Marché des emballages écologiques en Amérique du Nord, par type (emballages à contenu recyclé, emballages réutilisables et emballages dégradables), type de matériau (papier et carton, plastique, métal, verre, matériaux à base d'amidon et autres), type de produit (sacs, sachets et sachets, boîtes, conteneurs, films, plateaux, tubes, bouteilles et pots, canettes et autres), technique (emballage actif, emballage moulé, emballage en fibres alternatives et autres), couche (emballage primaire, emballage secondaire et emballage tertiaire), application (aliments, boissons, produits pharmaceutiques, soins personnels, soins à domicile et autres), pays (États-Unis, Canada, Mexique) Tendances et prévisions de l'industrie jusqu'en 2029

Analyse et perspectives du marché : marché nord-américain des emballages écologiques

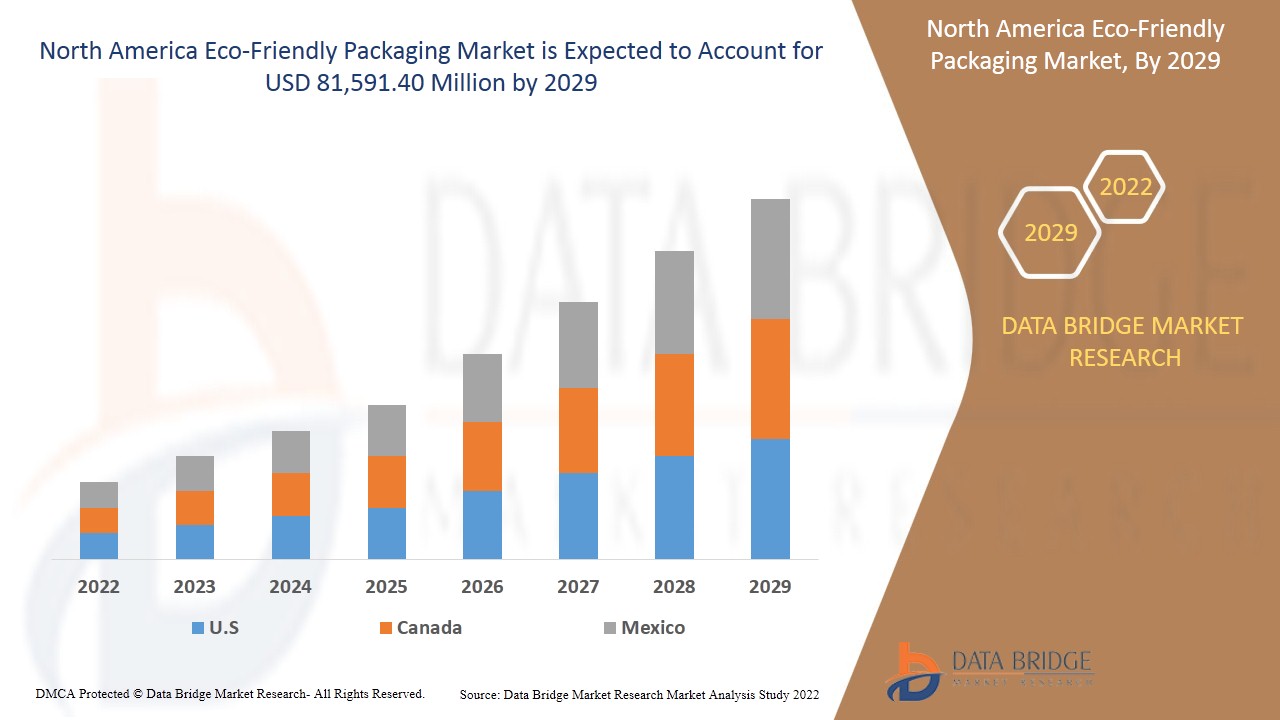

Le marché nord-américain des emballages écologiques devrait connaître une croissance de marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît à un TCAC de 4,6 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 81 591,40 millions USD d'ici 2029.

Les emballages écologiques sont faciles à recycler, sans danger pour les personnes et l'environnement, et sont fabriqués à partir de matériaux recyclés. Ils utilisent des matériaux et des pratiques de fabrication ayant un impact minimal sur la consommation d'énergie et les ressources naturelles. Les consommateurs sont de plus en plus préoccupés par les conséquences environnementales des emballages. Les entreprises subissent la pression des consommateurs et des gouvernements pour utiliser des emballages écologiques pour leurs produits.

Les solutions d’emballage écologiques visent à : réduire la quantité d’emballage des produits, promouvoir l’utilisation de matériaux renouvelables/réutilisables, réduire les dépenses liées à l’emballage, éliminer l’utilisation de matériaux toxiques dans la production d’emballages et fournir des options pour recycler facilement les emballages.

La sensibilisation croissante du public aux préoccupations environnementales et à la pollution causée par les emballages conventionnels tels que le plastique a entraîné une augmentation de la demande d'emballages écologiques, ce qui devrait largement stimuler la croissance du marché nord-américain des emballages écologiques. Le principal frein peut être le manque de sensibilisation aux avantages des produits d'emballage écologiques. Des innovations considérables dans les produits d'emballage devraient offrir des opportunités sur le marché. Le coût élevé et la mauvaise infrastructure des processus de recyclage peuvent constituer un défi pour le marché nord-américain des emballages écologiques.

Ce rapport sur le marché des emballages écologiques en Amérique du Nord fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste ; notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché des emballages écologiques en Amérique du Nord

Le marché nord-américain des emballages écologiques est segmenté en six segments notables, en fonction du type, du type de matériau, du type de produit, de la technique, de la couche et de l'application. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

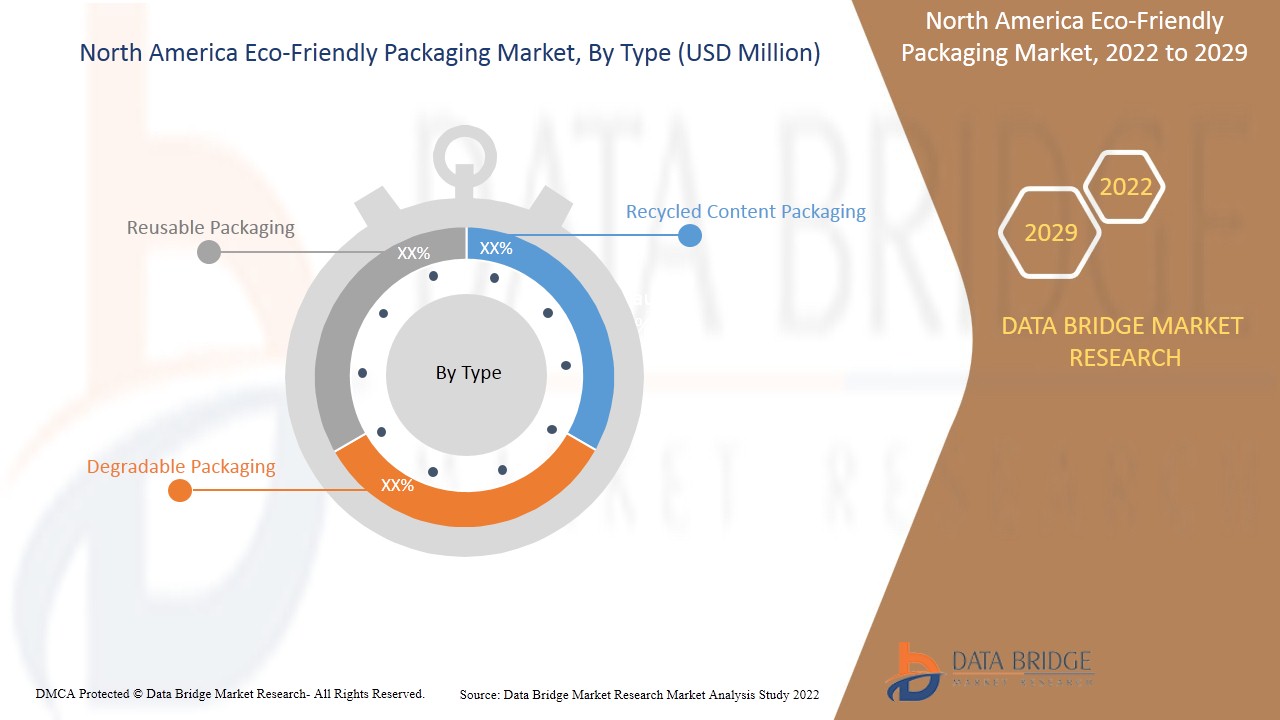

- Sur la base du type, le marché des emballages écologiques est segmenté en emballages à contenu recyclé, emballages réutilisables et emballages dégradables. En 2022, le segment des emballages réutilisables devrait dominer le marché nord-américain des emballages écologiques, car ils sont rentables. Étant donné que les emballages réutilisables sont conçus pour une utilisation répétée, ils sont plus solides et plus durables que les emballages à usage unique.

- En fonction du type de matériau, le marché nord-américain des emballages écologiques est segmenté en papier et carton, plastique, métal, verre, matériaux à base d'amidon et autres. En 2022, le segment du papier et du carton devrait dominer le marché nord-américain des emballages écologiques, en raison de l'avantage d'être, dans la plupart des cas, le matériau structurel le moins cher pour les emballages et une source renouvelable.

- En fonction du type de produit, le marché nord-américain des emballages écologiques est segmenté en sacs, sachets et pochettes , boîtes, conteneurs, films, plateaux, tubes, bouteilles et bocaux, canettes et autres. En 2022, le segment des boîtes devrait dominer, car les boîtes ont un bon rapport résistance/poids et protègent parfaitement leur contenu.

- Sur la base de la technique, le marché nord-américain des emballages écologiques est segmenté en emballages actifs, emballages moulés, emballages en fibres alternatives et autres. En 2022, le segment des emballages en fibres alternatives devrait dominer le marché nord-américain des emballages écologiques, car ils s'avèrent être une alternative écologique au papier. Il offre également une alternative indispensable au polystyrène , qui est nocif pour la santé humaine.

- Sur la base des couches, le marché nord-américain des emballages écologiques est segmenté en emballages primaires, emballages secondaires et emballages tertiaires. En 2022, le segment des emballages primaires devrait dominer le marché nord-américain des emballages écologiques, car il protège le produit des dommages externes.

- En fonction des applications, le marché nord-américain des emballages écologiques est segmenté en aliments, boissons, produits pharmaceutiques, soins personnels, produits d'entretien ménager et autres. En 2022, le segment alimentaire devrait dominer, car les emballages sont largement utilisés dans l'industrie alimentaire pour prévenir ou réduire les dommages aux produits et la détérioration des aliments.

Analyse du marché des emballages écologiques en Amérique du Nord au niveau des pays

Le marché des emballages écologiques en Amérique du Nord est analysé et des informations sur la taille du marché sont fournies par pays, type, type de matériau, type de produit, technique, couche et application.

Les pays couverts par le rapport sur le marché des emballages écologiques en Amérique du Nord sont les États-Unis, le Canada et le Mexique. Les États-Unis devraient dominer le marché des emballages écologiques en Amérique du Nord en raison de la croissance accrue des emballages écologiques dans la région en raison de la forte demande de biens de consommation à évolution rapide et de la préférence croissante des consommateurs pour les emballages écologiques. Le Canada devrait croître en raison du grand intérêt que portent les industries de l'emballage alimentaire et des boissons, des soins personnels et des médicaments aux matériaux écologiques et verts, ce qui fait que les clients se tournent vers les emballages durables. Le Mexique devrait croître sur le marché des emballages écologiques en Amérique du Nord en raison de la prise de conscience croissante des consommateurs à l'égard de la protection de l'environnement.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Croissance du marché nord-américain des emballages écologiques

Le marché nord-américain des emballages écologiques vous fournit également une analyse de marché détaillée de la croissance de chaque pays dans la base installée de différents types de produits pour le marché, l'impact de la technologie utilisant des courbes de survie et des changements dans les scénarios réglementaires des préparations pour nourrissons, et leur impact sur le marché des emballages écologiques. Les données sont disponibles pour la période historique de 2011 à 2019.

Analyse du paysage concurrentiel et des parts de marché des emballages écologiques en Amérique du Nord

Le paysage concurrentiel du marché nord-américain des emballages écologiques fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais cliniques, l'analyse de la marque, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise vers le marché nord-américain des emballages écologiques.

Certains des principaux acteurs couverts par le rapport sur les emballages écologiques en Amérique du Nord sont WestRock Company, Berry Global Inc., Crown Holdings, Inc., Amcor plc, Sonoco Products Company, Ardagh Group SA, DS Smith, Tetra Pak, Sealed Air, Smurfit Kappa, Huhtamaki, Pactiv Evergreen Inc., Ball Corporation, Printpack, Plastipak Holdings, Inc., Elopak, UFlex Limited, EMERALD PACKAGING, Mondi, Nampak Ltd., et d'autres. Les analystes de DBMR comprennent les atouts de la concurrence et fournissent une analyse concurrentielle pour chaque concurrent séparément.

Par exemple,

- En novembre 2021, Ardagh Group SA a annoncé avoir accepté d'acquérir Consol Holdings Proprietary Limited, le premier producteur d'emballages en verre sur le continent africain, pour une valeur nette de 10,1 milliards de ZAR (635 millions de dollars). Il dessert une large gamme de clients internationaux, régionaux et nationaux de premier plan, principalement dans les secteurs de la bière, du vin, des spiritueux, de l'alimentation et des boissons non alcoolisées. Cela renforcera la position de l'entreprise sur le marché international

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SINGLE-USE PLASTIC BAN HAS HEIGHTENED DEMAND FOR ECO-FRIENDLY PACKAGING

5.1.2 CHANGING CONSUMER PREFERENCES TOWARDS CONVENIENCE AND PACKAGED FOODS

5.1.3 RISE IN AWARENESS REGARDING ENVIRONMENTAL CONSERVATION AND SUSTAINABLE LIVING

5.1.4 STRINGENT GOVERNMENT REGULATIONS REGARDING ENVIRONMENTAL SUSTAINABILITY

5.2 RESTRAINTS

5.2.1 PRICE VOLATILITY OF RAW MATERIALS

5.2.2 CONSTRAINT IN PRODUCTION CAPACITIES

5.2.3 LACK OF KNOWLEDGE AND LOW ACCEPTANCE FOR SUSTAINABLE PACKAGING IN DEVELOPING ECONOMIES

5.3 OPPORTUNITIES

5.3.1 CONSIDERABLE INNOVATIONS IN PACKAGING PRODUCTS

5.3.2 SIGNIFICANT GOVERNMENT INITIATIVES TO PROMOTE USE OF ECO-FRIENDLY PACKAGING

5.3.3 INCREASE IN GROWTH POTENTIAL IN PACKAGING MARKET AND RISING R&D ACTIVITIES

5.4 CHALLENGES

5.4.1 HIGH COST OF ECO-FRIENDLY PACKAGING AS COMPARED TO CONVENTIONAL PRODUCTS

5.4.2 HIGH COST AND POOR INFRASTRUCTURE FOR RECYCLING PROCESSES

6 COVID 19 IMPACT ON THE NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON PRICE

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY TYPE

7.1 OVERVIEW

7.2 REUSABLE PACKAGING

7.3 RECYCLED CONTENT PACKAGING

7.4 DEGRADABLE PACKAGING

8 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE

8.1 OVERVIEW

8.2 PAPER & PAPER BOARD

8.2.1 PAPER & PAPER BOARD, BY MATERIAL TYPE

8.2.1.1 RECYCLED (COATED AND UNCOATED)

8.2.1.2 SOLID BLEACH SULFATE (SBS)

8.2.1.3 COATED UNBLEACHED KRAFT (CUK)

8.2.1.4 OTHERS

8.3 PLASTIC

8.3.1 PLASTIC, BY MATERIAL TYPE

8.3.1.1 BIO-BASED PLASTIC

8.3.1.2 BIODEGRADABLE PLASTIC

8.3.1.3 OTHERS

8.4 GLASS

8.4.1 GLASS, BY MATERIAL TYPE

8.4.1.1 SODA ASH

8.4.1.2 SAND

8.4.1.3 LIMESTONE

8.5 METAL

8.5.1 METAL, BY MATERIAL TYPE

8.5.1.1 ALUMINIUM

8.5.1.2 STEEL

8.5.1.3 OTHER

8.6 STARCH-BASED MATERIALS

8.7 OTHERS

9 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 BOXES

9.3 BAGS

9.4 POUCHES & SACHETS

9.5 CONTAINERS

9.6 BOTTLES & JARS

9.7 CANS

9.8 FILMS

9.9 TUBES

9.1 TRAYS

9.11 OTHERS

10 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE

10.1 OVERVIEW

10.2 ALTERNATE FIBER PACKAGING

10.2.1 ALTERNATE FIBER PACKAGING, BY TECHNIQUE

10.2.1.1 BAMBOO FIBER

10.2.1.2 MUSHROOM PACKAGING

10.2.1.3 OTHERS

10.3 MOLDED PACKAGING

10.3.1 MOLDED PACKAGING, BY TECHNIQUE

10.3.1.1 TRANSFER MOLDED PULP PACKAGING

10.3.1.2 THICK WALL PULP PACKAGING

10.3.1.3 THERMOFORMED PULP PACKAGING

10.3.1.4 PROCESSED PULP PACKAGING

10.4 ACTIVE PACKAGING

10.4.1 ACTIVE PACKAGING, BY TECHNIQUE

10.4.1.1 MODIFIED ATMOSPHERE PACKAGING (MAP)

10.4.1.2 ANTIMICROBIAL PACKAGING

10.4.1.3 BARRIER PACKAGING

10.5 OTHERS

11 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY LAYER

11.1 OVERVIEW

11.2 PRIMARY PACKAGING

11.3 SECONDARY PACKAGING

11.4 TERTIARY PACKAGING

12 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FOOD

12.2.1 FOOD, BY APPLICATION

12.2.1.1 BAKERY & CONFECTIONARY

12.2.1.2 DAIRY PRODUCTS

12.2.1.3 READY TO EAT FOOD

12.2.1.4 FROZEN FOOD

12.2.1.5 FRUITS & VEGETABLES

12.2.1.6 MEAT PRODUCTS

12.2.1.7 OTHERS

12.2.2 FOOD, BY TYPE

12.2.2.1 REUSABLE PACKAGING

12.2.2.2 RECYCLED CONTENT PACKAGING

12.2.2.3 DEGRADABLE PACKAGING

12.3 BEVERAGES

12.3.1 BEVERAGES, BY APPLICATION

12.3.1.1 NON-ALCOHOLIC

12.3.1.2 ALCOHOLIC

12.3.2 BEVERAGES, BY TYPE

12.3.2.1 REUSABLE PACKAGING

12.3.2.2 RECYCLED CONTENT PACKAGING

12.3.2.3 DEGRADABLE PACKAGING

12.4 PHARMACEUTICALS

12.4.1 PHARMACEUTICALS, BY TYPE

12.4.1.1 REUSABLE PACKAGING

12.4.1.2 RECYCLED CONTENT PACKAGING

12.4.1.3 DEGRADABLE PACKAGING

12.5 PERSONAL CARE

12.5.1 PERSONAL CARE, BY TYPE

12.5.1.1 REUSABLE PACKAGING

12.5.1.2 RECYCLED CONTENT PACKAGING

12.5.1.3 DEGRADABLE PACKAGING

12.6 HOME CARE

12.6.1 HOME CARE, BY TYPE

12.6.1.1 REUSABLE PACKAGING

12.6.1.2 RECYCLED CONTENT PACKAGING

12.6.1.3 DEGRADABLE PACKAGING

12.7 OTHERS

12.7.1 OTHERS, BY TYPE

12.7.1.1 REUSABLE PACKAGING

12.7.1.2 RECYCLED CONTENT PACKAGING

12.7.1.3 DEGRADABLE PACKAGING

13 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.2 MERGER & ACQUISITION

14.3 EXPANSIONS

14.4 NEW PRODUCT DEVELOPMENT

14.5 AWARD

14.6 PARTNERSHIP

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 WEST ROCK COMPANY

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT UPDATES

16.2 CROWN HOLDING, INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT UPDATES

16.3 AMCOR PLC

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT UPDATES

16.4 TETRA PAK

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT UPDATES

16.5 BERRY NORTH AMERICA INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT UPDATES

16.6 SMUFIT KAPPA

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT UPDATES

16.7 DS SMITH

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT UPDATES

16.8 MONDI

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT UPDATES

16.9 ARDAGH GROUP S.A.

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT UPDATES

16.1 BALL CORPORATION

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT UPDATES

16.11 ELOPAK

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT UPDATES

16.12 EMERALD PACKAGING

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT UPDATES

16.13 HUHTAMAKI

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT UPDATES

16.14 NAMPAK LTD.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT UPDATES

16.15 PACTIV EVERGREEN INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT UPDATES

16.16 PLASTIPAK HOLDINGS, INC.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT UPDATES

16.17 PRINTPACK

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT UPDATE

16.18 SEALED AIR

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT UPDATES

16.19 SONOCO PRODUCTS COMPANY

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT UPDATES

16.2 UFLEX LIMITED

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT UPDATES

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF CARTONS, BOXES, CASES, BAGS AND OTHER PACKING CONTAINERS, OF PAPER, PAPERBOARD, CELLULOSE WADDING; HS CODE - 4819 (USD THOUSAND)

TABLE 2 EXPORT DATA OF CARTONS, BOXES, CASES, BAGS AND OTHER PACKING CONTAINERS, OF PAPER, PAPERBOARD, CELLULOSE WADDING; HS CODE – 4819 (USD THOUSAND)

TABLE 3 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 5 NORTH AMERICA REUSABLE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA REUSABLE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 7 NORTH AMERICA RECYCLED CONTENT PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA RECYCLED CONTENT PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 9 NORTH AMERICA DEGRADABLE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA DEGRADABLE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 11 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA METAL IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA STARCH-BASED MATERIALS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA BOXES IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA BAGS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA POUCHES & SACHETS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA CONTAINERS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA BOTTLES & JARS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA CANS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA FILMS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA TUBES IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA TRAYS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA PRIMARY PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA SECONDARY PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA TERTIARY PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY COUNTRY , 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY COUNTRY, 2020-2029 (MILLION UNITS)

TABLE 62 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 64 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA PAPER & PAPER-BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 75 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 76 NORTH AMERICA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 77 NORTH AMERICA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 NORTH AMERICA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 NORTH AMERICA PHARMACEUTICALS ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 NORTH AMERICA PERSONAL CARE ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 NORTH AMERICA HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 NORTH AMERICA OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 U.S. ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 U.S. ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 ( MILLION UNITS)

TABLE 86 U.S. ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 87 U.S. PAPER & PAPER-BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 88 U.S. PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 89 U.S. METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 90 U.S. GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 91 U.S. ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 92 U.S. ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 93 U.S. ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 94 U.S. MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 95 U.S. ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 96 U.S. ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 97 U.S. ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 U.S. FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 U.S. FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 U.S. BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 101 U.S. BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 U.S. PHARMACEUTICALS ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 U.S. PERSONAL CARE ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 U.S. HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 U.S. OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 CANADA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 CANADA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 108 CANADA ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 109 CANADA PAPER & PAPER-BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 110 CANADA PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 111 CANADA METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 112 CANADA GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 113 CANADA ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 114 CANADA ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 115 CANADA ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 116 CANADA MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 117 CANADA ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 118 CANADA ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 119 CANADA ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 120 CANADA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 121 CANADA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 CANADA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 123 CANADA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 CANADA PHARMACEUTICALS ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 CANADA PERSONAL CARE ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 CANADA HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 CANADA OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 MEXICO ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 MEXICO ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 130 MEXICO ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 131 MEXICO PAPER & PAPER-BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 132 MEXICO PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 133 MEXICO METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 134 MEXICO GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 135 MEXICO ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 136 MEXICO ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 137 MEXICO ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 138 MEXICO MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 139 MEXICO ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 140 MEXICO ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 141 MEXICO ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 142 MEXICO FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 143 MEXICO FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 MEXICO BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 145 MEXICO BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 MEXICO PHARMACEUTICALS ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 MEXICO PERSONAL CARE ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 MEXICO HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 MEXICO OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET

FIGURE 2 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 CHANGING CONSUMER PREFERENCES TOWARDS CONVENIENCE AND PACKAGED FOODS IS DRIVING NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 REUSABLE PACKAGING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET IN 2022 & 2029

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET

FIGURE 18 PLASTIC WASTE GENERATED BY KEY COUNTRIES, 2021

FIGURE 19 CARDBOARD COSTS IN MONTH OF MAY 2020 & 2021

FIGURE 20 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2021

FIGURE 21 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2021

FIGURE 22 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2021

FIGURE 23 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2021

FIGURE 24 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2021

FIGURE 25 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2021

FIGURE 26 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 27 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 28 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: BY TYPE (2022-2029)

FIGURE 31 NORTH AMERICA ECO-FRIENDLY PACKAGING MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.