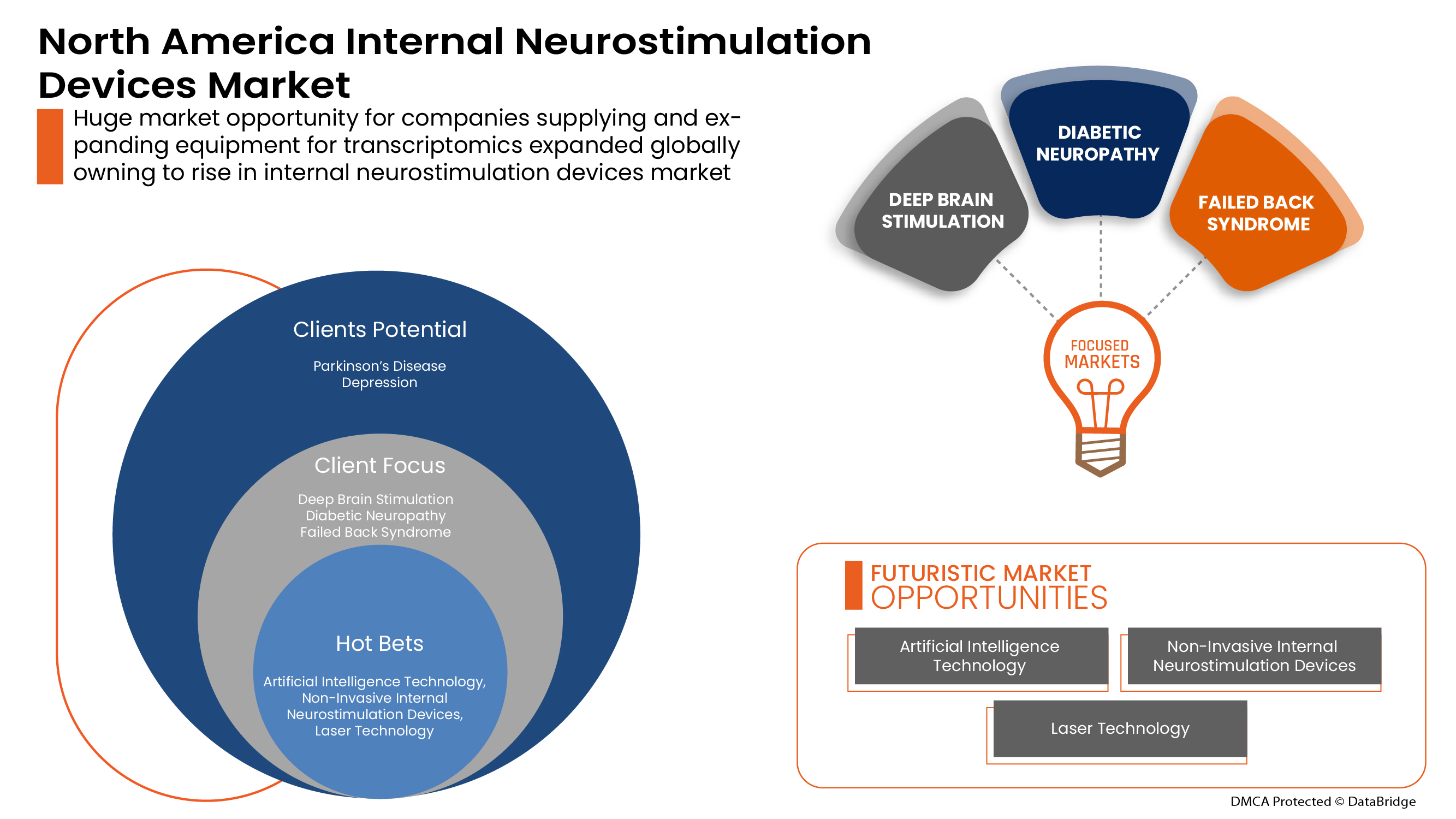

L'augmentation de la demande d'appareils de neurostimulation interne en tant que thérapie complémentaire, l'augmentation de la prévalence et de l'incidence des maladies neurologiques, l'augmentation du financement des appareils de neurostimulation, les avancées technologiques dans les appareils de neurostimulation interne et l'augmentation des approbations de produits devraient stimuler la croissance du marché.

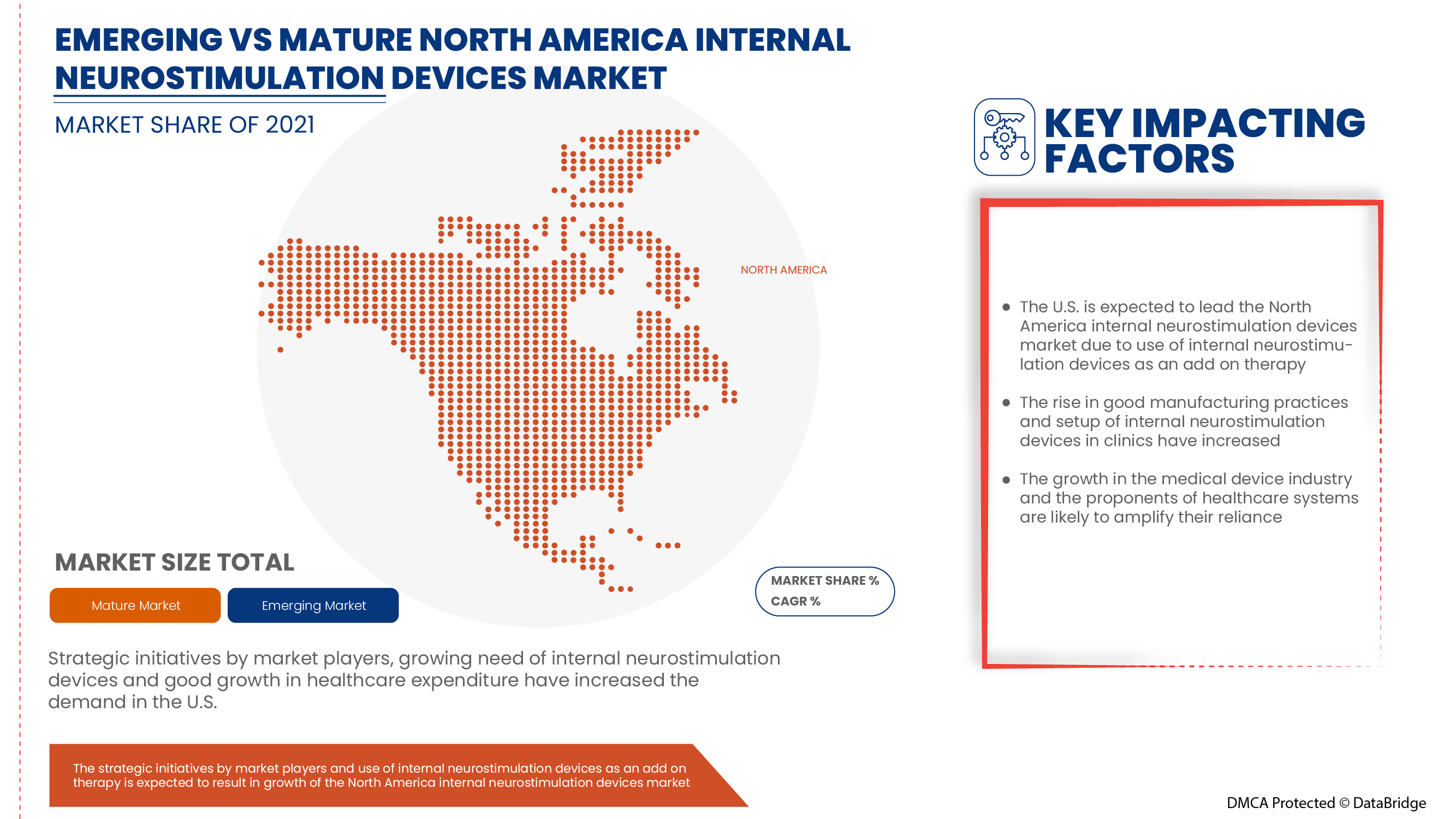

Les initiatives stratégiques des acteurs du marché et l'augmentation du financement des acteurs publics et privés pour les dispositifs de neurostimulation interne devraient créer des opportunités de croissance du marché. Cependant, le manque d'experts qualifiés et formés dans les dispositifs de neurostimulation interne devrait freiner la croissance du segment. La disponibilité d'autres dispositifs d'imagerie devrait remettre en cause la croissance du marché.

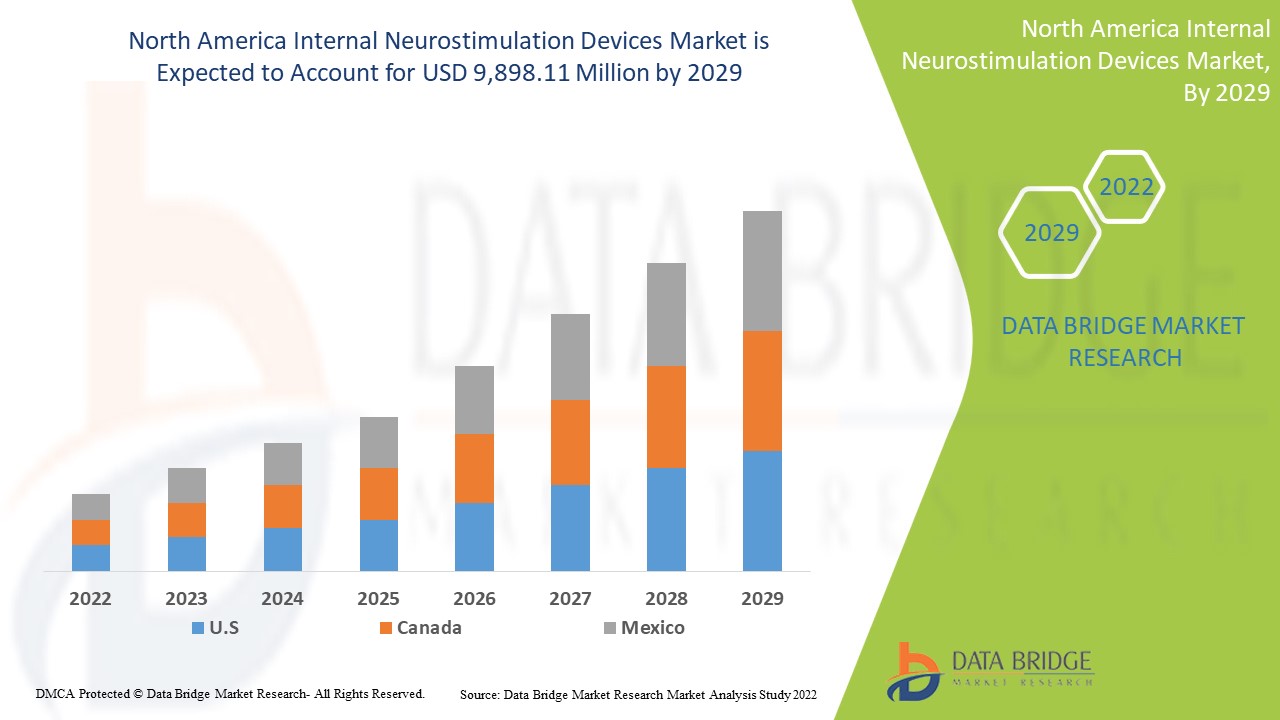

Data Bridge Market Research analyse que le marché nord-américain des dispositifs de neurostimulation interne croîtra à un TCAC de 20,5 % et 9 898,11 millions USD au cours de la période de prévision de 2022 à 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2024) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par type de produit ( stimulation de la moelle épinière (SCS), stimulation cérébrale profonde, stimulation du nerf vague, stimulation du nerf sacré et stimulation électrique gastrique ), canal de distribution (appel d'offres direct et fournisseur de services tiers) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

Medtronic, LivaNova PLC, Abbott, ONWARD, Sequana Medical NV, CIRTEC, Valencia Technologies, Nalu Medical, Inc., NEVRO CORP., Stimwave LLC, MicroTransponder Inc., Newronika SpA, Microsemi (une filiale de Microchip Technology Inc.), Boston Scientific Corporation, Inspire Medical Systems, Inc, Integer Holdings Corporation, BlueWind Medical, Micro-Leads, Axonics, Inc., entre autres |

Définition du marché

Un dispositif de neurostimulation interne est un dispositif placé chirurgicalement. Il délivre de légers signaux électriques à l'espace épidural près de votre colonne vertébrale via un ou plusieurs fils fins appelés sondes. La neurostimulation soulage la douleur en perturbant les signaux de douleur circulant entre la moelle épinière et le cerveau.

Les dispositifs de neurostimulation comprennent des approches invasives et non invasives impliquant une stimulation électrique pour stimuler la fonction neuronale dans un circuit. La demande croissante de dispositifs de neurostimulation interne est due aux progrès technologiques de nouvelle génération dans les dispositifs de neurostimulation, procurant un soulagement thérapeutique indispensable à un nombre sans précédent de personnes touchées par des troubles neurologiques et psychiatriques débilitants dans le monde entier. L'essor des thérapies de neuromodulation modernes a augmenté au cours d'un demi-siècle, riche en découvertes fortuites et en avancées technologiques qui ont conduit à différentes stratégies de neurostimulation. Au cours des deux dernières décennies, l'innovation dans la technologie des dispositifs médicaux a commencé à accélérer l'évolution de ces systèmes de neurostimulation.

Le dispositif de neurostimulation interne le plus pratique utilisé par les patients est la stimulation du nerf vague. Le dispositif de neurostimulation du nerf vague utilise un dispositif pour stimuler le nerf vague avec des impulsions électriques. Un stimulateur du nerf vague implantable est actuellement approuvé par la FDA pour traiter l'épilepsie et la dépression. Il y a un nerf vague de chaque côté du corps, allant du tronc cérébral à travers le cou jusqu'à la poitrine et l'abdomen. À l'avenir, les avancées logicielles telles que la stimulation en boucle fermée et la programmation à distance permettront aux dispositifs de neurostimulation interne d'être une technologie plus personnalisée et plus accessible. L'avenir des dispositifs de neurostimulation interne devrait encore améliorer la qualité de vie.

Dynamique du marché des dispositifs de neurostimulation interne en Amérique du Nord

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Sensibilisation accrue au traitement de l'incontinence urinaire chronique

La sensibilisation accrue des patients et des prestataires de soins de santé et un meilleur accès aux services de continence ont été des facteurs clés pour améliorer la prestation des soins. L'incontinence urinaire (IU) et les symptômes des voies urinaires inférieures (LUTS) sont courants et causent de la détresse chez de nombreuses femmes et de nombreux hommes de tous âges. La sensibilisation accrue aux dispositifs de neurostimulation interne implantables en neurologie signifie une augmentation des investissements liés à la recherche et au développement pour la découverte et le développement de dispositifs de neurostimulation interne avancés et indolores, ce qui devrait stimuler la croissance du marché.

- Progrès technologiques dans les dispositifs de neurostimulation interne

Les avancées technologiques dans le domaine des dispositifs de neurostimulation interne utilisent la technologie de neuromodulation, qui délivre directement les agents électriques ou pharmaceutiques à une zone ciblée. Les dispositifs et traitements de neuromodulation et de neurostimulation interne changent la vie. Les avancées technologiques modulent les fonctions neuronales de manière programmable et régulent l'activité neuronale désordonnée. Les résultats peuvent être obtenus avec un minimum d'erreurs.

Par exemple,

- En mai 2022, ONWARD a présenté le générateur d'impulsions implantable ARC (IPG) pour stimuler la moelle épinière afin de restaurer le mouvement et la fonction autonome des personnes atteintes de LME et d'autres affections ayant un impact sur la mobilité.

L'approbation des dispositifs de neurostimulation interne permettrait de déclarer l'appareil sûr à utiliser et prêt pour une approbation post-commercialisation. Cela entraînerait la fourniture et la distribution d'appareils d'IRM aux marchés en développement aux États-Unis. Par conséquent, l'augmentation des approbations de produits devrait propulser la croissance du marché des dispositifs de neurostimulation interne en Amérique du Nord.

Opportunités

- Développements récents de produits dans le domaine des dispositifs de neurostimulation interne

La courbe de croissance du marché nord-américain des dispositifs de neurostimulation interne suit une tendance à la hausse en raison de la demande de thérapies neurovasculaires efficaces qui augmente régulièrement en raison de la prévalence croissante des maladies neurovasculaires (telles que l'épilepsie, l'accident vasculaire cérébral et l'anévrisme cérébral) et de la gravité des maladies (telles que les écoulements et les troubles environnants) chez les patients ciblés. En raison de la prévalence croissante et de la sensibilisation croissante à la gravité de ces maladies, divers équipements ou dispositifs sont fabriqués ou font l'objet d'essais cliniques.

Ainsi, le développement de produits au cours des dernières années a montré le potentiel de ces technologies, et les entreprises travaillant sur ce marché tentent d'obtenir des produits plus avancés, qui constitueront une opportunité de croissance du marché.

- Initiatives stratégiques des principaux acteurs du marché

La demande d'appareils de neurostimulation interne augmente sur le marché en raison des niveaux accrus de recherche et développement ainsi que de la croissance du marché nord-américain des appareils de neurostimulation interne aidée par le désir de médicaments innovants. Ainsi, les principaux acteurs du marché ont mis en œuvre une nouvelle stratégie en développant de nouveaux appareils et équipements, en collaborant avec d'autres acteurs du marché et en améliorant les opérations commerciales et la rentabilité.

- En janvier 2021, Boston Scientific a commencé à expédier ses cadres de déclenchement de ligne vertébrale Wave Writer Alpha aux États-Unis

Ainsi, les entreprises opérant à l'échelle mondiale sur le marché des dispositifs de neurostimulation adoptent la collaboration pour élargir leur portefeuille de produits avec des produits riches en technologie de pointe afin de stimuler leurs activités dans diverses dimensions. Ainsi, les initiatives stratégiques des principaux acteurs du marché devraient offrir des opportunités significatives aux acteurs du marché opérant sur le marché interne des dispositifs de neurostimulation en Amérique du Nord.

Contraintes/Défis

- Risques associés à l’implantation de ces dispositifs

Les implants médicaux comportent plusieurs risques, notamment ceux liés à la chirurgie lors de l'installation ou du retrait, à l'infection et à la défaillance de l'implant. Les matériaux utilisés dans les implants peuvent potentiellement provoquer des réactions chez certaines personnes. Chaque intervention chirurgicale comporte certains risques. Ceux-ci comprennent des ecchymoses, une gêne, un gonflement et une rougeur au niveau du site chirurgical. Cela entravera proportionnellement la croissance des dispositifs implantaires. La prise de conscience croissante des risques croissants liés aux implants de neurostimulation peut donc entraver la croissance du marché.

Par exemple,

- Échec de l'implant

- Risques chirurgicaux lors de la mise en place ou du retrait

- Risque de détournement de dispositifs implantables

- Hausse des infections

- Les matériaux utilisés dans les implants peuvent provoquer des réactions indésirables chez les patients

Les risques mentionnés ci-dessus peuvent entraver la croissance du marché des dispositifs de neurostimulation interne, car les risques liés aux patients sont d'une importance capitale. Ainsi, la prise de conscience des risques potentiels des dispositifs implantables constitue un défi pour le marché nord-américain des dispositifs de neurostimulation interne.

- Manque de professionnels de santé qualifiés

Les dispositifs de neurostimulation sont des dispositifs médicaux implantables et programmables qui délivrent une stimulation électrique à des parties spécifiques du cerveau, de la moelle épinière ou du système nerveux périphérique du patient pour aider à traiter diverses pathologies, notamment la douleur chronique, les troubles du mouvement, l'épilepsie et la maladie de Parkinson. Ces technologies puissantes nécessitent une procédure de développement coûteuse et des professionnels qualifiés pour manipuler les appareils sensibles. Le remplacement doit être effectué tous les 3 à 6 ans après l'implantation, ce qui représente un fardeau financier et est généralement à la charge de la plupart des patients.

Dans les pays pauvres, seul un nombre relativement restreint de patients peuvent se permettre une thérapie neurologique en raison des prix élevés, d’un système de remboursement peu efficace et d’un manque de personnel médical qualifié. En conséquence, les établissements de santé hésitent à investir dans des technologies nouvelles ou de pointe, ce qui limite l’expansion du marché. Ces difficultés peuvent donc freiner la croissance du marché.

Impact du COVID-19 sur le marché nord-américain des dispositifs de neurostimulation interne

Pendant la pandémie, le secteur des dispositifs de neurostimulation interne en Amérique du Nord se concentre sur l'utilisation d'une combinaison de biologie et de technologie de l'information. Pendant la pandémie de COVID-19, de nouveaux défis thérapeutiques se sont ajoutés à ceux habituels des dispositifs de neurostimulation interne. Les patients porteurs d'un dispositif implantable pour perfusion intrathécale ont besoin d'une recharge de la pompe pour éviter le syndrome de sevrage. Les patients porteurs d'implants de neurostimulation peuvent avoir besoin de contrôles en cas d'infection, de déhiscence de plaie ou de migration de sonde.

Développements récents

- En janvier 2022, Medtronic a reçu l'approbation de la Food and Drug Administration (FDA) pour le neurostimulateur rechargeable Intellis, une thérapie de stimulation de la moelle épinière destinée au traitement de la douleur chronique résultant de la neuropathie diabétique périphérique. L'approbation du produit reçue a donné lieu à l'ajout d'un nouveau produit dans la catégorie des produits de stimulation de la moelle épinière. L'approbation devrait être approuvée après la mise sur le marché aux États-Unis

- En juillet 2022, Abbott a reçu l'approbation de la Food and Drug Administration (FDA) pour le système de stimulation cérébrale profonde Infinity pour le traitement de la dépression. L'approbation reçue a entraîné une augmentation du nombre d'approbations avant et après commercialisation et l'ajout d'un nouveau produit au portefeuille de produits

Portée du marché des dispositifs de neurostimulation interne en Amérique du Nord

Le marché nord-américain des dispositifs de neurostimulation interne est classé en type de produit et en canal de distribution. La croissance de ces segments vous aidera à analyser les segments de faible croissance dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de produit

- Stimulation de la moelle épinière (SCS)

- Stimulation cérébrale profonde

- Stimulation du nerf vague

- Stimulation du nerf sacré

- Stimulation électrique gastrique

Sur la base du type de produit, le marché nord-américain des dispositifs de neurostimulation interne est segmenté en stimulation de la moelle épinière (SCS), stimulation cérébrale profonde, stimulation du nerf vague , stimulation du nerf sacré et stimulation électrique gastrique.

Canal de distribution

- Appel d'offres direct

- Fournisseur de services tiers

Sur la base du canal de distribution, le marché nord-américain des dispositifs de neurostimulation interne est segmenté en appels d'offres directs et fournisseurs de services tiers.

Analyse/perspectives régionales du marché des dispositifs de neurostimulation interne en Amérique du Nord

Le marché des dispositifs de neurostimulation interne en Amérique du Nord est analysé et les régions fournissent des informations sur la taille du marché et les tendances par pays, type de produit et canal de distribution, comme indiqué ci-dessus.

Certains pays couverts par le marché des dispositifs de neurostimulation interne en Amérique du Nord sont les États-Unis, le Canada et le Mexique. Les États-Unis devraient dominer le marché en raison d'une augmentation des activités de recherche et développement, des exigences intégrées en matière de dispositifs de neurostimulation interne en neurologie et dans le traitement de l'incontinence urinaire, et d'une augmentation du financement des secteurs public et privé pour les dispositifs de neurostimulation.

La section du rapport sur les pays fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie du pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales ont un impact sur les canaux de vente, sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des dispositifs de neurostimulation interne en Amérique du Nord

Le paysage concurrentiel du marché des dispositifs de neurostimulation interne en Amérique du Nord fournit des détails sur le concurrent. Les détails comprennent un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché des dispositifs de neurostimulation interne en Amérique du Nord.

Certains des principaux acteurs opérant sur le marché des dispositifs de neurostimulation interne en Amérique du Nord sont Medtronic, LivaNova PLC, Abbott, ONWARD, Sequana Medical NV, CIRTEC, Valencia Technologies, Nalu Medical, Inc., NEVRO CORP., Stimwave LLC, MicroTransponder Inc., Newronika SpA, Microsemi (une filiale de Microchip Technology Inc.), Boston Scientific Corporation, Inspire Medical Systems, Inc, Integer Holdings Corporation, BlueWind Medical, Micro-Leads, Axonics, Inc., entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHIC SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 RESEARCH METHODOLOGY

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 THE CATEGORY VS TIME GRID

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

4.3 PIPELINE ANALYSIS FOR INTERNAL NEUROSTIMULATION DEVICES MARKET

5 REGULATIONS OF NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET

6 EPIDEMIOLOGY OF DISEASES

6.1 INCIDENCE OF ISCHEMIA

6.2 INCIDENCE OF PARKINSON'S DISEASE

6.3 INCIDENCE OF FAILED BACK SYNDROME

6.4 INCIDENCE OF TREMOR

6.5 INCIDENCE OF DEPRESSION

6.6 INCIDENCE OF URINE INCONTINENCE

6.7 INCIDENCE OF FECAL INCONTINENCE

6.8 INCIDENCE RATE OF EPILEPSY

6.9 INCIDENCE OF GASTROPARESIS

6.1 PREVALENCE OF OBESITY

7 EPIDEMIOLOGY OF NEUROSTIMULATION PROCEDURES

7.1 NUMBER OF SPINAL CORD STIMULATION (SCS) PROCEDURES

7.1.1 NUMBER OF TEST PROCEDURES

7.1.2 NUMBER OF IMPLANTATION PROCEDURES

7.2 NUMBER OF DEEP BRAIN STIMULATION PROCEDURES

7.3 NUMBER OF VAGUS NERVE STIMULATION PROCEDURES

7.4 NUMBER OF SACRAL NEVER STIMULATION PROCEDURES

7.5 NUMBER OF TRANSCRANIAL MAGNETIC STIMULATION (TMS) PROCEDURES

7.6 NUMBER OF INTERMITTENT THETA BURST STIMULATION (ITBS) PROCEDURES

7.7 NUMBER OF TRANSCRANIAL DIRECT ELECTRICAL STIMULATION (TDCS) PROCEDURES

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 RISE IN PREVALENCE AND INCIDENCE OF NEUROLOGICAL DISORDERS

8.1.2 DEMAND FOR INTERNAL NEUROSTIMULATION DEVICES AS A ADD ON THERAPY

8.1.3 INCREASED FUNDING FOR THE NEUROSTIMULATION DEVICES

8.1.4 TECHNOLOGICAL ADVANCEMENTS IN THE INTERNAL NEUROSTIMULATION DEVICES

8.1.5 RISE IN PRODUCT APPROVALS

8.2 RESTRAINTS

8.2.1 RISE IN COST OF THE DEEP BRAIN STIMULATION DEVICES

8.2.2 RISKS NOTICED WHILE USING THE INTERNAL NEUROSTIMULATION DEVICES

8.2.3 RISE IN PRODUCT RECALL

8.2.4 AVAILABILITY OF ALTERNATE IMAGING DIAGNOSTIC DEVICES

8.3 OPPORTUNITIES

8.3.1 STRATEGIC INITIATIVES BY THE KEY MARKET PLAYER

8.3.2 RECENT PRODUCT DEVELOPMENTS IN THE INTERNAL NEUROSTIMULATION DEVICES

8.3.3 DEMAND FOR MINIMALLY INVASIVE SURGERY

8.4 CHALLENGES

8.4.1 RISKS ASSOCIATED WITH THE IMPLANTATION OF THESE DEVICES

8.4.2 LACK OF SKILLED HEALTHCARE PROFESSIONALS

9 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 SPINAL CORD STIMULATION

9.2.1 SPINAL CORD STIMULATION, BY TYPE

9.2.1.1 BATTERY

9.2.1.1.1 RECHARGEABLE

9.2.1.1.2 NON-RECHARGEABLE

9.2.1.2 LEAD

9.2.1.2.1 PERCUTANEOUS

9.2.1.2.2 PADDLE

9.2.2 SPINAL CORD STIMULATION, BY APPLICATION

9.2.2.1 ISCHEMIA

9.2.2.2 CHRONIC LOW BACK PAIN (CLBP)

9.2.2.3 DIABETIC NEUROPATHY

9.2.2.4 FAILED BACK SYNDROME

9.3 DEEP BRAIN STIMULATION

9.3.1 DEEP BRAIN STIMULATION, BY TYPE

9.3.1.1 SINGLE CHANNEL DEEP BRAIN STIMULATOR

9.3.1.2 DOUBLE CHANNEL DEEP BRAIN STIMULATOR

9.3.1.3 BATTERY

9.3.1.3.1 RECHARGEABLE

9.3.1.3.2 NON-RECHARGEABLE

9.3.1.4 LEAD

9.3.2 DEEP BRAIN STIMULATION, BY APPLICATION

9.3.2.1 PARKINSON’S DISEASE

9.3.2.2 TREMOR

9.3.2.3 DEPRESSION

9.4 SACRAL NERVE STIMULATION

9.4.1 SACRAL NERVE STIMULATION, BY TYPE

9.4.1.1 BATTERY

9.4.1.2 LEAD

9.5 SACRAL NERVE STIMULATION, BY APPLICATION

9.5.1 URINE INCONTINENCE

9.5.2 FECAL INCONTINENCE

9.6 VAGUS NERVE STIMULATION

9.6.1 VAGUS NERVE STIMULATION, BY TYPE

9.6.1.1 BATTERY

9.6.1.2 LEAD

9.6.2 VAGUS NERVE STIMULATION, BY APPLICATION

9.6.2.1 EPILEPSY

9.6.2.2 OTHERS

9.7 GASTRIC ELECTRICAL STIMULATION

9.7.1 GASTRIC ELECTRICAL STIMULATION, BY TYPE

9.7.1.1 BATTERY

9.7.1.2 LEAD

9.7.2 GASTRIC ELECTRICAL STIMULATION, BY APPLICATION

9.7.2.1 GASTROPARESIS

9.7.2.2 OTHERS

10 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DIRECT TENDER

10.3 THIRD PARTY PROVIDER

11 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 MEDTRONIC (2021)

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 BOSTON SCIENTIFIC CORPORATION (2021)

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 ABBOTT (2021)

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 LIVANOVA PLC (2021)

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 NEVRO CORP. (2021)

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 AXONICS, INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 ALEVA NEUROTHERAPEUTICS

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 BIONIC VISION TECHNOLOGIES.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 BLUEWIND MEDICAL

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 BIOINDUCTION

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 CIRTEC

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 FINETECH MEDICAL

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 GIMER MEDICAL

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 INSPIRE MEDICAL SYSTEMS, INC.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 INTEGER HOLDINGS CORPORATION

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

14.16 INBRAIN NEUROELECTRONICS

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 MAINSTAY MEDICAL

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 MICROSEMI (A WHOLLY OWNDED SUBSIDIARY OF MICROCHIP TECHNOLOGY INC.)

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

14.19 MICROTRANSPONDER INC

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 MICRO-LEADS

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

14.21 NALU MEDICAL, INC

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENT

14.22 NEURONANO AB

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT DEVELOPMENTS

14.23 NEURIMPULSE S.R.L.

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCT PORTFOLIO

14.23.3 RECENT DEVELOPMENTS

14.24 NEWRONIKA S.P.A.

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT DEVELOPMENTS

14.25 OPTOGENTECH GMBH.

14.25.1 COMPANY SNAPSHOT

14.25.2 PRODUCT PORTFOLIO

14.25.3 RECENT DEVELOPMENTS

14.26 ONWARD

14.26.1 COMPANY SNAPSHOT

14.26.2 PRODUCT PORTFOLIO

14.26.3 RECENT DEVELOPMENT

14.27 STIMWAVE LLC (2021)

14.27.1 COMPANY SNAPSHOT

14.27.2 PRODUCT PORTFOLIO

14.27.3 RECENT DEVELOPMENTS

14.28 SEQUANA MEDICAL NV (2021)

14.28.1 COMPANY SNAPSHOT

14.28.2 REVENUE ANALYSIS

14.28.3 PRODUCT PORTFOLIO

14.28.4 RECENT DEVELOPMENTS

14.29 VALENCIA TECHNOLOGIES

14.29.1 COMPANY SNAPSHOT

14.29.2 PRODUCT PORTFOLIO

14.29.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA PREVALENCE OF OBESITY

TABLE 2 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA SPINAL CORD STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA SPINAL CORD STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA BATTERY IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA BATTERY IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 7 NORTH AMERICA BATTERY IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 8 NORTH AMERICA LEAD IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA LEAD IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 10 NORTH AMERICA LEAD IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 11 NORTH AMERICA SPINAL CORD STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA DEEP BRAIN STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA DEEP BRAIN STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA DEEP BRAIN STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 15 NORTH AMERICA DEEP BRAIN STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 16 NORTH AMERICA BATTERY IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA BATTERY IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 18 NORTH AMERICA BATTERY IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 19 NORTH AMERICA DEEP BRAIN STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA SACRAL NERVE STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA SACRAL NERVE STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA SACRAL NERVE STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 23 NORTH AMERICA SACRAL NERVE STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 24 NORTH AMERICA SACRAL NERVE STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA VAGUS NERVE STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA VAGUS NERVE STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA VAGUS NERVE STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 28 NORTH AMERICA VAGUS NERVE STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 29 NORTH AMERICA VAGUS NERVE STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA GASTRIC ELECTRICAL STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA GASTRIC ELECTRICAL STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA GASTRIC ELECTRICAL STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 33 NORTH AMERICA GASTRIC ELECTRICAL STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 34 NORTH AMERICA GASTRIC ELECTRICAL STIMULATION IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA DIRECT TENDER IN INTERNAL NEUROSTIMULATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA THIRD PARTY PROVIDER IN INTERNAL NEUROSTIMULATION DEVICES MARKET, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA SPINAL CORD STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 43 NORTH AMERICA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 44 NORTH AMERICA LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 46 NORTH AMERICA LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 47 NORTH AMERICA SPINAL CORD STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 50 NORTH AMERICA DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 51 NORTH AMERICA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 53 NORTH AMERICA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 54 NORTH AMERICA DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 57 NORTH AMERICA SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 58 NORTH AMERICA SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 61 NORTH AMERICA VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 62 NORTH AMERICA VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 65 NORTH AMERICA GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 66 NORTH AMERICA GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA NEUROSTIMULATION DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 68 U.S. NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 69 U.S. SPINAL CORD STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 70 U.S. BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 U.S. BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 72 U.S. BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 73 U.S. LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 74 U.S. LEAD IN N NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 75 U.S. LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 76 U.S. SPINAL CORD STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 77 U.S. DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 U.S. DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 79 U.S. DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 80 U.S. BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 81 U.S. BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 82 U.S. BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 83 U.S. DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 U.S. SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 U.S. SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 86 U.S. SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 87 U.S. SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 88 U.S. VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 U.S. VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 90 U.S. VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 91 U.S. VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 U.S. GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 U.S. GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 94 U.S. GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 95 U.S. GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 U.S. NEUROSTIMULATION DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 97 CANADA NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 98 CANADA SPINAL CORD STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 CANADA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 100 CANADA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 101 CANADA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 102 CANADA LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 103 CANADA LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 104 CANADA LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 105 CANADA SPINAL CORD STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 106 CANADA DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 CANADA DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 108 CANADA DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 109 CANADA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 110 CANADA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 111 CANADA BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 112 CANADA DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 113 CANADA SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 CANADA SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 115 CANADA SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 116 CANADA SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 117 CANADA VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 CANADA VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 119 CANADA VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 120 CANADA VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 121 CANADA GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 CANADA GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 123 CANADA GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 124 CANADA GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 125 CANADA NEUROSTIMULATION DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 126 MEXICO NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 127 MEXICO SPINAL CORD STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 MEXICO BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 129 MEXICO BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 130 MEXICO BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 131 MEXICO LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 132 MEXICO LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 133 MEXICO LEAD IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 134 MEXICO SPINAL CORD STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 MEXICO DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 MEXICO DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 137 MEXICO DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 138 MEXICO BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 139 MEXICO BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 140 MEXICO BATTERY IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 141 MEXICO DEEP BRAIN STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 142 MEXICO SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 MEXICO SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 144 MEXICO SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 145 MEXICO SACRAL NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 MEXICO VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 MEXICO VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 148 MEXICO VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 149 MEXICO VAGUS NERVE STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 150 MEXICO GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 MEXICO GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (ASP)

TABLE 152 MEXICO GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 153 MEXICO GASTRIC ELECTRICAL STIMULATION IN NEUROSTIMULATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 154 MEXICO NEUROSTIMULATION DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: GEOGRAPHIC SCOPE

FIGURE 3 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: DATA TRIANGULATION

FIGURE 4 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: SNAPSHOT

FIGURE 5 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BOTTOM UP APPROACH

FIGURE 6 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: TOP DOWN APPROACH

FIGURE 7 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: INTERVIEWS BY REGION AND DESIGNATION

FIGURE 8 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: THE CATEGORY VS TIME GRID

FIGURE 10 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET SEGMENTATION

FIGURE 11 INCREASE IN PREVALENCE AND INCIDENCE OF NEUROLOGICAL DISEASES AND DEMAND FOR INTERNAL NEUROSTIMULATION DEVICES AS A ADD ON THERAPY ARE EXPECTED TO DRIVE THE NORTH AMERICA INTERNAL NEUROSTIMULATIOJ DEVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SPINAL CORD STIMULATION IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET IN 2022 TO 2029

FIGURE 13 NORTH AMERICA INCIDENCE OF ISCHEMIA

FIGURE 14 NORTH AMERICA INCIDENCE OF PARKINSON'S DISEASES

FIGURE 15 NORTH AMERICA INCIDENCE OF TREMOR

FIGURE 16 NORTH AMERICA INCIDENCE RATE OF EPILEPSY

FIGURE 17 NORTH AMERICA INCIDENCE RATE OF GASTROPARESIS

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET

FIGURE 19 INCIDENCE OF ADULT ONSET BRAIN DISORDERS IN THE U.S. IN 2021

FIGURE 20 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY PRODUCT TYPE, 2021

FIGURE 21 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 22 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 23 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 24 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 25 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 26 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 27 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 28 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: SNAPSHOT (2021)

FIGURE 29 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY COUNTRY (2021)

FIGURE 30 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 31 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 32 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 33 NORTH AMERICA INTERNAL NEUROSTIMULATION DEVICES MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.