Marché des tubes thermorétractables en Amérique du Nord, par type (simple et double paroi), type de produit (bobines, longueur prédécoupée et autres), tension (faible, moyenne et élevée), rapport de rétrécissement (2:01, 3:01, 4:01, 6:01 et autres), matériau (polyoléfine, perfluoroalkoxy alcanes (PFA), polytétrafluoroéthylène (PTFE), éthylène tétrafluoroéthylène (ETFE), éthylène propylène fluoré (FEP), polyétheréthercétone (PEEK) et autres), utilisateur final (services publics, informatique et télécommunications, automobile, électronique, aérospatiale, soins de santé, pétrole et gaz, marine, alimentation et boissons, construction, produits chimiques et autres) Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des gaines thermorétractables en Amérique du Nord

L'augmentation de la capacité de production d'électricité à travers le monde stimule le marché nord-américain des gaines thermorétractables. Cependant, la modernisation des lignes de transmission et des sous-stations le long des corridors existants est un moyen rentable d'augmenter la capacité de transmission. Les lignes existantes peuvent être reconduites pour augmenter la capacité de transmission (en utilisant des matériaux tels que des conducteurs composites qui peuvent transporter des courants plus élevés). Ces matériaux sont actuellement disponibles mais ne sont pas largement utilisés car il est difficile de mettre les lignes hors service pour reconduire de nouveaux matériaux. De plus, lorsque les conditions météorologiques sont favorables, toutes les lignes aériennes peuvent transporter un courant supérieur à leur valeur nominale et une valeur nominale en temps réel qui pourrait être ajustée en permanence augmenterait la capacité disponible.

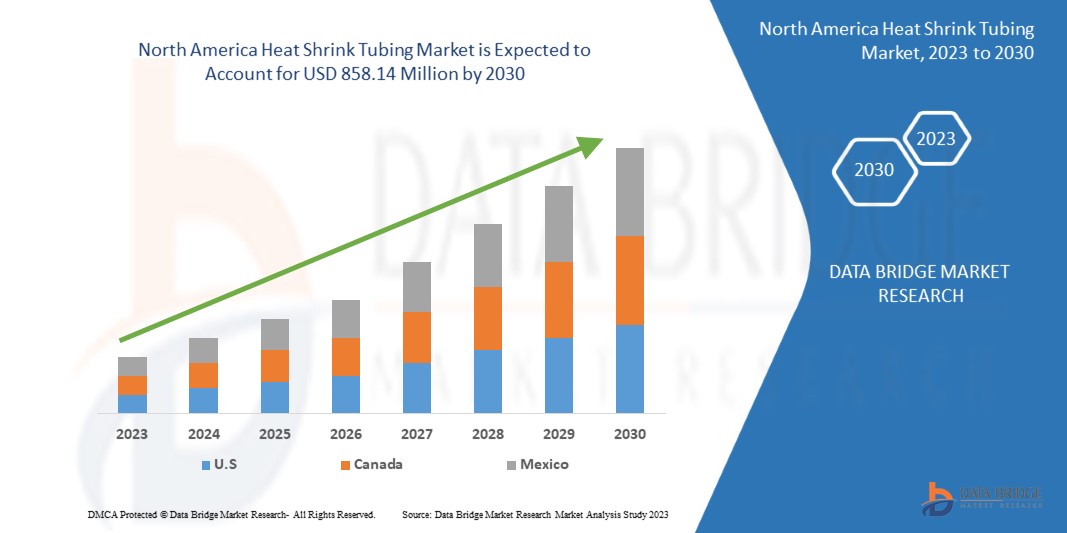

Data Bridge Market Research analyse que le marché nord-américain des tubes thermorétractables devrait croître à un TCAC de 6,2 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 858,14 millions USD d'ici 2030. Le rapport sur le marché nord-américain des tubes thermorétractables couvre également de manière exhaustive l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (Personnalisable 2015-2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Type (paroi simple et double), type de produit (bobines, longueur prédécoupée et autres), tension (faible, moyenne et élevée), rapport de rétraction (2:01, 3:01, 4:01, 6:01 et autres), matériau (polyoléfine, perfluoroalkoxy alcanes (PFA), polytétrafluoroéthylène (PTFE), éthylène tétrafluoroéthylène (ETFE), éthylène propylène fluoré (FEP), polyétheréthercétone (PEEK) et autres), utilisateur final (services publics, informatique et télécommunications, automobile, électronique, aérospatiale, soins de santé, pétrole et gaz, marine, alimentation et boissons, construction, produits chimiques et autres) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

ABB (Suisse), Sumitomo Electric Industries, Ltd. (Japon), TE Connectivity (Suisse), Thermosleeve USA (États-Unis), Techflex, Inc. (États-Unis), Dasheng Group (Chine), Shenzhen Woer Heat - Shrinkable Material Co., Ltd. (Chine), Huizhou Guanghai Electronic Insulation Materials Co., Ltd. (Chine), Panduit (États-Unis), HellermannTyton (Allemagne), Alpha Wire (États-Unis), 3M (États-Unis), SHAWCOR (Canada), Zeus Industrial Products, Inc. (États-Unis), Molex (États-Unis), PEXCO (États-Unis), Prysmain Group (Italie), GREMCO GmbH (Allemagne), Qualtek Electronics Corp. (États-Unis), Hilltop (Royaume-Uni), Dunbar Products, LLC. (États-Unis), cygia et Changyuan Electronics (Dongguan) Co., Ltd. (Chine) entre autres |

Définition du marché

Les gaines thermorétractables sont utilisées pour isoler les fils, offrant une résistance à l'abrasion et une protection environnementale pour les conducteurs de fils solides toronnés avec connexions, joints et bornes dans les travaux électriques. En général, un tube avec une température de rétraction plus basse rétrécira plus rapidement. Lorsque la gaine thermorétractable est enroulée autour de réseaux de fils et de composants électriques, elle s'affaisse radialement pour épouser les contours de l'équipement, formant ainsi une couche protectrice.

De plus, ces tubes utilisent divers matériaux tels que les perfluoroalkoxy alcanes (PFA), le polytétrafluoroéthylène (PTFE), l'éthylène propylène fluoré (FEP) et d'autres, pour fabriquer des tubes thermorétractables. Les tubes thermorétractables avec différents matériaux ont différentes caractéristiques de protection contre l'abrasion, les faibles impacts, les coupures, l'humidité et la poussière en recouvrant des fils individuels ou en enfermant des réseaux entiers. De plus, le matériau est choisi en fonction de l'utilisation finale, comme l'électronique, l'automobile, l'aérospatiale et autres. Les fabricants de plastique commencent par extruder un tube thermoplastique pour créer des tubes thermorétractables. Les matériaux des tubes thermorétractables varient en fonction de l'application prévue.

Dynamique du marché des gaines thermorétractables en Amérique du Nord

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Rôle du gouvernement dans le soutien et l'expansion des systèmes de transmission et de distribution sur le marché des gaines thermorétractables dans la région

Le rôle de la transmission et de la distribution d'électricité (T&D) joue un rôle important dans la relation entre les centrales électriques et les clients. Les charges croissantes et le stress créé par le vieillissement des équipements ainsi que l'augmentation du risque de pannes de courant généralisées sont quelques-uns des facteurs qui contribuent à générer le besoin de tubes thermorétractables. Une distribution d'électricité à la fois fiable et rentable est essentielle dans la société d'aujourd'hui. La transmission et la distribution (T&D) aux États-Unis sont composées de nombreux moteurs économiques, structures organisationnelles, technologies et formes de surveillance réglementaire. Les gouvernements fédéral et municipaux et les coopératives d'État et appartenant aux clients font tous partie de ces systèmes. Cependant, environ 80 % des transactions d'électricité se produisent sur des lignes appartenant à des services publics réglementés appartenant à des investisseurs (IOU). Ces services publics entièrement intégrés possèdent à la fois les centrales électriques et les systèmes de transmission et de distribution qui fournissent l'électricité de leurs clients. Ce modèle était l'un des modèles dominants dans le passé, mais la déréglementation dans certains États a transformé le secteur. La transmission, la production et la distribution peuvent être gérées par différentes entités dans les zones déréglementées.

- Augmentation de la capacité de production d'électricité à travers le monde

La fabrication de gaines thermorétractables se fait en deux étapes. La première étape est une extrusion standard suivie d'un second processus qui rend la gaine thermorétractable. Bien que les détails de ce second processus soient gardés confidentiels, la chaleur et la force sont utilisées pour élargir le diamètre de la gaine. Pendant qu'elle est encore élargie, la gaine est refroidie à température ambiante. Si la gaine est rigide, elle va rétrécir jusqu'à sa taille d'origine. La mise à niveau des lignes de transmission et des sous-stations le long des corridors existants est un moyen rentable d'augmenter la capacité de transmission. Les lignes existantes peuvent être reconduites pour augmenter la capacité de transmission (en utilisant des matériaux tels que des conducteurs composites qui peuvent transporter des courants plus élevés).

Opportunité

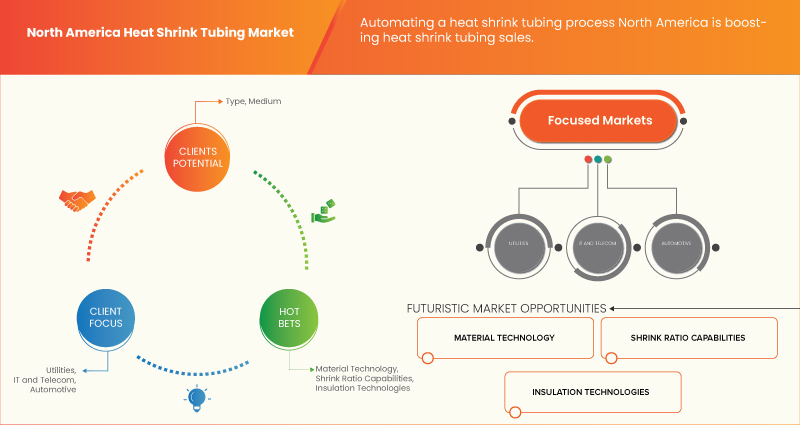

- Large adoption des tubes thermorétractables dans diverses industries

Les tubes thermorétractables sont fabriqués à partir de matériaux formulés de manière unique, qui ont été améliorés par réticulation par rayonnement, une technologie dont la conception du produit permet une installation répétable, fiable et rétractable, compatible avec de nombreux processus de fabrication. Ces produits sont en service dans le monde entier dans les domaines de l'automobile, des télécommunications, de la distribution d'énergie, de l'aérospatiale, de la défense, des applications industrielles et commerciales. L'application des tubes dans la protection des câbles sous le capot, les flexibles, les conduites de frein, la climatisation, les groupes d'injection diesel, les connecteurs, les épissures en ligne, les faisceaux de câbles, les cosses à anneau, les tiges de ceinture de sécurité, les ressorts à gaz, les antennes et autres améliore encore les capacités d'application dans l'industrie automobile. Les tubes sont fabriqués à partir de matériaux formulés de manière unique, qui ont été améliorés par réticulation par rayonnement, une technologie. Les produits faciles à utiliser offrent des solutions rentables et éprouvées dans diverses applications automobiles, de l'étanchéité et de la protection des épissures électriques à la protection mécanique des systèmes de gestion des fluides dans des environnements difficiles.

Contraintes/Défis

- Réglementation gouvernementale sur les émissions de gaz toxiques

L’impact environnemental de l’industrialisation rapide a entraîné la contamination d’innombrables sites de ressources en air, en terre et en eau par des matières toxiques et d’autres polluants, menaçant les humains et les écosystèmes de graves risques pour la santé. L’utilisation plus extensive et plus intensive de matières et d’énergie a créé des pressions cumulatives sur la qualité des écosystèmes locaux, régionaux et nord-américains. Avant qu’un effort concerté ne soit fait pour limiter l’impact de la pollution, la gestion environnementale ne s’étendait guère au-delà d’une tolérance de laisser-faire, tempérée par l’élimination des déchets pour éviter des nuisances locales perturbatrices conçues dans une perspective à court terme. La nécessité de remédier à la situation était reconnue à titre exceptionnel dans les cas où les dommages étaient jugés inacceptables. À mesure que le rythme de l’activité industrielle s’intensifiait et que la compréhension des effets cumulatifs s’améliorait, le paradigme du contrôle de la pollution est devenu la méthode dominante de gestion environnementale.

- Hausse des prix des matières premières pour les tubes

Les fluctuations de prix affectent les câbles, les fils et les produits et matériaux de connectivité achetés ou affectent les perspectives des projections budgétaires en matière d'approvisionnement, de finances, de gestion de la chaîne d'approvisionnement ou de développement de produits. Grâce à la hausse de la production industrielle et à des initiatives agressives en matière d'énergie durable, la Chine est le plus grand consommateur de cuivre au monde. L'Europe, les États-Unis et la Chine poursuivent des initiatives agressives en matière d'énergie renouvelable pour soutenir des économies plus vertes et la conductivité thermique et électrique élevée du cuivre les aidera à y parvenir. Les plus grands pays producteurs de cuivre tels que le Chili, le Pérou, la Chine et les États-Unis ont du mal à répondre à la forte demande des pays pour mettre en œuvre leur initiative économique verte, ce qui contribue à la montée en flèche du prix du cuivre. On spécule également qu'à mesure que le dollar américain s'affaiblit par rapport aux autres devises d'Amérique du Nord, les utilisateurs d'autres devises auront davantage d'opportunités d'augmenter leur pouvoir d'achat avec le cuivre et d'autres matières premières.

Développements récents

- En avril 2023, TE Connectivity a annoncé le lancement du nouveau tube EV Single Wall (EVSW) spécialement conçu pour les applications haute tension et permettant d'isoler et de protéger en toute sécurité les composants conducteurs et les câbles. Ce produit est un tube à paroi simple dont l'objectif principal est de fournir une isolation électrique et une protection pour les composants haute tension des véhicules électriques. Cela aidera l'entreprise à diversifier son portefeuille de produits et à relever les défis uniques des applications EV.

- En février 2023, Molex a publié un rapport sur la miniaturisation, faisant état des connaissances des experts et des innovations en matière d'ingénierie de conception de produits et de connectivité de pointe. Grâce à cette miniaturisation, l'entreprise a également augmenté l'efficacité des produits et leur sécurité. Ce développement a amélioré la gamme de produits de l'entreprise et a eu un impact positif sur la croissance du marché nord-américain des gaines thermorétractables.

Portée du marché des gaines thermorétractables en Amérique du Nord

Le marché nord-américain des gaines thermorétractables est segmenté en six segments notables en fonction du type, du type de produit, du matériau, de la tension, du taux de rétraction et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de faible croissance dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Paroi simple

- Double paroi

Sur la base du type, le marché nord-américain des tubes thermorétractables est segmenté en simple paroi et double paroi.

Type de produit

- Bobines

- Longueurs prédécoupées

- Autres

Sur la base du type de produit, le marché nord-américain des gaines thermorétractables est segmenté en bobines, longueurs prédécoupées et autres.

Tension

- Faible

- Moyen

- Haut

Sur la base de la tension, le marché nord-américain des gaines thermorétractables est segmenté en faible, moyen et élevé.

Taux de rétrécissement

- 2:01

- 3:01

- 4:01

- 6:01

- Autres

Sur la base du taux de rétraction, le marché nord-américain des tubes thermorétractables est segmenté en 2:01, 3:01, 4:01, 6:01 et autres.

Matériel

- Polyoléfine

- Alcane perfluoroalcoxy (PFA)

- Polytétrafluoroéthylène (PTFE)

- Éthylène Tétra Fluoro Éthylène (ETFE)

- Éthylène-propylène fluoré (FEP)

- Polyéther éther cétone (PEEK)

- Autres

Sur la base du matériau, le marché nord-américain des tubes thermorétractables est segmenté en polyoléfine, perfluoroalcoxy alcane (PFA), poly tétrafluoroéthylène (PTFE), éthylène tétrafluoroéthylène (ETFE), éthylène propylène fluoré (FEP), polyétheréthercétone (PEEK) et autres.

Utilisateur final

- Utilitaires

- Informatique et télécommunication

- Automobile

- Électronique

- Aérospatial

- Soins de santé

- Pétrole et gaz

- Marin

- Alimentation et boissons

- Construction

- Chimique

- Autres

Sur la base de l'application, le marché nord-américain des gaines thermorétractables est segmenté en services publics, informatique et télécommunications, automobile, électronique, aérospatiale, soins de santé, pétrole et gaz, marine, alimentation et boissons, construction, produits chimiques et autres.

Analyse/perspectives régionales du marché des gaines thermorétractables en Amérique du Nord

Le marché des tubes thermorétractables en Amérique du Nord est analysé et des informations et tendances sur la taille du marché sont fournies par type, type de produit, tension, rapport de rétraction, matériau et utilisateur final, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des tubes thermorétractables en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Les États-Unis dominent la région Amérique du Nord en raison du secteur des logiciels avancés de la région.

La section régionale du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces de Porter, ainsi que des études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données régionales.

Analyse du paysage concurrentiel et des parts de marché des tubes thermorétractables en Amérique du Nord

Le paysage concurrentiel du marché des tubes thermorétractables en Amérique du Nord fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché des tubes thermorétractables en Amérique du Nord.

Français Certains des principaux acteurs opérant sur le marché des gaines thermorétractables en Amérique du Nord sont ABB (Suisse), Sumitomo Electric Industries, Ltd. (Japon), TE Connectivity (Suisse), Thermosleeve USA (États-Unis), Techflex, Inc. (États-Unis), Dasheng Group (Chine), Shenzhen Woer Heat - Shrinkable Material Co., Ltd. (Chine), Huizhou Guanghai Electronic Insulation Materials Co., Ltd. (Chine), Panduit (États-Unis), HellermannTyton (Allemagne), Alpha Wire (États-Unis), 3M (États-Unis), SHAWCOR (Canada), Zeus Industrial Products, Inc. (États-Unis), Molex (États-Unis), PEXCO (États-Unis), Prysmain Group (Italie), GREMCO GmbH (Allemagne), Qualtek Electronics Corp. (États-Unis), Hilltop (Royaume-Uni), Dunbar Products, LLC. (États-Unis), cygia et Changyuan Electronics (Dongguan) Co., Ltd. (Chine) entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA HEAT SHRINK TUBING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET END-USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 ROLE OF THE GOVERNMENT IN SUPPORTING AND EXPANSION OF TRANSMISSION & DISTRIBUTION SYSTEMS IN THE HEAT SHRINK TUBING MARKET ACROSS THE REGION

5.1.2 INCREASE IN THE CAPACITY FOR POWER GENERATION ACROSS THE GLOBE

5.1.3 RISING USAGE OF PRODUCTS WITH ADVANCED INFRASTRUCTURE AND TECHNOLOGY

5.1.4 INCREASING PENETRATION OF ELECTRIC VEHICLES

5.2 RESTRAINTS

5.2.1 GOVERNMENT REGULATION ON THE EMISSION OF TOXIC GASES

5.2.2 PRODUCTION CHALLENGES IN THE LEAST DEVELOPED COUNTRIES

5.2.3 INVOLVEMENT OF PLASTIC HAS A DIRECT IMPACT ON THE COST AS WELL AS THE ENVIRONMENT

5.3 OPPORTUNITIES

5.3.1 WIDE ADOPTION OF HEAT SHRINK TUBES IN VARIOUS INDUSTRIES

5.3.2 EASY PRODUCTION OF THE HEAT-SHRINKABLE TUBING

5.3.3 AUTOMATING A HEAT SHRINK TUBING PROCESS

5.4 CHALLENGES

5.4.1 RISING PRICES OF RAW MATERIALS FOR TUBING

5.4.2 POOR INSTALLATION OF HEAT-SHRINK TUBES

5.4.3 AVAILABILITY OF ALTERNATIVE AND INEXPENSIVE PRODUCTS IN THE MARKET

6 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY TYPE

6.1 OVERVIEW

6.2 SINGLE WALL

6.3 DUAL WALL

7 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 SPOOLS

7.3 PRE-CUT LENGTH

7.4 OTHERS

8 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY VOLTAGE

8.1 OVERVIEW

8.2 LOW

8.3 MEDIUM

8.4 HIGH

9 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY MATERIAL

9.1 OVERVIEW

9.2 POLYOLEFIN

9.3 PERFLUOROALKOXY ALKANES (PFA)

9.4 POLYTETRAFLUOROETHYLENE (PTFE)

9.5 FLUORINATED ETHYLENE PROPYLENE (FEP)

9.6 ETHYLENE TETRAFLUOROETHYLENE (ETFE)

9.7 POLYETHER ETHER KETONE (PEEK)

9.8 OTHERS

10 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY SHRINK RATIO

10.1 OVERVIEW

10.2 12/30/1899 2:01:00 AM

10.3 12/30/1899 3:01:00 AM

10.4 12/30/1899 4:01:00 AM

10.5 12/30/1899 6:01:00 AM

10.6 OTHERS

11 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY END-USER

11.1 OVERVIEW

11.2 UTILITIES

11.3 IT AND TELECOMMUNICATION

11.4 AUTOMOTIVE

11.5 ELECTRONICS

11.5.1 COMMERCIAL/INDUSTRIAL

11.5.2 CONSUMER PRODUCT

11.6 AEROSPACE

11.7 HEALTHCARE

11.8 OIL AND GAS

11.9 MARINE

11.1 FOOD AND BEVERAGES

11.11 CONSTRUCTION

11.11.1 COMMERCIAL

11.11.2 RESIDENTIAL

11.12 CHEMICAL

11.13 OTHERS

12 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA HEAT SHRINK TUBING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 TE CONNECTIVITY

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 SUMITOMO ELECTRIC INDUSTRIES, LTD.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 MOLEX

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 ABB

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 PRYSMIAN GROUP

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 3M

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 ALPHA WIRE

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 CHANGYUAN ELECTRONICS (DONGGUAN) CO., LTD.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 DASHENG GROUP

15.9.1 COMPANY SNAPSHOT

15.9.2 COMPANY PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 DUNBAR PRODUCTS, LLC.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 GREMCO GMBH

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 HELLERMANNTYTON

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 HILLTOP

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 HUIZHOU GUANGHAI ELECTRONIC INSULATION MATERIALS CO., LTD.

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 PANDUIT

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 PEXCO

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 QUALTEK ELECTRONICS CORP

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 SHAWCOR

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 SHENZHEN WOER HEAT - SHRINKABLE MATERIAL CO., LTD.

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 TECHFLEX, INC.

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 THERMOSLEEVE USA

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

15.22 ZEUS INDUSTRIAL PRODUCTS, INC.

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA SINGLE WALL IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA DUAL WALL IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA SPOOLS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA PRE-CUT LENGTH IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA OTHERS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA LOW IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA MEDIUM IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA HIGH IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA POLYOLEFIN IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA PERFLUOROALKOXY ALKANES (PFA) IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA POLYTETRAFLUOROETHYLENE (PTFE) IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA FLUORINATED ETHYLENE PROPYLENE (FEP) IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA ETHYLENE TETRAFLUOROETHYLENE (ETFE) IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA POLYETHERETHERKETONE (PEEK) IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA OTHERS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY SHRINK RATIO, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA 2:01 IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA 3:01 IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA 4:01 IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA 6:01 IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA OTHERS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA UTILITIES IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA IT AND TELECOMMUNICATION IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA AUTOMOTIVE IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA AEROSPACE IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA HEALTHCARE IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA OIL AND GAS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA MARINE IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA FOOD AND BEVERAGES IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA CHEMICAL IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA OTHERS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY SHRINK RATIO, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 U.S. HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 U.S. HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 52 U.S. HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 53 U.S. HEAT SHRINK TUBING MARKET, BY SHRINK RATIO, 2021-2030 (USD MILLION)

TABLE 54 U.S. HEAT SHRINK TUBING MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 55 U.S. HEAT SHRINK TUBING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 56 U.S. ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 U.S. CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 CANADA HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 CANADA HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 60 CANADA HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 61 CANADA HEAT SHRINK TUBING MARKET, BY SHRINK RATIO, 2021-2030 (USD MILLION)

TABLE 62 CANADA HEAT SHRINK TUBING MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 63 CANADA HEAT SHRINK TUBING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 64 CANADA ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 CANADA CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 MEXICO HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 MEXICO HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 68 MEXICO HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 69 MEXICO HEAT SHRINK TUBING MARKET, BY SHRINK RATIO, 2021-2030 (USD MILLION)

TABLE 70 MEXICO HEAT SHRINK TUBING MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 71 MEXICO HEAT SHRINK TUBING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 72 MEXICO ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 73 MEXICO CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA HEAT SHRINK TUBING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA HEAT SHRINK TUBING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA HEAT SHRINK TUBING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA HEAT SHRINK TUBING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA HEAT SHRINK TUBING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA HEAT SHRINK TUBING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA HEAT SHRINK TUBING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA HEAT SHRINK TUBING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA HEAT SHRINK TUBING MARKET: MULTIVARIATE MODELING

FIGURE 10 NORTH AMERICA HEAT SHRINK TUBING MARKET: TYPE TIMELINE CURVE

FIGURE 11 NORTH AMERICA HEAT SHRINK TUBING MARKET: MARKET END-USER COVERAGE GRID

FIGURE 12 NORTH AMERICA HEAT SHRINK TUBING MARKET: SEGMENTATION

FIGURE 13 INCREASE IN THE CAPACITY FOR POWER GENERATION ACROSS THE GLOBE IS EXPECTED TO DRIVE THE NORTH AMERICA HEAT SHRINK TUBING MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 THE SINGLE WALL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA HEAT SHRINK TUBING MARKET IN 2023 & 2030

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA HEAT SHRINK TUBING MARKET

FIGURE 16 GOVERNMENT INITIATIVES TO ENHANCE POWER TRANSMISSION

FIGURE 17 GENERATION OF RENEWABLE ELECTRICITY

FIGURE 18 ELECTRICITY GENERATION IN VARIOUS COUNTRIES

FIGURE 19 NORTH AMERICA SALES VOLUME OF ELECTRIC VEHICLES

FIGURE 20 MANUFACTURING PROCESS FOR HEAT SHRINK TUBING

FIGURE 21 SILVER PRICING (SEPTEMBER 2022 TO MARCH 2023)

FIGURE 22 ALTERNATIVES FOR HEAT SHRINK TUBING

FIGURE 23 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY TYPE, 2022

FIGURE 24 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY PRODUCT TYPE, 2022

FIGURE 25 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY VOLTAGE, 2022

FIGURE 26 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY MATERIAL, 2022

FIGURE 27 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY SHRINK RATIO, 2022

FIGURE 28 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY END-USER, 2022

FIGURE 29 NORTH AMERICA HEAT SHRINK TUBING MARKET: SNAPSHOT (2022)

FIGURE 30 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY COUNTRY (2022)

FIGURE 31 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 32 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 33 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY TYPE (2023-2030)

FIGURE 34 NORTH AMERICA HEAT SHRINK TUBING MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.