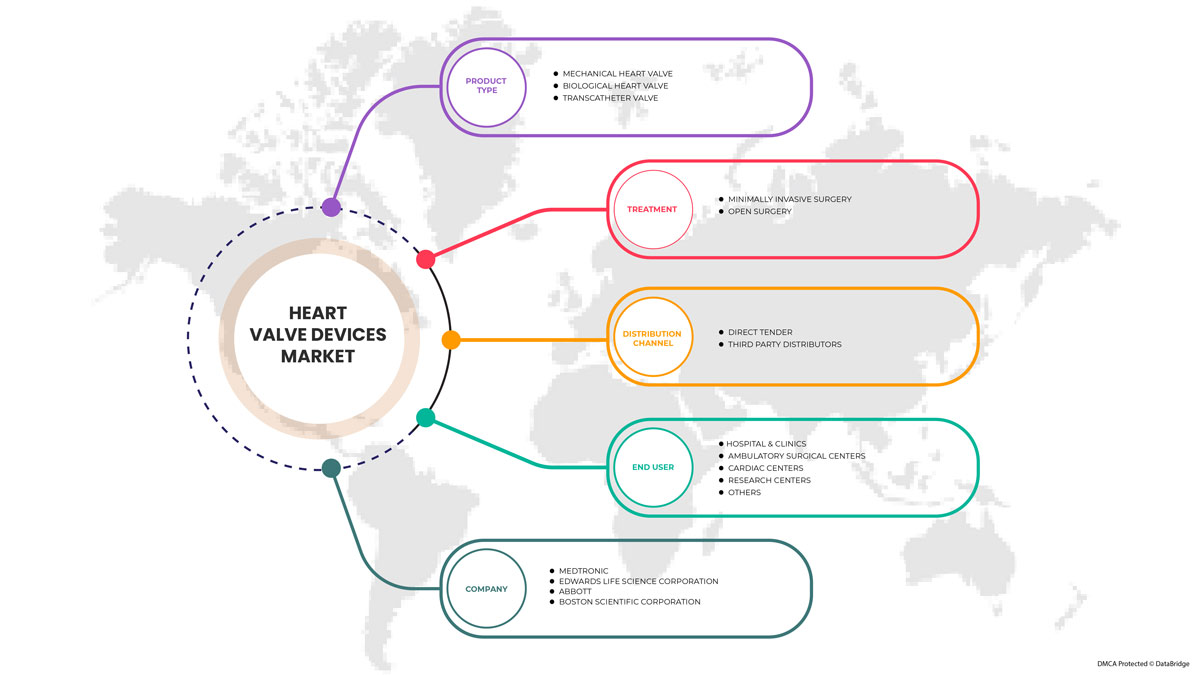

Marché des dispositifs de valve cardiaque en Amérique du Nord, par type de produit (valves cardiaques mécaniques, valves cardiaques biologiques et valves transcathéter), traitement (chirurgie ouverte et chirurgie mini-invasive (MIS)), utilisateur final (hôpitaux et cliniques, centres de chirurgie ambulatoire, centres cardiaques, centres de recherche et autres), canal de distribution (appel d'offres direct, distributeurs tiers) Tendances de l'industrie et prévisions jusqu'en 2030.

Analyse et perspectives du marché des dispositifs valvulaires cardiaques en Amérique du Nord

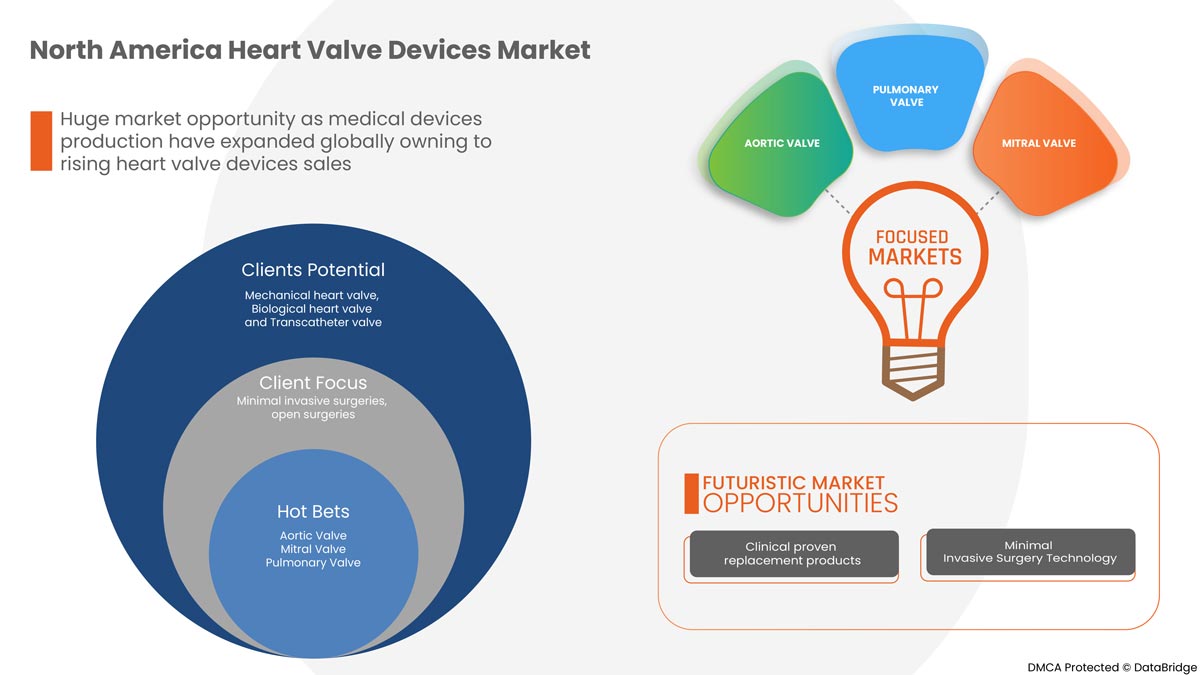

Les dispositifs de valve cardiaque sont utilisés pour traiter les valves cardiaques bloquées, et l'implantation de ces dispositifs est l'une des procédures les plus courantes. Les dispositifs de valve cardiaque structurels disponibles sur le marché comprennent les valves mécaniques, biologiques et transcathéter. Le marché nord-américain des dispositifs de valve cardiaque devrait croître régulièrement au cours de la période de prévision en raison du nombre croissant d'interventions chirurgicales de valve cardiaque à travers le monde. La croissance du marché nord-américain des dispositifs de valve cardiaque devrait être tirée par les développements des dispositifs et procédures cardiaques structurels tels que les valves aortiques, les dispositifs d'occlusion auriculaire gauche et les valves tissulaires ou biologiques. Les valves tissulaires ont déjà révolutionné le marché des dispositifs de valve cardiaque. Les chirurgies de valve cardiaque de nouvelle génération offrent des profils de patients à faible accouchement, des chirurgies plus contrôlées, une meilleure fonction de valve, une régurgitation paravalvulaire réduite, une durabilité accrue et des coûts inférieurs. Les innovations de produits des principaux acteurs du marché ont stimulé la croissance du marché en leur permettant de s'adresser à une population de patients plus large et d'obtenir de meilleurs résultats cliniques.

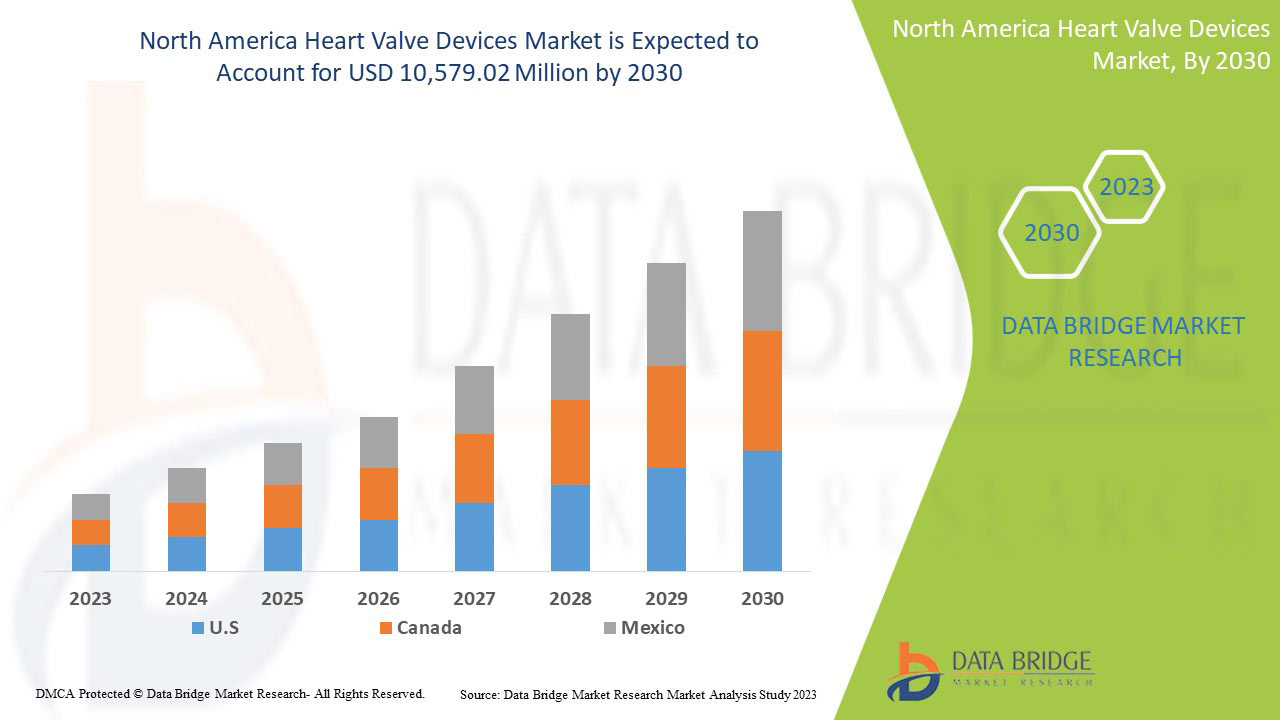

Data Bridge Market Research analyse que le marché des dispositifs de valves cardiaques devrait atteindre la valeur de 10 579,02 millions USD d'ici 2030, à un TCAC de 13,6 % au cours de la période de prévision. Le type de produit représente le segment de type le plus important du marché en raison de la demande rapide de dispositifs de valves cardiaques à l'échelle mondiale. Ce rapport de marché couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2020 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Par type de produit (valves cardiaques mécaniques, valves cardiaques biologiques et valves transcathéter), traitement (chirurgie ouverte et chirurgie mini-invasive (MIS)), utilisateur final (hôpitaux et cliniques, centres de chirurgie ambulatoire, centres cardiaques, centres de recherche et autres), canal de distribution (appel d'offres direct, distributeurs tiers). |

|

Pays couverts |

États-Unis, Canada, Mexique |

|

Acteurs du marché couverts |

Abbott, Boston Scientific Corporation ou ses sociétés affiliées, Artivion, Inc., Edwards Lifesciences Corporation, Medtronic, NeoVasc, Micro Interventional Devices Incorporated, XELTIS, TTK, Meril Life Sciences Pvt. Ltd, Foldax, Inc., Venus Medtech (Hangzhou) Inc., Colibri Heart Valve, entre autres. |

Définition du marché des dispositifs de valve cardiaque

Les valves cardiaques sont nécessaires pour fluidifier le mouvement du sang dans la bonne direction dans le corps. Les valves cardiaques sont responsables du flux sanguin constant et du maintien de la pression artérielle. Si elles ne fonctionnent pas correctement, la coupure du cœur provoque une sténose. Les maladies cardiaques comprennent généralement plusieurs maladies qui affectent considérablement le cœur. La régulation des valves cardiaques a augmenté rapidement au cours des dix dernières années, car le nombre de patients souffrant de maladies cardiovasculaires a augmenté. La croissance du marché des valves cardiaques est accélérée par des facteurs tels que les modes de vie instables, les maladies liées au mode de vie, l'augmentation de la population tabagique, le vieillissement de la population, l'amélioration de la qualité des soins de santé et le développement rapide du remboursement des soins de santé au cours de la période de prévision. En outre, le coût élevé des valves cardiaques et le risque d'infection des implants cardiaques peuvent être la raison qui est susceptible de ralentir la croissance du marché des valves cardiaques au cours de la période de prévision susmentionnée. La croissance des aspects commerciaux médicaux et le travail préparatoire dans les économies émergentes alimentent la croissance du tourisme médical, stimulant ainsi le marché des dispositifs de valves cardiaques. Le besoin de procédures mini-invasives pour traiter les anomalies cardiaques a considérablement augmenté. Les applications actuelles de l'automatisation dans la chirurgie des valves cardiaques, comme le remplacement de la valve aortique par voie transcathéter (TAVR), ont donné lieu à une variété croissante d'interventions similaires. À en juger par la proportion croissante de la population vieillissante, l'augmentation des polices d'assurance-vie devrait également contribuer à la croissance du marché des valves cardiaques.

Dynamique du marché des dispositifs de valve cardiaque

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Les innovations dans le domaine des dispositifs de valve cardiaque offrent de meilleurs résultats cliniques

Le lancement de nouveaux produits pour les procédures mini-invasives devrait stimuler le marché nord-américain des dispositifs valvulaires cardiaques. Les valves tissulaires ont révolutionné le marché des valves cardiaques. La prochaine génération de chirurgie valvulaire cardiaque offre moins de courbes de pose, un placement plus contrôlé, une fonction valvulaire améliorée, une régurgitation valvulaire réduite, une durabilité accrue et un coût réduit. L'innovation produit a stimulé les perspectives de croissance des acteurs du marché des dispositifs valvulaires cardiaques, car elle permet de traiter un plus grand nombre de patients avec des résultats cliniques supérieurs. Malgré des avancées significatives ces dernières années, la cardiologie interventionnelle structurelle reste un marché émergent avec un grand potentiel.

De plus, les conceptions intelligentes, les nouvelles technologies et les applications de biomatériaux continuent de repousser les limites du développement de nouveaux produits, garantissant que ces dispositifs seront à la pointe de l'innovation en matière de produits interventionnels pour les années à venir. Les innovations en matière de conception aident les acteurs du marché à exploiter des opportunités de croissance rentables dans le domaine des dispositifs de valve cardiaque.

Ainsi, la croissance du marché nord-américain des dispositifs de valves cardiaques devrait être stimulée par l’augmentation des innovations dans ce domaine.

- Augmentation du nombre de diverses maladies cardiaques

Les crises cardiaques et les accidents vasculaires cérébraux sont généralement des événements aigus et sont principalement causés par un blocage qui bloque le flux sanguin vers le cœur ou le cerveau. Au cours de la première année de la pandémie de COVID-19, les décès dus aux maladies cardiaques et aux accidents vasculaires cérébraux ont augmenté respectivement de 5,8 % et de 6,8 %. Cependant, les augmentations liées à l’âge ont été de 1,6 % et de 1,7 % pour les maladies cardiaques et les accidents vasculaires cérébraux, respectivement. La cause la plus courante est l’accumulation de dépôts graisseux dans la paroi des vaisseaux sanguins qui alimentent le cœur ou le cerveau. Un accident vasculaire cérébral peut être causé par un saignement ou des caillots sanguins dans un vaisseau sanguin du cerveau. Cette tendance suggère que l’incidence des maladies cardiovasculaires pourrait augmenter considérablement en raison de la croissance démographique et du vieillissement.

De plus, un diabète élevé, une pression artérielle élevée, un taux de cholestérol élevé et le tabagisme sont des facteurs de risque majeurs de maladie cardiaque. Environ la moitié des Américains (47 %) présentent au moins un de ces trois facteurs de risque. D’autres problèmes de santé et choix de vie peuvent également augmenter le risque de maladie cardiaque, notamment une alimentation malsaine, l’inactivité physique et la consommation excessive d’alcool.

De plus, le nombre croissant de maladies cardiaques devrait agir comme un moteur pour le marché des dispositifs de valves cardiaques en Amérique du Nord.

Opportunité

- Sensibilisation accrue aux prothèses

Une prothèse est un dispositif conçu pour remplacer une partie du corps manquante ou pour améliorer la fonction d'une partie du corps. Les prothèses valvulaires cardiaques sont de plus en plus utilisées dans les cas d'anomalies des valves naturelles qui nécessitent une intervention. En général, elles peuvent être divisées en valves cardiaques mécaniques, valves biologiques et greffes allogéniques. L'objectif des valves artificielles est d'agir hémodynamiquement comme une valve naturelle avec des effets secondaires minimes. Des prothèses cardiovasculaires ont été développées pour remplacer le tissu cardiaque endommagé. Ces dispositifs médicaux sont conçus pour imiter la fonction des organes cardiovasculaires normaux. Les cœurs artificiels permettent aux chirurgiens cardiaques d'augmenter le traitement des blocs cardiaques.

De plus, la prévalence des valves prothétiques varie de 0,2 pour 1 000 chez les personnes de 18 à 24 ans ou moins à 5,3 chez les personnes de 24 à 26 ans ou moins.

La sensibilisation croissante aux prothèses constitue donc une opportunité pour la croissance du marché.

Retenue/Défi

- Coût de production élevé des équipements

Le nombre de patients traités pour une valvulopathie aortique aux États-Unis augmente rapidement. Le remplacement valvulaire aortique par voie transcathéter (TAVR) remplace le remplacement valvulaire aortique chirurgical (SAVR) et le traitement médical (TM). Les conséquences économiques de ces tendances sont inconnues. Par conséquent, le coût total du TAVR est plus élevé que celui du SAVR et beaucoup plus cher que celui du TM seul. Les coûts du TAVR ont diminué au fil du temps, tandis que les coûts du SAVR et du TM sont restés les mêmes.

En outre, le coût chirurgical élevé du TAVI est principalement dû au coût élevé de la production. Cependant, en raison de la durée d'hospitalisation plus courte, le coût du TAVI non chirurgical est inférieur à celui de l'AVR. Le coût du kit d'implant TAVI seul (valve, ballon, gaine) est de 32 500 $, tandis que la valve chirurgicale ne coûte qu'environ 5 000 $. Tout comme en Suisse, le kit d'implant TAVI coûte environ 32 000 francs (environ 35 000 $), tandis que le coût d'une prothèse biochirurgicale est d'environ 3 000 francs suisses (environ 3 300 $ US). Selon les comorbidités et les complications, le remboursement aux États-Unis se situe entre 0,000 et 5 000 $, le TAVI en Suisse est d'environ 72 000 francs (78 000 $) et l'AVR est d'environ 3 000 francs (7 000 $), ce qui représente une perte financière pour l'hôpital.

Ainsi, l’augmentation du coût de production des équipements pourrait entraver la croissance du marché.

Développements récents

- En septembre 2023, Abbott a publié des données issues de cinq présentations de stade avancé montrant les avantages de ses dispositifs mini-invasifs dans le traitement des personnes atteintes de diverses maladies cardiaques structurelles. Les données comprennent des résultats qui soutiennent la valeur de MitraClip™. Il s'agit de la première et principale réparation bord à bord par cathéter (TEER) au monde pour traiter les valves qui fuient chez les personnes atteintes de régurgitation mitrale (RM). De nouvelles données sur les thérapies cardiaques structurelles d'Abbott ont été présentées lors du 34e symposium scientifique annuel sur la thérapie cardiovasculaire par cathéter (TCT) de la Cardiovascular Research Foundation à Boston. Cela a aidé l'entreprise à accroître sa position commerciale sur le marché.

- En septembre 2020, Boston Scientific Corporation a annoncé le lancement contrôlé du système de valve aortique ACURATE neo2™ en Europe. Cette technologie d'implantation de valve aortique transcatheter (TAVI) de nouvelle génération est une nouvelle plateforme conçue avec de multiples fonctionnalités pour améliorer les performances cliniques de la nouvelle plateforme ACURATE d'origine. Par rapport à la génération précédente, le système de valve ACURATE neo2 a une indication élargie pour les patients atteints de sténose aortique. Cela a aidé l'entreprise à élargir son portefeuille de produits.

Portée du marché des dispositifs de valve cardiaque

Le marché des dispositifs valvulaires cardiaques est segmenté en fonction du type de produit, du traitement, de l'utilisateur final et du canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

PAR TYPE DE PRODUIT

- Valves cardiaques mécaniques

- Valve cardiaque biologique

- Valves transcathéter

Sur la base du type de produit, le marché des dispositifs de valve cardiaque est segmenté en valve cardiaque mécanique, valve cardiaque biologique et valve transcathéter.

PAR TRAITEMENT

- CHIRURGIE OUVERTE

- CHIRURGIE MINIMALEMENT INVASIVE

Sur la base du traitement, le marché des dispositifs valvulaires cardiaques est segmenté en chirurgie ouverte et chirurgie mini-invasive.

PAR UTILISATEUR FINAL

- HÔPITAL ET CLINIQUES

- CENTRES DE CHIRURGIES AMBULATOIRES

- CENTRES CARDIAQUES

- CENTRES DE RECHERCHE

- AUTRES

Sur la base de l'utilisateur final, le marché des dispositifs de valve cardiaque est segmenté en hôpitaux et cliniques, centres de chirurgie ambulatoire, centres cardiaques, centres de recherche et autres.

PAR CANAL DE DISTRIBUTION

- APPEL D'OFFRES DIRECT

- DISTRIBUTEURS TIERS

Sur la base du canal de distribution, le marché des dispositifs de valve cardiaque est segmenté en appels d'offres directs et distributeurs tiers.

Analyse/perspectives régionales du marché des dispositifs de valve cardiaque en Amérique du Nord

Le marché des dispositifs valvulaires cardiaques est analysé et des informations sur la taille du marché sont fournies : type de produit, traitement, utilisateur final et canal de distribution.

Les pays couverts par ce rapport de marché sont les États-Unis, le Canada et le Mexique.

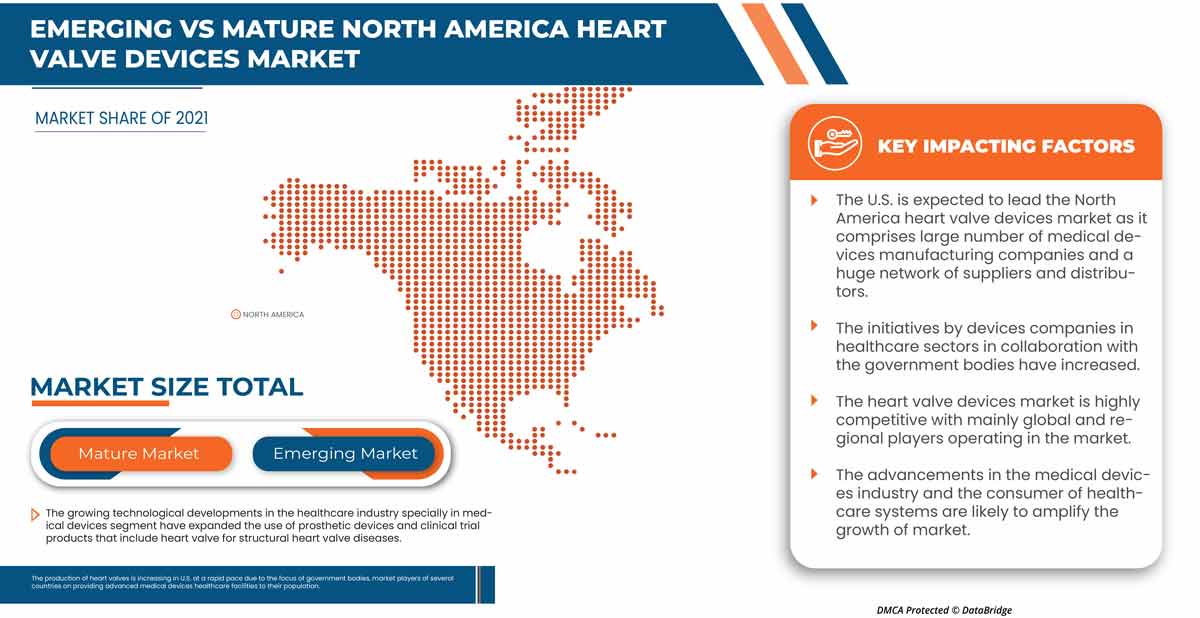

L'Amérique du Nord domine le marché en raison de l'augmentation des investissements en R&D. Les États-Unis dominent la région Amérique du Nord en raison de la forte présence d'acteurs clés.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des dispositifs de valve cardiaque

Le paysage concurrentiel du marché des dispositifs de valve cardiaque fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et la portée du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise sur le marché des dispositifs de valve cardiaque.

Certains des principaux acteurs opérant sur le marché des dispositifs de valve cardiaque sont Abbott, Boston Scientific Corporation ou ses filiales, Artivion, Inc., Edwards Lifesciences Corporation, Medtronic, NeoVasc, Micro Interventional Devices Incorporated, XELTIS, TTK, Meril Life Sciences Pvt. Ltd, Foldax, Inc., Venus Medtech (Hangzhou) Inc., Colibri Heart Valve, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA HEART VALVE DEVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 EPIDEMIOLOGY

3.2 PESTEL ANALYSIS

3.3 PORTER'S FIVE FORCE

4 MARKET OVERVIEW

4.1 DRIVERS

4.1.1 INNOVATIONS IN HEART VALVE DEVICES OFFER IMPROVED CLINICAL OUTCOME

4.1.2 RISING NUMBER OF VARIOUS HEART DISEASES

4.1.3 ADVANCEMENTS IN TRANSCATHETER VALVE TECHNOLOGY

4.1.4 INCREASING PREFERENCE FOR MINIMALLY INVASIVE SURGERIES

4.2 RESTRAINTS

4.2.1 HIGH COST ASSOCIATED WITH THE SURGERIES

4.2.2 COMPLICATIONS ASSOCIATED WITH HEART VALVE REPLACEMENT

4.3 OPPORTUNITIES

4.3.1 INCREASING AWARENESS OF PROSTHETIC DEVICES

4.3.2 RISING PREVALENCE OF STROKE & CARDIAC ARREST TO REINFORCE DEMAND FOR HEART VALVE DEVICES

4.3.3 INCREASING FDA APPROVALS OF TRANSCATHETER AORTIC VALVES

4.4 CHALLENGES

4.4.1 STRICT GOVERNMENT REGULATIONS

4.4.2 EXPENSIVE PRODUCTION COST OF EQUIPMENT

5 NORTH AMERICA HEART VALVE DEVICES MARKET, BY PRODUCT TYPE

5.1 OVERVIEW

5.2 MECHANICAL HEART VALVES

5.2.1 AORTIC VALVE

5.2.2 MITRAL VALVE

5.3 BIOLOGICAL HEART VALVES

5.3.1 AORTIC VALVE

5.3.2 MITRAL VALVE

5.3.3 PULMONARY VALVE

5.3.4 TRICUSPID VALVE

5.4 TRANSCATHETER VALVE

5.4.1 AORTIC VALVE

5.4.2 MITRAL VALVE

5.4.3 PULMONARY VALVE

6 NORTH AMERICA HEART VALVE DEVICES MARKET, BY TREATMENT

6.1 OVERVIEW

6.2 MINIMALLY INVASIVE SURGERY (MIS)

6.2.1 CARDIAC VALVE REPLACEMENT

6.2.2 CARDIAC VALVE REPAIR

6.3 OPEN SURGERY

6.3.1 CARDIAC VALVE REPLACEMENT

6.3.2 CARDIAC VALVE REPAIR

7 NORTH AMERICA HEART VALVE DEVICES MARKET, BY END USER

7.1 OVERVIEW

7.2 HOSPITAL & CLINICS

7.3 AMBULATORY SURGICAL CENTERS

7.4 CARDIAC CENTERS

7.5 RESEARCH CENTERS

7.6 OTHERS

8 NORTH AMERICA HEART VALVE DEVICES MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 DIRECT TENDER

8.3 THIRD PARTY DISTRIBUTORS

9 NORTH AMERICA HEART VALVE DEVICES MARKET, BY REGION

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

10 NORTH AMERICA HEART VALVE DEVICES MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 MEDTRONIC

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENTS

12.2 EDWARDS LIFESCIENCES CORPORATION

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENTS

12.3 ABBOTT

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT DEVELOPMENTS

12.4 BOSTON SCIENTIFIC CORPORATION OR ITS AFFILIATES.

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENT

12.5 ARTIVION, INC.

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT DEVELOPMENTS

12.6 COLIBRI HEART VALVE

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENTS

12.7 FOLDAX, INC.

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENTS

12.8 MERIL LIFE SCIENCES PVT. LTD.

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENTS

12.9 MICRO INTERVENTIONAL DEVICES, INCORPORATED.

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENTS

12.1 NEOVASC

12.10.1 COMPANY SNAPSHOT

12.10.2 REVENUE ANALYSIS

12.10.3 PRODUCT PORTFOLIO

12.10.4 RECENT DEVELOPMENTS

12.11 TTK

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUE ANALYSIS

12.11.3 PRODUCT PORTFOLIO

12.11.4 RECENT DEVELOPMENTS

12.12 VENUS MEDTECH (HANGZHOU) INC.

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 PRODUCT PORTFOLIO

12.12.4 RECENT DEVELOPMENTS

12.13 XELTIS

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA MINIMALLY INVASIVE SURGERY IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA MINIMALLY INVASIVE SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA OPEN SURGERY IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA OPEN SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA HEART VALVE DEVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA HOSPITALS & CLINICS IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA CARDIAC CENTERS IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA RESEARCH CENTERS IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA OTHERS IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA HEART VALVE DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA DIRECT TENDER IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA THIRD PARTY DISTRIBUTORS IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA HEART VALVE DEVICES MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA MINIMALLY INVASIVE SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA OPEN SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA HEART VALVE DEVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA HEART VALVE DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 32 U.S. HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 33 U.S. MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 34 U.S. MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 35 U.S. MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 36 U.S. BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 37 U.S. BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 38 U.S. BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 39 U.S. TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 40 U.S. TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 41 U.S. TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 42 U.S. HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 43 U.S. MINIMALLY INVASIVE SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 44 U.S. OPEN SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 45 U.S. HEART VALVE DEVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 46 U.S. HEART VALVE DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 47 CANADA HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 48 CANADA MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 49 CANADA MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 50 CANADA MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 51 CANADA BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 52 CANADA BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 53 CANADA BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 54 CANADA TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 55 CANADA TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 56 CANADA TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 57 CANADA HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 58 CANADA MINIMALLY INVASIVE SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 59 CANADA OPEN SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 60 CANADA HEART VALVE DEVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 61 CANADA HEART VALVE DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 62 MEXICO HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 63 MEXICO MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 64 MEXICO MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 65 MEXICO MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 66 MEXICO BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 67 MEXICO BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 68 MEXICO BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 69 MEXICO TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 70 MEXICO TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 71 MEXICO TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 72 MEXICO HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 73 MEXICO MINIMALLY INVASIVE SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 74 MEXICO OPEN SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 75 MEXICO HEART VALVE DEVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 76 MEXICO HEART VALVE DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA HEART VALVE DEVICES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA HEART VALVE DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA HEART VALVE DEVICES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA HEART VALVE DEVICES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA HEART VALVE DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA HEART VALVE DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA HEART VALVE DEVICES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA HEART VALVE DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA HEART VALVE DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA HEART VALVE DEVICES MARKET: SEGMENTATION

FIGURE 11 GROWING PREVALENCE OF VALVULAR DISEASES, SUCH AS AORTIC STENOSIS & AORTIC REGURGITATION, AND INCREASING PREFERENCE FOR MINIMALLY INVASIVE SURGERIES ARE EXPECTED TO DRIVE THE NORTH AMERICA HEART VALVE DEVICES MARKET IN THE FORECAST PERIOD

FIGURE 12 MECHANICAL HEART VALVE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA HEART VALVE DEVICES MARKET IN 2023 & 2030

FIGURE 13 INCIDENDE AND PREVALENCE OF HEART VALVE OF NORTH AMERICA

FIGURE 14 INCIDENDE AND PREVALENCE OF HEART VALVE OF EUROPE

FIGURE 15 INCIDENDE AND PREVALENCE OF HEART VALVE OF ASIA-PACIFIC

FIGURE 16 INCIDENDE AND PREVALENCE OF HEART VALVE OF SOUTH AMERICA & MIDDLE EAST AND AFRICA

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA HEART VALVE DEVICES MARKET

FIGURE 18 NORTH AMERICA HEART VALVE DEVICES MARKET : BY PRODUCT TYPE, 2022

FIGURE 19 NORTH AMERICA HEART VALVE DEVICES MARKET : BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA HEART VALVE DEVICES MARKET : BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA HEART VALVE DEVICES MARKET : BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA HEART VALVE DEVICES MARKET : BY TREATMENT, 2022

FIGURE 23 NORTH AMERICA HEART VALVE DEVICES MARKET : BY TREATMENT, 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA HEART VALVE DEVICES MARKET : BY TREATMENT, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA HEART VALVE DEVICES MARKET : BY TREATMENT, LIFELINE CURVE

FIGURE 26 NORTH AMERICA HEART VALVE DEVICES MARKET : BY END USER, 2022

FIGURE 27 NORTH AMERICA HEART VALVE DEVICES MARKET : BY END USER, 2023-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA HEART VALVE DEVICES MARKET : BY END USER, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA HEART VALVE DEVICES MARKET : BY END USER, LIFELINE CURVE

FIGURE 30 NORTH AMERICA HEART VALVE DEVICES MARKET : BY DISTRIBUTION CHANNEL, 2022

FIGURE 31 NORTH AMERICA HEART VALVE DEVICES MARKET : BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 32 NORTH AMERICA HEART VALVE DEVICES MARKET : BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 33 NORTH AMERICA HEART VALVE DEVICES MARKET : BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 34 NORTH AMERICA HEART VALVE DEVICES MARKET: SNAPSHOT (2022)

FIGURE 35 NORTH AMERICA HEART VALVE DEVICES MARKET: BY COUNTRY (2022)

FIGURE 36 NORTH AMERICA HEART VALVE DEVICES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 37 NORTH AMERICA HEART VALVE DEVICES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 38 NORTH AMERICA HEART VALVE DEVICES MARKET: BY PRODUCT TYPE (2023-2030)

FIGURE 39 NORTH AMERICA HEART VALVE DEVICES MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.