North America Exocrine Pancreatic Insufficiency Epi Therapeutics And Diagnostics Market

Taille du marché en milliards USD

TCAC :

%

USD

4.45 Billion

USD

7.82 Billion

2024

2032

USD

4.45 Billion

USD

7.82 Billion

2024

2032

| 2025 –2032 | |

| USD 4.45 Billion | |

| USD 7.82 Billion | |

|

|

|

|

Segmentation du marché nord-américain des thérapies et diagnostics de l'insuffisance pancréatique exocrine (IPE), par diagnostic (examens d'imagerie et de la fonction pancréatique), traitement (prise en charge nutritionnelle, thérapie de remplacement des enzymes pancréatiques [TREP]), type de médicament (générique et de marque), utilisateur final (hôpitaux, cliniques spécialisées, soins à domicile, centres de diagnostic, instituts de recherche et universitaires, etc.), canal de distribution (achat direct, pharmacies de détail, distributeurs tiers, etc.) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché nord-américain des thérapies et des diagnostics pour l'insuffisance pancréatique exocrine (IPE)

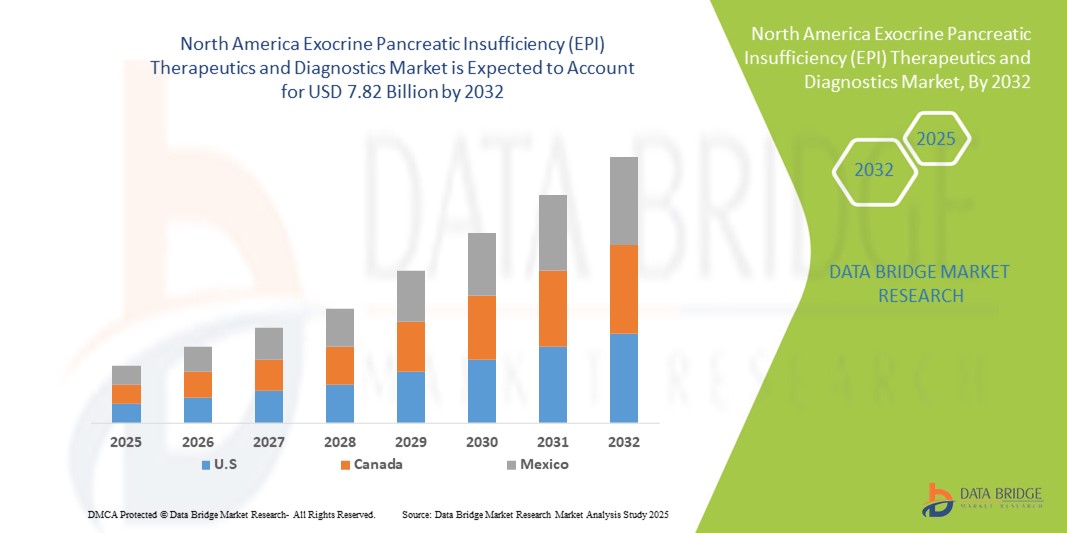

- La taille du marché nord-américain des thérapies et des diagnostics de l'insuffisance pancréatique exocrine (IPE) était évaluée à 4,45 milliards USD en 2024 et devrait atteindre 7,82 milliards USD d'ici 2032 , à un TCAC de 7,3 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la prévalence croissante de la pancréatite chronique et de la fibrose kystique , qui sont les principales causes d'EPI, ainsi que par les progrès technologiques dans les outils de diagnostic et les nouvelles thérapies, conduisant à une meilleure gestion de la maladie.

- De plus, la sensibilisation croissante des patients et la demande croissante pour une thérapie de remplacement des enzymes pancréatiques (TREP) efficace et facile à administrer, ainsi que pour des solutions diagnostiques associées, font de ces traitements la norme de soins pour l'IPE. Ces facteurs convergents accélèrent l'adoption des thérapies et des diagnostics de l'IPE, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché nord-américain des thérapies et diagnostics de l'insuffisance pancréatique exocrine (IPE)

- Les thérapies et les diagnostics de l'insuffisance pancréatique exocrine (IPE), y compris la thérapie de remplacement des enzymes pancréatiques (PERT) et les tests diagnostiques, sont des éléments de plus en plus essentiels des soins de santé gastro-intestinaux modernes, tant en milieu clinique qu'à domicile, en raison de leur efficacité dans la gestion de la malabsorption, l'amélioration de la qualité de vie des patients et l'intégration avec des plans de traitement personnalisés.

- La demande croissante de thérapies et de diagnostics EPI est principalement alimentée par la prévalence croissante de la pancréatite chronique, de la fibrose kystique et d'autres troubles pancréatiques, la sensibilisation croissante des patients et une préférence pour les thérapies de remplacement enzymatique efficaces et faciles à administrer.

- Les États-Unis ont dominé le marché nord-américain des thérapies et des diagnostics de l'insuffisance pancréatique exocrine (IPE) avec la plus grande part de revenus de 79,2 % en 2024, caractérisé par l'adoption précoce d'outils de diagnostic avancés, des dépenses de santé élevées et une forte présence de sociétés pharmaceutiques et biotechnologiques clés, avec une croissance substantielle dans les cliniques et hôpitaux spécialisés tirée par les innovations dans les formulations PERT et les tests de diagnostic.

- Le Canada devrait être le pays connaissant la croissance la plus rapide sur le marché nord-américain des thérapies et des diagnostics de l'insuffisance pancréatique exocrine (IPE) au cours de la période de prévision en raison d'une sensibilisation croissante aux troubles pancréatiques, de politiques de santé favorables et d'investissements croissants dans l'infrastructure de diagnostic.

- Le segment de la thérapie de remplacement des enzymes pancréatiques (PERT) a dominé le marché nord-américain des thérapies et des diagnostics de l'insuffisance pancréatique exocrine (IPE) avec une part de marché de 62,2 % en 2024, grâce à son efficacité établie dans la gestion des symptômes de l'IPE et à son adoption clinique généralisée dans les hôpitaux et les établissements de soins à domicile.

Portée du rapport et segmentation du marché nord-américain des thérapies et diagnostics de l'insuffisance pancréatique exocrine (IPE)

|

Attributs |

Analyses clés du marché nord-américain des thérapies et diagnostics de l'insuffisance pancréatique exocrine (IPE) |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché nord-américain des thérapies et diagnostics pour l'insuffisance pancréatique exocrine (IPE)

Soins aux patients améliorés grâce à des diagnostics avancés et une thérapie personnalisée

- Une tendance significative et croissante sur le marché nord-américain des thérapies et des diagnostics EPI est l'adoption croissante d'outils de diagnostic avancés et de schémas personnalisés de thérapie de remplacement d'enzymes pancréatiques (PERT), améliorant la gestion des maladies et les résultats des patients.

- Par exemple, les tests avancés d’élastase fécale et d’haleine permettent aux cliniciens de surveiller avec précision la progression de l’EPI et d’adapter le dosage des enzymes aux besoins individuels des patients.

- L'intégration de plateformes de santé numériques et d'appareils de surveillance portables permet un suivi en temps réel de l'efficacité du traitement et de l'amélioration des symptômes, favorisant ainsi des plans de soins plus proactifs et personnalisés.

- Ces technologies permettent une coordination transparente entre les gastro-entérologues, les prestataires de soins primaires et les patients, facilitant la surveillance à distance et l'ajustement de la thérapie enzymatique selon les besoins.

- Cette tendance vers une gestion plus précise, axée sur les données et centrée sur le patient transforme fondamentalement les attentes en matière de soins liés à l'IPE. Par conséquent, des entreprises comme AbbVie et Nestlé Health Science développent des kits de diagnostic et des solutions thérapeutiques dotés de capacités de surveillance améliorées et d'un dosage individualisé.

- La demande de thérapies et de diagnostics offrant une surveillance intégrée, un dosage de précision et une facilité d'utilisation augmente rapidement dans les milieux cliniques et de soins à domicile, car les patients et les prestataires accordent de plus en plus la priorité à l'efficacité et à la qualité de vie.

Dynamique du marché nord-américain des thérapies et diagnostics pour l'insuffisance pancréatique exocrine (IPE)

Conducteur

Prévalence croissante des troubles pancréatiques et sensibilisation croissante

- La prévalence croissante de la pancréatite chronique, de la fibrose kystique et des troubles pancréatiques associés, associée à une sensibilisation croissante des patients et des médecins, constitue un facteur important de la demande accrue de thérapies et de diagnostics EPI.

- Par exemple, en mars 2024, une mise à jour clinique a mis en évidence de meilleurs résultats chez les patients recevant un dosage optimisé de PERT, renforçant l'importance d'un diagnostic précoce et d'un ajustement thérapeutique.

- À mesure que les patients et les prestataires de soins de santé reconnaissent les avantages d’un diagnostic EPI rapide et d’un remplacement enzymatique efficace, la demande de diagnostics précis et de thérapies individualisées augmente considérablement.

- En outre, le réseau en expansion de cliniques spécialisées en gastroentérologie et de programmes de soutien aux patients favorise l’adoption du PERT et des outils de diagnostic dans les milieux hospitaliers et ambulatoires.

- La facilité d’administration du PERT aux côtés des outils de surveillance, combinée à des campagnes de sensibilisation et des programmes d’éducation de plus en plus nombreux, favorise encore davantage l’adoption de thérapies et de diagnostics en Amérique du Nord.

Retenue/Défi

Coûts de traitement élevés et observance limitée des patients

- Le coût relativement élevé des formulations enzymatiques avancées et des tests de diagnostic, en particulier pour les thérapies à long terme, constitue un défi important pour une adoption plus large du marché.

- Par exemple, certains patients interrompent ou sous-dosent le PERT en raison des dépenses personnelles, ce qui réduit l'efficacité et l'observance du traitement.

- Il est essentiel de rendre les traitements plus abordables grâce à une couverture d’assurance, des programmes d’assistance aux patients et des options enzymatiques à moindre coût pour améliorer l’accès et la conformité.

- De plus, la non-observance du traitement par le patient et l’administration inappropriée d’enzymes peuvent limiter l’efficacité du traitement, soulignant la nécessité d’un soutien éducatif et d’outils de surveillance pour garantir une utilisation correcte.

- Bien que la sensibilisation et les options de traitement augmentent, la complexité perçue et le coût de la thérapie entravent encore son adoption par certains patients, en particulier dans les régions où les ressources de santé sont limitées.

- Surmonter ces défis grâce à des stratégies de réduction des coûts, à l’éducation des patients et à des solutions de surveillance numérique sera essentiel pour une croissance soutenue du marché et de meilleurs résultats pour les patients.

Portée du marché nord-américain des thérapies et des diagnostics de l'insuffisance pancréatique exocrine (IPE)

Le marché est segmenté en fonction du diagnostic, du traitement, du type de médicament, de l’utilisateur final et du canal de distribution.

- Par diagnostic

En Amérique du Nord, le marché des traitements et diagnostics de l'insuffisance pancréatique exocrine (IPE) est segmenté en deux catégories : les tests d'imagerie et les tests de la fonction pancréatique. En 2024, le segment des tests de la fonction pancréatique a dominé le marché, affichant la plus forte part de chiffre d'affaires, grâce à son rôle essentiel dans le diagnostic précis de l'insuffisance enzymatique et l'orientation vers le traitement de substitution enzymatique pancréatique (TSP). Les cliniciens privilégient souvent les tests de stimulation de l'élastase fécale et de la sécrétine pour leur sensibilité et leur spécificité élevées. Ce segment bénéficie de la notoriété croissante de l'IPE auprès des patients et des professionnels de santé. Les tests non invasifs et réalisés au point de service favorisent également son adoption massive dans les hôpitaux, les cliniques spécialisées et les centres de diagnostic. La prévalence croissante de la pancréatite chronique et de la mucoviscidose stimule l'utilisation des tests de la fonction pancréatique. Les progrès technologiques en matière de précision des tests et la rapidité des délais d'exécution contribuent également à cette domination.

Le segment des examens d'imagerie devrait connaître la croissance la plus rapide au cours de la période de prévision, grâce aux progrès de l'IRM, de la tomodensitométrie et de l'échographie endoscopique. Les examens d'imagerie permettent de détecter les anomalies structurelles du pancréas et leurs causes sous-jacentes, telles que la pancréatite chronique. L'intégration croissante avec les plateformes de télémédecine permet une utilisation plus large en ambulatoire et à domicile. La disponibilité croissante des équipements d'imagerie et l'amélioration de la résolution accélèrent leur adoption. Les cliniciens s'appuient de plus en plus sur les examens d'imagerie pour suivre l'évolution de la maladie et l'efficacité des traitements. Cette croissance est également soutenue par la modernisation des infrastructures diagnostiques des hôpitaux et des cliniques spécialisées.

- Par traitement

En Amérique du Nord, le marché des traitements et diagnostics de l'insuffisance pancréatique exocrine (IPE) est segmenté en deux catégories : la prise en charge nutritionnelle et le traitement de substitution enzymatique pancréatique (TSP). En 2024, le segment des TSP a dominé le marché avec une part de marché de 62,2 % grâce à son efficacité prouvée dans la prise en charge des symptômes de l'IPE, tels que la malabsorption et les carences nutritionnelles. Le TSP est largement privilégié pour sa posologie standardisée, sa facilité d'administration et ses résultats cliniques positifs. Les hôpitaux, les cliniques spécialisées et les établissements de soins à domicile en sont les principaux utilisateurs. Des innovations telles que les formulations à libération prolongée, la réduction de la taille des gélules et les thérapies combinées améliorent l'observance thérapeutique des patients. Les programmes marketing et d'accompagnement des patients des laboratoires pharmaceutiques renforcent encore ce segment. La sensibilisation croissante des patients et des médecins aux techniques de substitution enzymatique adéquates contribue également à cette domination.

Le segment de la gestion nutritionnelle devrait connaître la croissance la plus rapide au cours de la période de prévision, grâce au rôle croissant des interventions diététiques dans le traitement de l'IPE. Les compléments alimentaires, les régimes hypercaloriques et les vitamines liposolubles sont de plus en plus utilisés en complément de la thérapie PERT. L'éducation des patients et les programmes dirigés par des diététiciens en milieu hospitalier et à domicile favorisent l'adoption de ces solutions. L'intégration de la nutrition aux plans thérapeutiques personnalisés améliore l'efficacité du traitement. La sensibilisation croissante à l'impact de l'alimentation sur la gestion des symptômes favorise la croissance. L'adoption de solutions de gestion nutritionnelle en soins à domicile et en ambulatoire s'accélère.

- Par type de médicament

En Amérique du Nord, le marché des médicaments et des diagnostics pour l'insuffisance pancréatique exocrine (IPE) est segmenté en génériques et en médicaments de marque. En 2024, le segment des médicaments de marque a dominé le marché grâce à une validation clinique solide, des autorisations réglementaires et la confiance des patients. Les médicaments PERT de marque offrent une activité enzymatique standardisée et un conditionnement cohérent. Les programmes d'accompagnement des patients et les campagnes de sensibilisation favorisent l'observance thérapeutique. Les médicaments de marque sont largement utilisés dans les hôpitaux, les cliniques spécialisées et les services de soins à domicile. Les laboratoires pharmaceutiques assurent une promotion active de ces produits, renforçant ainsi leur domination sur le marché. Les données cliniques et la préférence des médecins soutiennent ce segment.

Le segment des génériques devrait connaître la croissance la plus rapide au cours de la période de prévision, stimulé par la sensibilité aux coûts et l'augmentation de la couverture d'assurance. Les produits PERT génériques offrent une efficacité similaire à celle des médicaments de marque, à des prix plus bas. Leur adoption progresse dans les hôpitaux publics, les soins à domicile et les cliniques externes. Les initiatives gouvernementales favorisant des traitements abordables soutiennent la croissance. Les médicaments génériques élargissent l'accès aux populations mal desservies. La sensibilisation croissante aux options rentables accélère leur adoption en Amérique du Nord.

- Par utilisateur final

En Amérique du Nord, le marché des traitements et diagnostics de l'insuffisance pancréatique exocrine (IPE) est segmenté en fonction de l'utilisateur final : hôpitaux, cliniques spécialisées, soins à domicile, centres de diagnostic, instituts de recherche et universitaires, etc. En 2024, le segment hospitalier a dominé le marché grâce à la concentration d'installations de diagnostic avancées et de services d'administration de tests PERT. Les hôpitaux dispensent des soins hospitaliers et ambulatoires aux patients atteints d'IPE. De solides collaborations avec les laboratoires pharmaceutiques favorisent l'adoption de ces technologies. Les hôpitaux servent également de centres principaux pour l'éducation des patients et le suivi thérapeutique. Ce segment bénéficie de la prévalence de la pancréatite chronique et de la mucoviscidose. Le développement des services de gastroentérologie et des cliniques spécialisées contribue à cette domination.

Le segment des soins à domicile devrait connaître la croissance la plus rapide au cours de la période de prévision, grâce à des soins centrés sur le patient et à la gestion des traitements à distance. L'adoption des soins à domicile est facilitée par les plateformes de télémédecine et les outils de suivi numérique. Les patients peuvent bénéficier d'un PERT et de conseils nutritionnels dans le confort de leur domicile. Les soins à domicile favorisent l'observance grâce à la supervision à distance par un clinicien. La sensibilisation accrue à la gestion des EPI en dehors des hôpitaux favorise la croissance. La commodité et la réduction des visites à l'hôpital sont des facteurs clés de l'adoption du segment.

- Par canal de distribution

En Amérique du Nord, le marché des traitements et diagnostics de l'insuffisance pancréatique exocrine (IPE) est segmenté selon les canaux de distribution : vente directe, pharmacies de détail, distributeurs tiers, etc. En 2024, les pharmacies de détail ont dominé le marché grâce à leur praticité, leur accessibilité et la forte présence des produits PERT de marque. Les pharmacies offrent des services de conseil et d'accompagnement pour garantir l'observance thérapeutique. Les partenariats entre les laboratoires pharmaceutiques et les chaînes de distribution améliorent la disponibilité. Les patients bénéficient d'une exécution simplifiée des ordonnances et d'un accès rapide. Les pharmacies de détail sont largement utilisées aux États-Unis et au Canada. L'expansion continue des réseaux de pharmacies renforce leur domination.

Le segment des appels d'offres directs devrait connaître la croissance la plus rapide au cours de la période de prévision, stimulé par les achats groupés des hôpitaux, des cliniques spécialisées et des programmes gouvernementaux. Les appels d'offres directs offrent des solutions rentables pour le PERT et les diagnostics. Les acheteurs institutionnels peuvent gérer efficacement de larges populations de patients. La rationalisation des chaînes d'approvisionnement favorise l'adoption de ces solutions dans les hôpitaux et les cliniques. La demande croissante liée aux initiatives de santé publique accélère la croissance. Cette croissance est également alimentée par des contrats à long terme garantissant une disponibilité constante des produits.

Analyse régionale du marché nord-américain des traitements et diagnostics de l'insuffisance pancréatique exocrine (IPE)

- Les États-Unis ont dominé le marché nord-américain des thérapies et des diagnostics de l'insuffisance pancréatique exocrine (IPE) avec la plus grande part de revenus de 79,2 % en 2024, caractérisé par l'adoption précoce d'outils de diagnostic avancés, des dépenses de santé élevées et une forte présence de sociétés pharmaceutiques et biotechnologiques clés, avec une croissance substantielle dans les cliniques et hôpitaux spécialisés tirée par les innovations dans les formulations PERT et les tests de diagnostic.

- Les patients et les prestataires de soins de santé de la région apprécient grandement l'accessibilité de la thérapie de remplacement des enzymes pancréatiques (PERT), des tests de diagnostic avancés tels que l'élastase fécale et les tests d'imagerie, ainsi que des plans de traitement intégrés qui améliorent les résultats et la qualité de vie des patients.

- Cette adoption généralisée est en outre soutenue par une infrastructure de soins de santé bien établie, des dépenses de santé élevées, une population technologiquement avancée et une préférence croissante pour les modèles de soins centrés sur le patient, établissant les thérapies et les diagnostics EPI comme des solutions essentielles dans les milieux hospitaliers et de soins à domicile.

Analyse du marché américain des thérapies et diagnostics pour l'insuffisance pancréatique exocrine (IPE)

Le marché américain des traitements et diagnostics de l'insuffisance pancréatique exocrine (IPE) a représenté la plus grande part de chiffre d'affaires en 2024 en Amérique du Nord, porté par la forte prévalence de la pancréatite chronique, de la mucoviscidose et d'autres affections pancréatiques. Patients et professionnels de santé accordent de plus en plus d'importance à un diagnostic précoce et à un traitement efficace par substitution d'enzymes pancréatiques (TSEP) afin d'améliorer les résultats et la qualité de vie. La préférence croissante pour les outils de diagnostic intégrés, les systèmes de surveillance des patients et les soins à domicile stimule davantage le marché. De plus, une infrastructure clinique de pointe, une couverture d'assurance maladie étendue et la présence d'entreprises pharmaceutiques et biotechnologiques de premier plan contribuent significativement à l'expansion du marché. L'adoption de la télémédecine et des plateformes de santé numérique pour la gestion des traitements à distance améliore également l'accessibilité et l'observance thérapeutique.

Aperçu du marché canadien des thérapies et des diagnostics de l'insuffisance pancréatique exocrine (IPE)

Le marché canadien des traitements et diagnostics de l'insuffisance pancréatique exocrine (IPE) devrait connaître une croissance substantielle au cours de la période de prévision, principalement grâce à une sensibilisation accrue aux troubles pancréatiques et à des investissements croissants dans les infrastructures de santé. Les programmes gouvernementaux de soins de santé et les politiques de remboursement favorables favorisent l'adoption de ces deux types de traitements. Les patients et les cliniciens canadiens sont attirés par les avantages du PERT, des tests avancés de la fonction pancréatique et des solutions de gestion nutritionnelle. Le marché connaît une croissance dans les hôpitaux, les cliniques spécialisées et les établissements de soins à domicile, le diagnostic précoce et la thérapie personnalisée étant des axes prioritaires. L'essor des initiatives éducatives et des programmes de soutien aux patients favorise également l'adoption de ces technologies.

Analyse du marché mexicain des thérapies et diagnostics pour l'insuffisance pancréatique exocrine (IPE)

Le marché mexicain des traitements et diagnostics de l'insuffisance pancréatique exocrine (IPE) devrait connaître une croissance significative au cours de la période de prévision, portée par l'augmentation des dépenses de santé et la sensibilisation croissante des patients à l'IPE. Les efforts visant à élargir l'accès aux tests diagnostiques et à des formulations PERT abordables soutiennent la croissance du marché. Les hôpitaux et les cliniques spécialisées adoptent de plus en plus des options diagnostiques et thérapeutiques avancées, tandis que les soins à domicile s'imposent comme une solution pratique pour les patients des zones reculées. La collaboration avec les laboratoires pharmaceutiques et les campagnes de sensibilisation favorisent un diagnostic précoce et une meilleure observance du traitement. De plus, les initiatives gouvernementales visant à renforcer les infrastructures de santé devraient continuer à stimuler la croissance du marché.

Part de marché des thérapies et diagnostics de l'insuffisance pancréatique exocrine (IPE) en Amérique du Nord

L'industrie thérapeutique et diagnostique de l'insuffisance pancréatique exocrine (IPE) en Amérique du Nord est principalement dirigée par des entreprises bien établies, notamment :

- AbbVie Inc. (États-Unis)

- Entero Therapeutics, Inc. (États-Unis)

- Axovant Gene Therapies Ltd. (États-Unis)

- Cumberland Pharmaceuticals Inc. (États-Unis)

- Protalix BioTherapeutics, Inc. (États-Unis)

- Prometic Sciences de la Vie Inc. (Canada)

- Aptalis Pharma Inc. (Canada)

- Enzo Biochem, Inc. (États-Unis)

- Thermo Fisher Scientific Inc. (États-Unis)

- Bio-Rad Laboratories, Inc. (États-Unis)

- Abbott (États-Unis)

- F. Hoffmann-La Roche Ltd (États-Unis)

- Siemens Healthineers AG (Allemagne)

- Bio-Techne Corporation (États-Unis)

- PerkinElmer (États-Unis)

- llumina, Inc. (États-Unis)

- Agilent Technologies, Inc. (États-Unis)

- Merck & Co., Inc. (États-Unis)

Quels sont les développements récents sur le marché nord-américain des thérapies et des diagnostics de l’insuffisance pancréatique exocrine (IPE) ?

- En mai 2024, un nouvel outil d'évaluation des symptômes, l'EPI/PEI-SS, a été développé par une initiative de patients afin de faciliter le dépistage de l'insuffisance pancréatique exocrine. Cet outil, issu d'une revue de la littérature existante et de listes de symptômes générées par les patients, vise à fournir une méthode plus complète d'évaluation de la fréquence et de la gravité des symptômes courants de l'EPI.

- En décembre 2023, Codexis et Nestlé Health Science ont conclu un accord d'achat pour le CDX-7108, une nouvelle enzymothérapie orale pour l'IPE. Aux termes de cet accord, Nestlé Health Science sera responsable du développement et de la commercialisation du CDX-7108, y compris tous les coûts associés.

- En mai 2023, First Wave BioPharma a terminé la sélection des patients pour son essai clinique de phase II SPAN sur l'adrulipase pour le traitement de l'IPE chez les patients atteints de mucoviscidose. Cette étape marque une étape importante dans l'évaluation du potentiel de l'adrulipase comme option thérapeutique pour l'IPE, et les résultats devraient éclairer les stratégies thérapeutiques futures.

- En février 2023, Codexis et Nestlé Health Science ont annoncé les résultats intermédiaires d'un essai clinique de phase I portant sur le CDX-7108, une nouvelle enzymothérapie orale pour le traitement de l'IPE. Cet essai visait à évaluer l'innocuité, la tolérance et la pharmacocinétique du CDX-7108 chez des sujets sains. Cette collaboration marque une étape importante dans le développement d'enzymothérapies non porcines pour les patients atteints d'IPE.

- En août 2021, AzurRx Biopharma, Inc. (maintenant First Wave BioPharma, Inc.) a annoncé la fin du recrutement pour son essai clinique de phase 2 du MS1819 en association avec un traitement de remplacement des enzymes pancréatiques (PERT) pour traiter l'insuffisance pancréatique exocrine sévère (EPI) chez les patients atteints de fibrose kystique.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.