Marché des maladies rétiniennes héréditaires en Amérique du Nord, par type de maladie (rétinite pigmentaire, maladie de Stargardt, achromatopsie , dystrophie cône-bâtonnet, choroïdérémie, amaurose congénitale de Leber, œdème maculaire et autres), par type (diagnostic et thérapie), utilisateurs finaux (hôpitaux, cliniques spécialisées, centres de chirurgie ambulatoire, soins à domicile, autres), canal de distribution (vente au détail et appel d'offres direct) Tendances de l'industrie et prévisions jusqu'en 2029.

Analyse et perspectives du marché : Marché des maladies rétiniennes héréditaires en Amérique du Nord

Les maladies rétiniennes héréditaires (ou MRI) sont un groupe de maladies qui peuvent entraîner une perte de vision grave, voire la cécité. Chaque MRI est causée par au moins un gène qui ne fonctionne pas comme il le devrait. Les MRI peuvent toucher des individus de tous âges, peuvent progresser à des rythmes différents et sont rares. Cependant, beaucoup sont dégénératives, ce qui signifie que les symptômes de la maladie s'aggraveront avec le temps. Les types courants de MRI comprennent l'amaurose congénitale de Leber (LCA), la rétinite pigmentaire, la choroïdérémie, la maladie de Stargardt et l'achromatopsie. L'objectif de la thérapie génique est de corriger ou de compenser le gène défectueux. Les MRI sont des candidats particulièrement forts pour les traitements de thérapie génique, en raison de la constitution physique unique de la rétine . Comparé à d'autres organes du corps, l'œil est petit et facile d'accès pour l'administration du traitement. Cependant, certaines zones du corps sont privilégiées sur le plan immunitaire, ce qui signifie que la réponse immunitaire normale n'est pas aussi active. Ce type de greffe se situe généralement dans des zones très importantes de notre corps, qui peuvent être endommagées en cas de gonflement ou d'inflammation. Cela signifie que tout ce qui est implanté dans l'œil (une cellule avec un gène corrigé, par exemple) a moins de chances d'être rejeté.

Le diagnostic et le traitement des maladies rétiniennes héréditaires reposent sur diverses techniques qui permettent de diagnostiquer les maladies rétiniennes héréditaires après l'approbation du produit. Le traitement de la maladie a été récemment approuvé, ce qui soutient la croissance du marché.

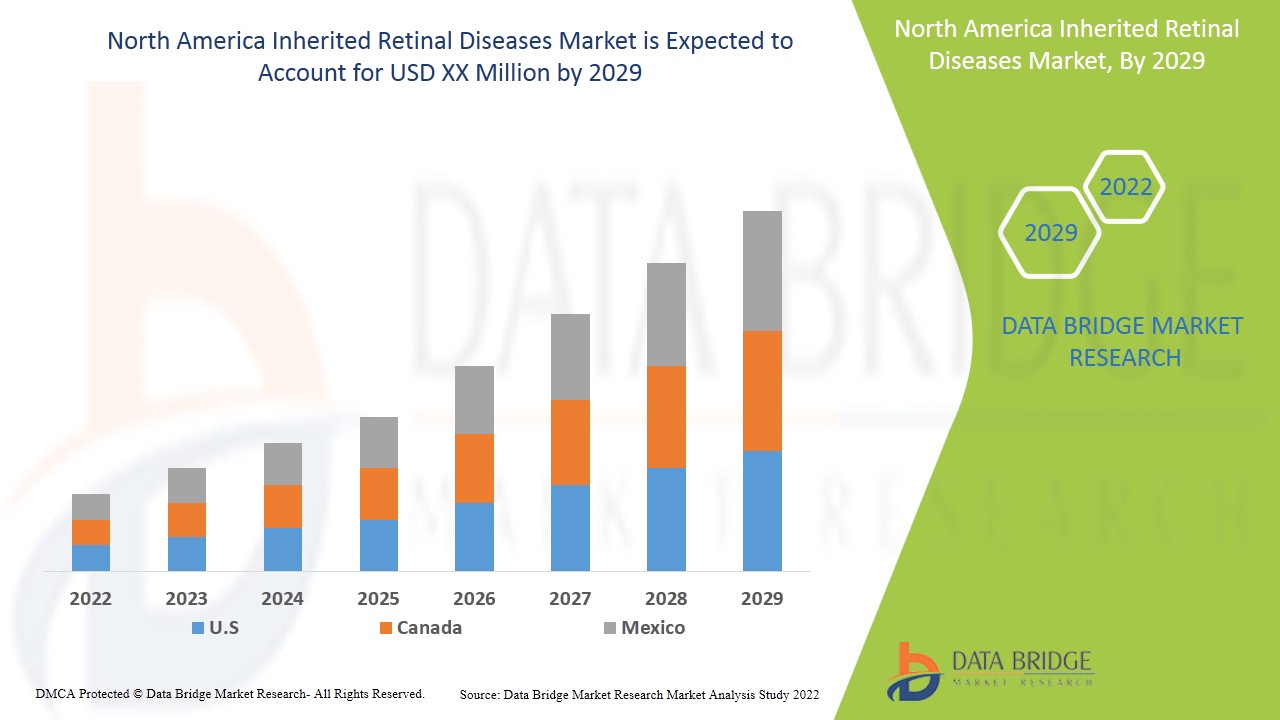

Les maladies rétiniennes héréditaires sont favorables et visent à réduire la progression de la maladie. Data Bridge Market Research analyse que le marché des maladies rétiniennes héréditaires connaîtra un TCAC de 7,6 % au cours de la période de prévision de 2022 à 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Type de maladie (rétinite pigmentaire, maladie de Stargardt, achromatopsie, dystrophie cône-bâtonnet, choroïdérémie, amaurose congénitale de Leber, œdème maculaire et autres), par type (diagnostic et thérapie), utilisateurs finaux (hôpitaux, cliniques spécialisées, centres de chirurgie ambulatoire, soins à domicile, autres), canal de distribution (vente au détail et appel d'offres direct) |

|

Pays couverts |

États-Unis, Canada et Mexique en Amérique du Nord |

|

Acteurs du marché couverts |

Spark Therapeutics, Novartis AG, Okuvision, Nidek Co. Ltd., Invitae Corporation, Carl Zeiss Meditech AG, Optos (une filiale de Nikon Corporation), Neurosoft, PIXIUM VISION, LKC TECHNOLOGIES, INC., Renurone, Astellas Pharma, REGENXBIO Inc., Ionis Pharmaceutics, Sparing Vision, Ocugen Inc, Johnson & Johnson, IVERIC bio, Second Sight, Coave Therapeutics, MeiraGTx Limited, Gensight Biologics, ProQR Therapeutics, Bionic Vision Technologies |

Dynamique du marché des maladies rétiniennes héréditaires

Conducteurs

- Augmentation de la prévalence des maladies rétiniennes héréditaires

La prévalence croissante et la découverte continue de nouveaux sites mutagènes transmissibles génétiquement devraient stimuler la croissance du marché. La prévalence des IRD monogéniques est d'environ 1 sur 2000, affectant deux millions de personnes en ligne.

- Augmentation des produits du pipeline

Alors que l'activité des essais cliniques atteint de nouveaux sommets, le domaine semble prêt à faire des progrès rapides et importants dans la recherche sur les maladies rétiniennes héréditaires et les soins aux patients. Il ne s'agit là que de quelques essais courants, c'est pourquoi les entreprises opérant sur ce marché effectuent en permanence des essais cliniques et soumettent leurs candidats à des essais cliniques. Cela devrait créer une opportunité et alimenter le marché nord-américain des maladies rétiniennes héréditaires. Forte prévalence des maladies génétiques

En outre, l’augmentation du taux de prévalence de certaines maladies génétiques telles que le syndrome de Miller-Dieker et le syndrome de Walker-Warburg favorisera encore la croissance du marché des maladies rétiniennes héréditaires.

En outre, l'augmentation des initiatives stratégiques des principaux acteurs, les progrès de la technologie médicale, l'augmentation de l'approbation des produits pour les IRD, les initiatives croissantes des organisations publiques et privées pour sensibiliser et l'augmentation du financement gouvernemental sont les facteurs qui élargiront le marché des maladies rétiniennes héréditaires. D'autres facteurs tels que l'augmentation de la demande de thérapies efficaces et le taux d'adoption croissant du conseil génétique précoce auront un impact positif sur le taux de croissance du marché des maladies rétiniennes héréditaires. De plus, le revenu disponible élevé et le nombre croissant de cas de diverses maladies rétiniennes entraîneront l'expansion du marché des maladies rétiniennes héréditaires.

Opportunités

- Augmentation des initiatives gouvernementales en matière de maladies rétiniennes héréditaires.

De plus, l'augmentation du taux de sensibilisation et de recherche de traitement ainsi que l'émergence de politiques de remboursement pour le traitement stimuleront de nouvelles opportunités pour le taux de croissance du marché.

En outre, le lancement de thérapies efficaces et la poursuite des essais cliniques offriront des opportunités bénéfiques pour le marché des maladies rétiniennes héréditaires au cours de la période de prévision 2022-2029. En outre, les besoins non satisfaits des traitements actuels et les développements des technologies de la santé augmenteront le taux de croissance du marché des maladies rétiniennes héréditaires à l'avenir.

Contraintes/Défis

Cependant, le coût élevé associé aux traitements disponibles et le manque d’infrastructures dans les pays à faible revenu entraveront le taux de croissance du marché des maladies rétiniennes héréditaires. De plus, le manque de professionnels qualifiés et les complications liées à la maladie entraveront la croissance du marché des maladies rétiniennes héréditaires.

Ce rapport sur le marché des maladies rétiniennes héréditaires fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et localisé, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché des maladies rétiniennes héréditaires, contactez Data Bridge Market Research pour un briefing d'analyste , notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Analyse épidémiologique des patients

La maladie rétinienne héréditaire est une maladie génétique relativement rare dont l'incidence est inconnue. Selon une étude sur les maladies rétiniennes héréditaires, la prévalence des maladies rétiniennes héréditaires est de 1 sur 3000.

La rétinite pigmentaire est la maladie la plus fréquente parmi les autres maladies. La rétinite pigmentaire est un groupe de maladies oculaires apparentées causées par des variations dans 60 gènes qui affectent la rétine. Les maladies oculaires orphelines sont un groupe hétérogène de maladies oculaires orphelines dont la prévalence est estimée entre 0,06 % et 0,2 %, avec un nombre de cas de maladies oculaires orphelines en Amérique du Nord de l'ordre de 5 à 10 millions de personnes.

Le marché des maladies rétiniennes héréditaires vous fournit également une analyse de marché détaillée pour l'analyse des patients, le pronostic et les remèdes. La prévalence, l'incidence, la mortalité et les taux d'adhésion sont quelques-unes des variables de données disponibles dans le rapport. Les analyses d'impact directes ou indirectes de l'épidémiologie sur la croissance du marché sont analysées pour créer un modèle statistique multivarié de cohorte plus robuste pour prévoir le marché pendant la période de croissance.

Impact post-COVID-19 sur le marché des maladies rétiniennes héréditaires

La COVID-19 a eu un impact négatif sur le marché. Les confinements et l’isolement pendant les pandémies compliquent la gestion de la maladie et l’observance du traitement. Le manque d’accès aux établissements de santé pour le traitement de routine et l’administration des médicaments affectera davantage le marché. L’isolement social augmente le stress, le désespoir et le soutien social, ce qui peut entraîner une réduction de l’observance du traitement anticonvulsivant pendant la pandémie.

Développement récent

- En janvier 2022, la principale organisation mondiale engagée dans la recherche de traitements et de remèdes contre les maladies rétiniennes aveuglantes, a annoncé le lancement du programme d'accélération de la recherche translationnelle améliorée de la Fondation Diana Davis Spencer.

Portée du marché des maladies rétiniennes héréditaires en Amérique du Nord

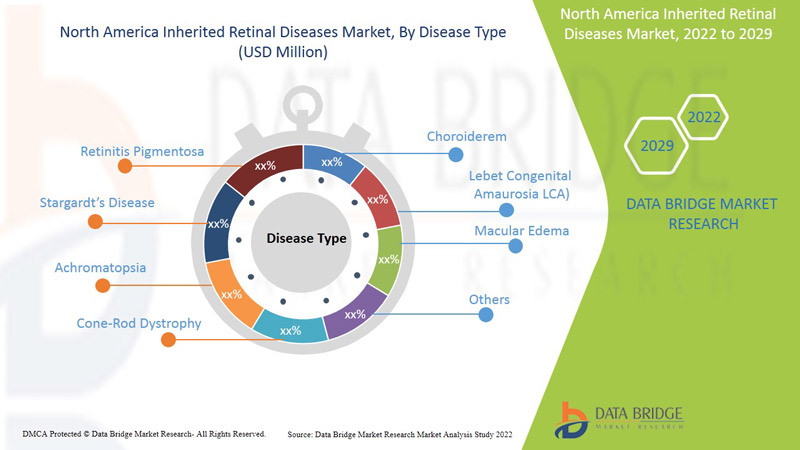

Le marché des maladies rétiniennes héréditaires est segmenté en type de maladie, type, utilisateur final et canal de distribution. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Type de maladie

- Rétinite pigmentaire

- Maladie de Stargardt

- Achromatopsie

- Dystrophie cône-bâtonnet

- Choroïdérémie

- Amaurose congénitale de Leber (ACL)

- Œdème maculaire

- Autres

Sur la base du type, le marché des maladies rétiniennes héréditaires est segmenté en type de maladie (rétinite pigmentaire, maladie de Stargardt, achromatopsie, dystrophie cône-bâtonnet, choroïdérémie, amaurose congénitale de Leber, œdème maculaire et autres).

Taper

- Diagnostic

- Thérapie

Sur la base du type, le marché des maladies rétiniennes héréditaires est segmenté en diagnostic et thérapie. Le segment du diagnostic est sous-segmenté en thérapie génique, prothèse rétinienne, agents neuroprotecteurs, autres. Les agents neuroprotecteurs sont en outre sous-segmentés en palmitate de vitamine A, acide docosahexaénoïque (DHA), lutéine, autres. Le segment du diagnostic est segmenté en diagnostic clinique et diagnostic génétique. Le diagnostic clinique est en outre sous-segmenté en imagerie rétinienne, tests électrophysiologiques, test du champ visuel et examen clinique de l'œil. L'imagerie rétinienne est en outre segmentée en tomographie par cohérence optique (OCT), imagerie par autofluorescence du fond d'œil (FAF), ophtalmoscopie laser à balayage (SLO), imagerie par optique adaptative (AO) et imagerie couleur conventionnelle du fond d'œil. Les tests électrophysiologiques sont en outre segmentés en électrorétinogramme plein champ (ERG) et adaptométrie sombre (DA). Le test du champ visuel est en outre segmenté en tests du champ visuel informatisés et test du champ manuel. L'examen clinique des yeux est segmenté en lampe à fente, ophtalmoscopie indirecte, test de réfraction, examen de dilatation

Utilisateur final

- Hôpitaux

- Cliniques spécialisées

- Centre de chirurgie ambulatoire

- Soins à domicile

- Autres

Sur la base des utilisateurs finaux, le marché des maladies rétiniennes héréditaires est segmenté en hôpitaux, cliniques spécialisées, centres chirurgicaux ambulatoires, soins de santé à domicile et autres

Canal de distribution

- Ventes au détail

- Appel d'offres direct

Le marché des maladies rétiniennes héréditaires est également segmenté sur la base du canal de distribution en ventes au détail et appels d'offres directs.

Analyse de pipeline

L'analyse du pipeline des médicaments contre les maladies rétiniennes héréditaires comprend diverses thérapies en pipeline telles que NCT05244304, NCT00999609, NCT05176717, NCT05158296, NCT04850118. Belite Bio, Inc, Spark Therapeutics, ProQR Therapeutics, Applied Genetic Technologies Corp, Biogen, MeiraGTx Ltd sont impliqués dans le développement de médicaments potentiels pour l'amélioration du traitement des crises.

Analyse/perspectives régionales du marché des maladies rétiniennes héréditaires

Le marché des maladies rétiniennes héréditaires est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type de maladie, type, utilisateur final et canal de distribution comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché des maladies rétiniennes héréditaires sont les États-Unis, le Canada et le Mexique en Amérique du Nord.

Les États-Unis dominent le marché des maladies rétiniennes héréditaires en termes de part de marché et de chiffre d'affaires et continueront de renforcer leur domination au cours de la période de prévision. Cela est dû à la présence d'acteurs clés majeurs et à une infrastructure de soins de santé bien développée dans cette région.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des maladies rétiniennes héréditaires

Le paysage concurrentiel du marché des maladies rétiniennes héréditaires fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché des maladies rétiniennes héréditaires.

Français Certains des principaux acteurs opérant sur le marché des maladies rétiniennes héréditaires sont Spark Therapeutics, Novartis AG, Okuvision, Nidek Co. Ltd., Invitae Corporation, Carl Zeiss Meditech AG, Optos (Une filiale de Nikon Corporation, Neurosoft, PIXIUM VISION, LKC TECHNOLOGIES, INC., Renurone, Astellas Pharma, REGENXBIO Inc., Ionis Pharmaceutics, Sparing Vision, Ocugen Inc, Johnson & Johnson, IVERIC bio, Second Sight, Coave Therapeutics, MeiraGTx Limited, Gensight Biologics, ProQR Therapeutics, Bionic Vision Technologies entre autres.

Méthodologie de recherche : Marché des maladies rétiniennes héréditaires en Amérique du Nord

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse de la part de marché Amérique du Nord/régionale et des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA INHERITED RETINAL DISEASES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PIPELINE ANALYSIS FOR NORTH AMERICA INHERITED RETINAL DISEASES MARKET

5 REGULATORY FRAMEWORK

6 PREMIUM INSIGHTS

6.1 PESTEL ANALYSIS

6.2 POTER’S FIVE FORCES MODEL

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASE IN THE PREVALENCE OF INHERITED RETINAL DISEASES

7.1.2 INCREASE IN PIPELINE PRODUCTS

7.1.3 INCREASING PRODUCT APPROVAL FOR INHERITED RETINAL DISEASES

7.1.4 INCREASE IN STRATEGIC INITIATIVE BY KEY PLAYER

7.2 RESTRAINTS

7.2.1 HIGH COST OF TREATMENT AND PROCEDURES

7.2.2 LACK OF ENOUGH QUALIFIED PROFESSIONALS

7.3 OPPORTUNITIES

7.3.1 INCREASE IN GOVERNMENT INITIATIVES TOWARDS INHERITED RETINAL DISEASES(IRDS)

7.3.2 INCREASE IN AWARENESS AND TREATMENT-SEEKING RATE

7.3.3 EMERGING REIMBURSEMENT POLICIES FOR THE TREATMENT

7.4 CHALLENGES

7.4.1 RISKS ASSOCIATED WITH IRD SPECIFIC GENE THERAPY

7.4.2 LIMITED ACCESS TO TREATMENT

8 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY DISEASE TYPE

8.1 OVERVIEW

8.2 RETINITIS PIGMENTOSA

8.3 STARGARDT’S DISEASE

8.4 ACHROMATOPSIA

8.5 CONE-ROD DYSTROPHY

8.6 CHOROIDEREMIA

8.7 LEBER CONGENITAL AMAUROSIS (LCA)

8.8 MACULAR EDEMA

8.9 OTHERS

9 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY TYPE

9.1 OVERVIEW

9.2 DIAGNOSIS

9.2.1 CLINICAL DIAGNOSIS

9.2.1.1 RETINAL IMAGING

9.2.1.1.1 OPTICAL COHERENCE TOMOGRAPHY (OCT)

9.2.1.1.2 FUNDUS AUTOFLUORESCENCE IMAGING (FAF)

9.2.1.1.3 SCANNING LASER OPHTHALMOSCOPY (SLO)

9.2.1.1.4 ADAPTIVE OPTICS (AO) IMAGING

9.2.1.1.5 CONVENTIONAL COLOR FUNDUS IMAGING

9.2.1.2 ELECTROPHYSIOLOGICAL TESTS

9.2.1.2.1 FULL-FIELD ELECTRORETINOGRAM (ERG)

9.2.1.2.2 DARK ADAPTOMETRY (DA)

9.2.1.3 VISUAL FIELD TEST

9.2.1.3.1 COMPUTERIZED VISUAL FIELD TESTS

9.2.1.3.2 MANUAL FIELD TEST

9.2.1.4 CLINICAL EYE EXAMINATION

9.2.1.4.1 SLIT LAMP

9.2.1.4.2 INDIRECT OPHTHALMOSCOPY

9.2.1.4.3 REFRACTION TEST

9.2.1.4.4 DILATION EXAM

9.2.1.5 OTHERS

9.2.2 GENETIC DIAGNOSIS

9.3 THERAPY

9.3.1 GENE THERAPY

9.3.2 RETINAL PROSTHETIC

9.3.3 NEUROPROTECTIVE AGENTS

9.3.3.1 VITAMIN A PALMITATE

9.3.3.2 DOCOSAHEXAENOIC ACID

9.3.3.3 LUTEIN

9.3.3.4 OTHERS

9.3.4 OTHERS

10 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITALS

10.3 SPECIALTY CLINICS

10.4 AMBULATORY SURGICAL CENTERS

10.5 HOME HEALTHCARE

10.6 OTHERS

11 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 RETAIL SALES

11.2.1 HOSPITAL PHARMACIES

11.2.2 RETAIL PHARMACIES

11.2.3 OTHERS

11.3 DIRECT TENDER

12 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 SPARK THERAPEUTICS, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.1.4.1 PROGRAM LAUNCH

15.1.4.2 ACQUISITIONS

15.2 NOVARTIS AG

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.2.5.1 AGREEMENT

15.3 OKUVISION

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.3.4.1 EXPANSION

15.3.4.2 EVENTS

15.3.4.3 APPROVAL

15.4 NIDEK CO., LTD

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.4.4.1 PRODUCT LAUNCH

15.4.4.2 PRODUCT LAUNCH

15.5 INVITAE CORPORATION

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.5.5.1 PROGRAM LAUNCH

15.5.5.2 ACQUISITION

15.6 ZEISS INTERNATIONAL

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.6.4.1 EVENTS

15.6.4.2 SOCIAL INVOLVEMENT

15.7 OPTOS (A SUBSIDIARY OF NIKON CORPORATION)

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 NEUROSOFT

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 ASTELLAS PHARMA INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 BIONIC VISION TECHNOLOGIES

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.10.3.1 AWARD

15.11 COAVE THERAPEUTICS

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.11.3.1 AGREEMENT

15.12 GENSIGHT BIOLOGICS

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.12.4.1 EVENT

15.12.4.2 AWARD

15.13 IONIS PHARMACEUTICALS

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.13.4.1 EVENT

15.14 IVERIC BIO

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 JOHNSON &JOHNSON SERVICES, INC.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.15.4.1 COLLABORATION

15.16 LKC TECHNOLOGIES, INC.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.16.3.1 PRODUCT LAUNCH

15.17 MEIRAGTX LIMITED

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.17.3.1 EVENTS

15.17.3.2 AWARD

15.17.3.3 COLLABORATION

15.18 OCUGEN INC.

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.18.3.1 INVESTMENT

15.18.3.2 CLINICAL TRIAL

15.19 PIXIUM VISION

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.19.4.1 AWARD

15.2 PROQR THERAPEUTICS

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.20.3.1 EVENT

15.21 SECOND SIGHT

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.21.3.1 PRODUCT LAUNCH

15.22 SPARING VISION

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.22.3.1 ACQUISITION

15.23 REGENXBIO INC.

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENTS

15.23.3.1 EVENT

15.23.3.2 COLLABORATION

15.23.3.3 CERTIFICATION

15.24 RENEURON GROUP PLC

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENT

15.24.3.1 STRATEGIC INITIATIVE

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 PIPELINE ANALYSIS FOR INHERITED RETINAL DISEASES:

TABLE 2 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA RETINITIS PIGMENTOSA IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA STARGARDT’S DISEASE IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA ACHROMATOPSIA IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA CONE-ROD DYSTROPHY IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA CHOROIDERMIA IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA LEBER CONGENITAL AMAUROSIS (LCA) IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA MACULAR EDEMA IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA OTHERS IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA CLINICAL DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA RETINAL IMAGING IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA ELECTROPHYSIOLOGICAL TETS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA VISUAL FIELD TEST IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA CLINICAL EYE EXAMINATION IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA THERAPY IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA THERAPY IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA NEUROPROTECTIVE AGENTS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA HOSPITALS IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA SPECIALTY CLINICS IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA HOME HEALTHCARE IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA OTHERS IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA RETAIL SALES IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA RETAIL SALES IN INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA DIRECT TENDER IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA THERAPY IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA NEUROPROTECTIVE AGENTS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA CLINICAL DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA RETINAL IMAGING IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA ELECTROPHYSIOLOGICAL TESTS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA VISUAL FIELD TEST IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA CLINICAL EYE EXAMINATION IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA RETAIL SALES IN INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 46 U.S. INHERITED RETINAL DISEASES MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 47 U.S. INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 U.S. THERAPY IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 U.S. NEUROPROTECTIVE AGENTS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 U.S. DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 U.S. CLINICAL DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 U.S. RETINAL IMAGING IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 U.S. ELECTROPHYSIOLOGICAL TESTS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 U.S. VISUAL FIELD TEST IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 U.S. CLINICAL EYE EXAMINATION IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 U.S. INHERITED RETINAL DISEASES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 57 U.S. INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 58 U.S. RETAIL SALES IN INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 59 CANADA INHERITED RETINAL DISEASES MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 60 CANADA INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 CANADA THERAPY IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 CANADA NEUROPROTECTIVE AGENTS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 CANADA DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 CANADA CLINICAL DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 CANADA RETINAL IMAGING IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 CANADA ELECTROPHYSIOLOGICAL TESTS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 CANADA VISUAL FIELD TEST IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 CANADA CLINICAL EYE EXAMINATION IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 CANADA INHERITED RETINAL DISEASES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 CANADA INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 71 CANADA RETAIL SALES IN INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 72 MEXICO INHERITED RETINAL DISEASES MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 MEXICO THERAPY IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 MEXICO NEUROPROTECTIVE AGENTS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 MEXICO DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 MEXICO CLINICAL DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 MEXICO RETINAL IMAGING IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 MEXICO ELECTROPHYSIOLOGICAL TESTS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 MEXICO VISUAL FIELD TEST IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 MEXICO CLINICAL EYE EXAMINATION IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 MEXICO INHERITED RETINAL DISEASES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 83 MEXICO INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 84 MEXICO RETAIL SALES IN INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: SEGMENTATION

FIGURE 12 NORTH AMERICA IS EXPECTED TO DOMINATE AND EUROPE IS GROWING AT THE FASTEST PACE IN NORTH AMERICA INHERITED RETINAL DISEASES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 INCREASE IN THE PREVALENCE OF INHERITED RETINAL DISEASES AND INCREASE IN PIPELINE PRODUCTS ARE DRIVING THE NORTH AMERICA INHERITED RETINAL DISEASES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 RETINITIS PIGMENTOSA SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA INHERITED RETINAL DISEASES MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA INHERITED RETINAL DISEASES MARKET

FIGURE 16 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY DISEASE TYPE, 2021

FIGURE 17 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY DISEASE TYPE, 2020-2029 (USD MILLION)

FIGURE 18 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY DISEASE TYPE, CAGR (2022-2029)

FIGURE 19 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY DISEASE TYPE, LIFELINE CURVE

FIGURE 20 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY TYPE, 2021

FIGURE 21 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY TYPE, 2020-2029 (USD MILLION)

FIGURE 22 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 23 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 24 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY END USER, 2021

FIGURE 25 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 26 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 27 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY END USER, LIFELINE CURVE

FIGURE 28 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 29 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

FIGURE 30 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 31 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 32 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: SNAPSHOT (2021)

FIGURE 33 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY COUNTRY (2021)

FIGURE 34 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 35 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 36 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY DISEASE TYPE (2022-2029)

FIGURE 37 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.