Marché des agents antiagglomérants alimentaires en Amérique du Nord, par type (composés de silicium, cellulose microcristalline, composés de calcium, composés de sodium, composés de magnésium et autres), source (agents synthétiques/artificiels et agents naturels), catégorie de produit (sans OGM et OGM), forme (poudre et liquide), application (confiserie, produits de boulangerie, produits laitiers, plats cuisinés, nutrition diététique, nutrition sportive , produits de viande transformée, boissons, soupes et sauces, assaisonnements et condiments, préparations pour nourrissons et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des agents anti-agglomérants alimentaires en Amérique du Nord

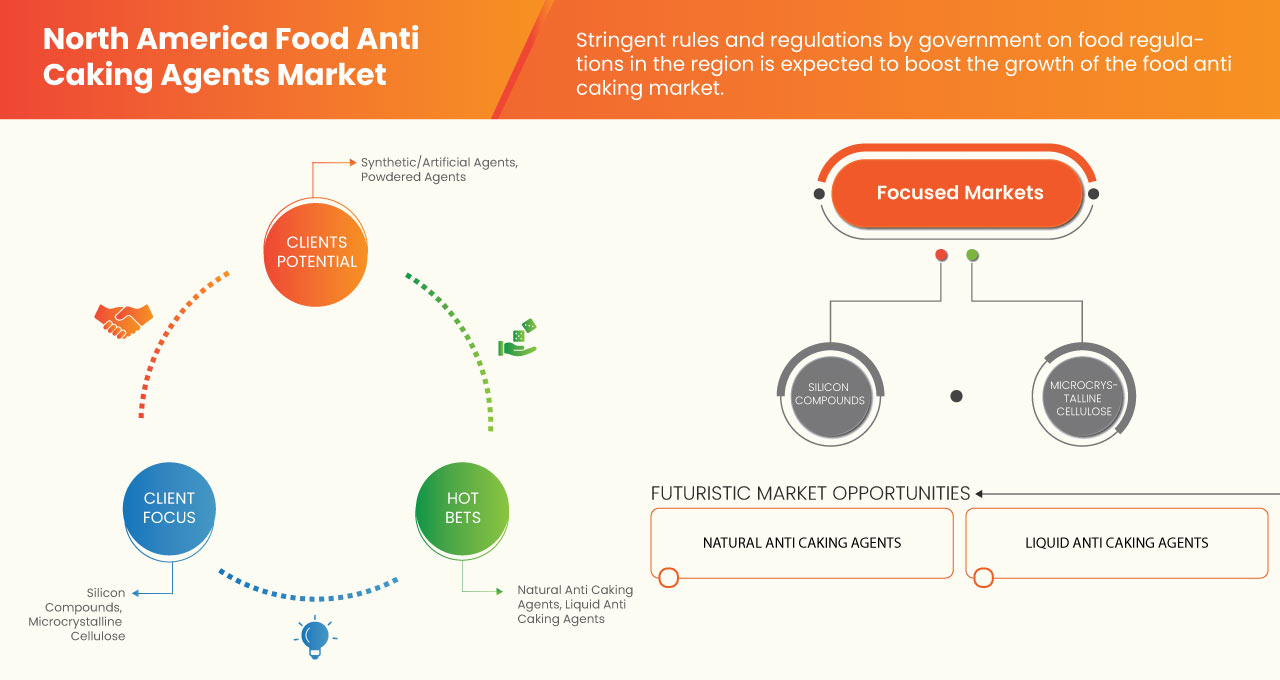

Les agents antiagglomérants sont des composés anhydres ajoutés aux aliments secs en petites quantités pour empêcher les particules de s'agglomérer et garder le produit sec et fluide. La demande croissante d'aliments prêts à consommer et de produits prêts à consommer entraînant une demande croissante d'agents antiagglomérants devrait stimuler le marché nord-américain des agents antiagglomérants alimentaires. En outre, une augmentation de la demande de produits alimentaires de meilleure qualité et une durée de conservation accrue devraient également stimuler la croissance du marché. Cependant, des règles et réglementations strictes sur les agents antiagglomérants peuvent entraver la croissance du marché. L'augmentation des innovations nanotechnologiques dans les agents antiagglomérants alimentaires peut servir d'opportunité pour le marché nord-américain. Les risques sanitaires croissants dus à l'utilisation excessive d'agents antiagglomérants peuvent constituer un sérieux défi pour la croissance du marché nord-américain des agents antiagglomérants alimentaires.

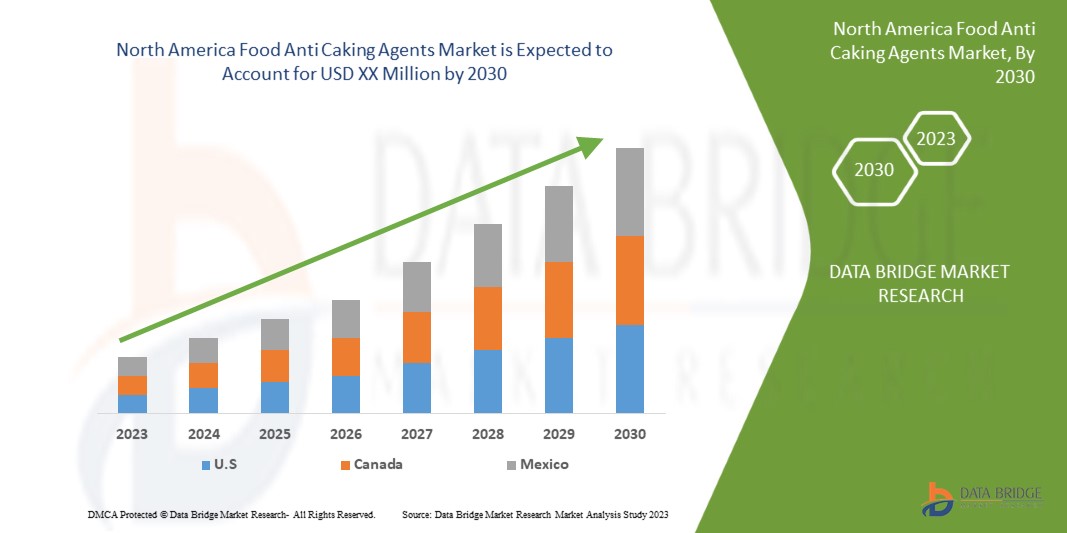

Data Bridge Market Research analyse que le marché nord-américain des agents antiagglomérants alimentaires connaîtra un TCAC de 5,3 % entre 2023 et 2030.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2019 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Type (composés de silicium, cellulose microcristalline , composés de calcium, composés de sodium, composés de magnésium et autres), source (agents synthétiques/artificiels et agents naturels), catégorie de produit (sans OGM et OGM), forme (poudre et liquide), application (confiserie, produits de boulangerie, produits laitiers, plats cuisinés, nutrition diététique, nutrition sportive, produits à base de viande transformée, boissons, soupes et sauces, assaisonnements et condiments, préparations pour nourrissons et autres) |

|

Pays couverts |

États-Unis, Canada, Mexique |

|

Acteurs du marché couverts |

Evonik Industries AG, PPG Industries, In, PQ, WR Grace & Co.-Conn, Solvay, Huber Engineered Materials, REMEDY LABS, Sigachi Industries, Konoshima Chemical Co., Ltd, RanQ, Fabricant de cellulose-Ankit Pulps, Ltd, MUBY CHEMICALS, JELU-WERK J. Ehrler GmbH & Co. KG, Jinsha Precipitated Silica Manufacturing Co., Ltd, Astrra Chemicals, SBF Pharma, Foodchem International Corporation |

Définition du marché

Les antiagglomérants sont des additifs utilisés dans les matériaux en poudre ou en granulés tels que le sel de table ou les confiseries pour empêcher la formation de grumeaux (agglomération) et pour améliorer l'emballage, le transport, la fluidité et la consommation. Les mécanismes d'agglomération varient en fonction du matériau. Les solides cristallins s'agglutinent fréquemment en raison de la formation d'un pont liquide et de la fusion ultérieure de microcristaux. Les transitions vitreuses et les changements de viscosité peuvent provoquer l'agglomération des matériaux amorphes. Les transitions de phase polymorphes peuvent également provoquer l'agglomération. Certains antiagglomérants absorbent l'excès d'humidité ou enrobent les particules d'un revêtement hydrofuge. Le silicate de calcium (CaSiO3), un antiagglomérant courant, absorbe l'eau et l'huile lorsqu'il est ajouté à des produits tels que le sel de table.

Dynamique du marché des agents anti-agglomérants alimentaires en Amérique du Nord

Cette section traite de la compréhension des moteurs, des opportunités, des défis et des contraintes du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

-

Augmentation de la demande de plats préparés et de produits alimentaires prêts à consommer

La demande croissante d’aliments prêts à consommer, tels que les aliments emballés et les aliments prêts à consommer, est due à l’augmentation de la population active, aux améliorations économiques et aux horaires trop chargés et stressants. Ces aliments, qui comprennent des produits de longue conservation, des produits réfrigérés ou surgelés, des mélanges secs sans préparation et autres, sont conçus pour être faciles à consommer. L’industrie des aliments et des boissons connaît une demande accrue en raison de l’urbanisation croissante, de l’élévation du niveau de vie et des changements dans les préférences alimentaires et le mode de vie. En outre, le marché des agents anti-agglomérants devrait connaître une croissance significative parallèlement à l’augmentation de la demande de cuisine traditionnelle, car ces plats contiennent une variété d’épaississants tels que la fécule de maïs, l’arrow-root, le manioc, l’agar-agar, la gélatine et les œufs.

Les agents anti-agglomérants peuvent être ajoutés aux produits alimentaires pour améliorer la viscosité, la texture, la densité, la stabilité et d'autres propriétés. De plus, l'ingrédient principal de l'industrie de la boulangerie est un agent anti-agglomérant. Les ingrédients des produits de boulangerie tels que les biscuits (sucre, farine, levure chimique, etc.) finiraient par se solidifier sous forme de blocs de craie si des produits chimiques anti-agglomérants n'étaient pas utilisés. Ces substances sèches absorbent progressivement l'humidité de l'air au fil du temps. À cause de l'eau, les particules peuvent se lier entre elles.

-

Augmentation de la demande de produits alimentaires de meilleure qualité et à durée de conservation prolongée

Les antiagglomérants alimentaires sont des conservateurs présents dans les aliments en poudre ou en granulés qui les empêchent de s'écouler parfaitement hors de l'emballage, empêchant la poudre ou les granulés de s'agglutiner ou de coller entre eux. Les confiseries peuvent contenir des antiagglomérants pour éviter la formation de grumeaux (agglomération) et faciliter l'emballage. La consommation accrue d'ingrédients alimentaires tels que la levure chimique, le lait et la crème en poudre, les préparations pour gâteaux et la poudre pour soupe instantanée devrait avoir un impact positif sur le développement des antiagglomérants alimentaires en raison de leur fonction essentielle de maintien de la capacité d'écoulement, de la texture et des caractéristiques organoleptiques supplémentaires, ainsi que d'une longue durée de conservation.

L'eau, l'alcool et l'éthanol sont tous des solvants organiques dans lesquels les composés anti-agglomérants sont solubles. Ils agissent soit en absorbant l'excès d'humidité, soit en recouvrant les particules d'un revêtement hydrofuge qui prolonge la durée de conservation du produit.

Opportunité

-

Augmentation des innovations nanotechnologiques dans les agents anti-agglomérants alimentaires

La nanotechnologie alimentaire est considérée comme une frontière technologique pour l'industrie alimentaire du XXIe siècle. La nanotechnologie est largement utilisée dans la transformation des aliments, la traçabilité des emballages et la conservation. En outre, les progrès en matière de nano-détection et d'ingrédients nanostructurés sont très prometteurs pour l'industrie alimentaire. Les récentes avancées technologiques ont transformé l'utilisation des nanoparticules (NP) dans l'industrie alimentaire. Ces NP sont reconnues pour avoir des propriétés distinctes telles que des agents anti-agglomérants, antibactériens, biothérapeutiques et une prolongation de la durée de conservation, qui devraient stimuler la croissance du marché.

La nanotechnologie dans la transformation des aliments peut contribuer à améliorer les goûts, les textures et les sensations en bouche grâce au traitement à l'échelle nanométrique des aliments ou à améliorer l'absorption, l'assimilation et la biodisponibilité des nutriments grâce à des formulations à l'échelle nanométrique. Plusieurs additifs alimentaires sont constitués de nanoparticules ou contiennent une fraction nanométrique. La silice amorphe synthétique (SAS) est utilisée dans de nombreux aliments en poudre comme agent d'écoulement et anti-agglomérant et pour le revêtement de surface des matériaux d'emballage. Elle est constituée d'agrégats de particules primaires de taille nanométrique.

Retenue/Défi

- Règles et réglementations strictes sur les agents anti-agglomérants

Les gouvernements du monde entier édictent des règles et des réglementations strictes concernant l'utilisation et la consommation d'antiagglomérants dans l'industrie alimentaire. Ces réglementations garantissent qu'aucun effet nocif ou toxique des antiagglomérants alimentaires ne soit présent dans les aliments. Le gouvernement a établi des réglementations spécifiques concernant le type et la quantité d'antiagglomérants alimentaires. Le règlement de 2011 sur la sécurité alimentaire et les normes (normes relatives aux produits alimentaires et additifs alimentaires) stipule que les antiagglomérants ne peuvent pas être utilisés à moins que la réglementation ne l'autorise spécifiquement.

Impact post-COVID-19 sur le marché nord-américain des agents anti-agglomérants alimentaires

Le COVID-19 a considérablement affecté le marché. En raison du confinement, la fabrication et la production de nombreuses petites et grandes entreprises ont été interrompues, la logistique et la chaîne d'approvisionnement ont été perturbées et la demande d'agents anti-agglomérants a également diminué, ce qui a influencé le marché. En raison du changement de nombreux mandats et réglementations, les fabricants conçoivent et lancent de nouveaux produits, ce qui pourrait contribuer à stimuler la croissance du marché.

Développement récent

- En juillet 2022, WR Grace & Co. a annoncé l'agrandissement de son site de développement et de fabrication sous contrat dans le sud du Michigan. L'agrandissement comprend un train de réacteurs polyvalents de 4 000 gallons et une centrifugeuse HASTELLOY, qui amélioreront la capacité commerciale du site conforme aux BPF.

Portée du marché des agents anti-agglomérants en Amérique du Nord

Le marché nord-américain des agents anti-agglomérants alimentaires est segmenté en segments notables en fonction du type, de la source, de la catégorie de produit, de la forme et de l'application. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Taper

- Composés de silicium

- Cellulose microcristalline

- Composés de calcium

- Composés de sodium

- Composés de magnésium

- Autres

En fonction du type, le marché nord-américain des agents antiagglomérants alimentaires est segmenté en composés de silicium, cellulose microcristalline, composés de calcium, composés de sodium, composés de magnésium et autres.

Source

- Agents synthétiques/artificiels

- Agents naturels

En fonction de la source, le marché nord-américain des agents antiagglomérants alimentaires est segmenté en agents synthétiques/artificiels et agents naturels.

Catégorie de produit

- Sans OGM

- OGM

En fonction de la catégorie de produits, le marché nord-américain des agents antiagglomérants alimentaires est segmenté en non-OGM et OGM.

Formulaire

- Poudre

- Liquide

En fonction de la forme, le marché nord-américain des agents antiagglomérants alimentaires est segmenté en poudre et liquide.

Application

- Confiserie

- Produits de boulangerie

- Produits laitiers

- Plats cuisinés

- Nutrition diététique

- Nutrition sportive

- Produits de viande transformés

- Boissons

- Soupes et sauces

- Assaisonnements et condiments

- Préparations pour nourrissons

- Autres

En fonction des applications, le marché nord-américain des agents antiagglomérants alimentaires est segmenté en confiseries, produits de boulangerie, produits laitiers, aliments de commodité, nutrition diététique, nutrition sportive, produits de viande transformée, boissons, soupes et sauces, assaisonnements et condiments, préparations pour nourrissons et autres.

Analyse/perspectives régionales du marché des agents anti-agglomérants en Amérique du Nord

Les agents antiagglomérants d’Amérique du Nord sont analysés et des informations sur la taille du marché et les tendances sont fournies sur la base des références ci-dessus.

Les pays couverts par le rapport sur le marché des agents antiagglomérants alimentaires en Amérique du Nord sont les États-Unis, le Mexique et le Canada.

Les États-Unis devraient dominer le marché nord-américain des agents anti-agglomérants alimentaires en termes de part de marché et de chiffre d'affaires. Ils devraient maintenir leur domination au cours de la période de prévision en raison de la montée en puissance des agents anti-agglomérants alimentaires dans diverses industries alimentaires et des boissons.

La section régionale du rapport présente également les facteurs individuels ayant un impact sur le marché et les changements de réglementation qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, tels que les ventes de véhicules neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays.

Analyse du paysage concurrentiel et des parts de marché des agents anti-agglomérants alimentaires en Amérique du Nord

Le paysage concurrentiel du marché des agents anti-agglomérants alimentaires en Amérique du Nord fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que l'orientation de l'entreprise sur le marché des agents anti-agglomérants alimentaires en Amérique du Nord.

Français Certains des principaux acteurs opérant sur le marché des agents antiagglomérants alimentaires en Amérique du Nord sont Evonik Industries AG, PPG Industries, In, PQ, WR Grace & Co.-Conn, Solvay, Huber Engineered Materials, REMEDY LABS, Sigachi Industries, Konoshima Chemical Co., Ltd, Cellulose Manufacturer-Ankit Pulps, Ltd, MUBY CHEMICALS, JELU-WERK J. Ehrler GmbH & Co. KG, Jinsha Precipitated Silica Manufacturing Co., Ltd, Astrra Chemicals, SBF Pharma, Foodchem International Corporation et RanQ, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE ANALYSIS FOR THE NORTH AMERICA ANTI CAKING AGENTS MARKET

4.2 VALUE CHAIN ANALYSIS: NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET

4.3 FACTORS INFLUENCING PURCHASE DECISION OF END-USER

4.4 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.6 OTHER BENEFITS OF ANTI CAKING AGENTS

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 RAW MATERIAL PROCUREMENT & MANUFACTURING

4.7.2 DISTRIBUTION

4.7.3 END USERS

4.8 TECHNOLOGICAL ADVANCEMENT IN THE NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET

4.9 TRADE ANALYSIS

4.1 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: RAW MATERIAL SOURCING ANALYSIS

4.10.1 ABSORBENT POWDER

4.10.2 BASE LIQUID

4.10.3 FLOW AGENTS

5 IMPACT OF ECONOMIC SLOWDOWN ON THE MARKET –NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET

6 PRICING INDEX (PRICE AT FOB & PRICES AT B2B)

7 PRODUCTION CAPACITY OF KEY MANUFACTURERS

8 BRAND OUTLOOK

8.1 BRAND COMPARATIVE ANALYSIS ON NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET

8.2 PRODUCT VS BRAND OVERVIEW

9 REGULATORY GUIDELINES AND FRAMEWORK

10 MARKET OVERVIEW

10.1 DRIVERS

10.1.1 RISING DEMAND FOR CONVENIENCE FOOD AND READY-TO-EAT FOOD ITEMS

10.1.2 RISE IN DEMAND FOR FOOD PRODUCTS WITH BETTER QUALITY AND INCREASED SHELF LIFE

10.1.3 INCREASE IN DEMAND FOR ANTI-CAKING AGENTS IN SPICES AND CONDIMENTS

10.1.4 MULTIFUNCTIONAL CHARACTERISTICS OF ANTI-CAKING AGENTS

10.2 RESTRAINTS

10.2.1 STRINGENT RULES AND REGULATIONS ON ANTI-CAKING AGENTS

10.2.2 MANUFACTURERS LIMITING USAGE OF ADDITIVES FALLING UNDER THE E-NUMBER CATEGORY

10.3 OPPORTUNITIES

10.3.1 INCREASING NANO-TECHNOLOGICAL INNOVATIONS IN FOOD ANTI-CAKING AGENTS

10.3.2 MANUFACTURERS LAUNCHING NEW AND INNOVATIVE ANTI-CAKING AGENTS

10.3.3 RISING DEMAND FOR ORGANIC ANTI-CAKING AGENTS

10.4 CHALLENGES

10.4.1 INCREASING HEALTH HAZARDS DUE TO EXCESSIVE USE OF ANTI-CAKING AGENTS

10.4.2 IMPACT OF ANTI-CAKING AGENTS ON NUTRITIVE VALUE OF FOOD ITEMS

11 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY TYPE

11.1 OVERVIEW

11.2 SILICON COMPOUNDS

11.2.1 SILICON DIOXIDE

11.2.2 CALCIUM SILICATE

11.2.3 ALUMINUM SILICATE

11.2.4 SODIUM ALUMINOSILICATE

11.2.5 POTASSIUM ALUMINUM SILICATE

11.2.6 CALCIUM ALUMINOSILICATE

11.2.7 POLYDIMETHYLSILOXANE

11.3 MICROCRYSTALLINE CELLULOSE

11.3.1 POWDERED CELLULOSE

11.3.2 TALCUM POWDER

11.4 CALCIUM COMPOUNDS

11.4.1 CALCIUM CARBONATES

11.4.2 TRI CALCIUM PHOSPHATE

11.4.3 CALCIUM FERROCYANIDE

11.4.4 CALCIUM PHOSPHATE

11.5 SODIUM COMPOUNDS

11.5.1 SODIUM BICARBONATE

11.5.2 SODIUM FERROCYANIDE

11.6 MAGNESIUM COMPOUNDS

11.6.1 MAGNESIUM CARBONATE

11.6.2 MAGNESIUM STEARATE

11.6.3 MAGNESIUM OXIDE

11.6.4 MAGNESIUM TRISILICATE

11.6.5 MAGNESIUM HYDROXIDE

11.7 OTHERS

11.7.1 ZEOLITES

11.7.2 BENTONITE

11.7.3 STEARIC ACID

11.7.4 OTHERS

12 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY SOURCE

12.1 OVERVIEW

12.2 SYNTHETIC/ARTIFICIAL AGENTS

12.3 NATURAL AGENTS

13 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY PRODUCT CATEGORY

13.1 OVERVIEW

13.2 NON GMO

13.3 GMO

14 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY FORM

14.1 OVERVIEW

14.2 POWDER

14.3 LIQUID

15 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY APPLICATION

15.1 OVERVIEW

15.2 CONFECTIONARY

15.2.1 CONFECTIONARY, BY TYPE

15.2.1.1 CHOCOLATE

15.2.1.2 HARD & SOFT CANDY

15.2.1.3 TOFFEES

15.2.1.4 CARAMEL & NOUGATS

15.2.1.5 GUMS& JELLY

15.2.1.6 CREAM FILLINGS

15.2.1.7 OTHERS

15.3 BAKERY PRODUCTS

15.3.1 BAKERY PRODUCTS, BY TYPE

15.3.1.1 BREAD AND ROLLS

15.3.1.2 CAKES AND PASTRIES

15.3.1.3 BISCUITS

15.3.1.4 MUFFINS

15.3.1.5 COOKIES

15.3.1.6 DOUGHNUTS

15.3.1.7 OTHERS

15.4 DAIRY PRODUCTS

15.4.1 DAIRY PRODUCTS, BY TYPE

15.4.1.1 CHEESE

15.4.1.1.1 SHREDDED CHEESE

15.4.1.1.2 CUBED CHEESE

15.4.1.1.3 HIGH MOISTURE CRUMBLED CHEESE

15.4.1.2 ICE-CREAM

15.4.1.2.1 IMPULSE ICE-CREAM

15.4.1.2.2 TAKE HOME ICE-CREAM

15.4.1.3 MILK POWDER

15.4.1.4 DAIRY SPREAD

15.4.1.5 YOGURT

15.4.1.6 OTHERS

15.5 CONVENIENCE FOOD

15.5.1 CONVENIENCE FOOD, BY TYPE

15.5.1.1 PIZZA

15.5.1.2 READY TO EAT PRODUCTS

15.5.1.3 PASTA

15.5.1.4 NOODLES

15.5.1.5 SOUPS & SAUCES

15.5.1.6 SEASONINGS & DRESSINGS

15.5.1.7 NUTS

15.5.1.8 SEEDS

15.5.1.9 PREMIXES

15.5.1.10 TRAIL MIXES

15.5.1.11 OTHERS

15.6 DIETARY NUTRITION

15.7 SPORT NUTRITION

15.8 PROCESSED MEAT PRODUCTS

15.8.1 PROCESSED MEAT, BY TYPE

15.8.1.1 BEEF

15.8.1.2 PORK

15.8.1.3 POULTRY

15.8.1.4 SWINE

15.8.1.5 MUTTON

15.8.1.6 OTHERS

15.9 BEVERAGES

15.9.1 BEVERAGES, BY TYPE

15.9.1.1 RTD BEVERAGES

15.1 SOUPS AND SAUCES

15.11 SEASONINGS AND CONDIMENTS

15.12 INFANT FORMULA

15.13 OTHERS

15.13.1 OTHERS, BY TYPE

15.13.1.1 SPICES POWDERED

15.13.1.2 HERBS EXTRACTS POWDERED

16 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY REGION

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

17 COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 EVONIK INDUSTRIES AG

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENTS

19.2 PPG INDUSTRIES, INC.

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENT

19.3 PQ

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENTS

19.4 W.R. GRACE & CO.-CONN

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 ALLIED BLENDING

19.5.1 COMPANY SNAPSHOT

19.5.2 COMPANY SHARE ANALYSIS

19.5.3 PRODUCT PORTFOLIO

19.5.4 RECENT DEVELOPMENT

19.6 ANMOL CHEMICALS

19.6.1 COMPANY SNAPSHOT

19.6.2 PRODUCT PORTFOLIO

19.6.3 RECENT DEVELOPMENT

19.7 ASTTRA CHEMICALS

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENT

19.8 BIMAL PHARMA PVT. LTD.

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENT

19.9 CELLULOSE MANUFACTURER- ANKIT PULPS

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENT

19.1 FOODCHEM INTERNATIONAL CORPORATION

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENT

19.11 FUJI CHEMICAL INDUSTRIES CO., LTD.

19.11.1 COMPANY SNAPSHOT

19.11.2 PRODUCT PORTFOLIO

19.11.3 RECENT DEVELOPMENT

19.12 HEFEI TNJ CHEMICAL INDUSTRY CO., LTD.

19.12.1 COMPANY SNAPSHOT

19.12.2 PRODUCT PORTFOLIO

19.12.3 RECENT DEVELOPMENT

19.13 HUBER ENGINEERED MATERIALS

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 RECENT DEVELOPMENTS

19.14 JELU-WERK J. EHRLER GMBH & CO. KG

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENT

19.15 JINSHA PRECIPITATED SILICA MANUFACTURING CO., LTD.

19.15.1 COMPANY SNAPSHOT

19.15.2 PRODUCT PORTFOLIO

19.15.3 RECENT DEVELOPMENT

19.16 KONOSHIMA CHEMICAL CO., LTD.

19.16.1 COMPANY SNAPSHOT

19.16.2 REVENUE ANALYSIS

19.16.3 PRODUCT PORTFOLIO

19.16.4 RECENT DEVELOPMENT

19.17 MUBY CHEMICALS

19.17.1 COMPANY SNAPSHOT

19.17.2 PRODUCT PORTFOLIO

19.17.3 RECENT DEVELOPMENT

19.18 NB ENTREPRENEURS

19.18.1 COMPANY SNAPSHOT

19.18.2 PRODUCT PORTFOLIO

19.18.3 RECENT DEVELOPMENT

19.19 RANQ

19.19.1 COMPANY SNAPSHOT

19.19.2 PRODUCT PORTFOLIO

19.19.3 RECENT DEVELOPMENT

19.2 REGOJ CHEMICAL INDUSTRIES

19.20.1 COMPANY SNAPSHOT

19.20.2 PRODUCT PORTFOLIO

19.20.3 RECENT DEVELOPMENT

19.21 REMEDY LABS GROUP

19.21.1 COMPANY SNAPSHOT

19.21.2 PRODUCT PORTFOLIO

19.21.3 RECENT DEVELOPMENT

19.22 SAPTHAGIRI AROMATICS

19.22.1 COMPANY SNAPSHOT

19.22.2 PRODUCT PORTFOLIO

19.22.3 RECENT DEVELOPMENT

19.23 SBF PHARMA

19.23.1 COMPANY SNAPSHOT

19.23.2 PRODUCT PORTFOLIO

19.23.3 RECENT DEVELOPMENT

19.24 SIGACHI INDUSTRIES

19.24.1 COMPANY SNAPSHOT

19.24.2 REVENUE ANALYSIS

19.24.3 PRODUCT PORTFOLIO

19.24.4 RECENT DEVELOPMENT

19.25 SINTHESIS GREENCHEM PVT. LTD.

19.25.1 COMPANY SNAPSHOT

19.25.2 PRODUCT PORTFOLIO

19.25.3 RECENT DEVELOPMENT

19.26 SOLVAY

19.26.1 COMPANY SNAPSHOT

19.26.2 REVENUE ANALYSIS

19.26.3 PRODUCT PORTFOLIO

19.26.4 RECENT DEVELOPMENTS

20 QUESTIONNAIRE

21 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA IMPORTERS OF SILICON DIOXIDE HS CODE OF PRODUCT: 28112 (UNIT US DOLLAR THOUSAND)

TABLE 2 NORTH AMERICA EXPORTERS OF SILICON DI OXIDE, HS CODE OF PRODUCT: 28112 (UNIT: US DOLLAR THOUSAND)

TABLE 3 NORTH AMERICA IMPORTERS OF CALCIUM CARBONATE, HS CODE OF PRODUCT: 283650 (UNIT US DOLLAR THOUSAND)

TABLE 4 NORTH AMERICA EXPORTERS OF CALCIUM CARBONATE, HS CODE OF PRODUCT: 283650 (UNIT US DOLLAR THOUSAND)

TABLE 5 NORTH AMERICA IMPORTERS OF CALCIUM PHOSPHATE, HS CODE OF PRODUCT: 283526 (UNIT US DOLLAR THOUSAND)

TABLE 6 NORTH AMERICA EXPORTERS OF CALCIUM PHOSPHATE, HS CODE OF PRODUCT: 283526 (UNIT US DOLLAR THOUSAND)

TABLE 7 NORTH AMERICA IMPORTERS OF SODIUM BICARBONATE, HS CODE OF PRODUCT: 283630 (UNIT US DOLLAR THOUSAND)

TABLE 8 NORTH AMERICA EXPORTERS OF SODIUM BICARBONATE, HS CODE OF PRODUCT: 283630 (UNIT US DOLLAR THOUSAND)

TABLE 9 FREE ON BOARD (FOB) OF NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET

TABLE 10 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 12 NORTH AMERICA SILICON COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA SILICON COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TONS)

TABLE 14 NORTH AMERICA SILICON COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA SILICON COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 16 NORTH AMERICA MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 18 NORTH AMERICA MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 20 NORTH AMERICA CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 22 NORTH AMERICA CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 24 NORTH AMERICA SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 26 NORTH AMERICA SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 28 NORTH AMERICA MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 30 NORTH AMERICA MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 32 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 34 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY SOURCE, 2021-2030 (TON)

TABLE 37 NORTH AMERICA SYNTHETIC/ARTIFICIAL AGENTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA SYNTHETIC/ARTIFICIAL AGENTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 39 NORTH AMERICA NATURAL AGENTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA NATURAL AGENTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 41 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY PRODUCT CATEGORY, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY PRODUCT CATEGORY, 2021-2030 (TON)

TABLE 43 NORTH AMERICA NON-GMO IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA NON-GMO IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 45 NORTH AMERICA GMO IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA GMO IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 47 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY FORM, 2021-2030 (TON)

TABLE 49 NORTH AMERICA POWDER IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA POWDER IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 51 NORTH AMERICA LIQUID IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA LIQUID IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 53 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY APPLICATION, 2021-2030 (TON)

TABLE 55 NORTH AMERICA CONFECTIONERY IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA CONFECTIONERY IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 57 NORTH AMERICA CONFECTIONARY IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA CONFECTIONARY IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 59 NORTH AMERICA BAKERY PRODUCTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA BAKERY PRODUCTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 61 NORTH AMERICA BAKERY PRODUCTS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA BAKERY PRODUCTS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 63 NORTH AMERICA DAIRY PRODUCTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA DAIRY PRODUCTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 65 NORTH AMERICA DAIRY PRODUCTS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA DAIRY PRODUCTS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 67 NORTH AMERICA CHEESE IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 NORTH AMERICA CHEESE IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 69 NORTH AMERICA ICE-CREAM IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA ICE-CREAM IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 71 NORTH AMERICA CONVENIENCE FOOD IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 72 NORTH AMERICA CONVENIENCE FOOD IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 73 NORTH AMERICA CONVENIENCE FOOD IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 74 NORTH AMERICA CONVENIENCE FOOD IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 75 NORTH AMERICA DIETARY NUTRITION IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 76 NORTH AMERICA DIETARY NUTRITION IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 77 NORTH AMERICA SPORT NUTRITION IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 78 NORTH AMERICA SPORT NUTRITION IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 79 NORTH AMERICA PROCESSED MEAT PRODUCTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 80 NORTH AMERICA PROCESSED MEAT PRODUCTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 81 NORTH AMERICA PROCESSED MEAT IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 NORTH AMERICA PROCESSED MEAT IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 83 NORTH AMERICA BEVERAGES IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 84 NORTH AMERICA BEVERAGES IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 85 NORTH AMERICA BEVERAGES IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 NORTH AMERICA BEVERAGES IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 87 NORTH AMERICA SOUPS & SAUCES IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 88 NORTH AMERICA SOUPS & SAUCES IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 89 NORTH AMERICA SEASONING & CONDIMENTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 90 NORTH AMERICA SEASONING & CONDIMENTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 91 NORTH AMERICA INFANT FORMULA IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 92 NORTH AMERICA INFANT FORMULA IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 93 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 94 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 95 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 97 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 98 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY COUNTRY, 2021-2030 (TON)

TABLE 99 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY COUNTRY, 2021-2030 (ASP)

TABLE 100 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 101 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 102 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 103 NORTH AMERICA CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 104 NORTH AMERICA CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 105 NORTH AMERICA CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 106 NORTH AMERICA SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 NORTH AMERICA SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 108 NORTH AMERICA MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 109 NORTH AMERICA MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 110 NORTH AMERICA MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 111 NORTH AMERICA SILICON COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 112 NORTH AMERICA SILICON COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 113 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 114 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 115 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 116 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (TON)

TABLE 117 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (ASP)

TABLE 118 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (USD MILLION)

TABLE 119 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (TON)

TABLE 120 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (ASP)

TABLE 121 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 122 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (TON)

TABLE 123 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (ASP)

TABLE 124 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 125 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (TON)

TABLE 126 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 127 NORTH AMERICA DAIRY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 128 NORTH AMERICA DAIRY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 129 NORTH AMERICA CHEESE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 NORTH AMERICA CHEESE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 131 NORTH AMERICA ICE-CREAM IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 132 NORTH AMERICA ICE-CREAM IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 133 NORTH AMERICA BAKERY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 134 NORTH AMERICA BAKERY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 135 NORTH AMERICA CONVENIENCE FOOD IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 136 NORTH AMERICA CONVENIENCE FOOD IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 137 NORTH AMERICA PROCESSED MEAT PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 138 NORTH AMERICA PROCESSED MEAT PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 139 NORTH AMERICA CONFECTIONERY IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 140 NORTH AMERICA CONFECTIONERY IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 141 NORTH AMERICA BEVERAGE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 142 NORTH AMERICA BEVERAGE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 143 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 144 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 145 U.S. FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 146 U.S. FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 147 U.S. FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 148 U.S. CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 149 U.S. CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 150 U.S. CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 151 U.S. SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 152 U.S. SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 153 U.S. MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 154 U.S. MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 155 U.S. MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 156 U.S. MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 157 U.S. SILICON COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 158 U.S. SILICON COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 159 U.S. OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 160 U.S. OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 161 U.S. FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 162 U.S. FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (TON)

TABLE 163 U.S. FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (ASP)

TABLE 164 U.S. FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (USD MILLION)

TABLE 165 U.S. FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (TON)

TABLE 166 U.S. FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (ASP)

TABLE 167 U.S. FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 168 U.S. FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (TON)

TABLE 169 U.S. FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (ASP)

TABLE 170 U.S. FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 171 U.S. FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (TON)

TABLE 172 U.S. FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 173 U.S. DAIRY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 174 U.S. DAIRY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 175 U.S. CHEESE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 176 U.S. CHEESE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 177 U.S. ICE-CREAM IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 178 U.S. ICE-CREAM IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 179 U.S. BAKERY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 180 U.S. BAKERY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 181 U.S. CONVENIENCE FOOD IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 182 U.S. CONVENIENCE FOOD IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 183 U.S. PROCESSED MEAT PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 184 U.S. PROCESSED MEAT PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 185 U.S. CONFECTIONERY IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 186 U.S. CONFECTIONERY IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 187 U.S. BEVERAGE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 188 U.S. BEVERAGE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 189 U.S. OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 190 U.S. OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 191 CANADA FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 192 CANADA FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 193 CANADA FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 194 CANADA CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 195 CANADA CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 196 CANADA CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 197 CANADA SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 198 CANADA SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 199 CANADA MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 200 CANADA MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 201 CANADA MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 202 CANADA MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 203 CANADA SILICON COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 204 CANADA SILICON COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 205 CANADA OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 206 CANADA OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 207 CANADA FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 208 CANADA FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (TON)

TABLE 209 CANADA FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (ASP)

TABLE 210 CANADA FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (USD MILLION)

TABLE 211 CANADA FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (TON)

TABLE 212 CANADA FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (ASP)

TABLE 213 CANADA FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 214 CANADA FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (TON)

TABLE 215 CANADA FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (ASP)

TABLE 216 CANADA FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 217 CANADA FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (TON)

TABLE 218 CANADA FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 219 CANADA DAIRY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 220 CANADA DAIRY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 221 CANADA CHEESE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 222 CANADA CHEESE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 223 CANADA ICE-CREAM IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 224 CANADA ICE-CREAM IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 225 CANADA BAKERY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 226 CANADA BAKERY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 227 CANADA CONVENIENCE FOOD IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 228 CANADA CONVENIENCE FOOD IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 229 CANADA PROCESSED MEAT PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 230 CANADA PROCESSED MEAT PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 231 CANADA CONFECTIONERY IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 232 CANADA CONFECTIONERY IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 233 CANADA BEVERAGE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 234 CANADA BEVERAGE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 235 CANADA OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 236 CANADA OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 237 MEXICO FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 238 MEXICO FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 239 MEXICO FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 240 MEXICO CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 241 MEXICO CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 242 MEXICO CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 243 MEXICO SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 244 MEXICO SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 245 MEXICO MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 246 MEXICO MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 247 MEXICO MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 248 MEXICO MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 249 MEXICO SILICON COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 250 MEXICO SILICON COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 251 MEXICO OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 252 MEXICO OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 253 MEXICO FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 254 MEXICO FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (TON)

TABLE 255 MEXICO FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (ASP)

TABLE 256 MEXICO FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (USD MILLION)

TABLE 257 MEXICO FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (TON)

TABLE 258 MEXICO FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (ASP)

TABLE 259 MEXICO FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 260 MEXICO FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (TON)

TABLE 261 MEXICO FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (ASP)

TABLE 262 MEXICO FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 263 MEXICO FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (TON)

TABLE 264 MEXICO FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 265 MEXICO DAIRY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 266 MEXICO DAIRY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 267 MEXICO CHEESE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 268 MEXICO CHEESE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 269 MEXICO ICE-CREAM IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 270 MEXICO ICE-CREAM IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 271 MEXICO BAKERY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 272 MEXICO BAKERY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 273 MEXICO CONVENIENCE FOOD IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 274 MEXICO CONVENIENCE FOOD IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 275 MEXICO PROCESSED MEAT PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 276 MEXICO PROCESSED MEAT PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 277 MEXICO CONFECTIONERY IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 278 MEXICO CONFECTIONERY IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 279 MEXICO BEVERAGE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 280 MEXICO BEVERAGE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 281 MEXICO OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 282 MEXICO OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

Liste des figures

FIGURE 1 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: SEGMENTATION

FIGURE 10 THE RISE IN DEMAND FOR CONVENIENCE FOOD PRODUCTS ACROSS THE GLOBE, LEADING TO THE RISE IN THE DEMAND FOR FOOD ANTI CAKING AGENTS, IS EXPECTED TO DRIVE THE NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 THE SILICON COMPOUNDS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET IN 2023 AND 2030

FIGURE 12 VALUE CHAIN ANALYSIS OF THE NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET

FIGURE 13 SUPPLY CHAIN OF NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET

FIGURE 15 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: BY TYPE, 2022

FIGURE 16 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: BY SOURCE, 2022

FIGURE 17 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: BY PRODUCT CATEGORY, 2022

FIGURE 18 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: BY FORM, 2022

FIGURE 19 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: BY APPLICATION, 2022

FIGURE 20 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: SNAPSHOT (2022)

FIGURE 21 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: BY COUNTRY (2022)

FIGURE 22 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 23 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 24 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: BY TYPE (2023-2030)

FIGURE 25 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.