Marché du traitement des gaz en Amérique du Nord, par type ( amine tertiaire , amine primaire, amine secondaire, non-amines), type de gaz (gaz acide, gaz de synthèse), traitement ( élimination des gaz acides , déshydratation, autres), technologie (OASE (BASF SE), Flexsorb (Exxon Mobil Corporation), ADIP (Royal Dutch Shell Plc), UOP (Honeywell International Inc.), SPREX (Axens), autres), industrie (centrales électriques, raffineries, métaux et mines, pétrole et gaz, pâtes et papiers, aliments et boissons, autres), pays (États-Unis, Canada, Mexique), tendances de l'industrie et prévisions jusqu'en 2028.

Analyse et perspectives du marché : marché du traitement des gaz en Amérique du Nord

Analyse et perspectives du marché : marché du traitement des gaz en Amérique du Nord

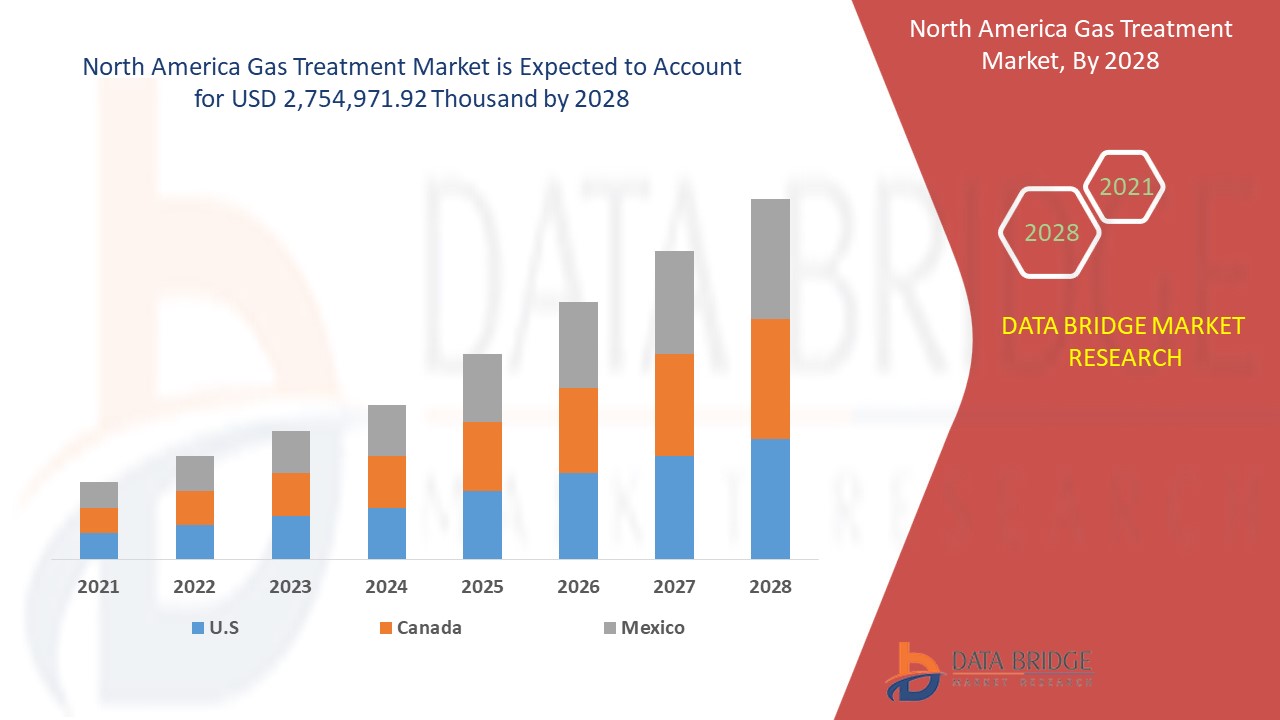

Le marché nord-américain du traitement du gaz devrait connaître une croissance significative au cours de la période de prévision de 2021 à 2028. Data Bridge Market Research analyse que le marché croît à un TCAC de 5,8 % au cours de la période de prévision de 2021 à 2028 et devrait atteindre 2 754 971,92 milliers USD d'ici 2028.

Le traitement des gaz est le processus d'amélioration de la qualité des gaz par lequel les composants indésirables des gaz sont éliminés. Les besoins en traitement des gaz augmentent en raison de l'augmentation de la consommation de gaz naturel comme source d'énergie dans diverses applications/industries. Il élimine le sulfure d'hydrogène et le dioxyde de carbone, ce qui le rend sûr à utiliser comme source d'énergie propre et conforme aux réglementations environnementales.

La demande croissante de gaz naturel en raison de sa faible empreinte environnementale stimule la croissance du marché. L'utilisation croissante de filtres industriels et de précipitateurs électrostatiques agit comme un moteur potentiel du marché. En outre, les réglementations de plus en plus strictes en matière de contrôle de la pollution de l'air augmentent les ventes et les bénéfices des acteurs opérant sur le marché.

Le principal obstacle qui pèse sur le marché est le coût élevé des matières premières spécialisées pour l'extraction du gaz. En outre, diverses complications associées au processus d'extraction du gaz freineront également la croissance du marché. Les opportunités pour le marché sont l'avancement de la technologie de traitement dans l'industrie pétrolière et gazière. L'un des principaux moteurs associés au marché du traitement du gaz est l'utilisation croissante des gaz naturels comme source plus propre pour la production d'électricité. Cependant, les réglementations gouvernementales strictes concernant le traitement du gaz peuvent remettre en cause la croissance du marché

Ce rapport sur le marché du traitement des gaz fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché du traitement des gaz en Amérique du Nord

Portée et taille du marché du traitement des gaz en Amérique du Nord

Le marché nord-américain du traitement des gaz est segmenté en fonction du type, du type de gaz, du traitement, de la technologie et de l'industrie. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

- Sur la base du type, le marché nord-américain du traitement du gaz est segmenté en amine primaire, amine secondaire, amine tertiaire et non-amines. En 2021, l'amine tertiaire devrait dominer en raison de la demande croissante de gaz naturel pour la production d' électricité , ce qui contribue à stimuler sa demande au cours de l'année de prévision.

- En fonction du type de gaz, le marché nord-américain du traitement des gaz est segmenté en gaz acide et gaz de synthèse. En 2021, le segment des gaz acides devrait dominer en raison de la montée en puissance des réglementations strictes contre la pollution de l'air dans la région, ce qui stimulera sa demande au cours de l'année de prévision.

- En fonction du traitement, le marché nord-américain du traitement du gaz est segmenté en déshydratation, élimination des gaz acides et autres. En 2021, l'élimination des gaz acides devrait dominer car elle élimine le H2S, le CO2 et les soufres organiques (tels que le mercaptan et le COS) dans le gaz d'alimentation brut afin de le rendre conforme au gaz naturel, ce qui augmente sa demande au cours de l'année de prévision.

- Sur la base de la technologie, le marché nord-américain du traitement du gaz est segmenté en SPREX (Axens), ADIP (Royal Dutch Shell plc), UOP (Honeywell International inc.), OASE (BASF SE), Flexsorb (Exxon Mobil Corporation) et autres. En 2021, OASE (BASF SE) devrait dominer car il élimine le dioxyde de carbone et le sulfure d'hydrogène dans les applications au gaz naturel, ce qui stimule sa demande au cours de l'année de prévision.

- Sur la base de l'industrie, le marché du traitement du gaz en Amérique du Nord est segmenté en raffineries, centrales électriques, pâtes et papiers, métaux et mines, aliments et boissons, pétrole et gaz, etc. En 2021, les centrales électriques devraient dominer le marché en raison de la demande croissante d'électricité dans la région, ce qui stimulera sa demande au cours de l'année de prévision.

Analyse du marché du traitement des gaz en Amérique du Nord au niveau des pays

Le marché du traitement du gaz en Amérique du Nord est analysé et des informations sur la taille du marché sont fournies par pays, type, type de gaz, traitement, technologie et industrie.

Les pays couverts par le rapport sur le marché du traitement des gaz en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Le marché nord-américain du traitement du gaz devrait être dominé par les États-Unis en raison de l'augmentation de l'utilisation du gaz naturel pour la production d'électricité et de la prise de conscience croissante du gaz naturel comme source plus propre pour la production d'électricité, ce qui a accru l'inclination vers les usines de traitement du gaz.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Croissance de l'industrie du traitement des gaz

Le marché du traitement des gaz en Amérique du Nord vous fournit également une analyse détaillée du marché pour chaque pays, la croissance de la base installée de différents types de produits pour le marché du traitement des gaz, l'impact de la technologie utilisant des courbes de survie et les changements dans les scénarios réglementaires des préparations pour nourrissons, ainsi que leur impact sur le marché du traitement des gaz. Les données sont disponibles pour la période historique de 2011 à 2019.

Analyse du paysage concurrentiel et des parts de marché du traitement du gaz

Le paysage concurrentiel du marché du traitement du gaz en Amérique du Nord fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production , les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais cliniques , l'analyse de la marque, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise vers le marché du traitement du gaz en Amérique du Nord.

Parmi les principaux acteurs couverts par le rapport, on trouve BASF SE, Dow, Exxon Mobil Corporation, Royal Dutch Shell plc, Honeywell International Inc., INEOS, Eastman Chemical Company, Clariant, Ecolab, Huntsman International LLC, Cabot Corporation, Lhoist, Axens, BERRYMAN CHEMICAL, Eunisell Chemicals, entre autres. Les analystes de DBMR comprennent les atouts de la concurrence et fournissent une analyse concurrentielle pour chaque concurrent séparément.

Par exemple,

- En octobre 2021, Exxon Mobil Corporation a lancé le processus de contractualisation des contrats d'ingénierie, d'approvisionnement et de construction dans le cadre de ses projets d'expansion du captage et du stockage du carbone (CSC) dans son usine de LaBarge, dans le Wyoming. Grâce à ce développement, l'entreprise est en mesure de réduire ses émissions en captant jusqu'à 1 million de tonnes métriques de CO2 supplémentaires chaque année

- En mai 2019, Royal Dutch Shell plc, par l'intermédiaire de sa filiale Shell Offshore Inc (Shell), a annoncé que la production avait démarré sur le système de production flottant Appomattox exploité par Shell plusieurs mois plus tôt que prévu, ouvrant ainsi une nouvelle frontière dans les eaux profondes du golfe du Mexique aux États-Unis. Grâce à ce développement, l'entreprise est en mesure d'augmenter sa capacité de production

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA GAS TREATMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE OF GAS LIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET INDUSTRY COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 NORTH AMERICA:

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR NATURAL GAS OWING TO ITS LOW ENVIRONMENTAL FOOTPRINT

5.1.2 GROWING USAGE OF INDUSTRIAL FILTERS AND ELECTROSTATIC PRECIPITATORS

5.1.3 RISING STRINGENT AIR POLLUTION CONTROL REGULATIONS

5.1.4 GROWING USAGES OF NATURAL GASSES AS A CLEANER SOURCE FOR ELECTRICITY GENERATION

5.2 RESTRAINTS

5.2.1 HIGH COST OF SPECIALIZED RAW MATERIALS FOR GAS EXTRACTION SUCH AS RAPID EVAPORATION SPEED MATERIAL AND FILTRATION PIPES

5.2.2 VARIOUS COMPLICATION ASSOCIATED WITH GAS EXTRACTION PROCESS

5.2.3 HUGE INSTALLATION AND INITIAL COST FOR GAS TREATMENT

5.3 OPPORTUNITIES

5.3.1 INCREASING GOVERNMENT INITIATIVES FOR GAS TREATMENT

5.3.2 DISCOVERY OF NEW GAS RESERVES ACROSS THE WORLD

5.3.3 ADVANCEMENT IN TREATMENT TECHNOLOGY IN OIL & GAS INDUSTRY

5.4 CHALLENGES

5.4.1 STRINGENT GOVERNMENT REGULATIONS REGARDING GAS TREATMENT

5.4.2 INCREASING HEALTH ISSUE AMONG THE WORKERS OF GAS INDUSTRY

6 ANALYSIS ON IMPACT OF COVID-19 ON THE GAS TREATMENT MARKET

6.1 AFTERMATH OF COVID-19 GOVERNMENT INITIATIVES TO BOOST GAS TREATMENT MARKET

6.2 STRATEGIC DECISIONS OF MANUFACTURERS AFTER COVID-19 TO GET COMPETITIVE MARKET SHARE

6.3 IMPACT ON PRICE

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 NORTH AMERICA GAS TREATMENT MARKET, BY TYPE

7.1 OVERVIEW

7.2 TERTIARY AMINE

7.2.1 TRIETHANOLAMINE

7.2.2 METHYLDIETHANOLAMINE

7.3 PRIMARY AMINE

7.3.1 MONOETHANOLAMINE

7.3.2 DIGLYCOLAMINE

7.4 SECONDARY AMINE

7.4.1 DIETHANOLAMINE

7.4.2 DIISOPROPANOLAMINE

7.5 NON-AMINES

7.5.1 GLYCOLS

7.5.2 TRIAZINE

7.5.3 OTHERS

8 NORTH AMERICA GAS TREATMENT MARKET, BY TYPE OF GAS

8.1 OVERVIEW

8.2 ACID GAS

8.3 SYNTHESIS GAS

9 NORTH AMERICA GAS TREATMENT MARKET, BY TREATMENT

9.1 OVERVIEW

9.2 ACID GAS REMOVAL

9.3 DEHYDRATION

9.4 OTHERS

10 NORTH AMERICA GAS TREATMENT MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 OASE (BASF SE)

10.3 FLEXSORB (EXXON MOBIL CORPORATION)

10.4 ADIP (ROYAL DUTCH SHELL PLC)

10.5 UOP (HONEYWELL INTERNATIONAL INC.)

10.6 SPREX (AXENS)

10.7 OTHERS

11 NORTH AMERICA GAS TREATMENT MARKET, BY INDUSTRY

11.1 OVERVIEW

11.2 POWER PLANTS

11.3 REFINERIES

11.4 METAL & MINING

11.5 OIL & GAS

11.6 PULP & PAPER

11.7 FOOD & BEVERAGES

11.8 OTHERS

12 NORTH AMERICA GAS TREATMENT MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA GAS TREATMENT MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.2 PARTNERSHIPS & ACQUISITIONS

13.3 EXPANSIONS

13.4 NEW PRODUCT DEVELOPMENTS

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 BASF SE

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT UPDATES

15.2 DOW

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT UPDATES

15.3 EXXON MOBIL CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT UPDATE

15.4 ROYAL DUTCH SHELL PLC

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT UPDATE

15.5 HONEYWELL INTERNATIONAL INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT UPDATES

15.6 INEOS

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT UPDATE

15.7 EASTMAN CHEMICAL COMPANY

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATES

15.8 CLARIANT

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT UPDATES

15.9 ECOLAB

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT UPDATES

15.1 AXENS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT UPDATE

15.11 BERRYMAN CHEMICAL

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT UPDATE

15.12 CABOT CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT UPDATE

15.13 EUNISELL CHEMICALS

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT UPDATES

15.14 HUNTSMAN INTERNATIONAL LLC

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT UPDATES

15.15 LHOIST

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT UPDATES

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF MACHINERY AND APPARATUS FOR FILTERING OR PURIFYING GASES; HS CODE: 842139 (USD THOUSAND)

TABLE 2 EXPORT DATA OF MACHINERY AND APPARATUS FOR FILTERING OR PURIFYING GASES; HS CODE: 842139 (USD THOUSAND)

TABLE 3 AIR POLLUTION CONTROL REGULATIONS IN EUROPE & U.S.

TABLE 4 NORTH AMERICA GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 5 NORTH AMERICA GAS TREATMENT MARKET, BY TYPE, 2019-2028 (TONS)

TABLE 6 NORTH AMERICA TERTIARY AMINE IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 7 NORTH AMERICA TERTIARY AMINE IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (TONS)

TABLE 8 NORTH AMERICA TERTIARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 9 NORTH AMERICA PRIMARY AMINE IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 10 NORTH AMERICA PRIMARY AMINE TYPE IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (TONS )

TABLE 11 NORTH AMERICA PRIMARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 12 NORTH AMERICA SECONDARY AMINE IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 13 NORTH AMERICA SECONDARY AMINE IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (TONS)

TABLE 14 NORTH AMERICA SECONDARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 15 NORTH AMERICA NON-AMINES IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 16 NORTH AMERICA NON-AMINE IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (TONS )

TABLE 17 NORTH AMERICA NON-AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 18 NORTH AMERICA GAS TREATMENT MARKET, BY TYPE OF GAS, 2019-2028 (USD THOUSAND)

TABLE 19 NORTH AMERICA ACID GAS IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 20 NORTH AMERICA SYNTHESIS GAS IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 21 NORTH AMERICA GAS TREATMENT MARKET, BY TREATMENT, 2019-2028 (USD THOUSAND)

TABLE 22 NORTH AMERICA ACID GAS REMOVAL IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 23 NORTH AMERICA DEHYDRATION IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 24 NORTH AMERICA OTHERS IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 25 NORTH AMERICA GAS TREATMENT MARKET, BY TECHNOLOGY, 2019-2028 (USD THOUSAND)

TABLE 26 NORTH AMERICA OASE (BASF SE) IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 27 NORTH AMERICA FLEXSORB (EXXON MOBIL CORPORATION) IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 28 NORTH AMERICA ADIP (ROYAL DUTCH SHELL PLC) IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 29 NORTH AMERICA UOP (HONEYWELL INTERNATIONAL INC.) IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 30 NORTH AMERICA SPREX (AXENS) IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 31 NORTH AMERICA OTHERS IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 32 NORTH AMERICA GAS TREATMENT MARKET, BY INDUSTRY, 2019-2028 (USD THOUSAND)

TABLE 33 NORTH AMERICA POWER PLANTS IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 34 NORTH AMERICA REFINERIES IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 35 NORTH AMERICA METAL & MINING IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 36 NORTH AMERICA OIL & GAS IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 37 NORTH AMERICA PULP & PAPER IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 38 NORTH AMERICA FOOD & BEVERAGES IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 39 NORTH AMERICA OTHERS IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 40 NORTH AMERICA GAS TREATMENT MARKET, BY COUNTRY,2019-2028 (USD THOUSAND)

TABLE 41 NORTH AMERICA GAS TREATMENT MARKET, BY COUNTRY,2019-2028 (TONS)

TABLE 42 NORTH AMERICA GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 43 NORTH AMERICA GAS TREATMENT MARKET, BY TYPE, 2019-2028 (TONS)

TABLE 44 NORTH AMERICA PRIMARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 45 NORTH AMERICA SECONDARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 46 NORTH AMERICA TERTIARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 47 NORTH AMERICA NON-AMINES AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 48 NORTH AMERICA GAS TREATMENT MARKET, BY TYPE OF GAS, 2019-2028 (USD THOUSAND)

TABLE 49 NORTH AMERICA GAS TREATMENT MARKET, BY TREATMENT, 2019-2028 (USD THOUSAND)

TABLE 50 NORTH AMERICA GAS TREATMENT MARKET, BY TECHNOLOGY, 2019-2028 (USD THOUSAND)

TABLE 51 NORTH AMERICA GAS TREATMENT MARKET, BY INDUSTRY, 2019-2028 (USD THOUSAND)

TABLE 52 U.S. GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 53 U.S. GAS TREATMENT MARKET, BY TYPE, 2019-2028 (TONS)

TABLE 54 U.S. PRIMARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 55 U.S. SECONDARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 56 U.S. TERTIARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 57 U.S. NON-AMINES AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 58 U.S. GAS TREATMENT MARKET, BY TYPE OF GAS, 2019-2028 (USD THOUSAND)

TABLE 59 U.S. GAS TREATMENT MARKET, BY TREATMENT, 2019-2028 (USD THOUSAND)

TABLE 60 U.S. GAS TREATMENT MARKET, BY TECHNOLOGY, 2019-2028 (USD THOUSAND)

TABLE 61 U.S. GAS TREATMENT MARKET, BY INDUSTRY, 2019-2028 (USD THOUSAND)

TABLE 62 CANADA GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 63 CANADA GAS TREATMENT MARKET, BY TYPE, 2019-2028 (TONS)

TABLE 64 CANADA PRIMARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 65 CANADA SECONDARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 66 CANADA TERTIARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 67 CANADA NON-AMINES AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 68 CANADA GAS TREATMENT MARKET, BY TYPE OF GAS, 2019-2028 (USD THOUSAND)

TABLE 69 CANADA GAS TREATMENT MARKET, BY TREATMENT, 2019-2028 (USD THOUSAND)

TABLE 70 CANADA GAS TREATMENT MARKET, BY TECHNOLOGY, 2019-2028 (USD THOUSAND)

TABLE 71 CANADA GAS TREATMENT MARKET, BY INDUSTRY, 2019-2028 (USD THOUSAND)

TABLE 72 MEXICO GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 73 MEXICO GAS TREATMENT MARKET, BY TYPE, 2019-2028 (TONS)

TABLE 74 MEXICO PRIMARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 75 MEXICO SECONDARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 76 MEXICO TERTIARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 77 MEXICO NON-AMINES AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 78 MEXICO GAS TREATMENT MARKET, BY TYPE OF GAS, 2019-2028 (USD THOUSAND)

TABLE 79 MEXICO GAS TREATMENT MARKET, BY TREATMENT, 2019-2028 (USD THOUSAND)

TABLE 80 MEXICO GAS TREATMENT MARKET, BY TECHNOLOGY, 2019-2028 (USD THOUSAND)

TABLE 81 MEXICO GAS TREATMENT MARKET, BY INDUSTRY, 2019-2028 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA GAS TREATMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA GAS TREATMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA GAS TREATMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA GAS TREATMENT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA GAS TREATMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA GAS TREATMENT MARKET: THE TYPE OF GAS LIFE LINE CURVE

FIGURE 7 NORTH AMERICA GAS TREATMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA GAS TREATMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA GAS TREATMENT MARKET: MARKET INDUSTRY COVERAGE GRID

FIGURE 10 NORTH AMERICA GAS TREATMENT MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA GAS TREATMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 NORTH AMERICA GAS TREATMENT MARKET: SEGMENTATION

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE NORTH AMERICA GAS TREATMENT MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 14 INCREASING DEMAND FOR NATURAL GAS OWING TO ITS LOW ENVIRONMENTAL FOOTPRINT IS DRIVING THE NORTH AMERICA GAS TREATMENT MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 15 TERTIARY AMINE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA GAS TREATMENT MARKET IN 2021 & 2028

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA GAS TREATMENT MARKET

FIGURE 17 NORTH AMERICA NATURAL GAS CONSUMPTION, TERA JOULE, (1990-2019)

FIGURE 18 NATURAL GAS CONSUMPTION IN U.S., 2019

FIGURE 19 PERCENTAGE BREAKDOWN OF COST SHARES FOR ONSHORE OIL AND NATURAL GAS DRILLING AND COMPLETION

FIGURE 20 NATURAL GAS RESERVES BY COUNTRY (MMCF) IN 2017

FIGURE 21 NORTH AMERICA GAS TREATMENT MARKET: BY TYPE, 2020

FIGURE 22 NORTH AMERICA GAS TREATMENT MARKET: BY TYPE OF GAS, 2020

FIGURE 23 NORTH AMERICA GAS TREATMENT MARKET: BY TREATMENT, 2020

FIGURE 24 NORTH AMERICA GAS TREATMENT MARKET: BY TECHNOLOGY, 2020

FIGURE 25 NORTH AMERICA GAS TREATMENT MARKET: BY INDUSTRY, 2020

FIGURE 26 NORTH AMERICA GAS TREATMENT MARKET: SNAPSHOT (2020)

FIGURE 27 NORTH AMERICA GAS TREATMENT MARKET: BY COUNTRY (2020)

FIGURE 28 NORTH AMERICA GAS TREATMENT MARKET: BY COUNTRY (2021 & 2028)

FIGURE 29 NORTH AMERICA GAS TREATMENT MARKET: BY COUNTRY (2020 & 2028)

FIGURE 30 NORTH AMERICA GAS TREATMENT MARKET: BY TYPE (2021-2028)

FIGURE 31 NORTH AMERICA GAS TREATMENT MARKET: COMPANY SHARE 2020 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.