Marché nord-américain des tests de sang occulte dans les selles, par type de test (kits de test immuno-Fob à flux latéral, kits de test d'agglutination immuno-FOB, kits de test ELISA immuno-FOB, test de selles FOB au gaïac, tampon réactif jetable ou tissu, et autres), application (dépistage du cancer colorectal, préoccupation pour les saignements gastro-intestinaux, polypes, diverticulose, ulcères, hémorroïdes, colite, anémie et autres), utilisateur final (laboratoires de diagnostic, hôpitaux, cliniques spécialisées et autres), canal de distribution (ventes directes, ventes au détail, commerce électronique et autres), tendances de l'industrie et prévisions jusqu'en 2030.

Analyse et taille du marché des tests de sang occulte dans les selles en Amérique du Nord

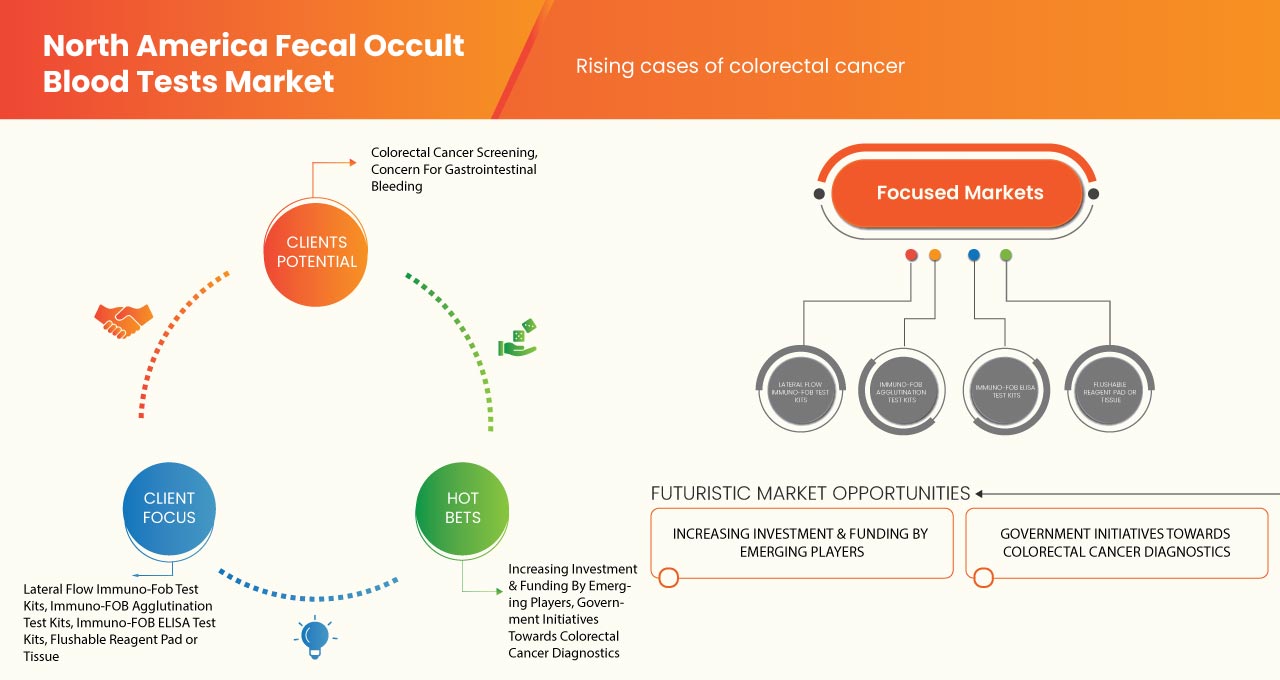

L'un des principaux facteurs à l'origine de la croissance du marché des tests de sang occulte dans les selles est l'augmentation du nombre de cas de cancer colorectal en Amérique du Nord. Les recherches cliniques continues menées par plusieurs entreprises pour améliorer le diagnostic conduisent à l'expansion du marché. Le marché est également influencé par le développement des tests de laboratoire directement destinés aux consommateurs et par la disponibilité facile des appareils de test immunologique de sang occulte dans les selles dans les magasins en ligne.

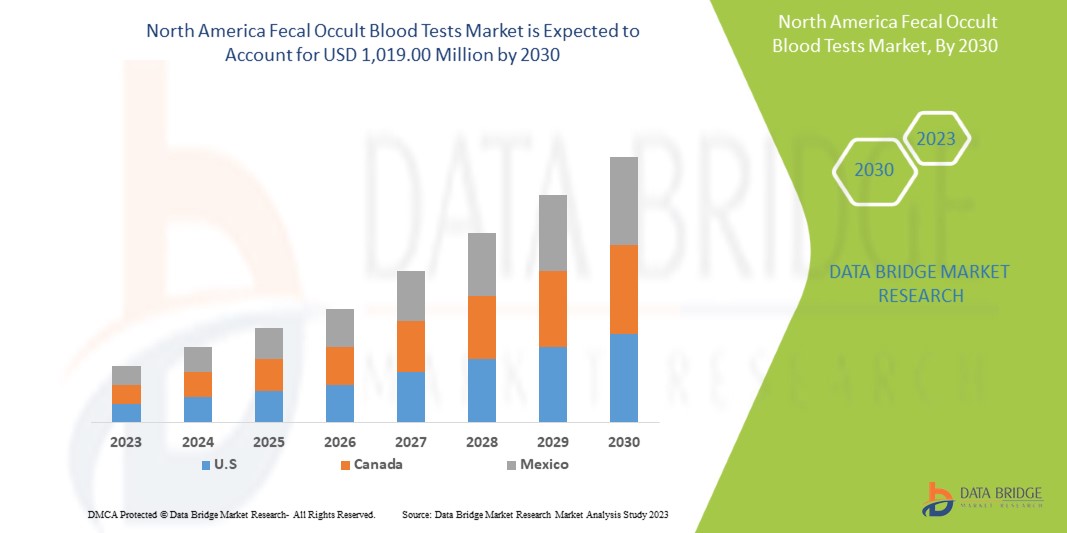

Le marché nord-américain des tests de sang occulte dans les selles devrait connaître une croissance au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 5,9 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 1 019,00 millions USD d'ici 2030.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type de test (kits de test immuno-Fob à flux latéral, kits de test d'agglutination immuno-FOB, kits de test ELISA immuno-FOB, test de selles FOB au gaïac, tampon réactif jetable ou tissu, et autres), application (dépistage du cancer colorectal, préoccupation pour les saignements gastro-intestinaux, polypes, diverticulose, ulcères, hémorroïdes, colite, anémie, et autres), utilisateur final (laboratoires de diagnostic, hôpitaux, cliniques spécialisées, et autres), canal de distribution (ventes directes, ventes au détail, commerce électronique, et autres) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

Biopanda Reagents Ltd, HUMASIS.COM, CTK Biotech, Inc., Biohit Oyj, CERTEST BIOTEC, Alfa Scientific Designs, Inc., Cenogenics Corporation et Jant Pharmacal Corporation., Quidel Corporation, Wondfo., Siemens Healthcare GmbH, entre autres |

Définition du marché

Le test de recherche de sang occulte dans les selles (FOBT) est un test de dépistage diagnostique effectué pour analyser le sang caché (occulte) dans les échantillons de selles. Le test de recherche de sang occulte dans les selles est également connu sous le nom de sang occulte dans les selles, immuno-essai FOBT, hémoocculte et IFOBT et test de frottis au gaïac. Le test est principalement utilisé pour dépister le cancer du côlon et analyser les causes possibles d'une anémie inexpliquée.

Dynamique du marché des tests de sang occulte dans les selles

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Augmentation des cas de cancer colorectal en Amérique du Nord

Le cancer colorectal est une maladie du côlon ou du rectum, deux parties du système digestif. Contrairement à la plupart des cancers, le cancer colorectal peut souvent être évité grâce au dépistage et peut être traité lorsqu'il est détecté tôt. La plupart des cas de cancer colorectal surviennent chez les personnes âgées de 45 ans et plus. La maladie touche de plus en plus de personnes plus jeunes en raison de modes de vie peu hygiéniques et du tabagisme. Les cancers colorectaux peuvent se développer sans symptômes. Les symptômes courants peuvent inclure du sang dans ou sur les selles, des mouvements intestinaux inhabituels persistants comme la constipation ou la diarrhée, des douleurs d'estomac, des courbatures ou des crampes qui durent plus longtemps et une perte de poids sans raison.

La plupart des cancers colorectaux débutent par une croissance anormale de tissu, appelée polype, à l'intérieur du côlon ou du rectum. Les médecins peuvent détecter les polypes à l'aide de tests de dépistage et les empêcher de se transformer en cancer colorectal. Même si le cancer se propage aux ganglions lymphatiques voisins, la chimiothérapie et les traitements chirurgicaux sont des moyens efficaces de le traiter. Des recherches sont en cours pour en savoir plus sur cette maladie et donner plus d'espoir aux personnes atteintes de cancer colorectal à tous les stades.

- Tests en laboratoire directement auprès du consommateur

Les tests de laboratoire en vente directe au consommateur constituent un moyen efficace pour les utilisateurs de commander leurs tests de laboratoire correspondants directement auprès d'un laboratoire sans aucun prestataire de soins de santé. De nos jours, le secteur de la santé s'oriente vers des tests de laboratoire en vente directe au consommateur plutôt que vers des tests de laboratoire effectués par des médecins, ce qui a considérablement augmenté la demande. La plupart des patients se concentrent sur les tests de laboratoire en vente directe au consommateur sans passer par un long processus en clinique, ce qui alimente la croissance du marché des tests de sang occulte dans les selles.

Pour identifier des troubles médicaux jusque-là inconnus, les résultats des tests sont utilisés. Les progrès réalisés dans le domaine des tests de laboratoire directs aux consommateurs sont devenus essentiels pour accroître l'engagement des patients en vue d'une meilleure surveillance et d'un meilleur dépistage des problèmes de santé existants. Il est donc très important pour les professionnels de laboratoire de mettre à niveau les appareils et instruments utilisés dans les laboratoires de test.

-

Disponibilité facile des dispositifs de test immunologique occulte fécal dans les magasins en ligne

Un test de recherche de sang occulte dans les selles (RSOS) se concentre généralement sur un échantillon de selles pour vérifier la présence de sang. La présence de sang dans les selles indique un saignement dans le tube digestif. Le saignement peut être causé par diverses affections telles que les polypes (excroissances anormales sur la paroi du côlon ou du rectum), les hémorroïdes (veines gonflées dans l'anus ou le rectum), la diverticulose (une affection caractérisée par de petites poches dans la paroi interne du côlon), les ulcères (plaies dans la paroi du tube digestif), la colite (un type de maladie inflammatoire de l'intestin) et le cancer colorectal.

Il existe un grand nombre de dispositifs de test immunologique occulte dans les selles disponibles sur le marché, et les gens peuvent acheter les kits et les dispositifs sur divers sites en ligne. Par conséquent, cela peut être un facteur moteur de la croissance du marché des tests de sang occulte dans les selles.

Opportunités

-

Augmentation des procédures de dépistage

La plupart des organismes gouvernementaux et des sociétés scientifiques recommandent le dépistage du cancer du col de l’utérus, du sein et colorectal en raison de la charge de morbidité de ces cancers, de la disponibilité des tests de dépistage et de l’efficacité prouvée du dépistage dans la réduction de la mortalité, ainsi que de l’incidence, des cancers du col de l’utérus et colorectaux.

La Communauté européenne recommande la mise en place de programmes de dépistage du cancer colorectal en population générale. Cette recommandation est appuyée par de nombreuses études observationnelles montrant que les programmes organisés réduisent efficacement la mortalité et contrôlent l'utilisation inappropriée des tests de dépistage.

-

Progrès techniques croissants

Les analyses sanguines ont toujours été un domaine dépendant de la technologie et des données. Les données et la technologie ont potentiellement révolutionné les services de diagnostic et ont permis de nouer des partenariats avec les patients, les familles, les praticiens, les chercheurs, les chefs de file de l'industrie, les décideurs politiques et les administrateurs pour garantir qu'un diagnostic précis, humaniste et de grande valeur, en constante amélioration, reste l'objectif central de l'avenir du diagnostic par analyse sanguine.

L'utilisation du test de recherche de sang occulte dans les selles s'est étendue à plusieurs indications, même si son utilisation principale est l'évaluation d'une source occulte de perte de sang gastro-intestinale et pour les kits à domicile dans le dépistage du carcinome colorectal. L'une des utilisations cliniques les plus courantes de l'hémorragie occulte dans les selles avant l'anticoagulation.

Contraintes/Défis

- Changement de préférence des consommateurs en faveur d'alternatives rentables

Les produits de test de sang occulte dans les selles sont très chers et ne sont généralement pas à la portée de tous. La technologie progresse de jour en jour et de nombreuses alternatives de test sont disponibles sur le marché. Par conséquent, les gens préfèrent des alternatives rentables pour les tests de sang occulte dans les selles. Il existe divers programmes de dépistage qui ciblent souvent les personnes apparemment en bonne santé et le nombre de personnes utilisant les services de dépistage est généralement plus élevé que le nombre réel de patients. Le test FOBT présente des avantages par rapport à la coloscopie en termes de coût moins élevé et de facilité de réalisation.

La plupart des alternatives aux tests de recherche de sang occulte dans les selles sont disponibles sur le marché. Par conséquent, les gens préfèrent des substituts moins coûteux et aux résultats plus précis. Par conséquent, le changement de préférence des consommateurs vers des alternatives rentables pourrait freiner la croissance du marché au cours de la période de prévision.

- Faible efficacité

Le test de sang occulte dans les selles n’est pas toujours précis et peut donner un résultat négatif en cas de cancer et un résultat faussement négatif si le cancer ou les polypes ne saignent pas.

Le test peut montrer un résultat positif lorsque la personne n’a pas de cancer (résultat faussement positif) ou présente des saignements provenant d’autres sources, comme un ulcère à l’estomac, une hémorroïde ou même du sang avalé par la bouche ou le nez.

Impact post-COVID-19 sur le marché des tests de sang occulte dans les selles

La pandémie de COVID-19 a eu un impact considérable sur les industries des tests de sang occulte dans les selles. Les groupes commerciaux du secteur des produits de diagnostic du cancer colorectal et des saignements gastro-intestinaux affirment que la chaîne d'approvisionnement nord-américaine des produits de diagnostic a été considérablement endommagée, ce qui a eu un impact sur la consommation des utilisateurs finaux du marché des tests de sang occulte dans les selles. Les ventes de produits de test au premier trimestre 2020 ont été considérablement retardées en raison de problèmes de logistique et de transport. Du côté de la demande, le marché est en hausse car les gens doivent se faire diagnostiquer après le scénario de confinement. La situation doit être prise en considération et des diagnostics d'urgence doivent être effectués. De plus, du côté de l'offre, la croissance du marché est à une échelle négative. Cela est dû aux situations de confinement dans de nombreux pays fabriquant des instruments de diagnostic, d'exploitation et de soins contre le cancer et de test de sang occulte dans les selles.

Développements récents

- En novembre 2022, Eiken Chemical Co, Ltd. a lancé le test immunochimique fécal entièrement automatisé/analyseur de calprotectine fécale « OC-SENSOR Ceres ». Cela a aidé l'entreprise à établir son produit en Amérique du Nord

- En janvier 2022, Boditech Med Inc. a annoncé avoir signé un accord d'approvisionnement de 19,2 millions USD avec A. Menarini Diagnostics pour accélérer son portefeuille de produits. Cela aide l'organisation à générer des revenus

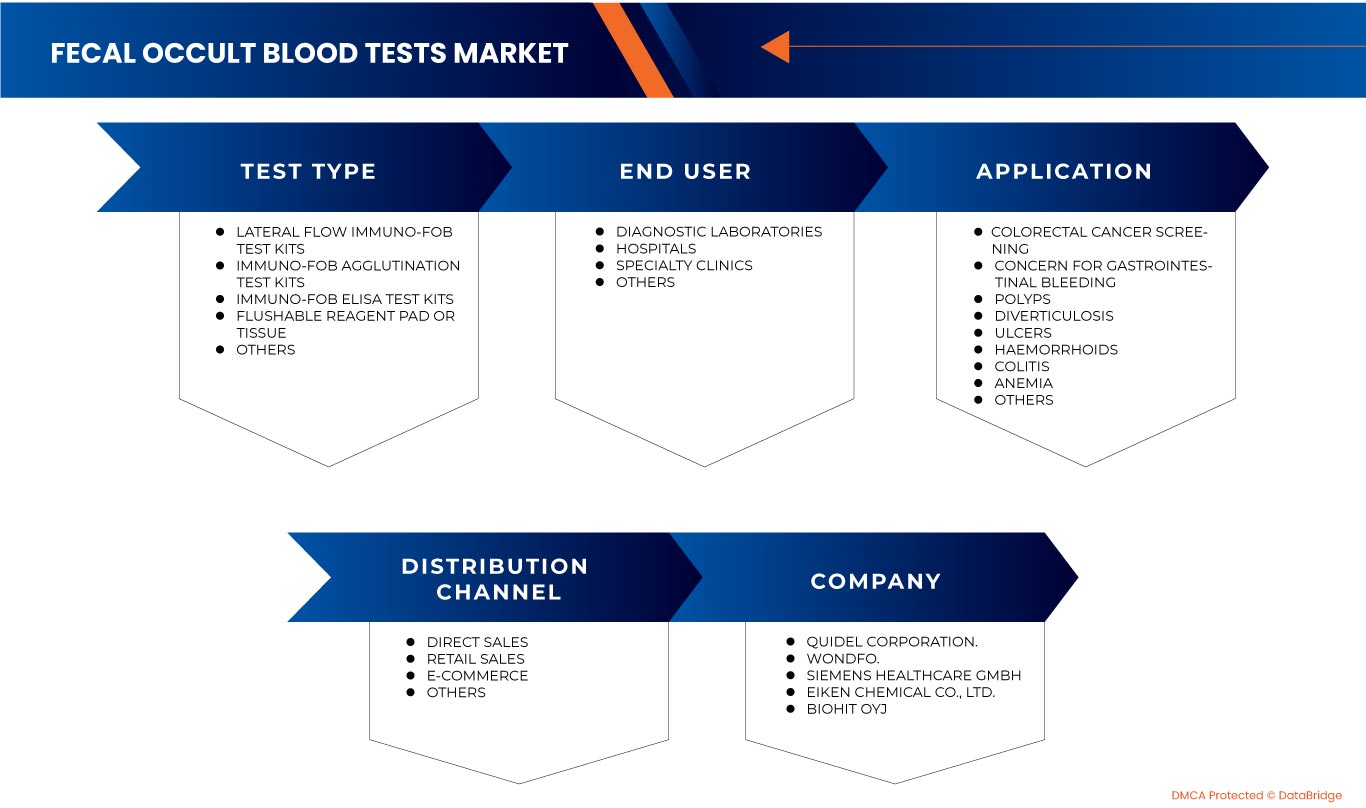

Portée du marché des tests de sang occulte dans les selles en Amérique du Nord

Le marché nord-américain des tests de sang occulte dans les selles est segmenté en quatre segments notables en fonction du type de test, de l'application, de l'utilisateur final et du canal de distribution. La croissance de ces segments vous aidera à analyser les segments de croissance limités dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Type de test

- Kits de test Immuno-FOB à flux latéral

- Kits de test d'agglutination Immuno-FOB

- Kits de test ELISA Immuno-FOB

- Tests de selles FOB au gaïac

- Tampon ou tissu réactif jetable

- Autres

Sur la base du type de test, le marché nord-américain des tests de sang occulte dans les selles est segmenté en kits de test immuno-FOB à flux latéral, kits de test d'agglutination immuno-FOB, kits de test ELISA immuno-FOB, tests de selles FOB au gaïac, tampon réactif jetable ou tissu, et autres.

Application

- Dépistage du cancer colorectal

- Préoccupation concernant les saignements gastro-intestinaux

- Polypes

- Diverticulose

- Ulcères

- Hémorroïdes

- Colite

- Anémie

- Autres

Sur la base de l'application, le marché nord-américain des tests de sang occulte dans les selles est segmenté en dépistage du cancer colorectal, préoccupation pour les saignements gastro-intestinaux, les polypes, la diverticulose, les ulcères, les hémorroïdes, la colite, l'anémie et autres.

Utilisateur final

- Laboratoires de diagnostic

- Hôpitaux

- Cliniques spécialisées

- Autres

Sur la base de l’utilisateur final, le marché nord-américain des tests de sang occulte dans les selles est segmenté en laboratoires de diagnostic, hôpitaux, cliniques spécialisées et autres.

Canal de distribution

- Appel d'offres direct

- Ventes au détail

- Commerce électronique

- Autres

Sur la base du canal de distribution, le marché nord-américain des tests de sang occulte dans les selles est segmenté en appels d'offres directs, ventes au détail, commerce électronique et autres.

Analyse/perspectives régionales du marché des tests de sang occulte dans les selles

Le marché des tests de sang occulte dans les selles est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type de test, application, utilisateur final, canal de distribution, comme référencé ci-dessus.

Le marché nord-américain des tests de sang occulte dans les selles comprend les États-Unis, le Canada et le Mexique.

Les États-Unis devraient dominer le marché nord-américain des tests de sang occulte dans les selles en raison de la tendance croissante à privilégier les diagnostics au point de service. Une augmentation de la demande de produits de test de sang occulte dans les selles et une augmentation des activités de recherche et développement dans l'industrie devraient également stimuler le marché au cours de la période prévue.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des tests de sang occulte dans les selles en Amérique du Nord

Le paysage concurrentiel du marché des tests de sang occulte dans les selles fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que les entreprises se concentrant sur le marché des tests de sang occulte dans les selles en Amérique du Nord.

Certains des principaux acteurs opérant sur ce marché sont Biopanda Reagents Ltd, HUMASIS.COM, CTK Biotech, Inc., Biohit Oyj, CERTEST BIOTEC, Alfa Scientific Designs, Inc., Cenogenics Corporation et Jant Pharmacal Corporation., Quidel Corporation, Wondfo., Siemens Healthcare GmbH entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE SEGMENT LIFELINE CURVE

2.8 MARKET APPLICATION COVERAGE GRID

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S 5 FORCES

5 INDUSTRY INSIGHTS

6 REGULATORY FRAMEWORK

6.1 REGULATORY SCENARIO BY U.S. FDA

6.2 REGULATORY SCENARIO IN U.S.

6.3 REGULATORY SCENARIO IN EUROPE

6.4 REGULATORY SCENARIO IN CANADA

6.5 REGULATORY SCENARIO IN AUSTRALIA

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING CASES OF COLORECTAL CANCER NORTH AMERICALY

7.1.2 DEVELOPMENT OF DIRECT-TO-CONSUMER LABORATORY TESTING

7.1.3 EASY AVAILABILITY OF FECAL OCCULT IMMUNOLOGICAL TEST DEVICES IN ONLINE STORES

7.1.4 INCREASING INCLINATION TOWARDS POINT-OF-CARE DIAGNOSTICS

7.2 RESTRAINTS

7.2.1 CHANGE IN CONSUMER PREFERENCE TOWARDS COST-EFFECTIVE ALTERNATIVES

7.2.2 LOW AWARENESS ABOUT FECAL OCCULT BLOOD TESTS IN UNDEVELOPED COUNTRIES

7.3 OPPORTUNITIES

7.3.1 INCREASE IN SCREENING PROCEDURES

7.3.2 RISING TECHNICAL ADVANCEMENTS

7.3.3 STRATEGIC INITIATIVES

7.4 CHALLENGES

7.4.1 LACK OF SKILLED PROFESSIONALS

7.4.2 LOW EFFICIENCY

8 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE

8.1 OVERVIEW

8.2 LATERAL FLOW IMMUNO-FOB TEST KITS

8.3 IMMUNO-FOB AGGLUTINATION TEST KITS

8.4 IMMUNO-FOB ELISA TEST KITS

8.5 GUAIAC FOB STOOL TEST

8.5.1 KITS

8.5.1.1 GUAIAC SLIDES

8.5.1.1.1 25 PACKAGE

8.5.1.1.2 20 PACKAGE

8.5.1.1.3 OTHERS

8.5.1.2 ALPHA GUAIACONIC ACID (GUAIAC) IMPREGNATED PAPER

8.5.1.2.1 SENSITIVITY IS 50NG/ML

8.5.1.2.1.1 25 PACKAGE

8.5.1.2.1.2 20 PACKAGE

8.5.1.2.1.3 OTHERS

8.5.1.2.2 SENSITIVITY IS 75NG/ML

8.5.1.2.2.1 25 PACKAGE

8.5.1.2.2.2 20 PACKAGE

8.5.1.2.2.3 OTHERS

8.5.1.2.3 OTHERS

8.5.1.3 OTHERS

8.5.2 REAGENTS

8.5.2.1 HYDROGEN PEROXIDE

8.5.2.2 OTHERS

8.6 FLUSHABLE REAGENT PAD OR TISSUE

8.7 OTHERS

9 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 COLORECTAL CANCER SCREENING

9.2.1 LATERAL FLOW IMMUNO-FOB TEST KITS

9.2.2 IMMUNO-FOB AGGLUTINATION TEST KITS

9.2.3 IMMUNO-FOB ELISA TEST KITS

9.2.4 GUAIAC FOB STOOL TEST

9.2.5 FLUSHABLE REAGENT PAD OR TISSUE

9.2.6 OTHERS

9.3 CONCERN FOR GASTROINTESTINAL BLEEDING

9.3.1 LATERAL FLOW IMMUNO-FOB TEST KITS

9.3.2 IMMUNO-FOB AGGLUTINATION TEST KITS

9.3.3 IMMUNO-FOB ELISA TEST KITS

9.3.4 GUAIAC FOB STOOL TEST

9.3.5 FLUSHABLE REAGENT PAD OR TISSUE

9.3.6 OTHERS

9.4 POLYPS

9.4.1 LATERAL FLOW IMMUNO-FOB TEST KITS

9.4.2 IMMUNO-FOB AGGLUTINATION TEST KITS

9.4.3 IMMUNO-FOB ELISA TEST KITS

9.4.4 GUAIAC FOB STOOL TEST

9.4.5 FLUSHABLE REAGENT PAD OR TISSUE

9.4.6 OTHERS

9.5 DIVERTICULOSIS

9.5.1 LATERAL FLOW IMMUNO-FOB TEST KITS

9.5.2 IMMUNO-FOB AGGLUTINATION TEST KITS

9.5.3 IMMUNO-FOB ELISA TEST KITS

9.5.4 GUAIAC FOB STOOL TEST

9.5.5 FLUSHABLE REAGENT PAD OR TISSUE

9.5.6 OTHERS

9.6 ULCERS

9.6.1 LATERAL FLOW IMMUNO-FOB TEST KITS

9.6.2 IMMUNO-FOB AGGLUTINATION TEST KITS

9.6.3 IMMUNO-FOB ELISA TEST KITS

9.6.4 GUAIAC FOB STOOL TEST

9.6.5 FLUSHABLE REAGENT PAD OR TISSUE

9.6.6 OTHERS

9.7 HAEMORRHOIDS

9.7.1 LATERAL FLOW IMMUNO-FOB TEST KITS

9.7.2 IMMUNO-FOB AGGLUTINATION TEST KITS

9.7.3 IMMUNO-FOB ELISA TEST KITS

9.7.4 GUAIAC FOB STOOL TEST

9.7.5 FLUSHABLE REAGENT PAD OR TISSUE

9.7.6 OTHERS

9.8 COLITIS

9.8.1 LATERAL FLOW IMMUNO-FOB TEST KITS

9.8.2 IMMUNO-FOB AGGLUTINATION TEST KITS

9.8.3 IMMUNO-FOB ELISA TEST KITS

9.8.4 GUAIAC FOB STOOL TEST

9.8.5 FLUSHABLE REAGENT PAD OR TISSUE

9.8.6 OTHERS

9.9 ANEMIA

9.9.1 LATERAL FLOW IMMUNO-FOB TEST KITS

9.9.2 IMMUNO-FOB AGGLUTINATION TEST KITS

9.9.3 IMMUNO-FOB ELISA TEST KITS

9.9.4 GUAIAC FOB STOOL TEST

9.9.5 FLUSHABLE REAGENT PAD OR TISSUE

9.9.6 OTHERS

9.1 OTHERS

10 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET, BY END USER

10.1 OVERVIEW

10.2 DIAGNOSTIC LABORATORIES

10.3 HOSPITALS

10.4 SPECIALITY CLINICS

10.5 OTHERS

11 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TENDER

11.3 RETAIL SALE

11.4 E-COMMERCE

11.5 OTHERS

12 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 QUIDEL CORPORATION

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 WONDFO.

15.2.1 COMPANY SNAPSHOT

15.2.2 COMPANY SHARE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 SIEMENS HEALTHCARE GMBH

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 RODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 EIKEN CHEMICAL CO., LTD.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 BIOHIT OYJ

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 ACCUBIOTECH CO LTD

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 ACCUQUIK TEST KITS

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 AIDIAN

15.8.1 COMPANY PROFILE

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 ALFA SCIENTIFIC DESIGNS, INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 APACOR LIMITED

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 BIOPANDA REAGENTS LTD

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 BODITECH MED INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 CENOGENICS CORPORATION

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 CERTEST BIOTEC.

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 CTK BIOTECH, INC.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 EDP BIOTECH

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 1.16.3 RECENT DEVELOPMENT

15.17 EPITOPE DIAGNOSTICS, INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 EUROLYSER DIAGNOSTICA GMBH

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 FIRSTEP

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 HANGZHOU CLONGENE BIOTECH CO., LTD

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 HUMASIS.COM

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 JANT PHARMACAL CORPORATION

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.23 PRIMA LAB SA

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENT

15.24 ULTI MED PRODUCTS (DEUTSCHLAND) GMBH

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA LATERAL FLOW IMMUNO-FOB TEST KITS IN FECAL OCCULT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA IMMUNO-FOB AGGLUTINATION TEST KITS IN FECAL OCCULT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA IMMUNO-FOB ELISA TEST KITS IN FECAL OCCULT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA GUAIAC FOB STOOL TEST IN FECAL OCCULT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA GUAIAC FOB STOOL TEST IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA KITS IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA GUAIAC SLIDES IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA ALPHA GUAIACONIC ACID (GUAIAC) IMPREGNATED PAPER IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA SENSITIVITY IS 50NG/ML IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA SENSITIVITY IS 75NG/ML IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA REAGENTS IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA FLUSHABLE REAGENT PAD OR TISSUE IN FECAL OCCULT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA OTHERS IN FECAL OCCULT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA COLORECTAL CANCER SCREENING IN FECAL OCCULT BLOOD TESTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA COLORECTAL CANCER SCREENING IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA CONCERN FOR GASTROINTESTINAL BLEEDING IN FECAL OCCULT BLOOD TESTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA CONCERN FOR GASTROINTESTINAL BLEEDING IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA POYLPS IN FECAL OCCULT BLOOD TESTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA POLYPS IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA DIVERTICULOSIS IN FECAL OCCULT BLOOD TESTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA DIVERTICULOSIS IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA ULCERS IN FECAL OCCULT BLOOD TESTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA ULCERS IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA HAEMORRHOIDS IN FECAL OCCULT BLOOD TESTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA HEMORRHOIDS IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA COLITIS IN FECAL OCCULT BLOOD TESTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA COLITIS IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA ANEMIA IN FECAL OCCULT BLOOD TESTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA ANEMIA IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA OTHERS IN FECAL OCCULT BLOOD TESTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA DIAGNOSTIC LABORATORIES IN FECAL OCCULT BLOOD TESTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA HOSPITALS IN FECAL OCCULT BLOOD TESTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA SPECIALITY CLINICS IN FECAL OCCULT BLOOD TESTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA OTHERS IN FECAL OCCULT BLOOD TESTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA DIRECT TENDER IN FECAL OCCULT BLOOD TESTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA RETAIL SALE IN FECAL OCCULT BLOOD TESTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA RETAIL SALE IN FECAL OCCULT BLOOD TESTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA OTHERS IN FECAL OCCULT BLOOD TESTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (UNIT)

TABLE 46 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 47 NORTH AMERICA GUAIAC FOB STOOL TEST IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA GUAIAC FOB STOOL TEST IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (UNIT)

TABLE 49 NORTH AMERICA GUAIAC FOB STOOL TEST IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 50 NORTH AMERICA KITS IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA KITS IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (UNIT)

TABLE 52 NORTH AMERICA KITS IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 53 NORTH AMERICA GUAIAC SLIDES IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA GUAIAC SLIDES IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (UNIT)

TABLE 55 NORTH AMERICA GUAIAC SLIDES IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 56 NORTH AMERICA ALPHA GUAIACONIC ACID (GUAIAC) IMPREGNATED PAPER IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA ALPHA GUAIACONIC ACID (GUAIAC) IMPREGNATED PAPER IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (UNIT)

TABLE 58 NORTH AMERICA ALPHA GUAIACONIC ACID (GUAIAC) IMPREGNATED PAPER IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 59 NORTH AMERICA SENSITIVITY IS 50NG/ML IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA SENSITIVITY IS 50NG/ML IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (UNIT)

TABLE 61 NORTH AMERICA SENSITIVITY IS 50NG/ML IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 62 NORTH AMERICA SENSITIVITY IS 75NG/ML IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 63 NORTH AMERICA SENSITIVITY IS 75NG/ML IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (UNIT)

TABLE 64 NORTH AMERICA SENSITIVITY IS 75NG/ML IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 65 NORTH AMERICA REAGENTS IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA REAGENTS IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (UNIT)

TABLE 67 NORTH AMERICA REAGENTS IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 68 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 69 NORTH AMERICA COLORECTAL CANCER SCREENING IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA CONCERN FOR GASTROINTESTINAL BLEEDING IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 71 NORTH AMERICA POLYPS IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 72 NORTH AMERICA DIVERTICULOSIS IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 73 NORTH AMERICA ULCERS IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 74 NORTH AMERICA HAEMORRHOIDS IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 75 NORTH AMERICA COLITIS IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 76 NORTH AMERICA ANEMIA IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 77 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 78 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 79 U.S. FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 80 U.S. FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (UNIT)

TABLE 81 U.S. FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 82 U.S. GUAIAC FOB STOOL TEST IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 83 U.S. GUAIAC FOB STOOL TEST IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (UNIT)

TABLE 84 U.S. GUAIAC FOB STOOL TEST IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 85 U.S. KITS IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 86 U.S. KITS IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (UNIT)

TABLE 87 U.S. KITS IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 88 U.S. GUAIAC SLIDES IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 89 U.S. GUAIAC SLIDES IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (UNIT)

TABLE 90 U.S. GUAIAC SLIDES IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 91 U.S. ALPHA GUAIACONIC ACID (GUAIAC) IMPREGNATED PAPER IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 92 U.S. ALPHA GUAIACONIC ACID (GUAIAC) IMPREGNATED PAPER IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (UNIT)

TABLE 93 U.S. ALPHA GUAIACONIC ACID (GUAIAC) IMPREGNATED PAPER IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 94 U.S. SENSITIVITY IS 50NG/ML IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 95 U.S. SENSITIVITY IS 50NG/ML IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (UNIT)

TABLE 96 U.S. SENSITIVITY IS 50NG/ML IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 97 U.S. SENSITIVITY IS 75NG/ML IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 98 U.S. SENSITIVITY IS 75NG/ML IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (UNIT)

TABLE 99 U.S. SENSITIVITY IS 75NG/ML IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 100 U.S. REAGENTS IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 101 U.S. REAGENTS IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (UNIT)

TABLE 102 U.S. REAGENTS IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 103 U.S. FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 104 U.S. COLORECTAL CANCER SCREENING IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 105 U.S. CONCERN FOR GASTROINTESTINAL BLEEDING IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 106 U.S. POLYPS IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 107 U.S. DIVERTICULOSIS IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 108 U.S. ULCERS IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 109 U.S. HAEMORRHOIDS IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 110 U.S. COLITIS IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 111 U.S. ANEMIA IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 112 U.S. FECAL OCCULT BLOOD TESTS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 113 U.S. FECAL OCCULT BLOOD TESTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 114 CANADA FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 115 CANADA FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (UNIT)

TABLE 116 CANADA FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 117 CANADA GUAIAC FOB STOOL TEST IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 118 CANADA GUAIAC FOB STOOL TEST IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (UNIT)

TABLE 119 CANADA GUAIAC FOB STOOL TEST IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 120 CANADA KITS IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 121 CANADA KITS IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (UNIT)

TABLE 122 CANADA KITS IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 123 CANADA GUAIAC SLIDES IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 124 CANADA GUAIAC SLIDES IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (UNIT)

TABLE 125 CANADA GUAIAC SLIDES IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 126 CANADA ALPHA GUAIACONIC ACID (GUAIAC) IMPREGNATED PAPER IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 127 CANADA ALPHA GUAIACONIC ACID (GUAIAC) IMPREGNATED PAPER IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (UNIT)

TABLE 128 CANADA ALPHA GUAIACONIC ACID (GUAIAC) IMPREGNATED PAPER IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 129 CANADA SENSITIVITY IS 50NG/ML IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 130 CANADA SENSITIVITY IS 50NG/ML IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (UNIT)

TABLE 131 CANADA SENSITIVITY IS 50NG/ML IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 132 CANADA SENSITIVITY IS 75NG/ML IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 133 CANADA SENSITIVITY IS 75NG/ML IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (UNIT)

TABLE 134 CANADA SENSITIVITY IS 75NG/ML IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 135 CANADA REAGENTS IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 136 CANADA REAGENTS IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (UNIT)

TABLE 137 CANADA REAGENTS IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 138 CANADA FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 139 CANADA COLORECTAL CANCER SCREENING IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 140 CANADA CONCERN FOR GASTROINTESTINAL BLEEDING IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 141 CANADA POLYPS IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 142 CANADA DIVERTICULOSIS IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 143 CANADA ULCERS IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 144 CANADA HAEMORRHOIDS IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 145 CANADA COLITIS IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 146 CANADA ANEMIA IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 147 CANADA FECAL OCCULT BLOOD TESTS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 148 CANADA FECAL OCCULT BLOOD TESTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 149 MEXICO FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 150 MEXICO FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (UNIT)

TABLE 151 MEXICO FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 152 MEXICO GUAIAC FOB STOOL TEST IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 153 MEXICO GUAIAC FOB STOOL TEST IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (UNIT)

TABLE 154 MEXICO GUAIAC FOB STOOL TEST IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 155 MEXICO KITS IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 156 MEXICO KITS IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (UNIT)

TABLE 157 MEXICO KITS IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 158 MEXICO GUAIAC SLIDES IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 159 MEXICO GUAIAC SLIDES IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (UNIT)

TABLE 160 MEXICO GUAIAC SLIDES IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 161 MEXICO ALPHA GUAIACONIC ACID (GUAIAC) IMPREGNATED PAPER IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 162 MEXICO ALPHA GUAIACONIC ACID (GUAIAC) IMPREGNATED PAPER IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (UNIT)

TABLE 163 MEXICO ALPHA GUAIACONIC ACID (GUAIAC) IMPREGNATED PAPER IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 164 MEXICO SENSITIVITY IS 50NG/ML IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 165 MEXICO SENSITIVITY IS 50NG/ML IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (UNIT)

TABLE 166 MEXICO SENSITIVITY IS 50NG/ML IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 167 MEXICO SENSITIVITY IS 75NG/ML IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 168 MEXICO SENSITIVITY IS 75NG/ML IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (UNIT)

TABLE 169 MEXICO SENSITIVITY IS 75NG/ML IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 170 MEXICO REAGENTS IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 171 MEXICO REAGENTS IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (UNIT)

TABLE 172 MEXICO REAGENTS IN FECAL OCCULT BLOOD TESTS MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 173 MEXICO FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 174 MEXICO COLORECTAL CANCER SCREENING IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 175 MEXICO CONCERN FOR GASTROINTESTINAL BLEEDING IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 176 MEXICO POLYPS IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 177 MEXICO DIVERTICULOSIS IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 178 MEXICO ULCERS IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 179 MEXICO HAEMORRHOIDS IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 180 MEXICO COLITIS IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 181 MEXICO ANEMIA IN FECAL OCCULT BLOOD TESTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 182 MEXICO FECAL OCCULT BLOOD TESTS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 183 MEXICO FECAL OCCULT BLOOD TESTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA FECAL OCCULT BLOOD TESTSMARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA FECAL OCCULT BLOOD TESTSMARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET: SEGMENTATION

FIGURE 11 RISING CASES OF COLORECTAL CANCER NORTH AMERICALY AND EASY AVAILABILITY OF FECAL OCCULT IMMUNOLOGICAL TEST DEVICES IN ONLINE STORES ARE EXPECTED TO DRIVE THE GROWTH OF THE NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET FROM 2023 TO 2030

FIGURE 12 THE LATERAL FLOW IMMUNO-FOB, TEST KITS SEGMENT, IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET

FIGURE 14 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET: BY TEST TYPE, 2022

FIGURE 15 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET: BY TEST TYPE, 2023-2030 (USD MILLION)

FIGURE 16 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET: BY TEST TYPE, CAGR (2023-2030)

FIGURE 17 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET: BY TEST TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET: BY APPLICATION, 2022

FIGURE 19 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 22 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET: BY END USER, 2022

FIGURE 23 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET: BY END USER, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET : BY END USER, LIFELINE CURVE

FIGURE 26 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET : BY DISTRIBUTION CHANNEL, 2022

FIGURE 27 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET : BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET : BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET : BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 30 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET: SNAPSHOT (2022)

FIGURE 31 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET: BY COUNTRY (2022)

FIGURE 32 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 33 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 34 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET: BY TEST TYPE (2023-2030)

FIGURE 35 NORTH AMERICA FECAL OCCULT BLOOD TESTS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.