Marché des géosynthétiques en Amérique du Nord, par produit ( géotextiles, géomembranes, géogrilles, géocellules, géofilets et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des géosynthétiques en Amérique du Nord

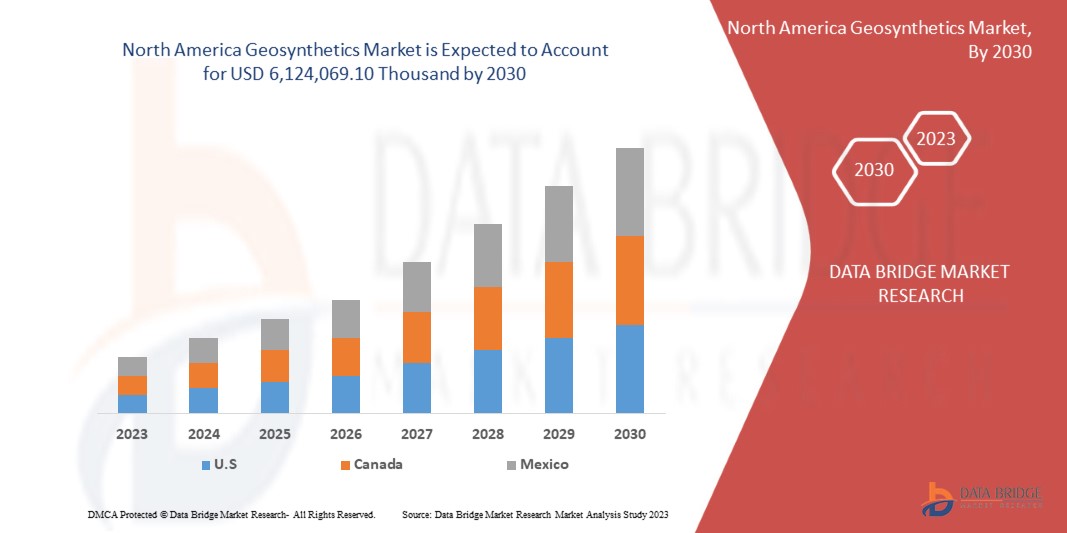

Le marché nord-américain des géosynthétiques devrait connaître une croissance significative au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 5,4 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 6 124 069,10 milliers USD d'ici 2030. Le principal facteur à l'origine de la croissance du marché nord-américain des géosynthétiques est l'expansion de l'industrie de la construction au niveau nord-américain.

Le rapport sur le marché des géosynthétiques en Amérique du Nord fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, des opportunités d'analyse en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2020 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, volume en milliers de mètres carrés |

|

Segments couverts |

Par produit (géotextiles, géomembranes, géogrilles, géocellules, géofilets et autres) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

Tensar, une division de CMC, Leggett & Platt, Incorporated, Berry North America, Inc., Carthage Mills, Inc., TENAX, North America Synthetics, HUESKER, AGRU, SKAPS Industries, Glen Raven Inc., SOLMAX, Schouw & Co., Naue Gmbh & Co.KG, Officine Maccaferri Spa, Swicofil AG, PRS Geo-Technologies., et Freudenberg entre autres |

Définition du marché

Les géosynthétiques désignent les polymères utilisés dans le génie civil, la construction et les applications connexes. Ils sont généralement utilisés pour stabiliser les terrains et présentent une grande durabilité qui complète les autres matériaux de construction. Les différents types de géosynthétiques comprennent, entre autres, les géotextiles, les géomembranes, les géocomposites et les revêtements géosynthétiques. Outre le génie civil et la construction, ils sont également utilisés dans les applications de transport et hydrauliques. Ils sont généralement fabriqués à partir de matériaux synthétiques tels que le PVC, le polyéthylène ou le polypropylène, qui, lorsqu'ils sont correctement intégrés, peuvent contribuer à la stabilisation du sol et à la prévention de l'érosion.

Dynamique du marché des géosynthétiques en Amérique du Nord

Conducteurs

- Expansion du secteur de la construction à l’échelle nord-américaine

Les géosynthétiques de toutes sortes sont utilisés dans les projets de génie civil et de construction. L'épuisement des sources de matières premières granulaires et autres matières premières de base, ainsi que le financement limité des projets, ont créé de nouvelles opportunités pour l'ingénierie inventive de fournir des solutions rentables. L'une de ces avancées est l'utilisation des géosynthétiques dans le génie civil. Les géosynthétiques sont reconnus comme de véritables matériaux d'ingénierie qui non seulement remplacent les ressources brutes limitées telles que le ciment et l'acier, mais s'avèrent également être une alternative assez solide et efficace aux conceptions traditionnelles.

Cette croissance du secteur de la construction accroît la demande de produits géosynthétiques tels que les géotextiles, les géogrilles, les géofilets, les géomembranes, les géocouches d'argile géosynthétiques (GCL), les géocellules, les géocomposites, les géotuyaux et les géomousses. Les géotextiles et les géogrilles sont utilisés pour améliorer les performances des routes permanentes ou pour réduire leur épaisseur.

- Augmentation des dépenses consacrées à la gestion des déchets

L'urbanisation rapide et la croissance rapide de la population nord-américaine contribuent toutes deux à l'augmentation des quantités de déchets liquides et solides. La prise de conscience environnementale croissante accroît la demande de projets qui gèrent correctement l'eau et les déchets. Les géosynthétiques fonctionnent comme des produits intelligents en tant que solutions de confinement et de gestion des déchets dans le but de protéger l'environnement des déchets industriels dangereux. Les gaz d'enfouissement et les lixiviats devraient idéalement être gérés de manière à préserver l'environnement.

Les géosynthétiques sont utilisés dans la gestion des déchets pour les solutions de revêtement des décharges, le drainage des lixiviats, la collecte des gaz et les systèmes d'assèchement. Les géomembranes fonctionnent comme des barrières contre les liquides et les gaz d'enfouissement, et le GCL est utilisé pour les revêtements des décharges. Les géofilets, les géotubes et les géocomposites sont des alternatives de drainage des lixiviats à faible coût. Ces géosynthétiques robustes peuvent supporter des débits élevés, sont simples à installer et peuvent supporter une charge verticale. Les géofilets biaxiaux dans les systèmes de collecte de gaz transportent rapidement le gaz vers le site de traitement. Les géotubes, également connus sous le nom de tubes d'assèchement, sont essentiels dans toute opération de gestion des déchets.

- Acceptation croissante des produits géosynthétiques dans de nombreux segments d'application

Les géosynthétiques ont une large gamme d'utilisations. Il est presque difficile de trouver un projet d'infrastructure important qui n'inclut pas l'utilisation d'une certaine forme de composant géosynthétique. C'est pourquoi les géosynthétiques sont un type de matériau distinct. Ils remplissent une variété de rôles allant du confinement chimique au renforcement structurel du sol, ainsi que bien d'autres encore, comme le drainage, la séparation des matériaux et la filtration. Ce sont les utilisations les plus importantes des géosynthétiques.

Une application de confinement est toute application qui utilise des géosynthétiques comme barrière contre les matériaux liquides ou gazeux. Les revêtements miniers de lixiviation en tas, la gestion des eaux usées, le confinement des réservoirs secondaires et les revêtements de lixiviat de décharge en sont quelques exemples. Les géosynthétiques les plus courants pour les applications de confinement sont les revêtements d'argile, les géocomposites et les géomembranes.

Les géosynthétiques utilisés dans les applications de drainage permettent d'évacuer l'eau souterraine ou de surface d'un endroit donné. Ils remplissent un double rôle : d'une part, ils empêchent les grains fins du sol de boucher les systèmes de drainage et, d'autre part, ils renforcent et maintiennent l'intégrité de la structure. Les barrages, les tunnels, les chaussées et les routes, le drainage souterrain et le contrôle de l'érosion utilisent tous des géomembranes, des géotextiles et des géogrilles.

Les couches géosynthétiques filtrantes sont utilisées dans la plupart des applications de génie civil pour éliminer et séparer l'humidité ou les particules fines d'une structure. Les géosynthétiques tels que les géomembranes et les géotextiles sont largement reconnus pour offrir une filtration supérieure. Ils offrent des solutions pour la construction d'aérodromes, de routes et de terrains de sport.

Par conséquent, les géosynthétiques sont fréquemment utilisés dans les applications décrites ci-dessus. De plus, l'industrialisation croissante et l'augmentation du nombre de grands projets d'infrastructure et environnementaux font progresser le marché des géosynthétiques.

OPPORTUNITÉS

- Contrôle de l'érosion des sols, meilleur drainage et conservation des sols grâce aux géosynthétiques

L'érosion des sols est considérée comme un phénomène courant, car le taux de développement naturel des sols a été assez lent ces dernières années. Par conséquent, il est recommandé d'utiliser la meilleure solution pour empêcher artificiellement l'érosion des sols. La gestion de l'érosion est également nécessaire pour assurer la stabilité d'autres bâtiments contre les glissements de terrain, entre autres, et elle est également nécessaire pour empêcher les planètes et les formations de sol de s'effondrer en raison de la pluie, de la gravité ou de divers autres facteurs. Les géosynthétiques sont utilisés pour « bloquer ou limiter les mouvements du sol ou d'autres particules à la surface, par exemple, d'une pente » dans la gestion de l'érosion des sols de surface.

Les géotextiles protègent les berges des cours d'eau contre l'érosion provoquée par les courants ou le clapotis. Ils fonctionnent comme un filtre lorsqu'ils sont associés à des enrochements naturels ou artificiels. Les géotextiles utilisés pour lutter contre l'érosion peuvent être tissés ou non tissés. Les textiles tissés conviennent aux sols à plus grosses particules car ils ont des pores plus larges. Les non-tissés sont utilisés dans les zones où se développent des sols tels que les limons argileux. Lorsqu'un soulèvement hydraulique est prévu, ces matériaux doivent avoir une perméabilité élevée.

Les géotextiles sont utilisés pour le drainage, la gestion de l'érosion et la modification rentable du sol, les géogrilles sont généralement utilisées pour le renforcement du sol et des agrégats, les géomembranes sont utilisées pour la séparation du sol et du fluide, améliorant la résistance au cisaillement du sol, et les géocomposites/géoweb sont utilisés dans le drainage.

- Augmentation des dépenses dans l'exploration minière et pétrolière

Les géomembranes sont généralement utilisées dans les applications minières telles que les installations de lixiviation en tas, les bassins d'évaporation et les bassins de résidus, où se produisent généralement des charges très élevées. Le polyéthylène haute densité (PEHD), le chlorure de polyvinyle (PVC), le polypropylène (PP) et d'autres matériaux sont des matières premières courantes pour les géomembranes. Cependant, en raison de leur résistance chimique et de leurs qualités physiques supérieures, les géomembranes en PEHD sont les plus couramment utilisées. D'autres considérations de conception doivent être prises en compte en plus des qualités des géomembranes, telles que l'influence des contraintes élevées, le type de fondation et le matériau placé sous et au-dessus des géomembranes. L'industrie minière consomme environ 40 % de la production mondiale de géomembranes. En outre, les entreprises du secteur minier fournissent et fabriquent de nombreux systèmes de géomembranes.

RESTRICTIONS/DÉFIS

- Lois gouvernementales strictes sur l'utilisation des géosynthétiques

Les géosynthétiques sont un sujet d'actualité car ils trouvent un plus large éventail d'utilisations. Les produits géosynthétiques sont moins dangereux pour l'environnement. Des problèmes spécifiques tels que la façon dont ils sont fabriqués, manipulés et installés, ainsi que les difficultés que les matériaux géosynthétiques peuvent générer, doivent également être pris en compte. Chaque gouvernement ou nation à travers le monde a élaboré des réglementations, des directives et des critères stricts pour leur utilisation contrôlée sans causer de dommages à l'environnement ou dans d'autres types d'applications clés où les géosynthétiques sont fréquemment utilisés.

- Fluctuations des prix des matières premières et interdiction de l'utilisation du plastique Problèmes socio-économiques dans la fabrication de produits géosynthétiques

Les fabricants de géosynthétiques doivent relever plusieurs défis. La chaîne d'approvisionnement, les problèmes de main-d'œuvre, la hausse des prix de l'énergie, l'amélioration de la qualité, le maintien de la compétitivité et la durabilité figurent parmi les principaux enjeux.

La suppression progressive des restrictions liées à la COVID en 2022 a fait augmenter la demande, exacerbant les problèmes de chaîne d’approvisionnement liés à la pandémie en matière de fret maritime et de résines polymères. En conséquence, les entreprises doivent s’approvisionner auprès d’usines de fabrication locales de taille PME. La stabilité géopolitique durable provoquant une migration du risque souverain vers les chaînes d’approvisionnement nationales, le marché semble percevoir ce changement comme quelque peu permanent et non cyclique.

Il existe également une disparité croissante des coûts d'inflation entre les pays dotés d'une compétence industrielle. Si l'on compare le taux d'inflation de la Chine (2 %), les pays européens (Espagne, France, Allemagne et Italie) ont des taux d'intérêt compris entre 6,2 % et 9,2 %, l'Australie (7,8 %) et les États-Unis (6,4 %). En conséquence, la hausse des coûts de l'énergie constitue un point d'arbitrage entre les différentes zones de fabrication. Avec une augmentation attendue du pétrole brut en amont et du polyéthylène utilisé comme matière première, les coûts de production augmenteront en conséquence, ce qui affectera le prix final des géosynthétiques à base de PEHD.

L'amélioration de la qualité conduit à une plus grande satisfaction des clients, à une réduction des déchets et à une baisse des coûts totaux. En revanche, une production continue de géomembranes sans arrêts de maintenance spécifiques pour le nettoyage des barils et des vis peut entraîner des problèmes de gels et d'inclusions de résine brûlée. Si cela se produit, l'investissement dans la maintenance de l'usine aura plus que quadruplé. Par conséquent, le contrôle de la qualité doit être amélioré afin de limiter le nombre de rejets.

Portée du marché des géosynthétiques en Amérique du Nord

Le marché nord-américain des géosynthétiques est segmenté en un seul segment notable en fonction du produit. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Produit

- Géotextiles

- Géomembranes

- Géogrilles

- Géocellules

- Géofilets

- Autres

En fonction du produit, le marché est segmenté en géotextiles, géomembranes, géogrilles, géocellules, géofilets et autres.

Analyse/perspectives régionales du marché des géosynthétiques en Amérique du Nord

Le marché nord-américain des géosynthétiques est segmenté en fonction du produit.

Les pays couverts par le marché nord-américain des géosynthétiques sont les États-Unis, le Canada et le Mexique. Les États-Unis dominent le marché nord-américain des géosynthétiques en termes de part de marché et de chiffre d'affaires en raison de l'expansion du secteur de la construction au niveau nord-américain dans la région.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des géosynthétiques en Amérique du Nord

Le paysage concurrentiel du marché des géosynthétiques en Amérique du Nord fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications et la courbe de durée de vie du produit. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises par rapport au marché.

Français Certains des principaux acteurs opérant sur le marché nord-américain des géosynthétiques sont Tensar, une division de CMC, Leggett & Platt, Incorporated, Berry North America, Inc., Carthage Mills, Inc., TENAX, North America Synthetics, HUESKER, AGRU, SKAPS Industries, Glen Raven, Inc., SOLMAX, Schouw & Co., Naue Gmbh & Co.KG, Officine Maccaferri Spa, Swicofil AG, PRS Geo-Technologies., et Freudenberg entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES MODEL

4.3 LIST OF KEY DISTRIBUTORS

4.4 LIST OF POTENTIAL USERS

4.5 ANALYSIS OF WEED OR GRASS PROOFING SHEET

4.6 CLIMATE CHANGE SCENARIO

4.6.1 ENVIRONMENTAL CONCERNS

4.6.2 INDUSTRY RESPONSE

4.6.3 GOVERNMENT’S ROLE

4.6.4 ANALYST RECOMMENDATION

4.7 IMPORT-EXPORT SCENARIO

4.8 PRICE TREND ANALYSIS

4.9 PRODUCTION CONSUMPTION ANALYSIS

4.1 PRODUCTION CAPACITY OVERVIEW

4.11 SUPPLY CHAIN ANALYSIS

4.11.1 OVERVIEW

4.12 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.13 VENDOR SELECTION CRITERIA

4.14 RAW MATERIAL PRODUCTION COVERAGE

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 EXPANSION IN CONSTRUCTION INDUSTRY ON A NORTH AMERICA LEVEL

6.1.2 RISING EXPENDITURE TOWARD WASTE MANAGEMENT

6.1.3 GROWING IMPORTANCE TOWARD WASTEWATER TREATMENT

6.1.4 INCREASING ACCEPTANCE OF GEOSYNTHETIC PRODUCTS ACROSS NUMEROUS APPLICATION SEGMENTS

6.2 RESTRAINTS

6.2.1 FLUCTUATING RAW MATERIAL COSTS AS A RESULT OF CRUDE OIL PRICE INSTABILITY

6.2.2 THREATS ARISE AS A RESULT OF INSTALLATION FLAWS

6.3 OPPORTUNITIES

6.3.1 SOIL EROSION CONTROL, BETTER DRAINAGE, AND SOIL CONSERVATION USING GEOSYNTHETICS

6.3.2 INCREASING SPENDING IN MINING AND PETROLEUM EXPLORATION

6.3.3 A MOVE TOWARD RECYCLED PLASTIC RESULTING IN NEW PRODUCT OFFERINGS FROM A VARIETY OF MAJOR BUSINESSES

6.4 CHALLENGES

6.4.1 STRINGENT GOVERNMENT LAWS ON THE USE OF GEOSYNTHETICS

6.4.2 SOCIO-ECONOMIC ISSUES IN MANUFACTURING GEOSYNTHETIC PRODUCTS

7 NORTH AMERICA GEOSYNTHETICS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 GEOTEXTILES

7.2.1 GEOTEXTILES, BY RAW MATERIAL

7.2.1.1 SYNTHETIC

7.2.1.1.1 POLYPROPYLENE

7.2.1.1.2 POLYESTER

7.2.1.1.3 POLYETHYLENE

7.2.1.2 NATURAL

7.2.1.2.1 JUTE

7.2.1.2.2 OTHERS

7.2.2 GEOTEXTILES , BY PRODUCT

7.2.2.1 WOVEN

7.2.2.2 KNITTED

7.2.2.3 NON - WOVEN

7.2.3 GEOTEXTILES, BY APPLICATION

7.2.3.1 EROSION CONTROL

7.2.3.2 REINFORCEMENT

7.2.3.3 DRAINAGE SYSTEMS

7.2.3.4 LINING SYSTEMS

7.2.3.5 ASPHALT OVERLAYS

7.2.3.6 SEPARATION & STABILIZATION

7.2.3.7 SILT FENCES

7.3 GEOMEMBRANES

7.3.1 GEOMEMBRANES, BY RAW MATERIAL

7.3.1.1 HDPEE

7.3.1.2 POLYVINYL CHLORIDE (PVC)

7.3.1.3 LDPE

7.3.1.4 ETHYLENE PROPYLENE DIENE MONOMER ( EPDM)

7.3.1.5 OTHERS

7.3.2 GEOMEMBRANES, BY APPLICATION

7.3.2.1 MINING

7.3.2.2 WASTE MANAGEMENT

7.3.2.3 LINING SYSTEMS

7.3.2.4 WATER MANAGEMENT

7.3.2.5 OTHERS

7.3.3 GEOMEMBRANES, BY TECHNOLOGY

7.3.3.1 EXTRUSION

7.3.3.2 CALENDERING

7.4 GEOGRIDS

7.4.1 GEOGRIDS, BY RAW MATERIAL

7.4.1.1 HDPE

7.4.1.2 POLYPROPYLENE

7.4.1.3 POLYESTER

7.4.2 GEOGRIDS, BY APPLICATION

7.4.2.1 SOIL REINFORCEMENT

7.4.2.2 ROAD CONSTRUCTION

7.4.2.3 RAILROAD

7.4.2.4 OTHERS

7.4.3 GEOGRIDS, BY PRODUCT

7.4.3.1 UNIAXIAL

7.4.3.2 MULTI-AXIAL

7.4.3.3 BIAXIAL

7.5 GEOCELLS

7.5.1 GEOCELLS, BY RAW MATERIAL

7.5.1.1 HDPE

7.5.1.2 POLYPROPYLENE (PP)

7.5.1.3 OTHERS

7.5.2 GEOCELLS, BY APPLICATION

7.5.2.1 EARTH REINFORCEMENT

7.5.2.2 SLOPE PROTECTION

7.5.2.3 TREE ROOT PROTECTION

7.5.2.4 LOAD SUPPORT

7.5.2.5 OTHERS

7.6 GEONETS

7.6.1 GEONETS, BY RAW MATERIAL

7.6.1.1 HDPE

7.6.1.2 MDPE

7.6.1.3 OTHERS

7.6.2 GEONETS , BY APPLICATION

7.6.2.1 DRAINAGE

7.6.2.2 ROAD CONSTRUCTION

7.6.2.3 RAILROAD

7.6.2.4 OTHERS

7.7 OTHERS

8 NORTH AMERICA GEOSYNTHETICS MARKET, BY REGION

8.1 NORTH AMERICA

8.1.1 U.S.

8.1.2 CANADA

8.1.3 MEXICO

9 NORTH AMERICA GEOSYNTHETICS MARKET: COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

9.2 ACQUISITION

9.3 PRODUCT LAUNCH

9.4 NEW DEVELOPMENT

9.5 INSTALLATION

9.6 ANNOUNCEMENT

9.7 INVESTMENT

9.8 PARTNERSHIP

9.9 PROJECT/EVENT

10 COMPANY PROFILES

10.1 CMC

10.1.1 COMPANY SNAPSHOT

10.1.2 COMPANY SHARE ANALYSIS

10.1.3 SWOT ANALYSIS

10.1.4 PRODUCT PORTFOLIO

10.1.5 RECENT DEVELOPMENTS

10.2 LEGGETT & PLATT, INCORPORATED

10.2.1 COMPANY SNAPSHOT

10.2.2 REVENUE ANALYSIS

10.2.3 COMPANY SHARE ANALYSIS

10.2.4 SWOT ANALYSIS

10.2.5 PRODUCT PORTFOLIO

10.2.6 RECENT DEVELOPMENTS

10.3 OFFICINE MACCAFERRI SPA

10.3.1 COMPANY SNAPSHOT

10.3.2 COMPANY SHARE ANALYSIS

10.3.3 SWOT ANALYSIS

10.3.4 PRODUCT PORTFOLIO

10.3.5 RECENT DEVELOPMENTS

10.4 FREUDENBERG

10.4.1 COMPANY SNAPSHOT

10.4.2 REVENUE ANALYSIS

10.4.3 COMPANY SHARE ANALYSIS

10.4.4 SWOT ANALYSIS

10.4.5 PRODUCT PORTFOLIO

10.4.6 RECENT DEVELOPMENT

10.5 BERRY NORTH AMERICA, INC.

10.5.1 COMPANY SNAPSHOT

10.5.2 REVENUE ANALYSIS

10.5.3 COMPANY SHARE ANALYSIS

10.5.4 SWOT ANALYSIS

10.5.5 PRODUCT PORTFOLIO

10.5.6 RECENT DEVELOPMENT

10.6 AGRU AMERICA, INC.

10.6.1 COMPANY SNAPSHOT

10.6.2 PRODUCT PORTFOLIO

10.6.3 SWOT

10.6.4 RECENT DEVELOPMENT

10.7 CARTHAGE MILLS, INC.

10.7.1 COMPANY SNAPSHOT

10.7.2 SWOT ANALYSIS

10.7.3 PRODUCT PORTFOLIO

10.7.4 RECENT DEVELOPMENT

10.8 GLEN RAVEN, INC.

10.8.1 COMPANY SNAPSHOT

10.8.2 BRAND PORTFOLIO

10.8.3 SWOT

10.8.4 RECENT DEVELOPMENT

10.9 NORTH AMERICA SYNTHETICS

10.9.1 COMPANY SNAPSHOT

10.9.2 PRODUCT PORTFOLIO

10.9.3 SWOT

10.9.4 RECENT DEVELOPMENT

10.1 HUESKER

10.10.1 COMPANY SNAPSHOT

10.10.2 PRODUCT PORTFOLIO

10.10.3 SWOT

10.10.4 RECENT DEVELOPMENTS

10.11 NAUE GMBH & CO.KG

10.11.1 COMPANY SNAPSHOT

10.11.2 SWOT ANALYSIS

10.11.3 PRODUCT PORTFOLIO

10.11.4 RECENT DEVELOPMENTS

10.12 PRS GEO-TECHNOLOGIES.

10.12.1 COMPANY SNAPSHOT

10.12.2 SWOT ANALYSIS

10.12.3 PRODUCT PORTFOLIO

10.12.4 RECENT DEVELOPMENTS

10.13 SCHOUW & CO.

10.13.1 COMPANY SNAPSHOT

10.13.2 REVENUE ANALYSIS

10.13.3 SWOT ANALYSIS

10.13.4 PRODUCT PORTFOLIO

10.13.5 RECENT DEVELOPMENTS

10.14 SKAPS INDUSTRIES

10.14.1 COMPANY SNAPSHOT

10.14.2 PRODUCT PORTFOLIO

10.14.3 SWOT

10.14.4 RECENT DEVELOPMENTS

10.15 SOLMAX

10.15.1 COMPANY SNAPSHOT

10.15.2 BRAND PORTFOLIO

10.15.3 SWOT

10.15.4 RECENT DEVELOPMENTS

10.16 SWICOFIL AG

10.16.1 COMPANY SNAPSHOT

10.16.2 SWOT ANALYSIS

10.16.3 PRODUCT PORTFOLIO

10.16.4 RECENT DEVELOPMENTS

10.17 TENAX

10.17.1 COMPANY SNAPSHOT

10.17.2 PRODUCT PORTFOLIO

10.17.3 SWOT

10.17.4 RECENT DEVELOPMENT

11 QUESTIONNAIRE

12 RELATED REPORTS

Liste des tableaux

TABLE 1 LIST OF MANUFACTURERS PRODUCING WEED OR GRASS-PROOFING SHEETS AND PRODUCTS

TABLE 2 REGULATORY COVERAGE

TABLE 3 NORTH AMERICA GEOSYNTHETICS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA GEOSYNTHETICS MARKET, BY PRODUCT, 2021-2030 (THOUSAND SQUARE METER)

TABLE 5 NORTH AMERICA GEOTEXTILES IN GEOSYNTHETICS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA GEOTEXTILES IN GEOSYNTHETICS MARKET, BY REGION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 7 NORTH AMERICA GEOTEXTILES IN GEOSYNTHETICS MARKET, BY RAW MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA SYNTHETIC IN GEOSYNTEHTICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA NATURAL IN GEOSYNTHETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA GEOTEXTILES IN GEOSYNTHETICS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA GEOTEXTILES IN GEOSYNTHETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA GEOMEMBRANES IN GEOSYNTHETICS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA GEOMEMBRANES IN GEOSYNTHETICS MARKET, BY REGION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 14 NORTH AMERICA GEOMEMBRANES IN GEOSYNTHETICS MARKET, BY RAW MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA GEOMEMBRANES IN GEOSYNTHETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA GEOMEMBRANES IN GEOSYNTHETICS MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA GEOGRIDS IN GEOSYNTHETICS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA GEOGRIDS IN GEOSYNTHETICS MARKET, BY REGION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 19 NORTH AMERICA GEOGRIDS IN GEOSYNTHETICS MARKET, BY RAW MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA GEOGRIDS IN GEOSYNTHETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA GEOGRIDS IN GEOSYNTHETICS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA GEOCELLS IN GEOSYNTHETICS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA GEOCELLS IN GEOSYNTHETICS MARKET, BY REGION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 24 NORTH AMERICA GEOCELLS IN GEOSYNTHETICS MARKET, BY RAW MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA GEOCELLS IN GEOSYNTHETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA GEONETS IN GEOSYNTHETICS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA GEONETS IN GEOSYNTHETICS MARKET, BY REGION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 28 NORTH AMERICA GEONETS IN GEOSYNTHETICS MARKET, BY RAW MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA GEONETS IN GEOSYNTHETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA GEONETS IN GEOSYNTHETICS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA GEONETS IN GEOSYNTHETICS MARKET, BY REGION, 2021-2030 (THOUSAND SQUARE METER)

TABLE 32 NORTH AMERICA GEOSYNTHETICS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA GEOSYNTHETICS MARKET, BY COUNTRY, 2021-2030 (THOUSAND SQUARE METER)

TABLE 34 NORTH AMERICA GEOSYNTHETICS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA GEOSYNTHETICS MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 36 NORTH AMERICA GEOTEXTILES IN GEOSYNTHETICS MARKET, BY RAW MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 37 NORTH AMERICA SYNTHETIC IN GEOSYNTHETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA NATURAL IN GEOSYNTHETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 NORTH AMERICA GEOTEXTILES IN GEOSYNTHETICS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA GEOTEXTILES IN GEOSYNTHETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 41 NORTH AMERICA GEOMEMBRANES IN GEOSYNTHETICS MARKET, BY RAW MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA GEOMEMBRANES IN GEOSYNTHETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 43 NORTH AMERICA GEOMEMBRANES IN GEOSYNTHETICS MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 44 NORTH AMERICA GEOGRIDS IN GEOSYNTHETICS MARKET, BY RAW MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 45 NORTH AMERICA GEOGRIDS IN GEOSYNTHETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 46 NORTH AMERICA GEOGRIDS IN GEOSYNTHETICS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 47 NORTH AMERICA GEOCELLS IN GEOSYNTHETICS MARKET, BY RAW MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 48 NORTH AMERICA GEOCELLS IN GEOSYNTHETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 49 NORTH AMERICA GEONETS IN GEOSYNTHETICS MARKET, BY RAW MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 50 NORTH AMERICA GEONETS IN GEOSYNTHETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 51 U.S. GEOSYNTHETICS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 52 U.S. GEOSYNTHETICS MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 53 U.S. GEOTEXTILES IN GEOSYNTHETICS MARKET, BY RAW MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 54 U.S. SYNTHETIC IN GEOSYNTHETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 U.S. NATURAL IN GEOSYNTHETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 U.S. GEOTEXTILES IN GEOSYNTHETICS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 57 U.S. GEOTEXTILES IN GEOSYNTHETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 58 U.S. GEOMEMBRANES IN GEOSYNTHETICS MARKET, BY RAW MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 59 U.S. GEOMEMBRANES IN GEOSYNTHETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 60 U.S. GEOMEMBRANES IN GEOSYNTHETICS MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 61 U.S. GEOGRIDS IN GEOSYNTHETICS MARKET, BY RAW MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 62 U.S. GEOGRIDS IN GEOSYNTHETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 63 U.S. GEOGRIDS IN GEOSYNTHETICS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 64 U.S. GEOCELLS IN GEOSYNTHETICS MARKET, BY RAW MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 65 U.S. GEOCELLS IN GEOSYNTHETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 66 U.S. GEONETS IN GEOSYNTHETICS MARKET, BY RAW MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 67 U.S. GEONETS IN GEOSYNTHETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 68 CANADA GEOSYNTHETICS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 69 CANADA GEOSYNTHETICS MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 70 CANADA GEOTEXTILES IN GEOSYNTHETICS MARKET, BY RAW MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 71 CANADA SYNTHETIC IN GEOSYNTHETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 72 CANADA NATURAL IN GEOSYNTHETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 CANADA GEOTEXTILES IN GEOSYNTHETICS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 74 CANADA GEOTEXTILES IN GEOSYNTHETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 75 CANADA GEOMEMBRANES IN GEOSYNTHETICS MARKET, BY RAW MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 76 CANADA GEOMEMBRANES IN GEOSYNTHETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 77 CANADA GEOMEMBRANES IN GEOSYNTHETICS MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 78 CANADA GEOGRIDS IN GEOSYNTHETICS MARKET, BY RAW MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 79 CANADA GEOGRIDS IN GEOSYNTHETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 80 CANADA GEOGRIDS IN GEOSYNTHETICS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 81 CANADA GEOCELLS IN GEOSYNTHETICS MARKET, BY RAW MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 82 CANADA GEOCELLS IN GEOSYNTHETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 83 CANADA GEONETS IN GEOSYNTHETICS MARKET, BY RAW MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 84 CANADA GEONETS IN GEOSYNTHETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 85 MEXICO GEOSYNTHETICS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 86 MEXICO GEOSYNTHETICS MARKET, BY TYPE, 2021-2030 (THOUSAND SQUARE METER)

TABLE 87 MEXICO GEOTEXTILES IN GEOSYNTHETICS MARKET, BY RAW MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 88 MEXICO SYNTHETIC IN GEOSYNTHETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 89 MEXICO NATURAL IN GEOSYNTHETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 90 MEXICO GEOTEXTILES IN GEOSYNTHETICS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 91 MEXICO GEOTEXTILES IN GEOSYNTHETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 92 MEXICO GEOMEMBRANES IN GEOSYNTHETICS MARKET, BY RAW MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 93 MEXICO GEOMEMBRANES IN GEOSYNTHETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 94 MEXICO GEOMEMBRANES IN GEOSYNTHETICS MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 95 MEXICO GEOGRIDS IN GEOSYNTHETICS MARKET, BY RAW MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 96 MEXICO GEOGRIDS IN GEOSYNTHETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 97 MEXICO GEOGRIDS IN GEOSYNTHETICS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 98 MEXICO GEOCELLS IN GEOSYNTHETICS MARKET, BY RAW MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 99 MEXICO GEOCELLS IN GEOSYNTHETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 100 MEXICO GEONETS IN GEOSYNTHETICS MARKET, BY RAW MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 101 MEXICO GEONETS IN GEOSYNTHETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA GEOSYNTHETICS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA GEOSYNTHETICS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA GEOSYNTHETICS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA GEOSYNTHETICS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA GEOSYNTHETICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA GEOSYNTHETICS MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 NORTH AMERICA GEOSYNTHETICS MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA GEOSYNTHETICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA GEOSYNTHETICS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA GEOSYNTHETICS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA GEOSYNTHETICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 NORTH AMERICA GEOSYNTHETICS MARKET: SEGMENTATION

FIGURE 13 RISING EXPENDITURE TOWARDS WASTE MANAGEMENT, WHICH IS EXPECTED TO DRIVE THE GROWTH OF THE NORTH AMERICA GEOSYNTHETICS MARKET IN THE FORECAST PERIOD

FIGURE 14 THE GEOTEXTILES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE NORTH AMERICA GEOSYNTHETICS MARKET IN 2023 AND 2030

FIGURE 15 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 16 PRICE ANALYSIS FOR NORTH AMERICA GEOSYNTHETICS PRODUCTS (USD/SQUARE METER)

FIGURE 17 ESTIMATED PRODUCTION CONSUMPTION ANALYSIS

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA GEOSYNTHETICS MARKET

FIGURE 19 NORTH AMERICA GEOSYNTHETICS MARKET: BY PRODUCT, 2022

FIGURE 20 NORTH AMERICA GEOSYNTHETICS MARKET: SNAPSHOT (2022)

FIGURE 21 NORTH AMERICA GEOSYNTHETICS MARKET: BY COUNTRY (2022)

FIGURE 22 NORTH AMERICA GEOSYNTHETICS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 23 NORTH AMERICA GEOSYNTHETICS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 24 NORTH AMERICA GEOSYNTHETICS MARKET: BY PRODUCT (2023 - 2030)

FIGURE 25 NORTH AMERICA GEOSYNTHETICS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.