North America Foundry Chemicals Market

Taille du marché en milliards USD

TCAC :

%

USD

2.68 Billion

USD

3.78 Billion

2025

2033

USD

2.68 Billion

USD

3.78 Billion

2025

2033

| 2026 –2033 | |

| USD 2.68 Billion | |

| USD 3.78 Billion | |

|

|

|

|

Segmentation du marché nord-américain des produits chimiques pour fonderie, par type (benzène, formaldéhyde, naphtalène, phénol, xylène et autres), type de produit (liants, additifs, revêtements, flux et autres), type de fonderie (ferreux et non ferreux), type d'outillage de fonderie (tuyau, truelles, étaux, tamis manuels, fils de ventilation, pilon, écouvillons, broches et coupe-canules et autres), type de procédé de fonderie (galvanisation thermique et nickelage chimique), type de système de fonderie (systèmes de moulage au sable et systèmes de moulage au sable à liant chimique), application (fonte, acier, aluminium et autres), canal de distribution (commerce électronique, magasins spécialisés, distributeurs B2B/tiers et autres) - Tendances du secteur et prévisions jusqu'en 2033

Taille du marché des produits chimiques de fonderie en Amérique du Nord

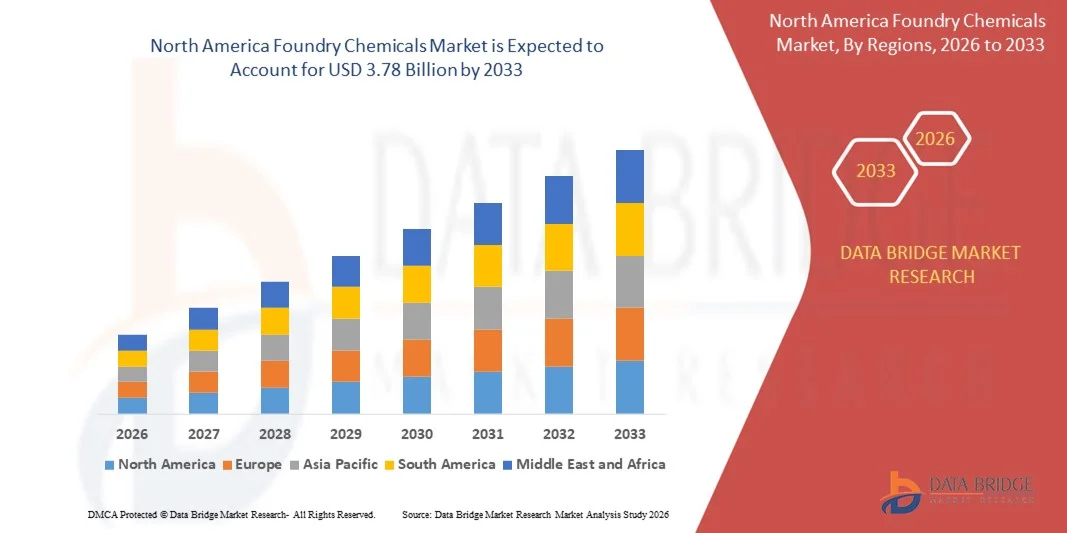

- Le marché nord-américain des produits chimiques pour fonderie était évalué à 2,68 milliards de dollars américains en 2025 et devrait atteindre 3,78 milliards de dollars américains d'ici 2033 , avec un TCAC de 4,4 % au cours de la période de prévision.

- La croissance du marché est largement tirée par la demande croissante de composants en métal coulé dans les secteurs de l'automobile, de la construction, des machines industrielles et des infrastructures, ce qui augmente directement la consommation de liants, d'additifs, de revêtements et de flux utilisés dans les opérations de fonderie.

- De plus, la modernisation continue des fonderies, l'automatisation croissante et l'importance accrue accordée à l'amélioration de la qualité des pièces moulées, de la productivité et à la réduction des défauts accélèrent l'adoption de solutions chimiques de fonderie avancées et performantes, soutenant ainsi une expansion durable du marché.

Analyse du marché des produits chimiques de fonderie en Amérique du Nord

- Les produits chimiques de fonderie, qui jouent un rôle crucial dans la préparation des moules et des noyaux, le traitement des métaux et la finition de surface, sont essentiels pour garantir la précision dimensionnelle, l'intégrité structurelle et la qualité constante des pièces moulées ferreuses et non ferreuses dans diverses applications industrielles.

- La demande croissante de métaux légers, les réglementations strictes en matière de qualité et d'environnement, ainsi qu'une attention accrue portée aux pratiques de fabrication durables et à faibles émissions sont des facteurs clés qui favorisent l'adoption constante de formulations chimiques de fonderie innovantes et respectueuses de l'environnement.

- Les États-Unis ont dominé le marché des produits chimiques pour fonderie en 2025, grâce à une forte demande des secteurs de l'automobile, de l'aérospatiale, des machines lourdes et de la fabrication industrielle, ainsi qu'à la présence d'une base de fonderie ferreuse et non ferreuse bien établie.

- Le Canada devrait connaître la croissance la plus rapide sur le marché des produits chimiques de fonderie au cours de la période de prévision, en raison de l'augmentation des investissements dans la fabrication automobile, le développement des infrastructures et la production d'équipements industriels.

- Le segment des métaux ferreux a dominé le marché avec une part de 62,8 % en 2025, grâce à la production à grande échelle de composants en fonte et en acier pour les secteurs de l'automobile, de la construction et des machines industrielles. La forte demande en composants durables et résistants aux charges lourdes assure une consommation continue de produits chimiques de fonderie pour les applications liées aux métaux ferreux. Une infrastructure de production établie et des volumes de production constants renforcent encore la position dominante de ce segment.

Portée du rapport et segmentation du marché des produits chimiques de fonderie

|

Attributs |

Principaux enseignements du marché des produits chimiques de fonderie |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Tendances du marché des produits chimiques de fonderie en Amérique du Nord

Adoption croissante de formulations chimiques écologiques pour la fonderie

- L'une des principales tendances du marché des produits chimiques pour fonderie est l'adoption croissante de formulations chimiques écologiques et à faibles émissions, sous l'impulsion d'une prise de conscience environnementale accrue et du renforcement des normes réglementaires dans les opérations de fonderie à l'échelle mondiale. Les fonderies se tournent progressivement vers des liants, des additifs et des revêtements durables afin de réduire les émissions de COV et d'améliorer la sécurité au travail, tout en préservant la qualité des pièces moulées.

- Par exemple, des entreprises comme ASK Chemicals et Hüttenes-Albertus fournissent des systèmes de liants inorganiques à faibles émissions qui favorisent des procédés de production plus propres et la conformité réglementaire. Ces solutions aident les fonderies à minimiser leur impact environnemental tout en garantissant une résistance et une précision dimensionnelle constantes des moules.

- Les constructeurs automobiles et industriels incitent les fonderies à adopter des solutions chimiques plus écologiques afin de s'aligner sur les objectifs de développement durable plus larges de l'ensemble des chaînes d'approvisionnement. Cette tendance renforce la demande en produits chimiques de fonderie respectueux de l'environnement, permettant une production de pièces moulées de haute précision et en grande série.

- Cette tendance est confortée par l'augmentation des investissements dans les technologies de fonderie modernes, qui permettent une utilisation efficace des produits chimiques et une réduction des déchets de matériaux. Les formulations avancées contribuent à améliorer la productivité tout en diminuant les taux de retouche et de rebut.

- Les fonderies produisant des pièces moulées en métaux non ferreux et légers adoptent de plus en plus des produits chimiques écologiques afin de respecter les normes d'émissions et les exigences de performance. Cette évolution renforce le rôle des formulations durables dans les environnements de fonderie modernes.

- L'importance croissante accordée au respect des normes environnementales, à l'efficacité opérationnelle et à l'optimisation des coûts à long terme positionne les produits chimiques de fonderie écologiques comme une tendance centrale qui façonne l'évolution du marché.

Dynamique du marché des produits chimiques de fonderie en Amérique du Nord

Conducteur

Demande croissante de composants moulés dans les secteurs automobile et industriel

- La demande croissante de pièces moulées dans les secteurs de l'automobile, de la construction et des machines industrielles est un moteur essentiel du marché des produits chimiques pour fonderie. L'augmentation de la production de moteurs, de systèmes de transmission, de pièces structurelles et d'équipements industriels stimule directement la consommation de liants, de revêtements et d'additifs.

- Par exemple, les constructeurs automobiles utilisent de plus en plus des composants en fonte, en acier et en aluminium de haute qualité, ce qui incite les fonderies à adopter des systèmes chimiques avancés garantissant résistance, précision et état de surface. Cette demande favorise l'utilisation systématique de produits chimiques de fonderie performants.

- L'expansion industrielle et les projets de développement des infrastructures accroissent la demande en pièces moulées durables et de grande taille. Les produits chimiques de fonderie jouent un rôle essentiel pour soutenir une production à grande échelle tout en maintenant des normes de qualité élevées.

- La croissance des véhicules électriques et l'utilisation accrue de matériaux légers intensifient la demande de formulations chimiques spécialisées adaptées aux pièces moulées en aluminium et en métaux non ferreux. Ceci favorise l'innovation continue et l'adoption de ces formulations sur le marché.

- Alors que les fabricants s'efforcent de réduire les défauts et d'améliorer la productivité, les fonderies investissent davantage dans des solutions chimiques haute performance. Cette demande industrielle soutenue continue de stimuler la croissance du marché.

Retenue/Défi

Réglementations environnementales strictes et coûts de mise en conformité

- Le marché des produits chimiques pour fonderie est confronté à des défis liés à des réglementations environnementales strictes en matière d'émissions, d'élimination des déchets et de manipulation des produits chimiques. Le respect de ces réglementations exige des investissements importants dans des technologies plus propres et des formulations chimiques conformes.

- Par exemple, les réglementations relatives aux émissions de COV et aux substances dangereuses contraignent les fonderies à remplacer les produits chimiques conventionnels par des alternatives plus performantes, souvent à un coût plus élevé. Cela augmente les dépenses d'exploitation, notamment pour les petites et moyennes fonderies.

- La transition vers des produits chimiques respectueux de l'environnement peut également nécessiter des modifications des procédés et la formation des employés, ce qui complexifie la mise en œuvre. Ces facteurs peuvent ralentir l'adoption dans les régions où les coûts sont un facteur déterminant.

- La hausse des prix des matières premières et la nécessité d'une surveillance continue augmentent encore les coûts de mise en conformité pour les fabricants de produits chimiques et les utilisateurs finaux. Cela exerce une pression sur les prix tout au long de la chaîne d'approvisionnement.

- Concilier conformité réglementaire et maîtrise des coûts demeure un défi constant pour les acteurs du marché. Ces contraintes continuent d'influencer les décisions d'achat et d'impacter le rythme global d'expansion du marché.

Portée du marché des produits chimiques de fonderie en Amérique du Nord

Le marché est segmenté en fonction du type, du type de produit, du type de fonderie, du type d'outil de fonderie, du type de procédé de fonderie, du type de système de fonderie, de l'application et du canal de distribution.

- Par type

Le marché des produits chimiques pour fonderie est segmenté, selon leur type, en benzène, formaldéhyde, naphtalène, phénol, xylène et autres. Le segment du phénol a dominé le marché en 2025, grâce à son utilisation intensive dans les résines phénoliques pour la fabrication de moules et de noyaux dans les fonderies de métaux ferreux et non ferreux. Les produits chimiques à base de phénol offrent une stabilité thermique élevée, une forte adhérence et une qualité de surface constante des pièces moulées, ce qui en fait un choix privilégié pour les applications industrielles à grande échelle. Leur compatibilité avec les procédés de fonderie automatisés et leur capacité à résister à des températures de coulée élevées favorisent leur adoption dans les secteurs de l'automobile et de la mécanique lourde.

Le segment du formaldéhyde devrait connaître la croissance la plus rapide entre 2026 et 2033, porté par une demande croissante de systèmes de liants économiques et à durcissement plus efficace. Les formulations à base de formaldéhyde permettent des temps de prise de moule plus courts et une productivité accrue, notamment dans les environnements de fonderie à grand volume. L'augmentation des investissements dans les infrastructures et la fabrication de machines accélère également l'adoption des dérivés du formaldéhyde dans les fonderies modernes.

- Par type de produit

Le marché est segmenté, selon le type de produit, en liants, additifs, revêtements, flux et autres. Le segment des liants a dominé le marché en 2025, ces derniers jouant un rôle crucial dans la résistance des moules, la précision dimensionnelle et la réduction des défauts lors de la fonderie. La forte consommation de liants organiques et inorganiques dans les procédés de fonderie en sable, notamment pour les composants automobiles et industriels, continue de stimuler la croissance du chiffre d'affaires. Leur capacité à améliorer la mallapsibilité et l'état de surface explique leur utilisation généralisée dans tous les types de fonderies.

Le segment des revêtements devrait connaître la croissance la plus rapide au cours de la période de prévision, porté par l'intérêt croissant porté à l'amélioration de la qualité de surface des pièces moulées et à la réduction des défauts de pénétration du métal. Les revêtements réfractaires avancés contribuent à renforcer l'isolation thermique et à prolonger la durée de vie des moules, ce qui favorise les gains d'efficacité. L'adoption croissante de la fonderie de précision et des alliages haute performance stimule davantage la demande en revêtements de fonderie spécialisés.

- Par type de fonderie

Selon le type de fonderie, le marché est segmenté en fonderie de métaux ferreux et non ferreux. Le segment de la fonderie de métaux ferreux détenait la part dominante de 62,8 % en 2025, grâce à une production à grande échelle de composants en fonte et en acier pour les secteurs de l'automobile, de la construction et des machines industrielles. La forte demande en composants durables et résistants aux charges lourdes alimente une consommation continue de produits chimiques de fonderie pour les applications liées aux métaux ferreux. Des infrastructures de production établies et une production en volume constante renforcent encore la position dominante de ce segment.

Le segment des métaux non ferreux devrait enregistrer la croissance la plus rapide entre 2026 et 2033, sous l'effet de l'utilisation croissante de l'aluminium et d'autres métaux légers dans les industries automobile et aérospatiale. L'accent mis sur l'efficacité énergétique et la réduction des émissions favorise une augmentation de la production de pièces moulées en métaux non ferreux. Cette tendance stimule directement la demande de produits chimiques spécialisés adaptés aux besoins des fonderies de métaux non ferreux.

- Par type d'outil de fonderie

Selon le type d'outillage de fonderie, le marché comprend des pelles, des truelles, des éjecteurs, des tamis manuels, des fils de ventilation, des pilonneuses, des écouvillons, des broches et des coupe-canons, et d'autres outils. Le segment des pilonneuses a dominé le marché en 2025, car ces outils sont essentiels pour obtenir un compactage uniforme du sable et une intégrité optimale du moule, tant dans les fonderies manuelles que semi-automatisées. Leur utilisation régulière dans les petites et grandes fonderies assure une demande constante en systèmes chimiques compatibles. Leur rôle dans la réduction des défauts de coulée favorise leur adoption continue.

Le segment des fils de ventilation devrait connaître la croissance la plus rapide au cours de la période de prévision, porté par une attention accrue portée à l'évacuation des gaz et à la prévention des défauts dans les conceptions de moules complexes. Les techniques de ventilation avancées améliorent la qualité des pièces moulées et réduisent les taux de rebut, favorisant ainsi une utilisation plus large. La croissance des pièces moulées de précision et de haute valeur accentue encore cette tendance.

- Par type de procédé de fonderie

Selon le type de procédé de fonderie, le marché est segmenté en galvanisation thermique et nickelage chimique. Le segment de la galvanisation thermique dominait le marché en 2025, grâce à son utilisation répandue pour la protection anticorrosion des pièces moulées de structures et d'industries. Ce procédé exige des formulations chimiques constantes afin de garantir l'uniformité et la durabilité du revêtement. La forte demande des projets de construction et d'infrastructures conforte la position dominante de ce segment.

Le segment du nickelage chimique devrait connaître la croissance la plus rapide entre 2026 et 2033, porté par la demande croissante de pièces moulées de haute précision, résistantes à l'usure et à la corrosion. Sa capacité à garantir une épaisseur de revêtement uniforme améliore les performances dans les applications automobiles et d'ingénierie. L'adoption croissante de technologies de traitement de surface avancées contribue également à cette croissance.

- Par type de système de fonderie

Selon le type de système de fonderie, le marché se divise en systèmes de fonderie en sable et systèmes de fonderie en sable à liant chimique. Le segment des systèmes de fonderie en sable a dominé le marché en 2025, grâce à son rapport coût-efficacité, sa flexibilité et son aptitude à convenir à une large gamme de pièces et de métaux. La forte consommation de produits chimiques liés au sable dans les opérations de fonderie traditionnelles soutient une demande soutenue. Son adoption généralisée dans les régions manufacturières en développement renforce sa part de marché.

Le segment des systèmes de fonderie en sable à liant chimique devrait connaître la croissance la plus rapide, porté par la demande croissante de précision dimensionnelle et de finition de surface améliorée. Ces systèmes réduisent les retouches et les besoins d'usinage, contribuant ainsi à une meilleure efficacité opérationnelle. L'automatisation croissante des fonderies accélère l'adoption des systèmes à liant chimique.

- Sur demande

En fonction de l'application, le marché est segmenté en fonte, acier, aluminium et autres. Le segment de la fonte a dominé le marché en 2025, grâce à son utilisation intensive dans les composants automobiles, les tuyaux et les pièces de machines. Des volumes de production élevés et des chaînes d'approvisionnement bien établies garantissent une consommation constante de produits chimiques de fonderie. Son rapport coût-efficacité et sa résistance mécanique soutiennent la demande à long terme.

Le segment de l'aluminium devrait connaître la croissance la plus rapide au cours de la période de prévision, portée par l'adoption croissante de matériaux légers dans les secteurs de l'automobile et des transports. La fonderie d'aluminium exige des formulations chimiques spécifiques pour garantir la qualité et la performance. La production croissante de véhicules électriques stimule davantage la demande dans ce segment.

- Par canal de distribution

En fonction du canal de distribution, le marché se segmente en e-commerce, magasins spécialisés, distributeurs B2B/tiers et autres. Le segment des distributeurs B2B/tiers a dominé le marché en 2025, les fonderies s'appuyant sur des réseaux de fournisseurs établis pour leurs achats en gros et leur assistance technique. Des contrats à long terme et une logistique fiable garantissent un approvisionnement constant en produits chimiques essentiels. Ce canal demeure central pour les opérations industrielles à grande échelle.

Le segment du commerce électronique devrait connaître la croissance la plus rapide entre 2026 et 2033, porté par la digitalisation croissante des achats industriels. Les plateformes en ligne offrent une meilleure visibilité des produits, des commandes plus rapides et une transparence accrue des prix. Les petites et moyennes fonderies adoptent de plus en plus ce canal pour un approvisionnement efficace.

Analyse régionale du marché des produits chimiques de fonderie en Amérique du Nord

- Les États-Unis ont dominé le marché des produits chimiques pour fonderie en 2025, détenant la plus grande part de revenus, grâce à une forte demande des secteurs de l'automobile, de l'aérospatiale, des machines lourdes et de la fabrication industrielle, ainsi qu'à la présence d'une base de fonderies ferreuses et non ferreuses bien établie.

- Des normes de qualité rigoureuses, des réglementations en matière de sécurité au travail et des exigences de conformité environnementale encouragent l'adoption de produits chimiques de fonderie haute performance et à faibles émissions aux États-Unis. La forte présence de fabricants de produits chimiques de premier plan, les investissements continus en R&D et l'automatisation croissante des fonderies renforcent encore la position de leader du pays sur le marché régional.

- L'accent croissant mis sur l'optimisation de la productivité, la réduction des défauts et la fonderie de métaux légers, ainsi que sur la modernisation des infrastructures de fonderie vieillissantes, garantissent que les États-Unis conservent leur rôle dominant tout au long de la période prévisionnelle.

Analyse du marché canadien des produits chimiques de fonderie

Le Canada devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide du marché nord-américain des produits chimiques de fonderie entre 2026 et 2033, grâce à la croissance des investissements dans la fabrication automobile, le développement des infrastructures et la production d'équipements industriels. L'adoption croissante des pièces moulées en aluminium et en métaux non ferreux, conjuguée à une demande accrue de systèmes de liants avancés et de produits chimiques respectueux de l'environnement, accélère la croissance du marché. La collaboration entre les fonderies canadiennes et les fournisseurs de produits chimiques internationaux, ainsi que l'accent mis sur l'efficacité et les pratiques de fabrication durables, positionnent le Canada comme le marché à la croissance la plus rapide de la région.

Analyse du marché des produits chimiques de fonderie au Mexique

Le Mexique devrait connaître une croissance soutenue entre 2026 et 2033, portée par le développement des secteurs automobile et industriel et par l'augmentation des investissements directs étrangers dans la fonderie. Le soutien gouvernemental au développement industriel, la hausse de la production de pièces moulées destinées à l'exportation et l'adoption progressive de produits chimiques modernes pour la fonderie contribuent à cette expansion constante. Le renforcement de la présence des fournisseurs régionaux et l'amélioration de l'accès aux solutions chimiques de pointe soutiennent cette croissance soutenue tout au long de la période de prévision.

Part de marché des produits chimiques de fonderie en Amérique du Nord

L'industrie des produits chimiques pour fonderie est principalement dominée par des entreprises bien établies, notamment :

- Saint-Gobain Performance Ceramics & Refractories (PCR) (France)

- Carpenter Brothers, Inc. (États-Unis)

- Compax Industrial Systems Pvt. Ltd (Inde)

- CS Additive GmbH (Allemagne)

- CAGroup (une filiale d'AMC Group) (États-Unis)

- Mancuso Chemicals Limited (Canada)

- Ceraflux India Pvt. Ltd. (Inde)

- Forace Polymers (P) Ltd. (Inde)

- DuPont (États-Unis)

- John Winter (Royaume-Uni)

- Georgia-Pacific Chemicals (États-Unis)

- Ultraseal India Pvt. Ltd. (Inde)

- Hüttenes-Albertus (Allemagne)

- Vésuve (Royaume-Uni)

- Ashland Global Holdings Inc. (Allemagne)

- Imerys (France)

- Shandong Crownchem Industries Co., Ltd (Chine)

- Cavenaghi SpA (Italie)

Dernières évolutions du marché des produits chimiques de fonderie en Amérique du Nord

- En juin 2024, Clariant a renforcé sa position sur le marché des produits chimiques pour fonderie grâce à sa participation au salon Metal China 2024 à Shanghai, où elle a présenté des solutions chimiques de fonderie avancées et durables. Cette initiative devrait influencer le marché en améliorant l'efficacité des procédés de fonderie, en optimisant les performances de coulée et en contribuant aux objectifs de développement durable des grands centres de production. L'engagement fort de Clariant en faveur de l'innovation et des formulations de nouvelle génération devrait accélérer l'adoption de ses produits chimiques spécialisés pour fonderie, tant sur le marché national qu'international.

- En janvier 2024, Loramendi a dynamisé le marché indien des produits chimiques pour fonderie en annonçant le lancement prochain d'une solution de pointe conçue pour redéfinir les normes opérationnelles. Ce développement devrait stimuler la demande en produits chimiques de fonderie avancés, compatibles avec les systèmes de fonderie hautement automatisés et de haute précision. Cette innovation soutient la croissance du marché en encourageant la modernisation des opérations de fonderie et en renforçant le recours aux formulations chimiques haute performance en Inde.

- En septembre 2023, Hüttenes-Albertus a lancé une nouvelle technologie de liant inorganique à faibles émissions, visant à réduire les émissions de COV tout en maintenant une qualité de fonderie élevée. Cette innovation devrait avoir un impact positif sur le marché en facilitant la conformité réglementaire, en améliorant la sécurité au travail et en renforçant les pratiques de fonderie axées sur le développement durable. Elle stimule la demande de produits chimiques de fonderie respectueux de l'environnement pour les applications de fonderie automobile et industrielle.

- En janvier 2021, ASK Chemicals, filiale d'Ashland, a lancé un système de liant polyuréthane autodurcissant respectueux de l'environnement, offrant de meilleurs résultats de moulage et une productivité accrue. Ce développement a renforcé la position de l'entreprise sur le marché en répondant à la demande croissante de systèmes de liants durables et performants. Ce lancement a contribué à la croissance des ventes à long terme en renforçant la confiance des clients et en favorisant l'adoption de technologies chimiques avancées.

- En novembre 2020, Vesuvius a renforcé sa présence sur le marché en participant au salon ANKIROS 2020 à Istanbul, où elle a présenté une large gamme de solutions pour la métallurgie et la fonderie. Cette participation a favorisé la croissance du marché en améliorant la visibilité des produits, en élargissant la clientèle et en renforçant les liens avec les fondeurs du monde entier. Elle a également contribué à une croissance soutenue des ventes et a consolidé la position concurrentielle de Vesuvius sur le marché des produits chimiques pour la fonderie.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.