North America Footwear Market

Taille du marché en milliards USD

TCAC :

%

USD

64.27 Billion

USD

98.63 Billion

2024

2032

USD

64.27 Billion

USD

98.63 Billion

2024

2032

| 2025 –2032 | |

| USD 64.27 Billion | |

| USD 98.63 Billion | |

|

|

|

|

Segmentation du marché nord-américain des chaussures, par type (mocassins, chaussures, sandales/tongs, ballerines, bottes, chaussures compensées, chaussures de sport, chaussures de santé et autres), matériau des chaussures (plastique, cuir, caoutchouc, textile et autres), matériau des semelles (plastique, caoutchouc, cuir et autres), canal de distribution (commerce électronique, magasins spécialisés, supermarchés/hypermarchés, supérettes et autres), utilisateur final (femmes, hommes et enfants) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché nord-américain de la chaussure

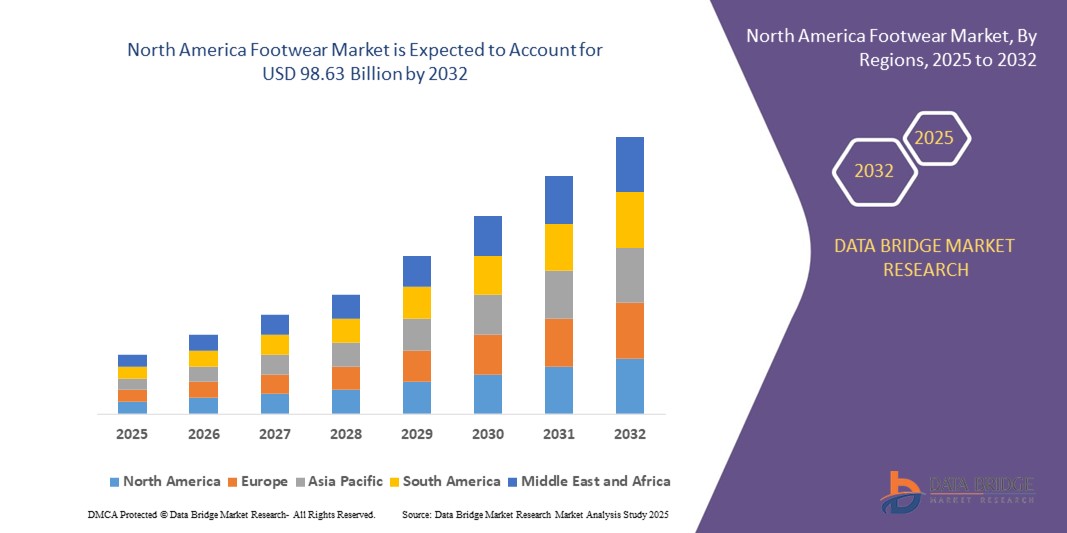

- La taille du marché nord-américain de la chaussure était évaluée à 64,27 milliards USD en 2024 et devrait atteindre 98,63 milliards USD d'ici 2032 , à un TCAC de 5,50 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la demande croissante de chaussures haut de gamme et personnalisées, la sensibilisation croissante à la santé favorisant les ventes de chaussures de sport et l'expansion des canaux de commerce électronique qui offrent commodité et variété aux consommateurs.

- Les avancées technologiques telles que l'impression 3D, les semelles intelligentes et la personnalisation de la conception basée sur l'IA améliorent encore l'innovation des produits et l'engagement des consommateurs dans l'ensemble de l'industrie de la chaussure dans la région.

Analyse du marché nord-américain des chaussures

- Le marché connaît une forte évolution vers des options de chaussures durables et respectueuses de l'environnement, motivée par les préférences des consommateurs pour une mode éthique et le soutien réglementaire à des pratiques de production plus écologiques.

- L'augmentation des revenus disponibles, les populations urbaines soucieuses de la mode et les recommandations de marques par des célébrités continuent d'influencer les habitudes d'achat dans toute la région, en particulier dans des catégories telles que les vêtements de sport, les baskets et les chaussures de luxe.

- Le marché américain de la chaussure a représenté la plus grande part de chiffre d'affaires en Amérique du Nord en 2024, avec 87 %, grâce à la forte consommation, à la rapidité des cycles de la mode et à une prise de conscience croissante des enjeux santé. Le marché bénéficie d'une forte demande sur les segments des chaussures de performance et lifestyle, notamment les chaussures de course, les baskets et les modèles décontractés haut de gamme.

- Le Canada devrait connaître le taux de croissance annuel composé (TCAC) le plus élevé du marché de la chaussure en Amérique du Nord en raison de la hausse du revenu disponible, de la participation croissante aux activités de plein air et de la demande croissante d'options de chaussures axées sur le confort et la durabilité.

- Le segment de l'athlétisme a dominé le marché, affichant la plus grande part de chiffre d'affaires en 2024, grâce à la sensibilisation croissante au fitness, à la pratique d'activités de plein air et à la popularité croissante de l'athleisure. Les consommateurs continuent d'accorder une importance primordiale au confort, à la performance et à l'identité de marque des chaussures de sport, ce qui incite les marques à se développer et à innover sur ce segment.

Portée du rapport et segmentation du marché nord-américain des chaussures

|

Attributs |

Informations clés sur le marché nord-américain des chaussures |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Acteurs clés du marché |

• Nike, Inc. (États-Unis) • Caleres, Inc. (États-Unis) |

|

Opportunités de marché |

• Expansion des produits de chaussures durables et recyclables |

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché de la chaussure en Amérique du Nord

L'essor des chaussures durables et intégrant la technologie

- La tendance croissante des consommateurs à adopter des pratiques d'achat éco-responsables stimule la demande de chaussures durables fabriquées à partir de matériaux recyclés et de composants biodégradables. Les marques innovent avec du cuir végétal, des plastiques issus des océans et des textiles renouvelables pour s'aligner sur les valeurs environnementales croissantes et répondre aux exigences réglementaires.

- Les progrès des technologies portables favorisent le développement de chaussures connectées intégrant des fonctionnalités telles que le suivi d'activité, la régulation thermique et l'analyse de la démarche. Ces innovations sont particulièrement appréciées dans les secteurs du sport et de la santé, offrant des fonctionnalités et une personnalisation améliorées.

- Les consommateurs privilégient de plus en plus les marques qui font preuve de transparence dans leurs approvisionnements et de production éthique. Par conséquent, les entreprises qui investissent dans des chaînes d'approvisionnement traçables et des opérations neutres en carbone gagnent un avantage concurrentiel et la confiance des consommateurs.

- Par exemple, en 2023, une grande marque américaine de vêtements de sport a lancé une chaussure de course entièrement recyclable, fabriquée à partir d'un seul matériau, pouvant être retournée et reconditionnée, réduisant ainsi considérablement les déchets. Autre exemple : une grande marque de sport a lancé des chaussures connectées à laçage automatique, offrant un ajustement personnalisé contrôlé via des applications pour smartphone.

- Alors que les chaussures durables et technologiques transforment le marché, leur adoption généralisée dépend de l'équilibre entre innovation, accessibilité et sensibilisation des consommateurs. Les marques doivent également répondre aux attentes en matière de longévité, de confort et de performance pour réussir dans ce paysage en constante évolution.

Dynamique du marché nord-américain de la chaussure

Conducteur

Sensibilisation croissante à la santé et demande croissante de chaussures de performance

• La prise de conscience croissante des enjeux de santé dans de nombreux groupes démographiques stimule la demande de chaussures performantes, notamment dans les catégories sport et loisirs. Les consommateurs privilégient le confort, le maintien et la fonctionnalité, ce qui stimule les ventes de chaussures de marche, de course et de cross-training.

• La popularité des entraînements à domicile, des applications de fitness et des activités récréatives en plein air a encore élargi la base de consommateurs cibles, encourageant les marques de chaussures à développer des lignes spécifiques à l'activité qui répondent à diverses préférences et besoins en matière de fitness.

L'évolution des modes de travail et de vie contribue également à la décontraction des chaussures, où le confort prime sur l'esthétique formelle. Cela a considérablement stimulé la demande de baskets polyvalentes et de chaussures hybrides, à la fois sportives et décontractées, notamment en milieu urbain.

• Par exemple, en 2022, les grandes marques ont signalé une croissance des ventes à deux chiffres dans leurs catégories de chaussures de sport, attribuant cette hausse à un engagement accru dans des modes de vie axés sur le bien-être et à la résurgence des clubs de marche, des abonnements à des salles de sport et des événements en plein air.

• Alors que la demande de chaussures de performance continue d'augmenter, le succès reposera sur l'innovation continue des produits, la différenciation des marques et l'accessibilité via divers canaux de vente au détail, y compris les plateformes de vente directe aux consommateurs et les applications mobiles.

Retenue/Défi

Coûts de production élevés et perturbations de la chaîne d'approvisionnement

• Le coût des matières premières telles que le cuir, le caoutchouc et les tissus synthétiques ne cesse d'augmenter, entraînant des coûts de production élevés pour les fabricants de chaussures. L'approvisionnement éthique, le respect de l'environnement et les réglementations du travail accentuent encore la pression financière, en particulier pour les marques de taille moyenne et émergentes.

Les perturbations de la chaîne d'approvisionnement mondiale, notamment les retards portuaires, les pénuries de conteneurs et les tensions géopolitiques, ont eu un impact sur les flux de stocks et les délais de livraison. Ces défis sont particulièrement importants en Amérique du Nord, où de nombreuses marques dépendent des importations en provenance d'Asie.

Les petits détaillants et les start-ups de vente directe sont plus vulnérables à ces perturbations, souvent confrontés à des ruptures de stock ou à des hausses de prix qui nuisent à la compétitivité et à la satisfaction client. Les pressions inflationnistes ont également impacté les habitudes de consommation, certains se tournant vers des alternatives plus économiques.

• Par exemple, en 2023, plusieurs marques de chaussures nord-américaines ont publiquement reconnu des marges réduites et des lancements de produits retardés en raison des fermetures d'usines dans les centres de fabrication et de la hausse des coûts de transport

• Relever ces défis nécessite une diversification stratégique des sites d’approvisionnement, des investissements dans la fabrication locale et l’adoption d’outils de chaîne d’approvisionnement numérique pour améliorer l’agilité et minimiser les risques opérationnels à long terme.

Portée du marché nord-américain de la chaussure

Le marché est segmenté en fonction du type, du matériau de la chaussure, du matériau de la semelle, du canal de distribution et de l'utilisateur final.

- Par type

En Amérique du Nord, le marché de la chaussure se segmente en fonction du type de chaussures : mocassins, chaussures de sport, sandales/tongs, ballerines, bottes, chaussures compensées, chaussures de sport, chaussures de santé, etc. Le segment des chaussures de sport a dominé le marché avec la plus grande part de chiffre d'affaires en 2024, porté par une sensibilisation croissante au fitness, la pratique d'activités de plein air et la popularité croissante de l'athleisure. Les consommateurs continuent d'accorder la priorité au confort, à la performance et à l'identité de marque des chaussures de sport, ce qui incite les marques à se développer et à innover sur ce segment.

Le segment des chaussures de santé devrait connaître la croissance la plus rapide entre 2025 et 2032, soutenu par la demande croissante de chaussures orthopédiques et thérapeutiques. La prévalence croissante des affections du pied et le vieillissement de la population stimulent l'intérêt pour les chaussures de santé conçues pour l'alignement du pied, l'amorti et les soins aux diabétiques.

- Par matériau de chaussure

En termes de matériaux, le marché nord-américain de la chaussure est segmenté en plastique, cuir, caoutchouc, textile, etc. Le segment du cuir a représenté la plus grande part de chiffre d'affaires en 2024, en raison de son attrait traditionnel, de sa durabilité et de la demande continue de chaussures haut de gamme et habillées, tant pour les hommes que pour les femmes.

Le segment textile devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à l'utilisation croissante de matériaux légers et respirants dans les chaussures décontractées et de sport. La demande croissante de matériaux durables, véganes et recyclables encourage également les marques de chaussures à adopter le textile comme matériau de base.

- Par matériau de semelle

En fonction du matériau de la semelle, le marché nord-américain de la chaussure est segmenté en plastique, caoutchouc, cuir et autres. Le segment du caoutchouc a dominé le marché avec la plus forte part de marché en 2024, grâce à son adhérence supérieure, ses propriétés d'absorption des chocs et sa durabilité sur tous les principaux types de chaussures.

Le segment des plastiques devrait connaître le taux de croissance le plus rapide entre 2025 et 2032, en raison de son faible coût de production et de son adaptabilité à une utilisation dans divers types de semelles, en particulier dans la mode et les chaussures grand public.

- Par canal de distribution

En termes de canaux de distribution, le marché nord-américain de la chaussure est segmenté entre le commerce électronique, les magasins spécialisés, les supermarchés et hypermarchés, les commerces de proximité, etc. Le commerce électronique a représenté la plus grande part de chiffre d'affaires en 2024, grâce à sa praticité, sa livraison rapide, la disponibilité de plusieurs marques et la facilité de comparaison des prix. Les plateformes en ligne ont également permis aux consommateurs d'accéder à des marques internationales et à des produits en édition limitée.

Le segment des magasins spécialisés devrait connaître le taux de croissance le plus rapide entre 2025 et 2032, grâce aux consommateurs à la recherche d'essayages en personne, de conseils d'experts et de sélections organisées adaptées à des besoins ou à des activités spécifiques.

- Par utilisateur final

En fonction de l'utilisateur final, le marché nord-américain de la chaussure est segmenté en femmes, hommes et enfants. Le segment féminin a dominé le marché avec la plus grande part de chiffre d'affaires en 2024, grâce à une large gamme de produits et à des mises à jour de style fréquentes, dictées par les tendances de la mode et la demande saisonnière.

Le segment des enfants devrait connaître le taux de croissance le plus rapide entre 2025 et 2032, en raison de l'attention croissante portée à la santé des pieds, de la demande de chaussures confortables et sûres et de la hausse des taux de natalité, ainsi que des dépenses croissantes en vêtements et accessoires pour enfants.

Analyse régionale du marché nord-américain de la chaussure

- Le marché américain de la chaussure a représenté la plus grande part de chiffre d'affaires en Amérique du Nord en 2024, avec 87 %, grâce à la forte consommation, à la rapidité des cycles de la mode et à une prise de conscience croissante des enjeux santé. Le marché bénéficie d'une forte demande sur les segments des chaussures de performance et lifestyle, notamment les chaussures de course, les baskets et les modèles décontractés haut de gamme.

- La présence de grandes marques mondiales, combinée à des réseaux de vente au détail étendus et à une infrastructure de commerce électronique mature, accélère encore la croissance du marché.

- En outre, la popularité croissante des chaussures durables et intégrant la technologie contribue à un changement dans les préférences et le comportement d'achat des consommateurs.

Aperçu du marché canadien de la chaussure

Le marché canadien de la chaussure devrait connaître sa croissance la plus rapide de 2025 à 2032, soutenu par la hausse du revenu disponible, l'évolution des tendances mode et la participation accrue aux activités de plein air. Les consommateurs manifestent un intérêt croissant pour les modèles confortables et les produits durables, ce qui stimule la demande de chaussures décontractées et sportives. L'essor du commerce en ligne et la pénétration croissante des marques internationales de chaussures permettent d'accéder à une vaste gamme de produits, contribuant ainsi aux perspectives de croissance robustes du marché.

Part de marché des chaussures en Amérique du Nord

L’industrie nord-américaine de la chaussure est principalement dirigée par des entreprises bien établies, notamment :

• Nike, Inc. (États-Unis)

• Adidas America, Inc. (États-Unis)

• Skechers USA, Inc. (États-Unis)

• Under Armour, Inc. (États-Unis)

• Wolverine World Wide, Inc. (

États-Unis) • Caleres, Inc. (États-Unis)

• Crocs, Inc. (États-Unis)

• Deckers Outdoor Corporation (États-Unis)

• Steven Madden, Ltd. (États-Unis)

• Genesco Inc. (États-Unis)

Derniers développements sur le marché nord-américain de la chaussure

- En mars 2024, Nike a lancé une innovation produit avec le lancement de l'Air Max DN, première chaussure à intégrer sa nouvelle technologie Dynamic Air. Cette innovation vise à améliorer la transition talon-orteil, offrant une sensation de douceur et de réactivité à chaque pas. Ce lancement enrichit la gamme de chaussures classiques Nike avec des caractéristiques de performance avancées, s'adressant aussi bien aux adeptes du lifestyle qu'aux sportifs, et devrait stimuler la demande sur le segment des vêtements de sport haut de gamme.

- En décembre 2022, Asics a dévoilé la GEL-RESOLUTION 9, une chaussure de tennis haute performance conçue pour favoriser le jeu de jambes dynamique et la stabilité latérale. Cette innovation améliore la stabilité cinétique lors des matchs rapides, offrant aux athlètes de meilleures performances sur le court. En s'adressant aux joueurs de tennis professionnels et confirmés, Asics renforce sa position sur le marché des chaussures de sport spécialisées.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.