North America Health Screening Market

Taille du marché en milliards USD

TCAC :

%

USD

2.02 Billion

USD

5.03 Billion

2025

2033

USD

2.02 Billion

USD

5.03 Billion

2025

2033

| 2026 –2033 | |

| USD 2.02 Billion | |

| USD 5.03 Billion | |

|

|

|

|

Marché nord-américain du dépistage de la santé, par type de test (tests de cholestérol, test du diabète , dépistage du cancer, test de contrôle général, MST, test de tension artérielle et autres), type d'emballage (dépistage de la santé de base, profil des personnes âgées, bilan de santé des femmes, bilan de santé des hommes, bilan cardiaque , bilan du diabète et autres), type de panel (panels multi-tests et panels à test unique), type d'échantillon (sang, urine, sérum , salive et autres), technologie (immuno-essais, imagerie médicale, QPCR (réaction en chaîne par polymérase quantitative), Q-FISH (fluorescence quantitative, hybridation in situ), TRF (fragment de restriction terminale), STELA (analyse de la longueur d'un seul télomère) et autres), état (maladie cardiovasculaire, troubles métaboliques, cancer, affections inflammatoires, troubles musculo-squelettiques, affections neurologiques, complications de l'hépatite C, affections liées à l'immunologie et Autres), sites de collecte d'échantillons (hôpitaux, domiciles, laboratoires de diagnostic, bureaux et autres), canal de distribution (appels d'offres directs, ventes au détail et autres), pays (États-Unis, Canada et Mexique), tendances et prévisions de l'industrie jusqu'en 2028.

Analyse et perspectives du marché : marché nord-américain du dépistage médical

Analyse et perspectives du marché : marché nord-américain du dépistage médical

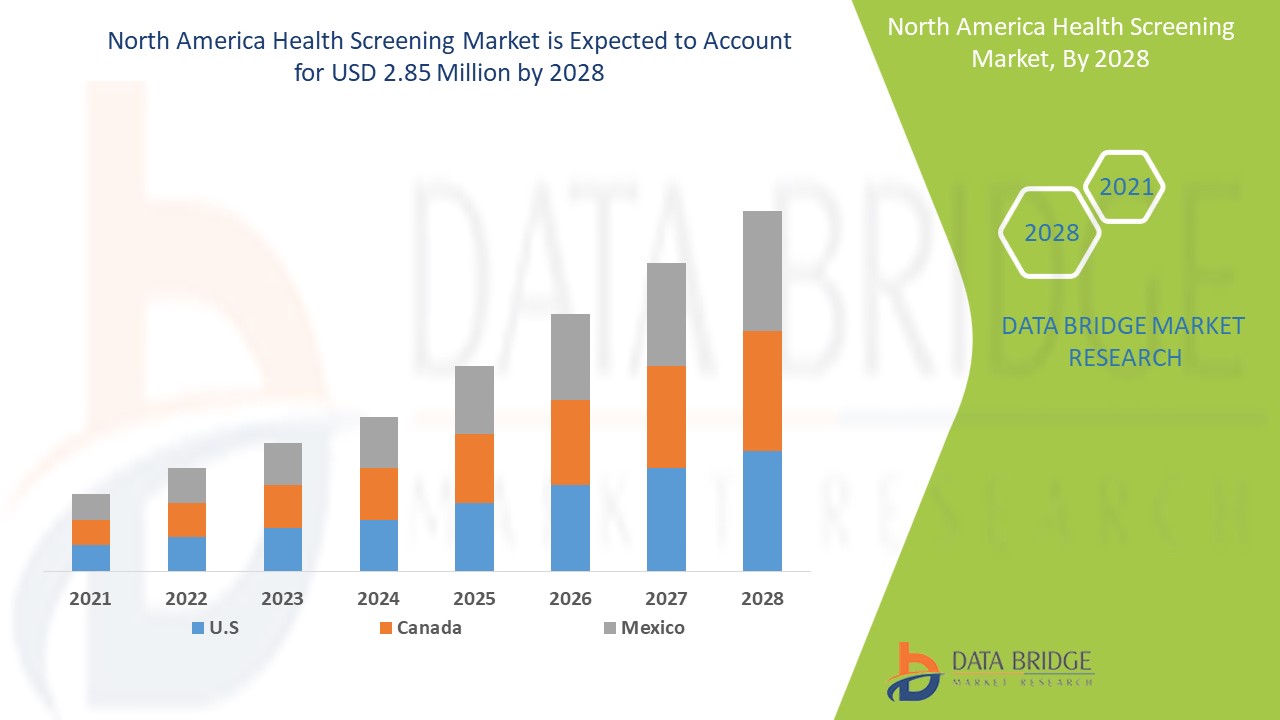

Le marché nord-américain du dépistage de santé devrait connaître une croissance du marché au cours de la période de prévision de 2021 à 2028. Data Bridge Market Research analyse que le marché croît avec un TCAC de 12,1 % au cours de la période de prévision de 2021 à 2028 et devrait atteindre 2,85 millions USD d'ici 2028. Le nombre croissant de maladies chroniques, la population gériatrique et la sensibilisation croissante à la détection et au traitement précoces des maladies sont les principaux moteurs qui ont propulsé la demande du marché au cours de la période de prévision.

Le dépistage médical est une méthode importante de détection précoce d'un trouble spécifique. Les tests de dépistage sont souvent utilisés en médecine préventive pour identifier si un individu présente des signes précoces de facteurs de risque d'une maladie. Les maladies qui peuvent être détectées par dépistage comprennent le cancer, le diabète, l'hypercholestérolémie, l'hypertension artérielle et l'ostéoporose. L'augmentation du volume des maladies chroniques, la population gériatrique et la sensibilisation croissante à la détection et au traitement précoces des maladies propulsent la croissance du marché du dépistage médical.

La sensibilisation croissante des citoyens à la détection et au traitement précoces des maladies et l'augmentation des dépenses de santé accroissent la demande de dépistage médical et agissent comme des moteurs du marché.

La demande croissante de dépistages médicaux en raison de leur efficacité, le nombre croissant de prestataires de services et la campagne de sensibilisation croissante des acteurs privés et publics en matière de dépistage médical stimulent la croissance du marché des dépistages médicaux au cours de la période de prévision et constituent une opportunité. Cependant, le coût élevé des tests de dépistage pourrait entraver la croissance du marché au cours de la période de prévision.

Le rapport sur le marché du dépistage médical en Amérique du Nord fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste ; notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché du dépistage médical en Amérique du Nord

Portée et taille du marché du dépistage médical en Amérique du Nord

Le marché nord-américain du dépistage médical est segmenté en fonction de huit segments notables : le type de test, le type d'emballage, le type de panel, le type d'échantillon, la technologie, l'état, les sites de collecte d'échantillons et le canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

- En fonction du type de test, le marché nord-américain du dépistage de la santé est segmenté en tests de cholestérol, tests de diabète, dépistage du cancer, tests de contrôle général, MST, tests de tension artérielle et autres. En 2021, le segment des tests de cholestérol devrait dominer le marché en raison de la prévalence croissante des troubles liés au cholestérol et des mauvaises habitudes alimentaires qui augmentent le risque de ces tests.

- En fonction du type de forfait, le marché nord-américain du dépistage médical est segmenté en dépistage médical de base, profil des personnes âgées, bilan de santé des femmes, bilan de santé des hommes, bilan cardiaque, bilan du diabète, etc. En 2021, le segment du dépistage médical de base devrait dominer le marché en raison de la concurrence croissante sur le marché, qui incite différents laboratoires à proposer des forfaits pour inciter les patients à se soumettre à un dépistage dans leur laboratoire.

- Sur la base du type de panel, le marché nord-américain du dépistage médical est segmenté en panels multi-tests et panels à test unique. En 2021, le segment des panels multi-tests devrait dominer le marché, car divers laboratoires et centres de diagnostic utilisent des panels multi-tests pour le dépistage et, dans le scénario actuel, les maladies sont interconnectées par des symptômes, ce qui augmente l'utilisation de panels multiples pour dépister différents tests en même temps

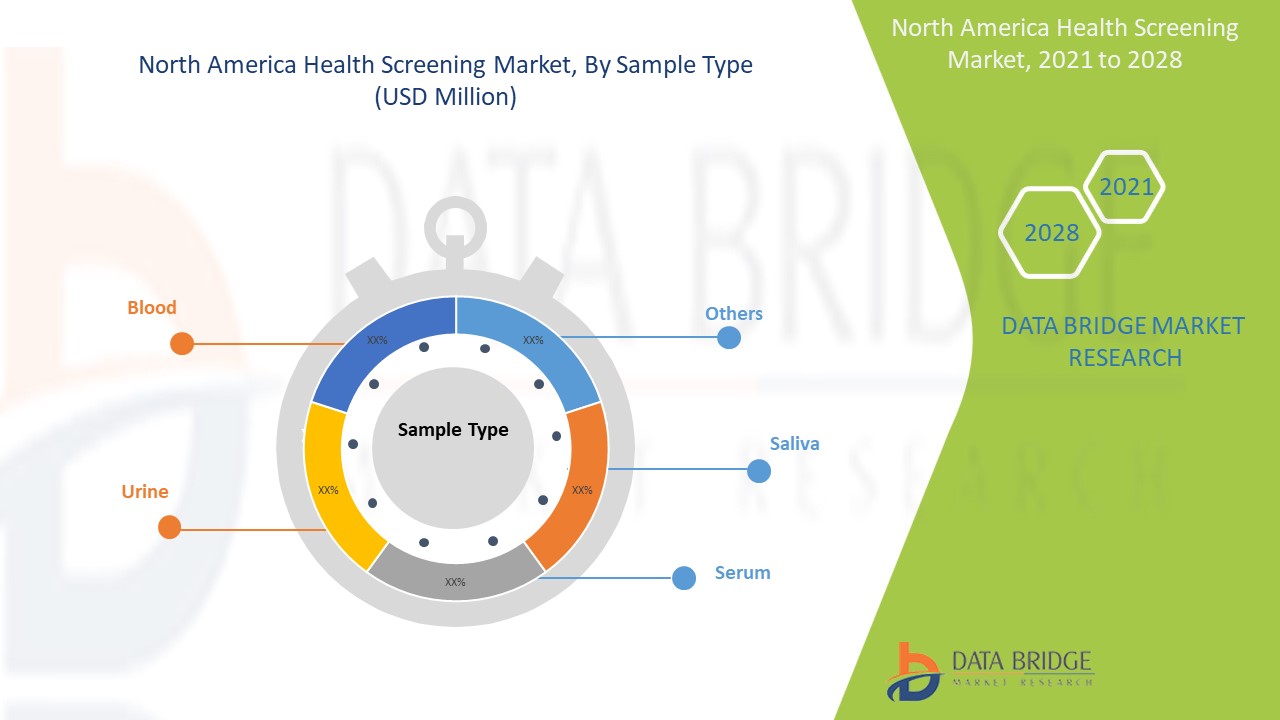

- En fonction du type d'échantillon, le marché nord-américain du dépistage médical est segmenté en sang, urine, sérum, salive et autres. En 2021, le segment sanguin devrait dominer le marché car il s'agit de la méthode de dépistage et de diagnostic la plus simple et la plus pratique.

- Sur la base de la technologie, le marché nord-américain du dépistage médical est segmenté en immuno-essais, imagerie médicale, QPCR (Quantitative Polymerase Chain Reaction), Q-FISH (Quantitative Fluorescence, hybridation in situ), TRF (Terminal Restriction Fragment), STELA (Single Telomere Length Analysis), et autres. En 2021, le segment des immuno-essais devrait dominer le marché car les immuno-essais contribuent à diverses applications, notamment les transfusions sanguines, les thérapies géniques, les opérations d'implantation, le dépistage des maladies infectieuses et autres. Les États-Unis et le Canada sont le principal marché des nouvelles technologies et croient en l'avancement de la technologie existante, ce qui est également un facteur majeur de croissance du segment.

- Sur la base des conditions, le marché nord-américain du dépistage médical est segmenté en maladies cardiovasculaires, troubles métaboliques, cancer, maladies inflammatoires, troubles musculo-squelettiques, maladies neurologiques, complications de l'hépatite C, maladies liées à l'immunologie et autres. En 2021, la prévalence du segment des maladies cardiovasculaires en Amérique du Nord est élevée, car près de 3 % des personnes souffrent de crises cardiaques nouvelles ou récurrentes, ce qui permet à ce segment de croître au cours de la période de prévision.

- Sur la base des sites de collecte d'échantillons, le marché nord-américain du dépistage médical est segmenté en hôpitaux, maisons, laboratoires de diagnostic, bureaux et autres. En 2021, le segment des hôpitaux devrait dominer le marché, car les hôpitaux disposent de toutes les installations nécessaires pour diagnostiquer et traiter les troubles.

- En fonction du canal de distribution, le marché nord-américain du dépistage médical est segmenté en appels d'offres directs, ventes au détail et autres. En 2021, le segment des appels d'offres directs devrait dominer le marché en raison de l'augmentation des ventes globales de programmes de dépistage médical.

Analyse du marché du dépistage médical en Amérique du Nord au niveau des pays

Le marché nord-américain du dépistage médical est analysé et des informations sur la taille du marché sont fournies sur le type de test, le type d'emballage, le type de panel, le type d'échantillon, la technologie, l'état, les sites de collecte d'échantillons et le canal de distribution. Les pays couverts par le rapport sur le marché nord-américain du dépistage médical sont les États-Unis, le Canada et le Mexique.

Les États-Unis, dans la région nord-américaine, devraient connaître le taux de croissance le plus élevé au cours de la période de prévision de 2021 à 2028 en raison de l'augmentation de la population gériatrique et de la sensibilisation croissante à la détection et au traitement précoces des maladies.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Le nombre croissant de maladies chroniques, telles que le cancer, le diabète et les maladies cardiovasculaires à travers le monde et l'augmentation de la population gériatrique stimulent la croissance du marché du dépistage médical en Amérique du Nord

Le marché nord-américain du dépistage de la santé vous fournit également une analyse de marché détaillée de la croissance de chaque pays dans le secteur des produits de dépistage avec les ventes de médicaments, l'impact des progrès, de la technologie et des changements dans les scénarios réglementaires avec leur soutien au marché du dépistage de la santé. Les données sont disponibles pour la période historique de 2010 à 2019.

Analyse du paysage concurrentiel et des parts de marché du dépistage médical en Amérique du Nord

Le paysage concurrentiel du marché du dépistage médical en Amérique du Nord fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise liée au marché du fluorure de diamine d'argent (SDF)

Français Les principales entreprises opérant sur le marché du dépistage cardiaque en Amérique du Nord sont Quest Diagnostics Incorporated, Laboratory Corporation of America, Sonic Healthcare Limited, Exact Sciences Corporation, Healius Limited, GRAIL, Eurofins Scientific, , SYNLAB International GmbH, UNILABS, LabPLUS, BioReference Laboratories, , ACM Global Laboratories, Cerba Healthcare, Quidel Corporation, Innova Medical Group, AMEDES Holding GmbH, RadNet, Inc., Natera, Inc., Trinity Biotech, Nuffield Health, RepeatDx, NeoGenomics Laboratories, HU Group Holdings, Inc., Lifelabs, ARUP Laboratories, Q2 Solutions, Genova Diagnostics, Life Length, DNA Labs India, , Telomere Diagnostics, Charles River Laboratories, Ambry Genetics, SpectraCell Laboratories, Inc., Dr. Lal PathLabs, et entre autres.

De nombreux événements, accords et webinaires sont également initiés par des entreprises du monde entier, ce qui accélère également le marché du dépistage médical en Amérique du Nord.

Par exemple,

- En avril 2021, Ambry Genetics a annoncé qu'elle participerait à la réunion annuelle de génétique clinique 2021 de l'ACMG. Cela a donné à l'entreprise une plate-forme pour présenter ses idées commerciales.

- En septembre 2021, les laboratoires ARUP ont annoncé un partenariat avec Air Med pour fournir des installations médicales aux patients en fournissant du sang aux vols et à d'autres installations. Cela augmentera le bassin de patients pour le prestataire de services qui aidera les laboratoires au cours de la période de prévision.

La collaboration, le lancement de produits, l'expansion commerciale, les récompenses et la reconnaissance, les coentreprises et d'autres acteurs du marché améliorent le marché de l'entreprise sur le marché du dépistage de santé en Amérique du Nord, ce qui profite également à l'organisation pour améliorer son offre de médicaments de dépistage de santé.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.