North America Hoses Market

Taille du marché en milliards USD

TCAC :

%

USD

9.25 Billion

USD

15.65 Billion

2024

2032

USD

9.25 Billion

USD

15.65 Billion

2024

2032

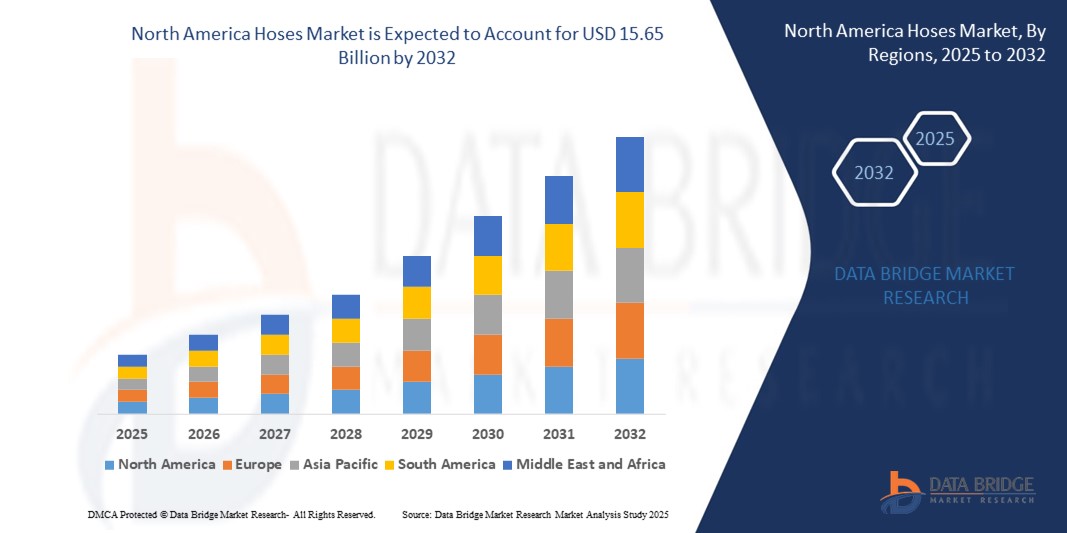

| 2025 –2032 | |

| USD 9.25 Billion | |

| USD 15.65 Billion | |

|

|

|

|

Marché des tuyaux en Amérique du Nord, par type de fluide (tuyaux hydrauliques, à air et à gaz, de manutention, alimentaires, à vapeur et autres), matériau (tuyaux en caoutchouc, en plastique/polymère, en métal, en composite, en silicone et autres), utilisateur final (automobile, industriel, commercial et résidentiel) et canal de vente (indirect et direct) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des tuyaux en Amérique du Nord

- La taille du marché des tuyaux en Amérique du Nord était évaluée à 9,25 milliards USD en 2024 et devrait atteindre 15,65 milliards USD d'ici 2032 , à un TCAC de 6,80 % au cours de la période de prévision.

- La croissance du marché est principalement tirée par la demande croissante de tuyaux durables et performants dans des secteurs tels que l'automobile, la fabrication industrielle et la transformation des aliments, associée aux progrès des matériaux des tuyaux pour une durabilité et une flexibilité accrues.

- La sensibilisation croissante aux solutions efficaces de transfert de fluides et de gaz, ainsi que l'adoption croissante des tuyaux dans les applications résidentielles et commerciales, propulsent davantage la demande du marché via les canaux OEM et de rechange.

Analyse du marché des tuyaux flexibles en Amérique du Nord

- Le marché nord-américain des tuyaux connaît une croissance robuste en raison du besoin croissant de systèmes de transfert de fluides fiables, de normes de sécurité améliorées et de solutions de tuyaux personnalisées pour diverses applications.

- La demande croissante des secteurs automobile et industriel encourage les fabricants à innover avec des solutions de tuyaux haute pression, résistants à la corrosion et légers

- Les États-Unis dominent le marché nord-américain des tuyaux avec la plus grande part de revenus de 54,5 % en 2024, grâce à une base industrielle mature, une production automobile importante et une forte demande de technologies de tuyaux avancées.

- Le Canada devrait être le pays connaissant la croissance la plus rapide sur le marché des tuyaux en Amérique du Nord au cours de la période de prévision, alimenté par une industrialisation rapide, un développement croissant des infrastructures et une adoption croissante de matériaux de tuyaux avancés dans divers secteurs.

- Le segment des flexibles hydrauliques a dominé la plus grande part de revenus du marché, soit 38,2 % en 2024, grâce à une utilisation généralisée dans les secteurs de l'automobile, de la construction et du pétrole et du gaz pour le transfert de fluides à haute pression.

Portée du rapport et segmentation du marché des tuyaux en Amérique du Nord

|

Attributs |

Informations clés sur le marché des tuyaux en Amérique du Nord |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur le marché telles que la valeur marchande, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse du pilon. |

Tendances du marché des tuyaux en Amérique du Nord

Adoption croissante de matériaux avancés et de technologies de tuyaux intelligents

- Le marché nord-américain des tuyaux connaît une tendance notable vers l'adoption de matériaux avancés tels que les élastomères thermoplastiques, les polymères hybrides et les composites respectueux de l'environnement.

- Ces matériaux améliorent la durabilité, la flexibilité et la résistance des tuyaux aux températures extrêmes, aux produits chimiques et aux hautes pressions, répondant ainsi à divers besoins industriels.

- Les technologies de tuyaux intelligents, intégrant des capteurs et des capacités IoT, gagnent du terrain, permettant une surveillance en temps réel des performances des tuyaux, la détection des fuites et la maintenance prédictive pour améliorer l'efficacité opérationnelle et la sécurité.

- Par exemple, les entreprises développent des tuyaux avec des capteurs intégrés pour surveiller la pression et l'usure dans des applications telles que le pétrole et le gaz ou la construction, réduisant ainsi les temps d'arrêt et les coûts de maintenance.

- Cette tendance accroît l'attrait des tuyaux pour les industries telles que l'automobile, la construction et la fabrication, où la fiabilité et les performances sont essentielles.

- La transition vers des matériaux durables, tels que les polymères recyclables et les tuyaux biosourcés, s'aligne sur les réglementations environnementales et la demande des consommateurs pour des produits plus écologiques, stimulant ainsi davantage l'innovation du marché.

Dynamique du marché des tuyaux flexibles en Amérique du Nord

Conducteur

Demande croissante dans les secteurs de la construction, de l'automobile et de l'industrie

- La demande croissante de tuyaux dans les secteurs de la construction, de l'automobile et de l'industrie est un facteur clé du marché des tuyaux en Amérique du Nord, alimentée par un développement robuste des infrastructures et une industrialisation, en particulier aux États-Unis et au Canada.

- Les tuyaux sont essentiels pour le transfert de fluides et de matériaux dans les équipements de construction, les systèmes automobiles et les processus industriels tels que le pétrole et le gaz ou le traitement chimique.

- Les investissements gouvernementaux dans les infrastructures, tels que le plan américain de 2 000 milliards de dollars pour les routes, les ponts et les travaux publics, stimulent la demande de tuyaux durables et performants.

- La prolifération des techniques de fabrication avancées et l'adoption de l'automatisation dans les industries nécessitent des tuyaux spécialisés qui répondent à des normes de sécurité et de performance strictes.

- Au Canada, le marché qui connaît la croissance la plus rapide, les investissements croissants dans les énergies renouvelables et l'agriculture stimulent la demande de tuyaux dans des applications telles que les systèmes hydrauliques pour les éoliennes et l'irrigation.

- Les États-Unis dominent le marché en raison de leur solide base industrielle, de leurs avancées technologiques et de la présence de grands fabricants tels que Gates Corporation et Parker Hannifin.

Retenue/Défi

Coûts élevés des tuyaux avancés et volatilité des prix des matières premières

- Le coût élevé du développement et de l'intégration de tuyaux avancés, en particulier ceux fabriqués à partir de matériaux spécialisés tels que le silicone ou les composites, constitue un obstacle important à l'adoption, en particulier pour les petites et moyennes entreprises sur un marché sensible aux coûts.

- La complexité de la personnalisation des tuyaux pour des applications spécifiques, telles que les systèmes hydrauliques haute pression ou les tuyaux de qualité alimentaire, augmente les coûts de fabrication et d'installation.

- La volatilité des prix des matières premières, telles que le caoutchouc, les thermoplastiques et les métaux, provoquée par les perturbations de la chaîne d'approvisionnement et les facteurs géopolitiques, a un impact sur la rentabilité et la stabilité des prix des fabricants.

- Les réglementations environnementales et les exigences de conformité pour les matériaux durables et l'élimination des tuyaux non biodégradables augmentent les coûts de production et posent des défis aux fabricants.

- Les problèmes de sécurité des données liés aux tuyaux intelligents avec intégration IoT, tels que les vulnérabilités cybernétiques potentielles dans les systèmes connectés, peuvent décourager l'adoption dans les industries privilégiant la sécurité et la fiabilité.

- Ces facteurs pourraient limiter la croissance du marché dans les régions où la réglementation est stricte ou où la sensibilité aux coûts est une considération clé, en particulier pour les petits acteurs du marché.

Portée du marché des tuyaux en Amérique du Nord

Le marché est segmenté en fonction du média, du matériel, de l’utilisateur final et du canal de vente.

- Par les médias

D'après les médias, le marché nord-américain des flexibles est segmenté en flexibles hydrauliques, pneumatiques et à gaz, pour la manutention, pour l'industrie alimentaire et pour la vapeur, entre autres. En 2024, le segment des flexibles hydrauliques a dominé le marché avec 38,2 % de chiffre d'affaires, grâce à son utilisation généralisée dans les secteurs de l'automobile, de la construction et du pétrole et du gaz pour le transfert de fluides à haute pression. Ces flexibles sont essentiels aux systèmes hydrauliques des machines lourdes, garantissant une transmission de puissance efficace et une fiabilité opérationnelle.

Le segment des flexibles de manutention devrait connaître la croissance la plus rapide entre 2025 et 2032, propulsé par la demande croissante des secteurs de la construction, de l'exploitation minière et de l'agriculture pour le transfert de matériaux abrasifs, de boues et de vrac sec. Les progrès réalisés dans le domaine des matériaux durables et résistants à l'abrasion, ainsi que l'essor des projets d'infrastructures, accélèrent encore leur adoption.

- Par matériau

En fonction du matériau, le marché nord-américain des tuyaux est segmenté en tuyaux en caoutchouc, tuyaux en plastique/polymère, tuyaux métalliques, tuyaux composites, tuyaux en silicone, etc. Le segment des tuyaux en caoutchouc a dominé le marché avec une part de chiffre d'affaires de 50,3 % en 2024, grâce à leur flexibilité, leur durabilité et leur large utilisation dans les applications automobiles, industrielles et agricoles. Les tuyaux en caoutchouc sont plébiscités pour leur capacité à gérer divers fluides et à résister aux conditions difficiles.

Le segment des tuyaux en plastique/polymère devrait connaître la croissance la plus rapide, soit 8,2 % entre 2025 et 2032, grâce à leur légèreté, leur résistance à la corrosion et leur adoption croissante dans les secteurs de l'automobile et de l'agroalimentaire. Les préoccupations environnementales croissantes et les progrès des matériaux polymères écologiques stimulent la demande de solutions de tuyaux durables.

- Par utilisateur final

En fonction de l'utilisateur final, le marché nord-américain des flexibles est segmenté en secteurs automobile, industriel, commercial et résidentiel. Le segment industriel détenait la plus grande part de chiffre d'affaires en 2024, avec 42,7 %, grâce à une utilisation intensive dans les secteurs du pétrole et du gaz, de la construction et de l'industrie manufacturière pour le transfert de fluides et de matériaux. La robustesse du tissu industriel américain, conjuguée aux investissements en infrastructures, renforce la domination de ce segment.

Le secteur automobile devrait connaître une croissance rapide de 2025 à 2032, avec un TCAC prévu de 7,9 %, alimentée par la demande croissante de tuyaux pour les systèmes de carburant, de refroidissement et de transfert d'air des véhicules. L'augmentation de la production de véhicules électriques et le besoin de tuyaux légers et durables dans le secteur automobile canadien en pleine croissance sont des moteurs de croissance clés.

- Par canal de vente

En termes de canaux de vente, le marché nord-américain des tuyaux flexibles est segmenté en deux catégories : indirect et direct. Le segment des canaux de vente directs représentait la plus grande part de chiffre d'affaires du marché, soit 60,8 % en 2024, grâce aux partenariats directs des fabricants avec les équipementiers et les grands clients industriels, garantissant des solutions personnalisées et des chaînes d'approvisionnement rationalisées. Ce phénomène est particulièrement marqué aux États-Unis, où dominent des fabricants établis tels que Gates Corporation et Parker Hannifin.

Le segment des canaux de vente indirects devrait connaître une croissance importante entre 2025 et 2032, stimulé par l'essor des plateformes de commerce électronique et des distributeurs s'adressant aux petites entreprises et aux particuliers. La commodité de l'approvisionnement en ligne et les prix compétitifs améliorent l'accessibilité, en particulier sur le marché canadien en pleine croissance.

Analyse régionale du marché des tuyaux flexibles en Amérique du Nord

- Les États-Unis dominent le marché nord-américain des tuyaux avec la plus grande part de revenus de 54,5 % en 2024, grâce à une base industrielle mature, une production automobile importante et une forte demande de technologies de tuyaux avancées.

- La tendance à l'automatisation et au développement des infrastructures, notamment dans les secteurs de la construction et des projets pétroliers et gaziers, stimule l'expansion du marché. L'intégration de flexibles avancés dans les équipements OEM et un marché secondaire florissant pour les solutions personnalisées créent un écosystème de produits diversifié.

Aperçu du marché des tuyaux flexibles au Canada

Le Canada devrait connaître la croissance la plus rapide du marché des tuyaux flexibles en Amérique du Nord, grâce à l'augmentation des investissements dans l'exploration pétrolière et gazière, notamment dans les sables bitumineux de l'Alberta, et à l'expansion des activités de construction. Les consommateurs et les industries recherchent des tuyaux flexibles performants, résistants aux produits chimiques et conformes aux réglementations de sécurité. L'adoption croissante de matériaux écologiques et de techniques de fabrication avancées accélère encore la croissance du marché.

Part de marché des tuyaux en Amérique du Nord

L'industrie des tuyaux est principalement dirigée par des entreprises bien établies, notamment :

- Parker Hannifin Corporation (États-Unis)

- Eaton Corporation (États-Unis)

- Gates Corporation (États-Unis)

- Continental AG (Allemagne)

- Trelleborg AB (Suède)

- Manuli Hydraulics (Italie)

- Kuriyama of America, Inc. (États-Unis)

- Semperit AG Holding (Autriche)

- Alfagomma SpA (Italie)

- Polyhose Inde Pvt. (Inde)

- RYCO Hydraulics (Australie)

- Hose Master, Inc. (États-Unis)

- Pacific Echo, Inc. (États-Unis)

Quels sont les développements récents sur le marché des tuyaux en Amérique du Nord ?

- En juillet 2025, Winston Products, importateur des tuyaux HydroTech, des « tuyaux extensibles anti-éclatement », vendus aux États-Unis, a procédé au rappel suite à 222 signalements d'éclatement inattendu de tuyaux, entraînant 29 blessures, dont des contusions, des entorses et une perte auditive temporaire due à la rupture bruyante. Les tuyaux, fabriqués le 31 août 2024 ou avant, étaient vendus chez de grands distributeurs tels qu'Amazon, Walmart, Home Depot et Target. Cet incident souligne l'importance cruciale de la sécurité des produits et du contrôle qualité des biens de consommation et industriels.

- En mars 2024, Jason Industrial, filiale du groupe AMMEGA, a dévoilé une nouvelle gamme de tuyaux industriels visant à optimiser les performances et la polyvalence dans de nombreux secteurs. Quatre tuyaux innovants ont été lancés : les tuyaux air/eau EPDM 4300 et 4301 pour les applications générales, le tuyau non conducteur multi-usages MP300 4306 pour les environnements résistants à l'huile et sensibles à l'électricité, et le tuyau non conducteur Atlas MP500 4308, conçu pour le transfert d'huile haute pression. Ces ajouts reflètent l'engagement de Jason Industrial envers la satisfaction client, la durabilité et l'innovation sectorielle, renforçant ainsi son rôle de fournisseur de confiance de solutions de tuyaux avancées.

- En janvier 2024, RYCO, leader mondial des solutions de transport de fluides, a lancé sa nouvelle gamme de tuyaux industriels, élargissant ainsi son offre à un large éventail d'applications de fluides non hydrauliques. Cette gamme complète comprend des tuyaux conçus pour le transfert d'eau, d'air, de vapeur, de carburant et de produits chimiques, adaptés aux exigences de secteurs tels que la construction, l'industrie manufacturière, l'agriculture et l'exploitation minière. Axée sur la durabilité, la sécurité et la performance, cette nouvelle gamme renforce l'engagement de RYCO à fournir des solutions technologiquement avancées qui améliorent l'efficacité opérationnelle et la fiabilité dans divers secteurs industriels.

- En septembre 2023, Singer Industrial, anciennement SBP Holdings, a acquis American Hose & Hardware Inc., un distributeur spécialisé dans les tuyaux, raccords et adaptateurs hydrauliques, industriels et métalliques. Cette acquisition stratégique a étendu la présence nord-américaine de Singer Industrial à environ 90 sites et plus de 1 200 employés, renforçant ainsi sa présence sur des marchés clés tels que la construction, l'agroalimentaire et les transports. Fort de plus de 45 ans d'expérience en Géorgie, American Hose & Hardware opère désormais sous la division Industrial Rubber de Singer, renforçant ainsi l'engagement de l'entreprise en faveur de solutions axées sur le client et de la croissance régionale.

- En mars 2023, Continental AG a dévoilé ses dernières innovations en matière de tuyaux hydrauliques et industriels lors des salons CONEXPO-CON/AGG et IFPE de Las Vegas. Parmi les points forts figuraient les gaines résistantes à l'abrasion X-Life™, conçues pour les environnements extrêmes, et le lancement de l'application mobile C-IQ™, une boîte à outils numérique intelligente qui simplifie la fabrication des tuyaux grâce à des spécifications de sertissage et une identification des raccords en temps réel. Continental a également lancé « Shop in a Box », une solution complète d'assemblage de tuyaux qui simplifie les opérations sur site. Ces innovations reflètent l'engagement de Continental à améliorer l'efficacité, la sécurité et la performance dans les secteurs de la construction, de l'agriculture et de l'industrie manufacturière.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.