North America Explosion Proof Equipment Market

Taille du marché en milliards USD

TCAC :

%

USD

3.01 Billion

USD

4.24 Billion

2024

2032

USD

3.01 Billion

USD

4.24 Billion

2024

2032

| 2025 –2032 | |

| USD 3.01 Billion | |

| USD 4.24 Billion | |

|

|

|

|

Segmentation du marché nord-américain des équipements antidéflagrants, par offre (matériel, logiciels et services), classe de température (T1 ( 450 °C), T2 ( 300 °C à 200 °C à 135 °C à 100 °C à 85 °C à

Taille du marché des équipements antidéflagrants en Amérique du Nord

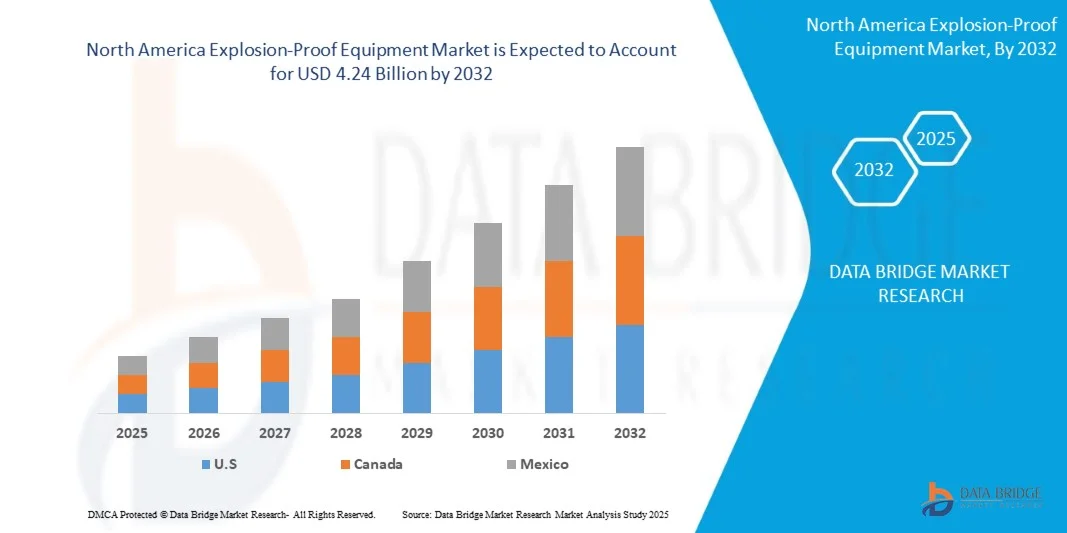

- La taille du marché des équipements antidéflagrants en Amérique du Nord était évaluée à 3,01 milliards USD en 2024 et devrait atteindre 4,24 milliards USD d'ici 2032 , à un TCAC de 6,8 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la demande croissante de solutions de sécurité dans les environnements industriels dangereux, tels que le pétrole et le gaz, l'exploitation minière et le traitement chimique.

- L’augmentation des réglementations gouvernementales axées sur la sécurité des travailleurs et la prévention des explosions industrielles accélère encore l’adoption d’équipements antidéflagrants dans toute la région.

Analyse du marché nord-américain des équipements antidéflagrants

- La demande croissante de solutions de protection avancées dans des secteurs tels que le pétrole et le gaz, les produits chimiques, les produits pharmaceutiques et la fabrication stimule l'expansion du marché.

- De plus, les innovations technologiques continues en matière d’éclairage antidéflagrant, de panneaux de contrôle et de systèmes de communication améliorent la sécurité et l’efficacité opérationnelles dans les environnements de travail dangereux.

- Le marché américain des équipements antidéflagrants a capturé la plus grande part de revenus en Amérique du Nord en 2024, alimenté par la mise en œuvre croissante de protocoles de sécurité industrielle et la présence de nombreuses installations pétrolières et gazières, chimiques et de fabrication.

- Le Canada devrait connaître le taux de croissance annuel composé (TCAC) le plus élevé sur le marché nord-américain des équipements antidéflagrants en raison des investissements croissants dans les secteurs de l'exploitation minière, du traitement chimique et de l'énergie, associés à une sensibilisation croissante à la sécurité industrielle et à l'adoption de solutions antidéflagrantes intelligentes et compatibles IoT.

- Le segment du matériel informatique a représenté la plus grande part de marché en 2024, grâce au déploiement massif d'armoires, de capteurs et de panneaux de contrôle certifiés dans les installations industrielles. Les solutions matérielles constituent l'épine dorsale des systèmes de sécurité industrielle et sont essentielles à la prévention des accidents en environnements dangereux.

Portée du rapport et segmentation du marché des équipements antidéflagrants en Amérique du Nord

|

Attributs |

Informations clés sur le marché des équipements antidéflagrants en Amérique du Nord |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une production et une capacité géographiquement représentées par entreprise, des configurations de réseau de distributeurs et de partenaires, une analyse détaillée et mise à jour des tendances des prix et une analyse des déficits de la chaîne d'approvisionnement et de la demande. |

Tendances du marché des équipements antidéflagrants en Amérique du Nord

« L'essor des solutions antidéflagrantes intelligentes en sécurité industrielle »

- L'adoption croissante d'équipements antidéflagrants intelligents transforme la sécurité industrielle en permettant une surveillance en temps réel et une maintenance prédictive. Ces systèmes permettent une détection précoce des conditions dangereuses, minimisant ainsi les temps d'arrêt et prévenant les accidents. Les entreprises intègrent de plus en plus l'analyse basée sur l'IA pour prédire les défaillances potentielles, tandis que les plateformes cloud permettent de centraliser les données de sécurité de plusieurs installations.

- La demande de dispositifs antidéflagrants automatisés et intégrés à l'IoT augmente dans des secteurs tels que le pétrole et le gaz, la chimie et l'exploitation minière, contribuant ainsi à des opérations plus sûres et plus efficaces. Ces dispositifs contribuent à réduire les erreurs humaines, à accélérer la réaction aux événements dangereux et à améliorer la conformité aux normes de sécurité sur les sites industriels complexes.

- Le développement de solutions d'équipement modulaires et évolutives simplifie l'installation et la maintenance, réduit les coûts d'exploitation et améliore la sécurité au travail. Ces solutions permettent une adaptation aisée aux systèmes existants, offrent une flexibilité d'extension et réduisent les temps d'arrêt lors des mises à niveau des équipements.

- Par exemple, en 2024, plusieurs usines pétrochimiques américaines ont déployé des capteurs antidéflagrants compatibles IoT dans leurs unités de traitement, ce qui a permis une détection précoce des fuites de gaz et une réduction des incidents de sécurité. Ce déploiement a également permis une surveillance continue, des alertes prédictives et une amélioration des rapports aux autorités réglementaires.

- Si les solutions antidéflagrantes intelligentes améliorent la prévention des risques et la fiabilité opérationnelle, leur efficacité dépend de l'innovation technologique continue, de la formation adéquate des employés et du respect des normes réglementaires. Les entreprises doivent également se concentrer sur la sécurité des données et l'intégration des systèmes pour maximiser les avantages des solutions de sécurité intelligentes.

Dynamique du marché nord-américain des équipements antidéflagrants

Conducteur

« Renforcement des réglementations en matière de sécurité industrielle et accent sur la protection des travailleurs »

- Les réglementations de sécurité strictes imposées par des autorités telles que l'OSHA et le NEC incitent à l'adoption d'équipements antidéflagrants afin de prévenir les accidents du travail et de garantir la conformité. Les organisations mettent en œuvre des audits de sécurité plus stricts, modernisent leurs équipements anciens et investissent dans des systèmes de sécurité certifiés pour satisfaire aux exigences réglementaires.

- Les exploitants industriels accordent désormais la priorité à la sécurité des travailleurs et à la réduction des risques, ce qui entraîne une demande accrue d'éclairages, de tableaux de commande et de systèmes de surveillance certifiés antidéflagrants. Cette évolution est également influencée par les exigences en matière d'assurance, les attentes des parties prenantes et la hausse du coût des accidents du travail et des temps d'arrêt.

- De plus, les progrès en matière de capteurs, de surveillance en temps réel et d'automatisation encouragent les entreprises à investir dans des solutions antidéflagrantes fiables qui réduisent les risques opérationnels. La maintenance prédictive, la surveillance à distance et les alertes automatisées favorisent encore l'adoption des équipements et l'efficacité opérationnelle.

- Par exemple, en 2023, plusieurs usines nord-américaines ont modernisé leurs salles de contrôle et leurs zones dangereuses en les dotant d'enceintes antidéflagrantes et de systèmes de surveillance intelligents, améliorant ainsi leur conformité en matière de sécurité. Ces améliorations ont également permis d'optimiser la collecte de données pour la maintenance préventive et de réduire les délais d'intervention d'urgence.

- Si le soutien réglementaire et le progrès technologique sont des moteurs clés, un investissement continu dans l'innovation et la formation des employés est essentiel pour maximiser les bénéfices en matière de sécurité. Les entreprises s'associent de plus en plus à des fournisseurs de technologies pour développer des solutions sur mesure adaptées aux environnements industriels complexes.

Retenue/Défi

« Besoins élevés en matière d'investissement et de maintenance »

- Le coût initial élevé des équipements antidéflagrants avancés limite leur adoption par les PME, rendant leur déploiement à grande échelle difficile. Ces dépenses incluent l'achat, l'installation, la certification et l'intégration aux systèmes de sécurité existants, ce qui peut s'avérer prohibitif pour les petites entreprises.

- De plus, l'installation spécialisée et la maintenance continue nécessitent du personnel qualifié, ce qui accroît les coûts d'exploitation et limite l'accessibilité pour les petites installations. La surveillance continue, les tests périodiques et les audits de conformité augmentent encore la complexité opérationnelle et les coûts liés au maintien de normes de sécurité élevées.

- Les défis logistiques et liés à la chaîne d'approvisionnement pour les équipements, les composants et les pièces de rechange sur les sites industriels isolés peuvent retarder la mise en œuvre et la maintenance. La dépendance à des fournisseurs spécialisés, l'allongement des délais et les problèmes de disponibilité régionale peuvent perturber les échéanciers des projets et augmenter les coûts totaux.

- Par exemple, en 2023, plusieurs usines de traitement chimique ont signalé des retards dans l'installation de leurs équipements en raison d'une disponibilité limitée de composants antidéflagrants certifiés et de prestataires de services qualifiés. Ces retards ont impacté les calendriers des projets, augmenté les coûts de main-d'œuvre et exposé temporairement les installations à des risques de sécurité accrus.

- Alors que la fiabilité et les performances des équipements continuent de s'améliorer, la résolution des problèmes de coûts et de maintenance est essentielle pour une pénétration plus large du marché et une croissance soutenue. Les entreprises explorent des modèles de location, des solutions modulaires et des partenariats de services locaux pour rendre les équipements de sécurité de haute qualité plus accessibles à un plus large éventail d'opérateurs.

Portée du marché nord-américain des équipements antidéflagrants

Le marché est segmenté en fonction de l'offre, de la classe de température, de la zone et du service de connectivité

• En offrant

Sur la base de l'offre, le marché des équipements antidéflagrants est segmenté en matériel, logiciels et services. Le segment matériel a représenté la plus grande part de chiffre d'affaires en 2024, grâce au déploiement massif d'enceintes, de capteurs et de panneaux de contrôle certifiés dans les installations industrielles. Les solutions matérielles constituent l'épine dorsale des systèmes de sécurité industrielle et sont essentielles à la prévention des accidents en environnements dangereux.

Le secteur des logiciels devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à l'adoption croissante des plateformes de surveillance IoT, des outils de maintenance prédictive et des analyses cloud. Les solutions logicielles améliorent l'efficacité des systèmes antidéflagrants en fournissant des alertes en temps réel, un contrôle centralisé et des informations basées sur les données pour une gestion proactive des risques.

• Par classe de température

Le marché est segmenté en fonction de la classe de température, de T1 à T6. Le segment T4 occupait une place importante en 2024, grâce à sa compatibilité avec un large éventail d'applications industrielles avec des limites de température de surface modérées. Les dispositifs classés T4 sont couramment déployés dans les secteurs de la chimie, du pétrole et du gaz, ainsi que de l'industrie manufacturière, en raison de leur fiabilité et de leur conformité aux normes de sécurité.

Le segment T6 devrait connaître une forte croissance entre 2025 et 2032, portée par la demande d'équipements capables de fonctionner dans des zones hautement sensibles présentant des températures de surface maximales très basses. Les dispositifs antidéflagrants T6 sont privilégiés dans les applications exigeant les normes de sécurité les plus strictes, notamment dans les environnements miniers et de traitement chimique dangereux.

• Par zone

Le marché est segmenté en zones, de la zone 0 à la zone 22. La zone 1 représentait la part la plus importante en 2024, en raison de son utilisation dans des zones où des atmosphères gazeuses explosives sont susceptibles de se former en fonctionnement normal. Ces zones couvrent la plupart des installations industrielles contenant des gaz ou vapeurs inflammables.

Le segment Zone 0 devrait connaître la croissance la plus rapide au cours de la période de prévision, stimulé par le besoin croissant de solutions de sécurité dans les environnements hautement dangereux où les atmosphères explosives sont présentes en permanence. Les équipements classés Zone 0 garantissent une protection maximale et le respect des réglementations strictes en matière de sécurité industrielle.

• Par service de connectivité

En fonction des services de connectivité, le marché est segmenté en filaire et sans fil. Le segment filaire détenait la plus grande part de marché en 2024, grâce à sa fiabilité, la stabilité de sa transmission de données et son adéquation aux opérations industrielles critiques où une connectivité ininterrompue est essentielle.

Le secteur du sans fil devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce au déploiement croissant d'appareils antidéflagrants, de solutions de télésurveillance et de systèmes de sécurité intelligents compatibles avec l'IoT. La connectivité sans fil permet une installation flexible, des alertes en temps réel et une intégration simplifiée aux plateformes centralisées de gestion de la sécurité.

Analyse régionale du marché nord-américain des équipements antidéflagrants

- Le marché américain des équipements antidéflagrants a capturé la plus grande part de revenus en Amérique du Nord en 2024, alimenté par la mise en œuvre croissante de protocoles de sécurité industrielle et la présence de nombreuses installations pétrolières et gazières, chimiques et de fabrication.

- Les entreprises accordent la priorité à l'amélioration de la sécurité au travail grâce à des dispositifs antidéflagrants certifiés et à des solutions de surveillance compatibles IoT

- La tendance croissante de l’automatisation industrielle, combinée à la demande de systèmes de détection des dangers en temps réel et de maintenance prédictive, propulse davantage la croissance du marché.

- De plus, l’intégration de systèmes antidéflagrants avec des plates-formes industrielles intelligentes contribue de manière significative à l’expansion du marché

Aperçu du marché canadien des équipements antidéflagrants

Le marché canadien des équipements antidéflagrants devrait connaître une croissance soutenue de 2025 à 2032, stimulée par les investissements dans les industries minière, des sables bitumineux et de la transformation chimique, qui exigent des normes de sécurité élevées. L'adoption de systèmes de surveillance avancés et de dispositifs de protection compatibles avec l'IdO est en hausse, soutenue par la réglementation gouvernementale en matière de sécurité. Les exploitants industriels canadiens se concentrent sur la réduction des risques d'accident et des temps d'arrêt opérationnels, ce qui favorise l'adoption d'équipements antidéflagrants.

Part de marché des équipements antidéflagrants en Amérique du Nord

L’industrie nord-américaine des équipements antidéflagrants est principalement dirigée par des entreprises bien établies, notamment :

- R. STAHL Inc. (États-Unis)

- RAE Systems (Honeywell) (États-Unis)

- Intertek Group PLC (États-Unis)

- Adalet Inc. (États-Unis)

- EX Industries (États-Unis)

- Larson Electronics LLC (États-Unis)

- Miretti Americas (États-Unis)

- Industries nord-américaines (NAI) (États-Unis)

- MSA Safety Incorporated (États-Unis)

- Applus+ QPS (États-Unis)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.