Marché des bouchons d'oreilles en Amérique du Nord, par style de fixation (avec ou sans cordon), ajustement (standard, personnalisé), matériau (PVC, silicone, polyuréthane, caoutchouc, autres), application (industrielle, domestique, divertissement, soins de santé, autres), prix (moins de 10 USD, 11 USD – 50 USD, 51 USD – 100 USD, plus de 100 USD), pays (États-Unis, Canada, Mexique), tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché : Marché des bouchons d'oreilles en Amérique du Nord

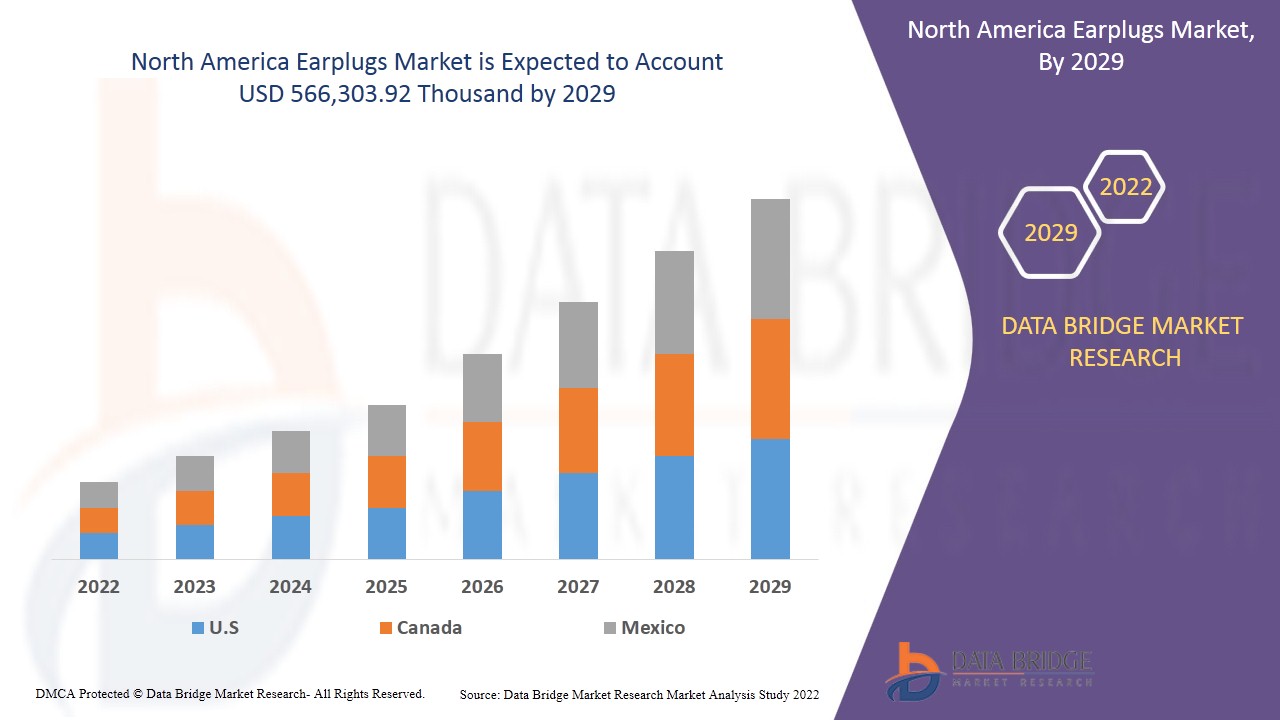

Le marché nord-américain des bouchons d'oreilles devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 7,8 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 566 303,92 milliers de dollars d'ici 2029. L'augmentation de l'exigence d'un processus de prise de décision rapide dans la biotechnologie devrait stimuler considérablement la croissance du marché.

Les bouchons d'oreilles sont des dispositifs insérés dans l'oreille pour protéger les oreilles de l'utilisateur des bruits forts, de l'infiltration d'eau , de la poussière ou de l'air excessif. Comme ils réduisent le volume du son, les bouchons d'oreilles sont souvent utilisés pour aider à prévenir la perte auditive et les acouphènes.

Les bouchons d'oreille moulés /moulables peuvent être insérés dans le conduit auditif. Ils sont disponibles en version jetable ou réutilisable et peuvent être trouvés dans la plupart des pharmacies et épiceries. Il existe principalement quatre types de bouchons d'oreille pour la protection auditive : les bouchons d'oreille en mousse, principalement fabriqués en polychlorure de vinyle ( PVC ) ou en polyuréthane (PU) (mousse à mémoire de forme), les bouchons d'oreille en cire, les bouchons d'oreille en silicone à bride et les bouchons d'oreille moulés sur mesure. De plus, des bouchons d'oreille conçus sur mesure sont disponibles et peuvent être fabriqués en consultant votre médecin ORL ou un autre professionnel de la santé auditive.

L'utilisation croissante de bouchons d'oreille dans les activités de construction et d'exploitation minière en Amérique du Nord est le principal facteur moteur du marché. La disponibilité de produits de substitution dans l'industrie peut s'avérer être un défi, mais la demande croissante de dispositifs de réduction du bruit (NRR) ou de suppression du bruit s'avère être une opportunité. Le manque de connaissances concernant l'utilisation et l'importance des bouchons d'oreille constitue un obstacle. Les défis rencontrés en raison de l'impact de la Covid-19 sur la chaîne d'approvisionnement des matières premières constituent également des facteurs restrictifs.

Le rapport sur le marché des bouchons d'oreilles fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et localisé, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché des bouchons d'oreilles, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché des bouchons d'oreilles

Le marché nord-américain des bouchons d’oreille est segmenté en cinq segments notables, à savoir le style de fixation, le matériau, l’ajustement, l’application et le prix.

- En fonction du style de fixation, le marché nord-américain des bouchons d'oreille est classé en sans fil et avec fil. En 2022, les bouchons sans fil devraient occuper le segment le plus élevé en raison de leur application facile et de leur prix moins cher.

- En fonction de l'ajustement, le marché nord-américain des bouchons d'oreille est classé en standard et personnalisé. En 2022, le standard devrait occuper le segment le plus élevé car ils sont disponibles à un prix très bas par rapport aux bouchons personnalisés.

- Sur la base du matériau, le marché nord-américain des bouchons d'oreille est classé en PVC, silicone, polyuréthane, caoutchouc et autres. En 2022, le PVC devrait occuper le segment le plus élevé en raison de la demande accrue de bouchons d'oreille moins chers à base de mousse sur le marché.

- En fonction des applications, le marché nord-américain des bouchons d'oreille est classé en secteurs industriel, domestique, de divertissement, de la santé et autres. En 2022, le secteur industriel devrait occuper le segment le plus élevé en raison des normes de sécurité auditive plus strictes et des réglementations des organismes de réglementation.

- En termes de prix, le marché nord-américain des bouchons d'oreille est classé en moins de 10 USD, de 11 USD à 50 USD, de 51 USD à 100 USD et plus de 100 USD. En 2022, les bouchons d'oreille à moins de 10 USD représentent le segment le plus élevé, car les consommateurs préfèrent les protections auditives à bas prix aux autres.

Analyse du marché des bouchons d'oreilles au niveau des pays

Le marché nord-américain des bouchons d’oreille est segmenté en cinq segments notables, à savoir le style de fixation, le matériau, l’ajustement, l’application et le prix.

Les pays couverts dans le rapport sur le marché des bouchons d'oreilles sont les États-Unis, le Canada et le Mexique. Les États-Unis dominent la région Amérique du Nord en raison de la sensibilisation accrue aux équipements de protection individuelle et des initiatives gouvernementales en matière de protection contre le bruit.

La section du rapport sur les pays fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

L'adoption croissante de bouchons d'oreilles dans les applications de musique et de sommeil pour stimuler la demande de produits stimule la croissance du marché des bouchons d'oreilles.

Le marché des bouchons d'oreilles vous fournit également une analyse de marché détaillée pour chaque croissance nationale sur un marché particulier. En outre, il fournit des informations détaillées sur la stratégie des acteurs du marché et leur présence géographique. Les données sont disponibles pour la période historique de 2012 à 2020.

Analyse du paysage concurrentiel et des parts de marché des bouchons d'oreilles

Le paysage concurrentiel du marché des bouchons d'oreilles fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise vers le marché des bouchons d'oreilles.

Certains des principaux acteurs opérant sur le marché des bouchons d'oreilles en Amérique du Nord sont EARGASM, Decibullz LLC., Wavy Ocean earplugs, EAROS, Inc., Vibes, QuietOn, Moldex-Metric, Honeywell International Inc., Etymotic, Magid Glove & Safety Manufacturing Company LLC, HEAROS, 3M, Liberty Glove & Safety, uvex group, Speedo International Limited et McKeon Products, Inc. entre autres.

De nombreux nouveaux développements de produits, extensions d'activité, contrats et accords sont également initiés par les entreprises du monde entier, ce qui accélère également le marché des bouchons d'oreille.

Par exemple,

- En mars 2021, Honeywell International Inc. a lancé un nouveau distributeur de bouchons d'oreilles doté d'une protection antimicrobienne. Ce lancement de produit aidera l'entreprise à diversifier son portefeuille de produits et à proposer une large gamme de produits susceptibles d'attirer les clients et d'accélérer les ventes.

- En juillet 2021, Magid Glove & Safety Manufacturing Company LLC s'est associée à des universitaires de Chicago pour créer un fonds destiné aux nouveaux professionnels de la sécurité. Cela aidera l'entreprise à augmenter sa capacité d'investissement et à développer de nouveaux produits et services qui peuvent diversifier le portefeuille de produits et attirer de nouveaux clients.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA EARPLUGS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COMPONENT TYPE TIMELINE CURVE

2.1 MARKET APPLICATION GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPORT AND EXPORT SCENARIO

4.2 RAW MATERIAL PRODUCTION COVERAGE

4.2.1 SILICON

4.2.2 PVC

4.2.3 POLYURETHANE

4.3 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.4 PORTER'S FIVE FORCES ANALYSIS

4.5 VENDOR SELECTION CRITERIA

4.6 PESTEL ANALYSIS

4.7 REGULATION COVERAGE

4.7.1 PRODUCT CODES

4.7.2 CERTIFIED STANDARDS

4.7.2.1 ANSI S12.6-2016

4.7.2.2 EN 352

4.7.3 SAFETY STANDARDS

4.7.3.1 MATERIAL HANDLING AND STORAGE

4.7.3.2 TRANSPORT & PRECAUTIONS

4.7.3.2.1 227.105 - PROTECTION OF EMPLOYEES:

4.7.3.2.2 227.107 - HEARING CONSERVATION PROGRAM.

4.7.3.3 HAZARD IDENTIFICATION

5 CLIMATE CHANGE SCENARIO

5.1 ENVIRONMENTAL CONCERNS:

5.2 INDUSTRY RESPONSE:

5.3 GOVERNMENT’S ROLE:

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW:

6.2 LOGISTIC COST SCENERIO:

6.3 IMPORTANCE OF LOGISTIC SERVICE PROVIDERS:

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWING USE OF EARPLUGS IN CONSTRUCTION AND MINING ACTIVITIES

7.1.2 INCREASING ADOPTION OF EARPLUGS IN MUSIC AND SLEEPING APPLICATIONS

7.1.3 GROWING ACCEPTANCE OF MOLDED EARPLUGS WITH THE USE OF DIFFERENT MATERIAL

7.1.4 GROWING PREVALENCE OF HEARING LOSS

7.2 RESTRAINTS

7.2.1 LACK OF KNOWLEDGE REGARDING THE USE AND IMPORTANCE OF EARPLUGS

7.2.2 HIGHER COST OF CUSTOMIZED EARPLUGS

7.3 OPPORTUNITIES

7.3.1 GOVERNMENT REGULATIONS ON INDUSTRIAL WORKERS AND MILITARY PERSONNEL

7.3.2 INCREASING TECHNOLOGICAL ADVANCEMENTS AND INNOVATIONS FOR EARPLUGS

7.3.3 RISING DEMAND FOR NOISE REDUCTION RATING (NRR) OR NOISE CANCELLATION DEVICES

7.3.4 INCREASE IN USAGE OF EARPLUGS IN MANUFACTURING INDUSTRY

7.4 CHALLENGES

7.4.1 AVAILABILITY OF PRODUCT SUBSTITUTES IN THE INDUSTRY

7.4.2 CONTINUED USE LEADING TO INFECTIONS

8 IMPACT OF COVID-19 ON THE NORTH AMERICA EARPLUGS MARKET

8.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

8.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE MARKET

8.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

8.4 IMPACT ON PRICE

8.5 IMPACT ON DEMAND

8.6 IMPACT ON SUPPLY CHAIN

8.7 CONCLUSION

9 NORTH AMERICA EARPLUGS MARKET, BY ATTACHMENT STYLE

9.1 OVERVIEW

9.2 UNCORDED

9.2.1 DISPOSABLE

9.2.2 REUSABLE

9.3 CORDED

9.3.1 DISPOSABLE

9.3.2 REUSABLE

10 NORTH AMERICA EARPLUGS MARKET, BY FITTING

10.1 OVERVIEW

10.2 STANDARD

10.3 CUSTOMIZED

11 NORTH AMERICA EARPLUGS MARKET, BY MATERIAL

11.1 OVERVIEW

11.2 PVC

11.3 SILICON

11.4 POLYURETHANE

11.5 RUBBER

11.6 OTHERS

12 NORTH AMERICA EARPLUGS MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 INDUSTRIAL

12.3 HOUSEHOLD

12.3.1 SLEEP

12.3.2 CONCENTRATION

12.3.3 NOISE SENSITIVITY

12.3.4 DIY

12.3.5 PARENTING

12.3.6 TRAVEL

12.4 ENTERTAINMENT

12.4.1 MUSIC

12.4.2 RECREATIONAL

12.4.3 MOTOR SPORTS

12.5 HEALTHCARE

12.6 OTHERS

13 NORTH AMERICA EARPLUGS MARKET, BY PRICE

13.1 OVERVIEW

13.2 UNDER US$ 10

13.3 US$ 11- US$ 50

13.4 US$ 51- US$ 100

13.5 ABOVE US$ 100

14 NORTH AMERICA EARPLUGS MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA EARPLUGS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY SHARE ANALYSIS

17.1 HONEYWELL INTERNATIONAL INC.

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 3M

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 SPEEDO INTERNATIONAL LIMITED

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 MOLDEX-METRIC

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 HEAROS

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 BLOX

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.7 DECIBULLZ LLC.

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 EARGASM

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 EARJOBS

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLI

17.1 EAROS, INC.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 EAR LABS AB

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 ETYMOTIC

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 HAPPY EARS

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 LIBERTY GLOVE & SAFETY

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 MAGID GLOVE & SAFETY MANUFACTURING COMPANY LLC

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 MCKEON PRODUCTS, INC.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 OHROPAX

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 QUIETON

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 UVEX GROUP

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 VIBES

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 WAVY OCEAN EARPLUGS

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA EARPLUGS MARKET, BY ATTACHMENT STYLE, 2022-2029 (USD THOUSAND)

TABLE 2 NORTH AMERICA EARPLUGS MARKET, BY ATTACHMENT STYLE, 2022-2029 (THOUSAND PAIRS)

TABLE 3 NORTH AMERICA UNCORDED IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 4 NORTH AMERICA UNCORDED IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 5 NORTH AMERICA UNCORDED IN EARPLUGS MARKET, BY TYPE, 2022-2029 (USD THOUSAND)

TABLE 6 NORTH AMERICA UNCORDED IN EARPLUGS MARKET, BY TYPE, 2022-2029 (THOUSAND PAIRS)

TABLE 7 NORTH AMERICA CORDED IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 8 NORTH AMERICA CORDED IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 9 NORTH AMERICA UNCORDED IN EARPLUGS MARKET, BY TYPE, 2022-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA UNCORDED IN EARPLUGS MARKET, BY TYPE, 2022-2029 (THOUSAND PAIRS)

TABLE 11 NORTH AMERICA EARPLUGS MARKET, BY FITTING, 2022-2029 (USD THOUSAND)

TABLE 12 NORTH AMERICA EARPLUGS MARKET, BY FITTING, 2022-2029 (THOUSAND PAIRS)

TABLE 13 NORTH AMERICA STANDARD IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA STANDARD IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 15 NORTH AMERICA CUSTOMIZED IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 16 NORTH AMERICA CUSTOMIZED IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 17 NORTH AMERICA EARPLUGS MARKET, BY MATERIAL, 2022-2029 (USD THOUSAND)

TABLE 18 NORTH AMERICA EARPLUGS MARKET, BY MATERIAL, 2022-2029 (THOUSAND PAIRS)

TABLE 19 NORTH AMERICA PVC IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 20 NORTH AMERICA PVC IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 21 NORTH AMERICA SILICON IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 22 NORTH AMERICA SILICON IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 23 NORTH AMERICA POLYURETHANE IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 24 NORTH AMERICA POLYURETHANE IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 25 NORTH AMERICA RUBBER IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 26 NORTH AMERICA RUBBER IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 27 NORTH AMERICA OTHERS IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA OTHERS IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 29 NORTH AMERICA EARPLUGS MARKET, BY APPLICATION, 2022-2029 (USD THOUSAND)

TABLE 30 NORTH AMERICA EARPLUGS MARKET, BY APPLICATION, 2022-2029 (THOUSAND PAIRS)

TABLE 31 NORTH AMERICA INDUSTRIAL IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA INDUSTRIAL IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 33 NORTH AMERICA HOUSEHOLD IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 34 NORTH AMERICA HOUSEHOLD IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 35 NORTH AMERICA HOUSEHOLD IN EARPLUGS MARKET, BY APPLICATION, 2022-2029 (USD THOUSAND)

TABLE 36 NORTH AMERICA HOUSEHOLD IN EARPLUGS MARKET, BY APPLICATION, 2022-2029 (THOUSAND PAIRS)

TABLE 37 NORTH AMERICA ENTERTAINMENT IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 38 NORTH AMERICA ENTERTAINMENT IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 39 NORTH AMERICA ENTERTAINMENT IN EARPLUGS MARKET, BY APPLICATION, 2022-2029 (USD THOUSAND)

TABLE 40 NORTH AMERICA ENTERTAINMENT IN EARPLUGS MARKET, BY APPLICATION, 2022-2029 (THOUSAND PAIRS)

TABLE 41 NORTH AMERICA HEALTHCARE IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 42 NORTH AMERICA HEALTHCARE IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 43 NORTH AMERICA OTHERS IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 44 NORTH AMERICA OTHERS IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 45 NORTH AMERICA EARPLUGS MARKET, BY PRICE, 2022-2029 (USD THOUSAND)

TABLE 46 NORTH AMERICA EARPLUGS MARKET, BY PRICE, 2022-2029 (THOUSAND PAIRS)

TABLE 47 NORTH AMERICA UNDER US$ 10 IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 48 NORTH AMERICA UNDER US$ 10 IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 49 NORTH AMERICA US$ 11- US$ 50 IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 50 NORTH AMERICA US$ 11- US$ 50 IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 51 NORTH AMERICA US$ 51- US$ 100 IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 52 NORTH AMERICA US$ 51- US$ 100 IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 53 NORTH AMERICA ABOVE US$ 100 IN EARPLUGS MARKET, BY REGION, 2022-2029 (USD THOUSAND)

TABLE 54 NORTH AMERICA ABOVE US$ 100 IN EARPLUGS MARKET, BY REGION, 2022-2029 (THOUSAND PAIRS)

TABLE 55 NORTH AMERICA EARPLUGS MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 56 NORTH AMERICA EARPLUGS MARKET, BY COUNTRY, 2020-2029 (THOUSAND PAIRS)

TABLE 57 NORTH AMERICA EARPLUGS MARKET, BY ATTACHMENT STYLE, 2020-2029 (USD THOUSAND)

TABLE 58 NORTH AMERICA EARPLUGS MARKET, BY ATTACHMENT STYLE, 2020-2029 (THOUSAND PAIRS)

TABLE 59 NORTH AMERICA UNCORDED IN EARPLUGS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 60 NORTH AMERICA UNCORDED IN EARPLUGS MARKET, BY TYPE, 2020-2029 (THOUSAND PAIRS)

TABLE 61 NORTH AMERICA CORDED IN EARPLUGS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 62 NORTH AMERICA CORDED IN EARPLUGS MARKET, BY TYPE, 2020-2029 (THOUSAND PAIRS)

TABLE 63 NORTH AMERICA EARPLUGS MARKET, BY FITTING, 2020-2029 (USD THOUSAND)

TABLE 64 NORTH AMERICA EARPLUGS MARKET, BY FITTING, 2020-2029 (THOUSAND PAIRS)

TABLE 65 NORTH AMERICA EARPLUGS MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 66 NORTH AMERICA EARPLUGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND PAIRS)

TABLE 67 NORTH AMERICA EARPLUGS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 68 NORTH AMERICA EARPLUGS MARKET, BY APPLICATION, 2020-2029 (THOUSAND PAIRS)

TABLE 69 NORTH AMERICA HOUSEHOLD IN EARPLUGS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 70 NORTH AMERICA HOUSEHOLD IN EARPLUGS MARKET, BY APPLICATION, 2020-2029 (THOUSAND PAIRS)

TABLE 71 NORTH AMERICA ENTERTAINMENT IN EARPLUGS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 72 NORTH AMERICA ENTERTAINMENT IN EARPLUGS MARKET, BY APPLICATION, 2020-2029 (THOUSAND PAIRS)

TABLE 73 NORTH AMERICA EARPLUGS MARKET, BY PRICE, 2020-2029 (USD THOUSAND)

TABLE 74 NORTH AMERICA EARPLUGS MARKET, BY PRICE, 2020-2029 (THOUSAND PAIRS)

TABLE 75 U.S. EARPLUGS MARKET, BY ATTACHMENT STYLE, 2020-2029 (USD THOUSAND)

TABLE 76 U.S. EARPLUGS MARKET, BY ATTACHMENT STYLE, 2020-2029 (THOUSAND PAIRS)

TABLE 77 U.S. UNCORDED IN EARPLUGS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 78 U.S. UNCORDED IN EARPLUGS MARKET, BY TYPE, 2020-2029 (THOUSAND PAIRS)

TABLE 79 U.S. CORDED IN EARPLUGS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 80 U.S. CORDED IN EARPLUGS MARKET, BY TYPE, 2020-2029 (THOUSAND PAIRS)

TABLE 81 U.S. EARPLUGS MARKET, BY FITTING, 2020-2029 (USD THOUSAND)

TABLE 82 U.S. EARPLUGS MARKET, BY FITTING, 2020-2029 (THOUSAND PAIRS)

TABLE 83 U.S. EARPLUGS MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 84 U.S. EARPLUGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND PAIRS)

TABLE 85 U.S. EARPLUGS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 86 U.S. EARPLUGS MARKET, BY APPLICATION, 2020-2029 (THOUSAND PAIRS)

TABLE 87 U.S. HOUSEHOLD IN EARPLUGS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 88 U.S. HOUSEHOLD IN EARPLUGS MARKET, BY APPLICATION, 2020-2029 (THOUSAND PAIRS)

TABLE 89 U.S. ENTERTAINMENT IN EARPLUGS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 90 U.S. ENTERTAINMENT IN EARPLUGS MARKET, BY APPLICATION, 2020-2029 (THOUSAND PAIRS)

TABLE 91 U.S. EARPLUGS MARKET, BY PRICE, 2020-2029 (USD THOUSAND)

TABLE 92 U.S. EARPLUGS MARKET, BY PRICE, 2020-2029 (THOUSAND PAIRS)

TABLE 93 CANADA EARPLUGS MARKET, BY ATTACHMENT STYLE, 2020-2029 (USD THOUSAND)

TABLE 94 CANADA EARPLUGS MARKET, BY ATTACHMENT STYLE, 2020-2029 (THOUSAND PAIRS)

TABLE 95 CANADA UNCORDED IN EARPLUGS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 96 CANADA UNCORDED IN EARPLUGS MARKET, BY TYPE, 2020-2029 (THOUSAND PAIRS)

TABLE 97 CANADA CORDED IN EARPLUGS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 98 CANADA CORDED IN EARPLUGS MARKET, BY TYPE, 2020-2029 (THOUSAND PAIRS)

TABLE 99 CANADA EARPLUGS MARKET, BY FITTING, 2020-2029 (USD THOUSAND)

TABLE 100 CANADA EARPLUGS MARKET, BY FITTING, 2020-2029 (THOUSAND PAIRS)

TABLE 101 CANADA EARPLUGS MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 102 CANADA EARPLUGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND PAIRS)

TABLE 103 CANADA EARPLUGS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 104 CANADA EARPLUGS MARKET, BY APPLICATION, 2020-2029 (THOUSAND PAIRS)

TABLE 105 CANADA HOUSEHOLD IN EARPLUGS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 106 CANADA HOUSEHOLD IN EARPLUGS MARKET, BY APPLICATION, 2020-2029 (THOUSAND PAIRS)

TABLE 107 CANADA ENTERTAINMENT IN EARPLUGS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 108 CANADA ENTERTAINMENT IN EARPLUGS MARKET, BY APPLICATION, 2020-2029 (THOUSAND PAIRS)

TABLE 109 CANADA EARPLUGS MARKET, BY PRICE, 2020-2029 (USD THOUSAND)

TABLE 110 CANADA EARPLUGS MARKET, BY PRICE, 2020-2029 (THOUSAND PAIRS)

TABLE 111 MEXICO EARPLUGS MARKET, BY ATTACHMENT STYLE, 2020-2029 (USD THOUSAND)

TABLE 112 MEXICO EARPLUGS MARKET, BY ATTACHMENT STYLE, 2020-2029 (THOUSAND PAIRS)

TABLE 113 MEXICO UNCORDED IN EARPLUGS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 114 MEXICO UNCORDED IN EARPLUGS MARKET, BY TYPE, 2020-2029 (THOUSAND PAIRS)

TABLE 115 MEXICO CORDED IN EARPLUGS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 116 MEXICO CORDED IN EARPLUGS MARKET, BY TYPE, 2020-2029 (THOUSAND PAIRS)

TABLE 117 MEXICO EARPLUGS MARKET, BY FITTING, 2020-2029 (USD THOUSAND)

TABLE 118 MEXICO EARPLUGS MARKET, BY FITTING, 2020-2029 (THOUSAND PAIRS)

TABLE 119 MEXICO EARPLUGS MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 120 MEXICO EARPLUGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND PAIRS)

TABLE 121 MEXICO EARPLUGS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 122 MEXICO EARPLUGS MARKET, BY APPLICATION, 2020-2029 (THOUSAND PAIRS)

TABLE 123 MEXICO HOUSEHOLD IN EARPLUGS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 124 MEXICO HOUSEHOLD IN EARPLUGS MARKET, BY APPLICATION, 2020-2029 (THOUSAND PAIRS)

TABLE 125 MEXICO ENTERTAINMENT IN EARPLUGS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 126 MEXICO ENTERTAINMENT IN EARPLUGS MARKET, BY APPLICATION, 2020-2029 (THOUSAND PAIRS)

TABLE 127 MEXICO EARPLUGS MARKET, BY PRICE, 2020-2029 (USD THOUSAND)

TABLE 128 MEXICO EARPLUGS MARKET, BY PRICE, 2020-2029 (THOUSAND PAIRS)

Liste des figures

FIGURE 1 NORTH AMERICA EARPLUGS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA EARPLUGS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA EARPLUGS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA EARPLUGS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA EARPLUGS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA EARPLUGS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA EARPLUGS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA EARPLUGS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA EARPLUGS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA EARPLUGS MARKET: SEGMENTATION

FIGURE 11 GROWING USE OF EARPLUGS IN CONSTRUCTION AND MINING ACTIVITIES IS EXPECTED TO BOOST NORTH AMERICA EARPLUGS MARKET IN THE FORECAST PERIOD

FIGURE 12 UNCORDED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA EARPLUGS MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND ASIA-PACIFIC IS THE FASTEST-GROWING REGION IN THE NORTH AMERICA EARPLUGS MARKET IN THE FORECAST PERIOD

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA EARPLUGS MARKET

FIGURE 15 EXPECTED GROWTH IN INFRASTRUCTURE CONSTRUCTION FROM 2020-2030 (IN %)

FIGURE 16 MUSIC INDUSTRY REVENUE WORLDWIDE FROM 2012 TO 2023 (IN BILLION U.S. DOLLARS)

FIGURE 17 ESTIMATED GROWTH RATES PERCENTS OF WORLD MANUFACTURING OUTPUT (Q3 2021 VS. Q3 2020)

FIGURE 18 USER PREFERENCES FOR HEARING PROTECTION (%)

FIGURE 19 NORTH AMERICA EARPLUGS MARKET, BY ATTACHMENT STYLE, 2021

FIGURE 20 NORTH AMERICA EARPLUGS MARKET, BY FITTING, 2021

FIGURE 21 NORTH AMERICA EARPLUGS MARKET, BY MATERIAL, 2021

FIGURE 22 NORTH AMERICA EARPLUGS MARKET, BY APPLICATION, 2021

FIGURE 23 NORTH AMERICA EARPLUGS MARKET, BY PRICE, 2021

FIGURE 24 NORTH AMERICA EARPLUGS MARKET: SNAPSHOT (2022)

FIGURE 25 NORTH AMERICA EARPLUGS MARKET: BY COUNTRY (2022)

FIGURE 26 NORTH AMERICA EARPLUGS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 NORTH AMERICA EARPLUGS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 NORTH AMERICA EARPLUGS MARKET: BY ATTACHMENT STYLE (2022-2029)

FIGURE 29 NORTH AMERICA EARPLUGS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.