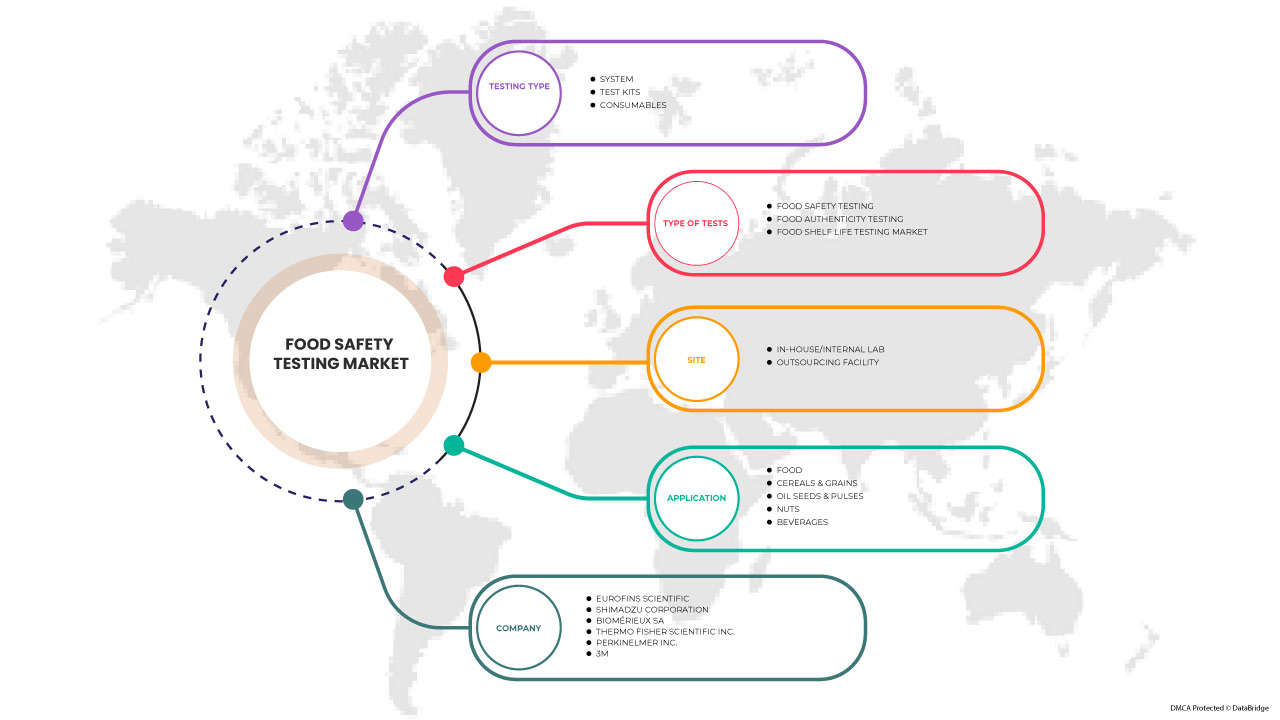

Marché des tests de sécurité alimentaire en Amérique du Nord, par type de test (système, kits de test, consommables et autres), type de tests (tests de sécurité alimentaire, par type de test (système, kits de test et consommables), type de tests (tests de sécurité alimentaire, tests d'authenticité des aliments et tests de durée de conservation des aliments), site (laboratoire interne/interne et installation d'externalisation), application (aliments, céréales et grains, oléagineux et légumineuses, noix et boissons) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des tests de sécurité alimentaire en Amérique du Nord

La sécurité et la qualité des aliments sont des préoccupations majeures pour la fabrication de produits alimentaires, le commerce de détail et l'hôtellerie. La qualité et l'hygiène des aliments ont un impact sur la productivité. Ces dernières années, la falsification intentionnelle et non intentionnelle est devenue une question de haute technologie et les laboratoires d'essai peuvent aider à détecter ces adultérants. La fonction la plus importante des laboratoires d'essai de sécurité alimentaire est de tester les aliments pour détecter les adultérants, les agents pathogènes, les résidus de pesticides, les contaminants chimiques tels que les métaux lourds, les contaminants microbiens, les additifs non autorisés, les colorants, entre autres, et les antibiotiques dans les aliments. Sans tests alimentaires, les producteurs et les fabricants de produits alimentaires ne peuvent pas garantir que les pesticides, les antibiotiques, les métaux lourds et les toxines naturelles, entre autres, sont présents. Il est donc important de garantir la sécurité alimentaire.

La demande de tests alimentaires est en augmentation, et les fabricants y accordent désormais une plus grande attention et s'impliquent davantage dans le lancement de nouveaux produits, la promotion, les récompenses, la certification et la participation à des événements sur le marché. Ces décisions favorisent en fin de compte la croissance du marché.

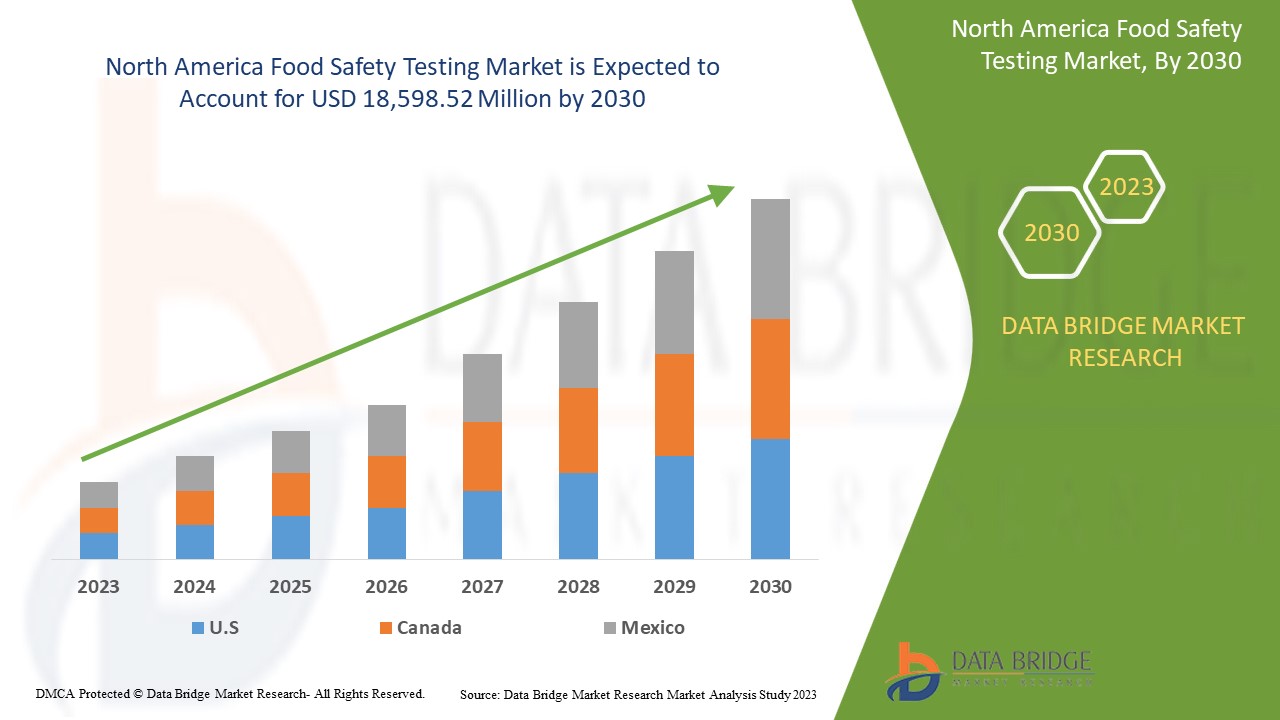

Selon les analyses de Data Bridge Market Research, le marché nord-américain des tests de sécurité alimentaire devrait atteindre une valeur de 18 598,52 millions USD d'ici 2030, à un TCAC de 8,0 % au cours de la période de prévision. Le rapport sur le marché nord-américain des tests de sécurité alimentaire couvre également tous les paramètres qui affectent le marché couvert dans cette étude de recherche. Ils ont été pris en compte, examinés en détail, vérifiés par des recherches primaires et analysés pour obtenir les données quantitatives et qualitatives finales.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Année historique |

2021 (personnalisable jusqu'au 2020-1015) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type de test (système, kits de test et consommables), type de tests (tests de sécurité alimentaire, tests d'authenticité des aliments et tests de durée de conservation des aliments), site (laboratoire interne/interne et installation d'externalisation), application (aliments, céréales et grains, graines oléagineuses et légumineuses, noix et boissons) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

Eurofins Scientific, Shimadzu Corporation, Thermo Fisher Scientific Inc., PerkinElmer Inc., FOSS, ALS, LexaGene, ROKA BIO SCIENCE, Biorex Food Diagnostics (BFD), Randox Food Diagnostics, Omega Diagnostics Group PLC, Romer Labs Division Holding GmbH, SGS Société Générale de Surveillance SA, 3M, Clear Labs, Inc., Invisible Sentinel, Ring Biotechnology Co Ltd., BIOMÉRIEUX SA, Agilent Technologies, Inc., NEOGEN Corporation, Spectro Analytical Labs Ltd. et Noack Group, entre autres |

Définition du marché

Les tests alimentaires sont des analyses scientifiques des aliments et de leur contenu. Ils sont effectués pour fournir des informations sur les différentes caractéristiques des aliments, notamment leur structure, leur composition et leurs propriétés physico-chimiques. Les tests de sécurité alimentaire comprennent divers tests effectués pour d'autres raisons, telles que le contrôle de la qualité et de la qualité du produit. Les tests de produits alimentaires peuvent être effectués à l'aide de plusieurs méthodes très avancées pour fournir des informations précises sur la valeur nutritionnelle et la sécurité des aliments. Les méthodes les plus courantes de test des produits alimentaires sont les tests de chimie analytique, les tests sensoriels, les tests microbiologiques et les analyses nutritionnelles. Les tests de produits alimentaires déterminent la teneur en éléments nutritifs à l'aide d'analyses nutritionnelles en laboratoire, clés en main, logicielles et en ligne. L'analyse en laboratoire est la méthode la plus préférée.

Les tests et analyses alimentaires sont essentiels à la sécurité alimentaire pour garantir que les aliments sont propres à la consommation. Cela implique de nourrir le réseau de laboratoires de tests alimentaires, de garantir la qualité des tests, d'investir dans les ressources humaines et de mener des activités de surveillance et d'éducation des consommateurs.

Dynamique du marché des tests de sécurité alimentaire en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Augmentation du nombre de cas de maladies d’origine alimentaire

Le nombre croissant de cas de maladies d’origine alimentaire parmi les individus dans le monde devrait stimuler le marché des tests de sécurité alimentaire en Amérique du Nord. La consommation d’aliments avariés, contaminés ou détériorés par divers micro-organismes, tels que des bactéries, des champignons, des parasites, des virus et autres, est la principale cause de maladies d’origine alimentaire. De plus, d’autres contaminants tels que les mycotoxines, les métaux lourds et les produits chimiques entraînent également une augmentation des cas de maladies d’origine alimentaire chez les personnes. Ces cas croissants augmentent considérablement la demande de kits, d’équipements et de systèmes de test alimentaire dans la région. La principale raison de l’augmentation des maladies d’origine alimentaire dans l’industrie alimentaire est l’ignorance de la main-d’œuvre, des manipulateurs d’aliments et des fabricants, car ils manquent de connaissances sur les technologies modernes, les bonnes pratiques de fabrication (BPF), les systèmes d’analyse des risques et de maîtrise des points critiques (HACCP) et le contrôle de la qualité. Le manque de connaissances des travailleurs entraîne une prévalence accrue des maladies d’origine alimentaire.

- Sensibilisation accrue des consommateurs à la sécurité alimentaire

Avec l'augmentation du nombre de cas de maladies d'origine alimentaire et de problèmes d'intoxication alimentaire, de plus en plus de consommateurs prennent conscience de l'importance de manger des aliments sûrs et sains. Cela a entraîné une demande accrue d'aliments de bonne qualité et sûrs parmi les individus, générant une demande d'équipements de test de sécurité alimentaire. L'incidence croissante des maladies d'origine alimentaire a incité les consommateurs à apporter des changements vitaux à leur régime alimentaire et à leur mode de vie, les rendant plus soucieux de la sécurité alimentaire. Les consommateurs sont conscients de leur alimentation et la sécurité alimentaire est leur principale préoccupation.

La sécurité alimentaire est importante pour la santé des consommateurs, pour l'ensemble de l'industrie alimentaire et pour les autorités réglementaires. Face à l'inquiétude croissante des consommateurs concernant la sécurité alimentaire, le gouvernement prend également des initiatives pour promouvoir la sécurité alimentaire auprès des consommateurs.

- Augmentation du nombre de rappels de produits alimentaires

Un rappel de produit est une demande d'un fabricant aux consommateurs de retourner le produit après avoir découvert la présence d'agents pathogènes ou de problèmes de sécurité dans le produit qui pourraient mettre en danger la vie du consommateur. Le rappel du produit peut exposer le fabricant à un risque de poursuites judiciaires. L'augmentation des cas de rappel de produits dans différentes marques et entreprises en raison de la contamination des aliments, que ce soit par un agent pathogène, des métaux lourds ou certains produits chimiques, entraîne une augmentation des demandes d'équipements et de systèmes de test de sécurité alimentaire. La contamination des aliments peut entraîner de graves problèmes de santé pour les consommateurs, ce qui nécessite de prendre davantage en compte les kits et systèmes de sécurité alimentaire. De nombreux cas de rappels de produits ont été recensés chez différents fabricants.

Restrictions

- Manque d'infrastructures pour tester les aliments

Le nombre croissant de rappels de produits, de cas de contamination alimentaire, d'incidents d'intoxication alimentaire et la sensibilisation croissante des consommateurs ont entraîné une demande croissante d'installations de sécurité alimentaire dans la région. Cependant, le manque d'infrastructures dans les laboratoires d'analyse des aliments freine la croissance du marché nord-américain des tests de sécurité alimentaire. Afin d'obtenir des résultats précis pour les tests alimentaires, de bonnes conditions d'hygiène doivent être maintenues dans les laboratoires, mais ces derniers ne sont pas bien développés en termes d'infrastructures, d'eau potable, de formation du personnel, de technologies modernes d'assurance qualité, d'opérations d'emballage et de procédures de désinfection standard. En outre, la mise en œuvre de contrôles microbiologiques dans le cadre d'un programme GMP ou HACCP est fondamentalement hors de question en raison de conditions d'usine insuffisantes ou inadéquates.

- Manque d’expertise technique dans les petites entreprises

Les petites entreprises et les fabricants de produits alimentaires ne disposent pas de suffisamment d'informations sur les méthodes, services et programmes de sécurité alimentaire nouveaux et de haute technologie. Ils ne sont donc pas en mesure de répondre aux exigences spécifiques en matière de sécurité alimentaire. Par conséquent, le manque de compétences et de connaissances, en particulier dans les pays en développement, affectera l'efficacité de l'évaluation et de l'inspection des opérations alimentaires. L'expertise et les connaissances techniques sont essentielles pour mettre en œuvre de telles procédures. Ainsi, le gouvernement devrait mener certains programmes pour former les travailleurs afin que les tests de sécurité alimentaire et, par conséquent, la sécurité puissent être atteints. Le manque d'expérience et de connaissances techniques, en particulier dans les petites entreprises, entraînera une grave contamination des produits alimentaires et des boissons, ce qui entraînera des maladies d'origine alimentaire et pourra causer de graves problèmes. Le manque d'expertise et de connaissances techniques pourrait nuire au secteur des tests de sécurité alimentaire. L'automatisation croissante de l'industrie exige des personnes qualifiées et techniquement solides pour faire fonctionner les machines et les petites entreprises ne peuvent pas trouver de professionnels qualifiés pour cela.

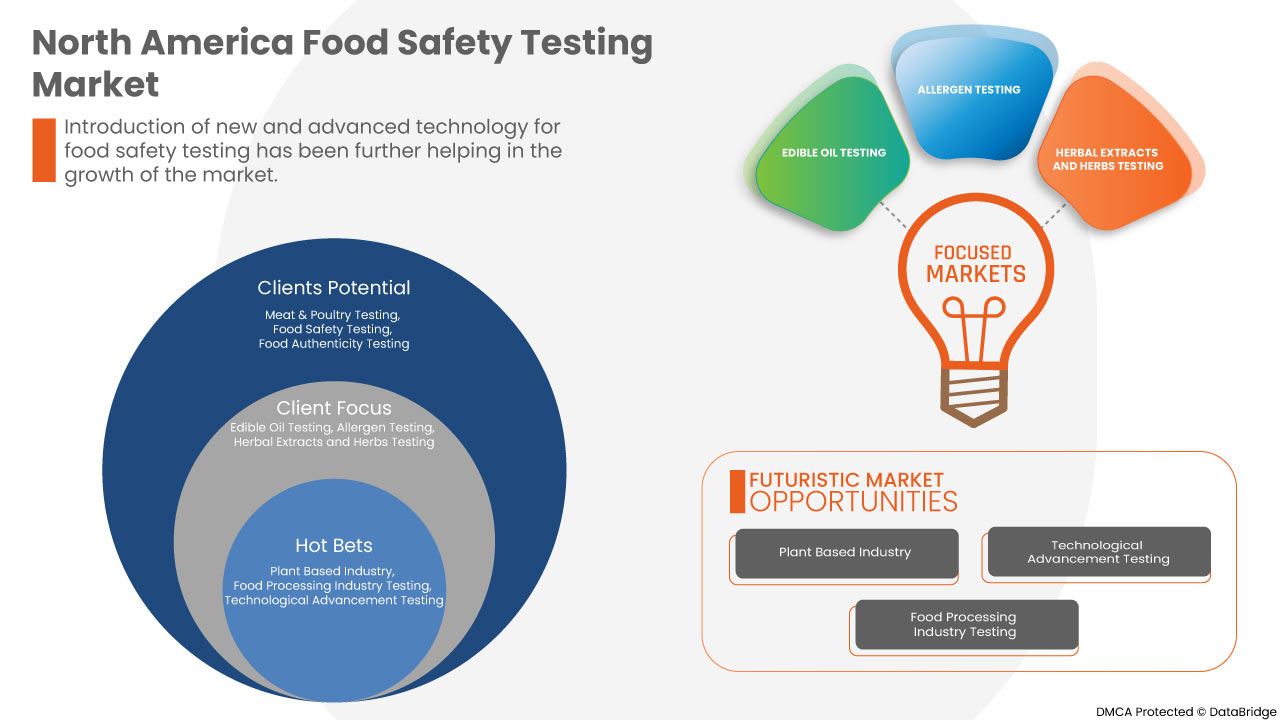

Opportunités

- Demande et popularité croissantes pour les aliments clean label

Les produits alimentaires clean label contiennent des ingrédients alimentaires les plus naturels et les moins transformés. Les consommateurs optent pour des options alimentaires saines et propres pour vivre un mode de vie plus sain, augmentant ainsi la demande de tests de sécurité alimentaire. De nos jours, les consommateurs sont de plus en plus enclins à se tourner vers des aliments clean label, sans conservateurs ni additifs, pour continuer à adopter un certain mode de vie. De plus, la sensibilisation à la promotion d'un environnement durable en utilisant des produits clean label stimule la croissance du marché. Avec la demande croissante d'aliments clean label ou de produits alimentaires sûrs, la demande de tests de sécurité alimentaire augmente également, car les fabricants proposent des produits alimentaires sûrs pour garantir aux consommateurs que les produits alimentaires sont exempts de tout agent pathogène nocif, de mycotoxines, de métaux lourds et de produits chimiques.

Défis

- Manque de normes de sécurité de qualité uniformes

Ces dernières années, la demande de produits alimentaires propres et sûrs a soudainement augmenté parmi les consommateurs, ce qui a conduit à l'élaboration de normes de sécurité alimentaire différentes et nouvelles par les organismes gouvernementaux. En conséquence, le nombre de normes nationales en matière de sécurité alimentaire a augmenté et est devenu confus. De plus, les réglementations en matière de sécurité alimentaire diffèrent d'un pays à l'autre, car les aliments sont considérés comme sûrs pour la consommation dans un pays mais pas sûrs pour l'importation dans d'autres pays. Par conséquent, la nécessité d'harmoniser les normes de sécurité alimentaire est de plus en plus importante. L'augmentation du nombre d'initiatives prises par les autorités gouvernementales pour uniformiser les normes de sécurité alimentaire contribuera à relever le défi majeur auquel est confronté le marché nord-américain des tests de sécurité alimentaire.

Développements récents

- En mai, Biomerieux a acquis Specific Diagnostics, une société privée qui a développé un test de sensibilité aux antimicrobiens. Cette acquisition a permis à l'entreprise d'étendre son leadership à l'échelle mondiale

- En avril, FOSS a annoncé la sortie de modèles de falsification ciblés, permettant aux installations de test du lait de programmer des instruments de test pour analyser les échantillons de lait cru à la recherche de sources connues de falsification du lait. Les nouveaux modèles complètent un modèle non ciblé existant qui permet de détecter toute anomalie

Portée du marché des tests de sécurité alimentaire en Amérique du Nord

Le marché nord-américain des tests de sécurité alimentaire est segmenté en type de test, type de tests, site et application. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de test

- Système

- Kits de test

- Consommables

Sur la base du type de test, le marché nord-américain des tests de sécurité alimentaire est segmenté en systèmes, kits de test et consommables.

Type de tests

- Tests de sécurité alimentaire

- Test d'authenticité des aliments

- Test de durée de conservation des aliments

Sur la base du type de tests, le marché nord-américain des tests de sécurité alimentaire est segmenté en tests de sécurité alimentaire, tests d'authenticité des aliments et tests de durée de conservation des aliments.

Site

- Laboratoire interne

- Facilité d'externalisation

Sur la base du site, le marché des tests de sécurité alimentaire en Amérique du Nord est segmenté en laboratoire interne et en installation d'externalisation.

Application

- Nourriture

- Céréales et grains

- Oléagineux et légumineuses

- Noix

- Boissons

Sur la base des applications, le marché nord-américain des tests de sécurité alimentaire est segmenté en aliments, céréales et grains, oléagineux et légumineuses, noix et boissons.

Analyse/perspectives régionales du marché des tests de sécurité alimentaire en Amérique du Nord

Le marché des tests de sécurité alimentaire en Amérique du Nord est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type de test, type de tests, site et application comme référencé ci-dessus.

Certains pays couverts par le rapport sur le marché des tests de sécurité alimentaire en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

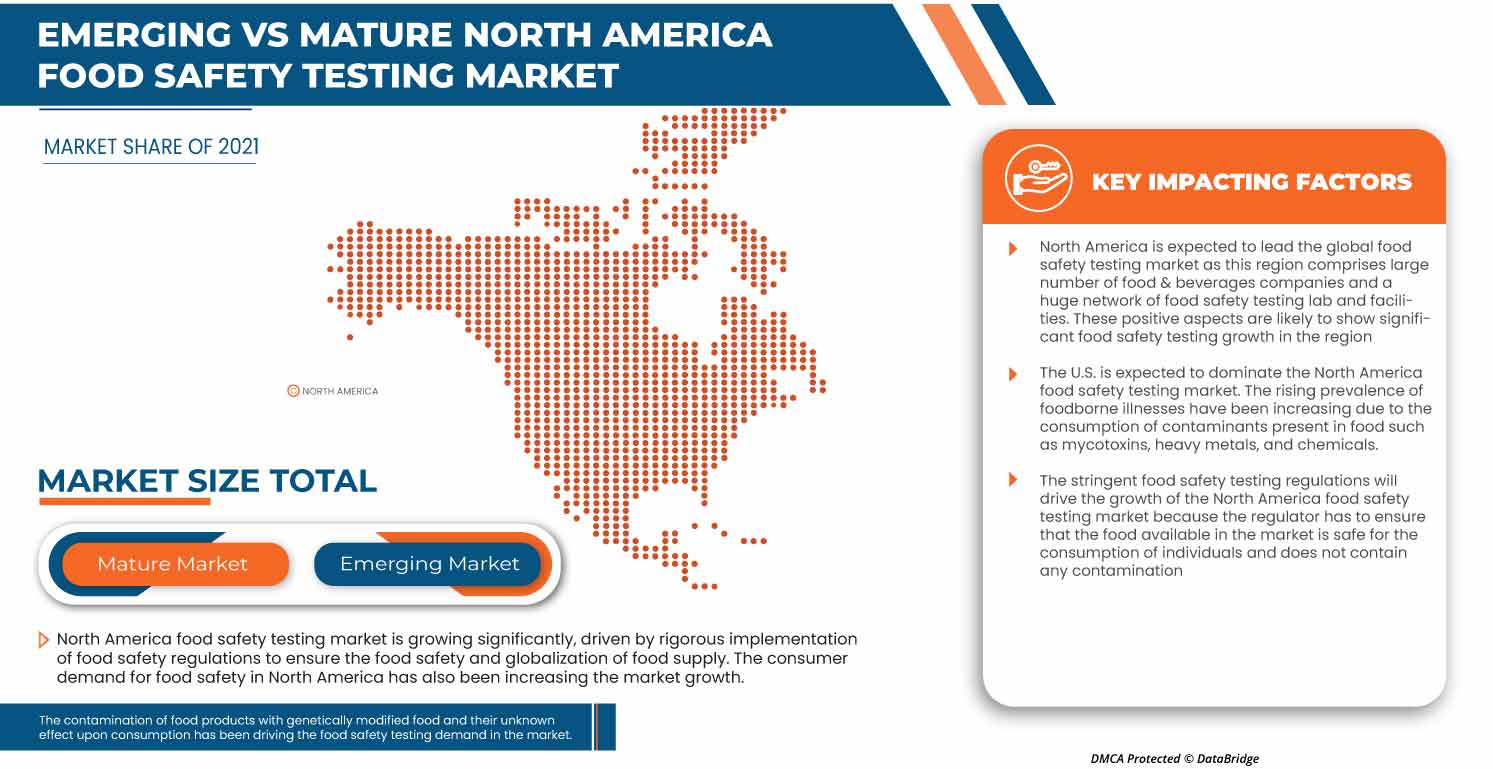

Les États-Unis devraient dominer le marché des tests de sécurité alimentaire en Amérique du Nord en raison de l’augmentation des cas de maladies d’origine alimentaire.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces de Porter, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des tests de sécurité alimentaire en Amérique du Nord

Le paysage concurrentiel du marché des tests de sécurité alimentaire en Amérique du Nord fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché des tests de sécurité alimentaire en Amérique du Nord.

Certains des principaux acteurs opérant sur le marché des tests de sécurité alimentaire en Amérique du Nord sont Eurofins Scientific, Shimadzu Corporation, Thermo Fisher Scientific Inc., PerkinElmer Inc., FOSS, ALS, LexaGene, ROKA BIO SCIENCE, Biorex Food Diagnostics (BFD), Randox Food Diagnostics, Omega Diagnostics Group PLC, Romer Labs Division Holding GmbH, SGS Société Générale de Surveillance SA, 3M, Clear Labs, Inc., Invisible Sentinel, Ring Biotechnology Co Ltd., BIOMÉRIEUX SA, Agilent Technologies, Inc. et NEOGEN Corporation, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA FOOD SAFETY TESTING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TESTING TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 COMPARATIVE ANALYSIS OF DIFFERENT TYPES OF FOOD SAFETY TESTING TECHNOLOGIES

4.2 EMERGING TREND ANALYSIS

4.3 GROWING FOOD ADULTERATION CASES

4.4 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.5 INDUSTRY TRENDS IN NORTH AMERICA FOOD SAFETY TESTING MARKET

4.5.1 INCREASING AUTOMATION IN FOOD TESTING

4.5.2 RISING TREND OF FOODBORNE PATHOGEN TESTING

4.5.3 INCREASING TREND OF ENVIRONMENTAL MONITORING

4.5.4 FOOD TESTING WITH HIGH ACCURACY AND PRECISION TECHNOLOGY

4.5.5 RISING TREND OF GMO TESTING

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 PRODUCTS/SERVICES

4.6.2 DISTRIBUTION

4.6.3 END USERS

4.7 TECHNOLOGICAL ADVANCEMENTS IN THE NORTH AMERICA FOOD SAFETY TESTING MARKET

4.8 INDUSTRY TRENDS IN NORTH AMERICA FOOD SAFETY TESTING MARKET

4.8.1 INTRODUCTION OF ROBOTICS FOR FOOD CONTAMINANT DETECTION

4.8.2 DEVELOPMENT OF BIO-SENSOR-BASED TECHNIQUES FOR PATHOGEN DETECTION

4.8.3 TECHNOLOGICAL ADVANCEMENT IN FOOD CHEMICAL AND MYCOTOXIN TESTING

4.8.4 INTRODUCTION OF DNA FINGERPRINTING TECHNIQUES

5 REGULATIONS ON NORTH AMERICA FOOD SAFETY TESTING MARKET

5.1 FOOD AND BEVERAGES SAFETY AND QUALITY REGULATIONS

5.2 FOODBORNE ILLNESS OUTBREAKS AND RELEVANT ACTIONS TAKEN BY GOVERNMENT BODIES

5.3 CHANGES IN NORTH AMERICA FOOD SAFETY REGULATIONS AND RECENTLY FORMED LAWS FOR FOOD SAFETY TESTING BY GOVERNMENT BODIES

5.4 LAWSUITS RELATED TO FOOD SAFETY TESTING

5.5 FOOD PRODUCTS WITHDRAWALS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN THE NUMBER OF FOODBORNE ILLNESS CASES

6.1.2 INCREASE IN CONSUMER AWARENESS REGARDING FOOD SAFETY

6.1.3 STRINGENT SAFETY RULES AND REGULATIONS FOR FOOD

6.1.4 RISE IN THE NUMBER OF FOOD PRODUCT RECALLS

6.2 RESTRAINTS

6.2.1 LACK OF INFRASTRUCTURE FACILITIES FOR FOOD TESTING

6.2.2 LACK OF TECHNICAL EXPERTISE IN SMALL ENTERPRISES

6.2.3 HIGH INITIAL INVESTMENT FOR INSTALLATION OF FOOD TESTING EQUIPMENT

6.3 OPPORTUNITIES

6.3.1 GROWING DEMAND AND POPULARITY FOR CLEAN-LABEL FOOD

6.3.2 INCREASE IN GOVERNMENT INITIATIVES TO MONITOR FOOD SAFETY

6.3.3 GROWING AUTOMATION IN THE FOOD TESTING INDUSTRY

6.4 CHALLENGES

6.4.1 LACK OF UNIFORM QUALITY FOOD SAFETY STANDARD

6.4.2 INCREASE IN THE NUMBER OF FALSE FOOD TESTING RESULT CASES

7 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY TESTING TYPE

7.1 OVERVIEW

7.2 SYSTEM

7.2.1 HYBRIDIZATION BASED

7.2.1.1 POLYMERASE CHAIN REACTION(PCR)

7.2.1.2 MIICROARRAYS

7.2.1.3 GENE AMPLIFIERS

7.2.1.4 SEQUNCES

7.2.2 CHROMATOGRAPHY BASED

7.2.2.1 LIQUID CHROMATOGRAPHY

7.2.2.2 GAS CHROMATOGRAPHY

7.2.2.3 COLUMN CHROMATOGRAPHY

7.2.2.4 THIN LAYER CHROMATOGRAPHY

7.2.2.5 PAPER CHROMATOGRAPHY

7.2.3 SPECTROMETRY BASED

7.2.4 IMMUNOASSAY BASED

7.2.5 BIOSENSOR/BIOCHIP

7.2.6 NMR TECHNIQUE/MOLECULAR SPECTROMETRY

7.2.7 ISOTOPE METHODS

7.3 TEST KITS

7.4 CONSUMABLES

8 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY SITE

8.1 OVERVIEW

8.2 IN-HOUSE/INTERNAL LAB

8.3 OUTSOURCING FACILITY

9 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY TYPE OF TEST

9.1 OVERVIEW

9.2 FOOD SAFETY TESTING

9.2.1 ALLERGEN TESTING

9.2.1.1 PEANUT & SOY

9.2.1.2 GLUTEN

9.2.1.3 MILK

9.2.1.4 EGG

9.2.1.5 TREE NUTS

9.2.1.6 SEAFOOD

9.2.1.7 OTHERS

9.2.2 PATHOGENS TESTING

9.2.2.1 SALMONELLA SPP

9.2.2.2 E. COLI

9.2.2.3 LISTERIA SPP

9.2.2.4 LISTERIA

9.2.2.5 VIBRIO SPP

9.2.2.6 CAMPYLOBACTER

9.2.2.7 OTHERS

9.2.3 HEAVY METALS TESTING

9.2.3.1 LEAD

9.2.3.2 ARSENIC

9.2.3.3 CADMIUM

9.2.3.4 MERCURY

9.2.3.5 OTHERS

9.2.4 NUTRITIONAL LABELING

9.2.5 GMO TESTING

9.2.5.1 STACKED

9.2.5.2 HERBICIDE TOLERANCE

9.2.5.3 INSECT RESISTANCE

9.2.6 PESTICIDES TESTING

9.2.6.1 INSECTICIDES

9.2.6.2 HERBICIDES

9.2.6.3 FUNGICIDES

9.2.6.4 OTHERS

9.2.7 MYCOTOXINS TESTING

9.2.7.1 AFLATOXINS

9.2.7.2 OCHRATOXINS

9.2.7.3 PATULIN

9.2.7.4 FUMONISINS

9.2.7.5 TRICHOTHECENES

9.2.7.6 DEOXYNIVALENOL

9.2.7.7 ZEARALENONE

9.2.8 ORGANIC CONTAMINANTS TESTING

9.3 FOOD SHELF LIFE TESTING

9.3.1 BY TYPE

9.3.1.1 CHEMICAL TESTS

9.3.1.2 ACIDITY LEVELS

9.3.1.3 RANCIDITY

9.3.1.3.1 PEROXIDE VALUE (PV)

9.3.1.3.2 FREE FATTY ACIDS (FFA)

9.3.1.3.3 P-ANISIDINE (P-AV)

9.3.2 ORGANOLEPTIC AND APPEARANCE

9.3.2.1 COLOUR

9.3.2.2 TEXTURE

9.3.2.3 AROMA

9.3.2.4 TASTE

9.3.2.5 PACKAGING

9.3.2.6 STRATIFICATION

9.3.3 INGREDIENT ACTIVITY

9.3.4 BROWNING

9.3.4.1 ENZYMATIC BROWNING

9.3.4.2 CHEMICAL BROWNING

9.3.5 NUTRIENT STABILITY

9.3.6 BY METHOD

9.3.6.1 REAL-TIME SHELF LIFE TESTING

9.3.6.2 ACCELERATED SHELF LIFE TESTING

9.3.7 BY PACKED FOOD CONDITION

9.3.7.1 FROZEN (-15°C TO -20°C)

9.3.7.2 REFRIGERATED (2°C TO 8°C)

9.3.7.3 AMBIENT (25°C/60%RH)

9.3.7.4 INTERMEDIATE (30°C/65%RH)

9.3.7.5 ACCELERATED (40°C/75%RH)

9.3.7.6 TROPICAL (30°C/75%RH)

9.3.7.7 OTHERS

9.4 FOOD AUTHENTICITY TESTING

9.4.1 ADULTERATION TESTS

9.4.2 ORGANIC

9.4.3 ALLERGEN TESTING

9.4.4 MEAT SPECIATION

9.4.5 GMO TESTING

9.4.6 HALAL VERIFICATION

9.4.7 KOSHER VERIFICATION

9.4.8 PROTECTED GEOGRAPHICAL INDICATION (PGI)

9.4.9 PROTECTED DENOMINATION OF ORIGIN (PDO)

9.4.10 FALSE LABELING

10 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 FOOD

10.2.1 EDIBLE OILS

10.2.1.1 EDIBLE OILS, BY TYPE

10.2.1.1.1 SUNFLOWER OIL

10.2.1.1.2 PEANUT OIL

10.2.1.1.3 SOYBEAN OIL

10.2.1.1.4 OLIVE OIL

10.2.1.1.5 COCONUT OIL

10.2.1.1.6 OTHERS

10.2.1.2 EDIBLE OILS, BY TESTING TYPE

10.2.1.2.1 FOOD SAFETY TESTING

10.2.1.2.2 FOOD AUTHENTICITY TESTING

10.2.1.2.3 FOOD SHELF LIFE TESTING

10.2.2 SPICES

10.2.2.1 SPICES, BY TESTING TYPE

10.2.2.1.1 FOOD SAFETY TESTING

10.2.2.1.2 FOOD AUTHENTICITY TESTING

10.2.2.1.3 FOOD SHELF LIFE TESTING

10.2.3 DAIRY PRODUCTS

10.2.3.1 DAIRY PRODUCTS, BY TYPE

10.2.3.1.1 CHEESE

10.2.3.1.2 PROCESSED CHEESES

10.2.3.1.3 ICE CREAM

10.2.3.1.4 YOGURT

10.2.3.1.5 MILK DESSERT

10.2.3.1.6 PUDDING

10.2.3.1.7 CUSTARD

10.2.3.1.8 CHEESE BASED DESSERTS

10.2.3.1.8.1 CHEESE CAKE

10.2.3.1.8.2 CHEESE CREAM

10.2.3.1.8.3 CHEESE PUDDING

10.2.3.1.8.4 OTHERS

10.2.3.1.9 OTHERS

10.2.3.2 DAIRY PRODUCTS, BY TESTING TYPE

10.2.3.2.1 FOOD SAFETY TESTING

10.2.3.2.2 FOOD AUTHENTICITY TESTING

10.2.3.2.3 FOOD SHELF LIFE TESTING

10.2.4 CONFECTIONARY

10.2.4.1 CONFECTIONARY, BY TYPE

10.2.4.1.1 CANDY BARS

10.2.4.1.2 JAMS AND JELLIES

10.2.4.1.3 JELLY CANDIES

10.2.4.1.4 MARMALADES

10.2.4.1.5 FRUIT JELLY DESSERT

10.2.4.1.6 MERINGUES

10.2.4.1.7 OTHERS

10.2.4.2 CONFECTIONARY, BY TESTING TYPE

10.2.4.2.1 FOOD SAFETY TESTING

10.2.4.2.2 FOOD AUTHENTICITY TESTING

10.2.4.2.3 FOOD SHELF LIFE TESTING

10.2.5 HERBAL EXTRACTS AND HERBS

10.2.5.1 HERBAL EXTRACTS AND HERBS, BY TESTING TYPE

10.2.5.1.1 FOOD SAFETY TESTING

10.2.5.1.2 FOOD AUTHENTICITY TESTING

10.2.5.1.3 FOOD SHELF LIFE TESTING

10.2.6 MEAT & POULTRY PRODUCTS

10.2.6.1 MEAT & POULTRY PRODUCTS, BY TYPE

10.2.6.1.1 CHICKEN

10.2.6.1.1.1 FROZEN

10.2.6.1.1.2 FRESH

10.2.6.1.2 PORK

10.2.6.1.2.1 FROZEN

10.2.6.1.2.2 FRESH

10.2.6.1.3 SEAFOOD

10.2.6.1.3.1 FROZEN

10.2.6.1.3.2 FRESH

10.2.6.1.4 BEEF

10.2.6.1.4.1 FROZEN

10.2.6.1.4.2 FRESH

10.2.6.1.5 LAMB

10.2.6.1.5.1 FROZEN

10.2.6.1.5.2 FRESH

10.2.6.1.6 OTHERS

10.2.6.1.6.1 FROZEN

10.2.6.1.6.2 FRESH

10.2.6.2 MEAT & POULTRY PRODUCTS, BY TESTING TYPE

10.2.6.2.1 FOOD SAFETY TESTING

10.2.6.2.2 FOOD AUTHENTICITY TESTING

10.2.6.2.3 FOOD SHELF LIFE TESTING

10.2.7 PROCESSED FOOD

10.2.7.1 PROCESSED FOOD, BY TYPE

10.2.7.1.1 CANNED FRUITS & VEGETABLES

10.2.7.1.2 JAMS, PRESERVES & MARMALADES

10.2.7.1.3 FRUIT & VEGETABLE PUREE

10.2.7.1.4 SAUCES, DRESSINGS AND CONDIMENTS

10.2.7.1.5 READY MEALS

10.2.7.1.6 PICKLES

10.2.7.1.7 SOUPS

10.2.7.2 PROCESSED FOOD, BY TESTING TYPE

10.2.7.2.1 FOOD SAFETY TESTING

10.2.7.2.2 FOOD AUTHENTICITY TESTING

10.2.7.2.3 FOOD SHELF LIFE TESTING

10.2.8 HONEY

10.2.8.1 HONEY, BY TESTING TYPE

10.2.8.1.1 FOOD SAFETY TESTING

10.2.8.1.2 FOOD AUTHENTICITY TESTING

10.2.8.1.3 FOOD SHELF LIFE TESTING

10.2.9 BABY FOOD

10.2.9.1 BABY FOOD, BY TESTING TYPE

10.2.9.1.1 FOOD SAFETY TESTING

10.2.9.1.2 FOOD AUTHENTICITY TESTING

10.2.9.1.3 FOOD SHELF LIFE TESTING

10.2.10 PLANT BASED MEAT AND POULTRY ALTERNATIVES

10.2.10.1 PLANT BASED MEAT AND POULTRY ALTERNATIVES, BY TYPE

10.2.10.1.1 BURGER & PATTIES

10.2.10.1.2 SAUSAGES

10.2.10.1.3 STRIPS & NUGGETS

10.2.10.1.4 MEATBALLS

10.2.10.1.5 TEMPEH

10.2.10.1.6 TOFU

10.2.10.1.7 SEITEN

10.2.10.1.8 OTHERS

10.2.10.2 PLANT BASED MEAT AND POULTRY ALTERNATIVES, BY TESTING TYPE

10.2.10.2.1 FOOD SAFETY TESTING

10.2.10.2.2 FOOD AUTHENTICITY TESTING

10.2.10.2.3 FOOD SHELF LIFE TESTING

10.2.11 TOBACCO

10.2.11.1 TOBACCO, BY TESTING TYPE

10.2.11.1.1 FOOD SAFETY TESTING

10.2.11.1.2 FOOD AUTHENTICITY TESTING

10.2.11.1.3 FOOD SHELF LIFE TESTING

10.2.12 CBD PRODUCTS

10.2.12.1 CBD PRODUCTS, BY TESTING TYPE

10.2.12.1.1 FOOD SAFETY TESTING

10.2.12.1.2 FOOD AUTHENTICITY TESTING

10.2.12.1.3 FOOD SHELF LIFE TESTING

10.3 CEREALS & GRAINS

10.3.1 CEREALS & GRAINS, BY TYPE

10.3.1.1 WHEAT

10.3.1.2 MAIZE

10.3.1.3 BARLEY

10.3.1.4 RICE

10.3.1.5 OAT

10.3.1.6 SORGHUM

10.3.1.7 OTHERS

10.3.2 CEREALS & GRAINS, BY TESTING TYPE

10.3.2.1 FOOD SAFETY TESTING

10.3.2.2 FOOD AUTHENTICITY TESTING

10.3.2.3 FOOD SHELF LIFE TESTING

10.4 OIL SEEDS & PULSES

10.4.1 OIL SEEDS & PULSES, BY TYPE

10.4.1.1 GRAM

10.4.1.2 PEA

10.4.1.3 LENTILS

10.4.1.4 SUNFLOWER

10.4.1.5 SOYABEAN

10.4.1.6 GROUNDNUT

10.4.1.7 SESAME

10.4.1.8 COTTON SEED

10.4.1.9 PALM

10.4.1.10 OTHERS

10.4.2 OIL SEEDS & PULSES, BY TESTING TYPE

10.4.2.1 FOOD SAFETY TESTING

10.4.2.2 FOOD AUTHENTICITY TESTING

10.4.2.3 FOOD SHELF LIFE TESTING

10.5 NUTS

10.5.1 NUTS, BY TYPE

10.5.1.1 ALMOND

10.5.1.2 WALNUT

10.5.1.3 CASHEW NUT

10.5.1.4 BRAZIL NUT

10.5.1.5 MACADAMIA NUT

10.5.1.6 OTHERS

10.5.2 NUTS, BY TESTING TYPE

10.5.2.1 FOOD SAFETY TESTING

10.5.2.2 FOOD AUTHENTICITY TESTING

10.5.2.3 FOOD SHELF LIFE TESTING

10.6 BEVERAGES

10.6.1 BEVERAGES, BY TYPE

10.6.1.1 NON-ALCOHOLIC

10.6.1.1.1 CARBONATED DRINKS

10.6.1.1.2 MINERAL WATER

10.6.1.1.3 COFFEE

10.6.1.1.4 JUICES

10.6.1.1.5 SMOOTHIES

10.6.1.1.6 TEA

10.6.1.1.7 PLANT-BASED MILK

10.6.1.1.7.1 SOY MILK

10.6.1.1.7.2 ALMOND MILK

10.6.1.1.7.3 OAT MILK

10.6.1.1.7.4 CASHEW MILK

10.6.1.1.7.5 RICE MILK

10.6.1.1.7.6 OTHERS

10.6.1.1.8 SPORTS DRINKS

10.6.1.1.9 NUTRITIONAL DRINKS

10.6.1.1.10 OTHERS

10.6.1.2 ALCOHOLIC

10.6.1.2.1 BEER

10.6.1.2.2 WINE

10.6.1.2.3 WHISKY

10.6.1.2.4 VODKA

10.6.1.2.5 TEQUILA

10.6.1.2.6 GIN

10.6.1.2.7 BRANDS

10.6.1.2.8 OTHERS

10.6.1.3 BEVERAGES, BY TESTING TYPE

10.6.1.3.1 FOOD SAFETY TESTING

10.6.1.3.2 FOOD AUTHENTICITY TESTING

10.6.1.3.3 FOOD SHELF LIFE TESTING

11 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 COMPANY LANDSCAPE: NORTH AMERICA FOOD SAFETY TESTING MARKET

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 EUROFINS SCIENTIFIC

14.1.1 COMPANY SNAPSHOT

14.1.2 RECENT FINANCIALS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 SHIMADZU CORPORATION

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 BIOMÉRIEUX SA

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 THERMO FISHER SCIENTIFIC INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 RECENT FINANCIALS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 PERKINELMER INC.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 3M

14.6.1 COMPANY SNAPSHOT

14.6.2 RECENT FINANCIALS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 AGILENT TECHNOLOGIES, INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 ALS

14.8.1 COMPANY SNAPSHOT

14.8.2 RECENT FINANCIALS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 BIOREX FOOD DIAGNOSTICS

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 CLEAR LABS, INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 FOSS

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 INVISIBLE SENTINEL

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 LEXAGENE

14.13.1 COMPANY SNAPSHOT

14.13.2 RECENT FINANCIALS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 NEOGEN CORPORATION

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 NOACK GROUP

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 OMEGA DIAGNOSTICS GROUP PLC

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENT

14.17 RANDOX FOOD DIAGNOSTICS

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 RING BIOTECHNOLOGY CO LTD

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 ROKA BIO SCIENCE

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 ROMER LABS DIVISION HOLDING GMBH

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

14.21 SGS SOCIÉTÉ GÉNÉRALE DE SURVEILLANCE SA

14.21.1 COMPANY SNAPSHOT

14.21.2 RECENT FINANCIALS

14.21.3 PRODUCT PORTFOLIO

14.21.4 RECENT DEVELOPMENTS

14.22 SPECTRO ANALYTICAL LABS LTD.

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA SYSTEM IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA SYSTEM IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA HYBRIDIZATION BASED IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA CHROMATOGRAPHY BASED IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA TEST KITS IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA CONSUMABLES IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY SITE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA IN-HOUSE IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA OUTSOURCING FACILITY IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY TYPE OF TEST, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA FOOD SAFETY TESTING IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA FOOD SAFETY TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA ALLERGEN TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA PATHOGEN TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA HEAVY METALS TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA GMO TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA PESTICIDES TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA MYCOTOXINS TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA RANCIDITY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA ORGANOLEPTIC AND APPEARANCE TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA BROWNING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY PACKAGED FOOD CONDITION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA FOOD AUTHENTICITY TESTING IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA FOOD AUTHENTICITY TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA FOOD IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA FOOD IN FOOD SAFETY TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA EDIBLE OILS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA EDIBLE OILS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA SPICES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA DAIRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA CHEESE BASED DESSERT IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA DAIRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA CONFECTIONARY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA CONFECTIONARY IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA HERBAL EXTRACTS AND HERBS PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA MEAT AND POULTRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA CHICKEN IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA PORK IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA SEAFOOD IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA BEEF IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA LAMB IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA OTHERS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA MEAT AND POULTRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA PROCESSED FOOD IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA PROCESSED FOOD IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA HONEY IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA BABY FOOD IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA PLANT BASED MEAT AND POULTRY ALTERNATIVES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA PLANT BASED MEAT AND POULTRY ALTERNATIVES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA TOBACCO IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA CBD PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA CEREALS, GRAINS & PULSES IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA CEREALS, GRAINS & PULSES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 NORTH AMERICA CEREALS AND GRAINS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA OIL SEEDS & PULSES IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA OILSEEDS & PULSES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA OIL SEEDS AND PULSES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 63 NORTH AMERICA NUTS IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA NUTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 NORTH AMERICA NUTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA BEVERAGES IN FOOD SAFETY TESTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 67 NORTH AMERICA BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 NORTH AMERICA NON-ALCOHOLIC BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 NORTH AMERICA PLANT-BASED MILK IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA ALCOHOLIC BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 NORTH AMERICA BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 72 NORTH AMERICA PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 73 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 74 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 75 NORTH AMERICA SYSTEM IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 NORTH AMERICA HYBRIDIZATION BASED IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 77 NORTH AMERICA CHROMATOGRAPHY BASED IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY TYPE OF TEST, 2021-2030 (USD MILLION)

TABLE 79 NORTH AMERICA FOOD SAFETY TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 NORTH AMERICA ALLERGEN TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 NORTH AMERICA PATHOGEN TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 NORTH AMERICA GMO TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 83 NORTH AMERICA MYCOTOXINS TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 NORTH AMERICA HEAVY METALS TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 NORTH AMERICA PESTICIDES TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 NORTH AMERICA FOOD SHELF LIFE TESTING, IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 87 NORTH AMERICA ORGANOLEPTIC AND APPEARANCE TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 88 NORTH AMERICA RANCIDITY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 89 NORTH AMERICA BROWNING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 NORTH AMERICA FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 91 NORTH AMERICA FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY PACKAGED FOOD CONDITION, 2021-2030 (USD MILLION)

TABLE 92 NORTH AMERICA FOOD AUTHENTICITY TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 93 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY SITE, 2021-2030 (USD MILLION)

TABLE 94 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 95 NORTH AMERICA FOOD IN SAFETY TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 96 NORTH AMERICA DAIRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 NORTH AMERICA CHEESE BASED DESSERT IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 NORTH AMERICA DAIRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 99 NORTH AMERICA CONFECTIONERY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 NORTH AMERICA CONFECTIONERY IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 101 NORTH AMERICA MEAT & POULTRY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 NORTH AMERICA CHICKEN IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 103 NORTH AMERICA PORK IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 104 NORTH AMERICA SEAFOOD IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 105 NORTH AMERICA BEEF IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 106 NORTH AMERICA LAMB IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 NORTH AMERICA OTHER IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 108 NORTH AMERICA MEAT AND POULTRY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 NORTH AMERICA HONEY IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 110 NORTH AMERICA SPICES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 111 NORTH AMERICA HERBAL EXTRACTS AND HERBS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 112 NORTH AMERICA TOBACCO IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 113 NORTH AMERICA BABY FOOD IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 114 NORTH AMERICA EDIBLE OIL IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 115 NORTH AMERICA EDIBLE OIL IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 116 NORTH AMERICA CBD PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 117 NORTH AMERICA PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 118 NORTH AMERICA PROCESSED FOODS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 119 NORTH AMERICA PROCESSED FOODS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 120 NORTH AMERICA CEREALS & GRAINS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 121 NORTH AMERICA CEREALS & GRAINS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 122 NORTH AMERICA OILSEED & PULSES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 123 NORTH AMERICA OILSEED & PULSES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 124 NORTH AMERICA NUTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 125 NORTH AMERICA NUTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 126 NORTH AMERICA BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 127 NORTH AMERICA ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 128 NORTH AMERICA NON-ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 129 NORTH AMERICA PLANT-BASED MILK IN NON-ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 NORTH AMERICA BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 131 U.S. FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 132 U.S. SYSTEM IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 133 U.S. HYBRIDIZATION BASED IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 134 U.S. CHROMATOGRAPHY BASED IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 135 U.S. FOOD SAFETY TESTING MARKET, BY TYPE OF TEST, 2021-2030 (USD MILLION)

TABLE 136 U.S. FOOD SAFETY TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 137 U.S. ALLERGEN TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 138 U.S. PATHOGEN TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 139 U.S. GMO TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 140 U.S. MYCOTOXINS TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 141 U.S. HEAVY METALS TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 142 U.S. PESTICIDES TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 143 U.S. FOOD SHELF LIFE TESTING, IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 144 U.S. ORGANOLEPTIC AND APPEARANCE TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 145 U.S. RANCIDITY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 146 U.S. BROWNING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 147 U.S. FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 148 U.S. FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY PACKAGED FOOD CONDITION, 2021-2030 (USD MILLION)

TABLE 149 U.S. FOOD AUTHENTICITY TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 150 U.S. FOOD SAFETY TESTING MARKET, BY SITE, 2021-2030 (USD MILLION)

TABLE 151 U.S. FOOD SAFETY TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 152 U.S. FOOD IN SAFETY TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 153 U.S. DAIRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 154 U.S. CHEESE BASED DESSERT IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 155 U.S. DAIRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 156 U.S. CONFECTIONERY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 157 U.S. CONFECTIONERY IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 158 U.S. MEAT & POULTRY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 159 U.S. CHICKEN IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 160 U.S. PORK IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 161 U.S. SEAFOOD IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 162 U.S. BEEF IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 163 U.S. LAMB IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 164 U.S. OTHER IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 165 U.S. MEAT AND POULTRY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 166 U.S. HONEY IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 167 U.S. SPICES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 168 U.S. HERBAL EXTRACTS AND HERBS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 169 U.S. TOBACCO IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 170 U.S. BABY FOOD IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 171 U.S. EDIBLE OIL IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 172 U.S. EDIBLE OIL IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 173 U.S. CBD PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 174 U.S. PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 175 U.S. PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 176 U.S. PROCESSED FOODS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 177 U.S. PROCESSED FOODS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 178 U.S. CEREALS & GRAINS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 179 U.S. CEREALS & GRAINS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 180 U.S. OILSEED & PULSES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 181 U.S. OILSEED & PULSES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 182 U.S. NUTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 183 U.S. NUTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 184 U.S. BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 185 U.S. ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 186 U.S. NON-ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 187 U.S. PLANT-BASED MILK IN NON-ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 188 U.S. BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 189 CANADA FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 190 CANADA SYSTEM IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 191 CANADA HYBRIDIZATION BASED IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 192 CANADA CHROMATOGRAPHY BASED IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 193 CANADA FOOD SAFETY TESTING MARKET, BY TYPE OF TEST, 2021-2030 (USD MILLION)

TABLE 194 CANADA FOOD SAFETY TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 195 CANADA ALLERGEN TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 196 CANADA PATHOGEN TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 197 CANADA GMO TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 198 CANADA MYCOTOXINS TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 199 CANADA HEAVY METALS TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 200 CANADA PESTICIDES TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 201 CANADA FOOD SHELF LIFE TESTING, IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 202 CANADA ORGANOLEPTIC AND APPEARANCE TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 203 CANADA RANCIDITY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 204 CANADA BROWNING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 205 CANADA FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 206 CANADA FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY PACKAGED FOOD CONDITION, 2021-2030 (USD MILLION)

TABLE 207 CANADA FOOD AUTHENTICITY TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 208 CANADA FOOD SAFETY TESTING MARKET, BY SITE, 2021-2030 (USD MILLION)

TABLE 209 CANADA FOOD SAFETY TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 210 CANADA FOOD IN SAFETY TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 211 CANADA DAIRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 212 CANADA CHEESE BASED DESSERT IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 213 CANADA DAIRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 214 CANADA CONFECTIONERY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 215 CANADA CONFECTIONERY IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 216 CANADA MEAT & POULTRY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 217 CANADA PORK IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 218 CANADA SEAFOOD IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 219 CANADA LAMB IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 220 CANADA OTHER IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 221 CANADA MEAT AND POULTRY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 222 CANADA HONEY IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 223 CANADA SPICES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 224 CANADA HERBAL EXTRACTS AND HERBS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 225 CANADA TOBACCO IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 226 CANADA BABY FOOD IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 227 CANADA EDIBLE OIL IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 228 CANADA CBD PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 229 CANADA PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 230 CANADA PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 231 CANADA PROCESSED FOODS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 232 CANADA PROCESSED FOODS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 233 CANADA CEREALS & GRAINS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 234 CANADA CEREALS & GRAINS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 235 CANADA OILSEED & PULSES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 236 CANADA OILSEED & PULSES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 237 CANADA NUTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 238 CANADA NUTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 239 CANADA BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 240 CANADA ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 241 CANADA NON-ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 242 CANADA PLANT-BASED MILK IN NON-ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 243 CANADA BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 244 MEXICO FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 245 MEXICO SYSTEM IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 246 MEXICO HYBRIDIZATION BASED IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 247 MEXICO CHROMATOGRAPHY BASED IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 248 MEXICO FOOD SAFETY TESTING MARKET, BY TYPE OF TEST, 2021-2030 (USD MILLION)

TABLE 249 MEXICO FOOD SAFETY TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 250 MEXICO ALLERGEN TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 251 MEXICO PATHOGEN TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 252 MEXICO GMO TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 253 MEXICO MYCOTOXINS TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 254 MEXICO HEAVY METALS TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 255 MEXICO PESTICIDES TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 256 MEXICO FOOD SHELF LIFE TESTING, IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 257 MEXICO ORGANOLEPTIC AND APPEARANCE TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 258 MEXICO RANCIDITY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 259 MEXICO BROWNING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 260 MEXICO FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 261 MEXICO FOOD SHELF LIFE TESTING IN FOOD SAFETY TESTING MARKET, BY PACKAGED FOOD CONDITION, 2021-2030 (USD MILLION)

TABLE 262 MEXICO FOOD AUTHENTICITY TESTING IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 263 MEXICO FOOD SAFETY TESTING MARKET, BY SITE, 2021-2030 (USD MILLION)

TABLE 264 MEXICO FOOD SAFETY TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 265 MEXICO FOOD IN SAFETY TESTING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 266 MEXICO DAIRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 267 MEXICO CHEESE BASED DESSERT IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 268 MEXICO DAIRY PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 269 NORTH AMERICA CONFECTIONERY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 270 MEXICO CONFECTIONERY IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 271 MEXICO MEAT & POULTRY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 272 MEXICO CHICKEN IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 273 MEXICO PORK IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 274 MEXICO SEAFOOD IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 275 MEXICO BEEF IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 276 MEXICO LAMB IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 277 MEXICO OTHER IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 278 MEXICO MEAT AND POULTRY IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 279 MEXICO HONEY IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 280 MEXICO SPICES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 281 MEXICO HERBAL EXTRACTS AND HERBS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 282 MEXICO TOBACCO IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 283 MEXICO BABY FOOD IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 284 MEXICO EDIBLE OIL IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 285 MEXICO EDIBLE OIL IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 286 MEXICO CBD PRODUCTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 287 MEXICO PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 288 MEXICO PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 289 MEXICO PROCESSED FOODS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 290 MEXICO PROCESSED FOODS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 291 MEXICO CEREALS & GRAINS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 292 MEXICO CEREALS & GRAINS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 293 MEXICO OILSEED & PULSES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 294 MEXICO OILSEED & PULSES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 295 MEXICO NUTS IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 296 MEXICO NUTS IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

TABLE 297 MEXICO BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 298 MEXICO ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 299 MEXICO NON-ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 300 MEXICO PLANT-BASED MILK IN NON-ALCOHOLIC IN FOOD SAFETY TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 301 MEXICO BEVERAGES IN FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA FOOD SAFETY TESTING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FOOD SAFETY TESTING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FOOD SAFETY TESTING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FOOD SAFETY TESTING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FOOD SAFETY TESTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FOOD SAFETY TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FOOD SAFETY TESTING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA FOOD SAFETY TESTING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA FOOD SAFETY TESTING MARKET: SEGMENTATION

FIGURE 10 STRINGENT RULES AND REGULATIONS REGARDING FOOD SAFETY BY DIFFERENT GOVERNMENT ORGANIZATIONS ARE EXPECTED TO DRIVE THE NORTH AMERICA FOOD SAFETY TESTING MARKET IN THE FORECAST PERIOD

FIGURE 11 TESTING TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FOOD SAFETY TESTING MARKET IN 2023 & 2030

FIGURE 12 SUPPLY CHAIN OF THE NORTH AMERICA FOOD SAFETY TESTING MARKET

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA FOOD SAFETY TESTING MARKET

FIGURE 14 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY TESTING TYPE, 2022

FIGURE 15 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY SITE, 2022

FIGURE 16 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY TYPE OF TEST, 2022

FIGURE 17 NORTH AMERICA FOOD SAFETY TESTING MARKET, BY APPLICATION, 2022

FIGURE 18 NORTH AMERICA MANGO MARKET: SNAPSHOT (2022)

FIGURE 19 NORTH AMERICA MANGO MARKET: BY COUNTRY (2022)

FIGURE 20 NORTH AMERICA MANGO MARKET: BY COUNTRY (2023 & 2030)

FIGURE 21 NORTH AMERICA MANGO MARKET: BY COUNTRY (2022 & 2030)

FIGURE 22 NORTH AMERICA MANGO MARKET: BY TESTING TYPE (2023 & 2030)

FIGURE 23 NORTH AMERICA FOOD SAFETY TESTING MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.