Marché des analyseurs de gaz dissous en Amérique du Nord, par type (détecteurs de fumée, surveillance DGA d'alerte précoce, surveillance DGA complète, services de laboratoire, logiciels de base de données et appareils DGA portables), type de gaz (monogaz et multigaz), technologie ( chromatographie en phase gazeuse , spectroscopie photoacoustique et autres), type de produit (en ligne, portable et utilisation en laboratoire), type d'extraction (extraction sous vide ou méthode de rack, extraction d'espace de tête et méthode de colonne de stripper) et puissance nominale (100-500 MVA, 501-800 MVA et 8001-1200 MVA) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des analyseurs de gaz dissous en Amérique du Nord

L'analyse des gaz dissous (DGA) est l'étude des gaz dissous dans l'huile du transformateur. Elle est également connue sous le nom de test DGA. Lorsqu'un transformateur est soumis à des contraintes thermiques et électriques anormales, divers gaz sont créés suite à la dégradation de l'huile du transformateur. Lorsque le défaut est grave, les gaz en décomposition s'accumulent et sont collectés dans un relais Buchholz. Cependant, supposons que les contraintes thermiques et électriques anormales ne soient pas excessivement sévères. Dans ce cas, les gaz produits par la désintégration de l'huile isolante du transformateur auront suffisamment de temps pour se dissoudre dans l'huile.

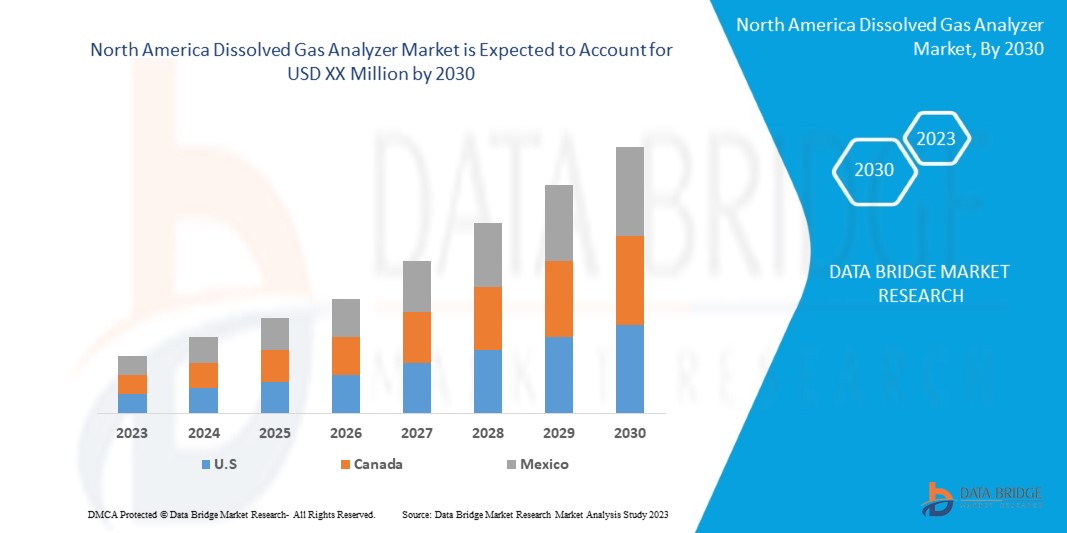

Au cours de la période de prévision, les fabricants impliqués dans le marché des analyseurs de gaz dissous bénéficieront probablement de manière significative d'une sensibilisation accrue aux avantages des analyseurs de gaz dissous et des investissements dans la construction d'infrastructures de services publics. Data Bridge Market Research analyse que le marché nord-américain des analyseurs de gaz dissous connaîtra un TCAC de 7,9 % au cours de la période de prévision de 2023 à 2030.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable pour 2020-2015) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, prix en dollars américains |

|

Segments couverts |

Par type (détecteurs de fumée, surveillance DGA à alerte précoce, surveillance DGA complète, services de laboratoire, logiciels de base de données et appareils DGA portables), type de gaz (monogaz et multigaz), technologie (chromatographie en phase gazeuse, spectroscopie photoacoustique et autres), type de produit (en ligne, portable et utilisation en laboratoire), type d'extraction (extraction sous vide ou méthode de rack, extraction d'espace de tête et méthode de colonne de stripping) et puissance nominale (100-500 MVA, 501-800 MVA et 8001-1200 MVA) |

|

Pays couverts |

États-Unis, Canada, Mexique |

|

Acteurs du marché couverts |

Français Société Doble Engineering, General Electric Company, Advanced Energy Industries, Inc., Qualitrol Company LLC, Siemens, SDMyers, Vaisala, Weidmann Electrical Technology AG, Camlin Ltd, Hitachi Energy Ltd., SRI Instruments, MM Tech, HV Hipot Electric, MTE Meter Test Equipment AG, Ap2e, Yokogawa Electric Corporation, Sieyuan Electric Co., Ltd., Thermo Fisher Scientific, Drallim Industries Limited, Agilent Technologies, entre autres. |

Définition du marché des analyseurs de gaz dissous

Les analyseurs de gaz WITT déterminent rapidement et précisément les concentrations de gaz dans les mélanges de gaz et sont très polyvalents. Des capteurs de pointe et des commandes intuitives permettent une manipulation aisée des analyseurs de gaz, garantissent des résultats d'analyse exacts et assurent la qualité de vos processus. Selon le type d'application, les analyseurs de gaz peuvent être fournis séparément ou intégrés dans des systèmes de mélange de gaz.

Dynamique du marché des analyseurs de gaz dissous en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

-

ACTIVITÉS DE CONSTRUCTION EN CROISSANCE DANS LE MONDE ENTIER

Le secteur de la construction est un secteur important qui contribue à la croissance économique du pays. Le secteur de la construction est également considéré comme un secteur axé sur les investissements pour lequel le gouvernement montre un grand intérêt. Il conclut des contrats avec le secteur de la construction pour construire des infrastructures dans les secteurs de la santé, des transports et de l'éducation.

-

PROGRESSION TECHNOLOGIQUE DANS LA PROTECTION DES TRANSFORMATEURS ET DES RÉSEAU

L'analyse des gaz dissous (DGA) est l'une des technologies les plus efficaces dont disposent les gestionnaires d'actifs pour déterminer l'état de santé de leurs transformateurs. Elle peut être utilisée pour détecter les problèmes à un stade précoce et les gérer au fur et à mesure de leur progression. La quantité et la composition relative des gaz mesurés peuvent être utilisées pour classer les problèmes en développement. La surchauffe du papier (matériaux cellulosiques), la surchauffe du liquide diélectrique (huile minérale ou autre), l'activité de décharge partielle ou l'arc électrique sont des exemples de problèmes. Ces derniers temps, de nombreuses entreprises proposent leur dernière solution de réseau haut de gamme, de protection et de surveillance des transformateurs.

-

DEMANDE D'ÉLECTRICITÉ AUGMENTANTE DANS LES PAYS ÉMERGENTS EN RAISON DE L'URBANISATION RAPIDE

Les niveaux élevés de pollution de l’air obligent les gens à consommer davantage d’électricité à l’intérieur, ce qui entraîne des problèmes environnementaux encore plus graves en augmentant les émissions de gaz à effet de serre. La demande en électricité devrait encore augmenter en raison de la hausse des revenus des ménages, de l’électrification des transports et du chauffage, et de la demande croissante d’appareils connectés et de climatisation. En outre, la hausse de la demande en électricité est l’une des principales raisons pour lesquelles les émissions de CO2 du secteur de l’électricité en Amérique du Nord ont atteint un niveau record ces dernières années. La demande en électricité suit deux trajectoires uniques. Les améliorations de l’efficacité énergétique contrecarrent considérablement la croissance future des économies avancées liée à la numérisation et à l’électrification accrues. La hausse des revenus, l’augmentation de la production industrielle et la croissance du secteur des services stimulent la demande en électricité dans les économies en développement.

Opportunités

-

AUGMENTATION DE LA DEMANDE DE ZÉRO TEMPS D'INTERRUPTION ET DE FLUCTUATION DE COURANT

Les coupures de courant imprévues entraînent non seulement des pertes de productivité des machines, mais peuvent également provoquer des dommages imprévus aux conséquences graves. Divers problèmes surviennent en raison d'une panne de transformateur due à l'indisponibilité d'un analyseur de gaz dissous. Cela conduit à l'absence de temps d'arrêt de l'alimentation électrique dans divers secteurs.

-

ALLIANCES STRATÉGIQUES ET PARTENARIATS ENTRE ORGANISATIONS

La coordination et l'intégration de diverses technologies sont essentielles pour créer des environnements durables dans diverses industries. Pour cette raison, le gouvernement s'efforce également, par le biais de partenariats et d'acquisitions, d'accélérer l'utilisation appropriée des technologies existantes telles que les analyseurs de gaz dissous (DGA) et les systèmes de surveillance des transformateurs. Cela contribue non seulement à faire connaître et à tirer profit de l'organisation, mais crée également des possibilités pour un environnement durable. En outre, cela aide les deux entreprises à être reconnues sur le marché haut de gamme. Par conséquent, l'augmentation des fusions et acquisitions entre organisations crée de nombreuses opportunités pour que le marché des analyseurs de gaz dissous se développe considérablement.

-

COÛT D'INSTALLATION TRÈS ÉLEVÉ

L'aspect le plus coûteux d'un analyseur de gaz dissous est la partie installation, qui peut coûter autant, voire plus, que la technologie installée. Bien que certaines entreprises gèrent une grande partie de ces tâches en interne, il faut toujours tenir compte des coûts de main-d'œuvre, des fournitures et des retards opérationnels. De plus, la plupart des systèmes nécessitent un contrat de maintenance logicielle (SMA) continu.

Défis

- PERTURBATION DANS LE SECTEUR DE LA CHAÎNE D'APPROVISIONNEMENT

La guerre des semi-conducteurs, particulièrement menée par le secteur des technologies de l'information et de la communication (TIC), est l'un des plus gros problèmes en Amérique du Nord qui affectent les chaînes d'approvisionnement des industries spécialisées. La pandémie de Covid-19, qui a mis à l'arrêt l'industrie automobile tout en faisant exploser la consommation d'électronique domestique en Amérique du Nord, en a été la principale cause. Cependant, la source du problème est antérieure au confinement en Amérique du Nord.

- DÉFIS OPÉRATIONNELS ET DYSFONCTIONNEMENT DE L'APPAREIL

L'obtention et le maintien de performances continues et fiables dans les analyseurs de gaz dissous dépendent essentiellement de la conception, de l'application, du fonctionnement et de la maintenance appropriés du transformateur et de l'équipement DGA. Bien que l'utilisation de DGA présente de nombreux avantages, le problème majeur est qu'il nécessite beaucoup de temps pour effectuer un test et qu'il est coûteux. L'opérateur DGA est confronté à de nombreux autres défis. Il doit également effectuer un étalonnage fréquent avec le système et le gaz auxiliaire pour effectuer la tâche, ce qui coûte très cher.

Impact du Covid-19 sur le marché nord-américain des analyseurs de gaz dissous

La COVID-19 a eu un impact négatif sur le marché. La guerre des semi-conducteurs, particulièrement menée par le secteur des technologies de l’information et de la communication (TIC), est l’un des plus gros problèmes en Amérique du Nord qui affectent les chaînes d’approvisionnement des industries spécialisées.

La pandémie de Covid-19, qui a paralysé l'industrie automobile et provoqué une forte hausse de la consommation d'électronique en Amérique du Nord, a été la principale cause du conflit. Cependant, la source du problème est antérieure au confinement en Amérique du Nord.

En 2020, la production manufacturière a soudainement diminué en raison de commandes annulées à la hâte et de procédures de flux tendus au début du confinement dû à la pandémie. Cependant, comme les clients ont utilisé davantage d'ordinateurs portables, de téléphones 5G, de consoles de jeux et d'autres appareils informatiques, la demande de puces de silicium a grimpé en flèche en raison des conditions de travail liées à l'épidémie. Une reprise en forme de V pour les ordinateurs personnels, les appareils mobiles, les voitures et les communications sans fil a résulté d'une baisse de la demande de semi-conducteurs à la fin de 2020.

Développement récent

- En janvier 2020, SDMyers a annoncé une nouvelle collaboration avec Camlin Power, un fabricant d'équipements de surveillance à distance des transformateurs. Cela apporte la dernière technologie de surveillance à 5 et 9 gaz. Cela a aidé l'entreprise à étendre sa présence sur le marché industriel nord-américain

Portée du marché des analyseurs de gaz dissous en Amérique du Nord

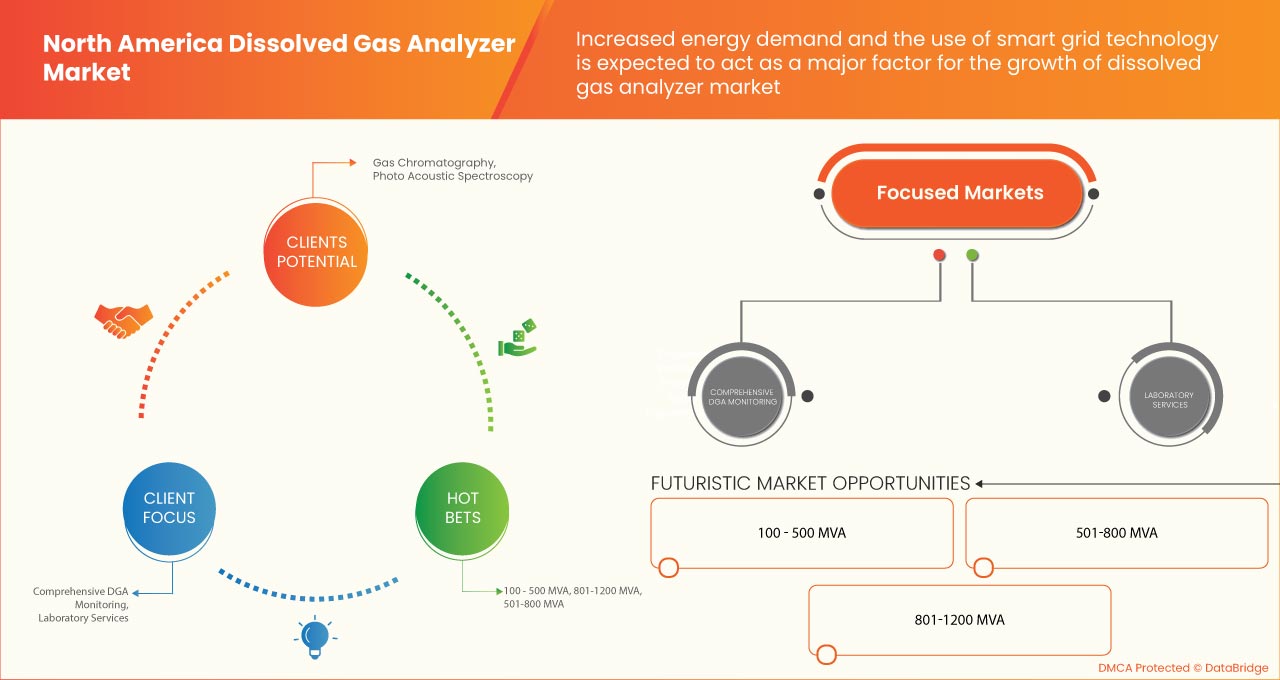

Le marché nord-américain des analyseurs de gaz dissous est segmenté en fonction du type, du type de gaz, de la technologie, du type de produit, du type d'extraction et de la puissance nominale. La croissance parmi ces segments vous aidera à analyser les segments de faible croissance dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Détecteurs de fumée

- Surveillance DGA à alerte précoce

- Surveillance complète de la DGA

- Services de laboratoire

- Logiciel de base de données

- Appareils DGA portables

Sur la base du type, le marché nord-américain des analyseurs de gaz dissous est segmenté en détecteurs de fumée, surveillance DGA d'alerte précoce, surveillance DGA complète, services de laboratoire, logiciels de base de données et appareils DGA portables.

Type de gaz

- Gaz unique

- Multi-gaz

Sur la base du type de gaz, le marché nord-américain des analyseurs de gaz dissous est segmenté en gaz unique, gaz multiples

Technologie

- Chromatographie en phase gazeuse

- Spectroscopie photoacoustique

- Autres

Sur la base de la technologie, le marché nord-américain des analyseurs de gaz dissous est segmenté en chromatographie en phase gazeuse, spectroscopie photoacoustique, autres

Type de produit

- En ligne

- Portable

- Utilisation en laboratoire

Sur la base du type de produit, le marché nord-américain des analyseurs de gaz dissous est segmenté en analyseurs en ligne, portables et en laboratoire.

Type d'extraction

- Méthode d'extraction sous vide ou méthode de rack

- Extraction de l'espace de tête

- Méthode de la colonne de stripping

Sur la base du type d'extraction, le marché nord-américain des analyseurs de gaz dissous est segmenté en extraction sous vide ou méthode de rack, extraction par espace de tête, méthode de colonne de stripping

Puissance nominale

- 100 - 500 MVA

- 501-800 MVA

- 801-1200 MVA

Sur la base de la puissance nominale, le marché nord-américain des analyseurs de gaz dissous est segmenté en 100-500 MVA, 501-800 MVA, 801-1200 MVA

Analyse/perspectives régionales du marché des analyseurs de gaz dissous en Amérique du Nord

Le marché nord-américain des analyseurs de gaz dissous est analysé et des informations et tendances sur la taille du marché sont fournies par type, type de gaz, technologie, type de produit, type d’extraction et puissance nominale.

Les pays couverts dans le rapport sur le marché des analyseurs de gaz dissous en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Les États-Unis dominent la région en raison du marché et de la croissance des infrastructures.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie du pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales sur les canaux de vente sont prises en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des analyseurs de gaz dissous en Amérique du Nord

Le paysage concurrentiel du marché des analyseurs de gaz dissous en Amérique du Nord fournit des détails sur le concurrent. Les détails comprennent un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement de la solution, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché des analyseurs de gaz dissous en Amérique du Nord.

Certains des principaux acteurs opérant sur le marché des analyseurs de gaz dissous en Amérique du Nord sont Doble Engineering Company, General Electric Company, Advanced Energy Industries, Inc., Qualitrol Company LLC, Siemens, SDMyers, Vaisala, Weidmann Electrical Technology AG, Camlin Ltd, Hitachi Energy Ltd., SRI Instruments, MM Tech, HV Hipot Electric, MTE Meter Test Equipment AG, Ap2e, Yokogawa Electric Corporation, Sieyuan Electric Co., Ltd., Thermo Fisher Scientific, Drallim Industries Limited, Agilent Technologies entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA DISSOLVED GAS ANALYZER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COMPONENT TYPE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 REGIONAL SUMMARY NORTH AMERICA DISSOLVED GAS ANALYZER MARKET

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING CONSTRUCTION ACTIVITIES ACROSS THE GLOBE

6.1.2 TECHNOLOGICAL ADVANCEMENTS IN TRANSFORMER/ GRID PROTECTION

6.1.3 INCREASING ELECTRICITY DEMAND ACROSS EMERGING NATIONS ON ACCOUNT OF RAPID URBANIZATION

6.1.4 RAPID GROWTH IN UTILITY INFRASTRUCTURE

6.1.5 INCREASED ENERGY DEMAND AND THE USE OF SMART GRID TECHNOLOGY IN DEVELOPING NATIONS

6.2 RESTRAINTS

6.2.1 STRINGENT GOVERNMENT REGULATIONS

6.2.2 VERY HIGH INSTALLATION COST

6.3 OPPORTUNITIES

6.3.1 RISE IN DEMAND FOR ZERO POWER DOWNTIME AND POWER FLUCTUATION

6.3.2 STRATEGIC ALLIANCES & PARTNERSHIPS BETWEEN ORGANIZATIONS

6.3.3 INCREASING GOVERNMENT INITIATIVES FOR ADVANCED POWER DISTRIBUTION/MONITORING

6.3.4 ADVANCEMENT IN THE SELF-DIAGNOSTIC SYSTEM FOR TRANSFORMERS

6.4 CHALLENGES

6.4.1 DISRUPTION IN THE SUPPLY CHAIN INDUSTRY

6.4.2 OPERATIONAL CHALLENGES AND MALFUNCTION OF THE DEVICE

7 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY TYPE

7.1 OVERVIEW

7.2 EARLY WARNING DGA MONITORING

7.3 LABORATORY SERVICES

7.4 COMPREHENSIVE DGA MONITORING

7.5 DATABASE SOFTWARE

7.6 SMOKE ALARMS

7.7 PORTABLE DGA DEVICES

8 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY GAS TYPE

8.1 OVERVIEW

8.2 MULTI- GAS

8.3 SINGLE- GAS

9 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 GAS CHROMATOGRAPHY

9.3 PHOTO ACOUSTIC SPECTROSCOPY

9.4 OTHERS

10 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY PRODUCT TYPE

10.1 OVERVIEW

10.2 LABORATORY USE

10.3 ONLINE

10.4 PORTABLE

11 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY EXTRACTION TYPE

11.1 OVERVIEW

11.2 HEADSPACE EXTRACTION

11.3 VACUUM EXTRACTION OR RACK METHOD

11.4 STRIPPER COLUMN METHOD

12 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY POWER RATING

12.1 OVERVIEW

12.2 501-800 MVA

12.3 100-500 MVA

12.4 801-1200 MVA

13 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 GE

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 SIEYUAN ELECTRIC CO.

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 RECENT DEVELOPMENT

16.3 HITACHI ENERGY LTD.

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 WEIDMANN ELECTRICAL TECHNOLOGY AG

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 THERMO FISHER SCIENTIFIC

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ADVANCED ENERGY INDUSTRIES, INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 AGILENT TECHNOLOGIES, INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 AP2E

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 CAMLIN LTD

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 DOBLE ENGINEERING COMPANY

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 DRALLIM INDUSTRIES LIMITED

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 HV HIPOT

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 MM TECH

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 MTE METER TEST EQUIPMENT AG

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 QUALITROL COMPANY LLC

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 SDMYERS

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 SIEMENS

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENT

16.18 SRI INSTRUMENTS

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 VAISALA

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENT

16.2 YOKOGAWA ELECTRIC CORPORATION

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 EMISSION STANDARDS FOR COAL-FIRED POWER PLANTS

TABLE 2 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 3 NORTH AMERICA EARLY WARNING DGA MONITORING IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA LABORATORY SERVICES IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA COMPREHENSIVE DGA MONITORING IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA DATABASE SOFTWARE IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA SMOKE ALARMS IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA PORTABLE DGA DEVICES IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY GAS TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA MULTI-GAS IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA SINGLE-GAS IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA GAS CHROMATOGRAPHY IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA PHOTO ACOUSTIC SPECTROSCOPY IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA OTHERS IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA LABORATORY USE IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA ONLINE IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA PORTABLE IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY EXTRACTION TYPE, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA HEADSPACE EXTRACTION IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA VACUUM EXTRACTION OR RACK METHOD IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA STRIPPER COLUMN METHOD IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA 501-800 MVA IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA 100-500 MVA IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA 801-1200 MVA IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY GAS TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY EXTRACTION TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 35 U.S. DISSOLVED GAS ANALYZER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 U.S. DISSOLVED GAS ANALYZER MARKET, BY GAS TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 U.S. DISSOLVED GAS ANALYZER MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 38 U.S. DISSOLVED GAS ANALYZER MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 U.S. DISSOLVED GAS ANALYZER MARKET, BY EXTRACTION TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 U.S. DISSOLVED GAS ANALYZER MARKET, BY POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 41 CANADA DISSOLVED GAS ANALYZER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 CANADA DISSOLVED GAS ANALYZER MARKET, BY GAS TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 CANADA DISSOLVED GAS ANALYZER MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 44 CANADA DISSOLVED GAS ANALYZER MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 CANADA DISSOLVED GAS ANALYZER MARKET, BY EXTRACTION TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 CANADA DISSOLVED GAS ANALYZER MARKET, BY POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 47 MEXICO DISSOLVED GAS ANALYZER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 MEXICO DISSOLVED GAS ANALYZER MARKET, BY GAS TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 MEXICO DISSOLVED GAS ANALYZER MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 50 MEXICO DISSOLVED GAS ANALYZER MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 MEXICO DISSOLVED GAS ANALYZER MARKET, BY EXTRACTION TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 MEXICO DISSOLVED GAS ANALYZER MARKET, BY POWER RATING, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: MARKET PLATFORM COVERAGE GRID

FIGURE 10 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: SEGMENTATION

FIGURE 11 INCREASING CONSTRUCTION ACTIVITIES ACROSS THE GLOBE ARE BOOSTING THE GROWTH OF THE NORTH AMERICA DISSOLVED GAS ANALYZER MARKET IN THE FORECAST PERIOD OF 2023 -2030

FIGURE 12 EARLY WARNING DGA MONITORING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA DISSOLVED GAS ANALYZER MARKET IN 2023 - 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR NORTH AMERICA DISSOLVED GAS ANALYZER MARKET

FIGURE 14 KEY COAL CAPACITY CONTRIBUTORS IN ASIA-PACIFIC REGION, 2017-18

FIGURE 15 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY TYPE, 2022

FIGURE 16 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY GAS TYPE, 2022

FIGURE 17 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY TECHNOLOGY, 2022

FIGURE 18 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY PRODUCT TYPE, 2022

FIGURE 19 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY EXTRACTION TYPE, 2022

FIGURE 20 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY POWER RATING, 2022

FIGURE 21 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: SNAPSHOT (2022)

FIGURE 22 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: BY COUNTRY (2022)

FIGURE 23 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: BY COUNTRY (2023 & 2030)

FIGURE 24 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: BY COUNTRY (2022 & 2030)

FIGURE 25 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: BY SOURCE (2023-2030)

FIGURE 26 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.