North America Epigenetics Diagnostic Market

Taille du marché en milliards USD

TCAC :

%

USD

3.29 Billion

USD

10.82 Billion

2024

2032

USD

3.29 Billion

USD

10.82 Billion

2024

2032

| 2025 –2032 | |

| USD 3.29 Billion | |

| USD 10.82 Billion | |

|

|

|

|

Segmentation du marché nord-américain du diagnostic épigénétique, par produit ( réactifs , kits, instruments et consommables, outils et enzymes bioinformatiques), technologie (méthylation de l'ADN, méthylation des histones, structures de la chromatine, acétylation des histones, modification des grands ARN non codants et des microARN), type de traitement (inhibiteurs d'histone désacétylase (HDAC), inhibiteurs d'ADN méthyltransférase (DNMT) et autres), application ( oncologie , maladies cardiovasculaires, maladies métaboliques , immunologie, maladies inflammatoires, maladies infectieuses et autres), utilisateur final (instituts universitaires et de recherche, sociétés pharmaceutiques et biotechnologiques , organismes de recherche sous contrat (CRO) et autres), canal de distribution (appels d'offres directs et vente au détail), tendances et prévisions du secteur jusqu'en 2032

Taille du marché nord-américain du diagnostic épigénétique

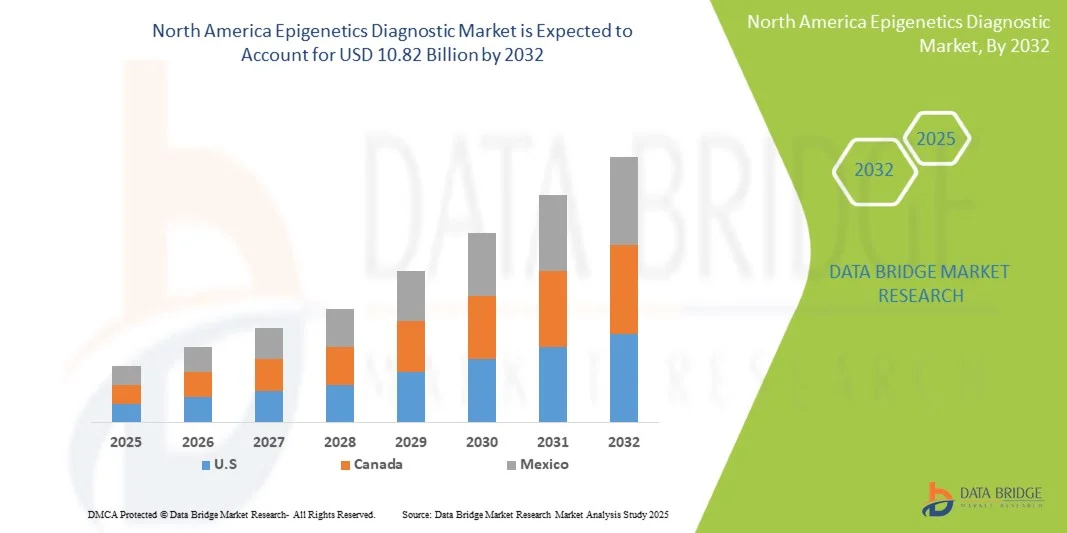

- La taille du marché nord-américain du diagnostic épigénétique était évaluée à 3,29 milliards USD en 2024 et devrait atteindre 10,82 milliards USD d'ici 2032 , à un TCAC de 16,00 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par l’adoption croissante de techniques avancées de biologie moléculaire et l’intégration des technologies de séquençage de nouvelle génération (NGS), qui améliorent la précision et l’efficacité des diagnostics épigénétiques dans la recherche et les applications cliniques.

- Par ailleurs, la demande croissante de détection précoce des maladies, de médecine personnalisée et de diagnostics basés sur des biomarqueurs stimule l'adoption de solutions de diagnostic épigénétique. Ces facteurs convergents accélèrent l'adoption de ces solutions, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché nord-américain du diagnostic épigénétique

- Le marché nord-américain du diagnostic épigénétique implique l'utilisation de marqueurs et de tests épigénétiques pour détecter, surveiller et gérer des maladies telles que le cancer, les troubles cardiovasculaires et les affections neurologiques, offrant des solutions de diagnostic mini-invasives, précises et personnalisées.

- La demande croissante de solutions de diagnostic épigénétique est principalement alimentée par la prévalence croissante des maladies chroniques, l’adoption croissante de la médecine de précision et la sensibilisation croissante à la détection précoce des maladies parmi les prestataires de soins de santé et les patients.

- Les États-Unis ont dominé le marché nord-américain du diagnostic épigénétique, avec une part de chiffre d'affaires de 87,3 % en 2024, grâce à une infrastructure de santé de pointe, une forte adoption des technologies de diagnostic moléculaire et des investissements importants dans la recherche clinique et les installations de diagnostic. Le pays a connu une croissance notable grâce à la prévalence croissante du cancer et des maladies chroniques, à la demande croissante de dépistage précoce et aux innovations dans les plateformes de tests épigénétiques à haut débit.

- Le Canada devrait être le pays connaissant la croissance la plus rapide sur le marché nord-américain du diagnostic épigénétique au cours de la période de prévision, en raison de l'augmentation des investissements dans les infrastructures de santé, de la sensibilisation croissante à la médecine de précision, de la prévalence croissante des maladies liées au mode de vie et de l'expansion des initiatives de recherche médicale.

- Le segment de l'oncologie a dominé le marché nord-américain du diagnostic épigénétique avec une part de chiffre d'affaires de 46,3 % en 2024. La prévalence croissante du cancer, l'augmentation des initiatives de détection précoce et l'adoption de biomarqueurs épigénétiques alimentent cette domination.

Portée du rapport et segmentation du marché nord-américain du diagnostic épigénétique

|

Attributs |

Analyses clés du marché nord-américain du diagnostic épigénétique |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché nord-américain du diagnostic épigénétique

« Progrès de l'IA et amélioration de la précision diagnostique en épigénétique »

- Une tendance importante et croissante sur le marché nord-américain du diagnostic épigénétique est l'intégration de l'intelligence artificielle (IA) et des algorithmes d'apprentissage automatique pour améliorer l'identification des biomarqueurs et l'analyse prédictive. Cette intégration améliore la précision du diagnostic, le suivi des maladies et la planification personnalisée des traitements.

- Les principales entreprises exploitent l'IA pour analyser les schémas de méthylation de l'ADN, les modifications des histones et l'accessibilité de la chromatine, permettant ainsi la détection précoce de maladies complexes telles que le cancer et les troubles cardiovasculaires.

- Les plateformes basées sur l'IA facilitent l'interprétation rapide de grands ensembles de données génomiques, réduisant ainsi le temps d'analyse et fournissant des informations plus exploitables aux cliniciens.

- L'intégration avec les systèmes basés sur le cloud permet une gestion centralisée des données épigénétiques des patients, permettant une consultation à distance, une recherche collaborative et des rapports en temps réel dans les établissements de santé.

- Les algorithmes d'IA peuvent apprendre en continu à partir de nouvelles données, améliorant ainsi la précision prédictive au fil du temps et soutenant la surveillance longitudinale des patients pour la progression de la maladie et la réponse thérapeutique.

- De plus, l’IA permet de prioriser les populations de patients à haut risque, en suggérant des stratégies de test optimisées, en réduisant les tests inutiles et en augmentant l’efficacité globale du flux de travail.

- Des entreprises telles que Guardant Health, EpigenDx et Exact Sciences développent activement des tests épigénétiques basés sur l'IA pour des applications cliniques et de recherche, en se concentrant sur la détection précoce et la médecine personnalisée.

- La tendance vers des diagnostics plus précis, prédictifs et basés sur les données transforme les attentes des prestataires de soins de santé, des instituts de recherche et des payeurs.

- La collaboration croissante entre les développeurs d’IA et les prestataires de soins de santé accélère l’adoption de diagnostics épigénétiques basés sur l’IA dans la pratique clinique.

- L’intégration de l’IA permet également des outils de reporting et de visualisation transparents, aidant les médecins à interpréter efficacement des données épigénétiques complexes.

Dynamique du marché nord-américain du diagnostic épigénétique

Conducteur

« Demande croissante de détection précoce, de médecine de précision et de soins de santé personnalisés »

- L’incidence croissante du cancer, des troubles métaboliques, des maladies neurologiques et des maladies cardiovasculaires entraîne une demande de diagnostics épigénétiques précis.

- La détection précoce des maladies grâce à des biomarqueurs épigénétiques permet une intervention rapide, améliorant considérablement les résultats des patients et les taux de survie

- Les initiatives de médecine personnalisée encouragent les prestataires de soins de santé à adopter des tests épigénétiques pour adapter les thérapies en fonction des profils épigénétiques individuels.

- Le financement gouvernemental et les investissements privés dans la recherche en génomique et en médecine de précision soutiennent le développement de nouveaux tests épigénétiques

- Les hôpitaux, les cliniques spécialisées et les instituts de recherche intègrent de plus en plus les diagnostics épigénétiques dans les flux de travail cliniques standard pour l'évaluation et la surveillance des risques de maladie.

- Les progrès des méthodes de test non invasives, telles que les biopsies liquides, élargissent l’application des diagnostics épigénétiques dans les soins de routine aux patients.

- Les campagnes de sensibilisation et l’éducation des cliniciens concernant l’utilité clinique des biomarqueurs épigénétiques stimulent l’adoption du marché

- La capacité de prédire la réponse des patients aux thérapies et de surveiller la récidive de la maladie renforce l’attrait des diagnostics épigénétiques

- L'intégration avec les plateformes d'IA et d'apprentissage automatique offre une précision diagnostique améliorée, ce qui est de plus en plus apprécié par les prestataires de soins de santé.

- L’expansion des programmes de recherche collaborative entre les institutions universitaires et les entreprises de biotechnologie accélère encore davantage les innovations technologiques et la croissance du marché

Retenue/Défi

« Coût élevé, obstacles réglementaires et préoccupations en matière de confidentialité des données »

- Le coût élevé des tests de diagnostic épigénétiques avancés reste un obstacle majeur, en particulier dans les régions en développement ou les petits établissements de santé.

- Les exigences complexes des laboratoires et le besoin de personnel hautement qualifié limitent l’adoption généralisée

- Les processus d’approbation réglementaire pour les nouveaux tests épigénétiques peuvent prendre du temps, retardant le lancement du produit et sa disponibilité sur le marché.

- La variabilité des politiques de remboursement selon les pays crée des incertitudes pour les prestataires de soins de santé et les patients

- Les préoccupations éthiques et de confidentialité concernant le traitement des données génomiques et épigénétiques peuvent limiter la volonté des patients de se soumettre à des tests.

- L'intégration de plateformes basées sur l'IA nécessite une infrastructure informatique importante et des mesures de sécurité des données, ce qui pose des défis d'investissement supplémentaires.

- Le manque de normalisation dans les procédures de tests épigénétiques et les bases de données de référence peut affecter la fiabilité des résultats

- La croissance du marché peut être entravée par une sensibilisation limitée des cliniciens à l’utilité clinique et à l’interprétation des données épigénétiques complexes.

- Le besoin de mises à jour continues des logiciels et de validation des algorithmes d'IA augmente les coûts opérationnels des laboratoires

- Surmonter ces défis nécessite une collaboration entre les autorités réglementaires, les prestataires de soins de santé et les acteurs de l’industrie pour garantir des solutions de diagnostic standardisées, rentables et sécurisées.

Portée du marché nord-américain du diagnostic épigénétique

Le marché nord-américain du diagnostic épigénétique est segmenté en fonction du produit, de la technologie, du type de thérapie, de l'application, de l'utilisateur final et du canal de distribution.

• Par produit

Sur la base des produits, le marché nord-américain du diagnostic épigénétique est segmenté en réactifs, kits, instruments et consommables, ainsi qu'en outils et enzymes bioinformatiques. Le segment des réactifs a dominé la plus grande part de chiffre d'affaires du marché, avec 42,8 % en 2024. Ce chiffre s'explique par leur rôle essentiel dans la préparation, la détection et l'analyse des échantillons dans les études épigénétiques. Hautement fiables, compatibles avec de multiples plateformes d'analyse, les réactifs fournissent des résultats reproductibles, ce qui les rend indispensables en recherche et en diagnostic clinique. L'adoption croissante de la médecine de précision et des diagnostics basés sur les biomarqueurs stimule encore davantage la demande. La recherche universitaire et les entreprises pharmaceutiques dépendent fortement de réactifs de haute qualité pour obtenir des résultats constants. De plus, les réactifs spécialisés pour la méthylation de l'ADN, les modifications des histones et l'analyse de l'ARN renforcent leur position sur le marché. Ce segment bénéficie d'une innovation continue dans la formulation des réactifs et d'une durée de conservation améliorée. L'augmentation des investissements dans la recherche épigénétique à l'échelle mondiale soutient la croissance du marché. Les réactifs facilitent également l'automatisation dans les laboratoires à haut débit. La pandémie de COVID-19 a mis en évidence l'importance de réactifs de diagnostic rapides et précis, favorisant leur diffusion et leur adoption. Les collaborations stratégiques entre fabricants de réactifs et instituts de recherche continuent d'en accroître la disponibilité. Globalement, les réactifs restent un élément essentiel des processus de diagnostic épigénétique.

Le segment des instruments et consommables devrait connaître le TCAC le plus rapide, soit 20,3 % entre 2025 et 2032. Cette croissance est alimentée par la demande croissante de plateformes de diagnostic épigénétique à haut débit, automatisées et précises. Des instruments tels que les séquenceurs de nouvelle génération et les machines de PCR en temps réel améliorent la précision et la reproductibilité des analyses. Ce segment bénéficie de la tendance vers des dispositifs miniaturisés et portables, adaptés aux laboratoires décentralisés. Les consommables tels que les pointes, les plaques et les tubes sont essentiels à la fiabilité et à l'efficacité des analyses. Leur adoption croissante dans les hôpitaux, les instituts de recherche et les entreprises de biotechnologie stimule la demande. L'automatisation avancée réduit les erreurs humaines et les délais de traitement. L'augmentation des investissements dans la médecine personnalisée et les thérapies ciblées stimule encore l'adoption. Le lancement de nouveaux instruments avec des solutions logicielles intégrées attire les utilisateurs finaux à la recherche de flux de travail simplifiés. Le développement continu de consommables spécifiques aux analyses améliore les performances. Le développement des collaborations entre fabricants d'instruments et fournisseurs de bioinformatique accroît également la pénétration du marché. Les applications émergentes en oncologie, en maladies cardiovasculaires et en recherche métabolique stimulent la croissance.

• Par technologie

Sur le plan technologique, le marché nord-américain du diagnostic épigénétique est segmenté en trois catégories : méthylation de l’ADN, méthylation des histones, structures de la chromatine, acétylation des histones et modification des grands ARN non codants et des microARN. Le segment de la méthylation de l’ADN, dominant avec une part de chiffre d’affaires de 44,5 % en 2024, est un biomarqueur clé du cancer, des maladies cardiovasculaires et métaboliques. Son adoption généralisée est due à des tests rentables et reproductibles, ainsi qu’à une utilité clinique validée. La méthylation de l’ADN est essentielle à la détection et au pronostic précoces des maladies, facilitant ainsi la prise de décision clinique. Les laboratoires de recherche et les entreprises de diagnostic utilisent largement le profilage de la méthylation de l’ADN. Ses applications en médecine de précision et dans le suivi des thérapies épigénétiques stimulent la demande. Les kits et plateformes de test éprouvés offrent fiabilité et simplicité d’utilisation. Les autorisations réglementaires pour les tests diagnostiques basés sur les biomarqueurs de la méthylation de l’ADN renforcent encore la position sur le marché. La recherche universitaire et pharmaceutique investit continuellement dans les études de méthylation, soutenant ainsi la demande. Les méthodes de détection de la méthylation de l’ADN sont compatibles avec les systèmes à haut débit. L'intégration aux outils bioinformatiques permet une compréhension plus approfondie de la régulation épigénétique. La croissance de ce segment est soutenue par l'augmentation des financements publics et privés consacrés à la recherche en épigénétique.

Le segment de la méthylation des histones devrait connaître le TCAC le plus rapide, soit 19,6 %, entre 2025 et 2032. Cette croissance est tirée par son rôle dans la compréhension de la progression des maladies et l'identification de cibles thérapeutiques. Le profilage de la méthylation des histones est de plus en plus adopté en oncologie et dans la recherche sur les maladies inflammatoires. Des techniques de détection avancées, notamment le ChIP-seq, améliorent la sensibilité et la précision. La demande est en hausse dans les secteurs universitaire et pharmaceutique. De nouveaux kits et instruments d'analyse ciblant les modifications des histones sont lancés. La recherche sur le remodelage de la chromatine et le développement de thérapies épigénétiques stimule l'adoption de cette technologie. Des plateformes automatisées à haut débit améliorent l'évolutivité et l'efficacité. Des initiatives mondiales en faveur de la recherche épigénétique soutiennent son expansion. Les organismes de recherche sous contrat externalisent de plus en plus les études sur la méthylation des histones. L'intégration avec la biologie computationnelle et la bioinformatique renforce les capacités analytiques. La méthylation des histones devient essentielle dans les applications de médecine personnalisée.

• Par type de thérapie

En fonction du type de thérapie, le marché nord-américain du diagnostic épigénétique est segmenté en inhibiteurs d'histone désacétylase (HDAC), inhibiteurs d'ADN méthyltransférase (DNMT) et autres. Le segment des inhibiteurs d'HDAC a dominé le marché avec une part de marché de 40,2 % en 2024. Largement utilisés dans le traitement du cancer et la recherche clinique grâce à leur capacité à moduler l'expression des gènes de manière épigénétique, ils bénéficient d'un pipeline clinique bien établi, ce qui explique leur adoption massive en milieu hospitalier et dans les études pharmaceutiques. Leur pertinence thérapeutique dans les tumeurs hématologiques et solides stimule la demande. Ce segment bénéficie d'une R&D continue sur les thérapies combinées. Les autorisations réglementaires accordées à plusieurs inhibiteurs d'HDAC garantissent une crédibilité sur le marché. La recherche universitaire explorant les voies d'action des HDAC assure une utilisation constante. Les entreprises pharmaceutiques investissent dans la découverte de médicaments à base d'inhibiteurs d'HDAC. Les inhibiteurs d'HDAC sont utilisés dans la recherche sur les maladies inflammatoires et métaboliques. Des procédés de fabrication éprouvés et la reproductibilité des composés renforcent leur adoption. L'activité d'essais cliniques à l'échelle mondiale soutient une croissance soutenue du marché. L'innovation continue dans les formulations d'HDAC assure la domination du segment.

Le segment des inhibiteurs de la DNMT devrait enregistrer le TCAC le plus rapide, soit 18,9 %, entre 2025 et 2032. Cette croissance est portée par l'intensification de la recherche en thérapie épigénétique et en médecine personnalisée. Les inhibiteurs de la DNMT ciblent les schémas de méthylation de l'ADN liés au cancer et à d'autres maladies chroniques. L'augmentation des essais cliniques explorant les inhibiteurs de la DNMT favorise leur adoption. Les laboratoires universitaires et pharmaceutiques mettent de plus en plus en œuvre des études sur les inhibiteurs de la DNMT. La recherche sur les thérapies combinées élargit leur champ d'application. Les marchés émergents investissent dans l'accessibilité des inhibiteurs de la DNMT. Les avancées technologiques en matière de formulation et d'administration améliorent l'efficacité. La connaissance des cibles épigénétiques dans les maladies cardiovasculaires et métaboliques stimule également la croissance. L'expansion continue du portefeuille de produits des sociétés pharmaceutiques soutient la dynamique du marché. Les inhibiteurs de la DNMT sont de plus en plus intégrés aux initiatives de médecine de précision. Leur adoption est encore renforcée par la croissance des financements publics et privés.

• Sur demande

En fonction des applications, le marché nord-américain du diagnostic épigénétique est segmenté en oncologie, maladies cardiovasculaires, maladies métaboliques, immunologie, maladies inflammatoires, maladies infectieuses, etc. Le segment oncologique a dominé le marché avec 46,3 % de parts de chiffre d'affaires en 2024. La prévalence croissante du cancer, l'intensification des initiatives de détection précoce et l'adoption de biomarqueurs épigénétiques alimentent cette domination. Les applications oncologiques reposent fortement sur la méthylation de l'ADN, les modifications des histones et le profilage de l'ARN non codant. L'utilité clinique pour le pronostic, le choix et le suivi des traitements stimule la demande. Les hôpitaux et les instituts de recherche adoptent massivement les diagnostics épigénétiques axés sur l'oncologie. Des entreprises commerciales développent des kits et des instruments spécifiques à l'oncologie. Le financement de la recherche sur le cancer soutient une croissance continue. L'intégration avec des plateformes à haut débit permet un dépistage efficace de larges cohortes de patients. Des outils bioinformatiques avancés améliorent les informations exploitables. Les initiatives gouvernementales en faveur du dépistage du cancer stimulent l'adoption. Les collaborations entre les entreprises de diagnostic et les centres d'oncologie renforcent la présence sur le marché.

Le segment des maladies cardiovasculaires devrait connaître le TCAC le plus rapide, soit 19,2 % entre 2025 et 2032. Cette croissance est alimentée par les recherches émergentes reliant les mécanismes épigénétiques aux maladies cardiaques. L'adoption d'outils de diagnostic épigénétique pour la détection précoce et la stratification du risque est en hausse. Les hôpitaux et les laboratoires de recherche investissent dans le profilage des biomarqueurs. Les tests de méthylation de l'ADN et de modification des histones sont appliqués à la recherche cardiovasculaire. Les avancées technologiques des plateformes de détection améliorent la précision et le rendement. La prévalence croissante des maladies cardiovasculaires dans le monde stimule le potentiel du marché. Les études universitaires et la R&D pharmaceutique contribuent à une adoption croissante. L'intégration aux programmes de médecine personnalisée accélère la croissance. Les investissements dans les infrastructures de diagnostic favorisent l'accessibilité. Les campagnes de sensibilisation et les recommandations cliniques intégrant l'épigénétique stimulent encore la demande.

• Par l'utilisateur final

En fonction de l'utilisateur final, le marché nord-américain du diagnostic épigénétique est segmenté en instituts universitaires et de recherche, sociétés pharmaceutiques et biotechnologiques, organismes de recherche sous contrat (CRO) et autres. Ce segment représentait la plus grande part de chiffre d'affaires du marché, soit 43,7 % en 2024. Les institutions mènent des recherches approfondies en épigénétique, axées sur la découverte de biomarqueurs, les mécanismes pathologiques et le développement thérapeutique. L'accès à des subventions et à des financements de recherche renforce l'adoption. Des investissements importants dans les infrastructures de biologie moléculaire soutiennent des tests sophistiqués. La collaboration avec les sociétés pharmaceutiques garantit l'accès aux réactifs, aux kits et aux instruments. Les résultats de la recherche stimulent l'innovation en matière de diagnostic épigénétique. L'intégration aux plateformes bioinformatiques améliore l'analyse et la reproductibilité. La formation d'un personnel qualifié garantit une utilisation optimale des outils. Les initiatives mondiales de recherche en oncologie, maladies cardiovasculaires et métaboliques soutiennent la domination du segment. Les publications évaluées par les pairs et les activités de brevets soutiennent la demande à long terme. L'expansion continue des programmes de recherche stimule la consommation de réactifs et d'instruments.

Le secteur des sociétés pharmaceutiques et biotechnologiques devrait connaître le TCAC le plus rapide, soit 18,5 % entre 2025 et 2032. Les entreprises se concentrent sur la découverte de médicaments, le développement de thérapies épigénétiques et les essais cliniques. L'augmentation des investissements dans la médecine de précision accélère l'adoption. Les partenariats avec des CRO améliorent l'évolutivité et l'expertise. La demande de réactifs, d'instruments et d'outils bioinformatiques de haute qualité est en hausse. Les technologies avancées permettent d'améliorer le criblage des composés et l'évaluation de leur efficacité. Les pipelines de R&D pharmaceutiques en oncologie et dans les maladies métaboliques stimulent la croissance du marché. Les applications émergentes en immunologie et en maladies infectieuses soutiennent l'expansion. Les collaborations stratégiques avec des instituts universitaires facilitent le transfert de connaissances. Les autorisations réglementaires de nouveaux diagnostics stimulent l'adoption. La concurrence mondiale encourage l'innovation continue.

• Par canal de distribution

En termes de canal de distribution, le marché nord-américain du diagnostic épigénétique est segmenté en ventes directes et ventes au détail. Le segment des ventes directes a dominé le marché en 2024, représentant la plus grande part de chiffre d'affaires, soit environ 48,5 %. Cette domination s'explique principalement par la préférence des hôpitaux, des établissements universitaires et des grands organismes de recherche pour l'approvisionnement en instruments et réactifs de diagnostic de haute qualité directement auprès des fabricants ou des distributeurs agréés. Les ventes directes garantissent la fiabilité, les avantages des achats en gros et un meilleur service après-vente, essentiels pour les outils de diagnostic épigénétique sophistiqués. Les grands utilisateurs finaux privilégient souvent ce canal, car il leur permet de négocier des contrats personnalisés, de bénéficier de formations techniques et de garantir un approvisionnement ininterrompu pour la recherche et les applications cliniques critiques. De plus, les ventes directes offrent l'avantage d'accéder à des produits haut de gamme, à des technologies de pointe et à des services de maintenance complets, essentiels à la précision des diagnostics. Ce segment bénéficie d'accords à long terme avec des fabricants de premier plan, garantissant une qualité de produit constante et une conformité réglementaire. De plus, l'appel d'offres direct facilite une meilleure intégration des instruments, des réactifs et des outils bioinformatiques, essentielle à la rationalisation des flux de travail dans les laboratoires de recherche et cliniques. La forte valeur ajoutée des produits, notamment les instruments, les kits et les logiciels bioinformatiques, fait de l'appel d'offres direct le canal privilégié des acheteurs institutionnels. De plus, les fabricants proposent souvent des solutions sur mesure et un support technique post-installation via ce canal, ce qui renforce la fidélité des clients et favorise les achats répétés.

Le segment de la vente au détail devrait connaître le TCAC le plus rapide, soit 18,3 % entre 2025 et 2032. Cette croissance est tirée par l'accessibilité croissante des kits de diagnostic épigénétique, des réactifs et des consommables pour les petits laboratoires, les cliniques spécialisées et les chercheurs individuels. Les canaux de distribution offrent une commodité et des cycles d'approvisionnement plus rapides, permettant aux petits utilisateurs finaux d'adopter des technologies de pointe sans passer par des processus d'appel d'offres complexes. L'expansion des plateformes de commerce électronique et des places de marché en ligne a encore accéléré l'adoption de la vente au détail, permettant aux chercheurs et aux laboratoires cliniques d'acheter directement des instruments, des consommables et des outils bioinformatiques dans des délais minimaux. De plus, la tendance croissante à la médecine personnalisée et la demande croissante de kits de test à domicile ou décentralisés contribuent à l'adoption croissante des canaux de vente au détail. Les canaux de distribution facilitent également une pénétration plus large du marché dans les zones semi-urbaines et régionales, où les appels d'offres directs peuvent être moins accessibles. Les fabricants proposent de plus en plus de solutions groupées et de packages promotionnels via le commerce de détail, améliorant ainsi l'accessibilité et l'adoption. Des stratégies marketing, telles que des remises pour les nouveaux acheteurs et des options de paiement flexibles, stimulent l'adoption par le commerce de détail. Le segment bénéficie également d'initiatives de sensibilisation et de formation renforcées auprès des clients particuliers, encourageant l'utilisation de diagnostics épigénétiques avancés. De plus, les canaux de vente au détail contribuent à accroître la visibilité de la marque, à élargir sa portée auprès de nouveaux utilisateurs finaux et à accélérer la collecte de retours pour l'amélioration des produits.

Analyse régionale du marché nord-américain du diagnostic épigénétique

- Les États-Unis ont dominé le marché nord-américain du diagnostic épigénétique, avec une part de chiffre d'affaires de 87,3 % en 2024, grâce à une infrastructure de santé de pointe, une forte adoption des technologies de diagnostic moléculaire et des investissements importants dans la recherche clinique et les installations de diagnostic. Le pays a connu une croissance notable grâce à la prévalence croissante du cancer et des maladies chroniques, à la demande croissante de dépistage précoce et aux innovations dans les plateformes de tests épigénétiques à haut débit.

- Le Canada devrait être le pays connaissant la croissance la plus rapide sur le marché nord-américain du diagnostic épigénétique au cours de la période de prévision, en raison de l'augmentation des investissements dans les infrastructures de santé, de la sensibilisation croissante à la médecine de précision, de la prévalence croissante des maladies liées au mode de vie et de l'expansion des initiatives de recherche médicale.

- Des investissements importants dans la recherche clinique, les installations de diagnostic et la médecine de précision soutiennent la croissance du marché

Aperçu du marché du diagnostic épigénétique en Amérique du Nord et aux États-Unis

Le marché nord-américain du diagnostic épigénétique a représenté la plus grande part de chiffre d'affaires en 2024, avec 87,3 %, grâce à la prévalence croissante du cancer et d'autres maladies chroniques, à la demande croissante de dépistage précoce et aux innovations en matière de plateformes de tests épigénétiques à haut débit. Le développement des laboratoires de diagnostic, la sensibilisation croissante des professionnels de santé à la médecine personnalisée et les initiatives gouvernementales en faveur des outils de diagnostic avancés stimulent également la croissance du marché.

Aperçu du marché canadien et nord-américain du diagnostic épigénétique

Le marché canadien du diagnostic épigénétique en Amérique du Nord devrait connaître la croissance la plus rapide au cours de la période de prévision, grâce à l'augmentation des investissements dans les infrastructures de santé, à la sensibilisation croissante à la médecine de précision et au développement des initiatives de recherche médicale. L'accent mis par le pays sur l'amélioration de l'accès aux services de diagnostic avancé, combiné aux collaborations entre les gouvernements et le secteur privé, favorise l'adoption des technologies de diagnostic épigénétique.

Part de marché du diagnostic épigénétique en Amérique du Nord

L’industrie du diagnostic épigénétique est principalement dirigée par des entreprises bien établies, notamment :

- PerkinElmer (États-Unis)

- Diagenode (Belgique)

- F. Hoffman-La Roche SA (Suisse)

- EpiCypher (États-Unis)

- Promega Corporation (États-Unis)

- QIAGEN (Allemagne)

- PacBio (États-Unis)

- Epigenomics AG (Allemagne)

- Biologie réactionnelle (États-Unis)

- Bio-Rad Laboratories, Inc. (États-Unis)

- Agilent Technologies, Inc. (États-Unis)

- Merck KGaA (Allemagne)

- Illumina, Inc. (États-Unis)

- ACTIVEMOTIF (États-Unis)

- Thermo Fisher Scientific, Inc. (États-Unis)

- EpiGentek Group Inc. (États-Unis)

- Enzo Life Sciences, Inc. (États-Unis)

- Epizyme, Inc. (États-Unis)

Développements récents sur le marché nord-américain du diagnostic épigénétique

- En mai 2025, une équipe de recherche collaborative issue d'institutions universitaires américaines de premier plan a publié une étude révolutionnaire présentant un modèle de classification de la méthylation de l'ADN capable de prédire l'origine des organes et des sites pathologiques à partir de l'ADN acellulaire (cfDNA). Ce modèle, utilisant l'apprentissage automatique et des ensembles de données de méthylation harmonisés, a démontré une grande précision dans la distinction des profils de méthylation spécifiques aux tissus, offrant un potentiel significatif pour le diagnostic non invasif en oncologie et dans les maladies inflammatoires.

- En juillet 2024, la Food and Drug Administration (FDA) américaine a approuvé un nouveau test de biomarqueurs épigénétiques pour la détection précoce du cancer colorectal. Développé par une entreprise de biotechnologie californienne, ce test analyse les profils de méthylation de l'ADN dans des échantillons sanguins, offrant ainsi une option de dépistage mini-invasive qui améliore le diagnostic précoce et les résultats du traitement.

- En mars 2023, une société pharmaceutique américaine a annoncé le lancement d'un essai clinique de phase II pour un médicament épigénétique ciblant les enzymes ADN méthyltransférases. Cet essai vise à évaluer l'efficacité de cette nouvelle approche thérapeutique dans le traitement des patients atteints de tumeurs solides avancées, marquant ainsi une étape importante vers l'intégration des thérapies épigénétiques dans les schémas thérapeutiques anticancéreux.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.