North America Industrial Machine Vision Market

Taille du marché en milliards USD

TCAC :

%

USD

3.37 Billion

USD

7.01 Billion

2024

2032

USD

3.37 Billion

USD

7.01 Billion

2024

2032

| 2025 –2032 | |

| USD 3.37 Billion | |

| USD 7.01 Billion | |

|

|

|

|

Segmentation du marché nord-américain de la vision industrielle, par composant (matériel et logiciel), produit (système de vision par caméra/capteur intelligent, système de vision hybride par caméra intelligente et système basé sur PC), type (systèmes de vision 2D, 3D et 1D), déploiement (cellule robotisée et général), applications (détection de défauts, inspection de produits, inspection de surfaces, inspection d'emballages, identification, OCR/OCV, reconnaissance de formes, calibrage, guidage et suivi des pièces, inspection de bandes, etc.), utilisateur final (automobile, électronique grand public, agroalimentaire et emballage, produits pharmaceutiques, métaux, imprimerie, aérospatiale, verre, caoutchouc et plastique, exploitation minière, textiles, bois et papier, machines, fabrication de panneaux solaires, etc.) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché de la vision industrielle

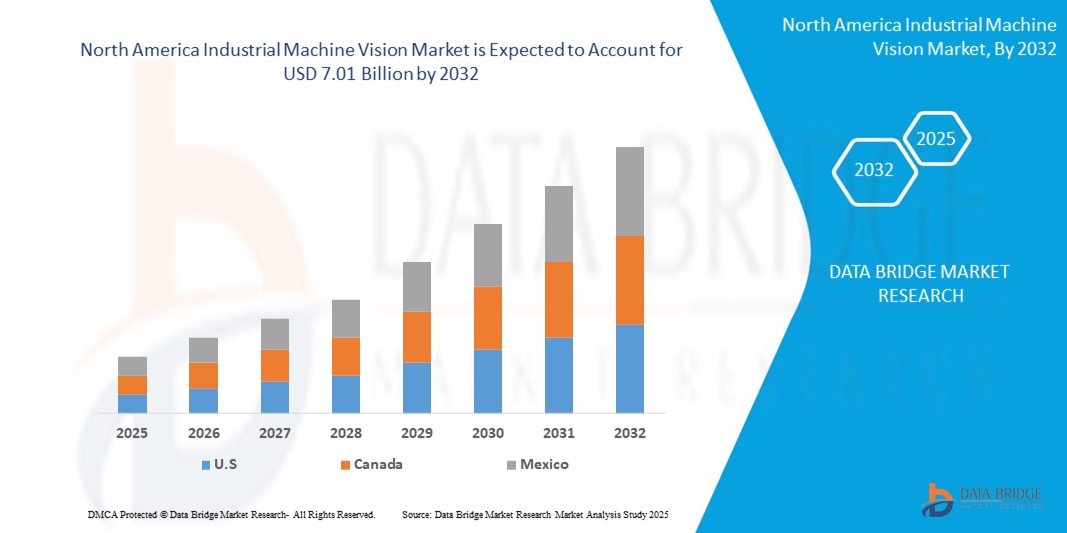

- La taille du marché nord-américain de la vision industrielle était évaluée à 3,37 milliards USD en 2024 et devrait atteindre 7,01 milliards USD d'ici 2032 , à un TCAC de 7,69 % au cours de la période de prévision.

- Cette croissance est tirée par des facteurs tels que l'adoption croissante de l'automatisation dans les industries manufacturières, la demande croissante d'inspection de la qualité et de détection des défauts, ainsi que les progrès technologiques dans l'apprentissage automatique et le traitement d'images.

Analyse du marché de la vision industrielle

- Les systèmes de vision industrielle sont des technologies essentielles utilisées dans les environnements de fabrication pour l'inspection automatisée, l'assurance qualité et le guidage robotique, offrant précision et efficacité dans divers secteurs, notamment l'automobile, l'électronique, les produits pharmaceutiques et l'alimentation et les boissons.

- La demande pour ces systèmes est fortement motivée par le besoin croissant d'automatisation, de précision dans la détection des défauts et de progrès dans les technologies d'imagerie intégrées à l'IA.

- Les États-Unis dominent le marché de la vision industrielle en Amérique du Nord, représentant environ 75 % du marché régional total. Cette domination s'explique par la solidité de son tissu industriel, l'adoption précoce de technologies de fabrication avancées et des investissements importants dans l'automatisation et les lignes de production pilotées par l'IA.

- Le Canada est le pays qui connaît la croissance la plus rapide sur le marché de la vision industrielle. Bien qu'il détienne actuellement une part de marché plus modeste, estimée à environ 20 %, sa croissance s'accélère grâce à l'accent accru mis sur la fabrication de pointe, aux initiatives gouvernementales visant à stimuler la productivité industrielle et à l'adoption croissante de l'automatisation dans les secteurs de la transformation alimentaire et de l'automobile.

- Le secteur de la construction automobile devrait dominer le marché de la vision industrielle avec une part de marché de 48,75 % en 2025, en raison de la forte demande d'automatisation et de contrôle qualité sur les lignes de production. Composants essentiels de la construction automobile moderne, les systèmes de vision industrielle améliorent la précision des processus tels que l'inspection, l'assemblage et l'identification des pièces.

Portée du rapport et segmentation du marché de la vision industrielle

|

Attributs |

Aperçus clés du marché de la vision industrielle |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché de la vision industrielle

« Intégration de l'IA, de l'apprentissage profond et des systèmes de vision 3D dans l'automatisation industrielle »

- L'une des tendances marquantes du marché de la vision industrielle est l'intégration croissante de l'intelligence artificielle (IA), des algorithmes d'apprentissage profond et des systèmes de vision 3D pour la prise de décision en temps réel et l'automatisation de précision dans les processus de fabrication.

- Ces innovations améliorent considérablement les performances de la vision artificielle en permettant aux systèmes de détecter des modèles complexes, de classer les défauts et de s'adapter à des conditions variables que les systèmes traditionnels basés sur des règles ne peuvent pas gérer efficacement

- Par exemple, les technologies modernes de vision 3D offrent une perception de la profondeur et une analyse volumétrique, permettant des applications telles que le prélèvement dans des bacs, le guidage de robots et le contrôle qualité d'objets de forme irrégulière avec une grande précision.

- Ces avancées transforment le paysage de l’automatisation industrielle, réduisent les taux d’erreur, augmentent l’efficacité de la production et stimulent la demande de systèmes de vision intelligents dans les secteurs de l’automobile, de l’électronique, de l’emballage et de la logistique.

Dynamique du marché de la vision industrielle

Conducteur

« Demande croissante d'inspection de la qualité et d'automatisation dans la fabrication »

- L'importance croissante accordée à l'assurance qualité, à l'optimisation des processus et à la détection des défauts dans la fabrication moderne contribue de manière significative à la demande accrue de systèmes de vision industrielle.

- Alors que les industries adoptent l'automatisation, la vision industrielle joue un rôle essentiel en permettant l'inspection en temps réel, la mesure de précision et le guidage robotique, garantissant ainsi la cohérence et la fiabilité des lignes de production.

- Des industries telles que l'automobile, l'électronique, les produits pharmaceutiques et l'agroalimentaire dépendent fortement des systèmes de vision industrielle pour répondre à des normes réglementaires et de qualité strictes.

Par exemple,

- En octobre 2023, Cognex Corporation a signalé une augmentation de la demande de systèmes de vision dans les secteurs de l'électronique et de la logistique, motivée par les attentes croissantes des consommateurs en matière de fiabilité des produits et d'exécution rapide des commandes.

- En raison de l’importance croissante accordée au contrôle qualité automatisé, on observe une augmentation substantielle de l’adoption de systèmes de vision industrielle pour améliorer la productivité, minimiser les erreurs et réduire les coûts de main-d’œuvre dans les écosystèmes de fabrication mondiaux.

Opportunité

« Faire progresser la vision industrielle grâce à l'intégration de l'intelligence artificielle »

- Les systèmes de vision industrielle alimentés par l'IA peuvent améliorer la détection d'objets, l'automatisation et le contrôle qualité dans les processus de fabrication, améliorant ainsi l'efficacité opérationnelle et la précision.

- Les algorithmes d'IA peuvent analyser des images en temps réel pour identifier les défauts, surveiller les lignes de production et suivre la qualité des produits, fournissant ainsi un retour d'information immédiat aux fabricants pour résoudre les problèmes avant qu'ils ne s'aggravent.

- Les systèmes de vision alimentés par l'IA peuvent également contribuer à la maintenance prédictive en analysant les performances des équipements et en identifiant les pannes potentielles, réduisant ainsi les temps d'arrêt et les coûts de maintenance.

Par exemple,

- En décembre 2024, un partenariat entre Siemens et un éditeur de logiciels d'IA a permis l'intégration d'un système de vision industrielle basé sur l'IA dans les usines de Siemens. Ce système d'IA assure un contrôle qualité en temps réel en identifiant les défauts des produits et en ajustant automatiquement les paramètres de production pour maintenir une qualité constante. Cette intégration a permis une augmentation de 15 % de l'efficacité de la production et une réduction de 20 % des défauts des produits.

- L'intégration de l'IA dans les systèmes de vision industrielle peut également conduire à une meilleure utilisation des ressources, à des cycles de production plus rapides et à une réduction des déchets. En exploitant la capacité de l'IA à analyser de vastes quantités de données visuelles, les fabricants peuvent optimiser leurs lignes de production, réduire les erreurs humaines et garantir une meilleure régularité de la qualité des produits.

Retenue/Défi

« Les coûts élevés des équipements entravent la pénétration du marché »

- Le coût élevé des systèmes de vision industrielle constitue un obstacle important à leur adoption généralisée, en particulier pour les petites et moyennes entreprises (PME) disposant de budgets limités.

- Ces systèmes de vision avancés, essentiels pour automatiser le contrôle qualité et améliorer les processus de fabrication, peuvent coûter de quelques dizaines de milliers à plusieurs centaines de milliers de dollars selon la complexité et les capacités du système.

- L'investissement financier important requis pour ces systèmes peut dissuader les petites entreprises de moderniser leurs équipements, ce qui les conduit à recourir à l'inspection manuelle ou à des solutions de vision industrielle obsolètes.

Par exemple,

- En octobre 2024, un rapport de l'International Society of Automation (ISA) a mis en lumière les difficultés rencontrées par les petites entreprises manufacturières lorsqu'elles envisagent d'adopter des systèmes de vision industrielle basés sur l'IA. Le rapport souligne que si les grandes entreprises peuvent se permettre un investissement initial élevé, de nombreuses PME peinent à gérer le coût d'intégration de systèmes basés sur l'IA à leurs opérations, ce qui ralentit le rythme d'adoption dans l'ensemble du secteur.

- En conséquence, cet obstacle financier peut entraîner un ralentissement de la croissance du marché et empêcher une adoption plus large des systèmes avancés de vision industrielle, en particulier dans les secteurs sensibles aux coûts tels que la fabrication à petite échelle ou les entreprises des marchés émergents.

Portée du marché de la vision industrielle

Le marché est segmenté sur la base du composant, du produit, du type, du déploiement, des applications et de l'utilisateur final.

|

Segmentation |

Sous-segmentation |

|

Par composant |

|

|

Par produit |

|

|

Par type |

|

|

Par déploiement |

|

|

Par applications |

|

|

Par utilisateur final |

|

En 2025, le segment de la fabrication automobile devrait dominer le marché avec la plus grande part dans le segment des utilisateurs finaux

Le secteur de la construction automobile devrait dominer le marché de la vision industrielle avec une part de marché de 48,75 % en 2025, en raison de la forte demande d'automatisation et de contrôle qualité sur les lignes de production. Composants essentiels de la construction automobile moderne, les systèmes de vision industrielle améliorent la précision des processus tels que l'inspection, l'assemblage et l'identification des pièces. La demande croissante de dispositifs de sécurité pour les véhicules, associée aux progrès des technologies de vision industrielle, favorise l'adoption de ces systèmes dans la production automobile. L'automatisation croissante des usines automobiles et la complexité croissante de la conception des véhicules contribuent également à la domination de ce segment sur le marché de la vision industrielle.

La reconnaissance de formes devrait représenter la plus grande part au cours de la période de prévision dans les segments d'application

En 2025, le segment de la reconnaissance de formes devrait dominer le marché de la vision industrielle avec une part de marché de 50,62 %, grâce à sa capacité à améliorer le contrôle qualité, l'inspection et l'automatisation des processus de fabrication. Les systèmes de reconnaissance de formes sont essentiels pour identifier et classer les objets, les défauts et les anomalies en temps réel, permettant ainsi aux fabricants de maintenir une qualité de produit constante et d'optimiser l'efficacité de la production. Face à l'exigence croissante de précision et de rapidité des industries, les systèmes de reconnaissance de formes, notamment en combinaison avec l'IA et les technologies d'apprentissage profond, stimulent la croissance du marché. La complexité croissante des produits et le besoin de normes de qualité élevées dans des secteurs tels que l'automobile, l'électronique et l'industrie pharmaceutique contribuent également à la domination des systèmes de vision industrielle basés sur la reconnaissance de formes sur le marché.

Analyse régionale du marché de la vision industrielle

« Les États-Unis détiennent la plus grande part du marché nord-américain de la vision industrielle »

- Les États-Unis bénéficient d'une base industrielle solide et d'une adoption précoce des technologies de fabrication intelligente, contribuant à leur domination sur le marché de la vision industrielle, détenant environ 75 % des parts de marché nord-américaines.

- Le déploiement croissant de l'automatisation et de la robotique dans les usines de fabrication américaines favorise l'intégration de systèmes de vision industrielle, permettant un contrôle qualité en temps réel et une efficacité opérationnelle.

- La demande croissante d'inspection à grande vitesse et de haute précision dans des secteurs tels que l'automobile, l'électronique et les produits pharmaceutiques entraîne une adoption significative des solutions IMV aux États-Unis.

- Des investissements importants dans la R&D industrielle, ainsi qu'une forte présence d'acteurs clés du marché et un soutien gouvernemental aux initiatives de fabrication avancées, renforcent encore le leadership des États-Unis sur le marché de la vision industrielle.

« Le Canada devrait enregistrer le TCAC le plus élevé du marché nord-américain de la vision industrielle »

- L'accent croissant mis par le Canada sur l'automatisation industrielle et la fabrication intelligente stimule l'adoption des technologies de vision artificielle, contribuant ainsi à la croissance attendue de son marché, avec une part de marché estimée à 20 % en Amérique du Nord.

- Les programmes soutenus par le gouvernement qui favorisent la modernisation des infrastructures de fabrication et l'adoption des technologies de l'industrie 4.0 accélèrent l'intégration des systèmes de vision industrielle dans le pays.

- La demande croissante en matière d’inspection de la qualité, en particulier dans des secteurs comme la transformation des aliments, l’automobile et les produits pharmaceutiques, favorise le déploiement de solutions de vision artificielle partout au Canada.

- Les investissements continus des secteurs public et privé dans les technologies d’automatisation et les systèmes de production avancés soutiennent l’expansion rapide des applications de vision industrielle partout au Canada.

Part de marché de la vision industrielle

Le paysage concurrentiel du marché fournit des détails par concurrent. Il comprend la présentation de l'entreprise, ses données financières, son chiffre d'affaires, son potentiel de marché, ses investissements en recherche et développement, ses nouvelles initiatives commerciales, sa présence mondiale, ses sites et installations de production, ses capacités de production, ses forces et faiblesses, le lancement de nouveaux produits, leur ampleur et leur portée, ainsi que la domination de ses applications. Les données ci-dessus ne concernent que les activités des entreprises par rapport à leur marché.

Les principaux leaders du marché opérant sur le marché sont :

- KEYENCE CORPORATION (Japon)

- OMRON Corporation (Japon)

- Sony Semiconductor Solutions Corporation (Japon)

- Cognex Corporation (États-Unis)

- SICK AG (États-Unis)

- Teledyne FLIR LLC (États-Unis)

- NATIONAL INSTRUMENTS CORP. (États-Unis)

- BASLER AG (Allemagne)

- ISRA VISION (Allemagne)

- Intel Corporation (États-Unis)

- Texas Instruments Incorporated (États-Unis)

- Cadence Design Systems, Inc. (États-Unis)

- Automatic Identification Systems (UK) Limited (Royaume-Uni)

- MV ASIA Infomatrix Pte Ltd (Singapour)

- Ceva Inc. (États-Unis)

- Soda Vision (Singapour),

- The Imaging Source, LLC (États-Unis)

- Kalypso : une entreprise de Rockwell Automation (États-Unis)

- Qualitas Technologies (Inde)

- Integro Technologies Corp. (États-Unis)

Derniers développements sur le marché nord-américain de la vision industrielle

- En juillet 2024, OMRON Corporation a lancé une mise à jour logicielle pour son système de vision FH et sa caméra intelligente FHV7, intégrant la technologie de décodage Digimarc pour améliorer l'identification numérique des produits. Cette mise à jour permet une vérification ultra-rapide des emballages grâce aux filigranes numériques, atteignant plus de 2 000 pièces par minute. Cette intégration améliore la précision de détection, la vitesse de traitement, la flexibilité de la caméra, la redondance et les capacités d'inspection, renforçant ainsi l'engagement d'OMRON en faveur de l'innovation dans l'automatisation industrielle. Conçue pour les fabricants de biens de consommation, cette avancée renforce l'assurance qualité et l'efficacité de la production.

- Le 6 mai 2025, AMETEK a annoncé l'acquisition de FARO Technologies pour environ 920 millions de dollars américains. FARO, leader des solutions de mesure et d'imagerie 3D, a enregistré un chiffre d'affaires de 340 millions de dollars américains en 2024. Cette opération stratégique vise à développer la division d'instruments électroniques d'AMETEK et à renforcer sa présence sur les marchés de l'aérospatiale, du médical, de la recherche, de l'énergie et de l'industrie. Cette acquisition enrichit le portefeuille d'AMETEK avec des solutions de fabrication de précision et de réalité virtuelle, complétant ainsi son activité Creaform.

- En avril 2024, Cognex Corporation a présenté le système de vision 3D In-Sight L38, le premier système de vision 3D au monde basé sur l'IA, conçu pour un déploiement rapide et des inspections fiables dans l'automatisation de la fabrication. Ce système intègre des technologies d'IA, de vision 2D et 3D, générant des images de projection uniques qui simplifient la formation et révèlent des caractéristiques invisibles à l'imagerie 2D traditionnelle. Grâce à des outils d'IA intégrés, il améliore la précision des inspections, la précision des mesures et l'efficacité opérationnelle, établissant ainsi de nouvelles normes en matière d'automatisation industrielle.

- En mai 2023, Teledyne DALSA a lancé la production de la caméra linéaire multispectrale 4K 5GigE Linea 2, une avancée technologique majeure dans le domaine des systèmes de vision. Cette caméra avancée est dotée d'une interface 5GigE, offrant une bande passante cinq fois supérieure à celle de son prédécesseur, la caméra Linea GigE. Grâce à l'imagerie multispectrale RVB et proche infrarouge (NIR) haute résolution, elle optimise la détection des défauts, la classification des matériaux et le tri optique dans les applications industrielles. Le capteur CMOS quadrilinéaire garantit une diaphonie spectrale minimale, améliorant ainsi la précision des inspections.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.